Hand Pallet Jack Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436084 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Hand Pallet Jack Market Size

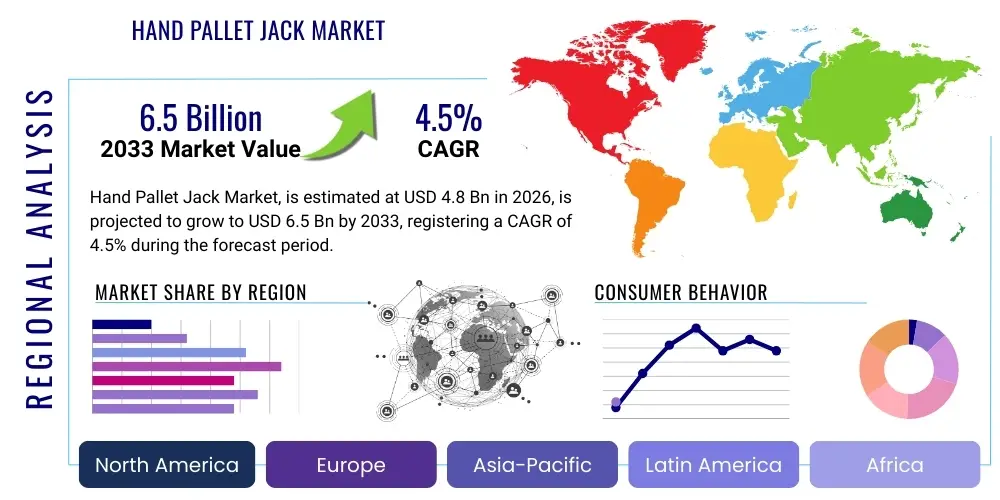

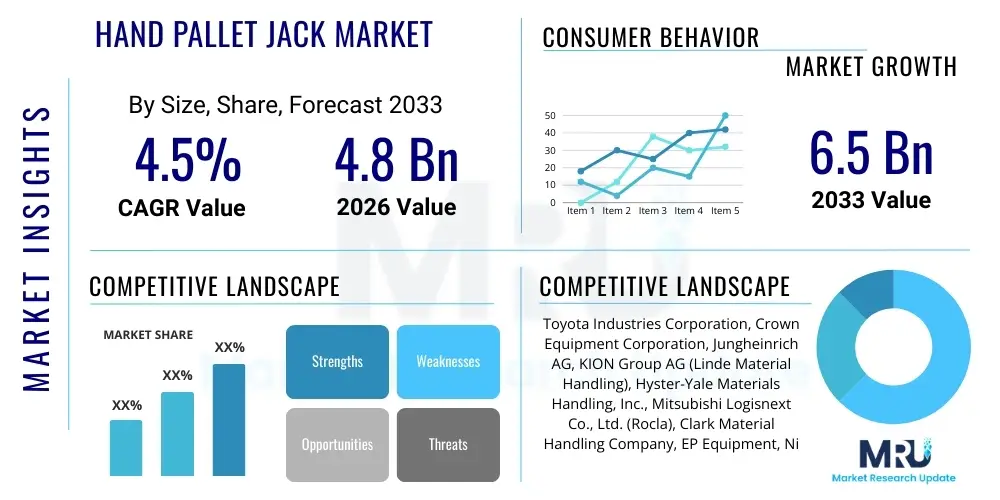

The Hand Pallet Jack Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 6.5 Billion by the end of the forecast period in 2033.

Hand Pallet Jack Market introduction

The Hand Pallet Jack Market comprises essential material handling equipment designed for lifting and moving palletized loads within warehouses, distribution centers, and retail environments. Hand pallet jacks, also known as pallet trucks or pump trucks, are manually operated or semi-electric devices providing a cost-effective and flexible solution for short-distance horizontal movement of goods. These tools are crucial components of modern logistics operations, particularly in scenarios requiring precision maneuvering in confined spaces or where heavy machinery is impractical. The core mechanism involves a hydraulic system activated by pumping the handle, which raises the forks just enough to clear the ground, allowing the operator to pull or push the load to its destination. Their simplicity, durability, and low maintenance requirements solidify their position as foundational equipment in the global supply chain infrastructure, supporting sectors ranging from Fast-Moving Consumer Goods (FMCG) and manufacturing to third-party logistics (3PL) providers.

Major applications of hand pallet jacks span various industries, primarily centering on loading and unloading trucks, moving inventory from storage racks to processing areas, and staging products for shipment. They are indispensable for inventory rotation, order picking fulfillment in smaller operations, and as supplementary tools in large automated warehouses. The primary benefit of using manual and semi-electric pallet jacks lies in their versatility, accessibility, and minimal operational complexity. Unlike forklifts, they require less specialized training, have zero emissions (for manual models), and pose a lower risk profile in high-traffic pedestrian areas. The driving factors propelling market growth include the explosive expansion of the e-commerce sector, which necessitates rapid and efficient handling of diverse product sizes, alongside increasing investments in optimizing supply chain efficiency across emerging economies. Furthermore, stringent occupational safety standards indirectly favor manual equipment where the risk of heavy vehicle accidents needs mitigation, providing a stable demand floor for these foundational tools.

The product landscape has evolved beyond purely manual models to include semi-electric and full-electric variants, addressing labor efficiency concerns and handling heavier loads with reduced physical strain on operators. This technological integration—where lifting is manual but driving is powered, or both functions are motorized—expands the utility of the traditional pallet jack, bridging the gap between basic handling tools and heavy-duty lift trucks. As global industrialization continues and warehouse density increases, the demand for compact, reliable, and energy-efficient material handling solutions like the hand pallet jack remains robust, ensuring its continued relevance in modern logistics ecosystems worldwide. Continuous product innovation focuses on ergonomic design, enhanced durability, and integrating basic telemetry features for fleet management, aligning the market with broader trends toward operational transparency and worker well-being.

Hand Pallet Jack Market Executive Summary

The Hand Pallet Jack Market is experiencing steady, moderate growth, primarily driven by concurrent expansion in the global warehousing and logistics sectors, coupled with the exponential rise in e-commerce activities requiring scalable, flexible material handling solutions. Key business trends indicate a shift towards semi-electric models, which offer the cost efficiency of manual jacks combined with the ergonomic benefits and productivity enhancements of powered equipment, especially in high-throughput environments where reducing operator fatigue is paramount. Furthermore, market competition is intensifying, leading manufacturers to focus on product differentiation through material science (lighter, stronger frames) and integrated safety features. Sustainability concerns are also beginning to influence purchasing decisions, favoring companies that demonstrate reduced manufacturing footprints or offer long-life, easily maintainable products. The reliance of small and medium enterprises (SMEs) on cost-effective manual solutions further stabilizes the foundational demand for traditional hydraulic units, balancing the shift toward electrification observed in larger corporate logistics chains.

Regionally, the Asia Pacific (APAC) market dominates the growth trajectory, fueled by massive infrastructure development, increasing foreign direct investment in manufacturing hubs, and the sheer scale of domestic consumption driving logistics volume. Countries like China and India are undergoing rapid modernization of their supply chains, creating an immediate and substantial need for basic material handling tools. North America and Europe, while mature, exhibit demand driven primarily by replacement cycles, regulatory compliance focusing on ergonomics, and the necessity to outfit increasingly automated, but densely packed, urban fulfillment centers. This regional variance necessitates tailored market strategies; in the West, the focus is on automation integration and high-specification models, whereas in APAC and Latin America, market penetration and robust, low-cost durability remain primary competitive advantages. Geopolitical stability and international trade flow fluctuations remain critical determinants influencing regional market performance and investment cycles within logistics infrastructure.

Segment trends reveal that the Manual Hand Pallet Jack segment retains the largest market share due to its universal applicability and lowest initial capital expenditure. However, the Semi-Electric and Full-Electric segments are demonstrating the highest growth rates, reflecting the industry's continuous drive for improved operational efficiency and reduced manual labor. Within end-user applications, the Warehousing and 3PL segment remains the most significant consumer, given the core function of pallet movement in these operations. There is also rising specialization, with pallet jacks being designed for specific load types (e.g., low-profile for specialized pallets or galvanized steel for harsh, moist environments like cold storage). The convergence of these trends suggests a future where standard manual pallet jacks coexist with specialized, technology-augmented powered versions, offering a broad spectrum of solutions catering to the nuanced demands of the diversified global supply chain.

AI Impact Analysis on Hand Pallet Jack Market

Users frequently inquire whether the rise of autonomous mobile robots (AMRs) and advanced warehouse automation, often powered by AI, will render the traditional hand pallet jack obsolete. Common concerns revolve around the integration compatibility between simple, manual equipment and complex, interconnected smart warehouses, and whether AI can optimize the deployment and maintenance scheduling of these basic assets. Users are also keen to understand if predictive maintenance algorithms can be applied to the hydraulic systems and mechanical components of hand pallet jacks to preempt failures and extend operational lifespan. The consensus suggests that while AI drives major shifts in automated picking and conveying, the flexibility and cost-effectiveness of manual tools for non-routine tasks or last-mile movements within tight spaces ensures their continued necessity. Key user expectations focus on AI enabling enhanced inventory visibility via integration with tracking tags attached to pallets, improving efficiency without fully replacing human operators.

- AI-driven optimization of warehouse layouts reduces unnecessary travel distance for hand pallet jack operators, enhancing manual efficiency.

- Predictive maintenance algorithms can analyze usage patterns (via sensors on semi-electric jacks) to forecast component failures, minimizing downtime.

- Integration of AI-powered inventory management systems (WMS) with pallet jack operations ensures precise tracking of goods moved, eliminating manual entry errors.

- AI facilitates demand forecasting, enabling optimized placement of high-demand items, thereby streamlining routes for manual operators.

- Potential for augmented reality (AR) combined with AI to guide operators through complex warehouses, improving navigation and safety.

- Development of AI-powered semi-autonomous pallet jacks capable of following pre-programmed routes or shadowing human operators (co-bot functionality).

- Data analytics derived from fleet usage (even non-powered assets) can inform future procurement decisions, optimizing fleet size and configuration based on actual operational needs.

- AI supports safety monitoring by analyzing video feeds to detect unsafe operating practices or potential collision risks involving manual equipment in shared spaces.

DRO & Impact Forces Of Hand Pallet Jack Market

The Hand Pallet Jack Market dynamics are fundamentally shaped by a confluence of interconnected forces. The primary Driver is the massive, ongoing expansion of the global logistics and warehousing infrastructure, particularly spurred by the sustained growth of global e-commerce, requiring economical and flexible internal transport solutions. A significant Restraint, however, is the increasingly competitive threat posed by more automated solutions like stackers, lift trucks, and automated guided vehicles (AGVs), which handle high-volume, long-distance movements more efficiently, potentially limiting the adoption ceiling for basic manual units in massive, modern fulfillment centers. The primary Opportunity lies in the electrification trend—the rapid adoption of semi-electric and full-electric pallet jacks, which address labor concerns regarding manual strain and offer better productivity, tapping into the desire for automation while maintaining the low profile and maneuverability of a pallet truck. These elements create dynamic Impact Forces centered around cost-efficiency versus labor scarcity, where the low initial investment of a manual jack battles the long-term operational savings and improved ergonomics provided by powered alternatives, continually forcing manufacturers to innovate on robustness, ease of use, and integration capability.

Further elaborating on the restraining factors, the high attrition rate of basic manual jacks, often due to misuse or lack of standardized maintenance schedules in smaller operations, contributes to significant total cost of ownership over the long term, potentially driving some sophisticated buyers toward more durable or fully automated equipment. Furthermore, regulatory hurdles in specific regions regarding manual handling weights and mandatory ergonomic standards push procurement managers toward powered lift aids, limiting the growth potential of purely manual units in highly regulated economies like those in Western Europe. Conversely, the opportunity landscape is broadened by the continuous need for backup equipment and peak-season surge capacity, where the simplicity and immediate deployment of hand pallet jacks become invaluable assets, resisting full displacement by complex, capital-intensive automated systems. The market equilibrium is maintained by the sheer volume of SMEs globally that cannot justify the capital outlay for full automation, guaranteeing continued strong demand for entry-level material handling tools.

Impact forces also include the fluctuating prices of raw materials, such as steel and hydraulic components, which directly affect manufacturing costs and final product pricing. Global trade disputes and tariffs introduce supply chain instability, influencing the competitive positioning of major international manufacturers versus local producers. Moreover, safety standards and mandatory compliance measures in developed markets act as continuous upward pressure on product quality and design, requiring integration of features like overload valves and enhanced braking systems, indirectly increasing the cost but also improving the perceived value. In essence, the market survives on the unique blend of cost-sensitivity and operational necessity: hand pallet jacks are the most pragmatic solution for tasks that are too short, too tight, or too occasional to justify dedicated mechanical heavy equipment, ensuring their enduring role within the complex logistical puzzle.

Segmentation Analysis

The Hand Pallet Jack Market is comprehensively segmented across several key dimensions, primarily differentiating the product based on its power source, the capacity it is designed to handle, and the specific application environment. This segmentation is crucial for understanding the varied demand profiles from a vast array of end-users, ranging from small, independent retail stores relying solely on manual models to multinational logistics giants deploying large fleets of specialized electric jacks. The segmentation highlights the market's diversity, indicating that it is not a monolithic commodity market but rather a layered structure offering tailored solutions for tasks ranging from routine 2,000 kg pallet movements to specialized operations involving unique pallet dimensions or corrosive environments. Analyzing these segments is essential for manufacturers to target specific industrial needs and for buyers to select the most appropriate equipment investment based on throughput requirements, budget constraints, and occupational safety mandates.

- By Type:

- Manual Hand Pallet Jack (Standard, Scissor Lift, Low-Profile)

- Semi-Electric Pallet Jack

- Full-Electric Pallet Jack

- By Load Capacity:

- Up to 2,500 kg

- 2,501 kg to 3,500 kg

- Above 3,500 kg (Heavy Duty)

- By Application/End-Use:

- Warehousing and Storage (Distribution Centers, Fulfillment Centers)

- Retail and Commercial (Supermarkets, Hypermarkets)

- Manufacturing (Automotive, Heavy Machinery, Electronics)

- Food and Beverage (Cold Storage, Processing Plants)

- Pharmaceutical and Healthcare

- 3PL (Third-Party Logistics) Services

- By Technology/Material:

- Standard Steel

- Galvanized/Stainless Steel (for corrosive/hygienic environments)

- Specialty Materials (e.g., Nylon wheels for reduced floor damage)

Value Chain Analysis For Hand Pallet Jack Market

The value chain for the Hand Pallet Jack Market begins with the Upstream Analysis, which focuses heavily on the procurement of essential raw materials, primarily steel (for the chassis and forks), hydraulic components (pumps, cylinders), and polymers or specialized materials for wheels and handles. Steel sourcing and quality control are critical determinants of the final product's load capacity and durability. Manufacturers rely on robust supplier relationships to ensure stable pricing and consistent material quality, mitigating risks associated with commodity price volatility. As the trend shifts toward electric models, the procurement of high-quality batteries (often Lithium-ion for efficiency) and motor components becomes a significant upstream consideration, requiring new specialized supplier partnerships and rigorous quality assurance processes tailored to electrical and electronic parts, increasing the complexity of the upstream phase compared to purely manual systems.

The core of the value chain involves Manufacturing and Assembly, where efficiency and standardization are paramount. High-volume manufacturing requires optimized welding processes, precision machining for hydraulic systems to prevent leaks and ensure reliable lifting, and efficient assembly lines. After manufacturing, the products enter the Distribution Channel, which is critical for market penetration. Distribution typically follows both Direct and Indirect routes. Direct channels involve large original equipment manufacturers (OEMs) selling directly to major corporate clients, such as large 3PL providers or automotive manufacturers, often including customized service and maintenance contracts. Indirect distribution relies on an extensive network of industrial equipment dealers, specialized material handling distributors, and increasingly, major e-commerce platforms and online B2B marketplaces, particularly for standard manual models sought by SMEs. The indirect channel relies on efficient regional stocking and quick fulfillment capabilities.

The Downstream Analysis involves the End-Users and Post-Sale Services. The effectiveness of the pallet jack in the customer's operations—whether it's maximizing warehouse throughput or simply ensuring safe unloading—defines its ultimate value. Post-sale services, including routine maintenance, repair parts availability, and training, constitute a crucial competitive differentiator, particularly for electric and high-capacity models. Reliable after-market support extends the product life cycle, enhancing customer loyalty and justifying higher initial investment costs. Furthermore, the decommissioning and recycling of obsolete units, especially the environmentally sensitive components like batteries and hydraulic fluid, are becoming increasingly integrated into the downstream value chain, reflecting global pressures for responsible product life cycle management and contributing to the circular economy within the industrial equipment sector.

Hand Pallet Jack Market Potential Customers

The primary consumers and End-User/Buyers of hand pallet jacks are organizations deeply embedded within the global supply chain, logistics, and manufacturing sectors. Third-Party Logistics (3PL) providers represent one of the largest customer groups, utilizing these jacks extensively across their vast networks of cross-docking facilities, fulfillment centers, and regional distribution points for loading, unloading, and staging operations. Retailers, encompassing both large-scale hypermarkets and smaller independent stores, are perpetual buyers, relying on the simplicity and compactness of manual jacks for stocking shelves, moving heavy goods within retail floors, and managing backroom inventory, where space is often constrained and low noise operation is desirable. The high volume of daily material movement makes the pallet jack a non-negotiable tool in these environments.

Furthermore, the Manufacturing sector, covering everything from automotive and heavy machinery to electronics and pharmaceutical production, represents a foundational customer base. In manufacturing environments, pallet jacks are vital for moving raw materials to production lines, transferring work-in-progress materials between assembly stages, and handling finished goods for shipment. The Food and Beverage industry, specifically those involved in cold storage and processing plants, often requires specialized stainless steel or galvanized jacks due to stringent hygiene standards and exposure to moisture and low temperatures, driving specialized demand. These customers prioritize durability, hygienic design, and resistance to corrosion, often justifying a higher price point for specialized equipment.

In essence, any commercial or industrial entity that manages palletized inventory constitutes a potential customer. This includes government entities (e.g., military logistics, postal services), educational institutions managing large inventory volumes, and even the construction sector for moving heavy materials around sites. The shift towards e-commerce has expanded the customer base to include smaller, online-focused fulfillment operations and micro-warehouses situated closer to urban centers, all requiring compact and flexible means of handling incoming and outgoing freight. The broad utility and relatively low investment cost of hand pallet jacks ensure market resilience across economic cycles, making nearly every link in the supply chain a consistent or prospective buyer.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 6.5 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Toyota Industries Corporation, Crown Equipment Corporation, Jungheinrich AG, KION Group AG (Linde Material Handling), Hyster-Yale Materials Handling, Inc., Mitsubishi Logisnext Co., Ltd. (Rocla), Clark Material Handling Company, EP Equipment, Ningbo Ruyi Joint Stock Co., Ltd. (Xilin), Noblelift Intelligent Equipment Co., Ltd., Godrej & Boyce Mfg. Co. Ltd., Blue Giant Equipment Corporation, Global Industrial, Interroll Holding AG, Logitrans A/S, Presto Lifts Inc., Wesco Industrial Products, Inc., Vestil Manufacturing Corporation, Pallet Mule, and TVH Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hand Pallet Jack Market Key Technology Landscape

The technology landscape of the Hand Pallet Jack Market, while fundamentally based on hydraulic lift mechanisms, is increasingly integrating advanced features, particularly in the electric and semi-electric segments, to enhance efficiency, ergonomics, and safety. The primary technology remains the high-efficiency hydraulic pump system, which utilizes a manual lever or an electric motor to convert low input force into high lifting capacity. Innovation in this area focuses on quick-lift pumps that minimize the number of strokes required to raise the load, thereby significantly reducing operator fatigue and increasing throughput. Furthermore, load weight sensing technology is becoming standard on high-end models, providing real-time data on the load handled, ensuring safety by preventing overloading and facilitating accurate inventory management integration. Material science advancements, such as the use of lightweight, high-tensile steel alloys and durable polymers for housing components and wheels, contribute to overall equipment longevity and ease of maneuvering.

The most transformative technologies are concentrated in the powered variants. Semi-electric and full-electric pallet jacks rely on highly efficient direct-current (DC) drive systems and robust battery technology. The shift from traditional lead-acid batteries to Lithium-ion (Li-ion) batteries is a major trend. Li-ion technology offers faster charging times, longer runtime per charge, zero maintenance requirements, and a longer overall lifespan, making powered jacks more viable for multi-shift operations. Integration of sophisticated Electronic Power Steering (EPS) systems in electric models reduces the steering effort required, especially for heavy loads, substantially improving operator control and reducing the risk of musculoskeletal injuries, a critical factor for compliance in regulated markets.

Beyond core power and hydraulics, connectivity is the emerging technological frontier. High-end electric pallet jacks are starting to incorporate telematics and basic sensor technology, allowing for fleet management monitoring. This enables real-time tracking of asset location, utilization rates, battery status, and even impact detection. This data is crucial for large logistics operations seeking to optimize fleet sizing, schedule preventative maintenance based on actual usage rather than time, and ensure compliance with operational safety protocols. Furthermore, specialized technologies like proprietary anti-tip systems and advanced ergonomic handle designs (e.g., handles with built-in cushioning and optimal grip angles) are essential for maintaining market competitiveness, positioning the pallet jack not just as a mover of goods, but as an integrated component of a smart, safe, and efficient material flow system.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market for hand pallet jacks globally. The robust growth is attributable to rapid industrialization, the establishment of massive manufacturing bases, and explosive expansion in the logistics and e-commerce sectors, particularly in China, India, and Southeast Asian nations. These countries require enormous volumes of basic, reliable material handling equipment to support newly built infrastructure. Demand is heavily skewed toward traditional manual pallet jacks due to their low cost and robustness, though increasing wages and focus on efficiency in advanced economies like Japan and South Korea are driving significant uptake of semi-electric models. Government initiatives supporting infrastructure modernization and foreign investment in logistics facilities continue to underpin market stability and future expansion potential across the region. The competitive environment is characterized by strong local manufacturers providing cost-effective alternatives alongside major global players.

- North America: North America is characterized as a mature market with high replacement demand and a strong emphasis on automation and safety compliance. The market exhibits high penetration rates of electric and specialized pallet jacks, often customized for specific industrial applications such as cold chain logistics or heavy-duty manufacturing. Growth is primarily driven by the continuous optimization of supply chains reacting to intense e-commerce pressures, necessitating high-throughput equipment and reliable fleet management solutions. Labor shortages and high labor costs make the productivity gains offered by semi-electric and full-electric models particularly attractive, driving purchasing decisions toward high-specification, ergonomically advanced equipment. Regulatory standards set by OSHA (Occupational Safety and Health Administration) and ergonomic best practices influence design specifications, favoring manufacturers who prioritize operator well-being and integrated safety features.

- Europe: Europe is another mature market, distinguished by stringent safety and environmental regulations. The demand profile favors highly efficient, low-emission, and ergonomically superior electric pallet jacks. Western European countries, particularly Germany, the UK, and France, lead in the adoption of advanced Li-ion battery technology and telematics integration for fleet efficiency. Replacement cycles are stable, driven by regulatory mandates and corporate sustainability goals requiring energy-efficient equipment. Eastern European countries, while growing their logistics infrastructure, still maintain significant demand for cost-effective manual units. The European market focuses heavily on certified equipment quality and long-term service agreements, making after-sales support a critical competitive factor. European manufacturers often pioneer standards in equipment design, influencing global trends in handling technology.

- Latin America (LATAM): The LATAM market is in an emerging phase, characterized by fluctuating economic conditions but high underlying potential driven by improving trade infrastructure and the growth of organized retail. Brazil and Mexico are key markets, demonstrating increasing demand for both manual and entry-level semi-electric jacks to modernize existing, often outdated, warehouse operations. Investment decisions are highly price-sensitive, favoring durable, easy-to-maintain equipment. Infrastructure limitations and lack of standardized pallet sizing in some sub-regions can sometimes restrain market potential, but the overall trend toward formalized logistics processes ensures consistent, albeit occasionally volatile, demand growth. Expanding access to financing for industrial equipment acquisition is critical for stimulating powered pallet jack adoption in this region.

- Middle East and Africa (MEA): The MEA market is highly diversified. The Middle East, particularly the Gulf Cooperation Council (GCC) states (UAE, Saudi Arabia), is undergoing massive investment in mega-logistics hubs, distribution centers, and free zones, creating strong demand for all material handling equipment, including specialized, heavy-duty pallet jacks suitable for handling large import/export volumes. Environmental factors (extreme heat) necessitate robust design and reliance on highly temperature-tolerant components. The African market is largely characterized by demand for basic, robust manual jacks for localized distribution networks, with South Africa and Nigeria being key commercial centers demonstrating increasing uptake of slightly more sophisticated equipment as industrialization progresses. Infrastructure development tied to oil, gas, and major construction projects ensures a steady demand flow, prioritizing reliability in challenging operational environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hand Pallet Jack Market.- Toyota Industries Corporation

- Crown Equipment Corporation

- Jungheinrich AG

- KION Group AG (Linde Material Handling)

- Hyster-Yale Materials Handling, Inc.

- Mitsubishi Logisnext Co., Ltd. (Rocla)

- Clark Material Handling Company

- EP Equipment

- Ningbo Ruyi Joint Stock Co., Ltd. (Xilin)

- Noblelift Intelligent Equipment Co., Ltd.

- Godrej & Boyce Mfg. Co. Ltd.

- Blue Giant Equipment Corporation

- Global Industrial

- Interroll Holding AG

- Logitrans A/S

- Presto Lifts Inc.

- Wesco Industrial Products, Inc.

- Vestil Manufacturing Corporation

- Pallet Mule

- TVH Group

Frequently Asked Questions

Analyze common user questions about the Hand Pallet Jack market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between manual, semi-electric, and full-electric hand pallet jacks?

Manual jacks require human power for both lifting (via hydraulics) and travel. Semi-electric jacks use an electric motor for travel, significantly reducing physical strain, but retain manual hydraulic lifting. Full-electric jacks utilize electric power for both lifting and travel, offering maximum ergonomic benefit and higher throughput suitable for intensive operations.

How is the growth of e-commerce impacting the demand for hand pallet jacks globally?

The e-commerce boom drives demand by rapidly expanding the number of distribution centers and fulfillment hubs worldwide. Hand pallet jacks are essential for rapid unloading, cross-docking, and moving high volumes of diverse goods efficiently within confined spaces, serving as vital supplementary tools even in highly automated facilities, thus ensuring sustained market demand.

Which geographical region exhibits the highest growth potential for hand pallet jack adoption?

The Asia Pacific (APAC) region, driven by massive investments in logistics infrastructure and large-scale industrialization in emerging economies like China and India, shows the highest growth potential. This region demands high volumes of cost-effective and reliable manual and entry-level semi-electric equipment to support expanding supply chains.

What are the key technological trends influencing the future design of pallet jacks?

Key trends include the rapid adoption of maintenance-free Lithium-ion batteries in electric models, integration of basic telematics for fleet management (tracking usage and location), and advanced ergonomic designs focusing on quick-lift hydraulic pumps and Electronic Power Steering (EPS) to improve safety and reduce operator fatigue in high-frequency handling tasks.

Are specialty pallet jacks, such as stainless steel versions, a significant market segment?

Yes, specialty jacks, particularly those made of galvanized or stainless steel, represent a high-value niche segment. They are critical for industries with stringent hygiene or corrosive environment requirements, such as Food and Beverage, Pharmaceuticals, and cold storage, where standard steel jacks would quickly degrade, commanding premium pricing and stable demand in these regulated sectors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager