Hardness Testing Machine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434569 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Hardness Testing Machine Market Size

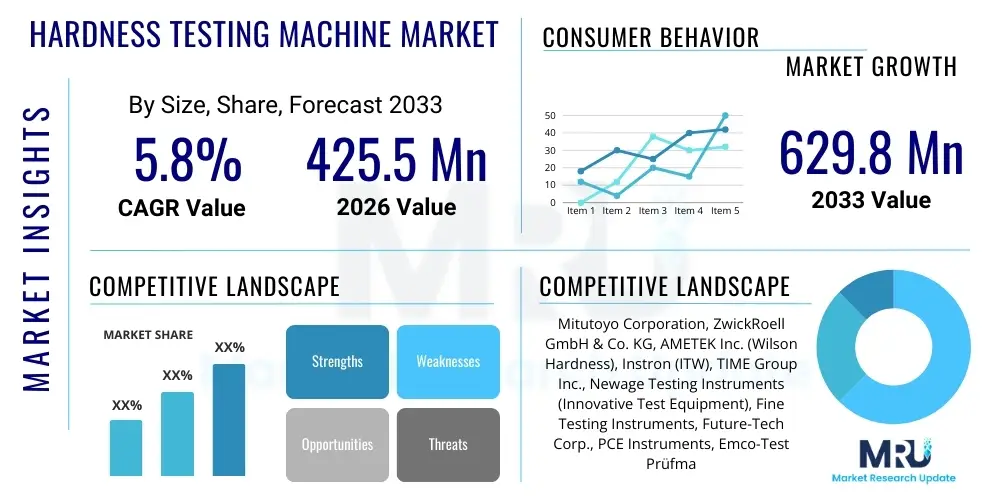

The Hardness Testing Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 425.5 Million in 2026 and is projected to reach USD 629.8 Million by the end of the forecast period in 2033.

Hardness Testing Machine Market introduction

The Hardness Testing Machine Market encompasses equipment designed to measure the resistance of a material to permanent deformation, indentation, or scratching. These instruments are fundamental tools in quality control, materials science research, and industrial inspection, ensuring that materials meet specified mechanical properties required for safety and performance in their intended applications. Hardness testing methodologies, such as Rockwell, Vickers, Brinell, and Knoop, provide critical data points for engineers regarding the material's strength, wear resistance, and overall structural integrity. The continuous demand for precise material characterization across high-stakes industries, including aerospace, automotive, and heavy machinery, fundamentally drives the adoption of these testing systems, leading to consistent market expansion.

Modern hardness testing machines are increasingly automated and integrated with digital data acquisition systems, enhancing repeatability, reducing human error, and facilitating real-time quality assurance processes. Key applications span testing raw materials, components post-manufacturing, heat-treated parts, and welds, making them indispensable in environments where material failure could lead to catastrophic consequences. The primary benefit derived from these machines is the accurate prediction of material behavior under stress and the validation of manufacturing processes, ensuring compliance with international standards such as ASTM and ISO. This rigorous testing minimizes production waste and maximizes product lifespan, contributing significantly to cost efficiency and brand reputation.

The market growth is primarily fueled by stringent regulatory requirements for material quality, particularly in safety-critical sectors like medical device manufacturing and energy production. Furthermore, the global proliferation of complex alloys and composite materials, which require highly specialized and accurate testing protocols, accelerates the demand for advanced testing systems. Driving factors also include the necessity for non-destructive or minimally destructive testing methods, leading to innovation in portable and automated hardness testers. The focus on lightweighting materials in the automotive and aerospace industries necessitates meticulous quality checks, positioning hardness testing machines as essential capital equipment globally.

Hardness Testing Machine Market Executive Summary

The global Hardness Testing Machine Market demonstrates robust growth, propelled primarily by escalating demand from high-growth manufacturing hubs in the Asia Pacific region and the persistent need for quality assurance in sophisticated European and North American manufacturing sectors. Business trends indicate a strong shift towards fully automated and robotic testing solutions, which integrate seamlessly into Industry 4.0 frameworks, improving throughput and data integrity. Companies are focusing on developing universal testing platforms capable of handling multiple hardness scales and incorporating advanced features such as closed-loop force application systems for enhanced accuracy. Furthermore, consolidation among key players is observed, driven by the desire to offer comprehensive material testing portfolios and capitalize on cross-selling opportunities across diverse end-user industries.

Regionally, the Asia Pacific dominates the market due to massive industrialization, particularly in China, India, and South Korea, where automotive production, electronics manufacturing, and infrastructure development are flourishing, necessitating large volumes of material quality inspection. North America and Europe, while mature, exhibit strong demand for high-end, precision-engineered testing equipment, particularly within aerospace maintenance, repair, and overhaul (MRO) activities and highly regulated medical device production. Emerging markets in Latin America and the Middle East are also expanding their procurement capabilities as they diversify their industrial bases away from reliance on raw commodity exports, focusing on local manufacturing and advanced processing capabilities.

Segment trends reveal that Rockwell hardness testing machines maintain the largest market share due to their speed and ease of use in general production environments. However, the Vickers and Knoop segment is experiencing the fastest growth, driven by the increasing need to test highly specialized, thin, or brittle materials, such as coatings, ceramics, and small electronic components, where micro and nano-indentation accuracy is paramount. By application, the quality control and inspection segment remains the largest consumer, but research and development (R&D) activities are showing substantial growth, fueled by global investments in metallurgy and advanced materials science aimed at creating next-generation alloys with superior mechanical properties for harsh operating conditions.

AI Impact Analysis on Hardness Testing Machine Market

Common user inquiries regarding the impact of Artificial Intelligence (AI) on the Hardness Testing Machine Market frequently center on automation, predictive maintenance, and data interpretation. Users are keen to understand how AI can reduce the subjectivity inherent in manual measurements, standardize complex testing protocols, and improve the efficiency of quality laboratories. Key themes include the integration of AI-powered image analysis for automated Vickers/Brinell indentation reading, the potential for machine learning algorithms to predict material defects or required heat treatment adjustments based on test results, and the implementation of predictive maintenance schedules for testing equipment itself. There is also significant interest in using AI to correlate hardness data with other mechanical properties (like tensile strength) in non-linear ways, providing deeper material insights than traditional statistical models.

The integration of AI is transforming hardness testing from a simple measurement process into a smart data generation system. Machine learning models are being deployed to automate the recognition and measurement of indentation marks, particularly in Vickers and Brinell tests, which traditionally require significant operator skill and time. This automation drastically reduces measurement variability, enhances accuracy, and accelerates the testing cycle, crucial for high-volume manufacturing environments. Furthermore, AI enables the development of adaptive testing protocols where the machine automatically adjusts load forces, dwell times, and positioning based on real-time feedback and pre-loaded material characteristics, optimizing the test sequence without continuous manual input.

Beyond measurement, AI contributes significantly to predictive quality management. By analyzing large datasets generated from continuous hardness testing across various batches and production lines, AI algorithms can identify subtle patterns that precede material quality degradation or process drifts. This predictive capability allows manufacturers to intervene proactively, adjusting parameters in heat treatment furnaces or cold rolling processes before defects manifest in the final product. This shifts the quality paradigm from post-mortem inspection to preventative control, delivering substantial savings and improving overall production reliability, solidifying AI as a critical enabler of next-generation quality assurance in metallurgy.

- AI enhances automated optical measurement accuracy, eliminating human error in indentation reading.

- Machine Learning (ML) algorithms optimize test parameters dynamically based on material type and historical data.

- Predictive maintenance models for testing equipment reduce downtime and calibration failures.

- AI correlates complex hardness data with microstructure and chemical composition for deeper material insights.

- Integration with digital twins allows for simulation and validation of material performance under varying conditions.

DRO & Impact Forces Of Hardness Testing Machine Market

The Hardness Testing Machine Market is shaped by a complex interplay of internal growth drivers (D), external constraints (R), emerging opportunities (O), and potent impact forces from the industrial ecosystem. The primary driver is the global imperative for quality assurance in highly engineered products, particularly the push toward zero-defect manufacturing standards across automotive, aerospace, and medical sectors. Simultaneously, the restraint posed by the high initial investment cost and the necessity for highly skilled technical personnel to operate and calibrate advanced systems sometimes limits adoption, particularly among Small and Medium Enterprises (SMEs) in developing regions. However, the burgeoning opportunity lies in the development of sophisticated portable and handheld testers that can perform accurate non-destructive testing in the field, expanding the market scope beyond fixed laboratory setups. These forces collectively dictate the market dynamics, pushing innovation towards greater automation and accessibility.

Key drivers include regulatory mandates, such as ISO certifications and specific industry standards (e.g., NADCAP for aerospace materials), which necessitate documented and verifiable hardness testing procedures throughout the supply chain. The continuous innovation in materials science, leading to the creation of ultra-hard ceramics, thin-film coatings, and highly complex metallic alloys, further drives the need for high-precision, specialized testing machines (like micro-Vickers and nano-indentation systems). Conversely, a significant restraint is the cyclical nature of capital expenditure in heavy manufacturing industries; economic downturns often lead to delayed purchases of new testing equipment, relying instead on older, sometimes less accurate, legacy systems. Furthermore, the variability in international calibration standards occasionally presents technical barriers to global market harmonization and trade.

The primary opportunities stem from the expansion of advanced manufacturing techniques, such as additive manufacturing (3D printing), which require novel methods for quality control of heterogeneous material structures, creating a demand for new, specialized hardness testing solutions. The global shift towards lightweighting in transportation sectors provides a specific opportunity for sophisticated testing of composite materials and high-strength, low-weight steel alloys. Moreover, the integration of Industry 4.0 technologies—including IoT connectivity, cloud data storage, and automated robotics for sample handling—presents a substantial growth vector, enhancing the efficiency and connectivity of material testing laboratories worldwide, thereby minimizing labor costs and accelerating the overall quality inspection timeline for critical components.

The impact forces are substantial, particularly the rapid advancement in sensor technology and digital measurement systems, which continually raise the bar for accuracy and repeatability, making older analog machines obsolete faster. The competitive landscape is intensely focused on patenting closed-loop force control systems and innovative indentation recognition algorithms. Furthermore, the environmental impact force, though subtle, encourages the use of non-destructive testing (NDT) methods where possible, aligning with sustainability goals by minimizing material waste during testing. These internal and external pressures mandate continuous R&D investment for companies operating within the hardness testing machine sector, compelling rapid feature upgrades and software enhancements to maintain market relevance.

Segmentation Analysis

The Hardness Testing Machine Market is segmented based on the method type, the level of automation and measurement scale, the primary application, and the end-user industry, providing a granular view of market dynamics. Understanding these segments is crucial for strategic planning as different methodologies cater to vastly different material properties and industry needs. The segmentation by method—Rockwell, Vickers, Brinell, Knoop, and others—reflects the technical requirements of the material being tested, where Rockwell is suitable for rapid, bulk testing, and Vickers/Knoop are essential for micro-analysis of thin layers and coatings. This technical diversification ensures that manufacturers can select the most appropriate equipment tailored to their specific quality assurance or R&D goals.

The market analysis further breaks down the segmentation by scale, distinguishing between macro, micro, and nano-indentation testers. Macro testers handle large loads and large samples, commonly found in heavy machinery and construction industries. Conversely, micro and nano testers address the precision demands of electronics, optics, and specialized surface engineering, reflecting the miniaturization trend across various high-tech sectors. Additionally, the market is categorized by product type: bench-top, portable, and floor-standing machines. The growing demand for portability and ease of use, driven by field maintenance requirements and large assembly line inspections, is causing the portable segment to expand rapidly, challenging the traditional dominance of fixed bench-top systems.

End-user segmentation is critical, highlighting the diverse industries relying on these instruments, including automotive, aerospace, metal processing, construction, and electronics. The automotive sector, driven by stringent safety regulations and the shift towards electric vehicles (EVs) requiring specialized battery casing and lightweight body materials, remains the largest consumer. Meanwhile, the aerospace and defense sector requires the highest level of accuracy and documentation, fueling demand for automated, highly traceable systems. This detailed segmentation allows market participants to tailor their sales and product development efforts towards sectors exhibiting the highest growth potential and the most sophisticated technological requirements.

- By Type (Methodology):

- Rockwell Hardness Testing Machine

- Vickers Hardness Testing Machine

- Brinell Hardness Testing Machine

- Knoop/Micro-Indentation Hardness Testing Machine

- Universal Hardness Testing Machine

- By Product Type:

- Bench-Top/Stationary Hardness Testers

- Portable/Handheld Hardness Testers

- By Application/Measurement Scale:

- Macro Hardness Testers (High Load)

- Micro Hardness Testers (Low Load)

- Nano-Indentation Systems (Ultra-Low Load)

- By End-User Industry:

- Automotive

- Aerospace and Defense

- Metallurgy and Material Science Research

- Machinery and Manufacturing

- Energy and Power Generation

- Electronics and Semiconductor

- Medical Devices

Value Chain Analysis For Hardness Testing Machine Market

The value chain for the Hardness Testing Machine Market begins with upstream activities involving specialized raw material suppliers and component manufacturers. This includes sourcing high-grade steel and alloys for machine frames, precision optics for measurement systems, high-accuracy load cells and force sensors, and sophisticated software components for data processing and automation. The quality and reliability of these upstream inputs—particularly the accuracy of the force application systems and the resolution of the optical components—directly dictate the performance and calibration stability of the final testing machine. Successful integration at this stage requires strong supplier relationships focused on quality compliance, traceability, and the ability to meet demanding technical specifications necessary for certified testing equipment.

The core of the value chain is the manufacturing and assembly phase, where Original Equipment Manufacturers (OEMs) design, integrate, and calibrate the testing machines. This stage involves complex engineering tasks, including designing the mechanical linkages, integrating advanced electronics, developing proprietary software for data acquisition, and rigorous factory calibration using certified reference standards. OEMs differentiate themselves through technological innovation, such as the implementation of closed-loop load application systems, automated turret mechanisms, and advanced image analysis software. Following manufacturing, the distribution channel plays a vital role. Direct sales channels are often employed for complex, high-value, customized systems, allowing OEMs to provide specialized installation, training, and ongoing technical support directly to major industrial clients, fostering long-term contractual relationships and service revenue.

Indirect distribution involves utilizing authorized distributors and specialized regional agents, particularly in geographically diverse markets or for standard, high-volume bench-top and portable testers. These intermediaries provide essential local inventory, rapid delivery, basic technical support, and local language training. Downstream activities involve comprehensive after-sales support, including installation, certification, calibration, repair, and regular maintenance contracts. Given that hardness testing machines are regulatory-critical instruments, the service revenue stream, driven by mandatory annual calibration and certification (often to standards like ISO 17025), represents a significant and stable portion of the total market value. This robust service component ensures continuous engagement with the end-users long after the initial sale.

Hardness Testing Machine Market Potential Customers

The primary customers in the Hardness Testing Machine Market are global manufacturers and research institutions that require precise, quantifiable data on the mechanical properties of their materials and components to ensure fitness for purpose and regulatory compliance. These end-users are characterized by their intense focus on quality control, process validation, and materials research. The largest buying segment is consistently the captive manufacturing sector, encompassing quality control departments within automotive component suppliers, major aerospace manufacturers, and large-scale metal fabrication facilities. These users prioritize speed, robustness, automation, and the seamless integration of testing results into their factory information systems and enterprise resource planning (ERP) solutions, necessitating automated data logging and reporting features.

Another significant group of potential customers includes independent third-party testing laboratories (3rd party labs) and university research departments. These customers typically require highly versatile and precise universal testing machines capable of performing multiple hardness scales (Rockwell, Vickers, Brinell) and accommodating a wide array of sample geometries and material types. For R&D customers, the demand leans heavily towards advanced nano-indentation and micro-indentation systems for cutting-edge materials characterization, such as measuring the mechanical properties of new thin films, composites, and novel surface treatments. Their purchasing decisions are often driven by technical specifications, high accuracy, and the capability of the equipment to handle unique, often custom, experimental conditions.

Furthermore, the maintenance, repair, and overhaul (MRO) sectors, particularly in aviation and heavy machinery (oil & gas, mining), represent a vital customer base for portable and handheld hardness testers. These end-users need robust, non-destructive tools that can quickly assess the integrity and material degradation of critical, installed components without requiring their removal. Buyers in this segment value durability, battery life, ease of field calibration, and reliable performance in harsh industrial environments, demonstrating a distinct purchasing profile focused on convenience and ruggedness over the ultimate high precision required by static laboratory equipment. This diversification of customer needs necessitates a broad and specialized product offering across the market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 425.5 Million |

| Market Forecast in 2033 | USD 629.8 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Mitutoyo Corporation, ZwickRoell GmbH & Co. KG, AMETEK Inc. (Wilson Hardness), Instron (ITW), TIME Group Inc., Newage Testing Instruments (Innovative Test Equipment), Fine Testing Instruments, Future-Tech Corp., PCE Instruments, Emco-Test Prüfmaschinen GmbH, Foundrax Engineering Products Ltd., Chennai Metco, Tinius Olsen, Elcometer, NextGen Material Testing Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hardness Testing Machine Market Key Technology Landscape

The technological landscape of the Hardness Testing Machine Market is rapidly evolving, moving away from purely mechanical systems toward integrated mechatronics solutions defined by precision digital control, sophisticated optics, and advanced software algorithms. A critical advancement driving this evolution is the widespread adoption of closed-loop load control systems. Unlike traditional deadweight systems, closed-loop technology utilizes highly accurate load cells and electronic feedback mechanisms to monitor and adjust the applied force in real-time. This ensures that the test force remains constant throughout the entire dwell time, independent of mechanical inconsistencies, significantly enhancing the accuracy, repeatability, and reliability of the hardness measurement, which is paramount for certifications in highly regulated industries like aerospace.

Another pivotal technological development involves advanced digital imaging and analysis software, particularly for Vickers and Brinell testing. High-resolution digital cameras and proprietary image processing software, often powered by machine learning and pattern recognition algorithms, automate the measurement of indentation diagonals. This eliminates the subjectivity and potential errors associated with manual optical measurement through an eyepiece, providing highly precise readings even on complex, irregularly shaped indentations or surfaces with challenging finishes. Furthermore, seamless data connectivity is now standard, with most modern machines equipped with IoT capabilities, allowing results to be instantly shared, analyzed, and stored in cloud-based quality management systems, facilitating centralized compliance reporting and statistical process control (SPC) across multiple manufacturing sites globally.

The frontier of innovation lies in nano-indentation technology, which enables the measurement of mechanical properties at the atomic scale (in nanometers), crucial for evaluating ultra-thin coatings, micro-electronic components, and single grains of material. These systems require extremely precise displacement control using sophisticated piezo-actuators and ultra-low noise environment isolation. Simultaneously, the portable testing segment is benefiting from advancements in sensor technology (e.g., dynamic rebound principles and ultrasonic contact impedance methods), allowing handheld devices to achieve accuracy levels previously restricted to bench-top models. These portable devices, often equipped with integrated touch screens and robust battery life, are transforming how quality inspections are conducted outside of the traditional laboratory setting, making them indispensable for MRO and rapid on-site assessment tasks across large industrial infrastructures.

Regional Highlights

- Asia Pacific (APAC) Market Dominance and Growth: The APAC region stands as the dominant market shareholder and is projected to exhibit the fastest growth rate during the forecast period. This trajectory is fueled by massive government investments in infrastructure, rapid urbanization, and the region's status as the global manufacturing hub for automotive components, consumer electronics, and construction materials. Countries like China, India, Japan, and South Korea are significantly upgrading their industrial quality control processes to meet international export standards, leading to substantial procurement of advanced, automated hardness testing systems. The local production of metal and machinery requiring continuous quality validation further accelerates market expansion.

- North America (NA) Focus on High-Precision Systems: North America represents a mature yet sophisticated market, primarily driven by the stringent quality requirements of the aerospace, defense, and medical device sectors. The demand here centers on highly automated, traceable, and specialized testing equipment, such as nano-indentation systems for semiconductor research and micro-Vickers testers for certified aerospace components. The presence of major R&D institutions and a strong regulatory environment necessitates continuous investment in high-accuracy, closed-loop testing instruments, even if the unit volume growth is slower than in APAC.

- Europe’s Strong Emphasis on Standards and Automation: Europe holds a significant market share, strongly influenced by the German machinery industry and the region's focus on maintaining high-quality manufacturing exports. European demand is driven by the robust automotive sector, particularly the electric vehicle transition, and the mandatory adherence to EU quality directives. Key trends include the integration of hardness testers into automated production lines using robotics (Industry 4.0), and a strong preference for universal testers that comply with both European (EN) and International (ISO) standards, ensuring cross-border product validation and material compatibility.

- Latin America (LATAM) and MEA Emerging Industrialization: Latin America and the Middle East and Africa (MEA) are emerging markets for hardness testing machines, primarily driven by diversification efforts in oil and gas (demanding pipeline material integrity testing), infrastructure expansion, and growing local automotive assembly operations (e.g., Brazil, Mexico, UAE). While currently smaller, these regions show considerable potential, especially for portable testers used in field environments and general-purpose bench-top models as local quality control laboratories are established and scaled up to support nascent manufacturing bases.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hardness Testing Machine Market.- Mitutoyo Corporation

- ZwickRoell GmbH & Co. KG

- AMETEK Inc. (Wilson Hardness)

- Instron (ITW)

- TIME Group Inc.

- Newage Testing Instruments (Innovative Test Equipment)

- Fine Testing Instruments

- Future-Tech Corp.

- PCE Instruments

- Emco-Test Prüfmaschinen GmbH

- Foundrax Engineering Products Ltd.

- Chennai Metco

- Tinius Olsen

- Elcometer

- NextGen Material Testing Inc.

- Sauter GmbH

- Starrett Company

- Shimadzu Corporation

- Struers A/S

- Affri S.p.A.

Frequently Asked Questions

Analyze common user questions about the Hardness Testing Machine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Rockwell, Vickers, and Brinell hardness testing methods?

The primary difference lies in the indenter shape, applied load, and measurement method. Rockwell measures the depth of permanent indentation; it is fast and suitable for production environments. Vickers uses a square-based diamond pyramid indenter and measures the diagonal length, suitable for testing virtually all material types and complex surfaces. Brinell uses a spherical carbide ball and measures the diameter, best suited for testing softer materials and large, coarse-grained structures, particularly in heavy metal industries.

How does automation benefit the hardness testing machine market, and what role does AI play?

Automation significantly improves testing throughput, reduces operator variability, and enhances data reliability. Automated systems handle sample loading, positioning, focus, and measurement sequences independently. AI integration, particularly machine vision and learning algorithms, further refines this by automating the precise detection and measurement of indentation boundaries, especially in complex Vickers and Brinell tests, ensuring higher accuracy and speeding up quality control cycles substantially within Industry 4.0 frameworks.

Which end-user industry holds the largest market share for hardness testing machines?

The automotive industry currently holds the largest market share. This dominance is driven by the rigorous quality control required for critical components such as engine parts, chassis materials, transmission gears, and brake systems. The ongoing global shift towards electric vehicles (EVs) also necessitates extensive testing of new battery casing alloys and structural components, guaranteeing market stability and consistent demand from this sector.

Are portable hardness testing machines as accurate as bench-top models, and what are their typical applications?

While historically less precise than bench-top models, modern portable testers utilizing Ultrasonic Contact Impedance (UCI) or dynamic rebound principles have significantly narrowed the accuracy gap. They are primarily used for non-destructive testing, large component inspection, and on-site maintenance, repair, and overhaul (MRO) checks, especially in oil and gas pipelines, large machinery, and structural integrity assessments where moving the test piece to a fixed laboratory is impractical or impossible.

What are the key drivers for the growth of the Micro and Nano Hardness Testing segment?

The key drivers for this segment are the increasing sophistication of material science, the miniaturization of electronic components, and the growing use of thin film coatings and surface treatments. Industries like semiconductor manufacturing, optics, and specialized aerospace coatings require mechanical property assessment at microscopic and atomic scales, a capability exclusively provided by micro-Vickers and nano-indentation systems, thereby fueling their substantial market expansion.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Construction Materials Testing Equipment Market Statistics 2025 Analysis By Application (Non-Destructive Testing (NDT), Universal Testing Machine (UTM), Servo Hydraulic Testing Machine (SHTM), Hardness Testing Machine (HTM), Impact Testing Machine (ITM)), By Type (On-site testing equipment, Laboratory testing equipment), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Hardness Testing Machine Market Statistics 2025 Analysis By Application (Steel and Metallurgy, Machinery Manufacturing, Plastic and Rubber, Scientific and Research), By Type (Vickers, Rockwell, Brinell, Universal), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Construction Materials Testing Equipment Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Non-Destructive Testing (NDT) Equipment, Universal Testing Machine (UTM) Equipment, Servo Hydraulic Testing Machine (SHTM) Equipment, Hardness Testing Machine (HTM) Equipment, Impact Testing Machine (ITM) Equipment), By Application (Soil Testing, Cement & Concrete Testing, Compressive Strength Testing, Aggregate Testing, Bitumen Testing, General Laboratory Testing), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager