Halal Food Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434621 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Halal Food Market Size

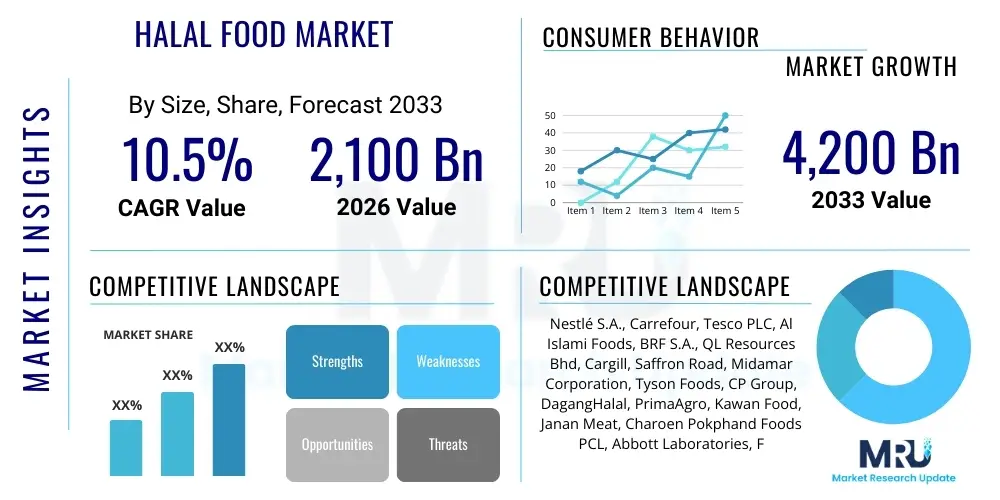

The Halal Food Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.5% between 2026 and 2033. The market is estimated at USD 2,100 Billion in 2026 and is projected to reach USD 4,200 Billion by the end of the forecast period in 2033.

Halal Food Market introduction

The Halal Food Market encompasses products manufactured and processed according to Islamic dietary laws (Shariah). This certification ensures cleanliness, safety, and adherence to specific ethical and preparation standards, covering everything from meat sourcing and slaughter methods to processing additives and storage. The market scope is extremely broad, including fresh products, packaged foods, beverages, and ingredients, catering primarily to the global Muslim population but increasingly attracting non-Muslim consumers due to perceived safety, quality, and ethical sourcing standards. Key product segments driving growth include processed meat, poultry, dairy alternatives, and ready-to-eat meals, reflecting modern consumer demands for convenience without compromising religious compliance.

Major applications for Halal food span the retail sector, encompassing supermarkets, hypermarkets, and online platforms, as well as the foodservice industry, including restaurants, catering services, and institutional feeding, such as schools and hospitals. The integration of Halal certification into mainstream supply chains has significantly broadened accessibility, particularly in non-Muslim majority regions like North America and Europe, where demand is fueled by growing Muslim diaspora communities and the ethical sourcing movement. Continuous urbanization and rising disposable incomes in key Muslim-majority countries (MMCs) further solidify the market's trajectory, prompting massive investment in standardized Halal infrastructure and logistics.

The core benefits of the Halal market extend beyond religious compliance, offering enhanced traceability, transparency, and assurance of ethical standards across the entire supply chain. Driving factors include the sheer demographic expansion of the global Muslim population, which is younger and growing faster than the global average. Furthermore, government initiatives in MMCs and growing awareness among consumers regarding product integrity are pushing food manufacturers to adopt Halal certification, transforming it from a niche requirement into a globally recognized quality standard. The increasing use of technology to ensure supply chain integrity and combat fraud also acts as a critical growth engine.

Halal Food Market Executive Summary

The Halal Food Market is characterized by robust commercial dynamics, driven simultaneously by demographic growth, heightened regulatory scrutiny, and technological integration across processing and certification. Business trends indicate a strong move toward industrialization and standardization, with multinational corporations (MNCs) actively acquiring or partnering with regional Halal-certified producers to expand their global footprint, particularly in high-growth areas like Asia Pacific and the Middle East. Strategic vertical integration, focusing on secure sourcing of raw materials compliant with Shariah, is becoming a necessary competitive edge, mitigating risks associated with supply chain transparency and ensuring premium product quality to meet increasingly discerning consumer expectations.

Regionally, Asia Pacific maintains the dominant market share, primarily fueled by massive consumer bases in Indonesia, India, and Malaysia, alongside significant infrastructure investment aimed at establishing global Halal hubs. However, the Middle East and Africa (MEA) region, particularly the Gulf Cooperation Council (GCC) states, represent the highest growth potential, acting as crucial trade and re-export centers, supported by governmental policies favoring Halal trade and investment. Europe and North America are experiencing strong demand expansion, not just from the Muslim diaspora, but also through non-Muslim consumers attracted by the ethical and cleanliness standards inherent in Halal certification, prompting localized production and dedicated retail sections.

Segment trends highlight the rapid expansion of the processed and packaged Halal food sector, reflecting global trends towards convenience and longer shelf life, while maintaining strict compliance. Furthermore, the Halal ingredients market, including functional additives, flavors, and processing aids, is showing accelerated growth as manufacturers seek to ensure the Halal integrity of complex formulations across various categories, including pharmaceuticals and cosmetics (often co-marketed with Halal food certification requirements). E-commerce penetration is also rapidly shaping the market, providing smaller, specialized Halal producers access to global distribution and directly catering to niche consumer demands previously underserved by traditional retail channels.

AI Impact Analysis on Halal Food Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Halal Food Market revolve primarily around authentication, supply chain traceability, and efficient certification processes. Consumers and businesses frequently ask: "How can AI verify the integrity of the Halal slaughter process remotely?" "Can blockchain integrated with AI prevent fraud and contamination throughout the supply chain?" and "How will AI speed up complex international Halal certification audits?" These concerns highlight a collective desire for enhanced trust, reduced human error, and improved efficiency in managing the intricate requirements of Shariah compliance across global logistical networks. Users expect AI to move Halal compliance beyond traditional manual audits into a realm of predictive modeling and real-time verification, ensuring consumer confidence and reducing commercial risks related to mislabeling or contamination.

The implementation of AI is poised to revolutionize the operational and ethical integrity of the Halal supply chain. In processing plants, computer vision systems powered by machine learning algorithms can monitor critical control points, such as stunning, slaughter, and deboning, ensuring absolute adherence to religious stipulations regarding animal welfare and preparation methods, providing an undeniable layer of digital accountability. Furthermore, AI-driven data analytics can optimize complex inventory management and logistics, predicting demand fluctuations while ensuring cross-contamination is prevented by optimizing storage and transportation routes, especially for perishable goods traveling across vast international corridors.

AI's role extends significantly into preventative compliance and market trend prediction. By analyzing massive datasets related to global regulatory changes, raw material sourcing risks, and past audit failures, AI platforms can proactively identify potential non-compliance hotspots within a company's operations before they become critical issues. This predictive capability transforms the auditing process from reactive checking to proactive risk management, dramatically enhancing the efficiency of Halal certification bodies. Additionally, AI algorithms can analyze consumer sentiment and regional preferences, allowing Halal food manufacturers to rapidly develop and customize compliant product lines that meet specific cultural tastes while maintaining strict adherence to religious dietary laws.

- AI-powered computer vision systems enable real-time, remote monitoring of slaughter and processing methods for absolute Shariah compliance verification.

- Predictive analytics leverage machine learning to optimize global Halal logistics, reducing the risk of cross-contamination and spoilage.

- Integration of AI with blockchain technology creates immutable digital ledgers for Halal certificates and product provenance, drastically enhancing traceability and combating fraud.

- AI-driven consumer insights allow for highly accurate forecasting of regional Halal demand and personalized product development strategies.

- Automated document review and regulatory compliance checks using Natural Language Processing (NLP) speed up and standardize complex international certification processes.

DRO & Impact Forces Of Halal Food Market

The dynamics of the Halal Food Market are shaped by powerful Drivers (D) such as demographic growth and standardization efforts, significant Restraints (R) including fragmentation and high certification costs, and expansive Opportunities (O) in technology integration and emerging non-traditional Halal products. These forces collectively dictate the market structure and competitive environment. The primary driving force is the rapid expansion of the global Muslim population, projected to exceed 2.2 billion by 2030, generating a continuous and escalating demand base. Simultaneously, international governmental and private standardization bodies are harmonizing Halal standards, reducing trade barriers and facilitating cross-border commerce, which acts as a powerful accelerator for global market integration.

Key restraints impeding growth include the lack of universal, globally accepted Halal certification standards, leading to fragmentation and complexity for exporters who must comply with varied national requirements, resulting in increased compliance costs. Furthermore, the issue of Halal integrity and fraud remains a persistent challenge, particularly in complex global supply chains, requiring substantial investment in verification technologies to maintain consumer trust. Economic fluctuations and geopolitical tensions in major Muslim markets also introduce volatility in pricing and distribution logistics, often delaying infrastructure development necessary for sophisticated Halal processing.

Opportunities for market penetration are concentrated in the rapidly expanding Halal travel and hospitality sector, demanding certified food services, and the burgeoning segment of Halal-certified ingredients used in pharmaceuticals and cosmetics, broadening the overall ecosystem. Technological advancements, particularly in traceability (blockchain) and automation (AI verification), present significant avenues for market participants to secure their supply chains, reduce auditing costs, and offer superior transparency, attracting ethical consumers. The convergence of Halal principles with organic and ethical sourcing movements offers a substantial cross-market opportunity, appealing to non-Muslim ethical consumers.

The impact forces are substantial, creating both market pressure and immense potential. The growing socio-economic influence of Muslim-majority nations is translating into trade policies that prioritize Halal imports and exports, altering global food trade flows. Consumer awareness, amplified by social media and digital platforms, has empowered buyers to demand higher levels of scrutiny and authenticity, forcing manufacturers to adopt stringent verification processes. The competitive landscape is intensely focused on strategic acquisitions and partnerships to control the crucial certification and distribution channels, especially in high-volume processed food segments, establishing robust quality infrastructure as a prerequisite for long-term commercial viability.

Segmentation Analysis

The Halal Food Market segmentation provides a crucial framework for understanding diverse consumer preferences and operational requirements across different product categories, distribution channels, and end-user types. The market is primarily segmented based on product type (e.g., meat & poultry, bakery, confectionery), source (animal-based, plant-based), and distribution channel (online, retail, foodservice). This layered analysis reveals that while meat and poultry remain the foundational segments, fast-growing categories like processed foods and Halal ingredients are increasingly influencing market revenue, driven by global urbanization and the demand for convenience and complex food formulations requiring certified components.

Segmentation by distribution channel indicates that traditional physical retail, including supermarkets and dedicated Halal grocery stores, still accounts for the largest share, particularly in established markets. However, the fastest growth trajectory is observed in the online retail segment, leveraging e-commerce platforms to reach niche markets and provide direct-to-consumer delivery, optimizing access for consumers in areas with limited physical Halal retail infrastructure. The Foodservice segment is also vital, encompassing airlines, hotels, and Quick Service Restaurants (QSRs), which are increasingly prioritizing certified Halal options to cater to diverse clientele, significantly boosting demand for industrial-scale Halal suppliers.

Geographically, while Asia Pacific leads in volume due to demographic size, regions like the Middle East demonstrate premiumization trends, demanding high-value, imported Halal products, influencing global trade dynamics and quality standards. Understanding these varied segment performances is essential for stakeholders to optimize marketing strategies, allocate investment efficiently in supply chain infrastructure, and tailor product innovation to specific regional or channel demands, ensuring compliance and maximizing penetration within the complex global Halal ecosystem.

- By Product Type:

- Meat, Poultry & Seafood

- Dairy Products

- Cereals & Grains

- Fruits & Vegetables (Halal certification applies primarily to processing and preparation)

- Processed Foods (Ready-to-eat meals, canned foods)

- Beverages

- Confectionery & Bakery

- By Source:

- Animal-based

- Plant-based

- Synthetic/Processed (e.g., flavors, additives)

- By Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Retail

- Specialty Stores

- By Application/End-User:

- Food Service (Hotels, Restaurants, Cafés)

- Retail Consumer

- Institutional (Airlines, Hospitals)

Value Chain Analysis For Halal Food Market

The Halal Food Value Chain is distinctively defined by the mandatory inclusion of Halal certification and verification checkpoints at virtually every stage, ensuring compliance from farm-to-fork. The upstream segment involves the ethical and Shariah-compliant sourcing of raw materials, focusing intensively on animal rearing standards, feed composition, and the crucial process of Dhabihah (Halal slaughter). This stage requires rigorous audits, often involving technology like IoT sensors and detailed documentation to establish irrefutable integrity of the raw supply, differentiating it significantly from conventional food sourcing where such religious and ethical scrutiny is not uniformly applied.

The midstream operations—processing, manufacturing, and packaging—are governed by strict regulations to prevent cross-contamination (Najis) and ensure that only Halal-certified ingredients and processing aids are used. Manufacturers must invest heavily in dedicated production lines or rigorous cleaning protocols, validated by Halal certifying bodies. The certification process itself, managed by recognized agencies, forms a critical, non-value-added but mandatory component of the cost structure. Packaging also plays a role, requiring clear labeling and tamper-proof sealing to maintain integrity throughout transit and retail presentation.

Downstream activities involve distribution and retail channels, both direct and indirect. Direct channels often include dedicated Halal butchers or specialty online platforms that maintain full control over storage and handling conditions, minimizing risk of contamination. Indirect distribution through major global logistics providers and mainstream retailers requires stringent compliance agreements and segregated storage facilities. The importance of traceability technology, such as blockchain, is paramount in the distribution phase to provide consumers with transparent evidence that the product's Halal status was maintained during transit. Sales and marketing efforts focus heavily on building trust and emphasizing the authenticity and ethical sourcing, distinguishing compliant products in a crowded marketplace.

Halal Food Market Potential Customers

The Halal Food Market’s primary customer base consists of the global Muslim population, which demands products conforming to Islamic dietary laws. This massive demographic segment is not monolithic; it includes varying socio-economic classes and regional tastes, ranging from high-income consumers in the GCC demanding premium organic Halal meats to cost-conscious consumers in developing nations seeking affordable staples. The core purchase motivation is religious obligation and cultural heritage, leading to brand loyalty built predominantly on trust in the certification authority and supply chain transparency. Demographic growth, urbanization, and the rise of a young, digitally aware Muslim consumer segment are continuously expanding this fundamental customer base.

Beyond the primary religious market, a rapidly expanding segment of potential customers includes non-Muslim consumers seeking ethically sourced, hygienic, and high-quality food options. Halal certification, particularly its rigorous standards regarding animal welfare, cleanliness, and the exclusion of specific harmful additives (like certain alcohols or pork derivatives), resonates strongly with the growing global movement towards ethical consumption and clean label products. This secondary segment often includes vegans, vegetarians, and health-conscious individuals who perceive Halal standards as synonymous with superior quality and assured traceability, driving demand in Western and Asian non-Muslim majority countries.

Institutional buyers represent a significant B2B customer segment. This includes major global institutions such as airlines requiring catering services for international routes, hospitals, schools, and military contracts in regions with large Muslim populations. Furthermore, multinational food and beverage companies (F&B) that operate across international borders, especially those targeting Muslim-majority markets, are key potential buyers of Halal-certified ingredients and raw materials, requiring assurance that their entire product formulation meets compliant standards before final production and packaging.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2,100 Billion |

| Market Forecast in 2033 | USD 4,200 Billion |

| Growth Rate | 10.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nestlé S.A., Carrefour, Tesco PLC, Al Islami Foods, BRF S.A., QL Resources Bhd, Cargill, Saffron Road, Midamar Corporation, Tyson Foods, CP Group, DagangHalal, PrimaAgro, Kawan Food, Janan Meat, Charoen Pokphand Foods PCL, Abbott Laboratories, FrieslandCampina, Emirates Refreshments. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Halal Food Market Key Technology Landscape

The technological landscape of the Halal Food Market is rapidly evolving, focusing heavily on enhancing transparency, integrity, and efficiency across complex, globally dispersed supply chains. The most impactful technologies include the integration of blockchain and distributed ledger technology (DLT) to create immutable, transparent records of every Halal verification step, from initial sourcing and slaughter to final retail delivery. This addresses the primary market challenge of trust and authenticity, replacing fragmented, paper-based certification processes with secure digital evidence. Furthermore, the use of IoT sensors embedded in transportation and storage units allows for real-time monitoring of critical environmental factors (temperature, humidity), crucial for maintaining the quality and compliance of perishable Halal products.

Advanced diagnostic tools and laboratory testing protocols are foundational to maintaining Halal integrity, particularly in detecting contaminants or non-compliant ingredients such as porcine DNA or certain alcohol derivatives. Polymerase Chain Reaction (PCR) and advanced spectroscopic techniques are increasingly standardized for rapid and accurate verification. Beyond chemical testing, the application of Artificial Intelligence (AI) and Machine Learning (ML) is transforming operational compliance. AI-powered computer vision systems monitor live production lines, ensuring slaughter processes adhere precisely to Shariah law, offering an objective audit layer previously unavailable, minimizing human error, and ensuring ethical standards are continuously met.

E-commerce and mobile applications are vital technological channels driving market access and consumer engagement. Dedicated Halal e-commerce platforms offer localized product availability and certification information. Mobile apps are being developed to allow consumers to scan QR codes on packaging, instantly accessing the product's full Halal journey and certification status, effectively building direct digital trust. This robust technological infrastructure is essential for the Halal market's global expansion, ensuring that compliance is not just a regulatory requirement but a digitally verifiable promise of quality and ethical sourcing to the end consumer.

Regional Highlights

The Halal Food Market exhibits significant regional variations in growth patterns, consumer maturity, and infrastructure development, making regional analysis critical for market stakeholders.

- Asia Pacific (APAC): Dominates the market share due to its massive Muslim population, particularly in Indonesia, Malaysia, and India. This region is characterized by high volume consumption and the development of major government-backed Halal hubs (e.g., Malaysia and Indonesia), aiming to standardize certification and facilitate global export. Growth is driven by urbanization and rising middle-class disposable income, increasing demand for packaged and convenient Halal foods.

- Middle East and Africa (MEA): Represents the highest growth rate potential, particularly the GCC countries (Saudi Arabia, UAE), which serve as crucial import and re-export centers. Demand here is characterized by premiumization, high reliance on imports, and significant governmental investment in Halal logistics and tourism infrastructure. Halal food security is a major strategic focus, driving local production and sourcing initiatives.

- Europe: Exhibits rapid growth driven by the expansion of the Muslim diaspora and increasing non-Muslim consumer interest in ethical food standards. The market is fragmented but highly profitable, with robust demand in countries like France, the UK, and Germany. Challenges include navigating diverse national Halal certification bodies, but the opportunity lies in catering to diverse ethnic preferences and integrating Halal products into mainstream supermarket chains.

- North America: Characterized by a highly specialized market focusing on imported and high-quality niche products. Growth is strong, fueled by increasing Muslim populations and a growing acceptance of Halal as a quality label. E-commerce plays a vital role in reaching dispersed consumer groups, and local processing facilities are expanding to meet domestic demand.

- Latin America: Emerging market primarily focused on large-scale Halal meat export to the Middle East and Africa, particularly from Brazil and Argentina. Domestic consumption is small but growing. The primary market driver is the region's capacity as a compliant, high-volume protein supplier for MMCs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Halal Food Market.- Nestlé S.A.

- Cargill, Incorporated

- BRF S.A.

- Tyson Foods, Inc.

- Charoen Pokphand Foods PCL (CP Group)

- Al Islami Foods

- QL Resources Bhd

- Saffron Road

- Midamar Corporation

- FrieslandCampina

- Abbott Laboratories (for Halal nutritional products)

- DagangHalal Group

- Kawan Food Berhad

- Janat Meat

- Hindustan Unilever Limited

- Craveable Brands (Red Rooster, Oporto)

- Emirates Refreshments (Masafi)

- PrimaAgro

- Carrefour S.A. (Retailer focus)

- Tesco PLC (Retailer focus)

Frequently Asked Questions

Analyze common user questions about the Halal Food market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Halal Food Market?

The primary driver is the rapid and sustained demographic growth of the global Muslim population, coupled with increasing consumer awareness and preference for certified products that assure religious compliance, ethical sourcing, and high quality standards.

How does technological integration, particularly blockchain, benefit the Halal supply chain?

Blockchain technology provides an immutable and transparent digital ledger for tracking Halal certification and product provenance from farm to shelf. This drastically enhances traceability, prevents fraud, and builds consumer trust by offering verifiable proof of Shariah compliance at every logistical stage.

Which regions hold the most significant growth potential for Halal food products?

While Asia Pacific currently holds the largest market share, the Middle East and Africa (MEA), particularly the GCC countries, exhibit the highest future growth potential due to substantial government investment in Halal infrastructure, high import dependency, and strong demand for premium products.

What are the main restraints impacting the global Halal Food Market?

The market is restrained primarily by the lack of universally recognized, harmonized global Halal certification standards, leading to regulatory complexity, market fragmentation, and increased compliance costs for international exporters.

Is Halal food consumption limited only to Muslim consumers?

No, a significant secondary market exists among non-Muslim consumers who purchase Halal products due to perceived superior standards in hygiene, safety, ethical treatment of animals, and traceability, aligning with the broader clean label and ethical consumption movements.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Halal Food Market Size Report By Type (Fresh Products, Frozen Salty Products, Processed Products, Others), By Application (Restaurant, Hotel, Home, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Halal Foods and Beverages Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Halal Food Products, Halal Beverages, Halal Supplements), By Application (Store-Based, Non-Store-Based), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager