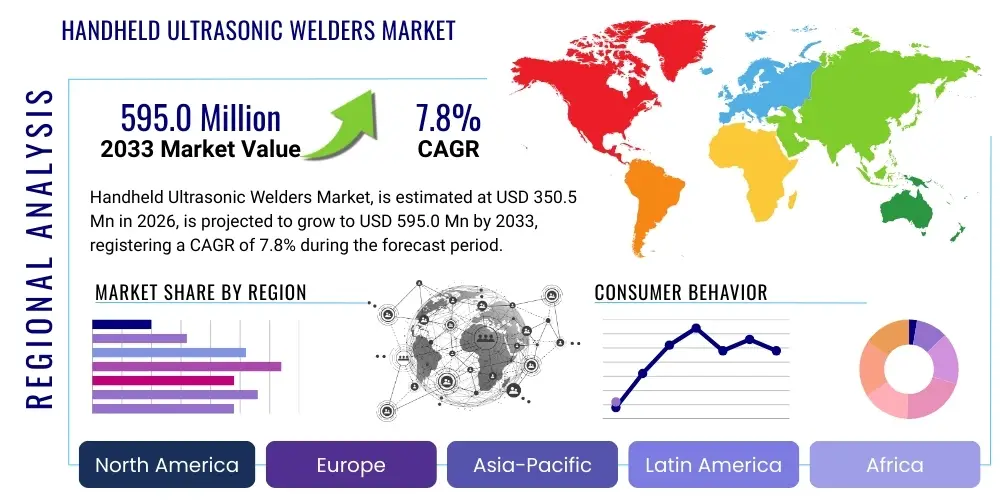

Handheld Ultrasonic Welders Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438329 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Handheld Ultrasonic Welders Market Size

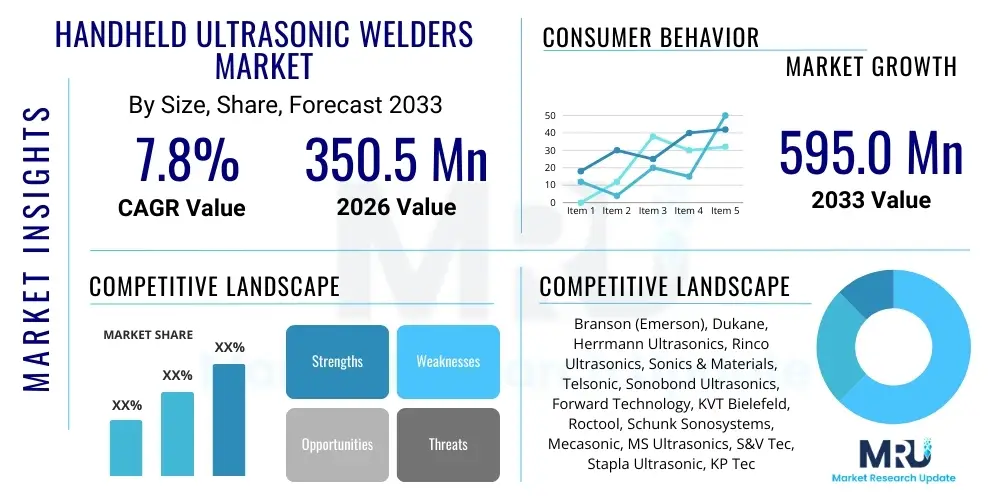

The Handheld Ultrasonic Welders Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 350.5 Million in 2026 and is projected to reach USD 595.0 Million by the end of the forecast period in 2033.

Handheld Ultrasonic Welders Market introduction

The Handheld Ultrasonic Welders Market represents a dynamic segment within the broader industrial joining and assembly equipment landscape, focusing specifically on portable devices that harness high-frequency (typically 20 kHz to 70 kHz) mechanical vibrations to generate localized heat for welding thermoplastic materials and, in specialized cases, staking or inserting thin metallic components into plastic substrates. These systems, comprising a generator, a handheld transducer (converter), a booster, and a sonotrode (horn), facilitate rapid, clean, and solvent-free bonding. The core appeal of handheld units lies in their flexibility and mobility, enabling precise welding operations in confined spaces, on large or installed assemblies (e.g., automotive interiors, pipes), or during field repair and maintenance activities where stationary, automated welding platforms are infeasible. The technology provides superior joint strength and consistency compared to chemical adhesives or heat-staking methods, proving indispensable across high-reliability applications where quality traceability is paramount. Modern systems incorporate sophisticated digital controls for amplitude profiling and power monitoring, ensuring highly repeatable results regardless of minor material or environmental variations, which is a critical differentiating factor driving enterprise adoption.

The spectrum of major applications for handheld ultrasonic welding equipment extends across sectors characterized by high volumes of plastic components and complex assembly geometries. In the automotive industry, these tools are essential for the rapid assembly of non-structural components like dashboards, seat fixtures, insulation panels, and exterior trim, contributing directly to weight reduction goals and noise mitigation through secure fastening. The medical device sector leverages the technology's non-contaminating nature for assembling intricate plastic housings, sealing sterile packaging, and manufacturing disposable devices such as syringes and blood filters, adhering to rigorous regulatory mandates (e.g., FDA requirements for biocompatibility and hermetic seals). Furthermore, the consumer electronics market relies on handheld ultrasonic welders for assembling small gadgets, sealing battery compartments, and securing aesthetic casings, valuing the minimal footprint of the weld joint and the speed of the assembly process. The versatility inherent in the handheld design allows manufacturers to quickly adapt to diverse production requirements and implement immediate design modifications without incurring the substantial tooling costs associated with reconfiguring fixed automation lines.

Market growth is being propelled by several overarching industrial and technological trends. Firstly, the escalating global consumption of engineered polymers and composites across nearly all manufacturing domains necessitates robust, fast, and environmentally benign joining solutions. Ultrasonic welding eliminates volatile organic compounds (VOCs) associated with solvent bonding, aligning with global sustainability initiatives. Secondly, continuous advancements in digital power generation technology, including the adoption of proprietary frequency scanning and tuning software, ensure optimal acoustic energy transmission, maximizing weld consistency and efficiency. Thirdly, the focus on operator ergonomics, through the development of lighter, better-balanced handheld units designed for sustained use, directly translates into reduced fatigue and improved quality output. Finally, the strategic adoption of handheld systems complements full automation by providing essential flexibility for low-volume production runs, prototyping, and decentralized repair stations, making them vital components of a resilient and agile manufacturing ecosystem poised for global expansion.

Handheld Ultrasonic Welders Market Executive Summary

The Handheld Ultrasonic Welders Market is witnessing a decisive shift towards smart, connected tooling, driven by the imperative to integrate shop floor data into enterprise management systems (Business Trends). Leading market participants are strategically investing in developing high-efficiency, multi-axis handheld systems capable of accommodating diverse material specifications and geometries using a single generator platform, thereby maximizing asset utilization for end-users. Consolidation among suppliers is observed, aimed at leveraging proprietary transducer and generator technologies to secure market share, particularly in high-value segments like medical device assembly where specialized knowledge is critical. Service revenue, including software licenses for quality monitoring and predictive maintenance contracts, is becoming an increasingly important stream, moving the business model beyond purely hardware sales toward comprehensive solution provision. Innovation centered on developing robust, high-performance battery packs for cord-free operation is transforming the operational flexibility of these tools across large industrial sites and field applications.

Regional market trajectories exhibit distinct characteristics, reflecting varied industrial maturity and regulatory landscapes. Asia Pacific (APAC) currently dominates in terms of unit shipment volume, spurred by massive industrial output in automotive components, electronics assembly, and general plastic fabrication, primarily in East Asia and India. This regional growth is characterized by cost sensitivity and high demand for reliable, mid-range power systems suitable for high-volume tasks (Regional Trends). Conversely, North America and Europe, while representing slower growth rates, dictate technological trends, focusing on high-specification, digitally integrated welders mandated by strict quality control standards in the medical, aerospace, and defense sectors. These developed regions emphasize AEO-optimized features like data integrity, validation readiness, and seamless integration with existing Manufacturing Execution Systems (MES), driving premium pricing and fostering competition in technological leadership rather than mere cost efficiency. Latin America and MEA continue to emerge, rapidly increasing adoption as localized manufacturing capabilities expand and reliance on imports diminishes, signaling substantial long-term opportunity for diversified market entrants.

Segmentation analysis reveals a growing bifurcation in demand based on precision versus power (Segments trends). High-frequency welders (40 kHz and above) are experiencing robust growth, propelled by the relentless miniaturization trend in consumer electronics and micro-medical devices, requiring precise energy input to prevent damage to delicate substrates. Concurrently, the demand for high-power handheld units (above 1000 Watts) persists, driven by the need to weld large plastic components, such as those found in heavy truck interiors or large appliance housings, demanding higher amplitude and robust construction. The end-user perspective shows a pronounced trend toward versatility; companies increasingly favor standardized handheld platforms that can quickly swap tooling (horns and boosters) to accommodate diverse material types—from standard ABS and PP to advanced engineered polymers like PEEK and ULTEM—without significant downtime. This adaptability ensures manufacturers maintain agility in response to evolving product designs and material selection, reinforcing the market’s underlying focus on operational flexibility and reduced complexity, defining the future scope of product development.

AI Impact Analysis on Handheld Ultrasonic Welders Market

User engagement and industry analysis concerning AI's integration into the Handheld Ultrasonic Welders Market highlight three critical themes: achieving 'zero-defect' welding, enhancing operational efficiency through automation of setup parameters, and mitigating the skill gap in manual operations. Common questions inquire about the practical feasibility of deploying complex neural networks within the embedded systems of portable welders, the ROI derived from automated quality monitoring compared to traditional destructive testing, and how AI can dynamically adapt welding parameters for material inconsistencies common in recycled or complex composite plastics. The consensus expectation is that AI will transform handheld welders from operator-dependent tools to intelligent, self-calibrating systems that provide verifiable quality assurance data instantaneously, crucial for regulatory compliance in high-stakes manufacturing. This intelligent feedback loop, analyzing thousands of data points related to power, frequency deviation, and acoustic feedback, is expected to revolutionize process control, drastically reducing manufacturing variability and reliance on subjective operator judgment, leading to massive gains in yield.

- Predictive Maintenance and Tooling Life Optimization: AI models continuously assess the wear rate of critical acoustic components (horns/boosters) by analyzing shifts in resonant frequency and power consumption signatures, providing proactive warnings and extending tool life predictability by up to 20%, thereby significantly reducing unplanned production halts.

- Autonomous Parameter Adjustment: Machine learning algorithms process real-time sensor data (temperature, pressure, material thickness) and automatically fine-tune welding parameters (amplitude and time) during the cycle to compensate for inherent material heterogeneity or external environmental factors, ensuring consistent joint strength and quality across diverse batches.

- Non-Destructive Quality Assurance: Deep learning networks analyze the entire ultrasonic welding curve profile (power draw versus time) against validated quality standards, offering instant, objective pass/fail decisions and classifying defect types without requiring physical testing, thereby accelerating the production line workflow and improving overall traceability.

- Augmented Operator Guidance and Training: AI-driven interfaces provide dynamic, real-time feedback to operators on their technique, such as force application consistency and angle, accelerating the training process for new personnel and standardizing performance across a global workforce, mitigating the impact of labor shortages.

- Supply Chain Material Tracking and Traceability: AI systems link welding performance data directly to specific material batches via IoT connectivity, providing comprehensive traceability logs required for regulatory audits and enabling precise root cause analysis for any eventual product failures attributable to material quality variations or supplier inconsistencies.

DRO & Impact Forces Of Handheld Ultrasonic Welders Market

The market is predominantly driven by the pervasive industry shift towards flexible manufacturing and assembly strategies, catalyzed by the increasing complexity of modern product designs that often combine multiple materials or require assembly in difficult-to-reach locations. The superior joint quality, operational speed, and low environmental impact (by eliminating solvents and consumables) of ultrasonic technology are core drivers, satisfying both efficiency and sustainability mandates across industrial operations globally. Furthermore, the rapid growth trajectory of sectors utilizing small plastic components, such as implantable medical devices and high-end consumer wearables, mandates the adoption of handheld systems capable of extreme precision and reliable micro-welding capabilities. The economic factor of reduced operational costs over the long term, despite higher initial investment, due to lower energy consumption and minimal material waste, significantly contributes to the strong market pull, especially in developed economies focused on total cost of ownership (TCO) and adherence to lean manufacturing principles that minimize process waste.

Key restraining forces center on both technical limitations and economic constraints that challenge broader adoption. Technically, ultrasonic welding remains highly dependent on the properties of the material being joined, proving less effective or unsuitable for many thermoset plastics, certain high-performance composites, or materials with high moisture content, necessitating specialized pre-treatment or alternative joining solutions. Economically, the initial capital outlay for a high-quality ultrasonic system, including the generator and a range of custom-machined tooling (horns and fixtures), is substantial, presenting a significant financial hurdle for small and medium-sized enterprises (SMEs) with tighter capital budgets. Additionally, the requirement for highly specialized training for technicians to accurately set up and troubleshoot sophisticated digital welding parameters—including amplitude, trigger force, and collapse distance—adds to operational complexity and labor costs, which can slow down large-scale decentralized implementation, particularly in regions with nascent technical infrastructure.

Opportunities for disruptive growth are concentrated around technological convergence and market expansion into untapped applications. The most substantial opportunity lies in refining battery technology and power electronics to produce cordless handheld ultrasonic welders that match the performance stability and power of corded units, thereby maximizing user mobility across expansive manufacturing floors (e.g., aircraft construction, large vehicle assembly) where cables pose hazards or limitations. Another area involves the strategic expansion into niche applications such as welding bio-based and recyclable polymers, driven by global mandates for circular economy practices and increasing consumer demand for sustainable products. Furthermore, the burgeoning demand for specialized, custom tooling solutions optimized for unique material combinations or intricate component geometries offers lucrative avenues for manufacturers specializing in advanced design and rapid prototyping services, bolstering the overall market value chain and securing high-margin service revenue alongside equipment sales through enhanced customer partnerships and innovation.

Segmentation Analysis

The segmentation of the Handheld Ultrasonic Welders Market is pivotal for analyzing specific market dynamics and growth vectors across distinct product capabilities, power specifications, and end-user applications. The market is rigorously segmented based on operating frequency, which directly correlates with the type of material and component size that can be effectively welded; lower frequencies are ideal for bulkier, robust assemblies, while ultra-high frequencies cater to micro-welding requirements essential for electronics. Further segmentation based on power output delineates the equipment's capacity for high-volume or heavy-duty industrial usage versus lighter-duty, precision work, informing optimal product selection for specific manufacturing contexts. This strategic breakdown allows manufacturers to identify high-growth sub-sectors and focus resources on developing targeted solutions that address nuanced industrial requirements, such as enhanced digital integration for the medical segment or rugged portability for the automotive sector.

- By Frequency:

- 20 kHz to 30 kHz (Heavy Duty/Large Components, High Amplitude)

- 30 kHz to 40 kHz (Standard Industrial Applications, Balanced Performance)

- Above 40 kHz (Micro-Welding/Precision Assembly, Low Amplitude)

- By Power Output:

- Up to 500 Watts (Low Power/Detail Work, Battery-Operated Potential)

- 500 Watts to 1000 Watts (Mid-Range/Versatile Assembly, General Manufacturing)

- Above 1000 Watts (High Power/Robust Industrial Use, Large Plastic Components)

- By End-User Industry:

- Automotive (Interior components, lighting, sensors, sound dampening)

- Medical & Healthcare Devices (Catheters, filters, diagnostic housings, sterile packaging)

- Consumer Electronics (Casings, speakers, battery sealing, aesthetic bonding)

- Packaging (Blister packs, flexible pouches, tamper-evident seals)

- Textiles & Non-wovens (Seaming, cutting, non-woven fabric assembly)

- Others (Aerospace interiors, Toys manufacturing, White Goods/Appliances assembly)

- By Component:

- Generators/Power Supplies (Digital vs. Analog, DSP capabilities)

- Handheld Guns/Transducers (Ergonomic design, Piezoelectric materials)

- Sonotrodes (Horns) & Boosters (Custom geometries, material alloys, tuning)

Value Chain Analysis For Handheld Ultrasonic Welders Market

The inception of the value chain for handheld ultrasonic welders is rooted in highly specialized upstream activities, primarily involving the procurement and processing of materials critical for energy conversion and transmission. This includes securing top-tier piezoelectric ceramic materials, often sourced from highly specialized chemical manufacturers, which form the core of the transducer responsible for converting electrical energy into mechanical vibration. The high precision required in manufacturing generator electronics, especially the DSP components necessary for accurate frequency tracking and amplitude control, necessitates robust partnerships with advanced semiconductor and power electronics suppliers. Successfully navigating the upstream segment demands rigorous intellectual property protection related to acoustic design and material science, as proprietary designs for titanium or aluminum alloy sonotrodes that maximize energy efficiency and minimize wear are a key competitive differentiator among leading original equipment manufacturers (OEMs). Cost efficiency at this stage is achieved through volume purchasing of standardized electrical components, while high-margin customization occurs later in tooling development, emphasizing the importance of securing reliable, high-purity input materials.

The midstream phase focuses on the intricate process of system assembly, calibration, and software development. OEMs invest heavily in R&D to optimize the acoustic stack design—ensuring perfect acoustic impedance matching between the transducer, booster, and sonotrode to minimize energy loss and maximize weld stability. This phase also includes developing advanced firmware and user interface software that provides comprehensive quality monitoring, data logging, and connectivity (IIoT capabilities). Distribution forms the critical downstream link, typically managed through a hybrid channel approach. Direct sales teams handle large, strategically important accounts in sectors like Tier 1 automotive suppliers or major medical device manufacturers, offering comprehensive support and customization. Conversely, a network of highly trained, local technical distributors is essential for reaching SMEs and providing immediate service, repair, and specialized tooling fabrication, which requires local engineering expertise to ensure proper tuning and application-specific performance optimization, critical for achieving high customer satisfaction.

The efficiency of the value chain is significantly influenced by after-market services, which constitute a vital segment for recurring revenue and customer loyalty. This includes the supply of specialized consumables, primarily the sonotrodes, which degrade over time due to wear and necessitate frequent replacement, often designed and supplied exclusively by the original equipment manufacturer or certified partners. Comprehensive maintenance contracts, calibration services, and the provision of software upgrades, particularly those incorporating AI-driven quality validation tools, ensure the longevity and peak performance of the installed equipment base. The technical complexity of the equipment makes indirect sales channels, such as purely online marketplaces, less effective for selling complete, high-specification systems, although they are heavily utilized for standard spare parts and accessories, reinforcing the dominance of technical consultation and direct/authorized distributor channels in the primary sales cycle, establishing a long-term partnership approach with industrial end-users.

Handheld Ultrasonic Welders Market Potential Customers

The primary cohort of potential customers for handheld ultrasonic welders are large-scale manufacturing enterprises and their Tier 1 suppliers within the highly regulated industries of automotive and medical devices. Automotive manufacturers are high-volume buyers, utilizing these portable tools extensively for interior assembly tasks—such as attaching plastic clips, brackets, and fabric components to larger structures—where fixed machinery cannot reach or is too cumbersome. Their demand is centered on units offering high duty cycles, repeatability, and robust data connectivity to ensure compliance with quality management systems like ISO/TS 16949. These customers prioritize ergonomic design to minimize operator strain during long shifts and demand comprehensive service contracts to minimize downtime on critical assembly lines, making them key targets for premium, high-reliability equipment offerings from market leaders who can guarantee uptime and certified performance.

The medical device sector represents a potential customer group defined by an unparalleled need for precision, material integrity, and regulatory compliance. Companies producing disposable medical components, diagnostic tools, and implantable devices require handheld welders capable of achieving hermetic, non-contaminating seals on complex, often heat-sensitive, engineered plastics. Key buying criteria in this sector include the validation of the welding process, verifiable traceability records for every weld cycle, and equipment certification that meets strict standards such as FDA Title 21 CFR Part 820. For these customers, the absence of consumables (like adhesives) and the gentle, localized heating characteristic of ultrasonic technology are crucial, ensuring product safety and biocompatibility, thereby justifying investment in the most advanced, digitally controlled handheld systems available, irrespective of marginal cost differences, focusing strictly on quality output and documentation capabilities.

Beyond the core industrial giants, a rapidly growing customer segment includes specialized maintenance and repair operations (MRO), prototyping facilities, and localized small-batch manufacturers (SBMs) across various sectors, including aerospace maintenance and telecommunications infrastructure. These users prioritize mobility and versatility above high-volume throughput. they often require multi-frequency, modular systems that can quickly adapt to welding dissimilar plastics or materials encountered in refurbishment and field repair scenarios, which may involve non-standard polymer compositions. The potential customer base is further expanded by the packaging industry, which uses handheld units for sealing large or non-standard plastic containers and pouches where automated sealing is impractical, relying on the technology to provide reliable, tamper-evident closures, demonstrating the broad, cross-industry appeal driven by operational flexibility and the capability to address unique assembly challenges that fixed automation cannot efficiently handle.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 350.5 Million |

| Market Forecast in 2033 | USD 595.0 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Branson (Emerson), Dukane, Herrmann Ultrasonics, Rinco Ultrasonics, Sonics & Materials, Telsonic, Sonobond Ultrasonics, Forward Technology, KVT Bielefeld, Roctool, Schunk Sonosystems, Mecasonic, MS Ultrasonics, S&V Tec, Stapla Ultrasonic, KP Tech, MaxiTek Systems, Hada Technology, Ultrasonics World, Weber Ultrasonics. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Handheld Ultrasonic Welders Market Key Technology Landscape

The current technology landscape for handheld ultrasonic welders is defined by the proliferation of sophisticated digital electronics aimed at enhancing precision and system intelligence, moving far beyond simple power delivery systems. The transition to advanced Digital Signal Processing (DSP) controlled generators is paramount, enabling rapid frequency autotuning and amplitude profiling capabilities. This level of control allows the welding system to dynamically adjust power delivery throughout the weld cycle to precisely match the changing mechanical impedance of the material, a feature critical for successfully joining amorphous plastics or managing variations inherent in recycled content. Furthermore, the integration of advanced diagnostic software that logs and analyzes detailed power-time signatures for every cycle is becoming standard, transforming the handheld unit into a critical quality monitoring instrument essential for modern manufacturing traceability requirements and minimizing batch failures, ensuring compliance with global quality standards like ISO 9001 and industry-specific regulations.

Material science and engineering design also represent a significant portion of the technological advancements, specifically concerning the durability and performance of the acoustic tooling. Manufacturers are actively pursuing specialized sonotrode designs, often employing Finite Element Analysis (FEA) to predict and optimize acoustic performance and lifespan. The use of exotic materials such as high-strength titanium alloys and specialized aluminum formulations for horns and boosters allows for higher efficiency energy transfer and reduced vibration damping, extending the tool's usable life even under rigorous industrial conditions. Furthermore, rapid prototyping technologies, including specialized additive manufacturing, are increasingly being used to quickly produce complex, non-standard sonotrode geometries necessary for unique, intricate assembly tasks, drastically reducing lead times for custom tooling and supporting faster product iteration cycles for end-users, giving them a strong competitive advantage in complex product fabrication.

Connectivity and ergonomic design are the two major thrusts ensuring AEO and GEO optimization. Modern handheld welders now incorporate comprehensive Industrial IoT (IIoT) capabilities, featuring wired and wireless interfaces (e.g., Wi-Fi, Ethernet/IP) that allow seamless communication with factory networks, cloud-based data repositories, and MES platforms. This integration supports centralized process control, remote diagnostics, and automated software updates, significantly enhancing operational transparency and reducing the need for costly manual data collection. Simultaneously, engineering efforts are devoted to maximizing the power-to-weight ratio; advanced ergonomic design, including optimized weight distribution and vibration dampening features, minimizes operator fatigue and improves handling characteristics, directly translating to superior weld quality consistency over extended production periods, thereby addressing both productivity and worker safety considerations in demanding industrial environments and aligning with global workplace safety mandates.

Regional Highlights

The Asia Pacific (APAC) region stands out as the undisputed leader in the Handheld Ultrasonic Welders Market, largely owing to its expansive and rapidly maturing manufacturing sector, particularly across consumer electronics assembly in countries like China, Taiwan, and Vietnam, and the booming automotive supply chain throughout the region. The high volume of plastic components produced for global export and domestic consumption drives massive demand for fast, reliable, and portable assembly tools. Governmental policies in countries such as China and South Korea heavily promote factory automation and the adoption of advanced manufacturing technologies to enhance global competitiveness, providing a fertile ground for the increased deployment of ultrasonic welding equipment. Furthermore, the emergence of localized medical device manufacturing caters to a massive regional population, requiring certified precision welding solutions, reinforcing APAC's position as the primary volume market characterized by a strong focus on cost-effective, scalable manufacturing solutions.

North America and Europe constitute highly mature markets that prioritize technological sophistication and adherence to stringent quality and safety standards over sheer unit volume. The demand in these regions is primarily concentrated within high-value, regulated industries, notably medical implant and device manufacturing, aerospace component assembly, and complex automotive safety features. Customers in North America and Europe typically invest in premium, digitally integrated handheld systems that feature comprehensive data logging, advanced closed-loop control, and AI-enabled quality monitoring systems to meet validation requirements (e.g., ISO 13485 for medical). The slower but steadier growth in these regions is fundamentally quality-driven, focusing on specialized applications, custom tooling, and high-margin after-sales service revenue rather than purely low-cost solutions, maintaining a commanding position in innovation and average selling price (ASP), often dictating the future technological roadmap for the entire industry.

Latin America (LATAM) and the Middle East and Africa (MEA) are characterized by significant untapped growth potential as they undergo rapid industrialization and diversify their economies away from resource extraction. In LATAM, countries like Mexico and Brazil are expanding their manufacturing bases, particularly in the automotive and packaging sectors, requiring modern, efficient assembly tools to compete globally, driving increased imports and local assembly of welding equipment. Similarly, MEA shows rising demand linked to expanding infrastructure projects, localized consumer goods manufacturing, and ambitious plans for industrial self-sufficiency (e.g., Saudi Arabia's Vision 2030). While these regions often exhibit higher price sensitivity and longer adoption cycles, they represent critical future growth engines for mid-range, versatile handheld ultrasonic welding solutions as industrial capacities and technical expertise continue to mature and localize, often relying on global vendors for initial training and technical support to bridge the skill gap.

- Asia Pacific (APAC): Market volume leader; driven by high-volume electronics, automotive, and fast-growing medical manufacturing; focused on speed, scalability, and efficiency within highly competitive supply chains.

- North America: Technologically advanced market; high adoption rate of digital, AI-integrated systems; dominated by highly regulated aerospace and medical industries focusing on traceable quality and regulatory compliance.

- Europe: Strong focus on sustainability and energy efficiency; demand for precise solutions in automotive interior and complex industrial assembly; driven by strict European Union regulations and the need to minimize high labor costs through optimized tooling.

- Latin America (LATAM): Emerging market growth fueled by expanding automotive assembly (e.g., Mexico) and packaging production; increasing demand for entry-to-mid-level versatility to support rising domestic production capabilities.

- Middle East & Africa (MEA): Nascent market primarily driven by infrastructure development and localized efforts in consumer packaging and light manufacturing, showing gradual adoption based on foreign investment inflows and industrial diversification strategies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Handheld Ultrasonic Welders Market.- Branson (Emerson)

- Dukane

- Herrmann Ultrasonics

- Rinco Ultrasonics

- Sonics & Materials

- Telsonic

- Sonobond Ultrasonics

- Forward Technology

- KVT Bielefeld

- Roctool

- Schunk Sonosystems

- Mecasonic

- MS Ultrasonics

- S&V Tec

- Stapla Ultrasonic

- KP Tech

- MaxiTek Systems

- Hada Technology

- Ultrasonics World

- Weber Ultrasonics

- Ultrasonic Engineering Co., Ltd.

- Keystone Automation

- Crest Ultrasonics

- Daeyang Technologies

Frequently Asked Questions

Analyze common user questions about the Handheld Ultrasonic Welders market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of handheld ultrasonic welding over traditional methods?

The primary advantages include achieving high-strength, clean, and aesthetic welds without the use of heat, adhesives, or solvents. This results in immediate cycle completion, low energy consumption, non-contamination of materials, and high portability, which is critical for flexible assembly or field repair tasks in dynamic manufacturing environments.

Which industrial sectors are the largest consumers of handheld ultrasonic welders?

The largest consuming sectors are Automotive (for interior components, sound proofing, and trims), Medical and Healthcare (for sterile device assembly, filters, and diagnostic housings requiring hermetic seals), and Consumer Electronics (for housing, speakers, and battery sealing), driven by the need for precision, structural integrity, and high-speed assembly processes.

How does frequency selection (e.g., 20 kHz vs. 40 kHz) impact the welding process?

Frequency selection directly correlates with power and precision. Lower frequencies (20 kHz) deliver higher amplitude and power, making them suitable for welding larger, thicker, or harder plastic components. Higher frequencies (40 kHz and above) provide finer control, lower amplitude, and minimal heating, making them ideal for delicate, miniaturized components (micro-welding) and intricate assemblies common in electronics and micro-medical devices.

What role does Artificial Intelligence play in modern handheld welding systems?

AI is increasingly used for advanced quality assurance and process optimization. It analyzes complex sensor data (acoustic signatures, power curves) in real-time to detect subtle welding faults, predict necessary tooling maintenance, and autonomously adjust parameters to compensate for material variability, thereby enhancing consistency and compliance while minimizing reliance on highly skilled human intervention.

What is the key technological restraint facing battery-powered handheld ultrasonic welders?

The key technological restraint is the difficulty in balancing the need for sustained high peak power output required for robust weld cycles with the necessity of maintaining a low tool weight and long battery life. Overcoming this requires continuous innovation in high-density lithium battery technology and advanced power management electronics to ensure mobility does not compromise welding performance stability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager