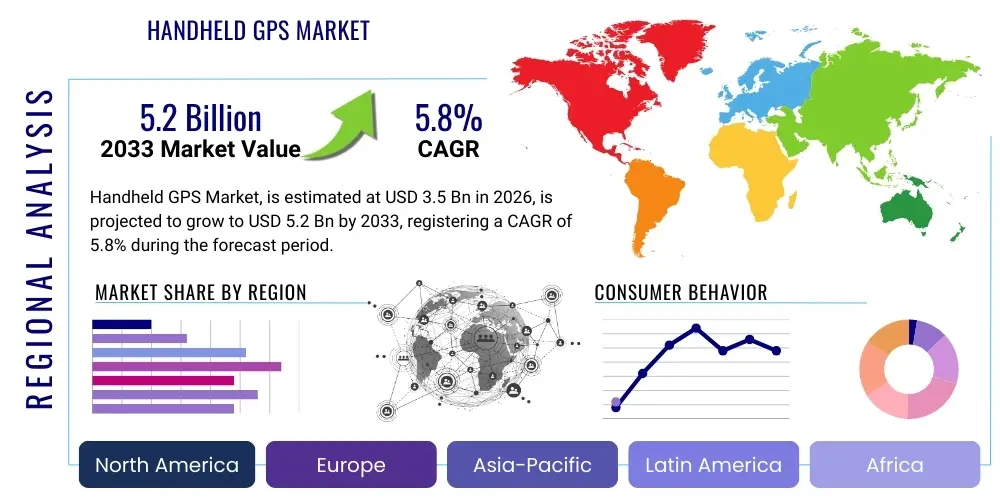

Handheld GPS Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435898 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Handheld GPS Market Size

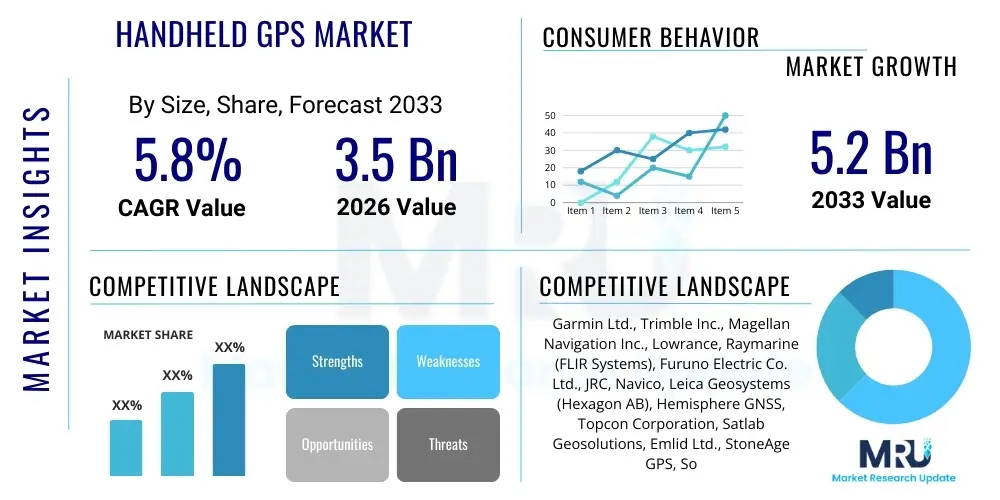

The Handheld GPS Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $3.5 Billion in 2026 and is projected to reach $5.2 Billion by the end of the forecast period in 2033.

Handheld GPS Market introduction

The Handheld GPS Market encompasses portable, ruggedized devices specifically engineered for accurate location determination, tracking, and navigation in environments where smartphone reliability or battery life may be compromised. These devices, integral to Global Navigation Satellite Systems (GNSS) technology, offer superior resilience, longer battery longevity, and access to advanced mapping and sensor integration capabilities often required for professional and extreme recreational activities. Product descriptions typically emphasize features such as waterproof ratings, barometric altimeters, electronic compasses, and highly sensitive receivers capable of tracking multiple satellite constellations (GPS, GLONASS, Galileo, BeiDou). The primary market focus includes devices tailored for applications such as wilderness exploration, surveying, mapping, search and rescue operations, military maneuvers, and specialized industrial field data collection.

Major applications of handheld GPS units span across diverse sectors, including outdoor recreation where they provide essential safety and route-finding tools for hikers, mountaineers, and hunters; and professional sectors such as precision agriculture, forestry management, and geological surveying where high-accuracy, rugged data collection is mandatory. The core benefits derived from utilizing these dedicated devices include unparalleled reliability in challenging signal environments (such as deep canyons or dense forests), robust construction ensuring durability against environmental stressors, and dedicated mapping functionality optimized for offline use. Furthermore, many high-end units support two-way communication features and emergency signaling (e.g., inReach technology), enhancing user safety far beyond the capabilities of standard consumer electronics.

Driving factors propelling the expansion of this market are heavily linked to the sustained global interest in adventure tourism and outdoor recreational activities, requiring reliable navigation tools. Simultaneously, the increasing demand from professional sectors, particularly for high-precision GNSS receivers used in infrastructure development and geospatial data capture, continues to boost market revenue. Technological advancements, notably the integration of multi-frequency GNSS receivers and sophisticated sensor fusion techniques, are improving positioning accuracy and device versatility, thereby broadening the potential applications and maintaining the competitive edge of dedicated handheld GPS solutions over ubiquitous smartphone applications.

Handheld GPS Market Executive Summary

The Handheld GPS Market is currently experiencing robust growth, primarily driven by strong demand from professional surveying and military applications alongside a steady increase in consumer adoption within the adventure tourism segment. Key business trends indicate a shift toward high-precision, multi-constellation (L1/L5, E1/E5) capable devices that offer enhanced positional accuracy and faster fix times, addressing the evolving needs of commercial users requiring sub-meter or centimeter-level accuracy in the field. Furthermore, the competitive landscape is characterized by established players focusing heavily on software integration, offering proprietary mapping solutions, cloud-based data synchronization, and subscription models for premium features, ensuring recurring revenue streams and deeper user engagement.

From a regional perspective, North America and Europe currently represent the most mature markets, dominating revenue share due to high consumer disposable income, established outdoor recreational cultures, and substantial governmental and military expenditure on advanced navigation equipment. However, the Asia Pacific (APAC) region is projected to register the fastest growth rate throughout the forecast period. This acceleration is attributed to rapidly increasing infrastructure development projects in countries like China and India, escalating demand for precision mapping in emerging economies, and the burgeoning popularity of adventure sports among the expanding middle class, fueling the need for reliable, off-grid navigation tools.

Analysis of segment trends highlights that the Professional/Industrial Application segment, encompassing surveying, construction, and government use, maintains the largest market share owing to the requirement for highly specialized and accurate equipment. Conversely, within the Product Type segment, mapping and guidance devices are witnessing substantial innovation, incorporating features like augmented reality navigation overlays and satellite communication capabilities. The market demonstrates resilience despite competition from smartphones, as handheld units continually differentiate themselves through superior durability, longer operating hours, and specialized functionality critical for mission-critical and extreme environmental use cases where failure is not an option.

AI Impact Analysis on Handheld GPS Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Handheld GPS Market primarily revolve around three key areas: enhanced navigational precision, predictive battery management, and personalized route optimization. Users frequently ask how AI can improve positional accuracy in signal-degraded environments, such as urban canyons or dense foliage, which is a traditional weakness of GNSS technology. Concerns also focus on whether AI can help extend the limited operational duration of devices through intelligent power management based on usage patterns and environmental conditions. Expectations center on the development of smart mapping systems that utilize machine learning (ML) algorithms to analyze vast datasets—including terrain morphology, weather patterns, and historical traffic (or foot) data—to suggest the safest, fastest, or most efficient routes dynamically, adapting instantly to unforeseen obstacles or emergencies.

AI's initial influence is profound in optimizing the algorithms used for sensor fusion. By employing ML models, handheld GPS units can more intelligently weigh inputs from disparate sensors—including accelerometers, gyroscopes, barometers, and magnetometers—alongside raw GNSS data. This capability significantly improves positioning accuracy and reliability, particularly during temporary signal outages, allowing for highly accurate dead reckoning. Furthermore, predictive modeling powered by AI is revolutionizing battery consumption. Devices can learn user behavior and environmental factors to dynamically adjust power settings, selectively enabling or disabling high-draw components like high-frequency GNSS tracking or display brightness, thereby maximizing operational time in the field, which is a critical specification for adventure users and field professionals.

The future trajectory involves AI enabling truly cognitive handheld devices capable of advanced environmental understanding. This includes automated feature recognition in mapping (identifying trails, water bodies, or boundaries from satellite imagery processed locally), and personalized safety features that learn the physical limits and typical pace of the user to proactively issue warnings or initiate emergency protocols if deviations or unexpected cessation of movement are detected. This integration transforms the handheld GPS from a simple tracking tool into an intelligent field assistant, providing advanced decision support tailored to the specific context of the user and their immediate surroundings, enhancing both efficiency and overall safety during remote operations.

- AI-driven sensor fusion algorithms dramatically enhance positioning accuracy and reliability in challenging environments.

- Machine Learning optimizes power management, predicting usage patterns to extend battery life in the field.

- Predictive mapping utilizes AI to analyze environmental data for dynamic route adjustments and hazard avoidance.

- Automated feature recognition accelerates field data collection and mapping updates.

- AI enables personalized navigation, adapting routes based on user profiles, pace, and physical capacity.

- Enhanced data anomaly detection minimizes errors in high-precision professional surveying applications.

DRO & Impact Forces Of Handheld GPS Market

The dynamics of the Handheld GPS Market are shaped by a complex interplay of driving forces (D), restraints (R), and opportunities (O), which collectively define the Impact Forces dictating market trajectory. A primary driver is the accelerating consumer interest in outdoor recreational pursuits, coupled with increasing requirements for reliable, off-grid navigation tools essential for personal safety and expedition planning in remote areas. This is strongly complemented by sustained governmental and defense sector investments globally, focusing on acquiring ruggedized, secure, and highly accurate positioning devices for military, law enforcement, and search and rescue missions. Additionally, technological advancements, such as the rollout of new satellite constellations (like Galileo and BeiDou) and multi-frequency receiver chipsets, continuously improve accuracy and signal resilience, thereby generating replacement cycles and expanding application potential across various industries.

Conversely, significant restraints hinder faster market expansion, most notably the intense competitive pressure exerted by ubiquitous and highly sophisticated smartphone applications that offer free or low-cost mapping and basic navigation services. While dedicated handheld units offer superior ruggedness and battery life, the vast majority of casual users find smartphone capabilities sufficient, eroding the lower-end recreational market segment. Furthermore, the specialized nature and often high initial cost of professional-grade handheld GPS units, particularly those offering centimeter-level accuracy (e.g., RTK-enabled devices), can act as a barrier to adoption for small businesses or budget-conscious organizations. The inherent challenge of maintaining connectivity and data synchronization in extremely remote environments also poses a technological and logistical restraint that vendors must continuously address through satellite communication integration.

The opportunities within the handheld GPS sector are vast, particularly through vertical integration and specialized product development. A major opportunity lies in integrating Handheld GPS devices with the broader Internet of Things (IoT) ecosystem, enabling seamless data flow to cloud platforms for real-time asset tracking, remote monitoring, and comprehensive fleet management in industrial settings. Furthermore, the burgeoning demand for high-accuracy Geospatial Information System (GIS) data collection in emerging markets, driven by infrastructure development and environmental monitoring, presents a substantial growth avenue for high-end professional units. Developing more intuitive user interfaces, integrating augmented reality (AR) features for field visualization, and expanding emergency communication capabilities via integrated satellite modems will be crucial in capturing these emerging opportunities and solidifying the market position of dedicated handheld devices against generalized consumer electronics.

Segmentation Analysis

The Handheld GPS Market is meticulously segmented based on application type, product type, and underlying technology, reflecting the diverse requirements of end-users ranging from casual hikers to professional surveyors and defense personnel. The segmentation structure allows manufacturers to tailor features, durability standards, and price points to specific demographic and professional needs, ensuring maximum market penetration across various economic tiers and usage scenarios. Application-based segmentation is critical, dividing the market into Professional/Industrial Use and Recreational/Consumer Use, where devices vary significantly in terms of required accuracy, processing power, and external sensor compatibility.

Product type segmentation distinguishes between dedicated mapping and guidance devices, which often feature large color screens and extensive pre-loaded topographical maps, and simple tracking devices primarily focused on location logging and basic navigation cues. Technological segmentation further refines the market by categorizing devices based on their GNSS capabilities, such as those relying solely on standard GPS L1 band versus advanced devices offering multi-constellation support (GPS, GLONASS, Galileo, BeiDou) and multi-frequency tracking (L1, L5, E5), which significantly enhances precision and reduces multipath errors, particularly crucial for high-accuracy professional tasks like land surveying and construction layout.

The evolution of these segments shows a clear trend towards convergence, with many professional-grade features, such as enhanced ruggedness and multi-band GNSS reception, slowly trickling down into premium recreational models, driving up the overall quality and capability of consumer offerings. However, the core distinction remains centered around accuracy: recreational devices generally target 3–5 meter accuracy, while professional devices incorporating real-time kinematic (RTK) corrections aim for centimeter-level accuracy, sustaining the price disparity and maintaining distinct market sub-categories tailored for highly specialized field operations.

- By Application Type:

- Recreational Use (Hiking, Hunting, Geocaching)

- Professional/Industrial Use (Surveying, Construction, Forestry, Agriculture)

- Military and Government Use (Search and Rescue, Defense Operations)

- By Product Type:

- Mapping and Guidance Systems

- Basic Tracking Devices

- High-Precision Data Collectors (GIS/Survey Grade)

- By Technology:

- Standard GNSS (L1 only)

- Advanced Multi-Constellation/Multi-Frequency GNSS (L1/L5, Galileo, BeiDou)

- Differential GPS (DGPS) and Real-Time Kinematic (RTK) Enabled Systems

Value Chain Analysis For Handheld GPS Market

The value chain for the Handheld GPS Market begins with upstream activities focused on the procurement of core technological components, dominated by specialized semiconductor manufacturers and sensor producers. Key upstream inputs include GNSS receiver chipsets (e.g., U-blox, Qualcomm), high-resolution display components, robust casing materials (often meeting IP and MIL-STD standards), and specialized mapping data/licensing providers. The cost structure at this stage is heavily influenced by technological advancements, such as the transition to multi-frequency chipsets, which require significant R&D investment but offer a superior product. Manufacturers engage in complex assembly, calibration, and rigorous quality control testing to ensure devices meet necessary ruggedness and accuracy specifications before moving to the downstream segment.

Downstream activities center around market reach and end-user engagement, primarily involving distribution channels and after-sales support. Distribution is bifurcated into direct sales to large professional/military organizations, ensuring bespoke solutions and training, and indirect sales through a network of specialized retailers, e-commerce platforms, and authorized dealers catering to the consumer and small business segments. Direct distribution is crucial for high-value, complex professional units (like RTK surveyors), while the recreational market heavily relies on broad retail and online presence for volume sales. Effective downstream strategy relies on providing comprehensive technical support, map updates, and warranty services, ensuring user satisfaction and brand loyalty.

Distribution channel strategies are optimized based on the segment served. Consumer-grade devices are largely sold via mass-market sporting goods stores and major online retailers (indirect channel), leveraging visibility and price competition. Professional-grade equipment, due to its complexity and requirement for technical integration, is often sold directly through dedicated enterprise sales teams or through highly specialized geospatial technology resellers (direct channel). This dual channel approach ensures efficient inventory management and targeted marketing efforts, minimizing channel conflict while maximizing reach across diverse customer types who possess highly specific purchasing behaviors and expectations regarding technical service and product expertise.

Handheld GPS Market Potential Customers

Potential customers for the Handheld GPS Market are primarily segmented into professional entities requiring precision and durability, and recreational users prioritizing reliability and safety in off-grid locations. Professional end-users include government agencies such as military and defense organizations that utilize ruggedized, encrypted GPS units for logistics, operational planning, and soldier tracking, often demanding the highest levels of accuracy and security. Additionally, the construction and surveying sectors represent a massive user base, purchasing high-accuracy (RTK-enabled) handheld devices for boundary mapping, asset location, and site preparation, valuing centimeter-level precision and seamless integration with GIS software for data analysis and visualization.

The recreational market targets individuals engaged in outdoor pursuits such as hiking, mountaineering, hunting, fishing, and geo-caching. These buyers prioritize devices with long battery life, intuitive interfaces, reliable offline mapping capabilities, and safety features like emergency satellite communication (e.g., inReach functionality). These devices serve as essential safety equipment, reducing dependence on cellular service in wilderness areas. This segment is highly sensitive to ease of use, mapping quality, and overall ruggedness, preferring brands recognized for resilience against harsh weather conditions (waterproofing and shock resistance).

A third significant customer group involves industrial field workers and logistics operators. This includes forestry personnel using GPS to map tree boundaries and inventory resources, agricultural professionals utilizing handheld units for precision farming tasks like soil sampling and variable rate application tracking, and utility companies needing accurate location tools for infrastructure maintenance and asset management. For these industrial applications, the device's ability to integrate data collection functions, support customizable mapping layers, and withstand industrial wear and tear are critical purchasing criteria, making them highly valuable customers seeking ROI through enhanced operational efficiency and data accuracy.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $3.5 Billion |

| Market Forecast in 2033 | $5.2 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Garmin Ltd., Trimble Inc., Magellan Navigation Inc., Lowrance, Raymarine (FLIR Systems), Furuno Electric Co. Ltd., JRC, Navico, Leica Geosystems (Hexagon AB), Hemisphere GNSS, Topcon Corporation, Satlab Geosolutions, Emlid Ltd., StoneAge GPS, South Surveying & Mapping. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Handheld GPS Market Key Technology Landscape

The technological landscape of the Handheld GPS Market is defined by continuous innovation focused on enhancing accuracy, reliability, and user interaction, moving far beyond basic satellite signal reception. A core technological advancement involves the widespread adoption of multi-frequency and multi-constellation GNSS receivers. Modern handheld devices are increasingly capable of tracking signals across multiple frequency bands (e.g., L1, L5 for GPS; E1, E5 for Galileo) and utilizing signals from multiple satellite systems simultaneously (GPS, GLONASS, Galileo, BeiDou). This multi-path capability significantly improves accuracy, particularly in challenging environments where line-of-sight to satellites is frequently obstructed, drastically reducing signal acquisition time and increasing positional integrity, which is vital for professional mapping and surveying applications where sub-meter or centimeter precision is mandatory for project success and data credibility.

Another crucial technological pillar is the evolution of sensor fusion and Inertial Navigation Systems (INS). High-end handheld GPS units now seamlessly integrate raw GNSS data with readings from built-in micro-electromechanical systems (MEMS) sensors—including barometric altimeters, 3-axis compasses, and sophisticated gyroscopes. This integrated system allows the device to maintain accurate navigation and positioning even when GNSS signals are temporarily lost (a technique known as dead reckoning). Sensor fusion algorithms, increasingly incorporating AI and machine learning, intelligently filter noise and compensate for drift, providing smooth, consistent position tracking indoors or under dense canopy cover, which is a major differentiator compared to basic mobile phone GPS capabilities relying solely on satellite fixes.

Furthermore, connectivity and display technologies are rapidly evolving. The integration of satellite communication capabilities, particularly technologies like Iridium's SBD (Short Burst Data) or Garmin's inReach platform, directly into handheld units transforms them into essential two-way communicators and emergency beacons, enabling location sharing and SOS signaling outside of cellular range. Display technology is trending towards rugged, transflective screens that are optimized for outdoor visibility under direct sunlight while minimizing power consumption. The development of specialized software interfaces, supporting Augmented Reality (AR) overlays that project navigational cues or GIS data directly onto a real-world camera view, represents a cutting-edge technological capability poised to revolutionize field data visualization and asset location for industrial and governmental users, dramatically enhancing operational efficiency and situational awareness in complex terrains.

Regional Highlights

Regional dynamics play a crucial role in shaping the Handheld GPS Market, with variations in technology adoption, consumer behavior, and infrastructure needs defining market growth across continents. North America, particularly the United States and Canada, remains the largest revenue generator, characterized by a highly active outdoor recreation segment and robust spending by federal agencies (such as the military, USGS, and forestry services) on advanced professional-grade devices. The region is a primary hub for technological innovation, with high demand for high-accuracy RTK systems and integrated satellite communication devices.

Europe is another mature market, exhibiting strong demand driven by established hiking, cycling, and mountaineering cultures, especially in the Alps and Scandinavian regions. European regulations, such as the deployment of the Galileo satellite system, further enhance local GNSS capabilities, driving the uptake of multi-constellation compatible devices. The market here is characterized by a strong emphasis on sustainability and environmental monitoring applications, fueling sales of professional GIS data collection tools.

The Asia Pacific (APAC) region is forecasted to achieve the highest CAGR during the forecast period. This exponential growth is propelled by rapid urbanization, massive infrastructure projects (roads, railways, smart cities), and increasing defense expenditures, particularly in emerging economies like China, India, and Southeast Asian nations. These countries are demanding cost-effective, high-precision handheld units for surveying and construction layout. The rising affluence in APAC is also catalyzing the growth of the consumer adventure tourism segment, further stimulating the market.

Latin America (LATAM) and the Middle East and Africa (MEA) represent emerging markets with substantial untapped potential. Growth in LATAM is linked to resource extraction industries (mining, oil & gas) and agricultural expansion, requiring durable handheld GPS units for asset management and boundary mapping. In MEA, governmental investment in smart infrastructure, security, and defense modernization drives the demand for specialized, rugged GPS devices, although economic instability and political factors can influence the pace of market penetration.

- North America (NA): Dominant market share due to high consumer spending on recreation and extensive governmental/military procurement of advanced, ruggedized systems.

- Europe: Strong market driven by dense outdoor recreational culture and high adoption rates of multi-constellation (Galileo-compatible) devices for professional mapping.

- Asia Pacific (APAC): Highest expected CAGR fueled by rapid infrastructure development, urbanization projects, and increasing defense modernization across key economies.

- Latin America (LATAM): Growth primarily generated by demand from mining, oil and gas, and precision agriculture sectors requiring durable field mapping tools.

- Middle East and Africa (MEA): Emerging demand tied to large-scale construction projects, national security initiatives, and utility mapping requirements.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Handheld GPS Market.- Garmin Ltd.

- Trimble Inc.

- Magellan Navigation Inc.

- Lowrance

- Raymarine (FLIR Systems)

- Furuno Electric Co. Ltd.

- JRC

- Navico

- Leica Geosystems (Hexagon AB)

- Topcon Corporation

- Hemisphere GNSS

- Satlab Geosolutions

- Emlid Ltd.

- South Surveying & Mapping

- U-blox Holding AG (Component Provider)

- CHC Navigation

- Spectra Precision (Trimble brand)

- Bad Elf, LLC

- StoneAge GPS

- Standard Horizon

Frequently Asked Questions

Analyze common user questions about the Handheld GPS market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a professional handheld GPS and a recreational unit?

The primary distinction lies in positional accuracy and feature ruggedness. Professional units, often using RTK or DGPS technology, provide centimeter-level accuracy essential for surveying and engineering, feature more robust casings (higher IP ratings), and support advanced GIS data collection software. Recreational units focus on user-friendly navigation, long battery life, and general reliability (3–5 meter accuracy) for hiking and adventure sports.

How does multi-frequency GNSS tracking improve handheld GPS performance?

Multi-frequency tracking, such as receiving L1 and L5 signals, allows the device to significantly reduce errors caused by atmospheric delays (ionospheric interference). This results in faster satellite acquisition, greater reliability in areas with poor signal visibility (like urban canyons or forests), and vastly improved positional accuracy compared to single-frequency receivers, making the devices suitable for precision mapping tasks.

Are handheld GPS devices vulnerable to competition from modern smartphone applications?

While smartphones dominate the casual navigation market, dedicated handheld GPS devices maintain a competitive edge due to superior durability (waterproofing, shock resistance), substantially longer operational battery life (often days vs. hours), and the ability to utilize external satellite communication networks (e.g., inReach) and highly sensitive multi-constellation receivers, which are critical features for professional and mission-critical off-grid use cases.

Which application segment drives the highest revenue in the Handheld GPS Market?

The Professional/Industrial Use segment, which includes surveying, construction, forestry, and military applications, currently drives the highest revenue. This is attributed to the high unit cost of high-precision devices (RTK/DGPS enabled) and consistent governmental expenditure on reliable, secure navigation and data collection equipment required for large-scale infrastructure and defense projects globally.

What emerging technology is most likely to revolutionize future handheld GPS functionality?

The integration of Augmented Reality (AR) with high-accuracy GNSS is poised to revolutionize the market. AR overlays can display real-time GIS data, utility lines, property boundaries, or navigation arrows directly onto the user's view of the physical world, dramatically enhancing field visualization, data collection efficiency, and situational awareness for surveyors and utility workers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager