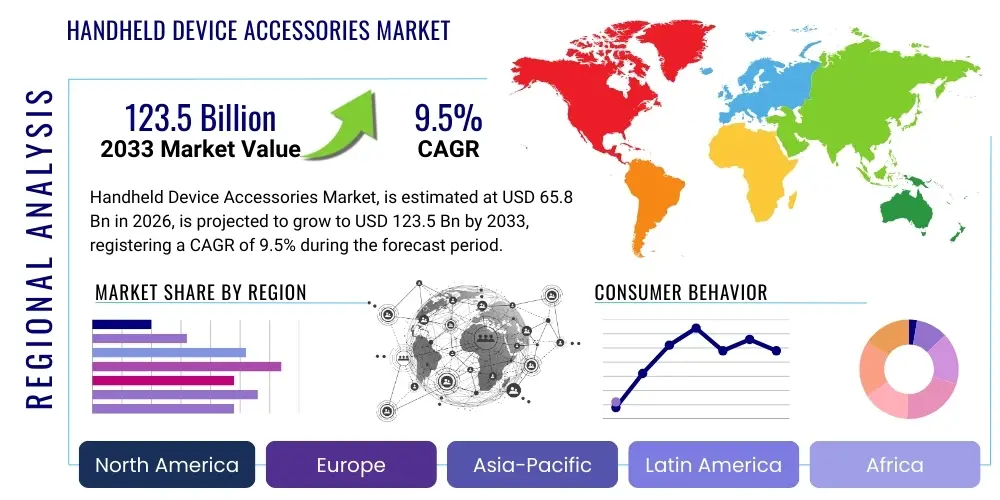

Handheld Device Accessories Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437176 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Handheld Device Accessories Market Size

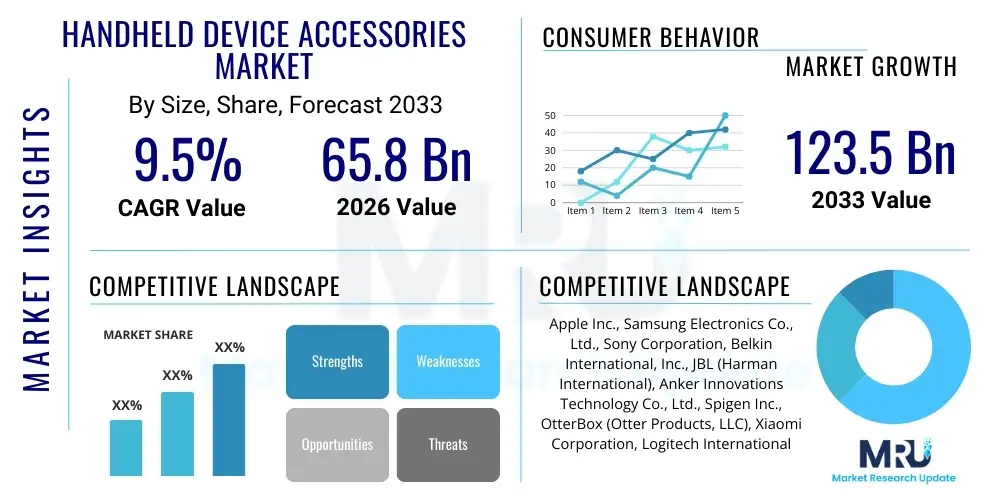

The Handheld Device Accessories Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 65.8 Billion in 2026 and is projected to reach USD 123.5 Billion by the end of the forecast period in 2033.

Handheld Device Accessories Market introduction

The Handheld Device Accessories Market encompasses a vast range of products designed to enhance the functionality, protection, and user experience of portable electronic devices such as smartphones, tablets, smartwatches, and portable gaming consoles. These accessories are crucial components in modern digital lifestyles, moving beyond mere supplementary items to becoming essential tools for communication, productivity, and entertainment. The market is highly dynamic, driven by rapid technological iterations in host devices, requiring accessories to constantly evolve in terms of connectivity (e.g., USB-C, MagSafe), power delivery (e.g., fast charging, wireless charging), and aesthetic design. The primary drivers include the high penetration rate of smartphones globally, the increasing average lifespan of devices, and the growing demand for specialized features like advanced audio quality and robust protection.

Key product categories include protective gear like cases and screen protectors, power management solutions such as chargers, adapters, and power banks, and audio peripherals including wired and wireless headphones and earbuds. Furthermore, niche markets such as mobile gaming controllers, stylus pens, and device mounts contribute significantly to the overall market valuation. The utility of these accessories extends across major applications, from basic device protection necessary for longevity, to optimizing performance for professional use, such as high-speed data transfer or extended battery life required by mobile workers and content creators. The cyclical nature of device replacement also fuels the demand for new generations of compatible accessories.

The market benefits significantly from consumer willingness to personalize and optimize their devices. Handheld accessories offer immediate and cost-effective ways to upgrade a device’s capabilities without replacing the core hardware. For instance, high-end true wireless stereo (TWS) earbuds provide superior audio quality, while fast chargers dramatically reduce downtime. Driving factors include the continuous rise of digital content consumption, the shift towards working remotely, and the persistent focus of manufacturers on integrating smart features (like ambient noise cancellation or health monitoring) directly into accessory ecosystems. Sustainability concerns are also emerging as a key factor, pushing manufacturers towards eco-friendly materials and responsible production practices.

Handheld Device Accessories Market Executive Summary

The Handheld Device Accessories Market is experiencing robust expansion, characterized by a fundamental shift toward wireless and smart connectivity. Business trends indicate strong growth in the premium segment, particularly for specialized products offering superior features like 100W fast charging or sophisticated active noise cancellation (ANC) in audio devices. Major technology companies are leveraging ecosystem lock-in, ensuring their accessories offer seamless integration and proprietary features exclusively with their main devices, thereby dominating significant market share. Simultaneously, the proliferation of private labels and the rise of direct-to-consumer (D2C) brands are intensifying competitive pressure, particularly in high-volume, lower-cost segments like cables and generic protective cases. Supply chain resilience, following recent global disruptions, is now a crucial differentiator, emphasizing geographically diversified manufacturing hubs.

Regionally, Asia Pacific (APAC) stands as the primary engine of growth, fueled by the highest volume of smartphone users, rapid urbanization, and increasing disposable incomes in countries like China, India, and Southeast Asian nations. North America and Europe, while mature, demonstrate high average selling prices (ASPs) due to a strong preference for premium, branded accessories and early adoption of innovative technologies, such as advanced MagSafe compatible peripherals and medical-grade protective cases. Emerging regional trends include the rapid adoption of power banks and portable charging solutions in regions with unreliable power infrastructure, and the growing demand for local language input accessories across various developing markets.

Segment trends highlight the dominance of audio accessories (TWS earbuds) and protective cases in terms of revenue, driven by frequent consumer upgrades and personalization desires. The fastest-growing segment, however, includes advanced charging technologies, encompassing Gallium Nitride (GaN) chargers and Qi2-certified magnetic wireless chargers, reflecting the ongoing consumer need for efficiency and portability. Distribution channels are undergoing transformation, with online sales platforms capturing an increasingly larger share, offering vast product selection, competitive pricing, and user reviews that heavily influence purchasing decisions. Conversely, the brick-and-mortar segment remains vital for immediate purchases and high-touch categories, such as professional installation of screen protectors.

AI Impact Analysis on Handheld Device Accessories Market

Common user questions regarding AI's impact on the Handheld Device Accessories Market primarily revolve around how AI can enhance the performance and personalization of accessories, moving them from passive tools to active, intelligent companions. Users frequently ask about AI integration in noise cancellation algorithms, adaptive charging protocols that prolong battery health, and predictive maintenance alerts for accessories. Key concerns also address the privacy implications of microphones and sensors embedded in smart accessories (like TWS earbuds) and the interoperability challenges when integrating third-party AI features into proprietary device ecosystems. The general expectation is that AI will significantly elevate the user experience, particularly through improved customization, advanced health monitoring via wearables integration, and optimization of power delivery based on learned usage patterns, minimizing user intervention.

- AI algorithms optimize battery charging cycles, extending the lifespan of both the accessory and the host device.

- Enhanced audio processing through AI-driven adaptive noise cancellation (ANC) tailored to specific environments.

- AI enables personalized sound profiles and hearing augmentation features in TWS earbuds.

- Predictive wear and tear analysis implemented in protective cases and screen protectors, providing early replacement warnings.

- Integration of advanced voice assistants (Edge AI) for faster, more localized processing directly on the accessory (e.g., smart neckbands).

- Optimized resource allocation in smart hubs and multi-device chargers based on real-time power requirements.

- AI-driven personalized marketing and product recommendations based on user interaction data collected from smart accessories.

DRO & Impact Forces Of Handheld Device Accessories Market

The dynamics of the Handheld Device Accessories Market are primarily shaped by three fundamental forces: high consumer dependency on mobile devices, rapid technological obsolescence of core devices, and intense price competition fueled by globalization. Drivers include the ever-increasing functionality of handheld devices (necessitating specialized peripherals), the global rise in disposable income encouraging discretionary spending on personalization, and the continuous innovation in power technology (like GaN and wireless charging standards). Restraints often involve the commoditization of basic accessories, leading to reduced profit margins, the proliferation of counterfeit products that erode consumer trust, and rising regulatory scrutiny concerning e-waste and material sourcing. Opportunities lie within the development of highly specialized, health-integrated accessories (like smart rings or advanced ear monitors), the expansion into modular accessories, and the strong growth potential in untapped markets in Africa and Latin America.

The market faces significant impact forces originating from both the supply side and the demand side. On the demand side, the force is the replacement cycle: while devices last longer, users frequently upgrade their accessories to gain incremental benefits (e.g., upgrading from a basic charger to a 65W GaN charger). This continuous demand cycle provides stability. On the supply side, the force is driven by standardization efforts, such as the EU mandate for USB-C, which simplifies manufacturing but increases competition among vendors capable of meeting these standardized requirements. Furthermore, Intellectual Property (IP) disputes around patented charging and connectivity technologies serve as a major external impact force, potentially limiting market entry for smaller players.

The primary impact force remains the speed of innovation in device connectivity. As manufacturers continually introduce new proprietary connection methods or refine existing ones (e.g., transitioning from proprietary magnetic connectors to universal standards), accessory makers must rapidly retool their product lines, leading to intense product churn and investment risk. This pressure compels companies to maintain robust R&D pipelines focused on backward compatibility and multi-standard support, ensuring market relevance across several generations of host devices. Successful companies use strategic partnerships with device OEMs to mitigate this risk, ensuring their accessories are validated and optimized for new device launches.

Segmentation Analysis

The Handheld Device Accessories Market is complexly segmented across multiple dimensions, reflecting the diverse consumer needs for protection, performance enhancement, and personalization. The core segmentation revolves around product type, encompassing everything from basic protective shells to advanced computational peripherals. Further layers of segmentation include distribution channels, distinguishing between expansive e-commerce platforms and traditional physical retail outlets, and application areas, categorizing accessories based on their primary intended host device (smartphones, tablets, gaming handhelds). This granular segmentation is essential for manufacturers to tailor their marketing strategies and product portfolios to specific demographic and regional preferences, maximizing market penetration across varied consumer price points and technological requirements.

- Product Type

- Protective Accessories (Cases, Covers, Screen Protectors)

- Power Accessories (Chargers, Adapters, Power Banks, Charging Pads)

- Audio Accessories (Headphones, Earbuds, Speakers, Headsets)

- Connectivity Accessories (Cables, Dongles, Hubs)

- Mounts and Stands (Car Mounts, Tripods)

- Input Devices (Stylus Pens, Keyboards, Gaming Controllers)

- Distribution Channel

- Online Retail (E-commerce Platforms, Brand Websites)

- Offline Retail (Specialty Stores, Hypermarkets, Carrier Stores)

- Application

- Smartphones

- Tablets and E-Readers

- Wearable Devices (Smartwatches, Fitness Trackers)

- Portable Gaming Devices

Value Chain Analysis For Handheld Device Accessories Market

The value chain for handheld device accessories begins with upstream activities heavily focused on raw material procurement, encompassing specialized plastics (polycarbonate, TPU), metals (aluminum, copper), and sophisticated electronic components (GaN chips, TWS chipsets). Due to the high volume and rapid turnover, optimizing material costs and securing consistent supply of niche components are critical. Semiconductor manufacturers, specialized battery cell producers, and sensor providers form the bedrock of the upstream market. This phase is highly susceptible to geopolitical trade tensions and fluctuations in commodity pricing, directly impacting final product costs.

Midstream activities involve design, manufacturing, and assembly. Original Design Manufacturers (ODMs) and Original Equipment Manufacturers (OEMs), often concentrated in Asian manufacturing hubs, play a pivotal role. Differentiation occurs through patented designs, quality control processes (especially for stress testing protective gear), and obtaining certifications (like Qi certification for wireless charging or MFi certification for Apple products). Efficient logistics and scalable production capabilities are necessary to handle seasonal demand spikes tied to major device launches. The shift towards automation in assembly lines is a key trend to maintain competitiveness and improve precision.

Downstream activities focus on distribution and final sale, leveraging both direct and indirect channels. Indirect distribution through major global e-commerce platforms (Amazon, Alibaba) allows for wide reach and reduced overheads, dominating sales of mass-market items. Direct distribution via brand-owned websites and flagship stores enables better control over branding and pricing, essential for premium accessory lines. Carrier stores (telecom providers) and specialty electronics retailers remain important indirect channels, offering consumers convenience and professional advice at the point of device purchase. Effective inventory management and robust after-sales support are crucial elements of the downstream segment, contributing significantly to brand loyalty.

Handheld Device Accessories Market Potential Customers

Potential customers for the Handheld Device Accessories Market span a broad demographic, categorized primarily by their usage patterns, device type, and priority focus—whether it be protection, performance, or personalization. The largest segment remains general smartphone users who require essential protective cases and basic charging solutions to maintain device functionality. These customers are highly price-sensitive but prioritize reliability, often choosing recognized brands or strong value propositions from D2C entrants. The frequent need for replacement (due to damage or wear) ensures a continuous demand cycle from this massive user base.

A rapidly growing segment includes professional users, such as digital nomads, remote workers, content creators, and corporate executives. These customers prioritize high-performance accessories, including advanced GaN chargers for maximum power output, ergonomic input devices (keyboards/styluses for tablets), and premium, feature-rich audio equipment for high-fidelity communication and concentration. This segment is less price-sensitive and seeks accessories that offer tangible productivity gains, driving demand for specialized, high ASP products.

A third significant segment is the mobile gaming community. These consumers are demanding accessories specifically engineered for performance, including low-latency TWS earbuds, specialized cooling fans, trigger buttons, and ergonomic gaming grips. Their purchasing decisions are heavily influenced by latency specifications, responsiveness, and brand reputation within the gaming ecosystem. Furthermore, niche potential buyers include patients requiring medical monitoring devices integrated into wearables accessories, and students needing affordable, durable accessories for educational tablets.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 65.8 Billion |

| Market Forecast in 2033 | USD 123.5 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Apple Inc., Samsung Electronics Co., Ltd., Sony Corporation, Belkin International, Inc., JBL (Harman International), Anker Innovations Technology Co., Ltd., Spigen Inc., OtterBox (Otter Products, LLC), Xiaomi Corporation, Logitech International S.A., Bose Corporation, Google LLC, Incipio Group, Nomad Goods, LLC, PopSockets LLC, Mophie (ZAGG Inc.), OnePlus Technology (Shenzhen) Co., Ltd., Sennheiser electronic GmbH & Co. KG, ZAGG Inc., Ptron India |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Handheld Device Accessories Market Key Technology Landscape

The technology landscape of the Handheld Device Accessories Market is dominated by advancements in power delivery and wireless connectivity, aiming to enhance speed, efficiency, and user convenience. The shift from traditional silicon-based chargers to Gallium Nitride (GaN) technology represents a significant evolution, allowing chargers to be smaller, lighter, and yet significantly more powerful, capable of handling outputs exceeding 100W while managing heat effectively. This development directly addresses the consumer pain point of carrying bulky power adapters. Parallelly, the evolution of wireless charging, particularly the adoption and standardization of technologies like Qi2 (based on MagSafe principles), is making magnetic alignment and faster charging speeds universally accessible across devices, reducing the reliance on physical cables.

In the audio segment, the critical technologies are Active Noise Cancellation (ANC) and spatial audio processing. ANC systems are moving toward hybrid configurations with multiple microphones and advanced digital signal processing (DSP) chips, often incorporating AI for adaptive noise profiles that adjust automatically to the user's environment. Spatial audio, which creates an immersive, 3D sound experience, requires precise head-tracking sensors and sophisticated algorithms embedded within the earbuds or headphones. Furthermore, advancements in Bluetooth standards, such as LE Audio, are crucial for improving power efficiency, reducing latency, and enabling higher quality audio streaming across various accessory types.

Connectivity accessories are driven by high-speed data transfer protocols, specifically the widespread adoption of USB4 and Thunderbolt standards, which are integrated into hubs and high-end cables. This allows professional users to connect multiple peripherals, monitors, and storage devices simultaneously with unprecedented bandwidth. For protective accessories, innovation is focused on advanced material science, including self-healing polymers, antimicrobial coatings, and enhanced drop protection ratings that utilize layered composite structures. The convergence of these power, connectivity, and material technologies defines the current competitive edge in the handheld device accessories industry.

Regional Highlights

Regional dynamics significantly influence the trajectory of the Handheld Device Accessories Market, primarily due to variations in mobile penetration, disposable income, and technological adoption rates. Asia Pacific (APAC) holds the leading position globally, driven by the sheer scale of its population and the massive number of new and replacement smartphone sales occurring annually in countries like India, China, and Indonesia. This region is characterized by high demand for affordable, high-volume accessories, such as basic cases and lower-cost power banks, though the premium segment is rapidly expanding within urban centers.

North America and Europe represent mature markets defined by high consumer spending power and a strong preference for premium, branded, and certified accessories. These regions are the primary early adopters of technological innovations, including GaN chargers, advanced TWS audio devices with superior ANC, and ecosystem-specific peripherals (e.g., MagSafe compatible products). Strict regulatory environments in Europe, particularly concerning data privacy and product safety, also shape the types of accessories introduced and sold, favoring high-quality, sustainable options.

Latin America (LATAM) and the Middle East and Africa (MEA) are emerging as high-growth potential markets. In LATAM, factors like increasing access to mobile finance and growing urbanization drive demand, focusing mainly on durable protective gear and mid-range audio products. The MEA region, particularly the GCC countries, shows a strong appetite for luxury and high-end accessories, while sub-Saharan Africa requires resilient, long-lasting power solutions, such as high-capacity power banks, due to localized power infrastructure challenges. The development of e-commerce infrastructure is rapidly unlocking potential in these previously underserved markets.

- North America: Dominates the premium segment; strong adoption of smart accessories and proprietary ecosystem solutions (e.g., MagSafe); high average selling prices (ASPs) due to brand loyalty and focus on quality and warranty services.

- Europe: Driven by regulatory adherence (e.g., USB-C standardization mandate); rapid adoption of sustainable and eco-friendly accessory materials; high demand for functional, multi-device charging solutions and premium TWS earbuds.

- Asia Pacific (APAC): Largest market volume globally; fueled by massive smartphone user base and manufacturing concentration; strong regional competition leading to aggressive pricing, high growth expected in power and protective accessories.

- Latin America (LATAM): Exhibits rapid growth in the mid-range segment; rising internet penetration driving online sales; significant demand for robust protective cases and portable charging devices.

- Middle East and Africa (MEA): Growing demand for power management accessories due to infrastructural gaps; luxury market expansion in the Gulf countries; high potential for basic, affordable connectivity accessories across Africa.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Handheld Device Accessories Market.- Apple Inc.

- Samsung Electronics Co., Ltd.

- Sony Corporation

- Belkin International, Inc.

- JBL (Harman International)

- Anker Innovations Technology Co., Ltd.

- Spigen Inc.

- OtterBox (Otter Products, LLC)

- Xiaomi Corporation

- Logitech International S.A.

- Bose Corporation

- Google LLC

- Incipio Group

- Nomad Goods, LLC

- PopSockets LLC

- Mophie (ZAGG Inc.)

- OnePlus Technology (Shenzhen) Co., Ltd.

- Sennheiser electronic GmbH & Co. KG

- ZAGG Inc.

- Ptron India

Frequently Asked Questions

Analyze common user questions about the Handheld Device Accessories market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary growth driver for the Handheld Device Accessories Market?

The primary growth driver is the continuous and rapid increase in the global adoption of smartphones and other handheld devices, combined with consumer demand for enhanced personalization, protection, and performance optimization through specialized accessories like fast chargers and TWS earbuds.

How is Gallium Nitride (GaN) technology influencing the accessories market?

GaN technology is revolutionizing power accessories by enabling the manufacture of chargers that are significantly smaller, lighter, and more energy-efficient than traditional silicon-based chargers, while maintaining or exceeding high power outputs required for modern handheld devices and laptops.

Which product segment holds the largest market share in terms of revenue?

The Audio Accessories segment, primarily driven by the massive consumer shift toward True Wireless Stereo (TWS) earbuds and premium headphones featuring advanced Active Noise Cancellation (ANC), currently holds the largest share of the market revenue.

What key challenges does the market face regarding counterfeit products?

Counterfeit products pose a significant challenge by offering low-quality, unsafe alternatives that erode brand value, reduce legitimate market share, and pose substantial safety risks to consumers, particularly concerning non-certified charging accessories and batteries.

Where is the highest geographical market growth projected in the forecast period?

The Asia Pacific (APAC) region is projected to exhibit the highest geographical market growth rate, fueled by its large consumer base, increasing urbanization, and expanding middle-class population driving demand for both basic and premium accessories.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager