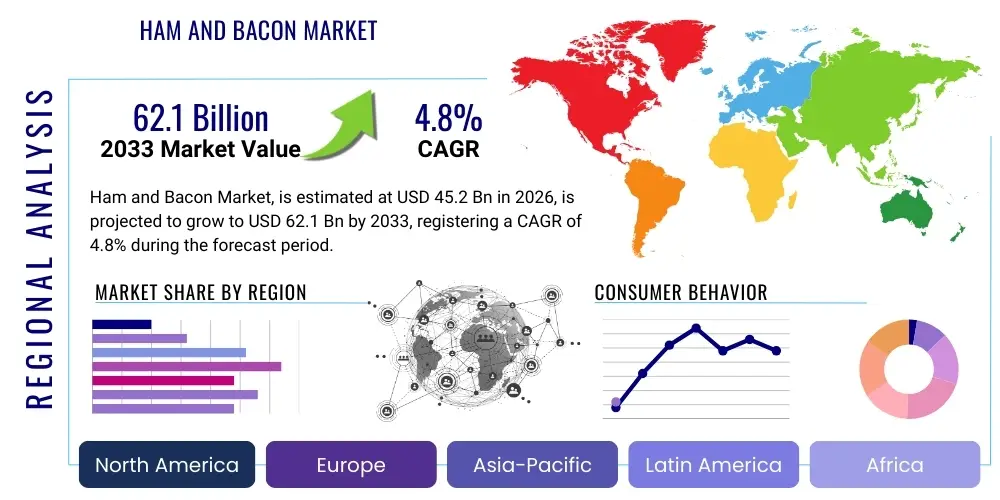

Ham and Bacon Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438239 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Ham and Bacon Market Size

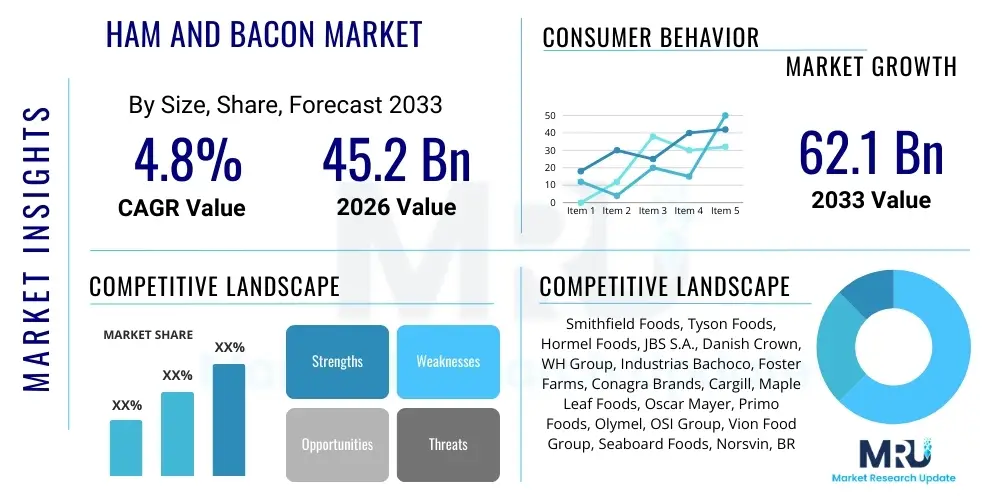

The Ham and Bacon Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 45.2 Billion in 2026 and is projected to reach USD 62.1 Billion by the end of the forecast period in 2033. This consistent expansion is underpinned by sustained demand for processed protein products, driven by rising global population, increasing urbanization, and the pervasive need for convenient meal solutions suitable for fast-paced modern lifestyles. The market size reflects the combined value of both retail sales and the extensive foodservice sector utilizing ham and bacon across diverse culinary applications.

Ham and Bacon Market introduction

The Ham and Bacon Market encompasses the production, distribution, and consumption of processed pork products derived primarily from hog meat, differentiated by curing methods, cuts, and flavor profiles. Ham, typically sourced from the leg cut, and bacon, primarily derived from the belly or back, represent foundational categories within the global meat processing industry, serving as essential ingredients across breakfast, lunch, and dinner segments. Products range from mass-market, highly processed options to premium, artisanal, dry-cured varieties, reflecting significant regional preferences and technological advancements in preservation and flavor enhancement.

Major applications of ham and bacon span across direct consumer purchases for home cooking, extensive use in Quick Service Restaurants (QSRs), Casual Dining Establishments (CDEs), and industrial applications such as pre-packaged sandwiches, ready-to-eat meals, and frozen foods. The inherent versatility, appealing savory flavor profile, and high protein content position these products favorably among consumers seeking readily available sources of sustenance. Furthermore, evolving dietary trends, including the popularity of high-protein and ketogenic diets, continue to bolster consumption, counteracting some of the historical scrutiny related to fat and sodium content.

Key driving factors fueling market expansion include robust growth in emerging economies, where Western dietary habits are increasingly adopted, leading to higher per capita meat consumption. Technological innovations in packaging, such as modified atmosphere packaging (MAP) and vacuum sealing, have extended product shelf life, facilitating broader distribution across complex supply chains. Moreover, manufacturers are capitalizing on opportunities through product diversification, introducing nitrite-free, lower-sodium, and plant-based alternatives to cater to health-conscious segments and market niches focused on clean label attributes, ensuring the market's resilience and continued growth trajectory.

Ham and Bacon Market Executive Summary

The Ham and Bacon Market is experiencing structural shifts driven by a combination of evolving business trends, distinct regional growth patterns, and dynamic segment performance. Current business trends emphasize supply chain resilience and sustainability, necessitating robust traceability systems and investments in automated processing technologies to enhance efficiency and maintain consistent product quality amidst volatile raw material pricing. A significant trend involves the strategic acquisition of smaller, artisanal producers by larger corporations, aiming to integrate premium, niche product lines into their mass-market portfolios and capture the rapidly growing demand for specialty and regionalized meat products, thereby achieving synergistic competitive advantages and expanding market reach across diverse consumer touchpoints.

Regionally, the market exhibits mature stability in North America and Western Europe, characterized by consumer emphasis on ethical sourcing, animal welfare standards, and premiumization, leading to higher average selling prices for specific certifications like Organic or PGI-labeled products. Conversely, the Asia Pacific (APAC) region stands out as the primary growth engine, fueled by rapid urbanization, substantial increases in disposable income, and the adoption of Western diets, particularly within high-population centers in China and Southeast Asia. Latin America also shows promising growth potential, driven by domestic consumption and strong export capabilities, positioning it as a key sourcing hub for global demand, while the Middle East and Africa (MEA) remain smaller but developing markets sensitive to pricing and import logistics.

Segment trends reveal accelerated growth within the ready-to-eat (RTE) category, where pre-cooked bacon and packaged ham slices offer unparalleled convenience for consumers. The foodservice segment, particularly Quick Service Restaurants (QSRs), continues to be a massive consumer, leveraging ham and bacon for standardized menu items. Furthermore, within product types, uncured or "naturally cured" products (often using vegetable extracts) are gaining market share, reflecting the consumer shift towards perceiving products with fewer synthetic additives as healthier. Conversely, traditional cured products maintain dominance, especially in regions with deep cultural affiliations to specific processing techniques, ensuring a balanced but competitive segmentation landscape focused heavily on innovation in flavor, texture, and preservation methods.

AI Impact Analysis on Ham and Bacon Market

User inquiries regarding the influence of Artificial Intelligence (AI) in the Ham and Bacon Market primarily center on operational efficiency, quality assurance, and predictive supply chain management. Common questions explore how AI algorithms can optimize livestock feeding schedules to improve meat yield and quality (specifically leanness and marbling), whether AI-driven imaging systems can accurately grade and sort processed cuts faster than manual inspection, and the effectiveness of predictive analytics in mitigating risks associated with pork disease outbreaks or sudden shifts in commodity prices. Users also frequently express interest in AI’s role in personalized product development, particularly how data analysis can inform flavor trends, ingredient combinations, and targeted marketing campaigns for specialty products like artisanal ham or flavored bacon, highlighting a strong focus on both production optimization and consumer relevance.

The immediate impact of AI is most evident in the optimization of complex logistics and processing flows within large slaughterhouses and processing plants. AI-powered sorting machines utilize computer vision to grade hams and bacon cuts based on specific criteria (e.g., fat-to-meat ratio, size, visual defects) with speed and consistency far exceeding human capacity, thus minimizing waste and ensuring uniform quality across production batches. Furthermore, predictive maintenance programs leverage sensor data collected from industrial machinery, such as slicers and packaging equipment, to anticipate potential failures, reducing unplanned downtime and significantly increasing overall equipment effectiveness (OEE), critical for maintaining the high throughput required in this large-scale market.

In the consumer-facing domain, AI is transforming demand forecasting, allowing manufacturers and retailers to better predict fluctuations in seasonality and promotional effectiveness, optimizing inventory levels and reducing spoilage—a major cost factor in fresh and processed meat sectors. Advanced machine learning models analyze vast datasets encompassing everything from weather patterns and social media sentiment to macroeconomic indicators to fine-tune production schedules. This data-driven approach allows for more agile response to market dynamics, enabling processors to quickly adjust production volumes of specific cuts or flavor profiles, such as seasonal specialty bacons or limited-edition cured hams, maximizing revenue while minimizing risk associated with perishable inventory management.

- AI-driven Computer Vision enhances quality control and automated grading of meat cuts, ensuring consistency.

- Machine Learning algorithms optimize livestock management, feed formulation, and projected yield metrics.

- Predictive analytics improves demand forecasting, reducing inventory waste and optimizing cold chain logistics.

- AI facilitates supply chain transparency and traceability, crucial for managing disease outbreaks and regulatory compliance.

- Robotics integrated with AI systems increases speed and hygiene in slicing, processing, and packaging operations.

DRO & Impact Forces Of Ham and Bacon Market

The Ham and Bacon Market is shaped by a confluence of powerful Drivers, significant Restraints, and evolving Opportunities (DRO), which collectively form the Impact Forces determining its future trajectory. Key drivers include the global demand for affordable and readily available protein sources, coupled with the rising popularity of convenience foods that prominently feature ham and bacon as foundational ingredients, particularly in the breakfast and sandwich sectors. Opportunities are largely concentrated in product premiumization through clean label initiatives, the introduction of certified sustainable products, and expansion into rapidly growing foodservice markets in developing nations, leveraging advanced cold chain infrastructure to penetrate new geographic regions effectively. These forces create a dynamic environment where innovation in preservation and flavor is paramount for sustaining competitive advantage against alternative protein sources.

Restraints, however, pose persistent challenges to sustained growth. Primary among these are growing consumer health concerns regarding the high sodium, saturated fat, and nitrate content associated with traditionally cured meats, leading to increased scrutiny and regulatory pressure, particularly in European markets. Furthermore, the market faces intense competition from plant-based meat substitutes, which are aggressively marketed toward environmentally conscious and flexitarian consumers. Operational risks, such as high volatility in global feed prices and the constant threat of animal disease outbreaks (like African Swine Fever), significantly disrupt the raw material supply chain, necessitating complex risk management strategies and substantial investment in biosecurity measures across all stages of production.

The Impact Forces manifest through shifts in consumer preference and regulatory mandates. The driving forces compel processors to invest in research and development aimed at healthier formulations, resulting in low-sodium and nitrite-free product lines that address restraint concerns. Simultaneously, opportunities around international trade expansion necessitate stringent adherence to diverse food safety and quality standards, turning global logistics into a critical competitive battlefield. The overall market equilibrium is maintained by balancing cost efficiency derived from large-scale automation (a major driver) with the need for transparency and ethical sourcing (addressing restraints), creating a market that rewards adaptable companies capable of navigating both economic efficiency and increasing social accountability demands.

Segmentation Analysis

The Ham and Bacon Market is segmented based on product type, processing technique, distribution channel, and application, allowing for a detailed analysis of specific growth pockets and competitive dynamics. The segmentation reflects both traditional processing methods and modern consumer demands for convenience and health-consciousness, illustrating a complex market where traditional cured products coexist with technologically advanced alternatives. This granular approach helps manufacturers tailor their production, marketing, and distribution strategies to effectively target distinct consumer demographics and exploit regional variations in culinary preferences and purchasing habits, ensuring optimized resource allocation across the product portfolio.

- By Product Type:

- Ham (Cured Ham, Uncured Ham, Ready-to-Eat Ham)

- Bacon (Streaky Bacon, Back Bacon, Side Bacon, Ready-to-Eat Bacon)

- By Processing Type:

- Smoked

- Cured (Dry Cured, Wet Cured)

- Fresh/Uncured

- By Distribution Channel:

- Food Service/HORECA (Hotels, Restaurants, Cafes)

- Retail (Supermarkets/Hypermarkets, Convenience Stores, Online Retail)

- By Application:

- Breakfast/Snacks

- Main Course/Sandwiches

- Ingredient in Ready Meals

- By Origin:

- Conventional Pork

- Organic Pork

- Free-Range/Certified Pork

Value Chain Analysis For Ham and Bacon Market

The Ham and Bacon Market value chain is characterized by multiple intensive stages, starting with upstream activities focused heavily on hog farming and feed production. Upstream analysis involves the procurement of high-quality livestock, where genetics, feed costs, and stringent biosecurity measures are paramount, as these factors directly dictate the quality and yield of the final processed product. Volatility in global commodity markets (especially corn and soy used in feed) significantly impacts processor profitability. The efficiency and scale of specialized slaughterhouses and initial processing facilities, which break down carcasses into primary cuts, establish the foundation for all subsequent value addition steps, requiring substantial capital investment and strict adherence to food safety regulations.

The core processing stage involves midstream activities such as curing, smoking, slicing, and packaging, where the majority of product differentiation occurs. This stage utilizes specialized technologies, including automated brine injectors, large-scale smokehouses, and precision slicers, to achieve standardized final products. Distribution is a critical component, managing the cold chain from processing plants to final consumers. Distribution channels are bifurcated into direct sales to large institutional buyers (such as major QSR chains), which demand bulk, customized specifications, and indirect channels relying on third-party logistics (3PL) providers and wholesale distributors to service retail outlets and smaller foodservice operations. The effectiveness of the cold chain is non-negotiable, given the perishable nature of the products, dictating shelf life and market reach.

Downstream analysis focuses on the final consumption points: retail (supermarkets, online platforms) and the vast foodservice sector. Direct distribution to major retailers involves intensive promotional activities and shelf space management, while indirect distribution leverages wholesalers and specialized food brokers to penetrate regional markets and independent stores. Online retail is gaining momentum, particularly for premium and specialty ham and bacon products that rely on optimized last-mile cold delivery solutions. Success in the downstream segment is highly dependent on brand strength, effective merchandising, and meeting the end-user preference for convenience, freshness, and transparent product labeling regarding origin and curing methods.

Ham and Bacon Market Potential Customers

The potential customer base for the Ham and Bacon Market is broad and diversified, spanning both institutional buyers and individual consumers across multiple channels, defined primarily by their volume requirements and need for product consistency. The largest segment remains the institutional end-users, notably the Food Service industry (HORECA and QSRs), which rely on large, consistent, and standardized supplies of bacon slices and ham portions for their fixed menu items, such as breakfast sandwiches, pizza toppings, and main course components. These buyers prioritize reliable supply chains, competitive bulk pricing, and specifications related to fat content, salt levels, and slicing dimensions, often requiring custom production runs to meet precise operational standards across thousands of locations globally.

The retail consumer segment represents the second major customer group, segmented further by demographics and purchasing drivers. Traditional consumers seek value and convenience, driving demand for pre-packaged, mass-market products available in hypermarkets and supermarkets. However, a rapidly growing segment comprises health-conscious and affluent consumers who act as buyers for premium, artisanal, and specialty products like Prosciutto di Parma, Jamón Ibérico, or heritage breed bacons. These buyers are willing to pay a premium for attributes like specific geographical origin (PGI/PDO), organic certification, or clean-label assurances (no nitrates/nitrites), driving sales through specialty food stores and high-end grocery retailers that emphasize provenance and quality narrative.

Emerging customer segments include industrial food manufacturers who use ham and bacon as ingredients in Ready-to-Eat (RTE) meals, frozen dinners, and packaged salads, demanding highly consistent, ready-to-incorporate product formats. Furthermore, the expansion of e-commerce platforms has created a specific customer profile: the digital consumer who values the ease of online ordering and temperature-controlled home delivery, particularly for specialty, high-value, and delicate cured meats that might not be readily available in local stores. Targeting these varied customers requires a dual strategy: maintaining cost leadership for institutional and value-driven retail customers while investing in brand storytelling and quality differentiation for the lucrative premium and specialty segments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.2 Billion |

| Market Forecast in 2033 | USD 62.1 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Smithfield Foods, Tyson Foods, Hormel Foods, JBS S.A., Danish Crown, WH Group, Industrias Bachoco, Foster Farms, Conagra Brands, Cargill, Maple Leaf Foods, Oscar Mayer, Primo Foods, Olymel, OSI Group, Vion Food Group, Seaboard Foods, Norsvin, BRF S.A., Tönnies Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ham and Bacon Market Key Technology Landscape

The technological landscape of the Ham and Bacon Market is defined by efforts to enhance food safety, extend shelf life, and improve processing efficiency while catering to consumer demands for cleaner ingredients. A critical technology involves advanced curing and smoking processes, including the sophisticated use of liquid smoke technology to impart flavor consistently and reduce the environmental impact associated with traditional smokehouses. Furthermore, the implementation of High-Pressure Processing (HPP) is increasingly adopted as a non-thermal method for post-packaging pasteurization, significantly extending the refrigerated shelf life of sliced ham and bacon without compromising flavor or requiring excessive use of chemical preservatives, thereby aligning with the "clean label" trend sought by modern consumers.

Automation and robotics constitute another foundational technology pillar, crucial for maintaining hygiene and maximizing throughput in large-scale facilities. High-speed, precision slicing equipment utilizes digital imaging and weighing systems to ensure every package contains the exact specified weight and slice count, minimizing give-away and optimizing yield from each primal cut. Robotics are deployed in hazardous or highly repetitive tasks, such as stacking, packaging, and palletizing, reducing labor costs and improving worker safety, while ensuring consistent product handling. These automated systems are often integrated with enterprise resource planning (ERP) platforms, allowing for real-time data tracking of yields, defects, and processing times, thereby enabling continuous optimization.

The increasing focus on supply chain transparency and traceability has made digital technologies essential. Blockchain technology is emerging as a critical tool, providing immutable records of the pig’s journey from farm to fork, detailing feed type, animal welfare certifications, processing parameters, and temperature logs during transit. This level of granular traceability satisfies stringent regulatory requirements in export markets and builds consumer trust, particularly important for premium, high-value specialty ham products like heritage breed or specific regional denominations. Furthermore, sophisticated sensor technology within cold storage and transport vehicles ensures continuous temperature monitoring, guaranteeing the integrity and safety of the perishable product throughout the entire distribution lifecycle.

Regional Highlights

- North America: This region is characterized as a mature, high-value market dominating global consumption of processed meats, particularly bacon. The United States and Canada exhibit high per capita consumption driven by entrenched cultural habits, such as the staple breakfast market and widespread use in foodservice, notably in QSRs. Key trends include the growth of artisanal and thick-cut bacon varieties, strong demand for value-added products like fully cooked and microwaveable options, and significant market consolidation among major processors focused on operational efficiency and addressing growing consumer demands for antibiotic-free and hormone-free pork products.

- Europe: Europe is a highly fragmented yet culturally rich market, heavily influenced by Protected Designation of Origin (PDO) and Protected Geographical Indication (PGI) labels, which protect traditional regional hams like Prosciutto di Parma (Italy) and Jamón Serrano (Spain). The market is heavily regulated, with strict standards on animal welfare and curing agents (nitrates/nitrites). Consumer trends strongly favor premium, ethically sourced, and low-additive products. Germany, Spain, and Italy remain the largest producers and consumers, driving innovation in traditional dry-cured meats and advanced safety protocols for fresh and chilled packaged ham.

- Asia Pacific (APAC): APAC represents the fastest-growing region, propelled by rapid urbanization, substantial increases in middle-class disposable income, and the gradual shift toward Westernized diets incorporating more processed meat products. China is the single largest consumer and producer of pork globally, dominating the market landscape. While domestic production is strong, rising demand for imported, high-quality products, especially specialty hams from Europe and North America, is noticeable. Growth is particularly accelerated in the foodservice sector and in modern retail formats in Southeast Asian countries, requiring massive investment in sophisticated cold chain logistics.

- Latin America: This region acts as a significant global supplier of pork, with Brazil and Mexico being key players in both production and consumption. The market is primarily driven by domestic consumption and strong export revenue, supported by cost-competitive livestock production. While local preferences for specific cuts and curing methods prevail, there is an increasing penetration of international quick-service brands, bolstering demand for standardized bacon and ham products in the region's rapidly expanding urban centers. Economic volatility remains a potential constraint, but long-term protein demand is robust.

- Middle East and Africa (MEA): The MEA market is highly distinct due to cultural and religious dietary restrictions, leading to very low consumption of conventional pork products. However, the market for imported, processed, non-pork meat alternatives (e.g., turkey ham, beef bacon) is growing, catering to the expatriate population and consumers seeking Western-style processed convenience meats. This region relies heavily on imports, and growth is concentrated in the tourism and institutional catering sectors, where product availability and adherence to stringent halal certification standards are crucial competitive factors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ham and Bacon Market.- Smithfield Foods (WH Group)

- Tyson Foods

- Hormel Foods Corporation

- JBS S.A.

- Danish Crown

- Vion Food Group

- Industrias Bachoco, S.A.B. de C.V.

- Foster Farms

- Conagra Brands

- Cargill, Incorporated

- Maple Leaf Foods

- Oscar Mayer (Kraft Heinz)

- Primo Foods

- Olymel S.E.C./L.P.

- OSI Group

- Seaboard Foods

- BRF S.A.

- Tönnies Group

- Faccenda Foods

- Norsvin International

Frequently Asked Questions

Analyze common user questions about the Ham and Bacon market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the global demand for ham and bacon products?

The primary drivers are increasing global urbanization, rising disposable incomes in emerging markets, and the pervasive consumer demand for convenient, ready-to-eat protein sources. Furthermore, the strong integration of ham and bacon into the growing quick-service and casual dining restaurant sectors globally solidifies continuous demand. Product innovation focused on convenience, such as fully cooked options, significantly supports market expansion across diverse demographic segments.

How are health and sustainability concerns impacting the Ham and Bacon Market?

Health concerns regarding sodium, saturated fat, and nitrate content are pushing manufacturers toward developing 'clean label' and 'uncured' products (using natural curing agents). Simultaneously, sustainability concerns are driving investments in ethical sourcing, animal welfare certifications (e.g., free-range), and optimizing supply chains to reduce environmental footprints and meet growing consumer demand for responsible protein consumption choices.

Which geographical region shows the highest growth potential for ham and bacon?

The Asia Pacific (APAC) region, specifically countries like China, Japan, and Southeast Asian nations, exhibits the highest growth potential. This rapid expansion is due to the rising adoption of Western diets, increased spending power, and significant infrastructural improvements in modern retail and cold chain logistics, facilitating the widespread distribution of both domestic and imported processed pork products.

What key technological advancements are shaping the processing of ham and bacon?

Key technological advancements include the extensive use of automation and robotics for high-speed, precision slicing and packaging to ensure product consistency and hygiene. Furthermore, High-Pressure Processing (HPP) is increasingly adopted for non-thermal pasteurization, extending product shelf life without relying on harsh chemicals, thereby meeting the demands of modern food safety and clean-label initiatives.

How is competition from plant-based alternatives affecting the traditional Ham and Bacon segment?

Plant-based alternatives, such as vegetarian ham and vegan bacon, pose a growing restraint, particularly targeting flexitarian and environmentally conscious consumers. While the traditional market remains dominant, manufacturers are responding by either acquiring or developing their own plant-based lines, or by focusing on premium, differentiated conventional products that emphasize superior flavor, origin, and quality attributes unattainable by current plant-based substitutes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager