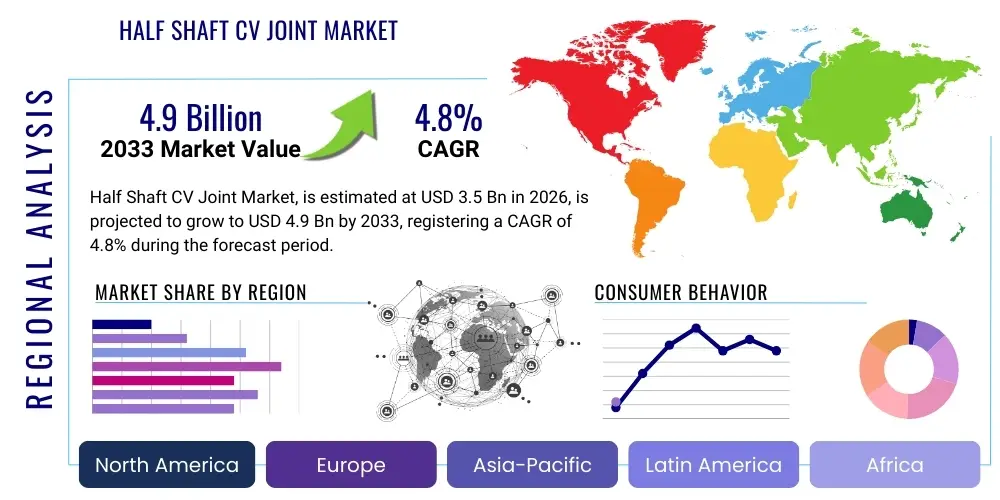

Half Shaft CV Joint Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438663 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Half Shaft CV Joint Market Size

The Half Shaft CV Joint Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at $3.5 Billion in 2026 and is projected to reach $4.9 Billion by the end of the forecast period in 2033.

Half Shaft CV Joint Market introduction

The Half Shaft Constant Velocity (CV) Joint Market encompasses the manufacturing and distribution of specialized mechanical components critical for transmitting torque and rotational motion from the differential or transaxle to the wheels at a constant speed, regardless of the operating angle or suspension movement. These joints are essential for vehicles with independent suspension systems, ensuring smooth power delivery while accommodating the constantly changing geometric relationship between the gearbox and the wheel hub. The increasing complexity of modern vehicle architectures, particularly the rise of All-Wheel Drive (AWD) and electric vehicles (EVs), fundamentally drives demand for high-performance, lightweight CV joint assemblies.

CV joints, forming a key part of the half shaft assembly, are segmented primarily into fixed (outboard) joints and plunging (inboard) joints. Fixed joints handle the large steering angles required by the wheels, while plunging joints accommodate the axial length variation caused by suspension travel. Major applications span the entire automotive sector, including passenger cars, light commercial vehicles (LCVs), and, increasingly, heavy-duty electric trucks requiring robust torque management systems. The integration of advanced materials, such as high-strength steel alloys and lightweight aluminum components, is a pivotal trend aimed at reducing unsprung weight and improving fuel efficiency or extending battery range in EVs.

Key driving factors accelerating market expansion include the consistent recovery and expansion of global automotive production volumes, particularly in the Asia Pacific region, coupled with the mandatory adoption of independent suspension systems across newer vehicle models. Furthermore, the global regulatory push towards stricter emission standards is inadvertently boosting the market for optimized, low-friction drivetrain components, wherein high-efficiency CV joints play a critical role. The robustness, durability, and precise engineering of half shaft CV joints are non-negotiable requirements for ensuring vehicle safety and reliability, sustaining their central position within the automotive supply chain.

Half Shaft CV Joint Market Executive Summary

The global Half Shaft CV Joint Market is characterized by a stable growth trajectory, largely insulated by the sustained demand for new vehicles and the substantial replacement cycle inherent in the aftermarket sector. Current business trends indicate a strong pivot toward engineering solutions suitable for Electric Vehicles (EVs), necessitating CV joints capable of handling instantaneous, high torque loads and operating quietly across high-speed ranges. Suppliers are focusing intensely on noise, vibration, and harshness (NVH) reduction technologies, alongside significant investments in lightweighting materials like composite elements and specialized forged steel, which address both performance and regulatory requirements regarding vehicle efficiency and weight reduction.

Regional trends highlight the dominance of the Asia Pacific (APAC) region, specifically China, India, and Japan, which serve as global manufacturing hubs and possess the highest volumes of vehicle production and sales. This region is expected to maintain the fastest growth rate due to rapid industrialization, expanding middle-class income, and governmental support for the automotive sector. Conversely, North America and Europe demonstrate mature market characteristics but lead in technological innovation, particularly concerning advanced joint designs for premium segments and early adoption of EV-specific drivetrain components. Market players are strategically expanding manufacturing capacity within APAC to capitalize on lower operational costs and proximity to major Original Equipment Manufacturers (OEMs).

Segmentation trends confirm that the OEM channel remains the largest revenue contributor, driven by large volume procurement contracts and stringent quality specifications for new vehicle assembly. However, the Aftermarket segment is registering robust growth, fueled by the rising average age of vehicles on the road, increasing mileage accumulation, and consumer preference for high-quality replacement parts, which often match or exceed OEM specifications. By product type, plunging CV joints are seeing enhanced development focused on greater axial movement capacity, a necessity for many modern SUV and CUV platforms with extensive suspension travel, ensuring stability and driving comfort across varied terrains.

AI Impact Analysis on Half Shaft CV Joint Market

User queries regarding the integration of Artificial Intelligence (AI) in the Half Shaft CV Joint Market predominantly center on three core areas: how AI can enhance manufacturing precision and reduce defect rates; the role of machine learning in optimizing supply chain logistics for complex component sourcing; and the application of predictive analytics for maintenance in high-stakes commercial vehicle applications. Users are keen to understand how AI-driven quality inspection systems (using machine vision and deep learning) can guarantee the tight tolerances required for NVH minimization, particularly as torque loads increase in performance vehicles and EVs. Furthermore, there is significant interest in how AI algorithms can predict wear patterns based on real-time vehicle data, thus improving the lifecycle and reliability of half shaft assemblies, transforming the traditional approach to aftermarket service and warranty management.

- AI-driven Predictive Maintenance: Utilizing sensor data and machine learning algorithms to predict CV joint failure before critical breakdown, optimizing vehicle uptime, especially in commercial fleets.

- Manufacturing Quality Control (QC): Implementation of AI-powered vision systems for 100% inspection of critical joint surfaces, dimensions, and material composition, drastically reducing manufacturing defects and ensuring high precision necessary for NVH reduction.

- Supply Chain Optimization: AI algorithms managing complex global supply chains, forecasting demand fluctuations for steel alloys, boots, and lubricants, thereby minimizing inventory costs and mitigating potential production bottlenecks.

- Design Optimization: Generative design tools using AI to simulate stress, fatigue, and thermal loads on new CV joint designs, leading to lightweight, high-performance components specifically tailored for high-torque electric powertrains.

- Autonomous Vehicle Integration: Ensuring component reliability and long service life required by autonomous vehicle platforms where maintenance needs to be planned far in advance and component robustness is paramount.

DRO & Impact Forces Of Half Shaft CV Joint Market

The Half Shaft CV Joint Market is primarily propelled by structural drivers within the automotive sector, counterbalanced by persistent manufacturing restraints, while technological evolution opens significant opportunities. The primary driver is the ongoing global surge in demand for SUVs and CUVs, which often utilize complex AWD or 4WD systems requiring multiple, robust CV joint assemblies per vehicle. Simultaneously, the accelerating transition toward electric vehicles (EVs) mandates redesigned half shafts capable of handling the instantaneous, high torque delivery characteristic of electric motors, pushing manufacturers to innovate rapidly in material science and joint geometry. These powerful drivers are creating significant volume demand and technical challenges simultaneously.

However, the market faces significant restraints, chiefly concerning volatile raw material costs, particularly high-grade steel and specialized lubricants, which heavily influence overall production economics and pricing stability, especially in the highly competitive aftermarket sector. Furthermore, the inherent complexity in eliminating Noise, Vibration, and Harshness (NVH) issues associated with high-speed rotation and varying angles requires extremely tight manufacturing tolerances, increasing production complexity and capital expenditure. Regulatory pressures regarding environmental compatibility of materials and manufacturing processes also add to operational costs.

Opportunities are emerging through the adoption of innovative lightweighting strategies, including using high-strength aluminum and carbon fiber composites for the shaft itself, drastically reducing inertia and improving overall vehicle efficiency. The development of modular, high-angle CV joint designs that simplify installation and maintenance presents a strong growth avenue, particularly for aftermarket sales. Impact forces such as supplier consolidation, stringent OEM performance standards, and the rapid pace of EV drivetrain architecture changes are profoundly influencing market structure, necessitating continuous investment in research and development to maintain competitive advantage and meet evolving torque and speed requirements.

Segmentation Analysis

The global Half Shaft CV Joint Market is comprehensively segmented based on product type, vehicle type, application, and sales channel, providing a nuanced view of market dynamics and revenue streams. Understanding these segments is crucial for strategic planning, as distinct requirements exist for each category—for instance, high-performance vehicles demand specialized fixed joints, while commercial vehicles prioritize durability and long service life. The market segmentation reflects the varied technological needs driven by vehicle design architecture (FWD, RWD, AWD) and the dual necessity of supplying both the original equipment manufacturers (OEMs) and the growing maintenance and repair sector (Aftermarket). Analysis of these segments indicates that the shift towards AWD/4WD systems in CUVs is currently the most significant structural factor influencing volume demand across all segments.

- By Joint Type:

- Fixed CV Joint (Outboard)

- Plunging CV Joint (Inboard)

- By Vehicle Type:

- Front-Wheel Drive (FWD)

- Rear-Wheel Drive (RWD)

- All-Wheel Drive / Four-Wheel Drive (AWD/4WD)

- By Application/End-Use:

- Passenger Cars

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- Electric Vehicles (EVs)

- By Sales Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket

Value Chain Analysis For Half Shaft CV Joint Market

The value chain for the Half Shaft CV Joint Market begins with the upstream sourcing of critical raw materials, primarily high-grade forged steel alloys (such as Chromium-Molybdenum steel) and specialized rubber or thermoplastic elastomers for the protective boots, alongside high-performance lubricants. Manufacturing activities involve complex processes including precision forging, machining, heat treatment, grinding, and assembly, requiring significant capital investment in advanced machinery capable of maintaining micro-level tolerances necessary for the high rotational speeds and torque demands. The performance and durability of the final product are highly dependent on the quality of the upstream materials and the precision of the forging and heat-treating phases.

Downstream activities center around distribution, which is bifurcated into two primary channels. The Direct Channel involves supplying finished half shaft assemblies directly to Original Equipment Manufacturers (OEMs) for integration into new vehicle production lines. This channel demands just-in-time delivery, exceptional quality compliance, and often involves long-term strategic contracts between Tier 1 suppliers and major global automakers. The Indirect Channel, or Aftermarket, involves distribution through independent parts distributors, wholesalers, retailers, and ultimately, independent repair shops or franchise dealerships for replacement parts. This channel relies heavily on inventory management, brand recognition, and competitive pricing strategies to serve the repair and maintenance sector efficiently.

The complexity in the midstream manufacturing phase acts as a significant barrier to entry, ensuring the market remains dominated by a few global Tier 1 suppliers with the scale and technological capability to meet OEM specifications globally. Profit margins are often higher in the Aftermarket for specialized, reliable replacement units, whereas the OEM segment is highly volume-driven and competitive. Effective logistics management across the entire chain is crucial due to the weight and size of the components and the global nature of both material sourcing and end-user markets.

Half Shaft CV Joint Market Potential Customers

The primary customer base for the Half Shaft CV Joint Market is segmented into high-volume institutional buyers (OEMs) and fragmented service-oriented buyers (Aftermarket). Automotive Original Equipment Manufacturers (OEMs) represent the largest segment, including global vehicle assemblers such as General Motors, Volkswagen Group, Toyota, Hyundai, and Ford. These customers purchase half shaft assemblies in massive quantities directly from Tier 1 suppliers like GKN, NTN, and ZF, demanding custom specifications, strict quality assurance (ISO/TS 16949 compliance), and integration services tailored to specific vehicle platforms and powertrain characteristics, particularly for newer EV and high-performance applications.

The second major category involves the independent automotive service sector and wholesale distributors catering to the replacement market. This includes national and regional auto parts retailers (e.g., AutoZone, Advance Auto Parts), independent wholesale distributors, and thousands of small-to-medium-sized repair garages and workshops. These buyers prioritize product availability, competitive pricing, broad application coverage across different vehicle models, and reliability backed by extensive warranty programs. As vehicles age and accumulate mileage, the need for replacement CV joints increases, making this segment a resilient and steadily growing source of revenue, often characterized by different purchasing criteria than the stringent demands of the initial OEM fitment.

A rapidly emerging customer group includes specialized performance and motorsports vehicle manufacturers and modification shops, which require ultra-high-performance, custom-engineered CV joints capable of handling extreme torque loads far exceeding standard road car specifications. Furthermore, fleet operators of large commercial vehicle fleets (trucking, logistics, public transport) are increasingly potential customers, relying on advanced diagnostic and maintenance services that require durable, long-life CV joint components to minimize operational downtime and total cost of ownership.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $3.5 Billion |

| Market Forecast in 2033 | $4.9 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | GKN Automotive, NTN Corporation, ZF Friedrichshafen AG, JTEKT Corporation, Dana Incorporated, Hyundai WIA, IFA Rotorion, Nexteer Automotive, Meritor, Wanxiang Group, Showa Corporation, American Axle & Manufacturing (AAM), SDS Group, SKF, RAPA, Trelleborg, Continental AG, BorgWarner, Mando Corporation, Linamar Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Half Shaft CV Joint Market Key Technology Landscape

The technological landscape of the Half Shaft CV Joint Market is rapidly evolving, driven primarily by the automotive industry’s dual mandates for electrification and weight reduction. A primary technological focus is on lightweighting the assembly without compromising torsional strength or durability. Manufacturers are achieving this through the substitution of traditional steel half shafts with advanced materials, including high-strength, thin-walled tubular steel, or even composite materials like carbon fiber reinforced polymers (CFRP) in performance applications. This material innovation is crucial for EVs, where every kilogram saved translates directly into increased battery range and improved energy efficiency, simultaneously addressing the need for components that can handle the increased complexity of regenerative braking systems.

Another significant area of advancement is the development of next-generation CV joint geometries and grease formulations aimed at minimizing internal friction and optimizing high-angle capability. The increasing complexity of modern suspension systems, particularly in CUVs and SUVs, demands joints capable of operating smoothly at larger articulation angles without inducing significant vibration or noise. Low-friction designs, such as specialized ball bearings and cage structures, along with synthetic high-performance greases, are being utilized to reduce heat generation and parasitic loss, contributing positively to vehicle fuel economy or battery life. NVH performance remains paramount, leading to sophisticated balancing and dampening technologies integrated into the overall shaft assembly.

Furthermore, Industry 4.0 methodologies, including highly automated manufacturing processes and sophisticated digital twinning, are being deployed to ensure the hyper-precision required for modern CV joints. The integration of non-contact measurement systems and robotic assembly guarantees the tightest tolerances, which are non-negotiable for high-speed applications where vibration minimization is key. The transition to integrated modular designs, where the CV joint, half shaft, and potentially the wheel bearing are supplied as a pre-assembled unit, also simplifies OEM assembly and enhances reliability, marking a major trend in streamlining the manufacturing and installation process across the entire supply chain.

Regional Highlights

The Asia Pacific (APAC) region stands as the undisputed epicenter of the global Half Shaft CV Joint Market, commanding the largest market share and demonstrating the fastest projected growth rate throughout the forecast period. This dominance is attributed to the presence of high-volume automotive production bases in countries like China, India, and Japan, which cater both to massive domestic demand and serve as global export hubs. The rapid expansion of local automotive manufacturing capacity, coupled with the mass adoption of vehicles by an expanding middle class, ensures continuous demand for both OEM fitment and aftermarket replacements. The increasing proliferation of electric vehicles, particularly in China, further accelerates the need for advanced, EV-specific half shaft designs, cementing APAC’s leading role in volume and scale.

Europe and North America represent mature markets characterized by high technological standards and significant demand for premium and specialized components. In Europe, the market is strongly influenced by stringent environmental regulations and the early, aggressive push toward vehicle electrification. This drives demand for technologically superior, lightweight, and high-efficiency CV joints capable of managing the specialized demands of performance EVs and high-end luxury vehicles. North America, characterized by a heavy reliance on light trucks, SUVs, and large CUVs, maintains high volume demand, especially for robust AWD/4WD systems, which require complex half shaft assemblies, ensuring sustained revenue generation in both the OEM and replacement segments.

Latin America and the Middle East & Africa (MEA) currently hold smaller market shares but offer substantial long-term growth potential. Latin American markets are driven by recovering automotive production volumes, particularly in Brazil and Mexico, focusing predominantly on cost-effective, durable components suitable for local economic conditions. MEA markets are characterized by a growing vehicle parc and high demand for aftermarket components due to challenging road conditions and a focus on vehicle longevity. Investment in localized manufacturing or strategic partnerships with global suppliers will be crucial for capturing the emerging market opportunities within these regions.

- Asia Pacific (APAC): Dominates the market size due to massive vehicle production volumes, centralized manufacturing capabilities, and rapid adoption of affordable and high-volume electric vehicles, particularly in China and India.

- Europe: Leading in technology adoption, driven by stringent emission standards and the high penetration rate of premium and performance electric vehicles, requiring lightweight and low-friction CV joint solutions.

- North America: Strong, consistent demand fueled by the high sales volume of large SUVs, CUVs, and light trucks, necessitating robust and highly durable components for AWD and 4WD powertrains.

- Latin America: Emerging market with growth tied to economic recovery and local production, focusing on durability and cost-efficiency in replacement parts.

- Middle East & Africa (MEA): Growth driven by infrastructure development, expanding vehicle fleet, and significant demand for reliable aftermarket parts due to severe operating environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Half Shaft CV Joint Market.- GKN Automotive

- NTN Corporation

- ZF Friedrichshafen AG

- JTEKT Corporation

- Dana Incorporated

- Hyundai WIA

- IFA Rotorion

- Nexteer Automotive

- Meritor

- Wanxiang Group

- Showa Corporation

- American Axle & Manufacturing (AAM)

- SDS Group

- SKF

- RAPA

- Trelleborg

- Continental AG

- BorgWarner

- Mando Corporation

- Linamar Corporation

Frequently Asked Questions

Analyze common user questions about the Half Shaft CV Joint market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the growth of the Half Shaft CV Joint Market?

Market growth is primarily driven by the sustained global increase in automotive production, particularly the rising consumer preference for SUVs and CUVs which frequently utilize AWD/4WD systems. Additionally, the mandated shift towards electric vehicles (EVs) necessitates new, high-performance joints capable of managing intense, instantaneous electric motor torque.

How is the adoption of Electric Vehicles impacting the design of CV joints?

EVs demand specialized CV joints engineered for low NVH (Noise, Vibration, and Harshness), higher operational speeds, and capacity to handle immediate, high torque delivery from electric motors. This necessitates lightweight materials like high-strength steel and aluminum, along with low-friction geometries, to maximize battery range and efficiency.

Which region holds the largest market share for Half Shaft CV Joints?

The Asia Pacific (APAC) region currently holds the largest market share due to its status as the world’s largest automotive manufacturing hub, driven by high volume production in countries like China, India, and Japan, catering to massive domestic and global export demand.

What are the key technological trends affecting CV joint manufacturing?

Key trends include advanced lightweighting technologies using high-strength alloys and composites to reduce unsprung mass; the development of high-angle, low-friction joint designs for improved driving dynamics; and the implementation of Industry 4.0 automation for ensuring ultra-precise manufacturing tolerances crucial for NVH performance.

What is the difference in demand between the OEM and Aftermarket segments?

The OEM segment provides the largest volume demand based on new vehicle production, focusing on stringent technical specifications and long-term contracts. The Aftermarket segment provides resilient growth driven by vehicle aging and replacement cycles, prioritizing parts availability, competitive cost, and reliability for repair and maintenance purposes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager