Hardmeter Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433784 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Hardmeter Market Size

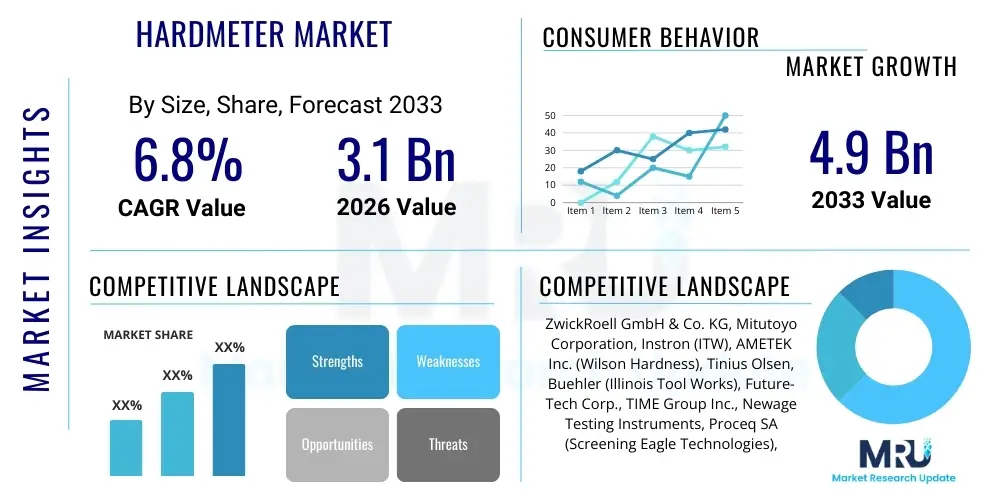

The Hardmeter Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 3.1 Billion in 2026 and is projected to reach USD 4.9 Billion by the end of the forecast period in 2033.

Hardmeter Market introduction

The Hardmeter Market encompasses sophisticated devices designed for precise measurement of material hardness, a critical quality metric across manufacturing, construction, and materials science. Hardmeters, including durometers, scleroscopes, and specialized indentation testers (such as Rockwell, Brinell, and Vickers), provide non-destructive or minimally destructive testing methods essential for evaluating material performance, structural integrity, and consistency in production batches. These instruments are vital in sectors where material specifications directly influence product safety and reliability, such as aerospace, automotive manufacturing, and quality assurance in infrastructure projects. The foundational necessity for rigorous quality control standards worldwide fuels the sustained demand for high-precision hardmeters, driving market expansion and innovation in sensor technology.

The core function of a Hardmeter is to quantify resistance to permanent deformation or indentation, which correlates directly with material properties like tensile strength and wear resistance. Major applications span from testing metallic alloys and plastics to rubbers, elastomers, and specialized coatings. Key benefits derived from the adoption of advanced hardmeters include enhanced product longevity, reduced material waste through optimized process control, compliance with stringent international quality standards (e.g., ISO and ASTM), and improved operational safety. Driving factors for market growth include the global resurgence in manufacturing activities, the rapid expansion of the electric vehicle (EV) sector requiring specialized material testing, and the increasing complexity of composite materials demanding sophisticated, multi-functional hardness testing solutions.

Hardmeter Market Executive Summary

The global Hardmeter Market is currently characterized by intense technological convergence, driven by the integration of IoT capabilities and automation into traditional testing protocols. Business trends indicate a strong shift towards portable and handheld devices, catering to the demand for efficient, on-site testing without compromising accuracy. Furthermore, manufacturers are focusing on developing high-throughput systems that can be integrated seamlessly into production lines, utilizing robotic automation to minimize human error and accelerate quality assurance cycles. This transition towards digitization and interconnected testing equipment is redefining competitive landscapes, favoring firms that offer comprehensive software ecosystems for data analysis and reporting, moving beyond simple measurement tools to holistic quality management platforms.

Regional trends highlight the Asia Pacific (APAC) as the fastest-growing market due to massive investments in automotive manufacturing, electronics production, and infrastructure development, particularly in China and India. North America and Europe remain key markets, distinguished by early adoption of highly specialized and automated hardness testing systems required by the aerospace and medical device industries, emphasizing precision and regulatory compliance. Segment trends indicate that the utilization of automated testing equipment (ATE) is outpacing manual devices, driven by cost efficiency and the requirement for consistent testing parameters. Furthermore, the market for material-specific hardmeters—especially those designed for high-strength steel and advanced polymers—is experiencing robust growth, reflecting the evolving landscape of modern engineered materials.

AI Impact Analysis on Hardmeter Market

User inquiries regarding AI's influence on the Hardmeter Market predominantly center on accuracy enhancement, data interpretation, and predictive maintenance capabilities. Key themes revolve around whether AI algorithms can minimize measurement variability caused by human factors (such as improper setup or reading errors) and how machine learning can accelerate material characterization processes. Users are concerned about the necessity of extensive, labeled datasets to train AI models effectively and the potential security risks associated with cloud-based data storage of sensitive quality control metrics. Expectations are high regarding AI's ability to correlate hardness data with other material properties (like tensile strength or microstructure) in real-time, providing immediate actionable insights far beyond the scope of traditional statistical process control.

The impact of Artificial Intelligence (AI) on the Hardmeter market is transformative, shifting the focus from mere data collection to intelligent data utilization. AI algorithms are increasingly being deployed to analyze high-volume indentation images, optimizing image processing and pattern recognition to ensure accurate measurement of indentation size and shape, especially in challenging materials. Furthermore, predictive maintenance models powered by machine learning are being integrated into high-end automated hardmeters, allowing for proactive calibration alerts and fault detection, thereby minimizing downtime and maintaining the metrological integrity of the equipment. This integration is fundamentally enhancing the reliability and throughput of hardness testing operations across industrial settings, setting new benchmarks for quality assurance and process optimization.

- AI-driven automation reduces subjectivity and operator dependence in manual testing procedures.

- Machine learning optimizes calibration schedules, predicting necessary recalibration based on usage patterns and environmental factors.

- Advanced image recognition algorithms enhance the accuracy of Vickers and Knoop micro-hardness testing measurements.

- AI facilitates real-time anomaly detection in production lines, flagging batches with unusual hardness distributions immediately.

- Integration with enterprise resource planning (ERP) systems enables smart reporting and automated compliance documentation.

- Predictive analytics correlate hardness results with ultimate product failure rates, optimizing material selection for specific applications.

DRO & Impact Forces Of Hardmeter Market

The Hardmeter Market is primarily driven by the escalating demand for stringent quality assurance protocols across critical manufacturing sectors, coupled with continuous technological advancements in sensor precision and digitalization. Restraints include the high initial capital investment required for advanced automated testing equipment (ATE) and the persistent challenges associated with achieving standardized testing methodologies across diverse material types and international boundaries. Significant opportunities exist in the development of specialized portable hardmeters tailored for non-conventional applications, such as geological testing or large-scale infrastructure inspection, and in the integration of testing results directly into digital twin models. The primary impact forces shaping the market involve the regulatory mandates for material safety and reliability, technological convergence with Industry 4.0 principles, and the fluctuating global supply chain dynamics influencing equipment production and deployment.

Drivers: The most significant driver is the global expansion of high-value manufacturing sectors, particularly aerospace and automotive, where zero-defect tolerance is mandatory. The rapid adoption of new, complex materials, including carbon fiber reinforced polymers (CFRPs) and specialized superalloys, necessitates highly accurate and adaptable hardness testing instruments capable of handling multi-phase materials and thin coatings. Furthermore, the increasing pressure from international bodies to comply with updated quality standards (like ISO 9001 revisions emphasizing risk-based thinking) compels companies to invest in certified and traceable hardness testing solutions. The move towards electrification in transportation also drives demand, as battery components and specialized lightweight chassis materials require specific and rigorous hardness testing regimes to ensure long-term performance and safety under operational stresses.

Restraints and Opportunities: Key restraints include the requirement for skilled technicians to operate and maintain sophisticated hardness testing equipment, which adds to operational costs, and the technical challenge of maintaining calibration accuracy for portable devices under varying environmental conditions. However, these challenges simultaneously unlock significant market opportunities. The market for comprehensive service contracts, including remote diagnostics and certified technician training programs, is expanding rapidly. Opportunities are also abundant in the development of non-contact hardness testing technologies (e.g., based on ultrasonic or resonance methods) which could circumvent the limitations of traditional destructive indentation tests, particularly for highly sensitive or finished components. Furthermore, the untapped market potential in developing economies, focusing on affordable and robust entry-level digital hardmeters, presents a viable expansion pathway for market players.

- Drivers:

- Stringent regulatory requirements and quality control mandates across global manufacturing.

- Technological progression towards non-destructive and highly precise testing methodologies.

- Growth in automotive, aerospace, and medical device sectors requiring specialized material verification.

- Increasing adoption of Industry 4.0 and automation in quality assurance processes.

- Restraints:

- High initial capital cost and maintenance complexity of fully automated testing systems.

- Challenges in achieving consistent calibration and standardization across diverse testing environments.

- Need for highly trained personnel to interpret complex testing data and operate specialized equipment.

- Opportunity:

- Development and commercialization of AI-integrated smart hardmeters for predictive testing.

- Expansion into emerging markets requiring foundational metrology tools for industrialization.

- Focus on non-contact or ultrasonic-based hardness testing technologies.

- Provision of specialized hardmeters for material testing in additive manufacturing (3D printing).

- Impact Forces: Regulatory Compliance Pressure, Digital Transformation, Materials Science Evolution, and Global Supply Chain Stability.

Segmentation Analysis

The Hardmeter Market segmentation is critical for understanding specific application needs and technological preferences across various industries. Segmentation is fundamentally based on the testing principle employed (e.g., indentation, rebound, ultrasonic), the product type (benchtop, portable), and the material being tested (metals, plastics, rubber). The most influential segmentation factor remains the testing method, as it dictates the level of precision, suitability for different material thicknesses, and adherence to specific ASTM or ISO standards required by end-users. Benchtop models, though less flexible, dominate high-precision laboratory and large-scale industrial quality control, while portable units are gaining traction in field testing and maintenance applications due to their increasing accuracy and user-friendly interfaces.

Further analysis reveals a robust sub-segmentation within the application category, distinguishing between quality control (QC) in mass production environments and research & development (R&D) in materials science laboratories. QC applications demand speed, automation, and reliability for repetitive tasks, often favoring automated optical measurement of indentations. Conversely, R&D environments prioritize versatility, high resolution, and the ability to test exotic materials or complex geometries, typically utilizing advanced micro and nano-indentation instruments. The continuous innovation in specialized hardness scales, such as Durometer Shore A, D, and various Vickers/Knoop scales for thin films, ensures continuous market diversification tailored to evolving industrial requirements.

- By Product Type:

- Benchtop Hardmeters (Stationary)

- Portable Hardmeters (Handheld/Mobile)

- Automated Testing Equipment (ATE)

- By Testing Principle:

- Rockwell Hardness Testers

- Brinell Hardness Testers

- Vickers and Knoop Hardness Testers (Micro/Macro)

- Durometers (Shore A, D, etc.)

- Leeb/Rebound Hardness Testers

- Ultrasonic Contact Impedance (UCI) Testers

- By Application:

- Quality Control and Inspection

- Research & Development (R&D)

- Field Testing and Maintenance

- By End-Use Industry:

- Automotive

- Aerospace & Defense

- Heavy Machinery/Manufacturing

- Metals & Metallurgy

- Plastics and Rubber

- Construction/Infrastructure

Value Chain Analysis For Hardmeter Market

The value chain of the Hardmeter Market begins with upstream activities focused on the procurement of highly specialized components, primarily high-precision mechanical parts (indenters made of diamond or cemented carbide), advanced sensor technology (load cells and displacement sensors), and sophisticated optics for automated measurement. Critical upstream processes involve material sourcing for robust machine frames that ensure vibration damping and thermal stability, crucial for maintaining measurement accuracy. Research and development activities, particularly in software development for data processing and automation, are high-value upstream components, establishing proprietary advantages for key manufacturers. Strategic sourcing of certified indenter materials is essential, as the quality of this component directly impacts the integrity and reliability of the final hardness measurement.

Downstream analysis highlights the complexity of distribution and post-sales support, which often defines market differentiation. Distribution channels are typically bifurcated: direct sales for high-value, automated benchtop systems sold to large automotive or aerospace OEMs, and indirect sales through specialized distributors and metrology solution providers for standard or portable units. Given the regulatory requirements for calibration and certification, after-sales service, including periodic maintenance, recalibration services (often ISO 17025 accredited), and operator training, constitutes a significant revenue stream. Direct channels allow for customized integration and close collaboration on application-specific solutions, whereas indirect channels offer wider geographical reach and quick access to standard product lines.

Hardmeter Market Potential Customers

Potential customers for Hardmeters are diverse, spanning virtually every sector involved in materials processing, fabrication, and quality assurance, with a distinct concentration in high-stakes engineering industries. The primary buyers include quality assurance departments within major manufacturing organizations, independent testing laboratories (ITLs) offering third-party certification, and academic/governmental research institutions focusing on material characterization and failure analysis. Automotive manufacturers represent a colossal customer base, driven by the need to verify the hardness of engine components, chassis materials, and plastic trim parts to meet strict safety and longevity standards, particularly for structural components made from advanced high-strength steels (AHSS).

Another crucial customer segment involves the aerospace and defense sectors, which demand unparalleled precision and traceability in hardness testing for mission-critical components, such as turbine blades, structural airframe parts, and landing gear assemblies. These customers typically invest in the most sophisticated, high-resolution, and fully automated Vickers and Knoop testing machines to comply with highly specific military and aerospace material specifications. Furthermore, manufacturers of industrial plastics, rubber components (tires, seals, gaskets), and composite materials are primary end-users of Durometers and specialized indentation systems, seeking to ensure product consistency and optimal mechanical properties against deformation and wear.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.1 Billion |

| Market Forecast in 2033 | USD 4.9 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ZwickRoell GmbH & Co. KG, Mitutoyo Corporation, Instron (ITW), AMETEK Inc. (Wilson Hardness), Tinius Olsen, Buehler (Illinois Tool Works), Future-Tech Corp., TIME Group Inc., Newage Testing Instruments, Proceq SA (Screening Eagle Technologies), INNOVATEST Europe BV, Struers ApS, Akashi Co., Ltd., AFFRI Group, PCE Instruments, Starrett Company, Qualitest International Inc., Fine Technology Co., Ltd., Testometric Company Ltd., Shimadzu Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hardmeter Market Key Technology Landscape

The technology landscape of the Hardmeter Market is rapidly evolving, driven by the shift from purely mechanical measurement to integrated digital and optical analysis. The transition is marked by the proliferation of automated optical systems utilizing high-resolution cameras and advanced image processing software to precisely measure indentation dimensions, eliminating manual measurement errors inherent in older optical microscopes. Modern benchtop hardmeters integrate closed-loop load control systems, which utilize electronic feedback mechanisms to ensure highly accurate and repeatable application of testing forces, critical for standardized testing procedures. This closed-loop technology significantly enhances the stability and precision of results across various hardness scales, especially under complex testing parameters required for exotic materials or thin surface coatings.

A major technological trend is the convergence of traditional hardness testing with non-destructive testing (NDT) methodologies, particularly Ultrasonic Contact Impedance (UCI) testing. UCI technology offers rapid, portable, and semi-non-destructive measurements by analyzing the resonant frequency shift of a vibrating rod when pressed against the test material. This is particularly valuable for testing finished components or large structures where conventional indentation methods are impractical or prohibited. Furthermore, the development of specialized nano-indentation technology is critical for R&D applications, allowing researchers to measure the mechanical properties of extremely thin films, coatings, and individual microstructure grains with resolutions down to the nanometer scale, providing essential data for advanced materials engineering.

Digital connectivity and IoT integration are standard features in high-end hardmeters. These instruments now offer seamless data transfer via Ethernet or Wi-Fi, allowing testing results to be instantly archived in centralized databases or cloud-based quality management systems. This connectivity enables remote monitoring, automated data logging, and the implementation of statistical process control (SPC) directly through the testing equipment interface. Furthermore, the incorporation of advanced robotics in automated testing systems allows for the precise handling and positioning of complex parts, enabling continuous, unattended testing cycles—a necessity in high-volume production lines in the automotive and aerospace industries seeking unparalleled throughput and measurement repeatability.

Regional Highlights

- Asia Pacific (APAC): APAC dominates the global Hardmeter Market in terms of volume and exhibits the highest projected Compound Annual Growth Rate (CAGR). This explosive growth is directly linked to the region’s status as the global manufacturing hub, particularly for automotive components, consumer electronics, and heavy machinery. Countries like China, India, Japan, and South Korea are making significant investments in infrastructure development and modernizing their manufacturing facilities, leading to a substantial demand for both high-end automated testers for R&D and robust, cost-effective digital hardmeters for production line quality control. The stringent export quality standards imposed by Western importers further compel APAC manufacturers to adopt certified and precise hardness testing methodologies, propelling the regional market.

- North America: North America represents a mature yet technologically advanced market for hardmeters, characterized by high demand for specialized and automated testing solutions, driven primarily by the aerospace, defense, and medical device sectors. The emphasis in this region is less on volume manufacturing and more on precision, traceability, and regulatory compliance (e.g., FAA and FDA requirements). The U.S. remains a key adopter of advanced nano-indentation and fully robotic testing systems used for analyzing new alloys and composite materials developed for next-generation aircraft and biomedical implants. High operational costs incentivize manufacturers to invest in ATE solutions that maximize efficiency and minimize reliance on manual labor, ensuring continuous growth in the high-value segment.

- Europe: Europe is a major revenue generator, driven by the strict industrial standards and long-standing manufacturing traditions in Germany, France, and Italy, particularly within the automotive (premium and luxury vehicles), industrial machinery, and energy sectors. The European market displays a strong focus on environmental considerations and material longevity, leading to consistent investment in high-accuracy Brinell and Vickers testers for critical safety parts. The region is also at the forefront of implementing Industry 4.0 standards, demanding seamless integration of hardmeters into smart factory environments, pushing manufacturers towards networked and secure data management solutions for metrology data.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions are emerging markets showing gradual but steady growth. Growth in LATAM is tied to the recovery and expansion of the automotive assembly and mining industries in Brazil and Mexico, requiring reliable testing equipment for component quality. The MEA market growth is primarily driven by large-scale infrastructure projects, expansion in oil and gas processing facilities, and nascent manufacturing diversification efforts. Demand is largely concentrated on portable Leeb and UCI testers for field inspection of pipelines, welds, and structural elements, prioritizing robustness and ease of use in challenging environments over high automation levels.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hardmeter Market.- ZwickRoell GmbH & Co. KG

- Mitutoyo Corporation

- Instron (ITW)

- AMETEK Inc. (Wilson Hardness)

- Tinius Olsen

- Buehler (Illinois Tool Works)

- Future-Tech Corp.

- TIME Group Inc.

- Newage Testing Instruments

- Proceq SA (Screening Eagle Technologies)

- INNOVATEST Europe BV

- Struers ApS

- Akashi Co., Ltd.

- AFFRI Group

- PCE Instruments

- Starrett Company

- Qualitest International Inc.

- Fine Technology Co., Ltd.

- Testometric Company Ltd.

- Shimadzu Corporation

Frequently Asked Questions

Analyze common user questions about the Hardmeter market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for Automated Hardness Testing Equipment (ATE)?

The primary factor driving the demand for ATE is the imperative to achieve high-throughput quality control with minimal measurement variability, essential in zero-defect manufacturing environments such as automotive and aerospace. ATE systems ensure consistent test parameters, reduce cycle times, and integrate seamlessly with Industry 4.0 data management systems.

Which hardness testing method is most suitable for assessing surface coatings and thin films?

Vickers and Knoop micro-hardness testing methods are most suitable for assessing surface coatings and thin films. These methods use very small applied loads and specialized indenters to produce micro-scale indentations, ensuring the measurement accurately reflects the mechanical properties of the thin layer without being influenced by the substrate material.

How does the integration of IoT technology benefit Hardmeter users?

IoT integration benefits Hardmeter users by enabling remote diagnostics, automated data logging, secure cloud storage of test results for traceability, and real-time monitoring of machine performance. This connectivity supports proactive maintenance, streamlines compliance reporting, and facilitates centralized quality management across geographically dispersed facilities.

Is the Hardmeter Market seeing a shift from traditional benchtop models to portable devices?

Yes, the market is experiencing a significant shift towards portable and handheld hardmeters, particularly those using Leeb or Ultrasonic Contact Impedance (UCI) principles. Advancements in sensor technology have improved the accuracy of portable devices, making them highly effective for on-site inspection, large component testing, and maintenance applications in diverse industrial environments.

What role does Artificial Intelligence (AI) play in modern hardness testing instruments?

AI plays a crucial role by optimizing the measurement process, primarily through advanced image analysis for automatic and precise indentation reading in Vickers and Brinell tests. AI algorithms also enable predictive maintenance of the equipment and facilitate smart data correlation between hardness measurements and other critical material properties.

What are the typical end-user sectors for advanced nano-indentation equipment?

Advanced nano-indentation equipment is predominantly utilized by academic research institutions, materials science laboratories, and high-tech manufacturing sectors involved in microelectronics, semiconductor fabrication, and the development of specialized coatings and thin film materials where mechanical properties must be characterized at the nanoscale.

How significant is calibration and certification in the overall Hardmeter Market value chain?

Calibration and certification are highly significant, representing a major recurring revenue stream and a mandatory component for market compliance. Because hardness testing results directly influence product safety and reliability, regulatory standards (like ISO and ASTM) require regular, traceable calibration, often performed by accredited third-party metrology labs, thereby forming a critical part of the post-sales service market.

What is the main challenge faced by manufacturers of highly specialized Hardmeters?

The main challenge faced by manufacturers of highly specialized Hardmeters is maintaining calibration and measurement accuracy across diverse testing environments and varying temperatures. Developing software and hardware that compensates for environmental variables while adhering to extremely tight tolerances for force application and displacement measurement requires continuous R&D investment and highly complex engineering solutions.

Which geographical region is expected to lead market growth and why?

The Asia Pacific (APAC) region is expected to lead market growth due to the immense scale of its manufacturing base, particularly in the automotive and electronics industries, coupled with continuous governmental investment in large-scale infrastructure and industrial modernization projects across key economies like China, India, and Southeast Asian nations.

How are environmental concerns influencing the design and material selection of Hardmeters?

Environmental concerns are driving demand for Hardmeters capable of testing lightweight, sustainable materials, such as advanced polymers and composites, used in eco-friendly products and electric vehicles. Manufacturers are also focusing on optimizing energy consumption in automated systems and reducing reliance on harmful materials in the construction and calibration fluids used in the equipment.

What distinguishes Rockwell testing from Brinell testing in industrial applications?

Rockwell testing is widely preferred for rapid, routine quality control testing due to its direct reading feature and minimal surface preparation requirements, making it ideal for finished components. Brinell testing, conversely, uses a larger ball indenter and is better suited for testing coarse-grained materials, larger components, and bulk material properties, often requiring subsequent optical measurement of the indentation diameter.

Why is the aerospace industry a key consumer of high-precision Hardmeters?

The aerospace industry is a key consumer because material hardness directly correlates with critical mechanical properties like fatigue life and tensile strength in aircraft components. Absolute precision and exhaustive traceability are non-negotiable for safety compliance, necessitating investment in the highest-accuracy automated Vickers and Rockwell testers for structural and engine parts.

What future innovation is expected to significantly disrupt the conventional Hardmeter design?

The most significant expected innovation is the widespread commercialization of truly non-contact hardness testing methods, potentially utilizing advanced laser vibrometry or ultra-high-frequency ultrasonic scanning. These methods could allow for instantaneous hardness mapping of large, complex surfaces without any material damage, fundamentally changing quality inspection protocols.

How does the shift towards Electric Vehicles (EVs) affect the Hardmeter Market?

The shift to EVs increases demand for specialized hardmeters used in testing lightweight battery housing alloys, high-strength structural steels for crash safety, and advanced plastic components used in interiors and thermal management systems, requiring diverse and highly accurate testing capabilities beyond traditional automotive requirements.

What financial restraint hinders the adoption of Automated Testing Equipment (ATE) for small-to-medium enterprises (SMEs)?

The significant initial capital investment required for high-end ATE systems acts as a major financial restraint for SMEs. While ATE offers long-term operational efficiency, the upfront cost, including integration and training, often exceeds the immediate budgetary capabilities of smaller manufacturing operations, forcing reliance on manual or semi-automated digital hardmeters.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager