Handheld Nutrunner Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432976 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Handheld Nutrunner Market Size

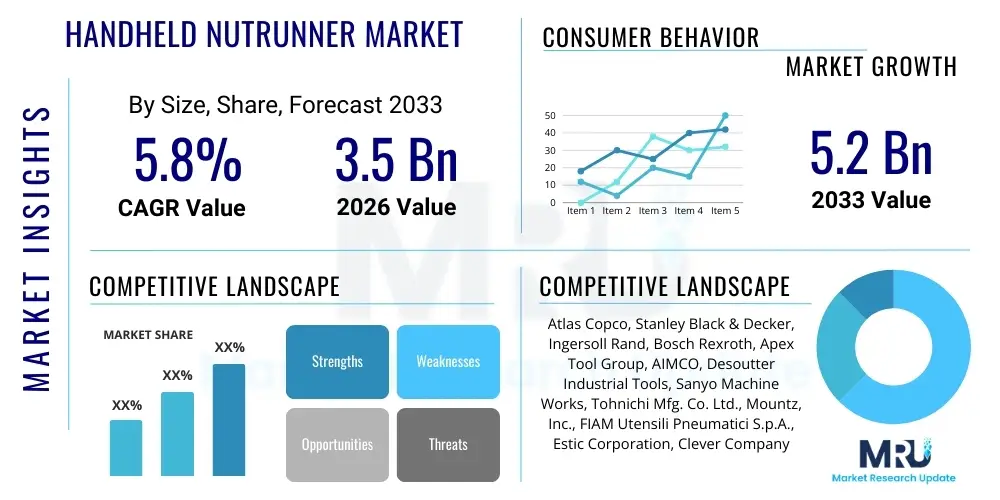

The Handheld Nutrunner Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.2 Billion by the end of the forecast period in 2033.

Handheld Nutrunner Market introduction

The Handheld Nutrunner Market encompasses specialized power tools designed for the precise and controlled tightening or loosening of fasteners, primarily nuts and bolts, in industrial assembly environments. These tools are crucial for ensuring joint integrity, which is paramount in safety-critical sectors like automotive, aerospace, and heavy machinery manufacturing. Handheld nutrunners offer significant advantages over traditional manual torque wrenches, including enhanced speed, repeatability, and sophisticated data collection capabilities, positioning them as indispensable assets in modern, automated production lines. The primary objective of these devices is to achieve specific torque targets reliably, minimizing production errors and enhancing overall operational efficiency.

Handheld nutrunners are broadly categorized by their power source, including electric (corded and battery-powered/cordless), pneumatic, and hydraulic variants. Electric nutrunners, particularly the DC electric models, have gained prominence due to their superior torque control algorithms, programmability, and ease of integration into digital factory ecosystems (Industry 4.0). Their product descriptions often emphasize features such as error-proofing, multi-step tightening strategies, and ergonomic designs that reduce operator fatigue, which is a major factor in high-volume assembly tasks. Major applications span vehicle final assembly, engine and transmission production, structural airframe assembly, and the construction of wind turbines and heavy earthmoving equipment.

The benefits derived from adopting advanced handheld nutrunners include improved quality assurance through traceability, reduced rework rates, and compliance with stringent international safety standards (e.g., ISO 9001). Driving factors for market expansion include the global surge in electric vehicle (EV) manufacturing, which requires extremely accurate battery pack assembly and thermal management component installation. Furthermore, increasing regulatory pressure on manufacturers to document and verify every critical joint in their products, combined with rising labor costs and the continuous pursuit of lean manufacturing principles, further solidifies the essential role of high-precision handheld fastening tools in the contemporary industrial landscape.

Handheld Nutrunner Market Executive Summary

The global Handheld Nutrunner Market is undergoing rapid transformation, driven primarily by the shift towards smart manufacturing and the proliferation of DC electric nutrunners offering unmatched precision and integration capabilities. Current business trends indicate a strong move away from traditional pneumatic tools towards cordless, battery-powered electric solutions, which provide operational flexibility and lower energy consumption, appealing significantly to automotive and aerospace original equipment manufacturers (OEMs) focused on optimizing their assembly floor layouts. Technology providers are heavily investing in software integration, enabling real-time monitoring, torque curve analysis, and predictive maintenance features, effectively turning the nutrunner into a data-generating endpoint within the industrial internet of things (IIoT).

Regionally, the Asia Pacific (APAC) market, spearheaded by China, Japan, and India, exhibits the highest growth potential, largely attributable to massive investments in automotive production capacity, particularly for EV and hybrid vehicles, and the expansion of heavy industrial infrastructure. North America and Europe remain mature markets but are driving innovation through stringent quality mandates in aerospace and high-end automotive manufacturing, demanding advanced features such as absolute encoder feedback and sophisticated torque control strategies to eliminate human error. The transition towards automated assembly in developing economies is simultaneously fueling demand for cost-effective, yet reliable, handheld tools suitable for high-volume, repetitive tasks.

Segmentation trends highlight the dominance of electric nutrunners (DC control systems) over pneumatic and hydraulic types, expected to capture the majority revenue share over the forecast period. Among applications, the automotive sector maintains its leading position, requiring diverse tool specifications ranging from small, low-torque instruments for interior components to heavy-duty nutrunners for chassis and powertrain assembly. Within the product categories, the demand for high-torque, reaction-less nutrunners designed for operator safety and ergonomic compliance is a notable segment trend, catering to applications where traditional torque multipliers introduce significant safety risks. Overall, market growth is intrinsically linked to global industrial output and the continuous requirement for validated, traceable assembly processes across various manufacturing domains.

AI Impact Analysis on Handheld Nutrunner Market

User inquiries regarding AI's impact on Handheld Nutrunners frequently center on how machine learning algorithms can enhance torque accuracy, predict tool failure before production halts, and optimize tightening strategies based on real-time joint characteristics and material variability. Key concerns involve the necessity of integrating complex AI platforms with existing factory infrastructure and the initial investment required for tools capable of generating the high-fidelity data needed for effective machine learning. Users also express strong interest in AI-driven error-proofing systems that go beyond simple pass/fail checks, offering diagnostic insights into why a joint failed and automatically suggesting corrective adjustments to the assembly process parameters, ensuring a zero-defect manufacturing environment. Expectations are high for AI to significantly reduce the dependency on manual calibration and expertise, democratizing the use of highly precise fastening technology across the shop floor.

The implementation of Artificial Intelligence and Machine Learning (ML) transforms the handheld nutrunner from a simple torque application device into a highly intelligent, self-optimizing system. AI algorithms analyze extensive datasets—including torque-angle curves, environmental factors, joint characteristics (material thickness, thread condition), and tool wear indicators—to predict optimal tightening parameters for each specific fastener sequence. This predictive capability minimizes over- or under-tightening, which are critical causes of joint failure and product recall, enhancing overall product reliability significantly. Furthermore, AI facilitates advanced anomaly detection; by establishing a 'digital twin' of a perfect tightening cycle, the system can instantly flag even subtle deviations that a human operator or traditional statistical process control (SPC) system might miss.

This integration supports true adaptive assembly. For instance, if the viscosity of thread-locking compound varies slightly across batches, or if the temperature affects the bolt elongation, the AI-powered nutrunner dynamically adjusts the final torque value in real-time to ensure the target clamp load is achieved consistently. This level of optimization is crucial in complex, high-mix manufacturing environments. The deployment of edge computing directly within the nutrunner control unit allows for immediate data processing and strategic adjustments, reducing latency and reliance on centralized cloud infrastructure for core decision-making processes, thereby reinforcing the tool's autonomy and enhancing its role in resilient manufacturing systems.

- AI-enhanced Predictive Maintenance: Forecasting bearing or motor degradation based on vibration analysis and torque signal anomalies, ensuring proactive tool replacement.

- Adaptive Tightening Strategies: Real-time adjustment of fastening parameters (speed, ramp-up, target torque) based on material or joint condition variability detected during the cycle.

- Advanced Error-Proofing: Utilizing ML to analyze complete torque-angle signatures against established success patterns, identifying subtle faults that deterministic controls miss.

- Automated Process Optimization: AI suggesting calibration adjustments or tool path modifications based on cumulative quality data feedback loops.

- Data Traceability Enhancement: Structuring and labeling high-volume fastening data for immediate correlation with batch records and quality audits.

DRO & Impact Forces Of Handheld Nutrunner Market

The Handheld Nutrunner Market is heavily influenced by four key external and internal forces: the relentless pressure from global automotive safety regulations mandating 100% traceability (Driver); the high initial cost and complexity associated with implementing high-end DC electric systems and supporting software infrastructure (Restraint); the vast, untapped potential in emerging markets rapidly industrializing and adopting automation technologies (Opportunity); and the fundamental shift in assembly methodologies toward lightweight materials and complex joint designs (Impact Force). These elements collectively dictate the rate of market adoption and technological evolution, compelling manufacturers to focus on solutions that balance high precision with ease of integration and operational expenditure management. The interplay between stringent quality mandates and the continuous improvement demands of Industry 4.0 creates a robust environment for innovation in fastening technology.

Drivers: The most powerful driver is the global emphasis on product reliability and safety, particularly in critical sectors like automotive and aerospace. Regulatory bodies worldwide require manufacturers to maintain complete traceability records for every safety-critical fastener, ensuring accountability and reducing liability. Modern DC electric nutrunners inherently facilitate this requirement by logging time-stamped, highly accurate torque and angle data for every fastening cycle. Furthermore, the drive towards mass customization and lower production volumes per model necessitates flexible, programmable assembly tools. The shift toward Electric Vehicles (EVs) is a critical growth catalyst, as battery assembly demands highly precise, low-tolerance torque application to maintain thermal integrity and structural resilience.

Restraints: Significant market restraints include the substantial capital investment required for high-precision DC electric fastening systems, which involve not just the tool but also dedicated controllers, sophisticated software, and network infrastructure for data management. For smaller manufacturing operations, this cost barrier can be prohibitive. Another major restraint is the scarcity of highly skilled labor capable of programming, maintaining, and troubleshooting complex industrial fastening systems. While the tools themselves are designed for ease of use, the underlying process setup and integration into Manufacturing Execution Systems (MES) require specialized engineering expertise. Competition from cost-effective alternatives, such as traditional pneumatic pulse tools in less safety-critical applications, also limits growth in certain low-tier manufacturing segments.

Opportunities: Major opportunities lie in the expansive industrialization occurring across Asia, Latin America, and Eastern Europe, where factories are leapfrogging older pneumatic technologies directly into modern electric systems for new construction and capacity expansion. The proliferation of collaborative robots (cobots) presents a niche market opportunity, as nutrunner manufacturers adapt their tools for integration onto robotic arms, requiring lighter weights, smaller profiles, and standardized communication protocols. Additionally, the development of reaction-free nutrunners (utilizing gear sets or internal balancing mechanisms) provides significant ergonomic benefits and opens doors to new applications where reaction bars are impractical or hazardous, simultaneously addressing operator safety concerns which are becoming increasingly critical in developed economies.

Impact Forces: The overarching impact force shaping the market is the paradigm shift towards Industry 4.0, which mandates that all assembly tools must communicate seamlessly, provide diagnostic feedback, and integrate into holistic factory automation platforms. This forces nutrunner manufacturers to evolve into software and data management solution providers. A secondary, yet significant, impact force is the necessity to adapt torque strategies for new composite materials and lightweight alloys, which require extremely gentle ramp-up procedures and angle control rather than brute force torque application to prevent material damage. The demand for tools that can perform complex, multi-stage tightening protocols (e.g., yielding strategies) in a handheld format fundamentally elevates the technical complexity and precision required from market offerings.

Segmentation Analysis

The Handheld Nutrunner Market is extensively segmented across multiple dimensions, including the type of power source, the level of torque control technology employed, the physical format of the tool, and the end-user application base. This granular segmentation allows suppliers to address highly specific industrial requirements, ranging from low-torque applications in electronics assembly to extremely high-torque needs in aircraft landing gear or heavy truck chassis production. The most significant differentiation occurs between electric (DC) nutrunners, which offer superior control and data collection, and pneumatic nutrunners, which are favored for their durability and power-to-weight ratio in non-critical tasks. Understanding these segments is crucial for predicting growth trajectories and identifying pockets of opportunity, especially as the industry consolidates around smart, connected tooling solutions required for modern manufacturing traceability standards.

- By Type (Power Source):

- Pneumatic Nutrunners (Air-powered)

- Electric Nutrunners (DC Electric, AC Electric)

- Hydraulic Nutrunners

- Battery-Powered (Cordless) Nutrunners

- By Technology/Control System:

- Transducerized Nutrunners (High Precision, Closed-Loop Control)

- Non-Transducerized Nutrunners (Clutch Mechanism Control)

- Pulse Nutrunners (Primarily Pneumatic)

- By Torque Range:

- Low Torque (< 50 Nm)

- Medium Torque (50 Nm – 500 Nm)

- High Torque (> 500 Nm)

- By Operation Type:

- Straight Nutrunners

- Pistol Grip Nutrunners

- Angle Nutrunners

- Offset Nutrunners

- By Application/End-User:

- Automotive (Passenger Vehicles, Commercial Vehicles, EV)

- Aerospace & Defense

- Heavy Machinery & Construction Equipment

- Energy (Wind Turbines, Power Generation)

- General Manufacturing & Assembly

- Railroad & Transportation

Value Chain Analysis For Handheld Nutrunner Market

The value chain for the Handheld Nutrunner Market begins with the sourcing of specialized raw materials and components, including high-grade steel alloys for gear mechanisms, advanced magnetics for DC motors, and sophisticated microprocessors and sensors (transducers) for precise torque measurement and control. Upstream activities are dominated by specialized component manufacturers focusing on high-reliability electronics, precision machining of gearing, and the development of robust lithium-ion battery packs for cordless models. Key challenges upstream include maintaining the supply of high-purity rare earth magnets necessary for powerful DC motors and managing the volatility in raw material costs, particularly steel and copper, essential for durable construction and efficient power transmission within the tool.

Manufacturing and assembly form the core of the value chain, where companies focus on optimizing production scale, leveraging automation, and implementing stringent quality control to ensure the calibration accuracy of every nutrunner. Distribution channels are critical, involving a mix of direct sales to large OEM clients (especially in automotive and aerospace) for customized solutions and indirect sales through a network of specialized industrial distributors, maintenance, repair, and overhaul (MRO) providers, and system integrators. The distribution strategy depends heavily on the complexity of the tool; high-end transducerized electric systems often require extensive technical support, favoring direct or highly specialized indirect channels, while standard pneumatic tools are readily available through broad-line industrial suppliers.

Downstream activities center around the installation, calibration, and long-term servicing of the tools within the end-user facility. This phase is increasingly software-driven, requiring integration with the customer's existing MES and quality assurance systems. Direct and indirect channels both play vital roles here: Direct sales teams provide highly technical consulting for complex assembly line setups and continuous process auditing, crucial for maximizing tool utilization and data traceability. Indirect channels, through local MRO providers, focus on rapid local maintenance, repair, and general calibration services, ensuring minimal downtime for high-volume production lines. The value chain is fundamentally shifting towards providing 'Service as a Solution,' where the tool's connectivity and the accompanying data management platform generate sustained revenue.

Handheld Nutrunner Market Potential Customers

The primary customers for Handheld Nutrunners are large-scale industrial manufacturers engaged in safety-critical assembly processes, where precise, verifiable torque application is non-negotiable. The automotive industry represents the largest segment, encompassing vehicle assembly plants (OEMs), Tier 1 and Tier 2 suppliers producing components like engines, transmissions, brakes, and chassis modules. Within the burgeoning electric vehicle sector, customers include specialized battery pack assemblers and manufacturers of electric drivetrains. These end-users demand sophisticated DC electric nutrunners with advanced error-proofing and full data traceability to meet stringent quality and warranty standards, making them the most valuable segment.

Another major segment includes the aerospace and defense sector, comprising manufacturers of commercial aircraft (e.g., fuselage, wing, and landing gear assembly), military vehicles, and satellite components. In aerospace, the emphasis is less on volume and more on absolute precision and specialized tooling, often requiring hydraulic or custom electric tools capable of high torque application in confined spaces, demanding rigorous calibration protocols validated by industry standards (e.g., AS9100). The potential customers in this sector prioritize tool longevity, certification, and the ability to integrate into complex quality management systems, often necessitating bespoke software solutions and long-term service contracts from the tool supplier.

Beyond these two giants, potential customers are found in heavy machinery (construction, mining, agricultural equipment), energy infrastructure (wind turbine manufacturing and maintenance, power plant construction), and railway production. These customers require robust, high-torque tools—often hydraulic or heavy-duty pneumatic—capable of handling large, structural fasteners under demanding, frequently outdoor, operating conditions. General manufacturing, while using lower volumes of high-end tools, represents a wide base for general-purpose pneumatic and battery-powered nutrunners utilized in non-critical assembly tasks for consumer goods, appliances, and industrial components, focusing more on ergonomic design and cost-effectiveness than on absolute transducerized precision.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.2 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Atlas Copco, Stanley Black & Decker, Ingersoll Rand, Bosch Rexroth, Apex Tool Group, AIMCO, Desoutter Industrial Tools, Sanyo Machine Works, Tohnichi Mfg. Co. Ltd., Mountz, Inc., FIAM Utensili Pneumatici S.p.A., Estic Corporation, Clever Company, RAD Torque Systems, Sturtevant Richmont, Uryu Seisaku, Alkitronic, Makita Corporation, Milwaukee Tool, and KUKEN Co. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Handheld Nutrunner Market Key Technology Landscape

The technological landscape of the Handheld Nutrunner Market is rapidly evolving, driven primarily by the need for enhanced connectivity, higher precision, and improved ergonomics. The most critical technological shift is the prevalence of Transducerized DC Electric Nutrunners. These tools incorporate sophisticated strain gauge transducers directly into the drive mechanism, providing closed-loop feedback on the actual applied torque and angle. This technology is superior to traditional clutch-based or pressure-regulated systems because it allows for real-time monitoring and dynamic adjustment during the tightening process, ensuring the fastening meets extremely narrow tolerance specifications. The supporting technology includes advanced digital controllers (often capable of managing 10 to 20 different tightening programs simultaneously) and proprietary software for data storage, analysis, and communication via industrial protocols like Ethernet/IP, Profibus, or proprietary TCP/IP stacks.

Cordless technology represents another pillar of modern nutrunner innovation. Advances in lithium-ion battery chemistry, coupled with highly efficient brushless DC motors, have resulted in battery-powered nutrunners that can achieve torque levels and consistency previously only possible with corded electric or pneumatic tools. This not only enhances flexibility on the assembly line, eliminating cable management issues and reducing trip hazards, but also supports rapid cell changes and flexible manufacturing layouts. Crucially, contemporary cordless systems often embed the full transducerized control system within the tool itself or the accompanying battery pack, allowing for fully portable traceability and error-proofing, an essential feature for complex operations like chassis assembly or line-side maintenance tasks that require mobility without sacrificing data integrity.

Furthermore, technology focusing on operator safety and ergonomics is gaining prominence. Reaction-free or reaction-less nutrunner designs utilize gear technology or internal mechanism balancing to absorb the reactive torque generated during fastening, protecting the operator's wrist and arm from repetitive stress injuries and sudden jerks. This innovation is critical in high-torque applications where traditional tools require cumbersome reaction bars or substantial physical effort. Alongside this, embedded connectivity (IIoT capabilities) and graphical user interfaces (GUIs) on the control units facilitate ease of programming and maintenance, allowing technicians to diagnose and recalibrate tools without specialized external hardware, thus enhancing tool uptime and minimizing operational friction in high-throughput manufacturing environments.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, driven by the massive expansion of the automotive manufacturing base, particularly in China and India, focusing on both traditional vehicles and the burgeoning electric vehicle ecosystem. Government initiatives promoting smart factory adoption (e.g., Made in China 2025) fuel the demand for high-end DC electric nutrunners and automated assembly solutions. Japan and South Korea remain hubs for technological innovation and high-volume, quality-critical assembly, providing robust growth for transducerized systems across electronics and automotive sectors.

- North America: This region is characterized by high demand for quality assurance and traceability, particularly within the aerospace and high-end automotive segments (e.g., heavy-duty trucks and premium passenger vehicles). Growth is steady, focused heavily on replacement cycles of older pneumatic tools with advanced cordless and connected DC electric systems. Stringent safety standards and high labor costs incentivize investments in error-proofing technologies and tools that offer superior ergonomic benefits, driving demand for specialized angle and reaction-free nutrunners.

- Europe: Europe maintains a strong foothold in the market due to its robust manufacturing legacy in Germany, Italy, and France, specializing in complex machinery and precision automotive engineering. The region emphasizes sustainability and energy efficiency, favoring highly efficient electric systems over pneumatic ones. Regulatory mandates from the European Union regarding product liability and worker safety contribute significantly to the consistent adoption of advanced, data-logging nutrunners capable of integration into sophisticated MES frameworks.

- Latin America: Market growth in Latin America is moderate but increasing, primarily driven by automotive assembly and commodity manufacturing centered in countries like Mexico and Brazil. This region often exhibits a mix of older pneumatic infrastructure and new investments in basic electric nutrunners, with high-end transducerized tools reserved primarily for specific export-oriented assembly lines requiring international certification standards.

- Middle East and Africa (MEA): MEA is a niche market driven by heavy industries, oil & gas infrastructure development, and defense spending. Demand focuses on high-torque hydraulic and robust pneumatic tools suitable for extreme environmental conditions and maintenance operations. The adoption of advanced electric systems is localized mainly in new assembly plants and specific aerospace maintenance facilities, with overall market penetration being lower compared to developed economies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Handheld Nutrunner Market.- Atlas Copco

- Stanley Black & Decker

- Ingersoll Rand

- Bosch Rexroth

- Apex Tool Group

- AIMCO

- Desoutter Industrial Tools

- Sanyo Machine Works

- Tohnichi Mfg. Co. Ltd.

- Mountz, Inc.

- FIAM Utensili Pneumatici S.p.A.

- Estic Corporation

- Clever Company

- RAD Torque Systems

- Sturtevant Richmont

- Uryu Seisaku

- Alkitronic

- Makita Corporation

- Milwaukee Tool

- KUKEN Co. Ltd.

Frequently Asked Questions

Analyze common user questions about the Handheld Nutrunner market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a pneumatic nutrunner and a DC electric nutrunner?

The DC electric nutrunner utilizes closed-loop transducer technology for precise torque control and traceability, logging data for every cycle. The pneumatic nutrunner operates on compressed air, typically using a mechanical clutch mechanism for torque regulation, which offers less precision and lacks inherent data collection capabilities, making the electric variant superior for safety-critical joints.

How does the rise of electric vehicles (EVs) impact the demand for Handheld Nutrunners?

The manufacturing of EVs, particularly battery packs and critical thermal management components, demands extremely tight torque tolerances and 100% traceability. This requirement significantly increases the demand for high-precision, connected DC electric and cordless nutrunners that can execute complex, multi-step tightening strategies reliably.

What is AEO in the context of Handheld Nutrunner technology?

AEO (Angle-Controlled Fastening) is a key strategy used by advanced nutrunners where, after reaching a snug torque, the tool applies a precise amount of additional rotation (angle) rather than continued torque. This method is crucial for ensuring accurate clamp load on fasteners, especially in materials where the relationship between applied torque and resulting tension (clamp load) is unpredictable.

Which application segment holds the largest share in the Handheld Nutrunner Market?

The Automotive industry holds the largest market share due to its high volume of assembly operations and the absolute necessity for error-proofing and full data traceability across thousands of safety-critical joints in every vehicle produced, including chassis, engine, and interior assemblies.

What are the main ergonomic benefits provided by modern nutrunners?

Modern nutrunners, especially high-torque models, employ reaction-free mechanisms to absorb torque kickback, significantly reducing the physical strain on the operator. Additionally, advanced cordless tools offer superior weight balance and smaller profiles, contributing to reduced fatigue and preventing repetitive strain injuries in high-cycle environments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Handheld Nutrunner Market Statistics 2025 Analysis By Application (Automotive, Transportation, Machinery Manufacturing, Other), By Type (Pistol Handheld Nutrunner, Angle Handheld Nutrunner, Straight Handheld Nutrunner), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Handheld Nutrunner Market Statistics 2025 Analysis By Application (Automotive, Transportation, Machinery Manufacturing), By Type (Pistol Handheld Nutrunner, Angle Handheld Nutrunner, Straight Handheld Nutrunner), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager