Hand and Power Tools Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432992 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Hand and Power Tools Market Size

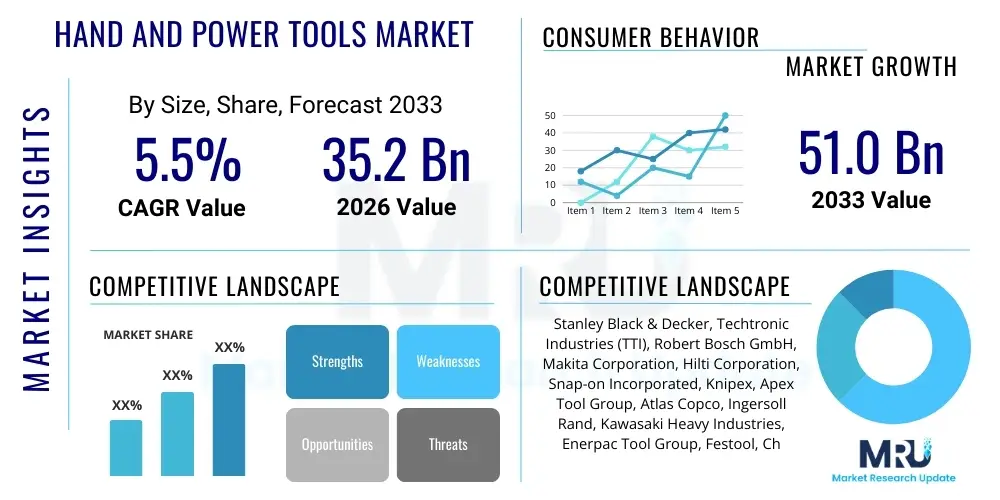

The Hand and Power Tools Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.5% between 2026 and 2033. The market is estimated at USD 35.2 Billion in 2026 and is projected to reach USD 51.0 Billion by the end of the forecast period in 2033.

Hand and Power Tools Market introduction

The Hand and Power Tools Market encompasses a vast array of instruments essential for construction, maintenance, repair, and manufacturing activities across residential, commercial, and industrial sectors. Hand tools, the traditional segment, rely entirely on manual force, including items like wrenches, hammers, and screwdrivers, focusing on precision and simple operation. Conversely, power tools utilize an external energy source, typically electricity (corded or cordless), pneumatics, or hydraulics, to multiply force and increase efficiency, significantly reducing labor time and physical strain. These tools, such as drills, saws, grinders, and impact wrenches, are critical productivity enhancers in complex engineering and assembly tasks. The evolution of this market is intrinsically linked to advancements in material science, battery technology, and motor efficiency, driving the shift from heavy, tethered equipment to lightweight, high-performance cordless solutions. The primary benefit derived from this product category is the enhanced speed, accuracy, and standardization of workmanship across various applications, making them indispensable components of global economic output and infrastructure development.

Major applications of hand and power tools span the entire industrial spectrum. In the construction industry, these tools are vital for site preparation, structural framing, plumbing, and electrical installations. The automotive sector relies heavily on high-torque power tools for assembly line production and maintenance, focusing on pneumatic and specialized battery-powered devices. Furthermore, the burgeoning aerospace and defense industries require highly accurate, specialized tools for working with advanced composites and alloys. Beyond professional applications, the robust growth in the residential sector, fueled by increasing disposable incomes and the popularization of Do-It-Yourself (DIY) culture, has created a substantial consumer market for compact, user-friendly power tool kits. This broad application base ensures sustained demand, especially as global urbanization and infrastructure modernization projects accelerate. The tools are designed to maximize user safety, incorporating features like anti-vibration technology and automatic shut-off mechanisms, which further enhances their appeal across regulated environments.

Driving factors for the Hand and Power Tools Market include the rapid globalization of construction activities, particularly in emerging economies like India and Southeast Asia, where massive investments in urban and industrial infrastructure are underway. Technological innovations, notably the development of advanced lithium-ion battery packs offering longer runtime and faster charging cycles, have made cordless power tools a viable and often preferred alternative to traditional corded counterparts, boosting market penetration. Moreover, stringent regulatory standards regarding worker safety and ergonomic design necessitate the continuous replacement of older, less efficient tools with newer, compliant models. The focus on automation and precision manufacturing in high-value industries also spurs demand for specialized, digitally-enabled power tools capable of providing data feedback and integration into smart factory systems, thereby linking tool performance directly to overall operational efficiency and quality control metrics.

Hand and Power Tools Market Executive Summary

The Hand and Power Tools Market is undergoing a significant transformative phase characterized by the aggressive adoption of cordless technology and digital integration, profoundly reshaping business trends globally. Manufacturers are shifting capital investment towards research and development focusing on brushless motor technology and improved battery density, which delivers superior performance and longer tool lifespan, directly addressing critical end-user pain points regarding durability and runtime. The business landscape is marked by intense competition, leading to strategic mergers and acquisitions aimed at consolidating market share and acquiring specialized technological capabilities, particularly in robotics and advanced material handling tools. Furthermore, sustainability is emerging as a critical trend, pushing companies to adopt circular economy principles, offering refurbished tools, and designing products with recyclable components, influencing consumer preference, especially in environmentally conscious regions like Europe.

Regionally, the Asia Pacific (APAC) market stands out as the primary growth engine, driven by unprecedented infrastructure investment and rapid industrialization in countries like China and India. Government initiatives supporting manufacturing expansion and urbanization projects create immense latent demand for both heavy-duty industrial power tools and standardized hand tools. North America, while a mature market, exhibits high adoption rates of advanced, premium tools, focusing on safety features and IoT connectivity, which enables asset tracking and usage monitoring on large construction sites. Europe maintains a strong focus on high-quality, precision tools tailored for specialized trades (e.g., carpentry, automotive repair) and is pioneering the integration of ergonomic design standards, setting a benchmark for worker health and safety regulations that often translate into global product specifications. The robust demand across these key geographies ensures a diversified revenue stream, mitigating risks associated with reliance on a single economic zone.

Segmentation trends highlight the dominance of the Power Tools segment over Hand Tools in terms of revenue growth, primarily fueled by the accelerating shift towards cordless equipment. Within Power Tools, battery-powered devices are rapidly replacing electric corded and pneumatic alternatives due to increased flexibility and mobility on job sites. The Industrial application segment maintains the largest market share, characterized by high purchase volumes of durable, heavy-duty machinery required for continuous operation in environments like manufacturing plants and shipbuilding yards. However, the Residential/DIY segment is projected to show the highest Compound Annual Growth Rate, spurred by the accessibility of affordable, high-quality power tool kits and the persistent trend of home improvement projects globally. Distribution trends show a sustained migration towards e-commerce platforms, offering manufacturers direct access to end-users and enabling detailed product information dissemination, although traditional brick-and-mortar retailers remain crucial for large-scale B2B distribution and demonstration of high-value industrial equipment.

AI Impact Analysis on Hand and Power Tools Market

Analysis of common user questions related to the impact of Artificial Intelligence (AI) on the Hand and Power Tools Market reveals core themes centered on operational efficiency, predictive maintenance capabilities, and the future role of human labor. Users frequently inquire about how AI can prevent tool failure on active construction sites, asking specifically if tools can self-diagnose issues and order replacement parts (Predictive Maintenance). Another major area of concern is quality assurance, with questions focusing on whether AI-driven computer vision systems can monitor tool usage to ensure fasteners are tightened to exact specifications or cuts are made perfectly straight, minimizing material waste (Precision and Quality Control). Furthermore, there is significant interest regarding the integration of AI into robotics and autonomous construction equipment, questioning whether future power tools will operate autonomously or require enhanced digital connectivity and training features (Automation and Training). These inquiries underscore a user expectation that AI will transform tools from simple mechanical devices into intelligent, interconnected assets contributing to 'smart' construction and manufacturing ecosystems, leading to better safety, reduced downtime, and enhanced overall project profitability.

The implementation of AI technology is poised to redefine the functional capabilities of high-end power tools and the efficiency of the manufacturing processes used to create them. In the manufacturing phase, AI algorithms are being deployed to optimize production lines, using machine learning to detect defects in raw materials or assembly errors far more rapidly and accurately than manual inspection. This not only improves the final product quality but also reduces manufacturing overheads by minimizing scrap rates and maximizing throughput. The use of generative design powered by AI is also enabling the creation of lighter yet stronger tool chassis and ergonomic handles, optimizing weight distribution and material usage based on simulating millions of usage scenarios, resulting in superior tools that adhere to strict safety and comfort standards. This intelligent approach to design shortens the product development lifecycle and ensures the swift integration of user feedback into new models, providing a substantial competitive edge.

For end-users, the immediate impact of AI is most visible in the development of 'smart' tools integrated with IoT sensors. These tools collect vast amounts of operational data—such as torque applied, temperature profiles, and usage duration—which is then analyzed by cloud-based AI systems. This allows for real-time performance monitoring and, crucially, predictive maintenance alerts. Instead of scheduled or reactive maintenance, AI predicts the exact moment a component is likely to fail (e.g., a motor brush or bearing wear), allowing technicians to intervene precisely before costly downtime occurs. Furthermore, in specialized industrial applications, AI assists in operational guidance; for instance, smart torque wrenches can communicate with the job management system, confirming that the correct pressure was applied to a specific bolt in a structured sequence, thereby creating a verifiable audit trail essential in regulated industries like aerospace or energy. This integration of intelligence transforms tools into data-generating assets, critical for modern project management.

- AI enhances manufacturing precision by optimizing assembly robotics and raw material defect detection.

- Predictive maintenance algorithms reduce operational downtime by forecasting component failure based on sensor data.

- AI-driven computer vision ensures quality control in fastening, welding, and cutting applications, verifying tolerances automatically.

- Intelligent tools offer real-time operational guidance and generate auditable compliance reports for critical tasks.

- Generative design using AI optimizes tool ergonomics and material use, leading to lighter, more durable products.

- AI facilitates resource allocation and inventory management for large fleets of networked power tools on construction sites.

DRO & Impact Forces Of Hand and Power Tools Market

The Hand and Power Tools Market is shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively constituting the core Impact Forces influencing strategic decisions and market growth trajectories. Key Drivers include the exponential growth in global construction and infrastructure spending, particularly in emerging economies, which necessitates high volumes of efficient tools for large-scale project execution. The relentless technological advancements in battery technology, specifically the evolution of high-capacity lithium-ion batteries and brushless motors, are fundamentally driving the mass transition from corded to cordless power tools, offering users unmatched mobility and power. Additionally, the increasing global emphasis on occupational safety regulations compels industries to invest in newer tools featuring advanced ergonomic designs, anti-vibration mechanisms, and safety clutches, thereby accelerating replacement cycles across mature markets. These drivers create a compelling and sustained demand environment, linking tool sales directly to macro-economic development and technological innovation cycles.

Conversely, significant Restraints challenge the market's maximum potential. High initial investment costs associated with advanced, professional-grade cordless power tool systems—including the tools, chargers, and multiple proprietary battery packs—can be prohibitive for smaller contractors or DIY consumers sensitive to pricing, particularly when compared to cheaper, corded alternatives. The market also suffers from volatility in the global supply chain, especially concerning essential raw materials such as steel, aluminum, and crucial battery components (e.g., lithium and cobalt), leading to unpredictable manufacturing costs and potential lead time delays. Furthermore, the persistent threat of counterfeit tools, particularly in developing regions, undermines established brand credibility and poses significant safety risks to end-users, forcing manufacturers to allocate substantial resources towards brand protection and intellectual property enforcement. Addressing these constraints requires strategic sourcing initiatives and aggressive cost management throughout the value chain.

The primary Opportunities available to market participants lie in penetrating underserved emerging markets through targeted pricing strategies and localized distribution networks, capitalizing on nascent urbanization trends. The burgeoning demand for smart, connected tools—integrated with IoT capabilities for inventory management, usage tracking, and remote diagnostics—represents a high-value growth segment, particularly within large industrial and rental fleet operations. Moreover, the expanding field of robotics and automation in manufacturing and construction creates opportunities for specialized, high-precision tools designed to interface directly with robotic arms, moving beyond traditional handheld operation. The collective impact forces indicate a market favoring innovation, where technology adoption and operational efficiency (driven by cordless and smart features) are paramount, while firms must strategically navigate material supply risks and price sensitivity to secure long-term profitability. This dynamic environment rewards companies capable of offering a blend of high performance, connectivity, and durable design.

Segmentation Analysis

The Hand and Power Tools Market is comprehensively segmented based on Type, Operation, Application, and Sales Channel, reflecting the diversity of product offerings and end-user needs. This segmentation is crucial for understanding specific market dynamics, identifying high-growth pockets, and tailoring product development strategies. The primary segmentation by Type distinguishes between manual Hand Tools and technologically complex Power Tools, with the latter commanding the larger revenue share due to their superior efficiency and application in industrial settings. Further segmentation based on Operation highlights the ongoing technological transition, showing robust growth in electric (specifically battery-powered) tools, which are rapidly displacing pneumatic and hydraulic options across various mid-to-high duty applications due to their ease of deployment and lower maintenance requirements.

Application-based segmentation divides the market into Industrial, Commercial, and Residential sectors. The Industrial segment, encompassing manufacturing (automotive, aerospace) and heavy construction, remains the largest revenue generator, demanding tools with extreme durability, high torque, and precision capabilities suitable for continuous professional use. However, the Residential segment is experiencing the fastest growth, largely driven by the expansion of the global DIY market and the proliferation of accessible, compact power tool sets marketed to homeowners and hobbyists. Commercial applications, including specialized maintenance, repair, and operation (MRO) services, provide a stable demand base for mid-range professional tools, requiring versatility and reliability. Understanding the distinct requirements of each application segment is vital for product portfolio optimization and distribution strategy alignment.

The segmentation by Sales Channel tracks the evolution of distribution models. While the Offline channel, including specialized industrial distributors, hardware stores, and large format retail chains (like Home Depot or Lowe's), currently accounts for the bulk of sales—especially for heavy-duty industrial equipment requiring physical demonstration or personalized expert consultation—the Online channel is demonstrating explosive growth. E-commerce platforms offer advantages in terms of competitive pricing, wide product selection, and direct consumer delivery, appealing strongly to the Residential/DIY segment and smaller commercial buyers. The ongoing migration to online purchasing is forcing traditional distributors to invest heavily in digital storefronts and robust logistics capabilities to maintain market relevance in a multi-channel distribution environment, optimizing inventory visibility and delivery speed across all segments.

- Type

- Hand Tools (Wrenches, Screwdrivers, Hammers, Pliers)

- Power Tools

- Drilling & Fastening Tools (Drills, Impact Drivers, Wrenches)

- Cutting & Grinding Tools (Saws, Grinders, Routers)

- Demolition Tools (Rotary Hammers, Jackhammers)

- Operation

- Electric (Corded, Cordless/Battery-Powered)

- Pneumatic

- Hydraulic

- Engine-Driven

- Application

- Industrial (Automotive, Construction, Aerospace, Energy, Manufacturing)

- Commercial (MRO, Professional Services, Utilities)

- Residential (DIY, Home Improvement)

- Sales Channel

- Offline (Specialty Stores, Hardware Stores, Retail Chains, Authorized Distributors)

- Online (E-commerce Platforms, Manufacturer Direct Sales)

Value Chain Analysis For Hand and Power Tools Market

The value chain for the Hand and Power Tools Market begins with the upstream procurement of essential raw materials, a phase characterized by global sourcing complexity and sensitivity to commodity price fluctuations. Key materials include various grades of steel and aluminum alloys necessary for tool housing and internal mechanisms, specialized plastics and polymers for ergonomic handles and casings, and critical components for power tools such as copper windings, motor components (increasingly brushless), and advanced chemical compounds (lithium, cobalt, nickel) for battery manufacturing. Upstream analysis highlights that companies heavily focused on power tools, especially cordless versions, must secure stable long-term agreements for battery cell procurement, often dealing directly with specialized battery suppliers or establishing captive battery manufacturing facilities to mitigate supply chain risks and maintain a competitive edge in performance metrics (runtime, charge speed). Efficient inventory management and strategic hedging against material price volatility are foundational for maintaining profitability in this stage.

The middle segment of the value chain involves sophisticated manufacturing, assembly, and quality assurance processes. The manufacturing phase requires significant capital expenditure in automated machinery, precision engineering capabilities, and highly skilled labor, particularly for producing complex components like brushless motors and gearbox assemblies. Manufacturers often utilize lean manufacturing principles to optimize production flow and minimize waste, adhering to strict international quality standards (e.g., ISO certifications). Following manufacturing, products move into the downstream phase which involves packaging, logistics, and distribution. The efficiency of logistics is paramount, especially for handling high volumes of varied SKUs and ensuring tools reach geographically dispersed end-users rapidly. Packaging must balance protection during transit with retail presentation, increasingly incorporating sustainable and recyclable materials in response to market demand and regulatory pressures.

Distribution channels are categorized into direct and indirect routes. Direct distribution involves manufacturers selling directly to large industrial end-users (B2B), major construction companies, or utilizing their proprietary online storefronts. This channel offers higher margins and direct control over customer relations but requires substantial internal sales and support infrastructure. Indirect distribution, which accounts for the majority of sales, relies on a network of specialized industrial distributors (essential for technical support and localized inventory holding), mass market retailers (critical for the Residential/DIY segment), and rapidly expanding third-party e-commerce platforms. The trend is moving towards an omni-channel approach, where consumers research products online but may still finalize purchases in a physical store for professional advice or hands-on assessment. Successful downstream strategy hinges on balancing the visibility and reach of e-commerce with the technical expertise and inventory depth offered by specialized, physical distribution partners, ensuring seamless delivery and post-sale service capabilities across all customer touchpoints.

Hand and Power Tools Market Potential Customers

The Hand and Power Tools Market caters to a wide spectrum of potential customers, broadly classified into two major segments: Professional/Industrial users and Consumer/Residential users. Professional customers represent the high-volume, high-value segment, demanding tools that are robust, durable, and engineered for continuous, heavy-duty operation, where tool failure directly translates to project delays and significant financial losses. Key end-users in this category include large-scale commercial and residential construction firms that require fleets of powerful drilling, fastening, and demolition tools compliant with the latest safety standards. Furthermore, manufacturing industries, notably automotive assembly plants and aerospace manufacturers, rely on specialized, precision power tools (often pneumatic or digitally controlled) to meet stringent quality control specifications and complex assembly requirements. These professional buyers prioritize performance specifications, reliability, service contracts, and often purchase high-end systems that include integrated IoT tracking capabilities for asset management on vast job sites, making their purchasing decisions driven by Total Cost of Ownership (TCO) rather than mere initial price.

The Consumer, or Residential, segment is characterized by rapid growth, price sensitivity, and a preference for ergonomic, lightweight, and versatile tools suitable for occasional use in DIY projects, home repairs, and gardening tasks. This segment's purchasing behavior is heavily influenced by retail accessibility, brand recognition, promotional pricing, and the availability of user-friendly combination kits that offer a range of essential tools and batteries. While these customers may not require the extreme durability of industrial-grade equipment, they increasingly seek the convenience of modern cordless technology, driving demand for efficient battery platforms compatible across various domestic tools. The rise of social media content and online tutorials dedicated to home improvement has significantly accelerated the adoption rates within this segment, making product aesthetics and ease of use crucial factors in market success.

Beyond the primary segments, significant potential lies within the Maintenance, Repair, and Overhaul (MRO) sector, which includes professional tradespeople such as electricians, plumbers, HVAC technicians, and facility management teams. These customers require highly specialized, portable tools that balance professional capability with light weight and ease of transport, often focusing on compact cordless solutions necessary for working in confined spaces or remote locations. Rental companies also form a substantial customer base, purchasing high-quality, resilient tools that can withstand rigorous use by multiple operators. Serving these varied end-users requires manufacturers to maintain a diversified product portfolio, ranging from affordable entry-level tools for the DIY market to high-performance, specialized equipment accompanied by robust warranty and service support for the industrial and professional trades, ensuring market coverage across all functional requirements and budget levels.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 35.2 Billion |

| Market Forecast in 2033 | USD 51.0 Billion |

| Growth Rate | 5.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Stanley Black & Decker, Techtronic Industries (TTI), Robert Bosch GmbH, Makita Corporation, Hilti Corporation, Snap-on Incorporated, Knipex, Apex Tool Group, Atlas Copco, Ingersoll Rand, Kawasaki Heavy Industries, Enerpac Tool Group, Festool, Chervon, and Klein Tools. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hand and Power Tools Market Key Technology Landscape

The technological landscape of the Hand and Power Tools Market is dominated by innovations centered on enhancing efficiency, portability, and connectivity, fundamentally changing how tasks are performed across professional and consumer environments. The single most impactful technology has been the evolution of battery chemistry, specifically the transition from Nickel-Cadmium (Ni-Cd) to advanced Lithium-Ion (Li-ion) batteries. Modern Li-ion packs offer significantly higher energy density, providing longer runtimes, reduced weight, and faster charging capabilities, which have enabled cordless tools to match and often exceed the performance of their corded or pneumatic predecessors, especially in high-torque applications. This battery supremacy is complemented by sophisticated Battery Management Systems (BMS) that regulate temperature, optimize charging cycles, and communicate remaining charge status, ensuring both safety and longevity of the power source. Manufacturers are also focusing on platform standardization, encouraging users to adopt a single battery system compatible across dozens of different tools, fostering brand loyalty and driving repeat purchases.

Another crucial technological advancement is the widespread adoption of brushless DC (BLDC) motors in power tools. Unlike traditional brushed motors, brushless motors use electronic commutation, eliminating the physical brushes that wear out over time. This design results in several superior performance characteristics: they are significantly more durable, require virtually no maintenance, generate less heat, and provide greater power and torque efficiency due to reduced friction. For the end-user, this translates directly into a longer tool life and a greater usable runtime per battery charge, making brushless tools mandatory for professional-grade applications. Coupled with advanced gearing systems and proprietary material construction, these motors enable tools to deliver high performance in compact, ergonomic packages, addressing the constant demand for lighter and more powerful equipment on job sites.

The rise of the Industrial Internet of Things (IIoT) is rapidly transforming high-end power tools into ‘smart’ assets. Key technology in this space involves the integration of micro-sensors and Wi-Fi or Bluetooth modules directly into the tool chassis. These connected tools can track vital performance data such as operational hours, torque setting adherence, temperature thresholds, and geographical location (Geo-fencing). This data is transmitted to cloud-based platforms, allowing construction managers and fleet operators to monitor tool utilization, optimize inventory allocation, and implement predictive maintenance schedules, thereby reducing theft and minimizing operational disruptions. Furthermore, digital feedback mechanisms are increasingly integrated, where the tool provides haptic or visual feedback to the user, ensuring precision in applications like torque tightening or depth control, significantly improving quality assurance and compliance in highly regulated industrial sectors.

Regional Highlights

The global Hand and Power Tools Market exhibits distinct growth patterns and maturity levels across key geographical regions, driven by localized economic conditions, infrastructure investment cycles, and differing levels of technological adoption. North America, encompassing the United States and Canada, represents a mature but highly lucrative market, characterized by high disposable income, stringent safety regulations, and a strong culture of professional contracting and DIY. The region is a primary adopter of premium, technologically advanced tools, particularly high-voltage cordless systems and smart, connected tools utilized for asset tracking and job site efficiency. High labor costs necessitate the use of the most efficient tools available, driving continuous demand for innovation in battery life and power-to-weight ratios. The replacement cycle for professional tools in North America remains relatively short due to rigorous usage and the consistent need to upgrade to safer, more efficient models, securing the region's position as a powerhouse for innovation and premium product sales.

Asia Pacific (APAC) is unequivocally the fastest-growing region globally, fueled by massive government spending on infrastructure development, rapid urbanization, and the exponential expansion of the manufacturing base across countries like China, India, and Indonesia. The vast scale of construction projects, from residential towers to large industrial complexes and transportation networks, creates an immense baseline demand for both affordable hand tools and efficient power tools. While the market initially focused on price-sensitive, standard-performance tools, there is a clear and accelerating trend towards adopting better quality, cordless power tools, driven by rising labor costs and a growing awareness of worker productivity and safety standards. China remains the dominant manufacturing hub and consumer market within APAC, but Southeast Asian countries are emerging as significant new consumption centers, presenting substantial opportunities for market expansion and localized product adaptation to meet specific regional requirements and power standards.

Europe constitutes a sophisticated and quality-driven market, where demand is heavily influenced by strict environmental, ergonomic, and safety regulations implemented by the European Union (EU). Consumers and professionals in countries like Germany, the UK, and France prioritize precision, durability, and ergonomic design, leading to strong sales of high-end specialized tools. The European market is also at the forefront of sustainability, driving demand for tools and packaging made from recycled materials, and favoring manufacturers who demonstrate corporate social responsibility in their supply chains. Western Europe is characterized by slow but stable growth, whereas Eastern European countries are showing higher growth rates as they modernize their industrial and residential infrastructure. The key differentiation factor in Europe is the preference for high-quality, long-lasting tools, resulting in less price elasticity compared to some APAC markets, focusing instead on Total Cost of Ownership and environmental compliance. Latin America and the Middle East & Africa (MEA) represent emerging markets facing economic volatility but hold long-term potential tied to localized industrialization and resource extraction projects, primarily driving demand for industrial-grade pneumatic and heavy-duty electric tools.

- North America: Mature market focusing on premium, cordless, and IoT-enabled tools; driven by high labor costs and strict safety regulations.

- Asia Pacific (APAC): Fastest-growing region; driven by rapid infrastructure development, urbanization, and manufacturing expansion in China and India.

- Europe: Quality-driven market emphasizing ergonomic design, environmental compliance, and high-precision tools for specialized trades.

- Latin America: Emerging market with growth tied to localized construction and resource industries; demand for durable, cost-effective tools.

- Middle East & Africa (MEA): Growth stimulated by large-scale energy, construction, and urbanization mega-projects; high adoption of heavy-duty industrial tools.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hand and Power Tools Market.- Stanley Black & Decker

- Techtronic Industries (TTI)

- Robert Bosch GmbH

- Makita Corporation

- Hilti Corporation

- Snap-on Incorporated

- Knipex

- Apex Tool Group

- Atlas Copco

- Ingersoll Rand

- Kawasaki Heavy Industries

- Enerpac Tool Group

- Festool (TTS Tooltechnic Systems)

- Chervon

- Klein Tools

- Hitachi Koki (now Koki Holdings - HiKOKI)

- Positec Tool Corporation

- Dixon Automatic Tool

- RIDGID (Emerson Electric Co.)

- Stihl AG & Co. KG

Frequently Asked Questions

Analyze common user questions about the Hand and Power Tools market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth in the Power Tools segment?

The primary factor driving the current growth in the Power Tools segment is the exponential advancement and widespread adoption of high-capacity Lithium-Ion battery technology combined with Brushless Motor technology. This allows cordless power tools to offer performance, durability, and runtime comparable to, or exceeding, traditional corded alternatives, providing unmatched mobility and efficiency for professional and residential users. The platform effect, where a single battery system powers numerous different tools, is also a significant catalyst for continued adoption and customer retention.

How is IoT technology being utilized to enhance the functionality of professional power tools?

IoT technology integrates micro-sensors and connectivity modules into professional power tools, transforming them into smart, connected assets. This enables features such as real-time asset tracking (Geo-fencing to prevent theft), usage monitoring, utilization reporting, and crucial data collection for predictive maintenance algorithms. By analyzing operational data (e.g., torque levels and temperature), users can optimize tool allocation, ensure compliance with project specifications, and significantly reduce unscheduled downtime on large industrial and construction sites, leading to improved project efficiency and compliance auditing.

Which application segment holds the largest market share and which is exhibiting the fastest growth rate?

The Industrial application segment currently holds the largest market share in terms of revenue, primarily driven by continuous, high-volume demand from sectors like manufacturing (automotive and aerospace) and heavy commercial construction, which require durable, high-performance, and specialized tools. Conversely, the Residential (DIY and Home Improvement) segment is exhibiting the fastest Compound Annual Growth Rate (CAGR), fueled by increasing global disposable incomes, the accessibility of affordable power tool kits, and the persistent global interest in home renovation and repair projects, accelerated by dedicated online content and tutorials.

What are the key differences between brushless and brushed motors in power tools and why is brushless technology preferred?

Brushed motors use physical carbon brushes that wear out, require periodic replacement, and generate friction, leading to heat and energy loss. Brushless motors (BLDC), conversely, use electronic commutation, eliminating the brushes. Brushless technology is preferred because it offers superior efficiency, translating to longer battery runtime, increased durability and service life, greater power density in a smaller package, and reduced maintenance requirements. These advantages make brushless tools the standard for professional and high-performance applications where reliability and longevity are critical.

How is sustainability impacting product development and design in the Hand and Power Tools Market?

Sustainability is a growing impact force, particularly in mature markets like Europe. It affects design by pushing manufacturers toward greater product longevity, use of recyclable and bio-based plastics in housings, and the development of energy-efficient charging systems. Additionally, sustainability drives business models focused on product life extension, such as offering robust repair programs, certified refurbishment services, and designing tools for easier disassembly and material recovery at the end of their lifecycle, appealing to environmentally conscious consumers and enterprises.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager