Handheld Drug Detectors Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434339 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Handheld Drug Detectors Market Size

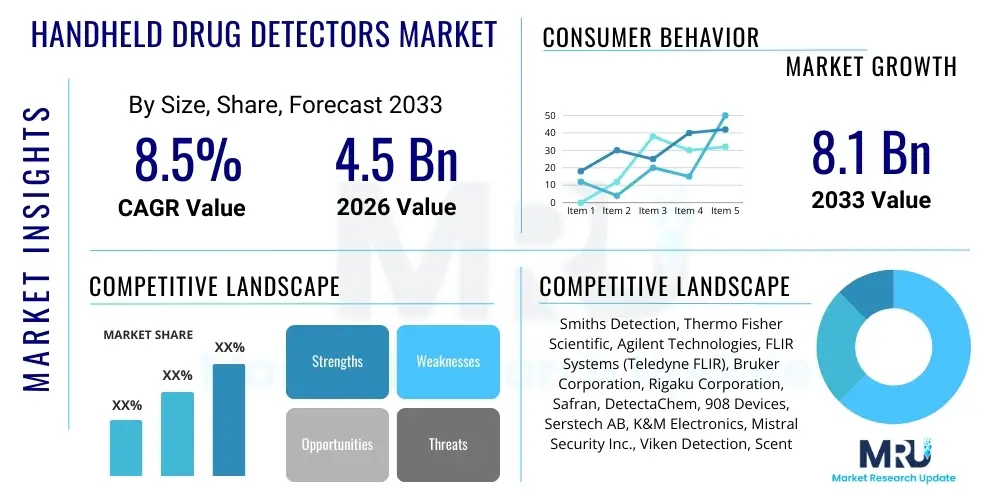

The Handheld Drug Detectors Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $4.5 Billion in 2026 and is projected to reach $8.1 Billion by the end of the forecast period in 2033.

Handheld Drug Detectors Market introduction

The Handheld Drug Detectors Market encompasses portable devices designed for the rapid and accurate identification of illicit substances and narcotics in diverse operational environments, ranging from highly regulated international border checkpoints and sophisticated airport security installations to routine law enforcement field operations, including roadside stops and raids on suspected drug manufacturing or distribution centers. These devices represent a critical intersection of advanced analytical chemistry and miniaturized engineering, utilizing sophisticated techniques such as non-contact Raman spectroscopy, highly sensitive ion mobility spectrometry (IMS), and rapid, colorimetric chemical assays to provide immediate, actionable screening results. The fundamental objective of deploying these advanced technologies is to significantly enhance operational effectiveness, drastically minimize the time taken for preliminary substance identification, and crucially, provide immediate, scientifically sound evidence for decision-making processes regarding potential criminal activities or drug offenses, thereby streamlining the entire investigative and judicial process.

The core application domains for handheld drug detectors are profoundly multifaceted, serving vital security, public safety, and increasingly, health and institutional monitoring needs. Within the national security sector, these detectors are indispensable tools for customs and border patrol agencies who face the immense challenge of interdicting vast quantities of drug contraband cleverly concealed within commercial cargo, personal vehicles, or the intricate layers of checked and carry-on baggage. For frontline law enforcement agencies, these devices offer an unparalleled tactical advantage during field work, enabling officers to confirm the presence and nature of illegal drugs (including trace residues) at the point of discovery without the delay associated with sending samples to centralized forensic laboratories, thereby ensuring the immediate and legal collection of evidence and the efficient processing of suspects. Furthermore, the rising awareness of internal security risks has led to the deployment of these robust detectors in non-traditional settings such as high-security correctional facilities aiming to control the flow of contraband, and even certain large corporate environments implementing proactive drug testing policies, underscoring the expanding utility and critical relevance of these mobile detection solutions.

The sustained impetus for market growth is driven by several macro-environmental factors, including the global escalation of substance abuse, the unprecedented rate of innovation in illicit drug manufacturing leading to new, sophisticated synthetic substances (most notably fentanyl and highly potent benzodiazepines), and the intensified commitment by governments worldwide to enhance national security, fortify border protection measures, and aggressively fund counter-narcotics strategies. The inherent benefits offered by these detectors—including exceptional portability, intuitive ease of operation, and their non-destructive testing capabilities—are paramount for preserving the forensic integrity of seized evidence. Regulatory convergence, alongside robust international cooperative frameworks aimed at disrupting cross-border drug supply chains, further stimulates the large-scale adoption of these advanced, certified detection systems. This confluence of security urgency and technological readiness positions the market for significant and predictable expansion throughout the 2026-2033 forecast period, particularly as agencies prioritize high-throughput, legally admissible, and highly reliable field detection solutions capable of handling the evolving chemical threat landscape.

Handheld Drug Detectors Market Executive Summary

The Handheld Drug Detectors Market is currently undergoing a period of profound transformation, characterized by the accelerated fusion of sophisticated analytical hardware and advanced computational intelligence, primarily driven by critical global security imperatives. Current key business trends reveal a decisive market shift toward the integration of Artificial Intelligence (AI) and Machine Learning (ML) for superior spectral analysis, coupled with cloud-based connectivity functionalities designed for enhanced, geo-tagged data logging, real-time sharing of threat intelligence, and instantaneous updates to detection libraries. Leading manufacturers are intensely focused on achieving significant miniaturization, maximizing energy efficiency to extend field operational time, and critically, developing highly intuitive, graphical user interfaces (GUIs) that significantly minimize the extensive training requirements traditionally associated with complex analytical equipment. This focus on simplified usability is essential for broadening the user base to include general frontline personnel rather than exclusively specialized chemical analysis teams. Segment-wise analysis highlights that spectroscopy-based detection, particularly utilizing high-resolution Raman and Fourier Transform Infrared (FTIR) techniques, maintains a dominant market position due to their verifiable specificity and minimal requirement for sample manipulation. Simultaneously, the persistent and growing threat posed by highly concentrated synthetic narcotics continues to boost R&D and subsequent procurement focused on advanced trace detection capabilities, predominantly through next-generation Ion Mobility Spectrometry (IMS) and portable Mass Spectrometry (MS) technologies.

From a geographical perspective, the North American region firmly maintains its leadership in market revenue, a position underpinned by massive federal and state funding allocations specifically targeting enhanced border security operations, highly proactive and well-funded law enforcement anti-drug initiatives, and the critical urgency driven by the domestic opioid crisis which mandates immediate, widespread deployment of rapid testing tools. In contrast, the Asia Pacific (APAC) region is strategically positioned to capture the highest compounded annual growth rate (CAGR), fueled by significant government investments across major economies in military modernization, the escalating challenge of managing complex illicit drug trafficking networks that exploit key maritime and overland trade routes, and extensive infrastructure security investments in newly developed airports, seaports, and rail transport hubs across nations such as India, Indonesia, and China. Europe also commands a substantial market share, motivated by the coordinated security efforts among European Union member states to manage internal border fluidity and combat the rising prevalence of sophisticated synthetic drug circulation originating from both internal European labs and international sources, leading to comprehensive, standardized procurement policies for advanced field detection equipment across member agencies.

The evolving competitive landscape reflects a transition where successful market participants are moving beyond mere hardware production to become holistic solution providers, placing emphasis on comprehensive service contracts, guaranteed regular software and chemical library updates, and extensive, mandatory training certifications to ensure the long-term effectiveness, compliance, and legal admissibility of their devices for institutional buyers. Strategic consolidation, including key mergers and acquisitions, is becoming a hallmark of the industry as larger defense and security conglomerates seek to vertically integrate specialized chemical analysis expertise and proprietary algorithms. The intrinsic stability and resilience of this market are firmly anchored by its direct correlation with non-discretionary governmental and public safety spending, which provides a significant buffer against general economic downturns. This foundational demand ensures the sector's continued momentum toward steady valuation growth and technological leadership throughout the projected 2026-2033 timeframe.

AI Impact Analysis on Handheld Drug Detectors Market

Users frequently inquire whether Artificial Intelligence can effectively mitigate the historically high rate of false positive readings that have plagued rapid chemical detection technologies, and they are particularly interested in how advanced Machine Learning (ML) algorithms are being specifically adapted to detect Novel Psychoactive Substances (NPS)—drugs that are structurally altered specifically to evade existing detection methods. Common concerns among security professionals often revolve around the logistical reliability of AI interpretation when operating in non-laboratory, harsh field settings and the critical security protocols required for protecting the sensitive, proprietary cloud-based data utilized for continuously training these complex ML models. Moreover, end-users are keen to ascertain if the integration of AI will genuinely simplify device operation, making sophisticated spectroscopic devices practically accessible and deployable by standard frontline personnel with minimal specialized chemical training. The prevailing consensus and high expectation is that AI is poised to fundamentally revolutionize drug detection, transforming the process from a basic, fixed chemical matching operation into a highly intelligent, dynamic spectral analysis tool. This transformation is expected to dramatically enhance accuracy, autonomously expand the detectable drug library without manual intervention, and furnish proactive, predictive threat intelligence derived directly from aggregated real-time field data across numerous deployment sites globally.

The current implementation of AI within this sector is intensely focused on optimizing the processing of highly complex spectral data and refining advanced pattern recognition capabilities. Traditional handheld detectors often operate based on a static, finite library of known chemical compounds. However, the nature of modern synthetic drugs, which frequently exhibit minor but significant structural variations, allows them to easily bypass older, threshold-based algorithms. Advanced Machine Learning models, especially those built on deep learning network architectures, possess the necessary computational power to accurately process the subtle, high-dimensional spectral fingerprints generated by modern Raman or FTIR technologies. This allows them to effectively and reliably distinguish between chemically similar, but forensically distinct, materials—such as differentiating benign chemical precursors or common cutting agents from subtle variations of illicit synthetic drugs. This superior capacity for nuanced data interpretation is critical for drastically reducing the incidence of false alarms, which represents a significant drain on law enforcement personnel time, financial resources, and operational credibility. Furthermore, AI contributes substantially to operational maintenance by facilitating automated system calibration, performing continuous self-diagnosis of sensor health, and ensuring optimal performance consistency even when faced with rapidly fluctuating environmental conditions, thereby significantly extending the reliable operational lifespan and consistency of the detection hardware.

The strategic future application of AI involves the sophisticated utilization of rich, heterogeneous field-collected data—including the specific spectral output, precise geographical location, confirmed substance type, and operational context—to continuously retrain, refine, and update the central, global detection database in near real-time cycles. This creates a decentralized yet tightly interconnected network of threat intelligence, ensuring that every detection unit deployed across the globe is instantly aware of and equipped to identify newly emerging threats or synthesis methods first encountered at any other site. This level of dynamic, adaptive threat intelligence is absolutely paramount for government agencies striving to maintain a proactive stance against highly agile illicit drug manufacturers. Beyond chemical identification, AI increasingly contributes to operational efficiency and safety; for instance, by analyzing the sample's physical characteristics, AI can recommend the most effective and safest scan procedures, optimizing parameters based on whether the matrix is a crystalline powder, a viscous liquid, or a minute residue on a surface. This maximizes testing efficiency, reduces procedural error, and improves the safety margin for the end-user during high-stakes screening operations.

- Enhanced Spectral Classification: AI/ML algorithms accurately differentiate between complex drug mixtures and common cutting agents, significantly minimizing costly false positives and reducing operational downtime.

- Detection of Novel Psychoactive Substances (NPS): Deep learning frameworks enable the rapid, autonomous identification of new synthetic drug variants based on pattern deviation analysis, allowing security services to proactively counter evolving threats.

- Real-time Database Updates: Cloud-connected AI platforms facilitate the instantaneous, secure dissemination of global threat intelligence and refined spectral libraries directly to all deployed units, ensuring up-to-date detection capabilities.

- Automated Calibration and Diagnostics: AI continuously optimizes device performance parameters by self-correcting for challenging environmental interference (temperature, humidity) and proactively notifying users of required maintenance schedules or sensor degradation.

- Improved User Interface (UI) and Workflow Guidance: AI-driven systems abstract complex analytical procedures, guiding users through optimized testing protocols via simplified interfaces, thereby lowering the expertise barrier for frontline security and enforcement personnel.

DRO & Impact Forces Of Handheld Drug Detectors Market

The Handheld Drug Detectors Market is fundamentally propelled by the inexorable rise in global security tensions linked to pervasive drug trafficking, most critically exemplified by the aggressive spread of synthetic opioids like fentanyl, which mandates the immediate, safe, and non-contact identification of trace amounts of high-potency substances. This primary driver is powerfully supplemented by sustained, high-level governmental funding directed towards securing national borders and augmenting internal law enforcement capabilities across major economies. Conversely, key market restraints encompass the significantly high initial capital expenditure required to procure advanced analytical instrumentation (particularly portable Raman and MS systems) and persistent operational concerns regarding the achieving regulatory harmonization necessary for the legal acceptance of field detection standards across disparate international jurisdictions. Nevertheless, substantial market opportunities are emerging through the robust integration of next-generation analytical techniques, continued miniaturization that enhances operational flexibility, and the successful expansion into burgeoning non-traditional application sectors, such as utilizing detection data for localized wastewater-based epidemiology screening and implementing targeted, proactive drug testing within large corporate and industrial environments. The combined effect of sustained, mission-critical governmental investment (acting as a foundational Driver) counterbalanced by the intrinsic complexity and recurring logistical costs associated with maintaining sophisticated, highly sensitive instruments (acting as a significant Restraint) collectively defines the overall trajectory and growth rate of the market, continuously pressuring manufacturers to develop increasingly cost-effective, durable, and highly multi-functional detection platforms.

Impact forces within this specialized market are overwhelmingly dominated by both technological advancements and national governmental policy decisions. Technologically, the ongoing and pronounced shift away from legacy, less specific methods (like basic wet chemistry kits or older generation IMS) toward advanced, high-specificity analytical methods such as high-resolution Raman, FTIR, and portable Mass Spectrometry sets an increasingly high technological barrier to entry for potential new competitors. This technological evolution concurrently acts as a powerful catalyst for continuous and rapid innovation among established, leading market players. Governmental policies, especially those governing the allocation of massive national security budgets, the statutory funding levels for key drug enforcement agencies (e.g., DEA, CBP, border agencies), and the implementation of highly stringent, modern border control measures across strategically vital regions such as North America, Western Europe, and parts of Asia, constitute the most profound and consistent external force, effectively guaranteeing a stable, high-volume demand base for certified equipment. Furthermore, the intensifying public and judicial expectation for expedited legal and judicial processes necessitates the deployment of field tools that can provide immediate, verifiable, legally reliable, and forensically sound evidence, substantially elevating the essential value proposition and required capability standards of modern handheld detection systems that must achieve near-laboratory grade accuracy at the point of discovery.

The market must also systematically address intrinsic technical constraints primarily related to the complex chemical matrix effect, where the physical form of the sample, or the intentional presence of common cutting or buffering agents (diluents), can obscure, complicate, or entirely mask the drug's core spectral signature. This complex limitation remains a critical challenge, driving continuous and significant investment in R&D specifically aimed at developing highly sophisticated software compensation techniques, advanced chemometric data modeling, and the engineering of smarter, more efficient sampling and preparation accessories. However, this challenge is being offset by substantial diversification opportunities presented by new and emerging market verticals. Utilizing these same detectors for rigorous pharmaceutical quality control validation, monitoring environmental compliance, or screening raw materials in the chemical supply chain offers robust pathways for revenue diversification, ensuring that the market’s long-term growth resilience extends strategically beyond its core governmental security applications, thereby providing a crucial mechanism for balancing inherent market dynamics and ensuring sustainable profitability.

Segmentation Analysis

The Handheld Drug Detectors market analysis is systematically segmented across four critical dimensions—Technology Type, Application Scope, Product Type, and the defined End-User classification—reflecting the vast heterogeneity in operational requirements, specific detection mandates, and the widely varying budgetary capacities across the spectrum of enforcement, security, and institutional agencies worldwide. The segmentation by Technology Type, which encompasses Ion Mobility Spectrometry (IMS), high-resolution Raman Spectroscopy, Fourier Transform Infrared (FTIR) analysis, and simple Colorimetric Testing, is fundamental, as it directly determines the device's core performance parameters: specificity, operational speed, detection limits (trace vs. bulk), and unit cost. Application segmentation, primarily categorizing usage into Border Security, routine Law Enforcement, and large-scale Critical Infrastructure Protection, is essential for dictating specific required hardware attributes, such as necessary ruggedization standards, environmental operating resilience, and the required throughput capacity. Deep understanding and strategic focus on these specialized segments are absolutely vital for manufacturers who must precisely tailor their product development and service offerings to meet the exact, often mission-critical, needs of disparate users—for example, producing highly ruggedized, weatherproof designs optimized for high-variability outdoor field operations versus providing devices designed for maximum speed and forensic accuracy within climate-controlled post-seizure analysis environments.

The segmentation by Product Type further defines the operational focus, separating the market into Trace Detection Devices, which excel at identifying minute residues or vapors (crucial for screening surfaces or persons), and Bulk Detection Devices, typically utilizing spectroscopy to identify larger quantities of solid or liquid substances quickly and non-destructively. A crucial emerging category is Combined or Hybrid Systems, which strategically integrate two or more analytical techniques into one portable unit, offering unparalleled confidence in identification and mitigating the weaknesses of single-method detection. The End-User segmentation categorizes purchasing power and requirement types, distinguishing between highly regulated, large-scale Governmental Agencies (defense, police, customs) and the increasingly important segment of Private Security Companies, which often require lower-cost, high-volume deployable solutions for commercial facilities or event security. This complex segmentation map provides the necessary granularity for market stakeholders to accurately assess competitive positioning, identify high-growth niches, and strategically allocate R&D resources toward the most commercially viable and technologically challenging sub-segments.

- Technology Type

- Ion Mobility Spectrometry (IMS): Excellent trace sensitivity; vapor and residue detection focus.

- Raman Spectroscopy: High chemical specificity; non-destructive, rapid solid/liquid identification.

- Infrared Spectroscopy (FTIR): Broad substance library capability; good for organic compounds and mixtures.

- Colorimetric Detection Kits: Lowest cost, high-volume screening; presumptive identification.

- Mass Spectrometry (Portable Devices): Highest level of forensic confirmation; emerging field technology.

- Application

- Border Security and Customs: High-throughput screening of cargo, vehicles, and personnel.

- Law Enforcement and Field Operations: Rapid roadside testing, search warrant support, and evidence processing.

- Critical Infrastructure Protection (Airports, Ports, Rail): Screening entry points and controlled access areas.

- Correctional Facilities and Prisons: Contraband interdiction and visitor screening.

- Military and Defense: Force protection, chemical/biological warfare agent detection, and drug route disruption.

- Homeland Security: Counter-terrorism and general security threat analysis in public spaces.

- Product Type

- Trace Detection Devices: Optimized for residue and vapor detection (e.g., IMS).

- Bulk Detection Devices: Optimized for larger quantities of unknown solids or liquids (e.g., Raman/FTIR).

- Combined/Hybrid Systems: Multi-method devices for comprehensive, high-confidence identification.

- End-User

- Government Agencies: Largest purchaser, including federal, state, and local police, customs, and defense departments.

- Private Security Companies: Growing segment for commercial, event, and corporate facility security.

- Pharmaceutical and Chemical Industries (QC): Rapid material verification and quality assurance testing.

- Educational Institutions: Campus security and research applications.

Value Chain Analysis For Handheld Drug Detectors Market

The value chain supporting the Handheld Drug Detectors market is intrinsically complex and highly specialized, initiating at the upstream level with the procurement and fabrication of highly specialized core components. This stage demands the strategic sourcing of high-tolerance optical elements (lenses, gratings, filters) and precision lasers (essential for Raman and FTIR), along with the careful management of exotic chemical reagents and specialized membranes crucial for Ion Mobility Spectrometry operation, alongside advanced semiconductor and sensor arrays. Key activities within this upstream R&D phase necessitate extensive, capital-intensive research to optimize sensor performance, develop robust chemical libraries, and create proprietary software algorithms capable of accurate spectral fingerprinting. This requires deep, interdisciplinary expertise bridging advanced analytical chemistry, specialized quantum physics, and sophisticated software engineering. The successful management of this intellectual capital and component supply chain determines the final efficacy and competitive edge of the detection product.

The midstream phase centers on the highly technical processes of sophisticated system assembly, exhaustive testing, and meticulous calibration of the final detection units. Due to the mission-critical nature of the equipment, manufacturers must rigorously adhere to the strictest international quality control standards, frequently requiring specific certifications relevant to military operation, public safety, and explosive/chemical agent detection (e.g., ISO certifications, potentially ATEX for hazardous environments). The substantial complexity of manufacturing these high-precision instruments drives up production costs and requires highly controlled manufacturing environments. A significant barrier to entry at this stage is the protection of proprietary Intellectual Property (IP), which often involves patents covering unique ionization methodologies, novel spectral processing techniques, or specialized miniaturized mass analyzer designs, securing the competitive position of established market leaders.

The downstream segment is defined by specialized distribution and comprehensive service provision, which contrasts sharply with typical commercial hardware sales. Distribution relies heavily on a vetted network of specialized security integrators, authorized technical distributors, and agents with established, deep relationships within governmental procurement hierarchies. Given the high unit value, the sensitive security applications, and the long deployment lifecycle, sales predominantly involve lengthy, direct negotiation processes and the awarding of multi-year service and supply contracts with major governmental end-users (e.g., Ministries of Defense, national police forces). After-sales support is not merely optional but an essential component of the purchase, mandating extensive, certified user training programs, providing continuous software updates to incorporate new drug threats into the spectral library, and implementing compulsory maintenance contracts. This reliance on a specialized, high-touch distribution model ensures correct deployment and sustained operational capability but dictates a longer sales cycle and exposes manufacturers to greater dependency on securing select, high-value institutional contracts.

Handheld Drug Detectors Market Potential Customers

The core customer base for handheld drug detectors is primarily composed of large governmental entities with explicit mandates in security, crime prevention, and the oversight of correctional facilities, as these agencies possess the necessary jurisdictional authority and the substantial, dedicated budgetary allocations required for modern security infrastructure acquisition. This dominant customer group includes, but is not limited to, federal and municipal police departments requiring immediate, scientifically verifiable field testing capability; customs and border protection agencies demanding high-throughput, legally compliant, and non-invasive inspection systems at all international ports of entry; and internal prison authorities utilizing trace detectors to establish a robust perimeter defense against contraband infiltration. The advanced analytical sensitivity of modern detectors makes them strategically essential tools for these agencies in countering both legacy narcotics routes and the dramatically more complex threat posed by ultra-potent synthetic drug proliferation. Procurement decisions within this sector are rigidly governed by formal tender processes, heavily weighted by factors such as device efficacy (sensitivity and specificity), proven operational reliability, the total lifecycle cost of ownership (TCO), and absolute compliance with standardized national or international forensic testing and data protection regulations.

A dynamically expanding customer segment encompasses operators of Critical National Infrastructure (CNI) and large private sector enterprises requiring heightened security measures. This includes complex entities such as international airport security consortia, major seaport operators, and large logistical hubs (often managed by specialized private contractors operating under government performance oversight), where continuous screening of voluminous cargo, vehicles, and transient personnel is mandatory. Moreover, the expansive private security industry, specifically those managing high-profile public events (stadiums, concerts) or corporate facilities enforcing zero-tolerance drug policies, represents a burgeoning and potentially high-volume market niche for moderately priced, highly intuitive spectroscopic or robust colorimetric devices. These commercial customers prioritize factors such as seamless integration into existing electronic security systems, minimizing disruptive delays to operational flow, and ensuring stringent adherence to regional labor laws and personal data protection requirements while maintaining a robust security posture against unauthorized substance entry.

Beyond the traditional security and enforcement clientele, new and valuable market verticals are rapidly emerging within the scientific, quality control, and industrial sectors. Pharmaceutical and high-end specialty chemical manufacturing companies are increasingly deploying portable spectroscopy units for rapid, on-site raw material verification, robust quality assurance testing, and immediate identification of potential counterfeiting or adulteration within their complex supply chains—a direct shift from reliance on centralized lab testing. Academic research institutions and specialized forensic toxicology laboratories also constitute a steady customer base, utilizing these field devices for efficient preliminary sample triage and rapid screening prior to committing resources to more expensive, time-consuming laboratory-based confirmation analysis (e.g., gas chromatography-mass spectrometry, GC-MS). This strategic diversification of the end-user base necessitates that manufacturers actively adapt their marketing strategies, product features, and regulatory compliance packages to simultaneously address the forensic precision required by laboratory standards and the essential rugged durability mandated by demanding, high-stress law enforcement field applications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $4.5 Billion |

| Market Forecast in 2033 | $8.1 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Smiths Detection, Thermo Fisher Scientific, Agilent Technologies, FLIR Systems (Teledyne FLIR), Bruker Corporation, Rigaku Corporation, Safran, DetectaChem, 908 Devices, Serstech AB, K&M Electronics, Mistral Security Inc., Viken Detection, Scentmate Technologies, Kromek Group, Proengin, Cobalt Light Systems (Agilent), Avantes, Ahura Scientific, Chemring Group, Leidos |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Handheld Drug Detectors Market Key Technology Landscape

The technological landscape within the Handheld Drug Detectors market is defined by a rigorous pursuit of non-destructive, highly sensitive, and chemically specific analytical techniques that prioritize operational speed and field utility. Ion Mobility Spectrometry (IMS) continues to be a cornerstone technology, especially for applications demanding ultra-high sensitivity trace detection, making it indispensable in high-security environments like airports and border crossings for screening residues on surfaces or in vapor samples. However, the operational efficacy of IMS is often limited by its sensitivity to ambient humidity and the potential for false positives from common household chemicals, necessitating frequent calibration and reliance on expensive consumables (dopants). Counterbalancing IMS's limitations is the accelerating adoption of advanced spectroscopy, chiefly Raman and Fourier Transform Infrared (FTIR) spectroscopy. These methods deliver superior chemical specificity by generating unique molecular fingerprints, enabling the definitive identification of substances within complex mixtures without destroying the sample. Spectroscopic detectors are rapidly gaining primacy due to their inherent ability to compare unknown substances against expansive, proprietary chemical libraries, positioning them as the ideal tool for proactive counter-measures against the rapidly evolving threat posed by novel psychoactive substances (NPS).

A pivotal technological advancement defining the current market trajectory is the widespread shift toward strategic hybridization and the integration of multiple analytical modalities within a single, portable architecture. Leading manufacturers are actively combining complementary detection methods—for example, pairing the high specificity of Raman spectroscopy with the ultra-low limit of detection provided by IMS, or integrating a basic colorimetric pre-screen with an advanced micro-Mass Spectrometer (Mini-MS)—to create highly reliable, multi-layered detection platforms. This multi-modality strategy is explicitly designed to nullify the inherent technical constraints of any single technology, dramatically boosting the overall confidence level in identification and substantially minimizing the costly frequency of false positives, particularly when devices are deployed in challenging, highly contaminated, or environmentally variable field settings. Crucially, the integration of highly sophisticated software solutions, including complex Chemometric analysis and AI/ML-driven spectral interpretation tools, is paramount for effectively translating the raw, complex analytical data produced by these advanced sensors into rapid, unequivocal, and operationally relevant results for the non-expert field operative.

The core innovation thrust is heavily focused on achieving extreme miniaturization, improving power efficiency, and increasing the overall robustness of these high-end analytical instruments. Significant research and development investment is currently being channeled into developing sophisticated Micro-Electro-Mechanical Systems (MEMS) technologies, particularly for creating smaller, lighter, and more field-deployable mass spectrometers. The goal is to successfully transition laboratory-grade sensitivity and confirmatory power directly into the hands of frontline security personnel. Concurrently, ubiquitous connectivity—facilitated by integrated 5G, LTE, and secure Wi-Fi modules—is essential for enabling seamless, real-time data exchange, immediate remote diagnostics, and instantaneous access to globally centralized threat databases, allowing deployed units to receive updated intelligence moments after a new threat is identified anywhere in the world. This holistic focus on durability, connectivity, and analytical rigor underscores the industry’s determined commitment to delivering truly enterprise-grade detection solutions that maintain reliability under intense operational conditions while providing the legally admissible, high-quality forensic data increasingly required by modern legal and regulatory frameworks.

Regional Highlights

- North America: Maintains its definitive leadership position in market size and revenue share, primarily driven by substantial and non-discretionary federal allocations directed toward countering the severe domestic opioid crisis and strengthening the operational capacity of homeland security and border patrol agencies (e.g., U.S. Customs and Border Protection). The region is characterized by early and pervasive adoption of advanced, high-specification spectroscopic and IMS hybridization technologies.

- Europe: Constitutes a highly mature and critical market, marked by standardized, stringent EU-wide security protocols and robust, cross-functional enforcement collaboration (e.g., coordinated efforts through Europol and border agencies). Demand is consistently high for mobile, certified, multi-drug screening devices required to effectively manage porous internal and complex external borders, with particular operational sensitivity to the inflow of potent synthetic drugs originating from various established supply routes.

- Asia Pacific (APAC): Projected to attain the highest Compound Annual Growth Rate (CAGR) throughout the forecast period. This rapid expansion is fundamentally supported by large-scale governmental investment in military and law enforcement modernization, escalating challenges posed by intricate transnational drug trafficking networks utilizing rapidly growing trade infrastructure, and proactive national security funding aimed at securing expanding airport, seaport, and logistics capabilities across industrializing economies such as Vietnam, Indonesia, and India.

- Latin America: Characterized by intensely high operational necessity due to its involvement in both drug production and critical transit routes. Market growth is structurally constrained by variable governmental expenditure and economic volatility; however, there is a consistent, foundational demand from military and specialized federal police units requiring highly durable, simple-to-operate field detection systems essential for interdiction and tactical anti-trafficking operations.

- Middle East and Africa (MEA): Represents an actively developing market segment with procurement heavily concentrated on critical infrastructure protection (ports, oil/gas terminals) and securing major international transport hubs (e.g., Dubai, Abu Dhabi, and key African shipping lanes) against illicit movement. The increasing adoption rate is driven by substantial defense and internal security spending, often involving the strategic, direct procurement of high-end Western spectroscopic and trace detection technologies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Handheld Drug Detectors Market.- Smiths Detection

- Thermo Fisher Scientific

- Agilent Technologies

- FLIR Systems (Teledyne FLIR)

- Bruker Corporation

- Rigaku Corporation

- Safran

- DetectaChem

- 908 Devices

- Serstech AB

- K&M Electronics

- Mistral Security Inc.

- Viken Detection

- Scentmate Technologies

- Kromek Group

- Proengin

- Cobalt Light Systems (Agilent)

- Avantes

- Ahura Scientific

- Chemring Group

- Leidos

Frequently Asked Questions

Analyze common user questions about the Handheld Drug Detectors market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary technological differentiators in handheld drug detection?

The primary differentiators are speed, specificity, and portability. Ion Mobility Spectrometry (IMS) offers ultra-high sensitivity for detecting trace residues, while Raman and FTIR spectroscopy provide superior chemical specificity for definitive, non-destructive bulk analysis. Hybrid systems combining these techniques offer the highest reliability and lowest false positive rates in dynamic field environments.

How is the opioid crisis impacting the demand for handheld drug detectors?

The opioid crisis, particularly the proliferation of highly potent synthetic drugs like fentanyl, is the main fundamental driver of market demand. These substances necessitate extremely sensitive trace detection capabilities, compelling law enforcement and border agencies to procure advanced, high-specificity devices (often Raman or hybrid IMS/spectroscopy) to ensure rapid and safe identification for first responders.

Is data from handheld drug detectors admissible as evidence in court?

Admissibility varies significantly by national and regional jurisdiction. Typically, data from certified handheld detectors is utilized for presumptive field identification to establish probable cause. For definitive legal admissibility in most superior courts, subsequent laboratory confirmation (using techniques like GC-MS or LC-MS) is often still mandated, although the use of newer, highly specific portable Mass Spectrometry devices is beginning to challenge this traditional forensic standard.

Which geographic region exhibits the strongest growth potential?

The Asia Pacific (APAC) region is strategically forecasted to experience the strongest growth rate due to rapidly increasing cross-border drug trafficking, significant governmental modernization investments in critical infrastructure security, and heightened defense spending aimed at boosting counter-narcotics and customs enforcement capabilities across major developing economies.

How does Artificial Intelligence improve the performance of these detection devices?

AI significantly enhances performance by employing deep machine learning for advanced spectral analysis, enabling devices to accurately classify complex, mixed chemical samples and effectively filter out environmental noise, thereby drastically reducing the operational burden of false positives. AI also facilitates the continuous, autonomous identification and addition of novel psychoactive substances (NPS) into the active threat detection libraries via real-time data aggregation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager