Hard Carbon Material Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436866 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Hard Carbon Material Market Size

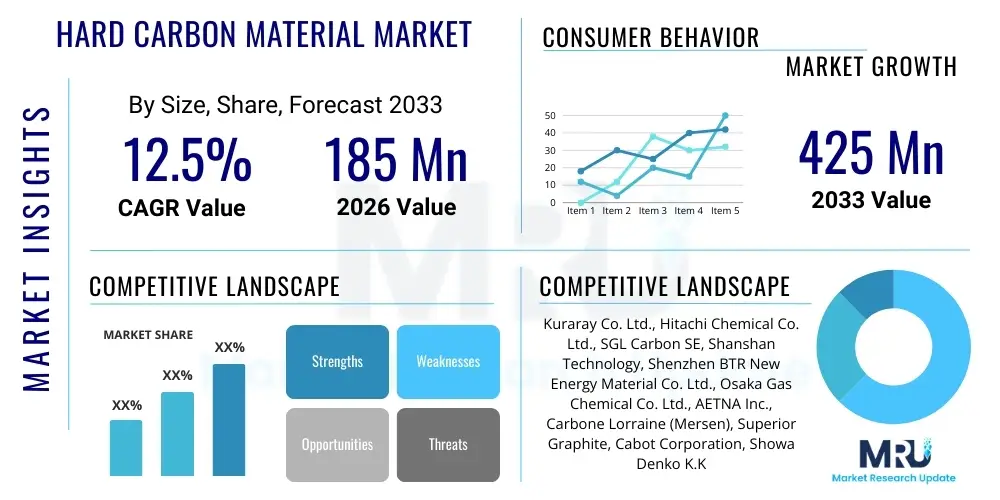

The Hard Carbon Material Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 185 Million in 2026 and is projected to reach USD 425 Million by the end of the forecast period in 2033.

Hard Carbon Material Market introduction

Hard carbon material, characterized by its non-graphitizable nature and amorphous structure, is rapidly emerging as a foundational material for advanced energy storage systems, particularly for anodes in next-generation batteries. Unlike soft carbon, hard carbon maintains a highly disordered structure even after high-temperature treatment, featuring closed pores and interstitial voids that allow for efficient lithium and sodium ion insertion and extraction. This unique structural architecture grants hard carbon superior cycling stability and enhanced safety characteristics compared to traditional graphite, making it particularly critical for applications demanding high power density and extended cycle life, such as electric vehicles and large-scale grid storage solutions. The material’s ability to utilize various sustainable precursors, including biomass and specific organic polymers, further positions it as an environmentally favorable alternative in the burgeoning battery manufacturing landscape. Furthermore, the selection of the precursor material and the precise control over pyrolysis temperature and conditions are pivotal determinants of the final electrochemical performance, influencing factors such as specific capacity, initial Coulombic efficiency, and rate capability, which are crucial metrics for commercial viability.

The primary application driving the demand for hard carbon is the development and commercialization of Sodium-ion Batteries (NIBs), where hard carbon serves as the benchmark anode material due to its demonstrated capability to effectively intercalate large sodium ions. While graphite performs poorly with sodium ions, hard carbon's expansive, house-of-cards structure facilitates sodium storage through a combination of intercalation within the defective graphitic crystallites and adsorption onto the porous surfaces. This technological superiority in NIBs is coinciding with a global push for diversifying battery chemistries away from sole reliance on lithium, driven by resource scarcity concerns and the need for lower-cost energy storage solutions. Beyond NIBs, hard carbon is also being investigated as an anode component in high-performance Lithium-ion Batteries (LIBs) and specialty electrochemical devices, offering improved low-temperature performance and faster charge rates compared to standard graphite anodes. The versatility of hard carbon processing methods and its adaptability to various battery system requirements underscore its growing importance as a cornerstone material in the transition toward a more sustainable and robust energy infrastructure.

Key benefits of utilizing hard carbon include excellent rate capability, long cycle life, and a lower operating voltage, which contributes to higher energy density in the final cell design. The material’s disordered structure also mitigates volume expansion issues typically observed in silicon or pure graphite anodes during deep cycling, leading to enhanced structural integrity and prolonged battery life. Driving factors for the market expansion include aggressive governmental support for electric mobility, escalating investments in grid energy storage projects across continents, and technological breakthroughs refining hard carbon synthesis to lower production costs and enhance purity. These advancements are essential for transitioning hard carbon from a niche material to a mainstream component, especially as manufacturers begin scaling up NIB production capacity globally to address utility-scale storage demands. The synergy between material science innovation and industrial scaling is central to realizing the full commercial potential of hard carbon anodes in the coming decade, making it a focal point for R&D efforts worldwide.

- Product Description: Non-graphitizable carbon material with a highly disordered, amorphous structure, primarily used as an anode in advanced electrochemical energy storage devices, particularly sodium-ion batteries.

- Major Applications: Sodium-ion batteries (NIBs), high-rate Lithium-ion batteries (LIBs), and advanced supercapacitors.

- Benefits: High specific capacity for sodium storage, superior rate capability, excellent cycling stability, and improved low-temperature performance.

- Driving Factors: Rapid commercialization of Sodium-ion Batteries, global shift towards sustainable and low-cost energy storage, and increasing demand for electric vehicles (EVs).

Hard Carbon Material Market Executive Summary

The Hard Carbon Material Market is characterized by intense innovation driven by the accelerating demand for diversified and low-cost battery chemistries, placing Sodium-ion batteries at the forefront of market development. Current business trends indicate a significant shift in manufacturing priorities, moving away from purely maximizing energy density (a focus historically dominated by LIBs) toward optimizing cost-efficiency, resource sustainability, and overall safety, attributes where hard carbon excels. Key corporate strategies revolve around securing stable and high-quality precursor supply chains, often involving vertical integration into bio-waste utilization or specialized polymer production to ensure cost-competitive raw material access. Furthermore, there is a pronounced focus on optimizing the pyrolysis process—the energy-intensive step in hard carbon production—through continuous furnace technology and improved thermal management systems to reduce operational expenditures and enhance material homogeneity, thereby accelerating time-to-market for next-generation hard carbon powders with highly tailored properties.

Regionally, the market exhibits strong bifurcation, with Asia Pacific, specifically China, dominating both the production and consumption of hard carbon materials, primarily due to its established leadership in battery manufacturing and early adoption of NIB technology for two-wheeler EVs and stationary storage. This region benefits from favorable regulatory frameworks and massive domestic investments in establishing complete NIB supply chains, which contrasts sharply with North America and Europe. While these Western regions lag in sheer production volume, they are leaders in high-performance R&D, focused on developing unique hard carbon derived from sustainable or local precursor sources (like lignin or specialized agricultural waste) to minimize import reliance and meet stringent domestic sustainability standards. European initiatives, fueled by the European Green Deal, particularly emphasize the circular economy, driving demand for innovative, environmentally conscious hard carbon solutions for grid balancing and renewable energy integration, suggesting a rapid increase in localized manufacturing capacity in the latter half of the forecast period.

Segment trends reveal that the Application segment dominated by Sodium-ion Batteries is projected to experience the most explosive growth, transitioning from pilot-scale production to large-scale commercial deployment, particularly in urban mobility and entry-level electric vehicle markets where the weight premium of sodium-ion is less critical than cost savings. Within the product type segmentation, hard carbon derived from pitch and polymer precursors currently holds a dominant share due to established synthesis routes and consistent material performance, although the Bio-mass derived hard carbon segment is expected to register the highest CAGR, propelled by sustainability mandates and successful technological advancements in optimizing bio-waste conversion yields and purity. The End-User analysis confirms that the Energy Storage Systems (ESS) sector, encompassing utility-scale and residential storage, is rapidly overtaking Consumer Electronics as the primary demand driver for hard carbon, reflecting global governmental commitments to decarbonization and stabilizing renewable energy grids.

- Business Trends: Focus on vertical integration for precursor sourcing, optimization of energy-intensive pyrolysis processes, and strategic partnerships between material suppliers and Tier 1 battery manufacturers to standardize material specifications for NIB platforms.

- Regional Trends: APAC leads in manufacturing scale (driven by China); North America and Europe focus on R&D, sustainable sourcing, and establishing localized supply chains to reduce geopolitical risks and meet strict environmental mandates.

- Segments Trends: Sodium-ion battery application segment is the fastest growing; Bio-mass derived hard carbon is gaining significant momentum due to sustainability benefits; Utility-scale Energy Storage Systems are becoming the primary end-user.

AI Impact Analysis on Hard Carbon Material Market

Common user questions regarding AI's influence on the Hard Carbon Material Market center on how artificial intelligence can overcome current industry bottlenecks, such as optimizing precursor selection, predicting the electrochemical performance of novel hard carbon structures before physical synthesis, and ensuring consistent quality control during high-volume manufacturing. Users are keenly interested in reducing the R&D cycle time, which traditionally involves resource-intensive trial-and-error experimentation across various precursors and pyrolysis conditions. The key theme emerging from user inquiries is the expectation that AI and Machine Learning (ML) will act as a pivotal accelerator, enabling the rapid discovery of optimal synthesis parameters, thereby drastically lowering material costs and accelerating the commercial viability of next-generation hard carbon materials with tailored pore size distributions and high initial Coulombic efficiencies, which are crucial for competitive advantage in the battery sector.

AI is strategically being deployed across the entire hard carbon value chain, starting from computational materials science to manufacturing execution systems. In the upstream R&D phase, ML algorithms are used to screen vast chemical spaces, predicting the final material morphology and electrochemical behavior (such as specific capacity and degradation rate) based on input parameters like precursor chemical composition, heating rate, and final treatment temperature. This predictive modeling dramatically narrows down the list of viable candidates, saving time and expensive laboratory resources. Furthermore, AI-driven process control systems are being implemented in pyrolysis furnaces to maintain ultra-precise temperature and atmosphere regulation. These systems utilize real-time sensor data—including gas composition, flow rates, and thermal imaging—to instantly adjust operational parameters, ensuring material consistency and uniformity across large production batches, thereby improving manufacturing yield and addressing a historical challenge of scaling hard carbon production.

In the downstream application segment, AI models are instrumental in analyzing the cycling data of hard carbon anodes within battery packs. By processing large datasets of current, voltage, temperature, and impedance measurements, AI can accurately model the degradation mechanisms specific to hard carbon, providing predictive health management (PHM) for battery management systems (BMS). This capability extends the useful life of the battery pack, optimizes charging profiles, and facilitates smarter diagnostics for warranty purposes. The ability of AI to detect subtle defects or inhomogeneities in the synthesized material, which might be invisible to traditional quality assurance methods, ensures that only high-performance, long-lasting hard carbon is incorporated into commercial cells. Ultimately, the adoption of AI promises to de-risk the massive capital investment required for NIB manufacturing scale-up, ensuring that hard carbon remains the economically attractive and technically reliable anode solution for grid storage and mass-market EVs.

- AI optimizes precursor material selection and pyrolysis temperature profiles using predictive modeling, significantly reducing R&D cycles.

- Machine Learning enhances manufacturing efficiency by providing real-time, closed-loop control over industrial pyrolysis equipment, ensuring high batch consistency and yield.

- Computational materials science accelerates the discovery of novel hard carbon structures with superior sodium-ion storage kinetics and stability.

- AI-driven Quality Control systems perform rapid defect detection and material characterization, ensuring purity and uniform electrochemical properties across large production volumes.

- Predictive Health Management (PHM) in Battery Management Systems (BMS) utilizes AI to forecast degradation rates of hard carbon anodes, maximizing battery lifespan and safety.

DRO & Impact Forces Of Hard Carbon Material Market

The dynamics of the Hard Carbon Material Market are fundamentally shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively forming the Impact Forces that dictate market direction and growth trajectory. A primary Driver is the burgeoning acceptance and commercialization readiness of Sodium-ion Batteries (NIBs), which inherently rely on hard carbon as the most effective anode material. The global push for energy security and resource independence, coupled with lithium price volatility, makes the cost advantage and widespread material availability (sodium) of NIBs highly attractive, directly fueling demand for hard carbon. This driver is powerfully reinforced by global climate initiatives that mandate the integration of high-capacity, stationary energy storage solutions to support intermittent renewable energy sources, requiring cost-effective materials at utility scale.

However, the market faces significant Restraints that impede faster adoption and scale-up. The most prominent restraint is the high manufacturing expenditure associated with hard carbon synthesis, specifically the extremely high energy input required during the high-temperature pyrolysis stage (often exceeding 1,000°C), leading to higher material costs compared to traditional LIB graphite. Furthermore, achieving consistent material performance, especially optimizing the initial Coulombic efficiency (ICE) across different precursor batches, remains a technical challenge. Scale-up complexity, often characterized by variations in furnace performance and the difficulty in homogenously controlling pore structure and surface area in massive industrial reactors, restricts the speed at which manufacturers can meet escalating market demand. Overcoming these technical and economic hurdles requires substantial capital investment in advanced manufacturing technologies and process optimization.

Opportunities for market expansion are vast and often intersect with technological innovation and regulatory support. The most significant opportunity lies in the development of sustainable, low-cost precursors, such as agricultural waste, lignin, and other biomass sources. Utilizing these materials not only addresses sustainability mandates but also drastically reduces raw material costs, making hard carbon a more cost-competitive solution. Furthermore, the integration of hard carbon into next-generation battery architectures, including solid-state batteries and advanced lithium-sulfur systems, presents long-term technological pathways for market diversification. These Impact Forces—the strong gravitational pull of NIB commercialization, the frictional drag of high manufacturing costs, and the propellant of sustainable precursor innovation—determine the speed and direction of hard carbon market growth, requiring stakeholders to strategically invest in process efficiency and material sourcing resilience.

- Drivers: Widespread commercial readiness and cost-effectiveness of Sodium-ion Batteries; increasing global investments in grid-scale Energy Storage Systems (ESS); strategic need to diversify energy storage chemistries away from lithium reliance.

- Restraints: High capital expenditure and operational costs associated with high-temperature pyrolysis manufacturing; challenges in achieving consistently high initial Coulombic efficiency (ICE) across large-scale production batches; limited availability of standardized hard carbon materials for NIB applications.

- Opportunities: Development and utilization of sustainable, low-cost biomass and industrial waste precursors; application in specialized, high-rate electrochemical devices and solid-state battery formulations; significant governmental incentives for localized NIB supply chain development in Europe and North America.

- Impact forces: Geopolitical shifts emphasizing resource localization; volatile lithium pricing accelerating NIB adoption; and technological advancements in automated, energy-efficient synthesis methods.

Segmentation Analysis

The Hard Carbon Material Market is comprehensively segmented based on Type, Application, and End-User, reflecting the diverse origins and varied end-market demands for this specialized anode material. This granular segmentation aids stakeholders in understanding specific growth pockets and tailoring product development efforts to meet targeted performance requirements. The market analysis confirms that while synthetic precursors derived from pitch and specific polymers offer superior purity and consistency, the future growth potential is increasingly tied to sustainable, bio-mass derived sources, which are gaining technological maturity and market acceptance due to environmental pressures and cost advantages. The application segmentation clearly demonstrates the market pivot towards Sodium-ion Batteries (NIBs), establishing hard carbon as an irreplaceable component in this emerging technology, overshadowing its application in traditional LIBs and capacitors.

- By Type:

- Pitch-based Hard Carbon

- Polymer-based Hard Carbon

- Bio-mass derived Hard Carbon (e.g., from coconut shells, lignin, sucrose)

- By Application:

- Sodium-ion Batteries (NIBs)

- High-rate Lithium-ion Batteries (LIBs)

- Capacitors and Supercapacitors

- Fuel Cells and Electrolyzers

- By End-User:

- Automotive (EVs and Light Electric Vehicles)

- Energy Storage Systems (Grid-scale and Residential)

- Consumer Electronics (Portable Devices)

- Industrial and Specialized Applications

Value Chain Analysis For Hard Carbon Material Market

The value chain for hard carbon material is complex and spans from the sourcing of carbonaceous precursors to the final integration into energy storage devices, involving several specialized transformation and distribution steps. The upstream segment is critical, revolving around securing consistent, high-purity, and cost-effective precursors, which can range from industrial coal tar pitch and specialized synthetic resins to diverse biomass sources. Precursor preparation, including pre-treatment and stabilization processes, directly impacts the final material morphology and electrochemical performance. Suppliers specializing in high-quality, standardized precursors—especially those innovating in biomass conversion technologies—hold significant leverage. Challenges in the upstream segment include ensuring supply resilience against commodity price fluctuations and establishing robust processing facilities capable of handling diverse raw material inputs while maintaining stringent quality control for battery-grade specifications, a necessity for high-performance applications.

The core manufacturing stage, involving the high-temperature pyrolysis and subsequent material processing (milling, sieving, and surface treatment), is dominated by specialized material producers. This midstream segment is characterized by high capital intensity and proprietary know-how regarding thermal profiles and furnace design, which are essential for controlling the material's pore structure, crucial for optimal ion storage. Downstream analysis focuses on the direct supply of finalized hard carbon powder to battery cell manufacturers (OEMs and dedicated cell producers). Distribution channels are predominantly direct, characterized by long-term strategic supply agreements between material producers and Tier 1 battery companies to ensure material security and collaborative R&D alignment for specific battery formats and chemistries. Indirect channels, such as specialty chemical distributors, play a minor role, typically catering to smaller R&D labs and niche application developers.

The structure of the value chain is increasingly shifting towards vertical integration, particularly among major players who aim to control precursor quality and reduce costs. For instance, large battery manufacturers are investing in or partnering with hard carbon producers to streamline the supply chain and integrate material research directly into battery design. This integrated approach minimizes risk and accelerates product customization, crucial for competitive NIB development. The distribution strategy emphasizes technical support and localized inventory management, especially in high-growth regions like Asia Pacific and Europe, where new gigafactories are rapidly coming online. Effective distribution ensures timely delivery of highly sensitive, battery-grade materials, minimizing potential supply bottlenecks that could hinder the mass production of sodium-ion and advanced lithium-ion cells utilizing hard carbon anodes.

Hard Carbon Material Market Potential Customers

Potential customers for hard carbon material are primarily large-scale manufacturers operating within the energy storage ecosystem, fundamentally comprising entities that require high-performance, cost-effective, and safe anode materials for mass-produced electrochemical cells. The most significant customer base resides among global Sodium-ion Battery (NIB) manufacturers who view hard carbon as the non-negotiable anode component for commercial deployment. These manufacturers span from established automotive battery suppliers diversifying their portfolio to new energy startups dedicated exclusively to NIB technology. Specifically, utility-scale Energy Storage System (ESS) integrators and developers constitute a rapidly expanding customer segment, as they require affordable, durable, and fire-resistant batteries—characteristics hard carbon anodes help confer—to stabilize power grids and manage renewable energy fluctuations efficiently, often purchasing cells in massive quantities directly from Tier 1 cell makers.

Furthermore, major automotive Original Equipment Manufacturers (OEMs) and their battery joint ventures represent critical buyers, particularly those targeting entry-level Electric Vehicles (EVs) and Light Electric Vehicles (LEVs), where battery cost reduction is paramount. While high-end EVs still rely predominantly on high-nickel LIBs, the growing market for cost-sensitive, urban-centric EVs is driving demand for NIBs, positioning hard carbon suppliers as essential partners. These automotive customers demand highly rigorous quality consistency, long-term supply guarantees, and materials certified to meet demanding automotive safety and performance standards (e.g., UN 38.3 and specific OEM certifications), making the material supplier selection process highly selective and long-term oriented.

A smaller, yet strategically important, customer segment includes specialized manufacturers of high-rate capacitors and industrial battery packs for specialized machinery, military applications, and uninterruptible power supplies (UPS). These buyers seek hard carbon's superior rate capability and low-temperature performance, where traditional materials may falter. Additionally, leading global battery research institutes and specialized material science laboratories, often funded by government grants or major universities, act as influential early adopters and buyers, driving initial demand for niche, highly customized hard carbon materials, and establishing performance benchmarks that eventually filter down to large-scale commercial customers. Establishing strong relationships with these R&D centers is vital for validating next-generation hard carbon formulations and securing future commercial contracts.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 185 Million |

| Market Forecast in 2033 | USD 425 Million |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Kuraray Co. Ltd., Hitachi Chemical Co. Ltd., SGL Carbon SE, Shanshan Technology, Shenzhen BTR New Energy Material Co. Ltd., Osaka Gas Chemical Co. Ltd., AETNA Inc., Carbone Lorraine (Mersen), Superior Graphite, Cabot Corporation, Showa Denko K.K., POSCO, Toray Industries Inc., Kureha Corporation, Mitsubishi Chemical Corporation, Nippon Carbon Co. Ltd., GS Yuasa Corporation, NEI Corporation, JFE Chemical Corporation, and Linyi Gelon New Battery Materials Co. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hard Carbon Material Market Key Technology Landscape

The technological landscape of the Hard Carbon Material Market is rapidly evolving, driven by the imperative to enhance electrochemical performance, reduce manufacturing costs, and improve sustainability. A crucial area of technological focus is the optimization of precursor material engineering. Traditionally, high-purity pitch and specialized polymers were used, but current innovation heavily favors the conversion of abundant, low-cost, and sustainable bio-mass into functional hard carbon. Techniques such as hydrothermal carbonization (HTC) followed by subsequent high-temperature pyrolysis are being refined to yield hard carbon with controlled porosity and high surface area. Controlling the final material’s microstructure, specifically the closed pore volume and the spacing between graphitic layers, is paramount, as these features dictate the rate and mechanism of sodium-ion storage, making precision material engineering a competitive differentiator in the market.

Another pivotal technological advancement involves refining the pyrolysis process itself. This stage is highly energy-intensive and largely determines the final cost and quality of the hard carbon. Manufacturers are investing in continuous pyrolysis furnace designs that allow for energy recuperation and more uniform temperature distribution across the reactor volume. Furthermore, the use of advanced process control systems, increasingly integrating AI, ensures precise atmosphere control (inert or specific gas mixtures) and heating ramp rates. These systems mitigate the formation of unwanted side products, improve carbon yield, and, most importantly, standardize the crucial initial Coulombic efficiency (ICE)—a critical hurdle for mass market acceptance of NIBs. Innovations here focus on achieving high ICE (>90%) consistently and cost-effectively, addressing a major barrier to competitive pricing against LIB technology.

Surface modification and coating technologies represent a third key technological pillar. Hard carbon, due to its high surface area and porous nature, often suffers from excessive side reactions with the electrolyte during the initial charge-discharge cycles, leading to the formation of a thick and unstable Solid Electrolyte Interphase (SEI), which consumes active lithium or sodium ions and lowers the ICE. Researchers are developing tailored surface coatings—such as thin layers of amorphous carbon or specialized polymers—applied through chemical vapor deposition (CVD) or wet chemical methods. These coatings help passivate the surface, stabilize the SEI formation, minimize irreversible capacity loss, and improve the overall lifespan and safety of the battery cell, offering a robust pathway to high-performance hard carbon anodes suitable for demanding automotive and utility applications where reliability is non-negotiable.

- Advanced techniques like Hydrothermal Carbonization (HTC) are being used to synthesize hard carbon from sustainable biomass precursors, optimizing cost and environmental footprint.

- Continuous, energy-efficient pyrolysis furnace designs integrated with advanced process control (APC) systems are reducing manufacturing costs and improving batch consistency.

- Surface functionalization and nano-coating technologies (e.g., thin amorphous carbon layers) are being developed to stabilize the Solid Electrolyte Interphase (SEI) and increase Initial Coulombic Efficiency (ICE).

- Computational materials science, leveraging DFT and ML, is guiding the synthesis process by predicting optimal precursor chemistry and thermal treatment parameters for specific performance goals.

Regional Highlights

- Asia Pacific (APAC): The APAC region, led by China, Japan, and South Korea, maintains overwhelming dominance in the Hard Carbon Material Market, primarily due to its established global leadership in battery cell manufacturing (specifically LIBs and the early scale-up of NIBs). China serves as the global manufacturing hub, characterized by massive production capacity and highly competitive pricing, fueled by robust government subsidies supporting the New Energy Vehicle (NEV) and stationary storage sectors. This region benefits from integrated supply chains, where precursor suppliers, material processors, and cell manufacturers are co-located, accelerating innovation and reducing logistics costs. Japan and South Korea, while focusing on high-end, customized hard carbon for specialized applications and developing proprietary synthesis technologies, contribute significantly to the R&D intensity of the region. The high penetration of electric two-wheelers and the massive utility storage market in China are the principal drivers for hard carbon consumption here.

- North America: North America is characterized by significant governmental and private investment aimed at localizing the entire battery supply chain, driven by geopolitical concerns and incentives like the Inflation Reduction Act (IRA). While production volume is currently low, the region is rapidly expanding its gigafactory footprint, creating massive future demand for hard carbon. Focus areas include advanced R&D on sustainable, bio-derived hard carbon and high-performance materials for extreme conditions (e.g., low temperature). The primary market driver is the electrification of transportation (EV mandates) and substantial investment in large-scale grid stabilization projects, necessitating secure, domestically sourced material inputs.

- Europe: The European market is strategically prioritizing sustainable and circular economy principles, heavily influencing hard carbon development. Driven by the European Green Deal and related battery regulations, European companies are focusing on developing hard carbon from locally available, recycled, or sustainable precursors (like lignin or waste tires). The continent is establishing numerous battery 'gigafactories' primarily focused on supplying the surging European EV market and developing highly efficient stationary storage solutions. Regulatory pressure to minimize carbon footprint across the value chain positions European demand towards premium, highly certified, and sustainable hard carbon materials, making it a critical market for technological differentiation rather than volume dominance.

- Latin America, Middle East, and Africa (MEA): These regions represent nascent but high-potential markets. Latin America, with its vast natural resources, presents opportunities for developing unique bio-mass precursors. The MEA region, particularly the Gulf Cooperation Council (GCC) nations, is increasingly investing in utility-scale solar and renewable energy projects, creating substantial future demand for stationary storage systems requiring cost-effective materials like hard carbon anodes, positioning these regions for significant market entry in the post-2030 period.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hard Carbon Material Market.- Kuraray Co. Ltd.

- Hitachi Chemical Co. Ltd.

- SGL Carbon SE

- Shanshan Technology

- Shenzhen BTR New Energy Material Co. Ltd.

- Osaka Gas Chemical Co. Ltd.

- AETNA Inc.

- Carbone Lorraine (Mersen)

- Superior Graphite

- Cabot Corporation

- Showa Denko K.K.

- POSCO

- Toray Industries Inc.

- Kureha Corporation

- Mitsubishi Chemical Corporation

- Nippon Carbon Co. Ltd.

- GS Yuasa Corporation

- NEI Corporation

- JFE Chemical Corporation

- Linyi Gelon New Battery Materials Co. Ltd.

Frequently Asked Questions

Analyze common user questions about the Hard Carbon Material market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical advantage of hard carbon over graphite in battery applications?

The primary advantage of hard carbon is its disordered, non-graphitizable structure, which contains extensive closed pores and voids. This structure efficiently accommodates large sodium ions, making it the benchmark anode material for Sodium-ion Batteries (NIBs) where conventional graphite is ineffective. Hard carbon also offers superior rate capability and structural integrity during repeated cycling.

Which application segment is driving the majority of the market growth for hard carbon materials?

The Sodium-ion Battery (NIB) application segment is the central driver for hard carbon market growth. The increasing commercialization of NIBs, particularly for stationary energy storage systems (ESS) and entry-level electric vehicles, relies heavily on hard carbon for stable and cost-effective anode performance, projecting the highest CAGR in this segment.

What are the main constraints impacting the mass production and cost of hard carbon?

The main constraints are the high energy consumption and associated costs of the ultra-high temperature pyrolysis process required to manufacture hard carbon. Additionally, achieving consistent material quality, specifically high initial Coulombic efficiency (ICE), across massive production batches remains a significant technological and economic hurdle for scaling up.

How are sustainable precursors influencing the hard carbon material market?

Sustainable precursors, such as bio-mass (e.g., coconut shells, lignin) and specific waste products, are critically important as they significantly lower the raw material cost and reduce the environmental footprint. Technological advances in converting these sources into battery-grade hard carbon are providing key opportunities for competitive differentiation and meeting stringent global sustainability mandates.

Which regional market holds the leading position in hard carbon production and why?

Asia Pacific, especially China, holds the leading position in hard carbon production and consumption. This dominance is attributed to massive established battery manufacturing capacity, favorable government policies supporting the NIB supply chain, and highly integrated infrastructure that allows for competitive pricing and rapid industrial scale-up.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager