Handheld Barcode Scanner Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434646 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Handheld Barcode Scanner Market Size

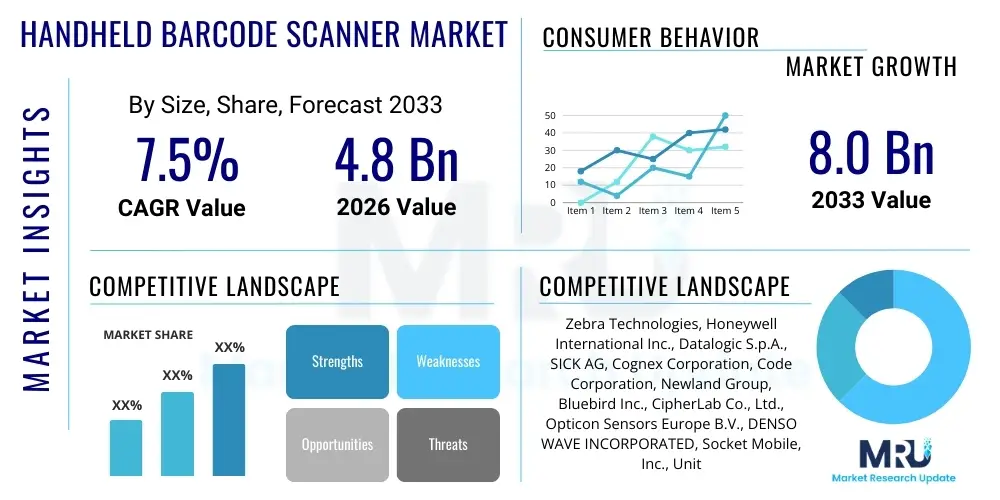

The Handheld Barcode Scanner Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 8.0 Billion by the end of the forecast period in 2033.

Handheld Barcode Scanner Market introduction

The Handheld Barcode Scanner Market encompasses devices designed for capturing and decoding linear (1D) and two-dimensional (2D) barcodes, enabling efficient data entry and inventory management across various industries. These devices utilize technologies ranging from laser and linear imaging to advanced area imaging (imagers) to quickly read complex symbologies, including QR codes and Data Matrix codes, critical for modern logistics, retail point-of-sale (POS), and manufacturing processes. The product portfolio includes wired and wireless models, often ruggedized for industrial environments, and integrated with mobile computing capabilities to enhance operational flexibility and real-time data synchronization. Key applications span retail stock management, healthcare patient tracking, warehouse operations, and field service management, underscoring the universal need for accurate and rapid data capture to optimize supply chains and improve customer service delivery.

The fundamental benefit derived from adopting handheld barcode scanners lies in their ability to minimize human error associated with manual data entry, dramatically accelerating transactional speed and improving inventory accuracy. This increase in operational efficiency translates directly into cost savings and enhanced competitiveness for businesses relying heavily on rapid physical processing. Furthermore, the shift towards 2D imaging technology is a significant trend, allowing businesses to capture larger volumes of data (such as expiration dates, batch numbers, and serial numbers) required for enhanced traceability and regulatory compliance, particularly prominent in pharmaceuticals and high-value logistics. The versatility and portability of these scanners make them indispensable tools in the digital transformation of physical operations, driving consistent demand across mature and emerging economies.

Major driving factors include the persistent expansion of the e-commerce sector, which necessitates highly optimized and rapid fulfillment centers reliant on mobile scanning solutions. Additionally, global regulatory mandates for product traceability, especially in food and drug safety, are forcing broader adoption of 2D barcodes, thereby boosting demand for advanced imaging scanners. The continuous technological advancements, such as the integration of Bluetooth 5.0 for extended range and reduced power consumption, and improved decoding algorithms capable of reading damaged or poorly printed codes, further solidify the market's growth trajectory. These innovations ensure that handheld scanners remain a foundational element of enterprise mobility strategies.

Handheld Barcode Scanner Market Executive Summary

The Handheld Barcode Scanner Market is characterized by robust growth, primarily fueled by the burgeoning demand for automation in supply chain logistics and the ubiquitous shift toward omni-channel retailing. Business trends emphasize the adoption of wireless and ruggedized area imagers, moving away from older laser technology, as companies prioritize mobility, durability, and the ability to scan complex 2D codes required for track-and-trace initiatives. The market sees intense competition centered on ergonomics, battery life optimization, and sophisticated integration capabilities with enterprise resource planning (ERP) and warehouse management systems (WMS), reflecting a focus on total cost of ownership (TCO) reduction and seamless data flow.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market, propelled by massive industrialization, the exponential growth of local e-commerce giants, and significant investments in modernizing infrastructure, particularly in countries like China and India. North America and Europe remain foundational markets, driven by the continuous replacement cycle of existing equipment and the sophisticated integration of scanning technologies within advanced healthcare and retail environments demanding high levels of accuracy and security. Market players are strategically expanding their distribution networks in MEA and Latin America, targeting emerging retail sectors and governmental modernization projects.

Segment trends highlight the dominance of the Retail and Logistics sectors in terms of revenue, while Healthcare exhibits the fastest segmental growth due to critical applications in medication administration and patient identification, where scanning accuracy is paramount. Technology-wise, 2D imagers are rapidly displacing 1D laser scanners due to their versatility and future-proofing capabilities. Connectivity remains highly skewed towards wireless solutions (Bluetooth and proprietary radio frequency), enabling workers to operate effectively without tethering to fixed workstations, which significantly enhances labor productivity in large operational areas like distribution centers.

AI Impact Analysis on Handheld Barcode Scanner Market

Users frequently inquire whether AI will render handheld barcode scanners obsolete, given the rise of integrated vision systems and computer vision applications within smart mobile devices. Common concerns revolve around the feasibility of using AI-powered cameras on consumer phones for enterprise-grade scanning, the accuracy of AI algorithms in reading highly damaged or irregular codes, and the immediate implications for hardware replacement cycles. Users are particularly keen on understanding how AI integration, specifically machine learning (ML) models, can improve the operational performance of dedicated handheld scanners, such as enhancing decoding speed, optimizing image capture under poor lighting conditions, and facilitating predictive maintenance based on usage patterns. The consensus expectation is that AI will augment, rather than replace, dedicated scanners, transforming them into more intelligent, predictive, and efficient data capture tools capable of identifying non-barcode objects or processing complex visual data beyond standard symbologies.

The core theme summarizing the market's expectation is the shift from passive data capture to intelligent data interpretation. AI allows scanners to interpret contextual information, such as differentiating between similar-looking products in a stockroom based on visual cues outside the barcode (e.g., color, size, packaging damage), thereby reducing scanning errors and speeding up auditing processes. Furthermore, AI capabilities are being leveraged to refine the sensor algorithms, improving the first-time read rate for codes that are obscured, scratched, or applied to highly reflective surfaces, areas where traditional decoding logic struggles. This augmentation ensures that the specialized hardware remains superior to consumer mobile devices for high-volume, mission-critical scanning applications.

Manufacturers are embedding ML models directly into the device firmware, enabling edge processing for functions like optical character recognition (OCR) alongside traditional barcode decoding. This not only enhances scanning versatility but also allows for immediate, on-device data validation and quality checks without relying on constant cloud connectivity, crucial for remote field operations. The incorporation of AI-driven analytics also feeds into asset management, predicting potential hardware failures (e.g., sensor degradation or battery depletion) before they cause operational downtime, thereby optimizing fleet utilization and reducing maintenance costs for large-scale enterprise deployments.

- AI-enhanced Decoding: Machine learning algorithms significantly improve the first-time read rate for damaged, dirty, or poorly printed 1D/2D codes.

- Predictive Maintenance: AI analyzes usage patterns and internal sensor data to forecast hardware failures, minimizing operational downtime.

- Intelligent Data Validation: On-device ML enables real-time validation and contextual data processing, reducing host system latency.

- Cognitive Vision: Integration of computer vision allows scanners to perform tasks like inventory counting or verifying product placement without solely relying on barcode input.

- OCR Integration: AI facilitates accurate optical character recognition, allowing the capture of non-barcode data like serial numbers or batch codes printed plainly on labels.

- Ergonomic Optimization: AI analysis of operator movement helps refine scanner design and workflow integration for reduced user fatigue.

DRO & Impact Forces Of Handheld Barcode Scanner Market

The Handheld Barcode Scanner Market is primarily driven by the unstoppable growth of global e-commerce and the necessity for highly efficient, automated logistics and warehousing operations, demanding mobility and high throughput. Restraints include the significant upfront capital expenditure required for large-scale enterprise deployments, particularly involving ruggedized and advanced 2D imagers, coupled with the increasing commoditization pressure from inexpensive entry-level scanners and the nascent threat posed by smartphone-based scanning applications leveraging enhanced camera technology. Opportunities are abundant in the rapid expansion of healthcare informatics, the increasing need for secure and reliable traceability solutions mandated by governments (e.g., pharmaceutical serialization), and the development of specialized industrial scanners capable of reading Direct Part Mark (DPM) codes crucial for automotive and aerospace manufacturing. These impact forces collectively create a dynamic environment where technological innovation and strategic pricing determine market leadership.

Impact forces stemming from technological shifts are profound. The transition from laser to advanced area imaging technology represents a strong force driving replacement cycles, as 2D codes (like QR and Data Matrix) become the global standard across nearly all industries. Economic forces, particularly the need for labor productivity enhancements in high-wage economies, enforce the continuous demand for high-performance wireless scanners that integrate seamlessly into complex enterprise mobility ecosystems. Furthermore, regulatory forces, specifically those mandating stringent product traceability throughout the supply chain (e.g., DSCSA in the US, Falsified Medicines Directive in the EU), are powerful catalysts for adopting advanced, reliable scanning solutions capable of validating complex code structures instantly.

The competitive landscape acts as another significant impact force, pushing manufacturers towards differentiating their products through superior ruggedness (IP ratings), extended battery life, and ergonomic design tailored for intensive usage shifts. The continuous development of new connectivity standards, such as enhanced Bluetooth Low Energy (BLE) and robust Wi-Fi roaming capabilities, ensures that scanners maintain reliable real-time communication, a non-negotiable requirement for modern WMS integration. Navigating the balance between offering cutting-edge features (Area Imaging, DPM capability, AI integration) and maintaining competitive price points for volume sectors like mass retail remains the central strategic challenge for market participants.

Segmentation Analysis

The Handheld Barcode Scanner Market is extensively segmented based on the technological capabilities of the devices, their degree of mobility, the type of codes they read, and the diverse industrial environments they serve. Critical differentiators include the scanning engine type (laser, linear imager, area imager), connectivity method (wired vs. wireless), and the intended application environment (standard vs. ruggedized). This segmentation provides a granular understanding of end-user requirements, highlighting the strong market shift towards advanced 2D imaging technology driven by superior versatility and the necessity for processing complex data matrices required for traceability and inventory management. The increasing demand for wireless solutions across all industrial segments underscores the paramount importance of mobility in enhancing worker productivity and optimizing operational flow in expansive logistical and retail settings.

- By Product Type:

- Rugged Barcode Scanners: Designed for harsh industrial environments, featuring high IP ratings (IP65+) and enhanced drop specifications; essential for warehouses, manufacturing, and cold chain logistics.

- Commercial Barcode Scanners: Standard, lightweight devices primarily used in retail point-of-sale (POS), office automation, and light inventory checks.

- By Technology:

- Laser Scanners (1D): Older technology, highly effective for reading linear codes quickly, but restricted to 1D symbologies.

- Linear Imagers (1D/Stacked 1D): Digital camera-based technology replacing lasers; offers better durability and can read poorly printed 1D codes.

- Area Imagers (2D/3D): The dominant technology, capable of reading 1D, 2D (QR, Data Matrix, Aztec), and sometimes 3D codes; crucial for regulatory compliance and advanced logistics.

- By Connectivity:

- Wired Scanners: Offer dependable power and data connection, commonly used at fixed POS stations and industrial assembly lines.

- Wireless Scanners (Bluetooth, Wi-Fi): Provide maximum mobility; essential for inventory management, receiving/shipping docks, and patient care applications.

- By End-Use Industry:

- Retail and Commercial: POS transactions, inventory management, price checking, and asset tracking in stores.

- Logistics and Warehouse: Receiving, picking, packing, shipping, cross-docking, and cycle counting in distribution centers.

- Manufacturing: Work-in-progress tracking, tool crib management, and component serialization (including DPM reading).

- Healthcare: Patient identification, medication administration, specimen tracking, and inventory control of medical supplies.

- Others (Government, Utilities, Field Service): Asset verification, meter reading, and mobile ticketing.

Value Chain Analysis For Handheld Barcode Scanner Market

The value chain for handheld barcode scanners commences with upstream analysis, focusing on the procurement of core components, primarily advanced optics (lenses and image sensors), sophisticated decoding algorithms, processing chips (microprocessors/DSPs), and specialized enclosure materials (plastics, rubber, protective glass). Manufacturers rely heavily on a specialized ecosystem of suppliers for high-quality CMOS sensors and proprietary ASIC chips designed for rapid image processing. Optimization in this stage involves strategic sourcing to ensure component quality, minimize lead times, and leverage economies of scale, particularly important for maintaining competitive pricing in the mid-range and high-end segments.

The mid-chain activities involve the design, assembly, and integration of the final product. Research and Development (R&D) is a critical bottleneck, focusing on ergonomics, battery longevity, and ruggedization (achieving higher IP ratings). Manufacturing involves precise optical alignment and firmware loading. Distribution channels are highly varied: Direct sales models are utilized for large enterprise contracts (e.g., a major retailer refitting all stores), ensuring specialized support and customized software integration. Conversely, indirect channels, involving global distributors, value-added resellers (VARs), and system integrators, handle the majority of volume sales, providing geographical reach and specialized industry solutions, particularly for small and medium-sized enterprises (SMEs).

Downstream analysis centers on deployment, integration, and aftermarket support. Once the scanners reach the end-users, system integrators play a vital role in integrating the devices with existing ERP, WMS, or EHR systems. Post-sales support, including maintenance contracts, software updates, and repair services, constitutes a significant revenue stream for established market players. The effectiveness of the service network, especially concerning turnaround time for repairs, directly impacts customer satisfaction and retention, particularly in high-uptime environments like 24/7 fulfillment centers. This entire structure is optimized to ensure rapid deployment and maximized operational life cycle for the scanning hardware.

Handheld Barcode Scanner Market Potential Customers

Potential customers for handheld barcode scanners are defined by any organization engaged in managing physical inventory, tracking assets, verifying identities, or processing point-of-sale transactions where efficiency and accuracy are critical. The largest customer base resides within the retail and logistics sectors, encompassing everything from massive global e-commerce companies requiring high-volume scanning in automated distribution centers to local small businesses utilizing scanners for basic inventory reconciliation and checkout processes. These customers seek high-performance wireless imagers that can withstand repeated drops and provide extended shift battery life, crucial for maximizing operational productivity across vast facilities. The demand is heavily skewed towards 2D imagers due to evolving requirements for omni-channel fulfillment and precise unit-level traceability.

The healthcare industry represents a rapidly expanding segment of potential buyers, including hospitals, clinics, pharmacies, and pharmaceutical manufacturers. In this vertical, scanners are used for positive patient identification (PPID), medication verification at the bedside (reducing medical errors), and tracking regulated biological samples and surgical instruments. Healthcare buyers prioritize scanners with antimicrobial casings, non-tethered operation for mobility, and stringent reading accuracy to comply with strict regulatory mandates like the Drug Supply Chain Security Act (DSCSA). These high-stakes applications necessitate premium, highly reliable, and easily cleanable devices that minimize infection risk.

Additionally, potential customers include global manufacturing operations (automotive, aerospace, electronics), utility companies for asset auditing, and government agencies for mobile verification and field data collection. Manufacturing firms specifically require rugged scanners capable of reading Direct Part Mark (DPM) codes—marks etched directly onto components—to ensure component traceability through complex assembly processes. The common thread among all these end-users is the fundamental requirement for portable, instantaneous, and error-proof data input to digitalize physical processes and ultimately drive measurable improvements in operational throughput and regulatory adherence.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 8.0 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Zebra Technologies, Honeywell International Inc., Datalogic S.p.A., SICK AG, Cognex Corporation, Code Corporation, Newland Group, Bluebird Inc., CipherLab Co., Ltd., Opticon Sensors Europe B.V., DENSO WAVE INCORPORATED, Socket Mobile, Inc., Unitech Electronics Co., Ltd., Wasp Barcode Technologies, Argox Information Co., Ltd., Handheld Group, Sunmi Technology, JADAK (Novanta), NCR Corporation, Generalscan. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Handheld Barcode Scanner Market Key Technology Landscape

The core technological landscape of the handheld barcode scanner market is defined by the ongoing transition from traditional laser technology to sophisticated area imaging, often referred to as 2D imagers. Area imaging utilizes high-resolution CMOS sensors and advanced optics to capture a complete image of the barcode, allowing for the rapid decoding of 1D, stacked 1D, and complex 2D symbologies (such as Data Matrix and QR codes) from any orientation. This technological shift is pivotal as it supports the rising need for traceability and detailed data embedding in product identification, far exceeding the capability of single-line laser scanners. Modern imagers also incorporate adaptive illumination and focus systems to ensure reliable performance under diverse conditions, ranging from low warehouse lighting to bright outdoor environments, critical for logistical efficiency.

A second crucial area of innovation lies in wireless connectivity and power management. Bluetooth Low Energy (BLE) 5.0 and specialized Wi-Fi roaming capabilities are now standard features, ensuring seamless and persistent connection to host systems across large operational footprints while minimizing power consumption. The development of high-density lithium-ion batteries and sophisticated power management software has significantly extended the operational life of wireless scanners, often lasting multiple shifts without recharging, directly addressing a primary pain point for warehouse and retail staff. Furthermore, manufacturers are increasingly incorporating enterprise-grade security protocols within the communication stack to protect sensitive data transmitted wirelessly.

The third major technological advancement involves ruggedization and ergonomic design. The market demands devices that can withstand repeated drops onto concrete, exposure to dust, moisture, and extreme temperatures, driving continuous improvements in materials science and enclosure design, reflected in increasingly higher IP (Ingress Protection) ratings. Complementary technologies include integrated OCR (Optical Character Recognition) capabilities, often powered by embedded AI/ML models, allowing the scanner to read human-readable text alongside barcodes. Furthermore, the ability to read Direct Part Marks (DPM)—low-contrast, challenging markings on materials like metal or plastic—is a specialized technological niche driving growth in industrial and defense sectors, requiring sophisticated lighting and high-speed processing algorithms unique to these niche applications.

Regional Highlights

The global distribution and growth dynamics of the Handheld Barcode Scanner Market show distinct regional variations based on economic development, technological adoption rates, and maturity of logistics infrastructure. North America and Europe currently hold the largest market shares, primarily due to the established presence of large retail chains, highly automated logistics networks, and mandatory regulatory standards in healthcare and pharmaceuticals that necessitate modern scanning equipment replacement cycles.

Asia Pacific (APAC) is anticipated to register the highest Compound Annual Growth Rate (CAGR) over the forecast period. This rapid growth is propelled by the swift expansion of domestic and international e-commerce markets, massive governmental investment in infrastructural development (including new distribution centers and modern ports), and the widespread adoption of 2D barcodes (such as QR codes) in consumer applications and payments, making the area imager the technology of choice across the region. Countries like China, India, Japan, and South Korea are key contributors to this exponential demand.

Latin America (LATAM) and the Middle East & Africa (MEA) represent emerging markets characterized by significant investments in modernizing traditional retail infrastructure and logistics supply chains. While adoption rates lag those of developed economies, the increasing penetration of organized retail and the gradual move towards digital inventory systems provide substantial growth opportunities. Market penetration in these regions is often driven by the competitive pricing of commercial-grade scanners, but demand for ruggedized devices is accelerating with the growth of natural resource extraction and large construction projects requiring robust asset tracking solutions.

- North America: Dominant market share driven by advanced logistics automation, continuous upgrade cycles in major retail organizations, and stringent healthcare regulations (e.g., DSCSA compliance).

- Europe: High adoption fueled by advanced manufacturing (Industry 4.0), robust postal/parcel services, and strict EU traceability mandates (FMD). Focus on high-end, ruggedized devices.

- Asia Pacific (APAC): Fastest growing region, powered by exploding e-commerce, massive warehouse expansion, and extensive use of mobile payment/QR code applications. China and India are major demand centers.

- Latin America (LATAM): Emerging market growth driven by retail modernization and expanding cross-border trade, requiring basic to mid-range scanning solutions.

- Middle East and Africa (MEA): Growth attributed to large infrastructural projects, developing retail sectors, and government initiatives aiming to digitize public services and supply chains.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Handheld Barcode Scanner Market.- Zebra Technologies

- Honeywell International Inc.

- Datalogic S.p.A.

- SICK AG

- Cognex Corporation

- Code Corporation

- Newland Group

- Bluebird Inc.

- CipherLab Co., Ltd.

- Opticon Sensors Europe B.V.

- DENSO WAVE INCORPORATED

- Socket Mobile, Inc.

- Unitech Electronics Co., Ltd.

- Wasp Barcode Technologies

- Argox Information Co., Ltd.

- Handheld Group

- Sunmi Technology

- JADAK (Novanta)

- NCR Corporation

- Generalscan

Frequently Asked Questions

Analyze common user questions about the Handheld Barcode Scanner market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Laser, Linear Imager, and Area Imager scanners, and which technology is recommended for future proofing?

Laser scanners use a moving mirror mechanism to read only 1D (linear) barcodes. Linear imagers use digital cameras to capture and decode 1D codes more durably. Area Imagers (2D imagers) are camera-based and can read 1D, 2D (like QR and Data Matrix), and complex codes from any orientation. Area imaging is strongly recommended for future-proofing inventory and tracking systems, as global regulations increasingly mandate 2D code usage for comprehensive traceability.

How is the growth of mobile computing devices affecting the dedicated handheld barcode scanner market?

While consumer smartphones can perform basic scanning, they lack the durability, dedicated scanning engine speed, ergonomic design, and advanced data collection features required for enterprise environments (e.g., high-volume continuous scanning or reading damaged codes). The market is trending toward high-performance, ruggedized dedicated scanners that are often integrated with enterprise mobile computers, ensuring superior performance and lower total cost of ownership in mission-critical applications.

Which industry segment drives the highest demand for ruggedized handheld barcode scanners?

The Logistics and Warehouse sector drives the highest demand for ruggedized handheld scanners. Operations in distribution centers, freight terminals, and manufacturing floors necessitate devices with high IP ratings (e.g., IP65 or higher) and enhanced drop specifications to withstand exposure to dust, moisture, and repeated accidental drops onto concrete floors during high-intensity, 24/7 operational cycles.

What are the key technological advancements expected to influence scanner performance over the next five years?

Key technological advancements include the pervasive integration of AI and Machine Learning (ML) for improved decoding of difficult or damaged codes and predictive maintenance features. Further advancements will focus on superior battery life through highly efficient components, enhanced wireless security protocols (WPA3), and improved Direct Part Mark (DPM) reading capabilities essential for industrial traceability across manufacturing and aerospace supply chains.

How do regulatory mandates, such as pharmaceutical serialization, influence the adoption rate of handheld scanners?

Regulatory mandates, such as the US DSCSA or the EU Falsified Medicines Directive, require unique serialization (often via 2D Data Matrix codes) for pharmaceutical products to prevent counterfeiting and ensure track-and-trace integrity. These mandates necessitate rapid adoption of highly reliable 2D Area Imagers across the entire pharmaceutical supply chain, from manufacturing and packaging to hospitals and pharmacies, directly increasing market demand for advanced, certified scanning equipment.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager