Halal Hair Care Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434368 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Halal Hair Care Market Size

The Halal Hair Care Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.9% between 2026 and 2033. The market is estimated at USD 8.5 Billion in 2026 and is projected to reach USD 15.3 Billion by the end of the forecast period in 2033. This significant expansion is primarily attributed to the global increase in the Muslim population, coupled with growing awareness regarding the ethical and health implications of cosmetic ingredients.

Halal Hair Care Market introduction

The Halal Hair Care Market encompasses products formulated, manufactured, and packaged according to Islamic dietary and ethical guidelines, ensuring they are free from alcohol, porcine derivatives, animal testing, and other Haram (forbidden) ingredients. These products typically include shampoos, conditioners, hair oils, styling gels, and masks, catering to consumers seeking ethically compliant and often plant-based alternatives to conventional beauty products. Major applications span daily cleansing, intensive moisturizing, and specific treatments addressing common hair issues while adhering to strict purity standards.

The core benefits driving consumer adoption include product safety, ingredient transparency, and alignment with faith-based values. For Muslim consumers, Halal certification guarantees compliance with religious tenets, making the purchasing decision straightforward. Furthermore, the market benefits from a spillover effect into the broader ethical consumer segment, as Halal products often overlap with vegan, cruelty-free, and natural formulations, appealing to a non-Muslim base concerned about sustainability and transparency.

Key driving factors accelerating market growth involve rising disposable income in Muslim-majority regions (particularly the Middle East and Southeast Asia), sophisticated marketing targeting younger, digitally savvy Muslim consumers (Generation M), and increased efforts by major multinational corporations to obtain Halal certification for specific product lines to capture this lucrative niche market. Regulatory bodies in key exporting countries are also streamlining certification processes, further facilitating market entry and cross-border trade.

Halal Hair Care Market Executive Summary

The Halal Hair Care Market is characterized by robust growth, driven by shifting consumer demographics and a heightened global demand for ethically sourced and transparent personal care products. Business trends highlight strategic investments in R&D to utilize plant-derived and bio-engineered Halal-compliant ingredients, minimizing reliance on petrochemicals. A critical trend is the focus on digital distribution, with specialized e-commerce platforms and social media campaigns playing a pivotal role in brand engagement and consumer education about Halal certification standards. The market is seeing increased consolidation, where established conventional players are acquiring niche Halal brands to swiftly integrate into the ethical cosmetics landscape, demonstrating confidence in the segment's long-term viability.

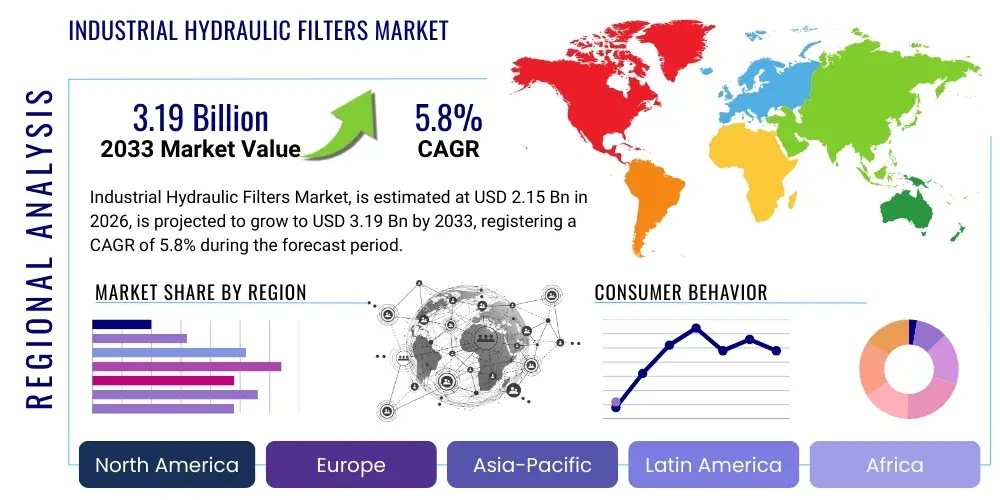

Regionally, Asia Pacific, particularly Indonesia and Malaysia, dominates the market due to large Muslim populations and government initiatives supporting Halal industries, establishing the region as both a major consumption hub and a manufacturing powerhouse. However, significant growth potential is identified in emerging markets within the Middle East & Africa (MEA) and Europe, where Muslim populations are growing and seeking accessible Halal options. Regional trends also show a diversification of product offerings, moving beyond basic cleaning agents to specialized anti-frizz, anti-dandruff, and hair loss treatments tailored to specific ethnic hair types common in these geographies.

Segmentation trends indicate that the Shampoo and Conditioner segments maintain the largest market share due to high daily usage rates, while the Hair Oil and Treatment segments exhibit the highest growth CAGR, reflecting consumer willingness to invest in premium, high-efficacy Halal treatments. Distribution-wise, online retail is rapidly gaining dominance, offering convenience, product variety, and detailed ingredient lists crucial for the discerning Halal consumer, challenging the traditional dominance of hypermarkets. The consumer base is primarily focused on the Women's segment, though the Men's grooming category, encompassing beard care and specialized styling products, is rapidly emerging as a high-potential, underserved niche.

AI Impact Analysis on Halal Hair Care Market

Common user questions regarding AI's impact on Halal Hair Care revolve primarily around supply chain integrity, personalized product discovery, and verifiable ethical sourcing. Users are keen to know how Artificial Intelligence can guarantee 100% Halal compliance throughout the product lifecycle, especially concerning ingredient origin and cross-contamination risk during manufacturing. There is significant interest in AI-driven personalization engines that can recommend Halal hair care routines based on individual hair types, climate data, and specific religious practices (e.g., routines optimized for frequent ablution). Furthermore, consumers anticipate AI tools will enhance transparency, offering instantaneous access to blockchain-verified certification data, thereby increasing consumer trust and mitigating skepticism regarding "Halal washing" practices.

AI adoption is poised to revolutionize the Halal Hair Care sector by optimizing ingredient screening and personalized marketing. AI algorithms can instantaneously analyze thousands of raw material certifications against strict Islamic jurisprudence guidelines, significantly speeding up the product development cycle and reducing the risk of accidental incorporation of Haram substances. On the consumer front, machine learning is utilized to analyze purchasing patterns, social media sentiment, and demographic data to develop highly personalized product bundles and marketing campaigns that resonate deeply with the faith-based consumer's values, moving beyond standard demographic targeting to psychographic alignment.

However, the ethical deployment of AI remains a key concern. Companies must ensure that AI systems used for personalization do not infringe upon user privacy or inadvertently exclude minority religious or ethnic groups within the broader Halal consumer base. Successful integration requires robust data governance frameworks to maintain the trust and authenticity central to the Halal market promise. The use of AI in predictive logistics and inventory management will also be crucial for maintaining product freshness and ensuring the efficient distribution of certified products globally, especially across complex international supply chains often crossing diverse regulatory environments.

- AI optimizes supply chain traceability and raw material verification against Halal standards.

- Machine Learning drives personalized product recommendations based on individual hair needs and ethical preferences.

- Natural Language Processing (NLP) enhances customer service chatbots, offering instantaneous, accurate information on Halal ingredients and certification status.

- Predictive analytics aids in anticipating demand fluctuations in key Muslim-majority regions (AEO Focus: Inventory Management and Demand Forecasting).

- Blockchain integration, facilitated by AI, offers immutable, transparent records of Halal certification, combating counterfeiting.

- AI-powered image recognition tools assist quality control in manufacturing plants to prevent cross-contamination risks.

DRO & Impact Forces Of Halal Hair Care Market

The Halal Hair Care Market dynamics are heavily influenced by the interplay of demographic shifts, ethical consumerism, strict regulatory requirements, and supply chain vulnerabilities. The primary driver is the accelerating growth and increasing affluence of the global Muslim population, which requires products compliant with their faith. Simultaneously, the global trend toward clean beauty, natural ingredients, and ethical sourcing creates a significant opportunity, allowing Halal brands to successfully penetrate non-Muslim markets seeking transparent and ethical alternatives. This confluence of religious necessity and ethical preference provides a powerful underlying market momentum.

Restraints largely center on the high costs and complexity associated with obtaining and maintaining global Halal certification, which varies significantly across different countries (e.g., Malaysia's JAKIM vs. Indonesia's MUI). This fragmented regulatory landscape increases operational costs and complicates international trade for smaller players. Furthermore, the limited availability of Halal-certified specialty raw materials and cosmetic bases presents a supply chain challenge. Impact forces include intense competition from established conventional beauty giants now entering the market, forcing niche Halal brands to continuously innovate in formulation and marketing authenticity to maintain their market position and protect brand integrity.

Opportunities reside in leveraging digital platforms for direct-to-consumer sales and education, particularly targeting younger consumers (Gen Z and Millennials) who prioritize digital transparency. Geographical expansion into Latin America and North America, where Muslim diaspora populations are actively seeking specialized religious goods, represents a key growth vector. The development of specialized Halal hair treatments for specific conditions (e.g., post-Hajj/Umrah hair care, scalp treatments compatible with frequent ablution) also offers premiumization opportunities. Successfully navigating the certification maze and establishing robust, blockchain-verified supply chains will be critical success factors for capitalizing on these market opportunities.

Segmentation Analysis

The Halal Hair Care Market is segmented based on Product Type, Distribution Channel, and Consumer Group, reflecting the diverse needs and purchasing behaviors of the target audience. Product segmentation highlights the dominance of high-volume, daily-use items like shampoos and conditioners, essential to regular hygiene. However, the segmentation also reveals significant growth in specialty treatment categories, indicating a market maturing beyond basic cleansing to focused therapeutic care. Analyzing these segments is critical for manufacturers to tailor their R&D and marketing efforts, ensuring product portfolios are balanced between mass-market appeal and high-margin specialized offerings.

Distribution analysis underscores the transition from traditional brick-and-mortar retail to specialized online channels. While supermarkets remain important for basic necessities, online platforms offer essential educational resources and a broader inventory of specialized Halal brands that might not be stocked locally. Consumer grouping is crucial, as the purchasing patterns of women often dictate household consumption, yet the emerging growth in men's Halal grooming signals untapped market potential that requires distinct product development and marketing messaging. Understanding these segments allows for precision marketing, focusing on the core values—purity and ethical sourcing—that drive purchasing decisions in each category.

The detailed segmentation structure provides a roadmap for market penetration strategies. For instance, focusing on the 'Online Retail' distribution channel for 'Premium Styling Products' aimed at the 'Women's' consumer group in Western markets requires different regulatory focus and logistical planning than marketing 'Basic Shampoos' through 'Hypermarkets' in Southeast Asia. This granular view is essential for effective capital allocation and achieving optimal market share across diverse geographical and cultural landscapes.

- Product Type

- Shampoo

- Conditioner

- Hair Oil

- Styling Products (Gels, Mousses, Sprays)

- Hair Colorants (Emerging segment)

- Others (Masks, Serums, Treatments)

- Distribution Channel

- Hypermarkets/Supermarkets

- Specialty Stores

- Online Retail (E-commerce platforms)

- Pharmacies and Drug Stores

- Consumer Group

- Women

- Men

- Kids and Infants

Value Chain Analysis For Halal Hair Care Market

The Value Chain for the Halal Hair Care market begins with upstream activities focused on the sourcing of raw materials, which is the most critical stage due to the stringent prohibition on Haram substances. Upstream analysis involves rigorous screening and certification of suppliers for ingredients such as plant extracts, specific fatty acids, and natural preservatives, ensuring they are not processed using animal-derived enzymes or alcohol-based solvents. This phase is characterized by high scrutiny and often requires dual certification (Halal compliance alongside standard quality checks), increasing initial procurement complexity and costs, but ensuring the foundational purity of the final product.

Midstream activities involve formulation, manufacturing, and packaging. Halal production facilities must adhere to strict segregation protocols to prevent cross-contamination with non-Halal products or machinery, often requiring dedicated production lines. This necessity adds complexity to manufacturing processes but is non-negotiable for certification integrity. Downstream analysis focuses on distribution and marketing. The distribution channel is often segmented into direct sales, leveraging e-commerce for global reach and education, and indirect sales through certified retailers, hypermarkets, and specialized Halal product stores, especially important in regions with high Muslim populations.

Direct distribution, primarily through dedicated online retail channels, offers brands greater control over messaging, allowing them to effectively communicate the nuances of Halal certification and ethical sourcing directly to the end consumer, thereby building essential brand trust. Indirect distribution, leveraging major retail chains, facilitates mass market accessibility but requires strict oversight to ensure product integrity and proper shelving away from non-Halal items. The efficiency of the distribution network is crucial for maintaining the freshness of natural ingredients typical in Halal formulations and swiftly delivering products to a geographically dispersed consumer base.

Halal Hair Care Market Potential Customers

The primary end-users and buyers of Halal hair care products are globally dispersed Muslim consumers who seek cosmetic products that align seamlessly with their faith and ethical mandates. This demographic is diverse, ranging from highly religious individuals who require strict certification to younger, affluent "Generation M" consumers who value both religious compliance and high-quality, fashion-forward product aesthetics. Their purchasing decisions are heavily influenced by the presence of verifiable Halal logos from recognized international certification bodies, transparency regarding ingredient origins, and effective communication highlighting cruelty-free and natural elements.

Beyond the core Muslim demographic, a rapidly expanding customer segment includes non-Muslim ethical consumers. This group, driven by global trends favoring clean beauty, veganism, and sustainable sourcing, often views Halal-certified products as meeting or exceeding standard ethical benchmarks. These buyers are attracted to the stringent vetting process inherent in Halal standards, which often guarantees the absence of common irritants, porcine derivatives, and unethical testing practices. Marketing strategies targeting this segment emphasize the product’s purity, transparency, and natural formulation rather than its religious compliance.

A third potential customer group includes parents seeking safe, gentle, and ethically sound products for their children. Halal certifications provide an added layer of assurance regarding the purity and mildness of ingredients used in children's shampoos and detanglers. For all potential customers, the purchase often represents a values-based transaction, where trust in the brand's integrity and commitment to ethical sourcing is often weighted equally, if not more, than functional product efficacy. Therefore, brands must invest heavily in verifiable supply chains and consumer education.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.5 Billion |

| Market Forecast in 2033 | USD 15.3 Billion |

| Growth Rate | 8.9% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Amara Halal Cosmetics, OnePure, PHB Ethical Beauty, Iba Cosmetics, Inika Organic, Wipro Unza, Saaf Pure Skincare, Cleo Halal Beauty, SirehEmas, Samira Halal, Natures Organics, Glow Recipe, Shay Herbals, Mersi Cosmetics, Wardah Beauty, Viva Cosmetics, Zahara, The Halal Cosmetics Company, Muslimah Manufacturing, Halal Beauty by Ethisphere |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Halal Hair Care Market Key Technology Landscape

The Halal Hair Care market leverages cutting-edge technology primarily for two crucial aspects: ensuring compliance and enhancing formulation efficacy while maintaining purity. Spectroscopic analysis techniques, such as Fourier-Transform Infrared (FTIR) spectroscopy, are increasingly used in quality control labs to rapidly detect and verify the absence of prohibited ingredients (like alcohol or porcine traces) in raw materials and finished products, moving beyond reliance solely on paper certification. This technological validation adds an essential layer of scientific rigor to the Halal compliance process, enhancing consumer confidence and regulatory adherence in key importing nations.

Furthermore, biotechnology plays a significant role in developing Halal-compliant active ingredients. Advances in fermentation and plant cell culture technology allow manufacturers to bio-engineer high-performance components (e.g., specific peptides, hyaluronic acid alternatives, specialized ceramides) derived from non-animal, non-alcohol sources. This innovation addresses the challenge of sourcing high-efficacy ingredients that meet Halal purity mandates, enabling Halal brands to compete directly with conventional luxury brands on performance metrics while maintaining ethical standards.

Digital technologies, particularly blockchain and mobile application integration, are transforming consumer interaction and supply chain transparency. Blockchain technology provides an immutable, decentralized ledger for tracking Halal certification status from farm to shelf, making it impossible to tamper with origin data. Consumers can scan QR codes on packaging using mobile apps to access real-time certification status, batch numbers, and ethical sourcing stories. This technological infrastructure meets the AEO demand for immediate and verifiable information, cementing the brand’s commitment to transparency and countering skepticism in the ethical marketplace.

Regional Highlights

Regional dynamics are paramount to understanding the Halal Hair Care Market's trajectory, given the concentration of the Muslim population and varying regulatory environments globally. Asia Pacific (APAC) dominates the market share, driven primarily by Indonesia and Malaysia, which possess large, affluent Muslim populations and robust governmental support for the Halal economy. These nations are not only huge consumption markets but also major export hubs, setting global standards for Halal cosmetic manufacturing. High internet penetration and sophisticated digital marketing further accelerate consumer engagement in urban centers across Southeast Asia, making APAC the undisputed leader in volume and innovation.

The Middle East and Africa (MEA) represent the second-largest market and a major epicenter for premium Halal hair care consumption. High per capita income in the Gulf Cooperation Council (GCC) countries allows consumers to purchase high-end, imported Halal brands. Local manufacturing in countries like the UAE and Saudi Arabia is rapidly expanding, focusing on indigenous ingredients and addressing climate-specific hair needs. The market in Africa, particularly in North and West African nations with large Muslim communities, shows promising growth potential, contingent on improving distribution infrastructure and local manufacturing capabilities.

Europe and North America, while having smaller market sizes, are experiencing the fastest growth rates. This surge is fueled by large, established Muslim diaspora communities increasingly demanding locally available, certified Halal products, moving away from imported or self-certified items. Brands in these regions often emphasize the "clean beauty" and vegan aspects of their Halal products to attract the broader, ethical non-Muslim consumer base. Strict European ingredient regulations also align often, making market entry feasible if the Halal compliance layer is successfully integrated.

- Asia Pacific (APAC): Market leader by volume; driven by robust regulatory frameworks in Indonesia (MUI) and Malaysia (JAKIM); significant export potential and manufacturing expertise.

- Middle East & Africa (MEA): High growth in premium segment; strong demand in GCC nations; focus on specialized treatments for arid climates and local ingredient utilization.

- Europe: Rapid growth fueled by ethical consumerism crossover and large diaspora populations; key focus on 'Clean Beauty' and vegan Halal positioning (AEO Focus: Ethical Sourcing Verification).

- North America: Emerging market with increasing distribution through specialized ethnic stores and large online retailers; demand centers around certified, natural, and transparent formulations.

- Latin America: Nascent but promising market, relying mainly on imports; small Muslim communities driving niche demand for specialized imported goods.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Halal Hair Care Market.- Amara Halal Cosmetics

- OnePure

- PHB Ethical Beauty

- Iba Cosmetics

- Inika Organic

- Wipro Unza

- Saaf Pure Skincare

- Cleo Halal Beauty

- SirehEmas

- Samira Halal

- Natures Organics

- Glow Recipe

- Shay Herbals

- Mersi Cosmetics

- Wardah Beauty

- Viva Cosmetics

- Zahara

- The Halal Cosmetics Company

- Muslimah Manufacturing

- Halal Beauty by Ethisphere

Frequently Asked Questions

Analyze common user questions about the Halal Hair Care market and generate a concise list of summarized FAQs reflecting key topics and concerns.What criteria define Halal certification for hair care products?

Halal certification requires that products are completely free from porcine derivatives, alcohol (ethanol, usually over a specific concentration), animal ingredients sourced without proper slaughter (Dhabihah), and must not involve animal testing. Production facilities must also prevent cross-contamination with Haram substances, ensuring purity throughout the supply chain.

Is the Halal Hair Care Market exclusively for Muslim consumers?

No. While rooted in Islamic standards, the market attracts a significant segment of non-Muslim consumers globally who seek products that are cruelty-free, vegan, ethically sourced, and free from harsh chemicals, aligning Halal standards with the broader clean beauty movement.

Which product segments show the highest growth potential in the Halal Hair Care Market?

While shampoo and conditioner hold the largest market share, the highest growth rates are projected in the specialized treatment segments, including Halal-certified hair oils, hair masks, and intensive repair serums, reflecting a trend toward premium and efficacious Halal formulations.

How does Halal certification status vary across key global regions?

Certification standards differ significantly. Indonesia (MUI) and Malaysia (JAKIM) set robust national benchmarks, often requiring strict facility audits. Brands operating internationally must manage compliance with multiple, sometimes conflicting, national Halal bodies to ensure global market access and consumer trust.

How is technology being used to enhance transparency in Halal supply chains?

Technology, particularly blockchain, is integrated to provide immutable records of ingredient origin and certification status. This allows consumers to verify the authenticity and purity of Halal products instantly via mobile apps, directly addressing key concerns regarding fraud and ingredient integrity.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager