Hardness Durometers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433827 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Hardness Durometers Market Size

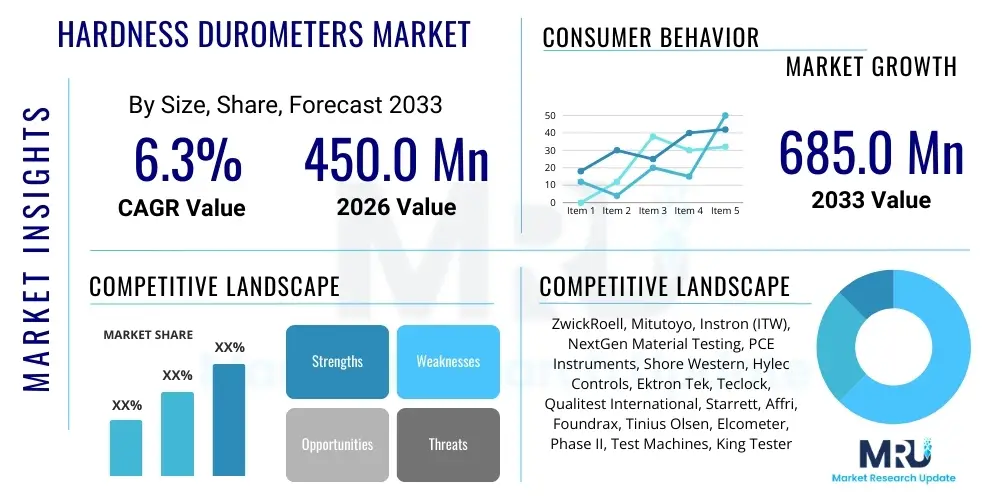

The Hardness Durometers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.3% between 2026 and 2033. The market is estimated at USD 450.0 Million in 2026 and is projected to reach USD 685.0 Million by the end of the forecast period in 2033.

Hardness Durometers Market introduction

The Hardness Durometers Market encompasses the manufacturing, distribution, and utilization of instruments specifically designed to measure the indentation hardness of materials, primarily focusing on soft materials such as polymers, elastomers, rubbers, and certain plastics. Durometers operate based on different scales, most notably Shore A and Shore D, to quantify the material's resistance to permanent indentation or elastic deformation when a standardized indenter is pressed into the surface under a specified force and duration. These devices are critical for quality control, material development, and conformance testing across diverse industrial sectors where material consistency and durability are paramount.

Hardness durometers offer precise and rapid assessment of material properties, making them indispensable tools in laboratories, production lines, and field testing environments. Major applications span the automotive sector for testing tires, seals, and gaskets; the rubber and plastics industry for raw material acceptance and final product verification; and the construction industry for evaluating composite materials and specialized coatings. The primary benefit of using durometers lies in their non-destructive nature for many materials and their ease of use, providing instant feedback on crucial physical characteristics that influence performance, longevity, and regulatory compliance of end products.

The market is currently being driven by the accelerating global demand for high-performance elastomers and specialized polymer blends, particularly within electric vehicle (EV) manufacturing and sophisticated medical device production. Regulatory pressures mandating strict quality checks in critical industries, coupled with continuous advancements in material science requiring highly accurate measurement instruments, further propel market expansion. Additionally, the shift towards digital and automated durometer systems, which offer enhanced data logging, repeatability, and integration capabilities, is fostering technological adoption and broadening the application base across developing industrial economies.

Hardness Durometers Market Executive Summary

The Hardness Durometers Market is poised for steady expansion, fueled primarily by robust business trends emphasizing quality assurance and advanced material testing across global manufacturing supply chains. Key business trends include the migration from analog to digital durometers, offering superior data management and connectivity, and the integration of these devices into automated quality control systems, enhancing throughput and minimizing human error. Segment trends show significant growth in the portable/handheld durometer category due to increasing demand for on-site material inspection in construction and infrastructure projects, while the Shore D scale segment is expanding rapidly, correlating with the rise in production of harder engineering plastics and composite materials used in aerospace and high-tech electronics. Simultaneously, advancements in specialized durometer technologies, such as micro-hardness testing tools, are catering to emerging needs in miniaturized components and thin films.

Regional trends indicate that Asia Pacific (APAC) remains the fastest-growing market, driven by massive industrialization, particularly in China and India, focusing on automotive, consumer electronics, and infrastructure development, which necessitate stringent material quality checks. North America and Europe maintain leading positions in terms of technological adoption and market value, primarily due to established stringent regulatory frameworks in the aerospace and medical device sectors, demanding high-precision testing equipment. Manufacturers are strategically focusing on developing wireless capabilities and ergonomic designs to capture the dynamic needs of field technicians, thereby increasing efficiency and accessibility of testing procedures across varied operating environments, including remote industrial sites.

The market landscape remains competitive, characterized by a mix of specialized testing equipment providers and diversified industrial measurement firms. Strategic initiatives such as mergers, acquisitions, and collaborative research agreements focused on enhancing sensor technology and improving software integration are common among key players. The overarching market stability is underpinned by the essential nature of hardness testing in maintaining product safety and reliability. Furthermore, the push for sustainable manufacturing practices is driving the need for better material lifecycle management, inadvertently increasing the reliance on precise testing tools like durometers to ensure material integrity and expected service life.

AI Impact Analysis on Hardness Durometers Market

Common user inquiries regarding AI’s influence on the Hardness Durometers Market center around automation of testing processes, predictive maintenance capabilities for the instruments themselves, and the use of machine learning to analyze large datasets generated during quality control. Users frequently ask if AI can interpret hardness readings in real-time to adjust production parameters, thereby eliminating subjective human intervention. There is a strong interest in AI models that can correlate durometer readings with other material properties (like tensile strength or elasticity) and predict future material performance based on initial hardness scores. Key concerns revolve around the cost of integrating AI-driven systems into existing analog or semi-digital testing setups and ensuring the accuracy and explainability of AI-derived material predictions, particularly in highly regulated industries where validation is paramount.

The primary influence of Artificial Intelligence in the durometer market is manifested through enhanced data processing and decision support systems. AI algorithms can be employed to analyze high-volume durometer measurements captured on production lines, identifying subtle anomalies or drift patterns that might be missed by standard statistical process control (SPC) methods. This predictive capability allows manufacturers to adjust curing times, ingredient ratios, or molding pressures preemptively, ensuring material consistency and significantly reducing waste associated with off-spec production runs. Furthermore, AI facilitates the development of automated robotic testing cells where durometers are integrated, ensuring precise placement and consistent measurement force, thereby achieving unprecedented levels of repeatability and removing operator bias.

Looking forward, AI is expected to revolutionize instrument calibration and maintenance. Machine learning models can analyze usage patterns, environmental factors, and historical calibration data of individual durometers to predict when a device is most likely to drift out of tolerance, triggering proactive servicing schedules. This shift from reactive to predictive maintenance minimizes downtime and ensures that testing validity is upheld consistently. AI also supports sophisticated material comparison and selection by cross-referencing durometer results against vast material databases, helping engineers identify optimal material choices for specific applications based on predicted long-term durability metrics derived from initial hardness testing data.

- AI enhances real-time anomaly detection in high-volume durometer testing data.

- Predictive maintenance models for durometers increase instrument uptime and measurement reliability.

- Machine learning facilitates automated correlation between hardness scores and complex material properties (e.g., aging characteristics).

- AI-driven automation supports robotic durometer systems, ensuring precision and eliminating human variability.

- Intelligent data logging and reporting systems improve audit trails and regulatory compliance documentation.

DRO & Impact Forces Of Hardness Durometers Market

The Durometers Market is strongly influenced by a robust set of Drivers, which include the expanding global manufacturing base, stringent quality standards in critical industries such as aerospace and medical, and the increasing complexity of engineered materials requiring precise characterization. These drivers are tempered by Restraints such as the relatively high initial cost of advanced digital and automated testing systems, the need for specialized training for accurate operation, and the inherent subjectivity and potential variability associated with manual durometer measurements, even with standardized procedures. Despite these hurdles, significant Opportunities arise from the ongoing development of wireless and IoT-enabled durometers, expansion into emerging economies with rapidly industrializing sectors, and the growing demand for specialized testing solutions in niche markets like food packaging and consumer electronics.

The overarching Impact Forces shaping the market equilibrium involve technological advancements, regulatory pressures, and material science evolution. Technological advancement acts as a positive force, promoting the adoption of highly accurate, repeatable, and automated testing devices, which subsequently improves data integrity. Regulatory forces, particularly in North America and Europe, mandate continuous improvement in quality control, making durometers essential tools for compliance with ISO and ASTM standards. Conversely, the rapid evolution of complex, multi-layered materials often presents a challenge, requiring durometer manufacturers to constantly innovate specialized indenters and testing methodologies that can accurately assess heterogeneous material structures without compromising precision.

In summary, the market exhibits a resilient demand structure driven by mandatory quality assurance requirements across manufacturing. While price sensitivity and operational expertise remain minor constraints, the trajectory is strongly upward, supported by automation trends and the continuous need for validated material performance data. The transition toward integrated systems that combine hardness testing with other mechanical property analyses represents a pivotal opportunity, allowing manufacturers to offer comprehensive material testing platforms rather than standalone durometer units, thus capturing greater market share and maximizing value proposition.

Segmentation Analysis

The Hardness Durometers Market is broadly segmented based on the scale type (Shore A, Shore D, others), product type (portable and benchtop), and the primary end-user application (automotive, aerospace, medical, rubber & plastics, etc.). This multifaceted segmentation reflects the diverse needs of industrial consumers, who require specific measurement ranges and instrument functionalities tailored to the hardness and composition of the materials they handle. Analyzing these segments provides critical insights into purchasing patterns, technological preferences, and the fastest-growing application areas, allowing manufacturers to strategically align their product development and marketing efforts. The segmentation highlights the market's differentiation based on precision requirements, field portability needs, and material specifications.

The Shore A segment historically dominates due to its applicability in measuring softer materials like rubber, elastomers, and flexible plastics, which are pervasive across consumer goods and industrial components. However, the Shore D segment is witnessing accelerated growth, mirroring the increased adoption of harder engineering plastics, rigid foams, and advanced composites in sectors such as electric vehicle bodies and specialized industrial machinery. Furthermore, the portable durometer segment commands a substantial share, valued for its flexibility in performing quick checks on large components or installed structures, contrasting with the benchtop segment which caters to high-precision laboratory testing requiring controlled environmental conditions and automated sequence measurements.

Technological refinement within these segments centers on enhancing repeatability across different operators and integrating digital data outputs for seamless quality auditing. The future market dynamics are expected to be influenced heavily by the demand from the medical devices and aerospace sectors, which prioritize high-reliability benchtop systems offering extensive data documentation capabilities, while the general manufacturing sector will continue to drive volume growth in the handheld, easy-to-use digital durometer categories. Understanding the interplay between material hardness scale requirements and instrument mobility is crucial for predicting market shifts.

- Type: Shore A, Shore D, Shore C, Shore B, Shore OO, Others (Specialized Scales)

- Product Type: Portable/Handheld Durometers, Benchtop/Laboratory Durometers

- Application: Automotive (Tires, Seals, Interior Components), Rubber & Plastics Manufacturing, Aerospace & Defense, Construction & Infrastructure, Medical Devices, Consumer Goods, Others (Electronics, Footwear)

- Technology: Analog Durometers, Digital Durometers, Automated Testing Systems

Value Chain Analysis For Hardness Durometers Market

The value chain for the Hardness Durometers Market begins with upstream activities involving the sourcing and refinement of specialized materials—primarily high-grade steel alloys and precision electronic components—necessary for manufacturing the indenters, pressure mechanisms, and digital readouts. Component suppliers, often specialized in sensor technology and high-precision machining, are crucial at this stage, focusing on ensuring metallurgical consistency and dimensional accuracy of the indenters, which directly impacts measurement precision. Research and Development plays an integral role upstream, continuously improving sensor technology, ergonomic design, and calibration standards to meet evolving industry needs and stricter regulatory requirements for measurement uncertainty. Quality control processes are rigorous here, ensuring the integrity of the core mechanical and electronic assemblies before integration.

Midstream activities involve the assembly, integration, and final calibration of the durometer instruments. Manufacturers focus on lean assembly lines and sophisticated calibration laboratories to guarantee that each device meets international standards (e.g., ASTM D2240, ISO 868). Distribution channels are highly varied: direct sales often handle high-value, complex automated benchtop systems sold directly to large testing laboratories or Tier 1 manufacturers, offering specialized training and after-sales support. Indirect channels utilize global distributors, specialized material testing equipment resellers, and e-commerce platforms to reach smaller enterprises, academic institutions, and remote field users, focusing primarily on portable digital durometers that require less intensive installation support.

Downstream activities center on the end-user deployment, focusing on ongoing maintenance, calibration services, and training. Specialized calibration labs and third-party service providers ensure that durometers maintain their accuracy over their operational lifespan, a critical requirement for regulatory compliance in industries like medical and aerospace. Customer feedback from end-users, regarding ease of use, durability, and integration capabilities, is channeled back to manufacturers for product improvement. The effectiveness of the value chain is determined by the seamless collaboration between precision component suppliers, certified manufacturers, and a robust network of service and calibration providers, ensuring sustained measurement integrity across the entire industrial usage spectrum.

Hardness Durometers Market Potential Customers

The primary customers for Hardness Durometers are organizations involved in the manufacture, processing, or quality control of materials categorized as elastomers, rubber, and polymers. The largest segment of end-users originates from the automotive industry, where durometers are essential for ensuring the performance and longevity of critical components such as tires, interior dash materials, various seals, gaskets, and vibration dampeners. Consistency in hardness is paramount here for safety and operational efficiency. The second major customer base resides within the specialized rubber and plastics processing sector, which includes compounders and molders who use durometers extensively for raw material inspection and verifying finished product quality against specifications before shipment.

Beyond high-volume manufacturing, technical industries like aerospace and medical device manufacturing represent high-value potential customers due to their stringent quality requirements. Aerospace necessitates durometers for testing specialized composite seals and non-metallic airframe components, demanding the highest precision benchtop models. Medical device manufacturers rely on durometers to verify the consistency of materials used in implants, tubing, and surgical tools, where biocompatibility and precise mechanical properties are non-negotiable. Furthermore, construction and civil engineering firms use handheld durometers to assess protective coatings, rigid insulation, and specific composite structural elements on-site, expanding the need for robust, portable devices.

A growing segment includes academic and institutional research laboratories focused on material science and polymer development. These customers require highly flexible and precise durometers for R&D purposes, often needing specialized scales (like Shore OO or micro-hardness) to characterize novel or experimental material compositions. Consequently, potential customers span the entire spectrum from massive global enterprises running fully automated testing lines to small, specialized compounding houses, all unified by the fundamental need for quantitative material hardness data to ensure product integrity and adherence to industry standards.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.0 Million |

| Market Forecast in 2033 | USD 685.0 Million |

| Growth Rate | CAGR 6.3% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ZwickRoell, Mitutoyo, Instron (ITW), NextGen Material Testing, PCE Instruments, Shore Western, Hylec Controls, Ektron Tek, Teclock, Qualitest International, Starrett, Affri, Foundrax, Tinius Olsen, Elcometer, Phase II, Test Machines, King Tester. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hardness Durometers Market Key Technology Landscape

The technology landscape of the Hardness Durometers Market is rapidly advancing, moving away from purely mechanical analog devices towards highly integrated digital and automated testing solutions. Digital durometers, which provide high-resolution readings and eliminate parallax error common in analog gauges, represent the current standard for most industrial applications. These devices incorporate advanced strain gauge sensors and microprocessors to ensure highly accurate force application and precise depth measurement, translating results directly to a digital display. Crucially, digital durometers are increasingly equipped with integrated data storage and communication ports (USB, Bluetooth), allowing for effortless transfer of results to statistical process control software or laboratory information management systems (LIMS), thereby supporting comprehensive quality auditing and traceability requirements.

A major technological trend is the proliferation of automated durometer testing systems. These benchtop units incorporate motorized loading mechanisms that ensure consistent test speed and force application, entirely removing operator influence on measurement variables, significantly boosting repeatability and reducing operator fatigue in high-volume testing environments. Automated systems often include integrated fixtures for standard sample geometry and are sometimes paired with robotic arms for hands-free sample handling. Furthermore, specialized durometer technologies are emerging to address unique material challenges, such as micro-hardness durometers designed for testing thin films, small components, or localized material areas, using specialized, smaller indenters and lower, more precise applied forces.

Connectivity and the Internet of Things (IoT) are becoming foundational elements of the key technology landscape. New generation durometers are often IoT-enabled, capable of wireless data transmission and remote calibration monitoring. This technological shift supports the development of smart factories where all testing instruments communicate seamlessly, providing a holistic view of quality metrics across the entire production line. Standardization efforts, particularly regarding consistent measurement force and dwell time, continue to drive technological innovation, ensuring that these advanced instruments adhere strictly to global standards like ASTM D2240, fostering confidence in the reliability and global comparability of the hardness data produced.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, primarily driven by massive expansion in manufacturing sectors, notably automotive production (especially EVs), consumer electronics, and infrastructure development across China, India, and Southeast Asia. The region’s focus on establishing robust local supply chains and increasing domestic quality control standards fuels the demand for both portable field testing devices and high-volume, automated benchtop durometers. Government initiatives supporting industrial modernization and investment in research and development centers further solidify APAC’s dominance in market volume, though price sensitivity remains a key factor influencing purchasing decisions, favoring local manufacturing in some segments.

- North America: North America holds a substantial market share characterized by high technological maturity and stringent regulatory requirements, particularly in the aerospace, defense, and medical device sectors. The demand here is centered on high-precision, digital, and automated durometers that offer superior data integrity and compliance capabilities. Manufacturers in this region prioritize seamless integration of durometer outputs into centralized quality management systems (QMS). Investment in R&D, focused on developing new calibration techniques and specialized scales for advanced composite materials, continues to drive market value and premium pricing.

- Europe: Europe represents a mature market with high penetration rates, emphasizing environmental standards and sustainable manufacturing practices, which necessitate rigorous material testing. Countries like Germany, Italy, and France, with strong bases in automotive engineering and precision manufacturing, are key consumers. European regulatory frameworks (e.g., REACH) drive the need for durometers capable of ensuring long-term material stability and compliance. The regional trend focuses on ergonomic design, data security, and the adoption of portable digital devices for in-field quality checks across construction and infrastructure projects, complementing robust laboratory testing facilities.

- Latin America, Middle East, and Africa (LAMEA): The LAMEA region shows emerging potential, driven by infrastructure investments (Middle East) and expanding automotive assembly operations (Latin America). While currently smaller in market size, the region offers significant long-term growth opportunities as industrialization accelerates. Demand is currently dominated by functional, reliable digital durometers, with investment decisions often influenced by cost-effectiveness and the availability of local technical support and calibration services. Growth is uneven, concentrated primarily in industrialized hubs within Brazil, Mexico, Saudi Arabia, and South Africa.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hardness Durometers Market.- ZwickRoell

- Mitutoyo

- Instron (ITW)

- NextGen Material Testing

- PCE Instruments

- Shore Western

- Hylec Controls

- Ektron Tek

- Teclock

- Qualitest International

- Starrett

- Affri

- Foundrax

- Tinius Olsen

- Elcometer

- Phase II

- Test Machines

- King Tester

Frequently Asked Questions

Analyze common user questions about the Hardness Durometers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Hardness Durometers Market?

Market growth is primarily driven by escalating global quality control standards, the rapid expansion of high-performance polymer and elastomer production (especially in automotive and medical sectors), and the transition toward automated, highly precise digital measurement systems that enhance data reliability and regulatory compliance.

How does the choice between Shore A and Shore D scales impact market segmentation?

Shore A dominates in volume for measuring softer materials like general rubber and flexible plastics. Shore D is experiencing faster growth in value, driven by the increasing use of harder engineering plastics and rigid composites in advanced manufacturing sectors like aerospace and high-end consumer electronics.

What role does Artificial Intelligence play in future durometer technology?

AI's role involves enhancing quality control through real-time anomaly detection in testing data, facilitating predictive maintenance for the instruments, and supporting automated testing routines to eliminate operator variability and ensure consistent measurement application force and speed.

Which region currently offers the highest growth potential for durometer sales?

Asia Pacific (APAC) offers the highest growth potential, largely due to extensive industrial modernization, significant investment in automotive and electronics manufacturing, and the subsequent need for validated material testing equipment across developing economies like China and India.

What are the main advantages of digital durometers over traditional analog instruments?

Digital durometers offer superior advantages including higher resolution, elimination of parallax measurement errors, built-in data logging capabilities, and connectivity (USB/Bluetooth) for seamless integration with quality management software, significantly improving data traceability and efficiency.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager