Hard Disk Drives Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437851 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Hard Disk Drives Market Size

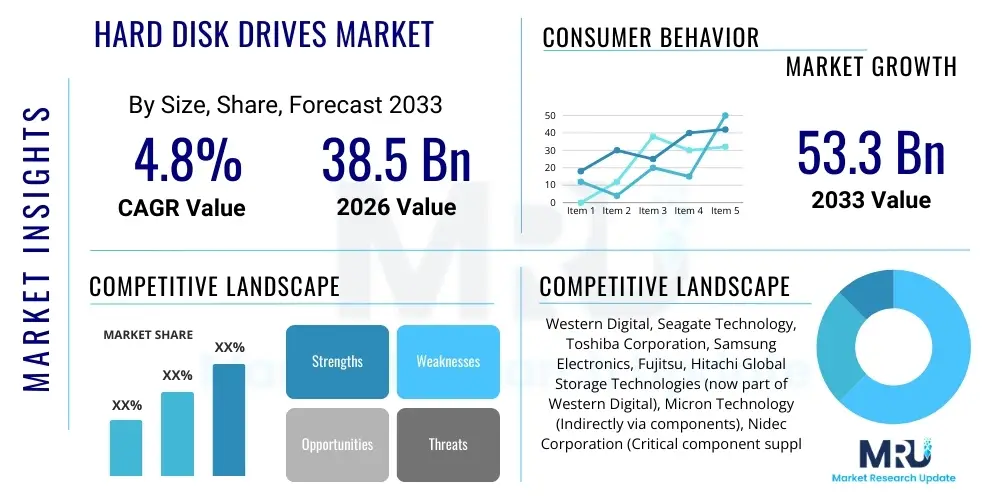

The Hard Disk Drives Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at $38.5 Billion in 2026 and is projected to reach $53.3 Billion by the end of the forecast period in 2033.

Hard Disk Drives Market introduction

The Hard Disk Drives (HDD) Market encompasses the manufacturing, distribution, and utilization of non-volatile data storage devices that store and retrieve digital information using rapidly rotating platters coated with magnetic material. HDDs remain a critical component in the global data infrastructure, particularly in areas requiring high-capacity, cost-effective, and long-term storage solutions. Despite the rising prominence of Solid State Drives (SSDs), HDDs maintain dominance in specific applications due to their superior cost-per-gigabyte ratio, making them essential for enterprise data centers, cloud storage infrastructure, and archival purposes. The technology continues to evolve, focusing on higher areal density through innovations like Heat-Assisted Magnetic Recording (HAMR) and Microwave-Assisted Magnetic Recording (MAMR), ensuring their continued relevance in the exabyte-scale data world.

Major applications of HDDs span across critical sectors, including large-scale data backup, nearline storage for cloud service providers (CSPs), video surveillance systems, and consumer electronics requiring vast storage capacities, such as desktop computers and external drives. The increasing global data generation, driven by IoT devices, 5G deployment, and media consumption, directly fuels the demand for high-capacity drives, especially those exceeding 16 terabytes. HDDs offer the fundamental benefit of high durability and reliability for mass storage archives, coupled with mature manufacturing processes that allow for economies of scale, providing a competitive edge over flash-based storage in specific enterprise scenarios.

Key driving factors supporting market expansion include the exponential growth of hyperscale data centers requiring massive, tiered storage solutions where HDDs serve the foundational tier. Furthermore, the burgeoning demand for centralized storage solutions in corporate environments for regulatory compliance and business intelligence necessitates reliable, high-density storage platforms. Geopolitical stability and supply chain optimization efforts are also crucial, ensuring continuous availability of components for leading HDD manufacturers. The continuous research and development into technologies that push the areal density limits are vital for sustaining the HDD market against competitive pressure from faster, albeit more expensive, storage alternatives.

Hard Disk Drives Market Executive Summary

The global Hard Disk Drives market demonstrates resilience, primarily driven by robust enterprise demand for high-capacity drives necessary for cloud infrastructure and big data analytics. Business trends indicate a bifurcation: the consumer segment is gradually transitioning towards SSDs for performance-critical applications, while the enterprise/nearline segment is experiencing significant growth, particularly for drives exceeding 12TB. Investment in next-generation recording technologies, such as HAMR, is the core strategic focus for market leaders seeking to maintain capacity leadership and cost efficiency. Furthermore, geopolitical shifts influencing supply chain routes and raw material costs introduce complexity, requiring manufacturers to adopt dynamic pricing and inventory management strategies to ensure profitability and sustained market presence across key operational regions.

Regionally, Asia Pacific (APAC) stands out as the primary growth engine, fueled by massive digital transformation initiatives in countries like China and India, coupled with rapid deployment of hyperscale data centers by international and local cloud providers. North America remains a highly mature market characterized by early adoption of the highest-capacity drives and significant expenditure by major tech giants (e.g., Google, Amazon, Microsoft) for their global cloud footprints. European market trends show steady demand, largely influenced by stringent data localization and privacy regulations, which necessitate localized storage infrastructure investments, thereby favoring stable demand for reliable nearline HDDs.

Segmentation trends highlight the overwhelming shift towards the Enterprise Nearline category, which utilizes high-capacity, high-reliability HDDs for bulk storage and archival purposes. The Interface segment is dominated by Serial ATA (SATA) due to its cost-effectiveness in archival and consumer spaces, while Serial Attached SCSI (SAS) maintains relevance in high-performance enterprise arrays requiring enhanced reliability and dual-port capability. Capacity segmentation confirms the escalating demand trend; the 'Above 8TB' category is expected to exhibit the fastest growth, directly reflecting the industry's need to store exponentially increasing volumes of unstructured data in the most space-efficient manner possible.

AI Impact Analysis on Hard Disk Drives Market

Users frequently inquire whether the shift towards AI and Machine Learning (ML) workloads, which often demand high Input/Output Operations Per Second (IOPS) and low latency typically provided by SSDs, will render HDDs obsolete. Another major theme revolves around how AI-driven data explosion, particularly generated by edge devices and large language models (LLMs), translates into storage needs—specifically, whether this massive scale requires the cost efficiency only HDDs can provide for cold storage and archival training data sets. Concerns also focus on whether AI can optimize HDD manufacturing processes or enhance drive performance predictability (predictive failure analysis). The prevailing expectation is that AI will accelerate data generation exponentially, necessitating a tiered storage strategy where HDDs remain indispensable for storing the vast majority of less frequently accessed, yet critical, data utilized for long-term ML training and compliance archives.

- AI drives exponential data generation, necessitating cost-effective, high-capacity archival storage (HDD strength).

- Increased demand for tiered storage architectures, where HDDs handle cold and warm data layers supporting AI infrastructure.

- AI algorithms are employed to enhance HDD quality control and improve yield rates during manufacturing processes.

- Predictive maintenance analytics, powered by ML, optimize HDD lifespan management in large data centers, increasing operational efficiency.

- Training data sets for large AI models often require massive, long-term storage volumes best served by bulk HDDs.

- The high-performance requirements of real-time AI inference favor SSDs, but the subsequent storage of inference results and historical data utilizes HDDs.

DRO & Impact Forces Of Hard Disk Drives Market

The dynamics of the Hard Disk Drives market are shaped by a complex interplay of drivers, restraints, and opportunities. The core driver is the unrelenting global production of digital data, particularly unstructured data generated by IoT, social media, and video content, which mandates scalable and economical storage solutions. However, a significant restraint is the accelerating substitution effect where Solid State Drives (SSDs) continue to penetrate sectors previously dominated by HDDs, especially in client computing and performance-sensitive server environments, due to their superior speed and lower power consumption. Opportunities lie primarily in advancing recording technologies, such as HAMR, enabling capacities far exceeding current limits, thereby strengthening the HDD value proposition in the hyperscale nearline segment. These forces combine to create an environment where HDDs must continually innovate on density and cost to maintain competitiveness.

Key drivers include the massive global investment in cloud services and hyperscale data centers by technology giants, demanding petabytes of nearline storage. Furthermore, the regulatory requirements across various industries for long-term data retention (e.g., financial, healthcare) ensure a stable, continuous demand for reliable archival HDDs. The increasing adoption of video surveillance systems (CCTV, security) worldwide, which generate enormous amounts of sequential write data, also acts as a powerful driver for high-endurance HDDs specifically designed for continuous operational loads. The economic benefit of HDDs, offering the lowest cost per terabyte compared to any other persistent storage technology, ensures their role remains secured in bulk storage applications.

Restraints include the ongoing challenges related to power consumption per terabyte, which is a growing concern for energy-conscious data center operators who increasingly favor energy-efficient SSDs despite the higher initial cost. Technological complexities associated with pushing areal density limits (e.g., perfecting HAMR technology) pose significant R&D risks and delays in product commercialization. Opportunities are abundant, specifically in developing highly specialized HDDs for specific market niches, such as ruggedized drives for automotive or industrial IoT applications. Moreover, expanding market penetration into emerging economies that are just beginning large-scale digitalization efforts presents significant potential for volume growth throughout the forecast period.

Segmentation Analysis

The Hard Disk Drives market is extensively segmented based on factors crucial for differentiating product functionality and end-user requirements. These primary segmentation criteria include Application (which distinguishes between enterprise needs for high reliability versus consumer needs for affordability), Interface Type (determining speed and compatibility with system infrastructure), and Capacity (reflecting the density required for specific storage tiers, from client devices to massive data centers). This structure helps market participants tailor their product lines—such as high-speed SAS drives for mission-critical enterprise workloads or high-density SATA drives for nearline cloud archives—to maximize market penetration across diverse technological ecosystems globally.

- By Application:

- Enterprise (Nearline, Mission-Critical)

- Consumer (Client Desktops, Laptops, External Drives)

- Surveillance Systems

- By Interface:

- SATA (Serial Advanced Technology Attachment)

- SAS (Serial Attached SCSI)

- Fibre Channel

- By Capacity:

- Less than 1 TB

- 1 TB to 8 TB

- 8 TB to 16 TB

- Above 16 TB

Value Chain Analysis For Hard Disk Drives Market

The value chain for the Hard Disk Drives market is intricate, beginning with the highly specialized upstream component manufacturing, primarily involving critical raw materials such as rare earth magnets, aluminum or glass platters, and sophisticated read/write heads (head stack assemblies). These components are sourced from a limited number of highly specialized vendors globally. The subsequent manufacturing phase involves complex assembly, precision calibration, and rigorous quality assurance processes, executed by the few dominant HDD manufacturers. Controlling the upstream supply, particularly for components like the head stack assembly, is crucial as technological advances often originate at this stage, dictating drive performance and capacity limits.

Downstream activities center on distribution and integration. HDDs are distributed through several channels, including Original Equipment Manufacturers (OEMs), who integrate them into servers, storage arrays, and personal computers; independent distributors who supply smaller system builders and resellers; and direct sales channels to hyperscale cloud service providers (CSPs) who buy drives in vast quantities directly from manufacturers. The direct channel to CSPs has become the most financially significant route, demanding tailor-made high-capacity drives and robust logistical support to handle rapid deployment cycles. The final stage involves installation and maintenance, often managed by the end-users themselves (data center operators) or specialized maintenance service providers.

The transition from manufacturing to end-user often involves significant indirect distribution through channel partners, who add value by offering integration services, localized support, and inventory management. Direct engagement with key hyperscale customers, however, allows manufacturers better control over product specifications and pricing, leading to higher margins and faster technology adoption. The efficiency of this value chain is continuously optimized to reduce the time-to-market for new high-capacity drives, which are crucial for maintaining market share in the competitive enterprise storage environment, making logistical and inventory excellence paramount across both direct and indirect routes.

Hard Disk Drives Market Potential Customers

Potential customers for Hard Disk Drives encompass a broad spectrum of entities, primarily segmented into high-volume enterprise users and individual consumer buyers. The largest and most lucrative customer segment comprises hyperscale cloud service providers (CSPs) such as Amazon Web Services, Microsoft Azure, and Google Cloud, who require exabytes of cost-effective, high-density nearline storage for their data centers to support global cloud computing, storage, and archival services. These customers drive demand for the latest capacity breakthroughs (e.g., 20TB+ drives) and prioritize total cost of ownership (TCO) over sheer performance, making HDDs the ideal solution for their foundational storage layers.

Another major segment includes Original Equipment Manufacturers (OEMs) of servers, storage arrays (e.g., NAS/SAN systems), and complete data center solutions (e.g., Dell Technologies, HPE, NetApp). These OEMs integrate HDDs into their finished products sold to corporate clients, governments, and educational institutions for internal data management, backup, and enterprise applications. Furthermore, the professional surveillance sector, comprising entities utilizing massive video recording systems (e.g., city surveillance networks, large corporate security installations), constitutes a specialized high-volume customer base that requires purpose-built, highly reliable surveillance-grade HDDs capable of continuous write operations.

Finally, the consumer and small business market remains a stable customer base, although increasingly price-sensitive and migrating towards SSDs for client devices. This segment still demands HDDs for external backup drives, budget desktop computers, and Small Office/Home Office (SOHO) network-attached storage (NAS) devices where multi-terabyte capacity at an affordable price is the primary purchasing criterion. These diverse customer needs underscore the strategic necessity for HDD manufacturers to maintain dual product lines catering to both the high-capacity, reliability-focused enterprise sector and the volume-driven, cost-conscious consumer segment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $38.5 Billion |

| Market Forecast in 2033 | $53.3 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Western Digital, Seagate Technology, Toshiba Corporation, Samsung Electronics, Fujitsu, Hitachi Global Storage Technologies (now part of Western Digital), Micron Technology (Indirectly via components), Nidec Corporation (Critical component supplier), Showa Denko (Media/Platter Supplier), TDK Corporation (Head supplier), HGST (Legacy), Hewlett Packard Enterprise, Dell Technologies, Lenovo, Quantum Corporation, Buffalo Technology, LaCie (A brand of Seagate), Iomega (A brand of EMC), ADATA Technology, NetApp. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hard Disk Drives Market Key Technology Landscape

The technological landscape of the Hard Disk Drives market is defined by continuous innovation aimed at increasing areal density, which is the amount of data that can be stored per square inch of platter surface. The transition from traditional Perpendicular Magnetic Recording (PMR) to Shingled Magnetic Recording (SMR) allowed for immediate density gains, particularly beneficial for sequential write workloads typical of archival storage. However, the future hinges on advanced recording techniques that overcome the superparamagnetic limit, the point at which magnetic grains become unstable. The two paramount technologies driving this evolution are Heat-Assisted Magnetic Recording (HAMR) and Microwave-Assisted Magnetic Recording (MAMR), both essential for enabling the next generation of 30TB+ drives needed by hyperscale data centers. HAMR uses a laser to momentarily heat the recording medium, allowing stable magnetic writing at higher densities, while MAMR uses a spin torque oscillator to generate a microwave field, assisting the writing process at ambient temperatures. Successful, high-yield commercialization of these technologies is the primary focus of R&D efforts among key market players.

Beyond areal density, advancements in internal drive architecture and component design significantly contribute to performance and reliability. Dual-actuator technology, for instance, splits the actuator arm into two independently controlled systems, effectively doubling the sequential read/write performance without increasing platter count or rotation speed. Furthermore, the use of Helium inside hermetically sealed drives (Helium-filled HDDs) reduces aerodynamic drag on the platters, allowing for thinner disks, increased platter count, lower power consumption, and improved rotational vibration characteristics. Helium technology has become standard for high-capacity enterprise drives (10TB and above), as it is crucial for maximizing storage density within the standard 3.5-inch form factor while maintaining energy efficiency targets critical to data center TCO.

Moreover, integration technologies focusing on firmware optimization, advanced error correction codes (ECC), and specialized interfaces continue to refine the HDD value proposition for enterprise use cases. Smart power management features allow drives to dynamically adjust their rotational speed or enter deep sleep modes when not actively reading or writing, substantially reducing operational power draw. The development of advanced monitoring systems, often utilizing AI/ML algorithms, allows data center operators to predict potential drive failures before they occur, enhancing data reliability and reducing downtime. The combined effect of these hardware and software innovations ensures that HDDs remain a technologically relevant and highly optimized solution for mass data storage in the face of intense competition from alternative storage mediums.

Regional Highlights

- Asia Pacific (APAC): This region is projected to register the highest growth rate, primarily driven by rapid urbanization, massive government investment in digital infrastructure (e.g., smart cities initiatives), and the widespread adoption of cloud services. Countries like China, India, and Southeast Asian nations are witnessing an explosion in data center construction, attracting significant investments from global cloud providers and local enterprises, thereby accelerating demand for nearline HDDs. Furthermore, APAC is the manufacturing hub for many critical HDD components, contributing to the region's overall market significance.

- North America: The most mature market, characterized by the presence of the world's largest hyperscale cloud companies and technology innovators. Demand is focused on the highest capacity drives (18TB, 20TB, and above) as these companies relentlessly pursue efficiency and density improvements for their massive storage footprints. This region dictates technology adoption rates and often represents the earliest commercialization stage for new technologies like HAMR, maintaining strong market value despite slower unit growth compared to APAC.

- Europe: The European market demonstrates steady, robust demand, significantly influenced by GDPR and other data localization regulations that mandate data storage within regional boundaries. This regulatory environment fuels local data center expansion and subsequent stable purchasing of enterprise HDDs for compliant archival and operational data. Western Europe shows high adoption of optimized storage solutions, prioritizing power efficiency and reliability in their complex enterprise environments.

- Latin America (LATAM): This region is an emerging market for HDD growth, stimulated by increasing internet penetration, governmental digitalization programs, and growing foreign investment in data center infrastructure, particularly in countries like Brazil and Mexico. The market is highly price-sensitive, balancing the need for high-capacity storage with budgetary constraints, often favoring cost-effective SATA interfaces for new deployments.

- Middle East and Africa (MEA): Growth is accelerating due to ambitious national digital transformation agendas, especially in the UAE and Saudi Arabia, alongside increased cloud adoption. Infrastructure development and rising enterprise IT spending are fueling the need for reliable storage solutions, particularly in the oil & gas and financial sectors, although procurement volumes remain smaller than in APAC or North America.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hard Disk Drives Market.- Western Digital

- Seagate Technology

- Toshiba Corporation

- Samsung Electronics (Active in component supply and historical HDD manufacturing)

- Fujitsu (Active in specialized and historical markets)

- Hitachi Global Storage Technologies (now part of Western Digital)

- Micron Technology (Indirect component supplier)

- Nidec Corporation (Key motor supplier)

- Showa Denko (Major media/platter supplier)

- TDK Corporation (Leading head/component supplier)

- HGST (Legacy brand absorbed by Western Digital)

- Hewlett Packard Enterprise (Major OEM/Customer)

- Dell Technologies (Major OEM/Customer)

- Lenovo (Major OEM/Customer)

- Quantum Corporation (Focus on archival solutions)

- Buffalo Technology (External storage solutions)

- LaCie (A brand of Seagate focused on creative professionals)

- Iomega (A brand of EMC, specialized storage)

- ADATA Technology (External drive market)

- NetApp (Storage array OEM/Customer)

Frequently Asked Questions

Analyze common user questions about the Hard Disk Drives market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the future outlook for Hard Disk Drives given the rise of SSDs?

HDDs have a strong future, particularly in the enterprise and cloud storage sectors. Their superior cost-per-terabyte ratio makes them indispensable for storing the vast amounts of archival, nearline, and cold data generated globally. Future innovation focuses on increasing areal density via technologies like HAMR, ensuring continued capacity leadership.

Which technology is driving the highest HDD capacity growth?

Heat-Assisted Magnetic Recording (HAMR) is the most critical technology driving next-generation high-capacity HDDs (30TB+). HAMR uses a focused laser to momentarily heat the magnetic medium, enabling writing on smaller, more stable magnetic grains and overcoming physical density limitations.

What are the key differences between Nearline and Mission-Critical HDDs?

Nearline HDDs prioritize massive capacity, low cost per terabyte, and high reliability for sequential access (bulk storage, cloud archives). Mission-Critical HDDs (often SAS interface) prioritize high rotational speed (10K or 15K RPM), low latency, and high IOPS for transactional and performance-sensitive enterprise applications.

How is the adoption of cloud services impacting the HDD market?

Cloud services are the single largest growth driver for the enterprise HDD market. Hyperscale cloud providers purchase HDDs in massive volumes for their tiered storage solutions, relying on HDDs for the foundational, cost-optimized storage layer that handles the majority of unstructured and archival data.

Which geographical region exhibits the fastest growth for HDDs?

The Asia Pacific (APAC) region is projected to experience the fastest growth due to extensive investment in data center infrastructure, rapid digitalization across emerging economies, and substantial increases in local cloud service adoption and data generation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Flash Memory Market Size Report By Type (NAND Flash Memory (Universal Serial Bus (USB) drives, Hard Disk Drives (HDDs), Solid State Drives (SDDs)), NOR Flash Memory), By Application (Tablets and PC, Smartphones, Handheld media player devices, solid state drives (SSD), Others (DSC Digital Still Camera)), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- SAS Hard Disk Drives Market Statistics 2025 Analysis By Application (Online Sales, Offline Sales), By Type (1T), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- SATA Hard Disk Drives Market Statistics 2025 Analysis By Application (Online Sales, Offline Sales), By Type (1T), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager