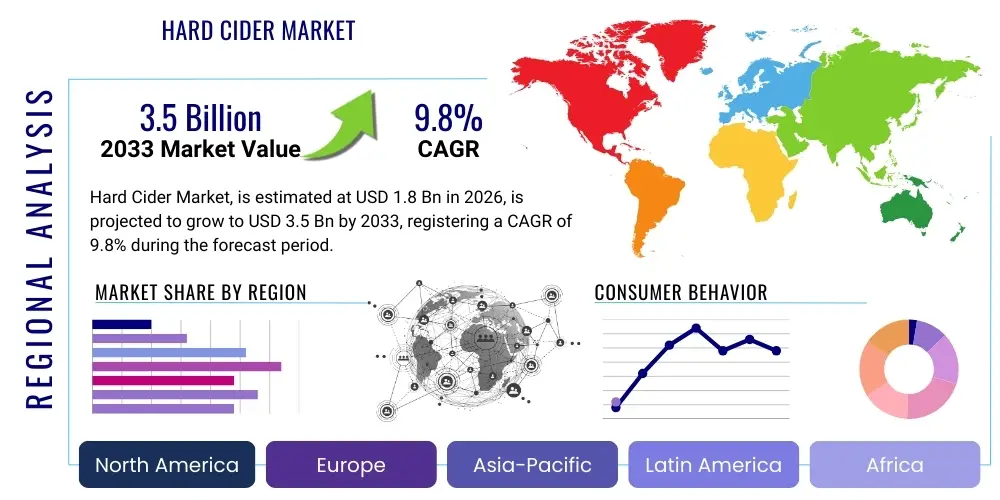

Hard Cider Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438010 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Hard Cider Market Size

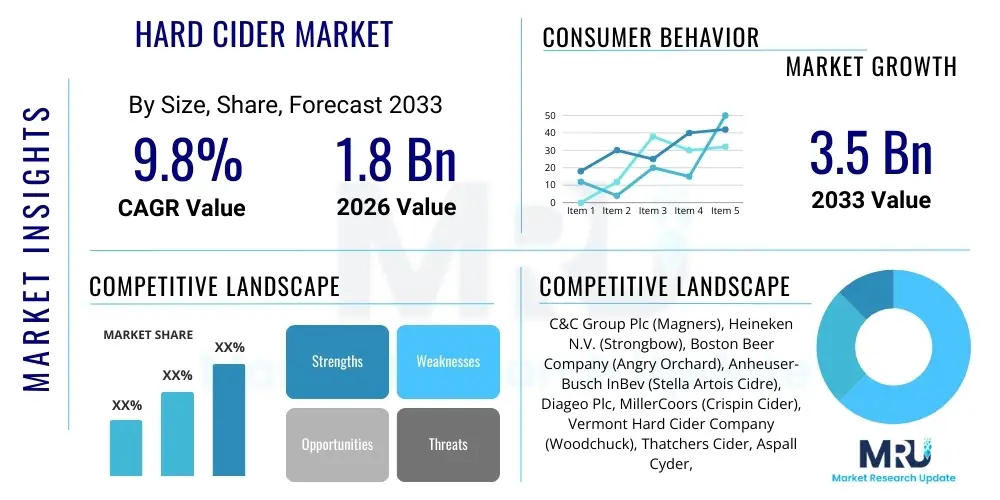

The Hard Cider Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.8% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 3.5 Billion by the end of the forecast period in 2033.

Hard Cider Market introduction

The Hard Cider Market encompasses the production, distribution, and consumption of fermented alcoholic beverages derived primarily from apple juice. This segment of the alcoholic beverage industry has experienced significant resurgence, driven by shifting consumer preferences towards alternatives to traditional beer and wine. Hard cider, often perceived as a natural, gluten-free option, appeals strongly to health-conscious consumers and those seeking sessionable, flavorful drinks. The core product categories include traditional apple cider, flavored ciders (such as pear, berry, or tropical fruit infusions), and specialty or craft ciders characterized by distinct fermentation techniques and unique apple varietals.

Major applications of hard cider consumption span various social settings, including on-trade establishments (bars, restaurants) and off-trade retail purchases for home consumption. The beverage is highly adaptable, often consumed year-round, though seasonal spikes occur, particularly in the autumn months associated with apple harvests. A primary benefit driving market growth is the beverage's inherently gluten-free nature, which expands its consumer base considerably. Furthermore, the lower alcohol by volume (ABV) compared to spirits and some wines positions hard cider favorably among moderate drinkers. The increasing sophistication in flavor profiles, moving beyond overly sweet offerings to encompass drier, complex, and hop-infused varieties, is broadening its gastronomic appeal.

Key driving factors accelerating the market include the continued premiumization trend within the alcoholic beverage industry, where consumers are willing to pay more for craft, authenticity, and high-quality ingredients. The rising demand for low-alcohol and alternative beverages, coupled with effective marketing campaigns emphasizing heritage and natural ingredients, further contributes to market momentum. Geographical expansion into non-traditional cider-drinking regions, particularly in Asia Pacific and Latin America, also presents substantial growth opportunities. Manufacturers are heavily investing in innovation related to packaging, flavors, and distribution optimization to capitalize on these evolving trends and maintain competitiveness against established alcoholic drink categories.

Hard Cider Market Executive Summary

The global Hard Cider Market is experiencing robust growth fueled by several macroeconomic and consumption trends. Business trends highlight a strong focus on merger and acquisition activities among large beverage conglomerates seeking to acquire smaller, regional craft cider brands to instantly diversify their portfolios and capture the premium segment. Furthermore, sustainability initiatives related to apple sourcing, water usage, and packaging—including the shift from glass bottles to recyclable aluminum cans—are becoming crucial competitive differentiators. Investment in efficient supply chain logistics and direct-to-consumer (DTC) digital platforms is also defining modern market operations, especially post-pandemic, ensuring wider market reach and improved profit margins.

Regionally, North America and Europe remain the dominant markets due to deeply entrenched drinking cultures and high production capabilities, particularly the UK, US, and France. However, Asia Pacific is projected to register the fastest growth rate, primarily driven by increasing disposable incomes, westernization of dietary habits, and the growing appeal of low-ABV, accessible alcoholic alternatives in densely populated economies like China and India. Regional trends also indicate a localized sourcing movement, where consumers increasingly prefer ciders made from apples grown within their vicinity, boosting regional agricultural economies and reinforcing the craft narrative.

Segment trends emphasize the rapid expansion of the Flavored/Fruit Cider segment, which appeals to younger consumers seeking diverse and innovative taste experiences beyond traditional apple profiles. Dry Ciders are also gaining traction, particularly in mature markets like the United States, as consumers mature away from historically sweeter varieties toward more wine-like, balanced beverages suitable for food pairing. Distribution channel trends show that the Off-Trade segment (supermarkets, liquor stores) continues to hold the largest market share, but the On-Trade segment is recovering strongly, driven by experiential consumption and specialized cider offerings in bars and taprooms. Packaging innovation favors cans for convenience, portability, and environmental benefits, rapidly outpacing traditional glass bottles in volume sales.

AI Impact Analysis on Hard Cider Market

Analysis of common user questions regarding AI's influence on the Hard Cider Market reveals significant interest in how technology can enhance product quality, operational efficiency, and consumer engagement. Users frequently inquire about AI applications in predicting successful flavor combinations, optimizing fermentation processes to ensure batch consistency, and improving traceability within the apple supply chain. Key concerns often revolve around whether AI could dilute the traditional "craft" identity of cider making or lead to homogenization of flavors. Expectations are high regarding AI's ability to personalize marketing efforts and predict regional flavor preferences with greater accuracy than conventional market research methods, thereby reducing risk in new product development and launch strategies.

AI’s primary influence is manifesting through sophisticated data analytics platforms capable of processing vast amounts of sensory data collected during the fermentation and aging processes. By monitoring variables such as temperature, pH, and specific gravity in real-time using IoT sensors, AI algorithms can identify deviations instantly, recommending precise adjustments to master cider makers, thus drastically reducing product wastage and ensuring consistency across large production volumes. This technical refinement is critical for scaling craft operations without compromising the artisan quality associated with premium ciders. Furthermore, predictive maintenance models powered by machine learning are optimizing bottling and canning line efficiency, minimizing downtime, which is crucial for seasonal production cycles.

In the consumer-facing domain, AI tools are revolutionizing demand forecasting and inventory management, allowing producers and retailers to align stock levels precisely with local purchasing patterns, thereby preventing spoilage of seasonal products. The deployment of AI-driven chatbots and virtual tasting experiences on digital platforms enhances customer service and offers personalized product recommendations based on past purchase history and stated flavor preferences. Ultimately, AI serves not as a replacement for human expertise but as an advanced augmentation tool, enabling cider producers to achieve unparalleled levels of quality control, supply chain resilience, and targeted consumer outreach, accelerating growth in a competitive beverage landscape.

- Flavor Prediction and Formulation: Utilizing machine learning algorithms to analyze consumer trends and ingredient compatibility to generate novel, market-ready cider flavor profiles.

- Supply Chain Optimization: Implementing AI for improved apple yield prediction, resource allocation, and real-time traceability from orchard to shelf.

- Fermentation Quality Control: Using sensor data and predictive modeling to monitor and optimize fermentation conditions, ensuring batch-to-batch consistency and minimizing spoilage.

- Personalized Marketing: Deploying AI to segment consumers and deliver highly targeted advertisements and product recommendations across digital platforms.

- Robotics and Automation: Integrating robotic systems for automated bottling, packaging, and palletizing, increasing operational speed and reducing labor costs in production facilities.

- Demand Forecasting: Applying advanced analytics to predict seasonal and regional sales fluctuations, optimizing inventory levels for perishable goods.

DRO & Impact Forces Of Hard Cider Market

The dynamics of the Hard Cider Market are governed by a complex interplay of drivers, restraints, opportunities, and external impact forces. A dominant driver is the sustained shift in consumer preference toward lower alcohol content beverages, often referred to as 'sessionable' drinks, coupled with the desire for gluten-free options, positioning cider as a natural alternative to traditional beer. Restraints largely center on intense competition from established beverage categories, particularly flavored malt beverages (FMBs) and ready-to-drink (RTDs) cocktails, which often offer aggressive pricing and broader distribution networks. Opportunities are significant in international expansion into emerging markets, coupled with product diversification into niche categories such as organic ciders, hard seltzers utilizing apple bases, and high-end specialty reserves, allowing premium pricing strategies.

The primary driving force is the increasing market acceptance and demand for craft alcoholic beverages. Consumers are increasingly valuing authenticity, locally sourced ingredients, and diverse flavor complexity, which the craft cider segment delivers effectively. The growth of specialized cider houses and tasting rooms further enhances consumer awareness and appreciation for the product's quality and heritage. Furthermore, strategic marketing efforts that link hard cider to culinary experiences and sophisticated drinking occasions are successfully transitioning the beverage from a niche seasonal drink to a year-round staple, particularly among millennials and Gen Z consumers seeking novel experiences.

However, the market faces significant challenges, including the reliance on agricultural inputs (apples), making it susceptible to climate change impacts and commodity price volatility, which can affect production costs and consistency. Regulatory complexity concerning taxation, labeling, and distribution across different geographical regions poses a perpetual restraint, particularly for smaller craft producers attempting cross-border sales. Impact forces, such as changes in consumer health trends (e.g., increased scrutiny on sugar content in beverages), necessitate continuous reformulation and innovation towards drier ciders or those sweetened naturally. The competitive landscape mandates constant differentiation, compelling producers to invest heavily in brand building and novel fermentation techniques to maintain market relevance.

Segmentation Analysis

The Hard Cider Market is rigorously segmented across multiple dimensions, including flavor type, packaging, distribution channel, and alcohol content, which are crucial for defining targeted marketing strategies and product development. Flavor segmentation is arguably the most dynamic area, differentiating between traditional apple-only ciders and the high-growth flavored segments incorporating fruits like berries, pears (perry), stone fruits, and exotic tropical infusions. Distribution segmentation distinguishes between the high-volume Off-Trade retail segment (supermarkets, liquor stores) and the margin-rich On-Trade segment (bars, restaurants, and hospitality venues), each requiring distinct sales and promotional approaches.

- By Flavor Type:

- Traditional Apple

- Fruit Flavored (Pear/Perry, Berry, Stone Fruit, Citrus)

- Specialty/Botanical (Hop-infused, Spiced, Herbal)

- By Packaging:

- Bottles (Glass)

- Cans (Aluminum)

- Draft/Kegs

- By Distribution Channel:

- Off-Trade (Supermarkets, Hypermarkets, Liquor Stores, Online Retail)

- On-Trade (Bars, Restaurants, Pubs, Hotels)

- By Alcohol Content:

- Low ABV (Below 4.5%)

- Standard ABV (4.5% to 7%)

- High ABV (Above 7%)

- By Sweetness Level:

- Dry

- Semi-Dry/Medium

- Sweet

Value Chain Analysis For Hard Cider Market

The value chain for the Hard Cider Market is characterized by a high reliance on agricultural inputs (upstream analysis) and complex distribution networks (downstream analysis) required to deliver a perishable product efficiently. The upstream segment involves intensive activities such as orchard management, apple harvesting, pressing, and initial juice preparation. Quality control at this stage is paramount, as the varietal selection and quality of the apple juice directly determine the final product's characteristics. Producers must establish robust relationships with specialized apple growers, often signing long-term contracts to ensure a consistent supply of cider-specific apple varieties, which are typically different from eating apples, possessing higher tannin levels crucial for balanced flavor profiles. Any disruption in the agricultural supply chain, such as adverse weather, significantly impacts the entire market's operational stability.

The core production phase, involving fermentation, blending, aging, and packaging, adds substantial value. Modern producers increasingly utilize sophisticated fermentation tanks, temperature control systems, and blending expertise to achieve consistent flavor profiles at scale. This intermediate stage includes secondary processing steps like pasteurization, filtration, and carbonation. The packaging stage, involving bottling, canning, or kegging, is critical for market access, with a notable trend towards aluminum cans due to their lighter weight, better light protection, and superior sustainability profile. Efficient management of this phase, often involving high capital investment in automation, is essential for cost management and throughput optimization.

Downstream analysis focuses on distribution channels, which are generally categorized into direct and indirect methods. Direct distribution involves sales through company-owned taprooms, online stores, and local farmers' markets, offering higher margins and direct consumer feedback, crucial for craft brands. Indirect distribution relies heavily on a three-tier system in many regions (producer to wholesaler/distributor to retailer/on-trade), which ensures wide market penetration but significantly reduces profit margins. Wholesalers play a vital role in handling logistics, inventory, and regulatory compliance. The ultimate point of sale—be it Off-Trade (high volume, competitive pricing) or On-Trade (premium pricing, brand building)—defines the final consumer interaction. Successful market participants optimize their channel mix based on regional regulatory frameworks and target consumer demographics.

Hard Cider Market Potential Customers

Potential customers for the Hard Cider Market are broad, extending across diverse demographics but showing particular concentration among two key groups: consumers seeking gluten-free alcoholic alternatives and younger millennials/Gen Z who prioritize flavor innovation and low-ABV options. Individuals diagnosed with gluten sensitivities or choosing a gluten-free lifestyle often transition from beer to hard cider, viewing it as a safer and more natural choice compared to distilled spirits or wine. This segment values ingredient transparency and often prefers craft brands that emphasize natural fermentation and minimal artificial additives.

The second major segment comprises consumers aged 25 to 45 who are highly experimental in their beverage consumption. This group is less brand-loyal than older generations and actively seeks variety, driving demand for innovative flavor combinations (e.g., hopped, botanical, and tropical fruit ciders). They often engage with the product in On-Trade settings, treating cider as a premium, sophisticated alternative to conventional drinks. Furthermore, the rising popularity of 'session drinking' and moderation has made ciders (typically 4-6% ABV) highly attractive for social consumption, aligning perfectly with the trend of responsible drinking.

Geographically, while core cider markets like the UK and US appeal strongly to traditional cider drinkers (often skewing older, valuing classic profiles), emerging markets are characterized by younger, urban populations embracing sweet or fruit-flavored variants as a gateway into alcoholic beverages. Specialized consumer groups, such as environmental advocates, represent a growing niche, specifically seeking ciders made from sustainable or organic apple farming practices, driving the demand for certified organic labels and environmentally conscious packaging.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 3.5 Billion |

| Growth Rate | 9.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | C&C Group Plc (Magners), Heineken N.V. (Strongbow), Boston Beer Company (Angry Orchard), Anheuser-Busch InBev (Stella Artois Cidre), Diageo Plc, MillerCoors (Crispin Cider), Vermont Hard Cider Company (Woodchuck), Thatchers Cider, Aspall Cyder, Downeast Cider, Seattle Cider Co., Tieton Cider Works, Austin Eastciders, Blake's Hard Cider, Rekorderlig, E&J Gallo Winery, Carlton & United Breweries, Cidrerie Stassen. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hard Cider Market Key Technology Landscape

The technology landscape in the Hard Cider Market is centered on enhancing fermentation control, maximizing flavor complexity, and improving packaging efficiency to meet stringent quality and sustainability standards. Advanced fermentation technology is crucial; this includes the use of jacketed stainless steel tanks coupled with precise temperature control systems to manage yeast activity, which is vital for achieving desired sugar-to-alcohol conversion rates and preventing off-flavors. Furthermore, producers are utilizing specialized non-Saccharomyces yeast strains to introduce complex aromatic profiles and enhance mouthfeel, moving beyond simple single-strain fermentations. Filtration technology, particularly cross-flow filtration, is increasingly adopted for efficient clarification without sacrificing the subtle nuances of the cider, improving shelf stability and visual appeal.

In the area of quality assurance and supply chain integrity, sophisticated analytical instruments are becoming commonplace. High-performance liquid chromatography (HPLC) and gas chromatography-mass spectrometry (GC-MS) are utilized to monitor volatile compounds, identify potential contaminants, and ensure flavor consistency across batches, mitigating the risk associated with natural product variability. The integration of Internet of Things (IoT) sensors throughout the orchard and production facilities allows for real-time monitoring of variables like Brix levels in apples and atmospheric conditions in aging facilities. This data is leveraged through cloud-based platforms to facilitate predictive maintenance and quality adjustments, transforming traditional artisan practices into scalable industrial processes.

Packaging technology innovations are focused on sustainability and consumer convenience. The shift towards light-weighting glass bottles and the accelerated adoption of aluminum canning lines are major technological trends. High-speed canning and bottling equipment featuring minimized oxygen pickup (to prevent oxidation and preserve freshness) are essential for maintaining product quality in mass production. Furthermore, digital technologies, including QR codes and blockchain implementation, are being explored to enhance product traceability, providing consumers with detailed information about apple sourcing, production methods, and sustainability metrics, catering to the demand for transparency and authentic provenance.

Regional Highlights

The global Hard Cider Market exhibits distinct regional consumption patterns and growth dynamics. Europe currently holds the largest market share, driven primarily by the historical significance and cultural dominance of cider in countries like the UK, Ireland, France, and Spain (particularly Asturias and the Basque Country). The UK is the most mature market, characterized by strong consumer loyalty to established brands and a growing craft movement emphasizing dry, complex, and traditional "scrumpy" styles. Regulatory environments in Europe are generally favorable, supporting high levels of production and export activities, particularly for protected regional designations like "Cidre de Normandie" or specific Spanish DOP ciders.

North America, led by the United States, represents the fastest-growing market in absolute terms. The US market surged in the early 2010s, initially favoring sweeter, mass-market brands, but has rapidly matured into a highly fragmented landscape dominated by regional craft producers focusing on innovative flavors, single-varietal ciders, and drier profiles mimicking fine wine characteristics. The demand here is fundamentally driven by the gluten-free trend and consumers' willingness to explore non-traditional alcoholic beverages. Canada also shows consistent growth, with strong local craft scenes emerging in British Columbia and Quebec, emphasizing locally sourced apples and sustainable practices.

Asia Pacific (APAC) is positioned as the primary future growth engine, albeit starting from a lower base. Market penetration in countries such as Australia and New Zealand is already high, benefiting from established beverage consumption habits. Crucially, urbanization and the growth of the middle class in populous nations like China and India are creating receptive markets for imported, Western-style alcoholic beverages. Hard cider appeals here due to its lighter profile compared to dark spirits and its association with novelty and modern consumption. Latin America and the Middle East & Africa (MEA) remain relatively nascent, with sporadic but increasing consumption, often driven by imports and niche distribution targeting expatriate communities and upscale hotel/tourism sectors.

- North America (United States, Canada, Mexico): Dominant growth area, characterized by the shift from mass-market sweet ciders to high-end, dry craft varieties; strong focus on innovative flavors and gluten-free positioning.

- Europe (UK, France, Spain, Germany): Largest market share globally; driven by historical consumption and strong regional traditions; UK remains the largest consumer, seeing renewed interest in traditional and single-varietal products.

- Asia Pacific (China, Japan, Australia, New Zealand): Highest expected CAGR; growth fueled by rising disposable incomes, westernization, and the increasing appeal of imported, low-ABV, fruit-based alcoholic drinks.

- Latin America (Brazil, Argentina): Emerging markets showing slow but steady adoption, often driven by imported brands and specialized retail channels catering to adventurous drinkers.

- Middle East and Africa (MEA): Niche market focused primarily on non-alcoholic variants or limited alcoholic distribution in urban centers and tourism areas.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hard Cider Market.- C&C Group Plc (Magners)

- Heineken N.V. (Strongbow)

- Boston Beer Company (Angry Orchard)

- Anheuser-Busch InBev (Stella Artois Cidre)

- Diageo Plc

- MillerCoors (Crispin Cider)

- Vermont Hard Cider Company (Woodchuck)

- Thatchers Cider

- Aspall Cyder

- Downeast Cider

- Seattle Cider Co.

- Tieton Cider Works

- Austin Eastciders

- Blake's Hard Cider

- Rekorderlig

- E&J Gallo Winery

- Carlton & United Breweries

- Molson Coors Beverage Company

- Vandestreek Brouwerij

- Kopparbergs Bryggeri

Frequently Asked Questions

Analyze common user questions about the Hard Cider market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary growth driver for the Hard Cider Market?

The primary growth driver is the escalating consumer demand for gluten-free and low-alcohol by volume (low-ABV) beverages. Hard cider is inherently gluten-free, positioning it favorably as a refreshing and healthier alternative to traditional beer, attracting health-conscious consumers and those seeking moderate drinking options.

Which geographical region dominates hard cider consumption?

Europe, specifically the United Kingdom, France, and Spain, currently dominates the hard cider market, holding the largest market share due to long-standing cultural heritage, established production techniques, and high per capita consumption rates of traditional cider variants.

What are the key trends influencing product innovation in hard cider?

Key innovation trends include the shift towards drier, less sweet ciders; the extensive use of diverse fruit and botanical infusions (Flavored Cider segment); and the adoption of modern packaging formats, particularly aluminum cans, driven by portability and sustainability demands.

How is the craft cider segment impacting the overall market?

The craft cider segment is a critical growth driver, elevating the market by emphasizing premium ingredients, single-varietal apples, specialized fermentation, and local sourcing. This segment justifies higher price points and attracts consumers seeking authenticity and unique flavor complexity.

Is hard cider production significantly affected by seasonality?

Yes, hard cider production is inherently linked to agricultural cycles, making it susceptible to seasonality regarding apple harvesting and fluctuating raw material costs. While modern inventory management and juice storage mitigate supply instability, peak consumption often aligns with seasonal events, particularly autumn.

What role does e-commerce play in hard cider distribution?

E-commerce is increasingly important, providing essential direct-to-consumer (DTC) channels, particularly for smaller craft producers circumventing traditional three-tier systems. Online platforms facilitate niche market access and allow for tailored, personalized product offerings and subscription services.

How are producers addressing consumer concerns about high sugar content?

Producers are responding by innovating towards "dry" and "semi-dry" ciders that undergo extended fermentation to convert more sugars into alcohol. Many brands are also transparently labeling calorie and sugar counts, aligning with the broader consumer trend toward low-sugar beverages.

What are the primary challenges for new entrants in the hard cider market?

New entrants face challenges including securing consistent supply chains for cider-specific apples, navigating complex regional alcohol regulations and distribution laws (especially the three-tier system in the US), and competing against the massive marketing budgets of large, established beverage conglomerates.

What is the most preferred packaging type in the market currently?

While bottles retain a significant share, aluminum cans are rapidly becoming the most preferred packaging type, particularly in North America, due to their logistical benefits (lighter weight, better shelf life preservation) and their appeal in outdoor, casual, and sustainable consumption settings.

How does technological advancement in fermentation affect hard cider quality?

Advanced fermentation technology, including precise temperature control systems and the use of specialized, non-conventional yeast strains, allows producers to achieve superior batch-to-batch consistency, manage complex flavor development, and drastically reduce the incidence of production faults or spoilage, enhancing overall quality and scalability.

What is the projected growth trajectory for the Asia Pacific hard cider market?

The Asia Pacific market is expected to demonstrate the highest Compound Annual Growth Rate (CAGR) globally. This growth is driven by expanding westernized drinking habits, increased urbanization, and rising disposable incomes, making imported and premium alcoholic alternatives increasingly accessible and desirable.

Beyond apples, what ingredients are becoming popular in modern ciders?

Modern ciders frequently incorporate ingredients such as pears (Perry), hops (creating hop-infused ciders), various berries (e.g., blackberry, raspberry), and botanicals (like ginger or hibiscus). These innovations aim to diversify the flavor spectrum and capture market share from craft beer and flavored malt beverages.

What is the significance of the On-Trade versus Off-Trade segments?

The Off-Trade segment (retail stores) accounts for the largest volume sales, driven by convenience and lower pricing. However, the On-Trade segment (bars, restaurants) is crucial for brand building, premium positioning, and introducing consumers to specialized or seasonal draft offerings, driving initial trial and perception.

How does AI contribute to supply chain resilience for hard cider producers?

AI contributes by enabling predictive analytics for apple yield forecasting, optimizing logistics routes to minimize transport costs and delivery times, and utilizing blockchain for enhanced traceability, ensuring rapid response to quality issues or material sourcing disruptions.

Are organic and sustainable practices important in the hard cider market?

Yes, sustainability and organic practices are increasingly important. Consumers, particularly in North America and Western Europe, show a growing preference for ciders made from organically grown apples using eco-friendly production methods, driving certification and sustainable sourcing initiatives among leading producers.

What is the role of aging in producing premium hard ciders?

Aging, often in oak barrels previously used for wine or spirits, imparts complexity, softness, and distinctive notes (such as vanilla or spice) to premium hard ciders. This process transforms simple fermented apple juice into a sophisticated beverage comparable to fine wine, justifying premium prices.

How do cider makers manage quality control with natural variability of apples?

Cider makers utilize advanced blending techniques, combining juice from different apple varietals and harvests, alongside laboratory testing (HPLC/GC-MS) to analyze acidity, sugar content, and volatile compounds. This rigorous process ensures the final product consistently meets the established flavor profile regardless of minor variations in the raw agricultural input.

What is the difference between hard cider and perry?

Hard cider is traditionally fermented exclusively from apple juice. Perry is a similar alcoholic beverage fermented primarily from pear juice. Although sometimes grouped together, perry has a distinct, often lighter flavor profile and slightly different production characteristics dictated by the unique composition of pears.

Why are large beverage companies acquiring craft cider brands?

Large beverage companies acquire craft brands to rapidly gain market share in the high-growth, premium segment; to diversify their portfolios against declining traditional beer consumption; and to leverage the innovation and authentic brand narratives established by smaller, regional producers.

What impact do excise taxes and tariffs have on market growth?

Excise taxes and tariffs significantly impact market growth by increasing the final consumer price, potentially reducing demand, and complicating international trade. Producers continuously lobby for favorable taxation classifications, often seeking differentiation from higher-taxed spirits or wine categories.

How are producers utilizing digital marketing to reach consumers?

Producers leverage digital marketing through targeted social media campaigns, influencer partnerships, and localized digital advertising based on geotargeting. They also utilize content marketing, sharing brand stories and pairing guides to reinforce the authentic, craft image of their products and drive online sales.

What defines a 'sessionable' hard cider in the current market?

A 'sessionable' hard cider typically has a lower ABV, generally under 5%, is highly refreshing, and possesses a balanced, moderate flavor profile that encourages sustained consumption over a longer period without leading to rapid intoxication, catering to responsible drinking preferences.

How is climate change posing a risk to the hard cider industry?

Climate change poses a risk by increasing the unpredictability of weather patterns, leading to volatile apple yields, changes in fruit sugar and acid composition, and potentially impacting the quality and consistency of raw materials, increasing overall production costs.

What is the role of the three-tier system in the US distribution of hard cider?

The three-tier system mandates that producers sell to licensed wholesalers, who then sell to retailers. This system, established post-Prohibition, governs most US alcohol distribution and requires significant effort and cost for producers to achieve wide market penetration.

How does consumer interest in traceability influence packaging technology?

Consumer interest in traceability drives the adoption of smart packaging technologies, such as QR codes and embedded NFC tags, allowing consumers to scan the product and access detailed information about the apple orchard source, production date, and sustainability credentials.

Are high-ABV hard ciders gaining popularity?

Yes, while the mainstream trend favors low-ABV, a niche segment of high-ABV ciders (often over 7%) is gaining popularity, appealing to consumers accustomed to craft beers or seeking a more potent, complex beverage, often aged and marketed as specialty or reserve offerings.

What is the significance of the term 'scrumpy' in cider culture?

'Scrumpy' is a traditional British term referring to a rough, rustic, often unpasteurized, and very strong hard cider, typically associated with farm production. It signifies heritage and a less refined, often cloudier, and more potent style of cider, catering to traditionalist consumers.

How are cider producers managing water usage sustainability?

Cider producers are implementing water conservation strategies, including dry cleaning processes, installing efficient washing systems, and recycling process water where possible, often driven by consumer demand for environmentally conscious manufacturing practices and compliance with local water regulations.

What is the outlook for fruit-flavored hard ciders versus traditional apple ciders?

Fruit-flavored ciders are projected to sustain higher growth rates, particularly in emerging and mass markets, due to their broad appeal and perceived accessibility. Traditional apple ciders, however, will maintain stability and premium positioning, driven by established craft connoisseurs and heritage markets.

How do tariffs on imported apples or apple concentrate impact market pricing?

Tariffs increase the cost of imported raw materials, forcing producers who rely on foreign sourcing to raise their product prices, which can negatively affect price competitiveness and potentially slow down market expansion in regions dependent on international apple supply.

What differentiates dry cider from sweet cider in terms of production?

The key differentiator is the fermentation length and residual sugar content. Dry cider is fermented for a longer period, allowing yeast to convert nearly all sugars into alcohol, resulting in low residual sugar. Sweet cider fermentation is arrested earlier, leaving a higher concentration of unfermented sugars.

Why is temperature control crucial during the cider fermentation process?

Temperature control is crucial because it dictates the activity and lifespan of the yeast strains. Maintaining lower, stable temperatures during fermentation allows for a slower process that preserves volatile aromatic compounds, resulting in a cleaner, more complex, and superior tasting final product.

What demographic group is showing the highest rate of hard cider adoption?

Millennials and younger consumers (Gen Z) are demonstrating the highest adoption rates, attracted by hard cider's perceived health benefits (gluten-free), diverse flavor options, and alignment with trends favoring lower alcohol content and sustainable consumption choices.

How is augmented reality (AR) being used in hard cider marketing?

AR is used primarily on packaging labels and in digital advertisements to create engaging, interactive brand experiences. Consumers can use smartphone apps to unlock virtual orchard tours, recipe suggestions, or animated branding elements directly from the physical product label.

What risks are associated with the heavy reliance on seasonal marketing campaigns?

Heavy reliance on seasonal campaigns (like Autumn/Harvest themes) risks limiting the beverage's perception as a year-round drink. Producers are mitigating this by introducing seasonal specialty flavors and increasing marketing during warmer months to promote chilled consumption.

Why has the market seen a decline in bottle usage in favor of cans?

Cans are preferred due to being lighter (reducing transport costs), completely blocking UV light (preventing skunking), and having superior recyclability. They also provide better convenience for outdoor activities and modern retail stacking requirements.

What is the impact of craft beer consumers migrating to hard cider?

The migration of craft beer consumers has driven the demand for more sophisticated and bitter profiles, leading to the innovation of hopped ciders and barrel-aged varieties. These consumers often seek flavor complexity and appreciate the artisanal process.

How do regional cider varieties (e.g., French, Spanish) influence the global market?

Regional varieties influence the global market by introducing specialized techniques (like keeving in France or natural carbonation in Spain) and unique flavor profiles, stimulating demand for premium, authentic imported products among discerning consumers worldwide.

What steps are manufacturers taking to ensure product safety and quality consistency?

Manufacturers employ stringent Quality Assurance/Quality Control (QA/QC) protocols, including advanced microbial testing, routine pasteurization or sterile filtration, and standardized blending protocols managed by automated systems to guarantee both safety and consistent sensory characteristics.

In value chain analysis, what is the most critical upstream activity?

The most critical upstream activity is the sourcing and pressing of high-quality cider apples. The chemical composition of the apple juice—specifically its balance of tannins, acids, and sugars—is the fundamental determinant of the final cider's structure and flavor profile.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager