Halal Pharmaceuticals Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433741 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Halal Pharmaceuticals Market Size

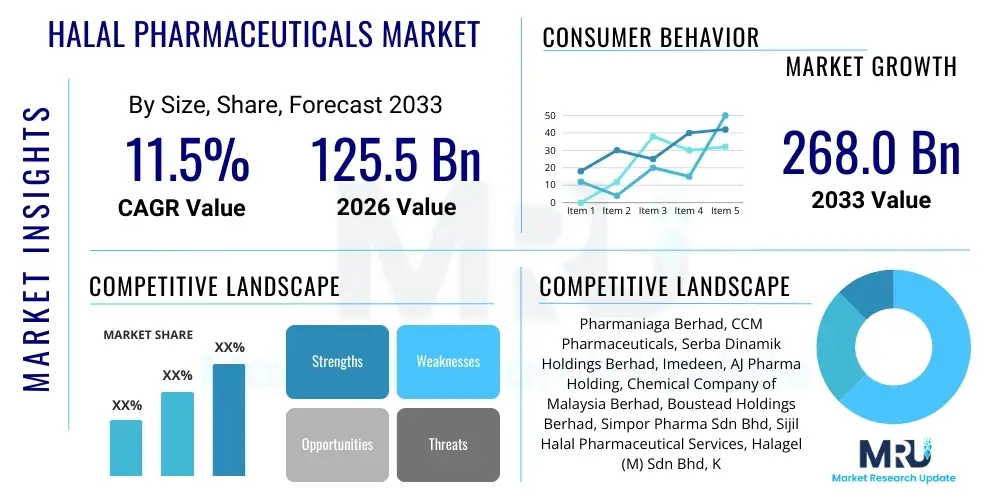

The Halal Pharmaceuticals Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 125.5 Billion in 2026 and is projected to reach USD 268.0 Billion by the end of the forecast period in 2033.

Halal Pharmaceuticals Market introduction

The Halal Pharmaceuticals market encompasses drugs, vaccines, and nutraceutical products manufactured, processed, and distributed according to Islamic dietary laws (Sharia). This mandates that all ingredients, processing aids, excipients, and manufacturing procedures must be free from prohibited substances (Haram), such as porcine gelatin, alcohol, or ingredients derived from improperly slaughtered animals. The primary objective is to provide Muslim consumers globally with ethically compliant and safe therapeutic solutions, addressing a significant demand gap in the conventional pharmaceutical supply chain.

Key applications of Halal pharmaceuticals span across various therapeutic areas, including pain management, infectious disease treatment, cardiovascular health, and the increasingly important segment of preventative care through certified vitamins and supplements. The rigorous certification process ensures traceability and purity, often requiring specialized sourcing of raw materials, particularly for gelatin alternatives like plant-derived cellulose (HPMC) or bovine sources certified through strict Halal slaughter methods. This focus on ethical sourcing and stringent quality control enhances consumer trust not only within the Muslim community but also among general consumers seeking cleaner, transparent product origins.

The market is primarily driven by the rapid growth of the global Muslim population, which demands compliance with their religious obligations even in essential areas like healthcare. Furthermore, rising awareness regarding the composition of pharmaceutical products, coupled with stronger governmental support for Halal standardization in countries like Malaysia, Indonesia, and the UAE, is fostering market expansion. The increasing accessibility of Halal-certified healthcare products is facilitating greater penetration into emerging economies where adherence to religious doctrines in healthcare choices is paramount.

Halal Pharmaceuticals Market Executive Summary

The Halal Pharmaceuticals market is exhibiting robust growth, driven fundamentally by demographic expansion and the increasing institutionalization of Halal certification processes across major pharmaceutical production centers. Business trends indicate a shift towards strategic partnerships between global pharmaceutical giants and regional Halal certifiers to streamline complex regulatory pathways, particularly concerning excipient replacement technology and supply chain auditing. Investments are heavily focused on research and development into non-animal derived ingredients, particularly alternatives to conventional gelatin capsules and complex excipients that often pose Halal compliance risks, thereby positioning botanical extracts and synthetic compounds as key growth areas.

Regionally, Asia Pacific (APAC), led by Indonesia and Malaysia, dominates the market due to strong regulatory frameworks supporting Halal industries and large Muslim consumer bases. However, the Middle East and Africa (MEA) region remains the highest potential growth area, driven by governmental mandates to secure domestic pharmaceutical supply chains that are fully compliant with Sharia law, particularly in Gulf Cooperation Council (GCC) countries. North America and Europe are growing steadily, primarily through import channels catering to immigrant populations and proactive labeling for ethical consumers, emphasizing the necessity for clear product traceability and internationally recognized certification standards.

Segment trends highlight the strong performance of the nutraceutical and vitamin segment, where consumer choice and preventative health focus make Halal certification highly influential in purchasing decisions. Within finished dosage forms, capsules and tablets represent the largest market share, compelling manufacturers to rapidly adopt HPMC and pullulan substitutes. The market is consolidating around specialized companies that manage the entire Halal integrity process from raw material procurement to final packaging, indicating that vertical integration and robust certification management are critical success factors for sustainable growth in this specialized pharmaceutical niche.

AI Impact Analysis on Halal Pharmaceuticals Market

User queries regarding the impact of Artificial Intelligence (AI) on the Halal Pharmaceuticals market frequently revolve around ensuring religious compliance and accelerating the often-lengthy certification process. Key themes explored by stakeholders include how AI can enhance the traceability of raw materials across complex global supply chains, verify the origin and processing methods of excipients (such as non-porcine gelatin substitutes), and predict potential contamination or non-compliance risks before batch production. Users are also keenly interested in AI’s role in accelerating the discovery of novel, naturally derived, and fully compliant drug compounds, minimizing the reliance on animal testing and potentially Haram substances. The overarching expectation is that AI will introduce unprecedented levels of transparency and efficiency, reducing the cost and time associated with Halal certification while strengthening consumer trust through auditable digital records.

- AI enhances supply chain visibility, using blockchain integration to provide immutable records of every ingredient’s Halal certification status, mitigating fraud risks.

- Accelerated R&D by utilizing Machine Learning (ML) models to screen thousands of compounds and excipients for compliance with Sharia law, focusing on plant-based alternatives.

- Predictive maintenance and quality control systems driven by AI identify potential cross-contamination risks in shared manufacturing facilities, ensuring Halal integrity is maintained.

- Automation of documentation and audit processes reduces the time required for Halal certification issuance, speeding up market entry for new compliant products.

- AI-driven consumer intelligence helps pharmaceutical companies understand specific regional demands for Halal product lines and tailor marketing and distribution strategies effectively.

DRO & Impact Forces Of Halal Pharmaceuticals Market

The market dynamics of Halal Pharmaceuticals are dictated by a delicate balance between escalating consumer demand for ethical products and the significant regulatory hurdles associated with global standardization. The primary drivers include the exponential growth of the global Muslim population, increased disposable income in Muslim-majority regions, and aggressive promotional campaigns by governments in countries aiming to become global Halal hubs. These drivers push manufacturers to invest in Halal compliance, viewing it not just as a religious necessity but as a lucrative market differentiator. The socio-economic impact of these drivers is substantial, forcing major conventional drug manufacturers to adapt their sourcing and production protocols.

Restraints primarily center on the fragmented nature of Halal certification standards across different nations, which complicates international trade and raises manufacturing costs due to the need for multiple certifications. Furthermore, the higher procurement cost of non-Haram certified raw materials, especially specialized excipients and purified animal derivatives, often translates into a premium price for the final product, potentially limiting accessibility in lower-income markets. The perceived complexity of transitioning existing production lines to stringent Halal standards, including the requirement for dedicated or fully sanitized equipment, also acts as a significant impediment to new market entrants.

Opportunities are vast, focusing particularly on emerging markets in Central Asia, Africa, and parts of Europe where the Halal supply chain is underdeveloped. Technological advancements, especially in non-gelatin capsule technologies (HPMC, pullulan), offer scalable solutions to common compliance issues. The strong impact forces driving the market include governmental standardization bodies actively seeking mutual recognition agreements for Halal certification, thereby simplifying cross-border trade and integrating the Halal economy into the global pharmaceutical framework. This movement toward harmonization creates a clearer pathway for global expansion for certified entities.

Segmentation Analysis

The Halal Pharmaceuticals market is systematically segmented based on product type, source of ingredients, and application, allowing for precise market targeting and strategic investment. Products range from complex prescription drugs and vaccines to over-the-counter (OTC) medicines and increasingly popular dietary supplements. The segmentation highlights the critical compliance challenges related to ingredient sourcing, distinguishing between synthetically produced, plant-derived, and animal-derived (certified compliant) components. This rigorous breakdown provides stakeholders with essential data on which segments are experiencing the most rapid adoption of Halal standards and where consumer preference is strongest, particularly noting the high growth rates within the nutraceutical sector due to high consumer consciousness regarding purity.

- By Product Type:

- Ethical Drugs (Prescription drugs)

- Over-the-Counter (OTC) Drugs

- Nutraceuticals and Supplements

- Vaccines

- By Source:

- Plant-derived Ingredients

- Synthetic/Chemical Ingredients

- Animal-derived Ingredients (Must be Halal certified)

- Microbial/Biotechnology Ingredients

- By Formulation/Dosage Form:

- Tablets

- Capsules (Vegetable-based)

- Syrups and Suspensions

- Injections and Vials

- By Application:

- Pain Management and Analgesics

- Cardiovascular Diseases

- Infectious Diseases

- Endocrine and Metabolic Disorders

- Respiratory Diseases

Value Chain Analysis For Halal Pharmaceuticals Market

The Halal Pharmaceuticals value chain begins with the critical upstream segment, focusing intensely on the sourcing and meticulous qualification of raw materials and excipients. Unlike conventional pharmaceuticals, this stage mandates rigorous auditing to ensure all starting materials—whether plant-derived, synthetic, or particularly animal-derived—are compliant with Islamic law and certified by recognized Halal bodies from the point of origin. This specialized sourcing often involves negotiating contracts for non-porcine gelatin alternatives or Halal-certified bovine derivatives, significantly influencing the cost structure and traceability requirements of the finished product. Transparency and verifiable documentation are paramount at this foundational level.

The midstream segment involves manufacturing and production, where operational integrity is highly scrutinized. Halal compliance requires dedicated production lines or stringent cleaning and sanitation protocols (SOPs) to prevent cross-contamination (Najis) with non-compliant substances. Key manufacturing steps, including mixing, encapsulation, and packaging, must be overseen and periodically audited by certification bodies. The integration of technology, such as automated monitoring systems and smart sensors, is increasingly essential to maintain and prove the continuity of Halal integrity throughout the complex transformation process, ensuring final product validity.

The downstream segment encompasses distribution channels, marketing, and retail, all of which require meticulous inventory separation and logistics management to preserve the Halal status. Direct distribution often targets specialized healthcare providers or pharmacies in Muslim-majority countries that prioritize Halal certification. Indirect channels involve wholesalers and global distributors who must adhere to stringent storage and handling conditions. Crucially, the final step involves the continuous renewal of Halal certification and transparent communication of the product’s compliance status to the end-user, often through clear labeling and digital verification tools, thereby closing the loop of trust and traceability with the consumer.

Halal Pharmaceuticals Market Potential Customers

The primary customer base for Halal pharmaceuticals comprises the vast global Muslim community, estimated at over 1.8 billion individuals, who prioritize Sharia-compliant products in all aspects of their lives, including essential healthcare. This segment is highly sensitive to the religious compliance of medicines and actively seeks out certified alternatives to conventional drugs, especially for long-term treatments or chronic conditions where ethical consumption is non-negotiable. Their purchasing decisions are heavily influenced by the endorsement of trusted religious authorities and recognized global Halal certification bodies, making transparent certification a mandatory prerequisite for market acceptance.

Beyond the direct consumer, major potential buyers include government procurement agencies and national healthcare systems in Muslim-majority nations (e.g., GCC, Indonesia, Malaysia). These institutional buyers are increasingly prioritizing Halal certification in their tenders to ensure the drugs supplied meet the needs of their populace, often driven by public policy and national strategic goals to bolster the domestic Halal economy. This B2G segment represents large-volume purchasing opportunities, requiring robust regulatory compliance and stable supply chains from manufacturers.

Furthermore, international aid organizations, charitable foundations, and global nutraceutical and supplement distributors targeting ethical consumer markets represent rapidly growing customer segments. These organizations require Halal-certified inventory to cater to diverse populations worldwide, viewing Halal status as an indicator of high quality, ethical sourcing, and stringent purity standards. The market is also seeing increased demand from general consumers globally who seek plant-based or transparently sourced pharmaceutical products, associating the Halal certification mark with premium quality and ethical manufacturing practices.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 125.5 Billion |

| Market Forecast in 2033 | USD 268.0 Billion |

| Growth Rate | CAGR 11.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Pharmaniaga Berhad, CCM Pharmaceuticals, Serba Dinamik Holdings Berhad, Imedeen, AJ Pharma Holding, Chemical Company of Malaysia Berhad, Boustead Holdings Berhad, Simpor Pharma Sdn Bhd, Sijil Halal Pharmaceutical Services, Halagel (M) Sdn Bhd, Kumpulan Medic Iman Sdn Bhd, Sunward Pharmaceutical, PT Kalbe Farma Tbk, Zydus Cadila, Hovid Berhad, YSP Industries, Duopharma Biotech, Mega Lifesciences, Sterling Drug, Halal Industry Development Corporation (HDC) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Halal Pharmaceuticals Market Key Technology Landscape

The technological landscape in the Halal Pharmaceuticals market is heavily focused on overcoming the challenges associated with replacing conventional non-compliant ingredients and ensuring absolute transparency in manufacturing processes. A paramount technology is the widespread adoption of Hydroxypropyl Methylcellulose (HPMC) and pullulan as alternatives to porcine or non-certified bovine gelatin in capsule manufacturing. These plant-derived capsule shells offer equivalent functionality while being inherently compliant, driving significant capital investment into scalable production facilities for these substitutes. Furthermore, microencapsulation techniques are being refined to protect sensitive Halal ingredients and ensure precise drug delivery without compromising ethical sourcing.

Advanced analytical and verification technologies play a crucial role in maintaining Halal integrity. Modern High-Performance Liquid Chromatography (HPLC) and Mass Spectrometry (MS) are increasingly utilized to test final products and excipients for trace amounts of non-compliant materials, such as specific alcohol residues or porcine DNA markers. This rigorous quality assurance necessitates sophisticated laboratory infrastructure and expertise. Simultaneously, synthetic biology is emerging as a critical field, enabling the engineered production of complex drug molecules and proteins using non-animal, microbial fermentation processes, offering a path to producing completely compliant active pharmaceutical ingredients (APIs) and minimizing sourcing risks.

Crucially, the implementation of distributed ledger technology (Blockchain) is rapidly gaining traction for supply chain management within the Halal sector. Blockchain offers an immutable, transparent record of every transition—from raw material harvest or synthesis to final distribution—including verification timestamps from Halal certification bodies at each stage. This digital traceability enhances consumer trust and satisfies regulatory demands for auditability, effectively neutralizing concerns about material substitution or cross-contamination during transport and storage. The integration of IoT sensors within the supply chain further reinforces this transparency by monitoring environmental conditions relevant to product integrity.

Regional Highlights

- Asia Pacific (APAC): Dominates the Halal Pharmaceuticals market both in terms of consumer base and manufacturing capacity. Countries like Indonesia and Malaysia are global leaders, driven by proactive government policies (e.g., mandatory Halal certification in Indonesia by 2024 for certain products) and strong domestic demand. This region is a major hub for R&D into plant-derived excipients and is heavily investing in large-scale Halal industrial parks.

- Middle East and Africa (MEA): Represents the fastest-growing region, characterized by high religious adherence and strong government-led initiatives to achieve pharmaceutical self-sufficiency while maintaining strict Halal standards. GCC countries, particularly Saudi Arabia and the UAE, are importing significant volumes of certified products and investing heavily in local manufacturing capabilities to serve regional Muslim populations and establish themselves as Halal trade gateways.

- Europe: Growth is primarily fueled by the substantial Muslim diaspora and rising ethical consumerism. The European market focuses heavily on imports of certified products and stringent regulatory checks on ingredients. Certification harmonization with major Halal standard bodies (like those in Malaysia or Indonesia) is a key challenge, often requiring dual or tripartite certification for market entry.

- North America: A growing market driven by increasing awareness and the efforts of organizations to standardize Halal certification for pharmaceutical products aimed at the North American Muslim community. Demand is strong for Halal nutraceuticals and supplements, reflecting a broader trend towards ethical and clean-label products.

- Latin America: Currently a minor market share, but represents significant future potential due to rising trade relations with MEA and APAC countries. Efforts are underway to establish local Halal certification bodies and leverage agricultural resources for plant-based excipient production, positioning it as a potential sourcing region for certified raw materials.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Halal Pharmaceuticals Market.- Pharmaniaga Berhad

- CCM Pharmaceuticals

- Duopharma Biotech Berhad

- AJ Pharma Holding

- Halagel (M) Sdn Bhd

- Simpor Pharma Sdn Bhd

- Hovid Berhad

- PT Kalbe Farma Tbk

- Kumpulan Medic Iman Sdn Bhd

- Sterling Drug Private Limited

- YSP Industries (M) Sdn Bhd

- Sunward Pharmaceutical Sdn Bhd

- Mega Lifesciences Public Company Limited

- Fuji Gelatin (Supplier focusing on certified sourcing)

- Capsugel (Now Lonza) (Key player in HPMC capsule technology)

- Achelios Therapeutics

- Zydus Cadila

- Abbott Laboratories (Developing Halal certified product lines)

- Sanofi (Strategic interest in Halal vaccine production)

- Novartis AG (Exploration of Halal compliant supply chains)

Frequently Asked Questions

Analyze common user questions about the Halal Pharmaceuticals market and generate a concise list of summarized FAQs reflecting key topics and concerns.What criteria define a Halal pharmaceutical product?

A Halal pharmaceutical product must be entirely free from prohibited substances (Haram) such as porcine derivatives, alcohol, or ingredients from animals not slaughtered according to Sharia law. Crucially, the manufacturing process, equipment, storage, and handling must also prevent contamination (Najis) from non-compliant materials, requiring rigorous certification and auditing throughout the value chain.

Why is the replacement of gelatin capsules a major challenge in the Halal pharmaceuticals market?

Gelatin, primarily sourced from bovine or porcine hides, is extensively used in conventional capsule manufacturing due to its efficacy and low cost. Porcine gelatin is strictly prohibited, while certified bovine gelatin is expensive and often complicated to source globally. This drives manufacturers to adopt plant-based alternatives like HPMC (Hypromellose), which requires retooling and validated stability testing.

Which regulatory bodies are most influential in establishing global Halal pharmaceutical standards?

Key influential bodies include the Halal Industry Development Corporation (HDC) in Malaysia, Majelis Ulama Indonesia (MUI), and the Emirates Authority for Standardization and Metrology (ESMA) in the UAE. These organizations work towards mutual recognition agreements (MRA) to harmonize diverse national standards, thereby facilitating international trade and reducing compliance complexity for global manufacturers.

How does blockchain technology improve Halal integrity in the pharmaceutical supply chain?

Blockchain technology provides a decentralized, immutable ledger that tracks and verifies the Halal certification status of every raw material and production step from origin to consumer. This digital transparency ensures auditability, prevents fraudulent substitution of materials, and guarantees that the product’s Halal integrity has been maintained across international borders and multiple handlers, bolstering consumer trust.

What is the primary factor driving market growth in the Middle East and Africa (MEA) region?

The primary growth factor in MEA is strong governmental commitment, particularly in GCC countries, to achieve healthcare security and self-sufficiency using entirely Sharia-compliant supply chains. This is combined with high discretionary spending capacity and a rapidly growing population that demands ethical consumption, fueling both local production and specialized imports of Halal-certified medicines and nutraceuticals.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager