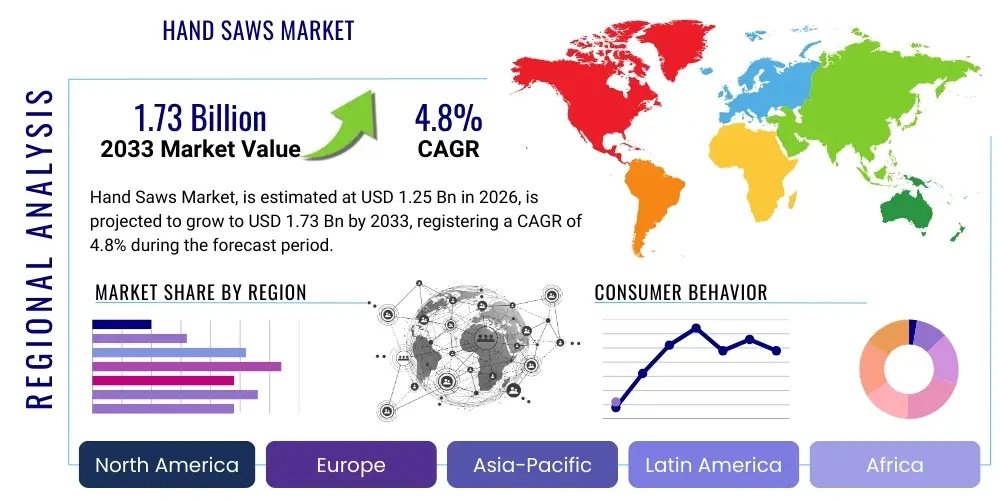

Hand Saws Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438205 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Hand Saws Market Size

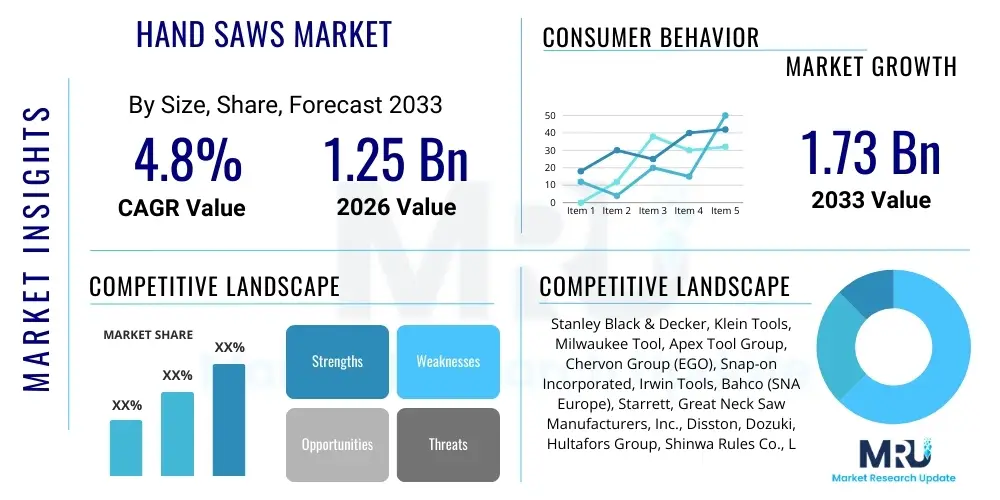

The Hand Saws Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 1.25 Billion in 2026 and is projected to reach USD 1.73 Billion by the end of the forecast period in 2033.

Hand Saws Market introduction

The Hand Saws Market encompasses the global trade of non-powered cutting tools designed for manual operation, primarily used for precision cutting, shaping, and material reduction in various substrates such as wood, plastic, and soft metals. These essential tools maintain relevance despite the proliferation of power tools, owing to their requirement in intricate tasks, locations lacking electricity, and for applications where low noise and high control are paramount. The product portfolio ranges significantly, including specialized types like coping saws for complex curves, dovetail saws for fine joinery, and standard rip and crosscut saws fundamental to general construction and woodworking disciplines. Hand saws are characterized by their blade material, tooth geometry, handle ergonomics, and overall utility, catering to both professional tradesmen and the expansive DIY consumer base.

Major applications of hand saws span several key economic sectors, including residential and commercial construction, dedicated fine woodworking and cabinetry, basic home repair and renovation, and specific tasks within gardening and arboriculture. Their fundamental benefit lies in portability, affordability, and the high degree of user control they offer, which is crucial for achieving precise cuts and minimizing material waste in sensitive projects. Furthermore, hand saws require minimal maintenance compared to their electric counterparts, contributing to their long operational lifespan and perceived value among experienced users. The continuous demand for high-quality, specialized saws designed for specific tasks ensures their persistent role in the modern toolbox.

Driving factors for sustained market growth include robust residential construction activity in emerging economies, increasing participation in DIY and home improvement projects globally, and the consistent need for detailed finishing work that power tools often cannot achieve effectively. Additionally, advancements in material science, particularly in blade coatings and specialized steel alloys, enhance the durability and cutting efficiency of modern hand saws, making them more attractive to professional users seeking reliable, long-lasting tools. The push towards sustainable building practices, often favoring manual precision over energy-intensive machinery, also subtly supports the continued adoption of traditional, high-quality hand tools, solidifying their market standing.

Hand Saws Market Executive Summary

The global Hand Saws Market is characterized by stable demand driven primarily by the cyclical nature of the construction and renovation sectors, coupled with an expanding consumer interest in traditional craftsmanship and personal woodworking hobbies. Business trends indicate a strong focus among leading manufacturers on ergonomic handle design and the integration of advanced blade technologies, such as induction-hardened teeth and anti-friction coatings, which aim to improve user comfort and extend tool life. The competitive landscape is moderately fragmented, with large diversified tool manufacturers competing alongside specialized, high-end niche producers, creating a tiered market structure where premium pricing is acceptable for specialized, high-performance tools.

Regional trends highlight the Asia Pacific (APAC) region as the fastest-growing market due to rapid urbanization, massive infrastructure projects, and the rise of a skilled labor force requiring foundational tools. North America and Europe, while mature, exhibit strong demand for replacement tools and specialized, professional-grade hand saws, underpinned by significant expenditure in home remodeling and professional trade services. Growth strategies across all regions increasingly involve direct-to-consumer digital channels and strong partnerships with large hardware retail chains, optimizing distribution efficiency and maximizing brand visibility in competitive retail environments.

Segment trends reveal that the construction segment remains the largest application area, favoring durable crosscut and general-purpose panel saws. However, the DIY and Hobbyists segment is showing the highest growth rate, spurring demand for multi-purpose and folding saws that prioritize compactness and ease of storage. Technology-wise, saws featuring Japanese-style pull cutting mechanisms are gaining significant traction globally among fine woodworking enthusiasts due to their superior thin kerf and precision capabilities, indicating a consumer shift towards tools that offer greater control and finish quality. The market also sees ongoing consolidation, with major players acquiring smaller, specialized manufacturers to quickly expand their product portfolios and access proprietary blade technology.

AI Impact Analysis on Hand Saws Market

User inquiries regarding AI's impact on the Hand Saws Market often revolve around two primary themes: first, how AI could streamline manufacturing processes and supply chain logistics for manual tools, and second, whether AI-driven design tools could optimize hand saw ergonomics or material selection. Users frequently question if AI will lead to the 'smart' hand saw, or if the technology is strictly reserved for powered or automated cutting machinery. The general consensus sought is clarity on whether AI primarily affects the operational efficiency behind the scenes—such as predictive maintenance for manufacturing equipment, demand forecasting, and inventory management—rather than fundamentally changing the manual tool itself. There is also interest in using AI analytics to understand user behavior and preferences, thereby guiding the development of new handle shapes and blade specifications tailored for maximum efficiency and reduced fatigue.

The practical application of Artificial Intelligence within the Hand Saws Market is largely indirect, focusing on improving the efficiency, precision, and cost-effectiveness of the manufacturing and distribution ecosystem. AI algorithms are increasingly employed in predictive analytics to forecast localized demand fluctuations, enabling manufacturers to optimize production schedules and reduce costly stockouts or overstocking of seasonal or specialized saw types. Furthermore, machine learning models are utilized in quality control on the factory floor, analyzing high-resolution images of newly stamped blades to instantly detect micro-defects, tooth inconsistencies, or material flaws that would be difficult or time-consuming for human inspectors to identify consistently, thereby ensuring higher finished product quality.

While the hand saw remains inherently non-digital, AI indirectly drives market differentiation by optimizing the tool's physical characteristics. AI-driven simulation software is beginning to play a role in advanced ergonomic design, running millions of simulated stress tests to determine the optimal angle, material density, and grip texture for handles, maximizing force transmission while minimizing vibration and repetitive strain injuries for the end-user. This optimization, based on biomechanical data and usage patterns analyzed by AI, allows manufacturers to introduce genuinely innovative and user-centric designs, enhancing the perceived value and performance of traditional manual tools without adding electronic complexity to the saw itself.

- AI optimizes supply chain management through predictive demand forecasting and inventory placement.

- Machine Learning improves manufacturing quality control by rapidly identifying blade defects and tooth geometry inconsistencies.

- AI-driven simulation tools enhance ergonomic handle design, leading to reduced user fatigue and improved cutting efficiency.

- Predictive maintenance schedules for manufacturing machinery are optimized by AI, minimizing downtime and production costs.

- Natural Language Processing (NLP) analyzes customer feedback and reviews to inform future product development and feature prioritization.

DRO & Impact Forces Of Hand Saws Market

The Hand Saws Market is influenced by a dynamic interplay of Drivers, Restraints, and Opportunities, which collectively form the impact forces shaping its trajectory. Key drivers include the resurgence in DIY culture, fueled by online tutorials and accessible educational resources, alongside robust global construction activity, particularly in residential and light commercial sectors. Restraints primarily involve the pervasive competition from electric and battery-powered portable cutting tools, which offer significant speed advantages, especially in large-scale professional applications. Furthermore, the inherent maturity of the hand saw design limits radical technological innovation, forcing companies to rely on incremental improvements in materials and ergonomics rather than disruptive technological leaps.

Opportunities for growth are significant, centering on product specialization—developing highly specific saws for niche applications, such as thin-kerf Japanese pull saws popular in fine woodworking, or specialized pruning saws for professional arborists. Market players also have opportunities in expanding their presence in emerging markets, where cost sensitivity and the lack of reliable electrical infrastructure often favor manual tools. The overarching impact forces dictate a strategy focused on differentiation; companies must constantly justify the value proposition of the hand saw by emphasizing precision, portability, reliability in remote settings, and superior finish quality that powered tools often struggle to match without advanced attachments.

The sustained impact forces favor manufacturers who prioritize quality and branding, maintaining a reputation for durability and performance that justifies investment over cheaper, mass-produced alternatives. The ongoing evolution of material science represents a long-term driver, offering opportunities to use lighter, stronger materials for blades and handles, thereby improving the user experience and reducing the physical effort required. Conversely, economic downturns pose a substantial restraint, as both professional trades and home improvement projects typically slow, leading to reduced tool purchasing across the board. Successfully navigating this market requires constant attention to user-centric design and efficient localized distribution networks.

Segmentation Analysis

The Hand Saws Market is segmented based on critical characteristics including the Type of saw, the material used for the blade, the primary Application, and the End-User demographic. This multi-dimensional segmentation allows manufacturers and marketers to precisely target their products to specific user needs, optimizing inventory and sales strategies. Type segmentation—ranging from specialized coping saws to foundational crosscut saws—reflects the diverse cutting requirements in the market. Blade material is essential for determining durability and cutting capability across different substrates, influencing the tool's price point and target professional segment. Application and End-User segmentation clarify who is buying the product and for what purpose, helping to differentiate between the heavy usage demands of professional construction workers and the occasional needs of residential consumers.

Detailed analysis of these segments reveals varying growth rates. The DIY segment is exhibiting the highest growth due to increased leisure time and accessibility of tutorials, favoring multi-purpose and easy-to-use models. Conversely, the professional woodworking segment drives demand for premium-priced, high-precision tools like tenon and dovetail saws, focusing on quality and consistency rather than cost. Manufacturers are responding by creating distinct product lines tailored to these identified segments—robust, ergonomic tools for professionals, and lighter, budget-friendly options for the residential market. The geographical segmentation is equally vital, as different regions show preferences for distinct saw types, such as the high demand for Japanese-style pull saws in Asian markets and specialized timber saws in regions with forestry-centric economies.

- By Type: Rip Saw, Crosscut Saw, Tenon Saw, Dovetail Saw, Keyhole Saw, Backsaw, Bow Saw, Fret Saw, Coping Saw.

- By Blade Material: High Carbon Steel, Stainless Steel, Bi-Metal, Specialty Alloys.

- By Application: Woodworking, Construction, Gardening & Landscaping, DIY & Hobbyists.

- By End-User: Professional Tradesmen, Industrial Users, Residential Consumers.

- By Geography: North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA).

Value Chain Analysis For Hand Saws Market

The value chain for the Hand Saws Market begins with upstream activities involving the sourcing and processing of raw materials, primarily high-grade steel alloys (carbon steel, stainless steel) for blades and various materials (wood, composite plastics, rubber overmolds) for handles. Critical upstream elements involve steel milling and treatment processes, including hardening, tempering, and specialty coating applications which significantly impact the final tool’s performance and cost. Maintaining tight control over material quality and ensuring sustainable sourcing practices are key strategic differentiators at this stage. Manufacturers often establish long-term relationships with specific steel suppliers recognized for their consistency, as blade integrity is the core determinant of customer satisfaction.

Midstream activities encompass the core manufacturing process, including stamping, laser cutting, tooth grinding, induction hardening of teeth, and assembly with the handles. Efficiency in this stage is paramount, utilizing automated machinery and precision robotics to ensure uniformity in tooth geometry and set. The final product then moves into the downstream distribution channels, which are highly complex due to the global nature of the market. Distribution occurs both directly—via e-commerce platforms and specialized industrial supply catalogs—and indirectly, through an extensive network of wholesalers, regional distributors, and large-scale hardware retail outlets (e.g., Home Depot, Lowe's). Indirect channels dominate volume sales due to the widespread availability requirements of general construction tools.

Direct distribution, though lower in volume, is critical for specialized, high-margin tools targeting professional tradesmen who seek specific technical specifications and often purchase directly from specialized tool suppliers or online professional platforms. The increasing reliance on e-commerce necessitates robust logistics and strong digital marketing strategies (AEO/SEO) to capture end-user attention in a crowded online marketplace. Successful market players optimize their value chain by leveraging global manufacturing bases to reduce production costs while investing heavily in brand development and efficient last-mile delivery systems to maintain competitive pricing and speed-to-market. Quality assurance protocols throughout the manufacturing and distribution stages are non-negotiable, given the expectation of durability associated with professional tools.

Hand Saws Market Potential Customers

The Hand Saws Market caters to a wide spectrum of potential customers, broadly categorized into three major end-user groups: Professional Tradesmen, Industrial Users, and Residential Consumers/DIY enthusiasts. Professional Tradesmen represent the segment demanding the highest quality, most durable, and specialized saws, including carpenters, joiners, cabinetmakers, plumbers (using hack saws), and electricians. These customers prioritize ergonomic design for all-day use, reliability, and precision, and are generally less price-sensitive, focusing instead on the long-term cost of ownership and productivity gains. Their purchasing decisions are heavily influenced by brand reputation, professional recommendations, and industry-specific tool reviews.

Industrial Users, encompassing sectors like manufacturing, maintenance, repair, and overhaul (MRO) operations within factories or large institutions, often require general-purpose hack saws or bow saws for cutting pipe, conduit, and metal sheeting. This segment typically purchases in bulk through B2B contracts or industrial supply distributors, emphasizing standardization, competitive pricing, and certified compliance with safety and material specifications. The primary need here is for robust, versatile tools capable of standing up to harsh, repetitive industrial environments, often procured through centralized procurement departments based on defined technical criteria.

Residential Consumers and the rapidly growing DIY (Do-It-Yourself) market constitute a significant volume driver, purchasing tools for minor repairs, household projects, and hobby woodworking. This demographic values affordability, ease of use, safety features, and compact storage. Multi-purpose saws and those featuring retractable blades or folding handles are popular. Their purchasing pathway is predominantly through large retail hardware chains and online consumer marketplaces. Market success in this segment hinges on highly visible packaging, clear instructional labeling, and accessible price points, with purchases often being impulsive or project-driven rather than strategic investments.

| Report Attributes | Report Details | |

|---|---|---|

| Market Size in 2026 | USD 1.25 Billion | |

| Market Forecast in 2033 | USD 1.73 Billion | |

| Growth Rate | 4.8% CAGR | |

| Historical Year | 2019 to 2024 | |

| Base Year | 2025 | |

| Forecast Year | 2026 - 2033 | |

| DRO & Impact Forces |

| |

| Segments Covered |

| |

| Key Companies Covered | Stanley Black & Decker, Klein Tools, Milwaukee Tool, Apex Tool Group, Chervon Group (EGO), Snap-on Incorporated, Irwin Tools, Bahco (SNA Europe), Starrett, Great Neck Saw Manufacturers, Inc., Disston, Dozuki, Hultafors Group, Shinwa Rules Co., Ltd., Z-Saw, Spear & Jackson, Corona Clipper, Lenox, Nicholson, Marshalltown. | |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) | |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hand Saws Market Key Technology Landscape

The technology landscape in the Hand Saws Market, while fundamentally mechanical, is heavily reliant on advanced material science and manufacturing precision rather than electronics. The most significant technological advancements revolve around blade metallurgy and treatment. This includes the widespread adoption of induction hardening for individual saw teeth, which creates an extremely durable, long-lasting cutting edge that does not require traditional sharpening, differentiating modern disposable saws from historical counterparts. Furthermore, the use of specialized steel alloys, such as those with higher chromium or vanadium content, improves corrosion resistance and tensile strength, allowing for thinner blades (kerf) without compromising structural integrity, crucial for precision cuts.

Another pivotal technological area is surface coating application. Manufacturers utilize low-friction coatings, often PTFE-based or similar proprietary formulas, applied to the blade surface. These coatings dramatically reduce friction and the accumulation of resin or sap during cutting, leading to smoother strokes, faster cutting speeds, and reduced user fatigue. This innovation enhances the performance of general-purpose saws and is particularly valued in green woodworking and lumber applications. Additionally, advancements in laser-cutting technology enable highly precise and consistent shaping of blades and cutting of critical features like expansion slots (gullets) and relief areas, ensuring superior geometric accuracy across mass-produced units.

Ergonomics and handle technology constitute the third major area of innovation. Modern hand saws incorporate injection-molded, co-material handles that utilize thermoset plastics combined with soft, slip-resistant elastomers (rubber overmolds). Computer-aided design (CAD) and finite element analysis (FEA) are employed to optimize the handle shape, ensuring balanced weight distribution and comfortable fit across a wide range of hand sizes. The connection between the blade and handle has also evolved, moving towards more robust, fixed attachment methods that eliminate wobble and maximize energy transfer from the user to the cutting edge, reinforcing the perception of a high-quality, professional-grade tool built for sustained, rigorous use.

Regional Highlights

- North America (NA): This region represents a mature, high-value market driven by significant residential remodeling activity, robust commercial construction, and a strong preference for high-quality, professional-grade tools. The U.S. and Canada are characterized by a high adoption rate of specialized hand saws for finish carpentry and fine woodworking. Key market players benefit from established distribution networks through major hardware retail chains. Demand is stable, focusing on replacement cycles and ergonomic improvements, favoring brands known for lifetime warranties and exceptional durability. The DIY segment remains a powerful consumer base, consistently purchasing tools for immediate home projects.

- Europe: The European market is diverse, with strong demand across Western Europe (Germany, UK, France) for precision tools, particularly traditional joinery saws and specialized pruning equipment. Sustainable construction practices and stringent quality standards influence purchasing decisions, often favoring high-end, traditionally manufactured tools. Eastern Europe shows faster growth, tied to infrastructural development and rising disposable incomes leading to increased renovation activity. The influence of classic European woodworking traditions ensures persistent demand for specific, non-powered precision tools essential for craft-based industries.

- Asia Pacific (APAC): APAC is the fastest-growing region, fueled by rapid urbanization, massive infrastructure investment, and burgeoning manufacturing sectors in countries like China, India, and Southeast Asia. The market is characterized by a high volume of sales, with a strong demand for affordable, functional tools in the construction segment. Notably, countries like Japan maintain a global leadership position in precision hand saw technology (e.g., Ryoba, Kataba), influencing international design trends, particularly among high-end hobbyists and professional cabinetmakers worldwide. Increased skilled labor availability necessitates basic, reliable hand tools.

- Latin America (LATAM): Growth in LATAM is variable but steady, driven primarily by residential building projects and a high reliance on manual labor in construction due to cost considerations. Affordability and durability are key purchasing factors. The market often sees a mixture of globally branded tools and locally manufactured, entry-level products. Distribution challenges related to logistics and retail penetration can restrict access in certain remote areas, making local suppliers and simplified distribution models crucial for market success.

- Middle East and Africa (MEA): The MEA region is experiencing growth tied to major development projects (e.g., Saudi Arabia’s Vision 2030, UAE construction boom) and expanding residential sectors in key African economies. The demand is heavily skewed towards general construction tools (hack saws for metal, large crosscut saws). Climatic conditions require tools made from corrosion-resistant materials. The market is highly dependent on imports, making brand presence and supply chain resilience critical for sustained sales volume.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hand Saws Market.- Stanley Black & Decker

- Klein Tools

- Milwaukee Tool

- Apex Tool Group

- Chervon Group (EGO)

- Snap-on Incorporated

- Irwin Tools

- Bahco (SNA Europe)

- Starrett

- Great Neck Saw Manufacturers, Inc.

- Disston

- Dozuki

- Hultafors Group

- Shinwa Rules Co., Ltd.

- Z-Saw

- Spear & Jackson

- Corona Clipper

- Lenox

- Nicholson

- Marshalltown

Frequently Asked Questions

Analyze common user questions about the Hand Saws market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth of the Hand Saws Market?

The primary driver is the global resurgence of interest in DIY home improvement and fine woodworking hobbies, alongside consistent robust activity in residential construction and remodeling sectors worldwide, necessitating reliable, precision manual cutting tools.

How do Japanese-style pull saws compare to traditional western push saws in terms of performance?

Japanese pull saws (e.g., Ryoba) cut on the pull stroke, providing greater control, requiring less effort, and allowing for a thinner blade (kerf). Western push saws cut on the push stroke, are generally more robust for rough work, and are preferred by many construction professionals for raw material breakdown.

Which geographical region exhibits the highest growth potential for hand saw manufacturers?

The Asia Pacific (APAC) region is projected to demonstrate the highest growth potential, driven by rapid urbanization, large-scale infrastructure investments, and increasing consumer spending on basic tools in emerging economies like India and Southeast Asia.

What technological innovations are most relevant to modern hand saw design?

Key technological innovations include induction-hardened tooth tips for extended sharpness, specialized low-friction blade coatings (like PTFE), and advanced ergonomic handle designs utilizing co-molded materials to reduce fatigue and improve user power transfer.

How is the competition from electric power tools impacting the Hand Saws Market?

Power tools constrain high-volume market growth by offering speed in large tasks. However, hand saws maintain market relevance in niche areas requiring high precision, quiet operation, portability without power access, and superior finishing cuts (e.g., fine joinery, dovetails), ensuring stable demand for specialized products.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager