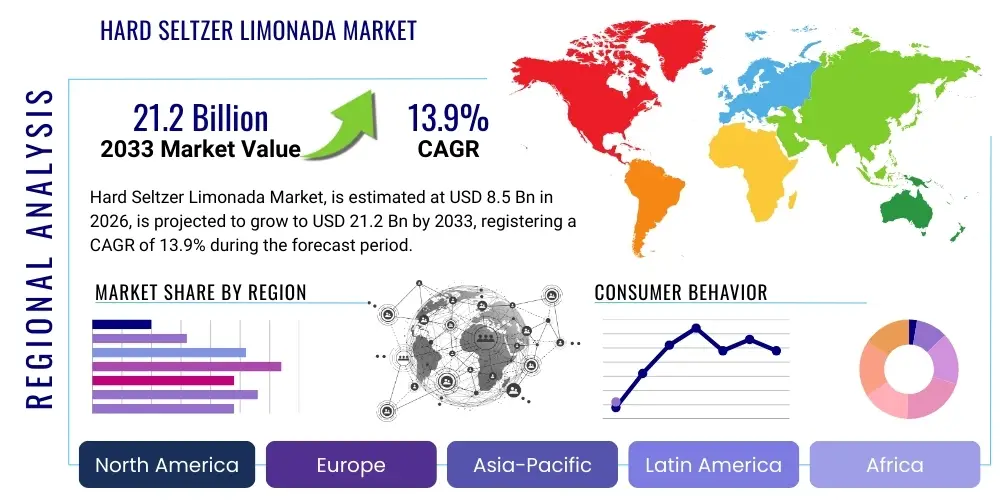

Hard Seltzer Limonada Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437557 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Hard Seltzer Limonada Market Size

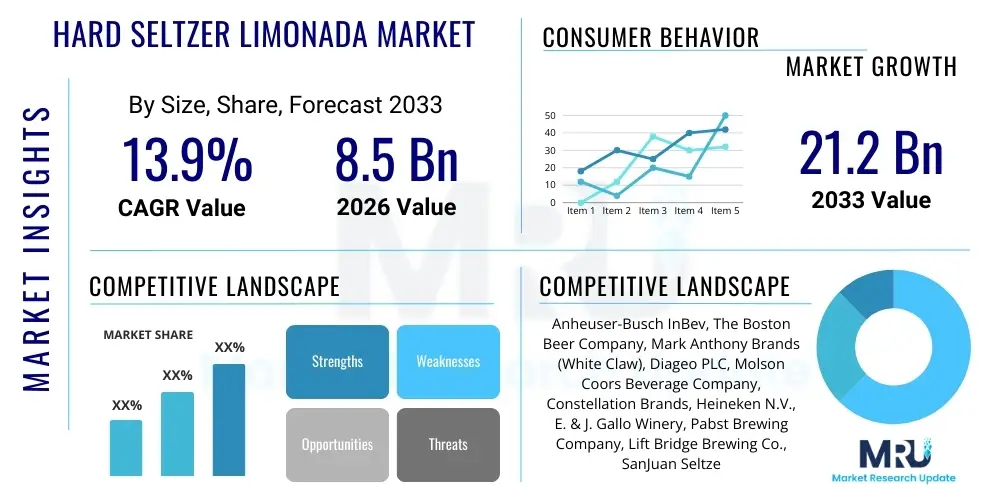

The Hard Seltzer Limonada Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 13.9% between 2026 and 2033. The market is estimated at $8.5 Billion in 2026 and is projected to reach $21.2 Billion by the end of the forecast period in 2033.

Hard Seltzer Limonada Market introduction

The Hard Seltzer Limonada Market constitutes a significant and dynamically growing sub-sector within the global ready-to-drink (RTD) alcoholic beverage industry. This category distinguishes itself by marrying the refreshing attributes of traditional hard seltzer—carbonation, clarity, and low caloric content—with the classic, nostalgic flavor profile of lemonade, or "limonada." This convergence has created a product that strongly resonates with contemporary consumers who are actively migrating away from heavier, high-sugar, and high-carbohydrate alternatives such as craft beer and pre-mixed cocktails. The market’s sustained appeal is largely attributable to its alignment with broader consumer movements focused on health, wellness, and ingredient transparency. Producers emphasize the use of natural lemon essences and often feature 'clean label' claims, highlighting minimal ingredients and specific nutritional facts, cementing its position as a "better-for-you" indulgence. The underlying alcohol is typically derived from highly filtered fermented cane sugar, ensuring a neutral base that allows the tart, crisp lemon notes to dominate the palate, providing a truly sessionable drinking experience suitable for a wide variety of social contexts.

The product's key applications revolve around social and recreational consumption, serving as an ideal beverage for casual outdoor settings, sporting events, and informal gatherings. Its high portability, facilitated by the prevalent use of aluminum cans, makes it a favored choice for consumers seeking convenience without sacrificing quality or flavor. Furthermore, Hard Seltzer Limonada has successfully carved out a niche in year-round consumption, transitioning effectively from a summer seasonal favorite to a permanent staple, replacing lighter beers and basic spirits in many consumer portfolios. The benefits derived by consumers are multifaceted: low-calorie counts (typically around 100 calories per 12oz serving), moderate alcohol content (usually 4.5% to 5% ABV), and a palatable flavor that avoids the artificial sweetness often associated with older RTD categories. These attributes collectively drive repeat purchase behavior and support premium pricing strategies adopted by major market participants.

Driving factors underpinning the market's robust trajectory include the sustained global rise in health consciousness, which places intense pressure on manufacturers to deliver products with quantifiable nutritional advantages. Beyond health, intense innovation in flavor diversification—introducing variants such as pink limonada, blackberry limonada, or herbal-infused limonada—ensures continuous consumer engagement and relevance. Marketing strategies are highly effective, often employing aspirational lifestyle branding that associates the product with active, social, and moderation-focused lifestyles. Manufacturers must continuously invest in advanced fermentation and filtration technology to scale production while maintaining the purity and crispness that consumers expect from the limonada profile. The ongoing shift in regulatory frameworks in key Asian and European markets, making way for easier RTD classification and distribution, further fuels the market’s international expansion potential, promising high growth across multiple emerging markets over the forecast period.

Hard Seltzer Limonada Market Executive Summary

The Hard Seltzer Limonada market is characterized by dynamic business trends focusing on rapid product cycle innovation and aggressive market entry by both established beverage giants and specialized craft producers. Major business trends include significant capital investment directed toward expanding domestic production capacity, particularly in North America, to meet surging demand and mitigate potential supply chain disruptions. Brands are increasingly adopting complex portfolio strategies, launching tiered product lines that include low-ABV (under 4%) options and premium, spirit-based limonada seltzers (over 6% ABV) to capture maximum share across all consumption occasions. There is a perceptible move toward sustainability, with companies prioritizing lightweight, highly recyclable aluminum packaging and engaging in carbon-neutral production practices, reflecting consumer sensitivity to environmental, social, and governance (ESG) factors. Strategic M&A activity remains brisk, as larger entities seek to acquire small, successful craft brands with strong regional presence or unique flavor technologies, thereby consolidating competitive advantage and accelerating market penetration into niche demographics.

Regionally, the market presents a clear contrast between mature consumption landscapes and high-potential emerging regions. North America dominates, accounting for the largest share in terms of value and volume, exhibiting sophisticated consumer palates demanding continuous flavor novelty beyond the original limonada. European markets, led by the UK and Germany, demonstrate accelerating adoption rates, driven by a growing culture of moderation and the summer popularity of outdoor drinking, though regulatory hurdles regarding product definition and taxation pose unique regional challenges. The Asia Pacific region is strategically crucial for long-term growth; while current per capita consumption is low, the sheer size of the urban middle class and their growing affinity for Western lifestyle products and convenient, low-calorie alcohol ensures APAC will be the fastest-growing region post-2028. Successful regional penetration hinges on localized flavor adaptation—for example, incorporating subtle tropical fruit notes with the limonada base—and tailored distribution strategies bypassing complex traditional alcoholic distribution networks where possible.

Analysis of segment trends confirms the structural importance of the off-premise distribution channel, which maintains its lead driven by convenience, competitive pricing, and the popularity of bulk purchasing via variety packs. The most significant trend within segmentation is the rapid diversification of the flavor profile, moving beyond single lemon offerings to layered, complex flavors, often incorporating botanical extracts or exotic fruit infusions that complement the acidic lemon core. This diversification supports premiumization efforts, allowing brands to command higher price points for specialized offerings. Furthermore, packaging trends solidify the 12-ounce standard can as the format leader, but there is growing experimentation with sleek, smaller cans (e.g., 8-ounce) catering to the micro-dosing and mindful consumption movement. The preference for hard seltzers derived from fermented sugar remains robust, favored for delivering the cleanest taste profile, essential for the transparent flavor matrix of a quality Hard Seltzer Limonada.

AI Impact Analysis on Hard Seltzer Limonada Market

User inquiries regarding the role of Artificial Intelligence (AI) in the Hard Seltzer Limonada market frequently center on three critical themes: optimizing flavor innovation, predicting consumer trends, and enhancing supply chain efficiency. Consumers and industry professionals commonly ask how AI can move beyond standard market research to dynamically identify successful flavor combinations before launch, minimizing the risk inherent in new product development. There is significant interest in using predictive AI models to forecast hyper-local demand fluctuations, especially concerning seasonal beverages like hard seltzer, thereby preventing stockouts or costly overstocking. Furthermore, questions arise concerning AI's application in quality assurance, particularly in monitoring fermentation processes and ensuring the consistent, clean taste profile essential to the Limonada category, often touching upon personalized marketing efforts driven by sophisticated consumer data analysis.

AI's influence is most acutely felt in augmenting the innovation lifecycle and providing unprecedented granularity in consumer insights. By applying neural networks to analyze data streams from retail point-of-sale systems, social listening platforms, and proprietary taste testing panels, AI can identify latent demand for specific Hard Seltzer Limonada variants, such as seasonal offerings or region-specific blends that incorporate local citrus varieties. This predictive capability significantly compresses the research and development timeline, enabling brands to launch highly targeted products faster than competitors relying on traditional, slower market research methodologies. Furthermore, generative AI is actively employed in marketing and design, enabling rapid iteration on packaging designs, crafting personalized digital advertising campaigns that resonate with precise micro-segments (e.g., health-conscious urban professionals vs. suburban outdoor enthusiasts), and optimizing ad spend across highly fragmented digital media channels, ensuring high visibility and maximizing conversion rates for the limonada category.

Operationally, AI implementation ensures scalability and quality assurance, two non-negotiable requirements for high-volume RTD production. Machine learning models are integrated into manufacturing execution systems (MES) to monitor real-time production variables, including temperature, pH levels, and carbonation saturation during the fermentation and canning stages. This allows for immediate, autonomous adjustments that prevent batch spoilage and maintain the stringent quality standards required for 'clean' alcohol bases. In supply chain management, AI algorithms optimize global logistics, factoring in variable lead times for specialized flavor ingredients (e.g., specific lemon zest oils) and optimizing transport routes, which is vital for managing the fragile aluminum can packaging and ensuring timely delivery to retailers, especially during the high-pressure summer months. This holistic integration of AI transforms the Hard Seltzer Limonada market from a purely intuitive product category into a data-driven, precision manufacturing segment.

- AI enhances predictive flavor modeling, drastically reducing new product development risk and forecasting long-term trend viability.

- Machine learning algorithms optimize supply chain logistics and demand forecasting for seasonal peaks, ensuring ingredient sourcing consistency.

- Generative AI tools accelerate marketing content creation and package design personalization, improving digital campaign resonance.

- AI-driven quality control systems monitor fermentation processes for taste consistency and purity in real-time.

- Predictive maintenance implemented via AI reduces downtime in high-volume production facilities, maximizing summer output.

- Advanced analytics facilitate precise pricing strategies and promotional optimization based on hyper-local sales performance.

- AI supports consumer segmentation, enabling highly personalized product recommendations via e-commerce and retail apps.

DRO & Impact Forces Of Hard Seltzer Limonada Market

The trajectory of the Hard Seltzer Limonada market is fundamentally shaped by a synergistic combination of powerful internal and external forces. Key drivers include the overwhelming consumer shift towards sessionable and functional beverages, where low-calorie claims are paramount, directly benefiting the limonada segment which inherently offers a crisp, refreshing, and guilt-free experience compared to traditional alternatives. Furthermore, robust marketing and distribution efforts by global beverage powerhouses inject massive capital into the category, guaranteeing high visibility and broad availability across diverse retail environments. Another significant driver is continuous product innovation, particularly the introduction of spirit-based limonadas (e.g., vodka-based seltzers) which cater to consumers seeking higher quality or smoother alcohol bases, effectively broadening the market’s premium frontier and increasing average transaction value. This dynamic market momentum is underpinned by favorable socio-cultural trends globally that normalize moderation and prioritize active, social lifestyles compatible with RTD consumption.

Conversely, the market faces significant restraints that necessitate careful strategic navigation. The primary restraint is the rapidly increasing market saturation; the low barrier to entry for flavor innovation has led to an explosion of similar products, making brand differentiation immensely difficult and often resulting in intense price wars and margin erosion. Regulatory complexities also act as a constraint; inconsistencies in alcohol taxation, labeling laws, and marketing restrictions across different states and countries impose substantial operational burdens on global players. Furthermore, dependence on agricultural outputs for natural lemon flavorings and other complementary fruit essences exposes the supply chain to volatility in commodity pricing and climate-related risks, which can impact both cost structure and flavor consistency, demanding sophisticated hedging and procurement strategies to maintain profitability.

Opportunities for sustained market expansion lie primarily in geographical diversification, targeting underserved markets in Latin America and key parts of Southeast Asia where the RTD category is still in nascency but growing rapidly due to rising disposable incomes and exposure to global drinking trends. Product development opportunities include pioneering functional benefits, such as adding electrolytes or natural energy boosters to the limonada seltzer base, transforming the product into a genuine hybrid beverage. The growing digital sales ecosystem offers a chance for brands to bypass traditional distributor tiers in specific legal jurisdictions, establishing higher-margin Direct-to-Consumer (DTC) channels. The critical impact forces that summarize these dynamics are: 1) The Health and Wellness Imperative (Driver), 2) Category Commoditization and Price Pressure (Restraint), and 3) Premium Spirit-Based RTD Migration (Opportunity). Successfully managing the balance between these forces, particularly avoiding deep discounting while maintaining aggressive innovation, is central to securing market leadership and long-term viability in this competitive space.

Segmentation Analysis

Detailed segmentation of the Hard Seltzer Limonada Market is essential for manufacturers to tailor their production, marketing, and distribution strategies effectively. The classification by Alcohol Base—Fermented Sugar, Malt Base, and Spirit Base—reveals shifting consumer preferences for purity and quality. While fermented sugar remains the volume leader due to its affordability and clean profile, the Spirit Base segment, typically utilizing high-purity vodka or neutral grain spirits, is the fastest-growing segment. Consumers perceive spirit-based seltzers as higher quality and often accept a higher price point, particularly in on-premise settings, indicating a strong trend toward premiumization within the Limonada category. Malt-based seltzers, though historically significant, are declining as their residual flavor components are often seen as detracting from the desired crispness of a true limonada profile. Understanding these base preferences dictates the core production technology investment and raw material procurement strategies.

Segmentation by Flavor Profile showcases the need for continuous innovation to prevent market fatigue. While Original Limonada (Classic Lemon) is the anchor flavor, maintaining foundational sales, growth is driven by Fruit-Infused Limonada variants such as Strawberry Limonada, Raspberry Limonada, and Peach Limonada. These combinations provide novelty while retaining the familiar, refreshing lemon core. A niche but expanding segment is Spiced or Botanical Limonada, incorporating subtle complexity through elements like ginger, mint, or lavender. This latter segment is critical for attracting sophisticated adult palates and positioning brands in the premium artisanal category, often sold in boutique liquor stores or high-end bars. Successful brands manage a balanced portfolio, ensuring widespread availability of the classic flavor while aggressively piloting new, high-margin, unique flavor combinations.

Distribution Channel analysis confirms the market's dependence on the Off-Premise sector, which encompasses grocery stores, mass merchandisers, and specialized liquor retailers. This channel supports high-volume sales of variety packs and core 12-pack offerings, capitalizing on consumer convenience and price sensitivity for large purchases. Conversely, the On-Premise channel (bars, clubs, and restaurants) plays a crucial role in brand building, consumer trial, and the sale of premium single-can offerings. A robust presence in the on-premise environment is vital for maintaining brand perception as a fashionable and high-quality product, justifying the typically higher retail margins achieved through off-premise sales. Packaging segmentation, dominated by the aluminum can, reflects a focus on sustainability, portability, and optimal preservation of carbonation, further emphasized by the rising demand for variety packs which mitigate commitment risk and encourage flavor exploration across the consumer base.

- By Alcohol Base:

- Fermented Sugar Base (Volume Leader)

- Malt Base (Declining Share)

- Spirit Base (e.g., Vodka or Neutral Grain Spirit) (Fastest Growing, Premium Segment)

- By Flavor Profile:

- Original Limonada (Classic Lemon) (Foundation Sales)

- Fruit-Infused Limonada (e.g., Strawberry, Raspberry, Mango) (Growth Driver)

- Spiced/Botanical Limonada (Premium Niche)

- By Packaging Type:

- Cans (Standard 12 oz, Tall Boy 16 oz, Sleek 8 oz) (Dominant Format)

- Bottles (Used for specific premium/artisan releases)

- Variety Packs (High Consumer Value and Trial Mechanism)

- By Distribution Channel:

- Off-Premise (Supermarkets, Hypermarkets, Liquor Stores, Online Retail) (Market Share Leader)

- On-Premise (Bars, Restaurants, Pubs, Clubs) (Brand Building and Trial)

Value Chain Analysis For Hard Seltzer Limonada Market

The efficiency of the Hard Seltzer Limonada value chain dictates cost management and product quality, beginning with highly specialized upstream activities. Upstream analysis focuses on securing high-purity water, which is essential for the product’s core composition, and the consistent sourcing of fermentable sugars or high-grade neutral spirits. Crucially, the procurement of natural lemon flavorings—whether concentrated juices, essential oils, or natural extracts—must be robust and reliable to ensure the authentic limonada taste that consumers expect. Suppliers of specialized yeast strains and fermentation aids also play a vital role in ensuring a rapid, clean fermentation process that yields minimal off-flavors. Risk mitigation in the upstream segment involves diversification of flavor suppliers and long-term contracts to stabilize input costs against agricultural volatility, alongside rigorous quality checks on all incoming raw materials to meet stringent 'clean label' requirements, distinguishing premium products from mass-market offerings.

The transformation and manufacturing stage is where technology plays a decisive role. This includes advanced brewing techniques designed for light alcohol bases, sophisticated cross-flow or membrane filtration for clarity, precise flavor dosing, and high-pressure carbonation. Manufacturing excellence centers on maximizing throughput, especially during peak season, while maintaining consistency in flavor and carbonation levels across millions of units. Downstream activities are concerned with logistics, distribution, and retail placement. Given the low-margin, high-volume nature of much of the category, efficient, high-speed canning and case packing operations are non-negotiable. Direct distribution channels, leveraging e-commerce and brand-owned outlets, are emerging as key profit centers, offering enhanced margins and invaluable direct feedback loops, though they represent a small fraction of overall volume.

The prevailing distribution structure relies on indirect channels: a network of national and regional wholesalers and distributors who handle the physical delivery to the vast network of off-premise and on-premise retail outlets. Success in this downstream segment is measured by speed-to-shelf, minimizing stockouts, and effective management of retailer relationships to secure prime shelf space, particularly for new product launches or seasonal variety packs. The optimization of the entire value chain—from sourcing the purest water and natural lemon extracts upstream to achieving rapid inventory turnover downstream—is the foundation for maintaining profitability in a highly competitive and price-sensitive RTD category. Continuous monitoring and AI-driven adjustments to inventory levels at the wholesale tier are becoming standard practices to optimize market responsiveness.

Hard Seltzer Limonada Market Potential Customers

The demographic centerpiece of the Hard Seltzer Limonada market is the digitally native, wellness-focused consumer, primarily spanning the late Generation Z cohort through mature Millennials. These individuals, typically aged 21 to 45, exhibit purchasing behaviors characterized by a strong preference for transparency in ingredients, active label reading, and a willingness to substitute traditional alcoholic beverages for lighter alternatives that support an active lifestyle. They are frequently engaged in social activities, utilizing the product for casual consumption during recreational events, gatherings, and while dining out. The segment’s loyalty is often tied to brand authenticity, sustainable practices, and the consistent delivery of a clean, crisp flavor profile. Marketing efforts are thus highly effective when leveraging social media platforms, emphasizing visual appeal, and aligning the product with outdoor and fitness-related activities, framing the limonada seltzer as a seamless part of a balanced modern life.

Secondary, yet rapidly expanding, customer segments include individuals actively participating in the "mindful drinking" or "sober curious" movements, who prioritize controlled alcohol intake and strictly monitor caloric and sugar consumption. For these buyers, the Hard Seltzer Limonada category serves as a viable, flavorful compromise that allows social participation without excessive consumption. This group is highly attuned to product claims and often seeks out the lowest-calorie and lowest-sugar variants, including those utilizing alternative natural sweeteners. Their purchasing decisions are highly rational and data-driven, reinforcing the need for clear, accurate nutritional labeling on all packaging. Retailers must ensure easy access to nutritional data, both in-store and online, to capture this discerning, high-value segment which is less susceptible to generic price promotions and more loyal to brands that genuinely deliver on health commitments.

Finally, a crucial institutional customer segment includes large-scale event organizers, catering services, and hospitality groups (restaurants, resorts, and cruise lines). These entities purchase Hard Seltzer Limonada in bulk because it addresses a broad spectrum of guest preferences, requires minimal preparation (RTD format), and offers a higher profit margin compared to traditional bar staples, due to its rising popularity and premium positioning. For these commercial customers, reliability of supply, case price stability, and the ability to source a diverse flavor portfolio are key determinants. The versatility of the limonada base also allows these professional clients to use the seltzer as a low-ABV mixer, expanding its utility within the hospitality setting and ensuring year-round relevance, even outside traditional summer consumption peaks.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $8.5 Billion |

| Market Forecast in 2033 | $21.2 Billion |

| Growth Rate | 13.9% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Anheuser-Busch InBev, The Boston Beer Company, Mark Anthony Brands (White Claw), Diageo PLC, Molson Coors Beverage Company, Constellation Brands, Heineken N.V., E. & J. Gallo Winery, Pabst Brewing Company, Lift Bridge Brewing Co., SanJuan Seltzers, FMB Brewing Co., Hardwater Beverage Co., Willie’s Superbrew, Bon & Viv Spiked Seltzer, Press Seltzer, Kona Brewing Co., Smirnoff, High Noon Spirits, Crook & Marker. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hard Seltzer Limonada Market Key Technology Landscape

The manufacturing process for Hard Seltzer Limonada relies heavily on precision engineering and biotechnological advancements to deliver the required purity and consistency at scale. The foundational technology involves specialized High-Efficiency Fermentation (HEF) processes, utilizing customized yeast strains that efficiently convert simple sugars into alcohol while minimizing the production of undesirable fermentation byproducts like fusel alcohols and diacetyl. This ensures the resulting alcoholic base is virtually neutral in flavor, which is critically important for allowing the delicate lemon flavorings to express themselves cleanly without being masked by residual off-notes commonly found in traditional malt fermentation. Coupled with HEF are advanced filtration systems, particularly sterile filtration and reverse osmosis units, which ensure the removal of particulate matter and microscopic impurities, resulting in the characteristic crystal-clear appearance and ultra-crisp mouthfeel demanded by consumers.

Beyond the base production, the technology applied to flavoring and packaging is crucial for market success. Automated, highly precise flavor injection systems are used to blend natural lemon essences, secondary fruit notes, and sweeteners (if any) to extremely tight tolerances, ensuring that every batch, regardless of size, maintains an identical and complex flavor profile. In packaging, the industry relies on state-of-the-art high-speed rotary canning lines equipped with ultra-low dissolved oxygen (DO) control features. Minimizing oxygen ingress during the filling and sealing process is paramount for preserving product quality and shelf life, as oxygen can quickly degrade both the delicate flavor and the carbonation integrity. Continuous investment in these high-speed, low-DO canning technologies is necessary to handle the tremendous seasonal volume peaks and maintain competitive operational costs in a high-volume, low-margin segment.

Supporting the physical production technologies is an increasingly sophisticated digital layer. Modern beverage manufacturers utilize integrated Enterprise Resource Planning (ERP) systems coupled with sophisticated Supervisory Control and Data Acquisition (SCADA) systems to monitor and control every parameter of the production line in real-time. Furthermore, predictive data analytics and AI-driven demand planning systems are employed to accurately forecast market needs, optimize inventory placement across complex regional distribution networks, and minimize waste from overproduction or understocking. Future technological advancements are expected to focus on sustainable packaging innovations, such as bio-degradable can liners or novel lightweight aluminum alloys, further enhancing the product's environmental profile and maintaining its appeal to the ethically conscious consumer base that drives the Limonada seltzer market.

Regional Highlights

Regional dynamics within the Hard Seltzer Limonada market are characterized by varying levels of maturity, consumer acceptance, and regulatory landscapes. North America remains the undisputed global leader, particularly the United States, where the hard seltzer phenomenon originated and quickly adopted the limonada variant as a core staple. The US market dictates global trends in terms of product size, flavor complexity, and marketing expenditure. Market saturation is high, pushing brands to focus on internal competition via premiumization (spirit-based seltzers) and functional additions. Canada also shows strong per capita consumption, though distribution is heavily regulated by provincial control boards. The established infrastructure, high consumer awareness, and aggressive brand rivalry ensure North America will maintain its volume leadership, even as growth rates moderate compared to emerging regions.

Europe represents a crucial second wave of growth, with rapid acceleration observed across Western European countries, particularly the UK, Germany, and the Nordic nations. European consumers are actively seeking alternatives to sugary RTDs and heavy beers, making the low-calorie limonada seltzer an appealing substitute. Challenges here involve navigating the regulatory patchwork; many European countries impose higher taxes on spirit-based RTDs, incentivizing manufacturers to focus on fermented malt or sugar bases to remain competitively priced. Success in Europe requires tailored flavor profiles that often integrate less sweetness than their US counterparts, aligning with regional palate preferences. Marketing is increasingly focused on sophisticated, design-led campaigns that emphasize natural ingredients and European heritage, distinct from the American mass-market approach.

The Asia Pacific (APAC) region offers the most significant long-term expansion potential. Australia and New Zealand are highly mature and exhibit similar consumer behavior to North America. However, the true opportunity lies in emerging giant economies like China and India, alongside rapidly developing Southeast Asian nations. Market entry in these areas is complex, constrained by high import tariffs, complex licensing requirements, and the necessity of adapting product attributes (such as alcohol content and sugar levels) to local tastes and regulations. Brands focusing on APAC emphasize the aspirational, Western lifestyle association of the product, targeting young urban professionals with disposable income. Growth is expected to be exponential post-2027 as distribution networks mature and local manufacturing capabilities are established, focusing on localized fruit-limonada blends that appeal directly to Asian consumer preferences for exotic and refreshing beverages.

- North America (Dominant Market): Highest consumption volume; driven by established market culture, intense brand competition, and high spirit-based seltzer adoption. Focus on continuous innovation and premiumization.

- Europe (Accelerating Growth): Rapid adoption in Western Europe; success tied to navigating complex regulatory/taxation environments and adapting sweetness levels to local palates. Strong growth in UK, Germany, and Southern Europe.

- Asia Pacific (High Future Potential): Strong foundation in Australia; burgeoning interest in urban centers (China, Japan, SEA). Growth contingent on successful cultural adaptation, supply chain development, and navigating strict import regulations.

- Latin America (Emerging Market): Growth tied to premium import status; interest in Mexico and Brazil, driven by young consumer willingness to pay for trendy, low-calorie alcoholic options. Focus on intense, natural fruit-forward limonada flavors.

- Middle East & Africa (Niche Growth): Limited primarily to specific legal jurisdictions (e.g., UAE, South Africa) and duty-free channels; opportunities exist for non-alcoholic seltzer extensions in stricter markets focusing on hydration and flavor.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hard Seltzer Limonada Market.- Anheuser-Busch InBev

- The Boston Beer Company

- Mark Anthony Brands (White Claw)

- Diageo PLC

- Molson Coors Beverage Company

- Constellation Brands

- Heineken N.V.

- E. & J. Gallo Winery

- Pabst Brewing Company

- Lift Bridge Brewing Co.

- SanJuan Seltzers

- FMB Brewing Co.

- Hardwater Beverage Co.

- Willie’s Superbrew

- Bon & Viv Spiked Seltzer

- Press Seltzer

- Kona Brewing Co.

- Smirnoff

- High Noon Spirits

- Crook & Marker

Frequently Asked Questions

Analyze common user questions about the Hard Seltzer Limonada market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Hard Seltzer Limonada Market?

The primary driver is the accelerating consumer demand for healthier, low-calorie alcoholic alternatives. Hard Seltzer Limonada offers a low-sugar, low-carbohydrate profile that aligns strongly with the wellness and moderation trends prevalent among Millennial and Gen Z drinkers, positioning it as a guilt-free indulgence.

How is the Hard Seltzer Limonada market segmented by alcohol base?

The market is predominantly segmented by the source of alcohol: fermented sugar base, malt base, and spirit base (usually vodka or neutral grain spirits). The spirit base segment is currently experiencing the fastest growth, appealing to premium consumers seeking enhanced purity and flavor neutrality.

Which region currently holds the largest market share for Hard Seltzer Limonada?

North America, specifically the United States, holds the largest market share and leads in innovation. This dominance is attributed to early category adoption, high consumer acceptance, and aggressive competitive strategy and marketing investments from leading global beverage companies.

What are the main technological challenges in producing high-quality Hard Seltzer Limonada?

Key technological challenges include maintaining flavor consistency and purity across high-volume batches through High-Efficiency Fermentation (HEF), implementing advanced microfiltration systems for clarity, and utilizing ultra-low dissolved oxygen (DO) canning lines to preserve carbonation and shelf stability.

What role does the off-premise distribution channel play in the market?

The off-premise channel (supermarkets, hypermarkets, liquor stores) is the dominant sales channel, responsible for the vast majority of volume sales. It capitalizes on consumer preferences for convenience, competitive pricing, and the popularity of bulk purchasing, particularly through variety packs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager