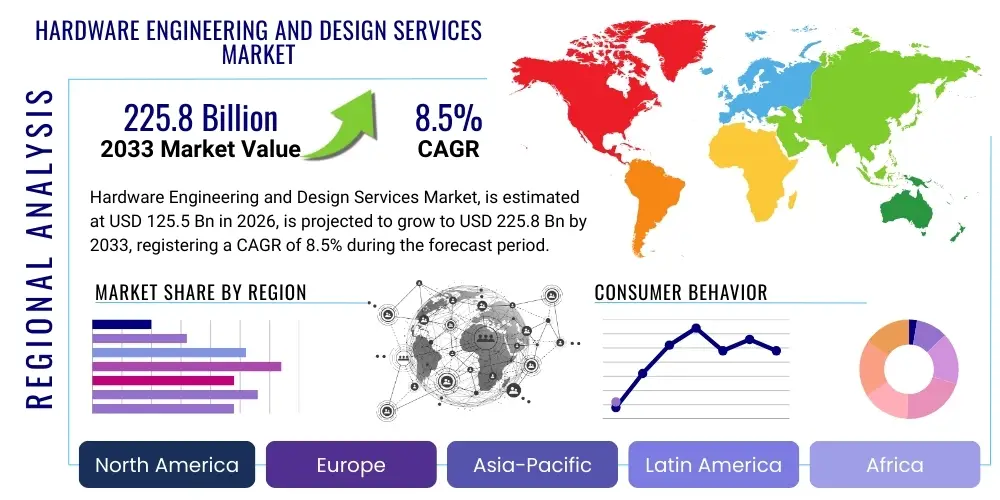

Hardware Engineering and Design Services Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435715 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Hardware Engineering and Design Services Market Size

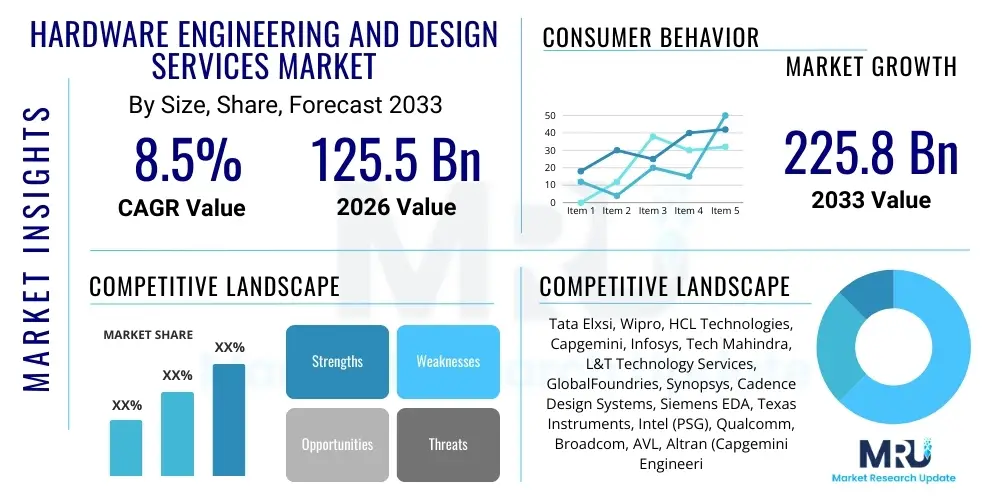

The Hardware Engineering and Design Services Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 125.5 Billion in 2026 and is projected to reach USD 225.8 Billion by the end of the forecast period in 2033.

Hardware Engineering and Design Services Market introduction

The Hardware Engineering and Design Services Market encompasses the specialized outsourced activities related to the conception, development, testing, and production readiness of electronic hardware systems and components. This sector provides critical expertise across the entire product lifecycle, spanning initial architectural definition, digital and analog circuit design, printed circuit board (PCB) layout, embedded software integration, and rigorous testing and compliance procedures. The increasing complexity of modern Systems-on-Chip (SoC), coupled with rapid technological convergence across diverse industries like automotive, healthcare, and telecommunications, necessitates reliance on these specialized services to accelerate time-to-market and ensure performance optimization. These services are pivotal in translating complex functional specifications into efficient, manufacturable physical designs, addressing critical concerns such as power consumption, thermal management, and regulatory compliance in increasingly miniaturized devices.

The core product offerings within this market are non-tangible services, focusing heavily on intellectual property (IP) development, system-level design optimization, and advanced verification methodologies, which are crucial for first-time-right silicon success. Major applications span high-performance computing (HPC), industrial automation systems, advanced driver-assistance systems (ADAS) in vehicles, and complex consumer electronics such as smart devices and wearables. The primary benefit derived by original equipment manufacturers (OEMs) and semiconductor companies is the reduction of internal R&D overhead, access to specialized engineering talent pools (particularly in areas like AI acceleration and 5G baseband), and enhanced flexibility to manage fluctuating project demands. Furthermore, outsourcing hardware design functions allows companies to focus their core resources on differentiating software layers and critical market strategy, thereby maximizing competitive advantage in fast-evolving technology landscapes.

Key driving factors fueling market expansion include the proliferation of the Internet of Things (IoT), demanding billions of connected, low-power devices, the global rollout of 5G infrastructure requiring complex radio frequency (RF) and baseband processing hardware, and the massive investment in electric vehicles (EVs) and autonomous driving platforms. Additionally, the relentless pursuit of high-performance computing, particularly for data centers handling massive AI workloads, requires continuous innovation in specialized processor architectures and thermal management systems, driving demand for expert design services focused on chiplet technology and heterogeneous integration. Regulatory standards concerning safety, security, and sustainability also mandate sophisticated verification and compliance checks, further elevating the necessity of specialized hardware engineering services across all geographical regions.

Hardware Engineering and Design Services Market Executive Summary

The global Hardware Engineering and Design Services Market is undergoing a fundamental transformation characterized by heightened complexity and integration, demanding sophisticated, specialized outsourcing partnerships. Current business trends indicate a significant shift from traditional discrete hardware design toward integrated system-level engineering, where hardware design is tightly coupled with firmware and software development, often referred to as hardware-software co-design. This trend is prominently observed in the development of custom AI accelerators and edge computing devices, where optimized performance per watt is paramount. Major semiconductor firms and large technology conglomerates are increasingly leveraging external design expertise to navigate the economic volatility associated with high-cost, high-risk silicon fabrication cycles, viewing outsourcing as a strategic method for scalable resource management and risk mitigation, particularly in complex nodes below 7nm. Furthermore, the market is seeing consolidation among service providers to offer end-to-end solutions, integrating design, verification, prototyping, and production management under a unified service umbrella, facilitating quicker turnaround times for complex projects.

Regionally, the Asia Pacific (APAC) continues its dominance, driven by robust manufacturing ecosystems, the massive concentration of consumer electronics production, and increasing indigenous capabilities in semiconductor design, notably in South Korea, Taiwan, and mainland China. However, North America and Europe remain the primary centers for high-value architectural design, IP development, and advanced verification services, especially those related to defense, aerospace, and cutting-edge automotive technology, sustaining high average service fees. The regional trends highlight a global supply chain where high-level strategic design often originates in Western markets, while scaling, low-cost engineering, and volume manufacturing support are concentrated in APAC. The geopolitical landscape and supply chain resilience concerns are also fostering a trend of localized design hubs in regions like Europe and North America to diversify risk and address data sovereignty requirements, slightly altering the traditional outsourcing paradigm towards a more distributed model of service delivery.

Segmentation trends reveal Verification and Validation (V&V) services as the fastest-growing segment, reflecting the exponential increase in design complexity and the zero-tolerance requirement for defects in mission-critical applications such as autonomous vehicles and medical devices. Within the application landscape, the Automotive segment is experiencing unparalleled growth, fueled by the transition to electric powertrains, centralized domain controllers, and sophisticated sensor fusion systems that necessitate highly reliable, custom-designed hardware platforms. Concurrently, the proliferation of specialized cloud and edge infrastructure is driving strong demand for custom silicon design in the Telecommunications and High-Performance Computing segments. Service providers are adapting by investing heavily in specialized toolsets, AI-driven verification platforms, and highly skilled personnel capable of managing multi-domain system integration, ensuring market buoyancy across various end-user categories including large OEMs and emerging fabless startups seeking flexible, scalable design partnerships.

AI Impact Analysis on Hardware Engineering and Design Services Market

User queries regarding the impact of Artificial Intelligence (AI) on the Hardware Engineering and Design Services Market predominantly center on three core themes: the automation potential of Electronic Design Automation (EDA) tools, the role of AI in optimizing complex silicon characteristics (power, performance, area), and the growing demand for specialized hardware specifically tailored for AI/ML workloads. Users are concerned about whether AI will replace human designers, or if it will augment their capabilities, fundamentally shifting the required skill sets towards prompt engineering and data-driven optimization management. The expectation is that AI will significantly compress design cycles, reduce manual verification bottlenecks, and enable highly customized chip designs that were previously computationally intractable, thereby creating both a disruptive force for existing service models and a massive opportunity for providers offering AI-enhanced design capabilities.

The integration of machine learning algorithms into the design flow is transforming traditional methods of layout generation, routing optimization, and timing closure. AI is now capable of analyzing vast datasets of prior successful and failed designs to predict optimal design choices, drastically improving efficiency. This shift means that design services are increasingly focused on leveraging these intelligent automation tools rather than purely manual intervention, requiring service firms to invest heavily in proprietary AI-enhanced frameworks and specialized data scientists familiar with hardware constraints. The overarching user theme is the validation of AI's effectiveness in achieving superior results in areas traditionally dependent on experienced human intuition, such as optimizing power delivery networks and minimizing signal integrity issues in high-speed interfaces.

Furthermore, the demand for hardware engineering services is amplified by the necessity of designing custom AI hardware, including neural network processors (NNPs), tensor processing units (TPUs), and domain-specific architectures (DSAs). These specialized chips are designed to accelerate specific AI tasks more efficiently than general-purpose CPUs or even GPUs, driving a massive wave of design complexity. Consequently, service providers are focusing their offerings on architectural exploration, definition of heterogeneous computing elements, and the challenging co-optimization of hardware architecture alongside the AI models they are intended to run. This dual impact—AI augmenting the design process and AI creating a need for new custom hardware—establishes AI as the singular most significant technological catalyst in the contemporary hardware engineering market, shifting focus toward algorithmic verification and data-centric validation.

- AI/ML enhances Electronic Design Automation (EDA) for faster physical design closure.

- Automation of verification and validation tasks, reducing simulation runtime and bug detection time.

- Optimization of Power, Performance, and Area (PPA) through predictive modeling and automated routing.

- Increased demand for design services specializing in custom AI accelerators (TPUs, NNPs) and chiplet architecture.

- Shift in required skills towards data science, prompt engineering, and utilizing AI-driven design tools.

- Facilitation of complex architectural exploration and rapid prototyping through algorithmic synthesis.

DRO & Impact Forces Of Hardware Engineering and Design Services Market

The Hardware Engineering and Design Services Market is shaped by a confluence of accelerating drivers, persistent restraints, and significant long-term opportunities, resulting in potent impact forces that dictate market direction and investment strategies. The primary driver is the exponentially increasing complexity of hardware systems, particularly in advanced semiconductor nodes (below 7nm), where traditional design methodologies struggle to manage billions of transistors and sophisticated integration requirements like 3D stacking and chiplet architectures. This complexity mandates specialized expertise and prohibitively expensive EDA toolsets, pushing even large OEMs and semiconductor giants to outsource. Key restraints include the severe shortage of highly specialized engineering talent, particularly in cutting-edge domains like millimeter-wave RF design and robust hardware security implementation, coupled with the volatility of global semiconductor supply chains and capital expenditure required for advanced testing equipment. These constraints introduce bottlenecks in rapid scaling and geographical expansion for service providers, often limiting the ability to meet surging demand efficiently.

Opportunities are robust, driven primarily by emerging technological waves such as the global migration to autonomous systems, 5G/6G communication infrastructure, and the continuous innovation in medical technology requiring highly reliable, power-efficient custom hardware. The massive growth trajectory of edge computing, which requires localized data processing capabilities, presents a lucrative niche for designing specialized, low-latency silicon that integrates compute, connectivity, and sensing capabilities. Furthermore, the rising awareness of cyber vulnerabilities is driving significant investment in hardware-level security implementation, creating an opportunity for services specializing in secure architecture design and immutable root-of-trust mechanisms. These drivers and opportunities collectively reinforce the market, indicating a period of sustained high growth focused on quality and specialization rather than pure cost reduction.

The resulting impact forces on the market structure are substantial. The increasing cost of internal R&D and the shortened product lifecycles in consumer technology act as strong catalysts, driving increased outsourcing penetration across various industries. Conversely, intellectual property (IP) protection and data confidentiality concerns act as moderating forces, requiring service providers to adopt stringent security protocols and often leading to highly regulated contractual arrangements, especially in defense and sensitive technology sectors. The net effect of these forces is a market characterized by high barriers to entry for new competitors lacking deep domain expertise or established IP libraries, favoring existing large-scale service providers who can offer integrated, secure, and technologically advanced design partnerships across multiple specialized domains.

Segmentation Analysis

The Hardware Engineering and Design Services Market is structurally segmented based on the type of service delivered, the specific application area the designed hardware targets, and the type of end-user utilizing these services. This segmentation provides a granular view of market dynamics, revealing where investment is most concentrated and where specialized expertise commands the highest premium. The service type segmentation (System Design, Verification & Validation, Prototyping, Manufacturing Support) highlights the value placed on ensuring design correctness and reliability early in the cycle, with Verification & Validation dominating spend due to the critical nature of modern silicon. The Application segmentation (Automotive, Telecom, Consumer Electronics) shows significant growth divergence, particularly driven by the regulatory and technological mandates within the automotive sector, demanding robust and certified hardware designs for safety-critical functions.

Understanding the segmentation allows service providers to tailor their capabilities, focusing resources on high-growth, high-margin areas. For instance, services dedicated to complex SoC design for AI acceleration in the High-Performance Computing segment require deep knowledge of proprietary instruction sets and custom memory architectures. Meanwhile, consumer electronics demand highly competitive cost structures, power optimization expertise, and rapid iterative design cycles. The End-User segmentation often differentiates between large fabless semiconductor companies seeking architectural support and OEMs seeking comprehensive, turn-key product development assistance, influencing the scale and scope of engagement models adopted by service firms.

Overall, market expansion is not uniform; instead, it is highly dependent on the intersection of advanced technological demand and stringent regulatory requirements. The trend toward heterogeneous integration and chiplet-based designs is blurring the lines between traditional hardware and software roles, meaning service segmentation is increasingly defined by the ability to manage complexity across multiple domains (e.g., analog, digital, RF, and embedded software) simultaneously, establishing full system integration capabilities as a key competitive differentiator across all primary segments.

- By Service Type:

- System Design and Architecture

- Hardware Verification and Validation (V&V)

- Prototyping and Testing

- Manufacturing Support and Sustenance Engineering

- Embedded Software and Firmware Integration

- By Application:

- Automotive (ADAS, Infotainment, EV Powertrain Control)

- Telecommunications (5G/6G Infrastructure, Baseband Processing)

- Consumer Electronics (Wearables, Smart Home Devices)

- Industrial Automation and Robotics

- Healthcare and Medical Devices

- High-Performance Computing (Data Centers, AI Accelerators)

- By End-User:

- Original Equipment Manufacturers (OEMs)

- Fabless Semiconductor Companies

- Integrated Device Manufacturers (IDMs)

- Tier 1 Suppliers

Value Chain Analysis For Hardware Engineering and Design Services Market

The value chain for the Hardware Engineering and Design Services Market is characterized by a high degree of specialization and strong interdependence among various stakeholders, starting with core technology providers and culminating in the end-user deployment. Upstream activities are dominated by Electronic Design Automation (EDA) tool vendors (like Synopsys, Cadence, and Siemens EDA), IP core providers (offering specialized blocks such as processors and memory controllers), and advanced semiconductor fabrication facilities (foundries). These upstream players dictate the technical possibilities and cost structures of the design process, providing the essential software infrastructure and foundational building blocks required for complex silicon development. The relationship between design service providers and IP vendors is critical, as access to pre-verified, high-quality IP significantly reduces design risk and time-to-market, forming a crucial component of modern design service offerings.

The midstream segment is occupied by the core design service firms themselves, which act as integrators and specialized engineering hubs. They take the foundational IP and EDA tools and transform high-level specifications into manufacturable designs. These firms utilize both direct channels, engaging directly with large OEMs and semiconductor clients on long-term design contracts, and indirect channels, often partnering with smaller, specialized testing houses or consulting firms for niche expertise like electromagnetic compatibility (EMC) testing or specific compliance verification. The distribution channel for these services is predominantly consultative and direct; complex engineering projects necessitate deep, continuous collaboration between the service provider's team and the client's internal engineering stakeholders, focusing on managing project scope, deliverables, and rigorous verification milestones throughout the development cycle.

Downstream analysis focuses on the manufacturing and assembly stages, followed by the deployment and end-user engagement. This includes outsourced semiconductor assembly and test (OSAT) providers, PCB manufacturers, and final product assemblers. Design services often extend into manufacturing support, assisting clients with yield optimization, resolving manufacturing defects (NPI support), and ensuring long-term product sustenance. The end-users—ranging from automotive giants and telecommunications infrastructure providers to consumer device makers—determine the ultimate success and specifications of the designed hardware. The efficiency of the entire value chain hinges on seamless data flow and security across all stages, especially given the sensitivity of proprietary IP involved in the design and fabrication process, emphasizing the role of robust project management and secure collaboration platforms as key differentiators within the service segment.

Hardware Engineering and Design Services Market Potential Customers

Potential customers and end-users of the Hardware Engineering and Design Services Market span a broad range of technology-intensive industries, all sharing the common need for highly specialized, custom-designed electronic systems that outperform standard off-the-shelf components. The primary buyers include large Original Equipment Manufacturers (OEMs) in sectors such as automotive (e.g., manufacturers developing ADAS domain controllers), aerospace (e.g., avionics systems developers), and industrial machinery (e.g., firms building complex robotic automation platforms). These OEMs typically lack the internal engineering scale or highly specialized expertise required for cutting-edge silicon or system-level design, preferring to leverage external partners to manage peak R&D load and access niche skills like advanced thermal modeling or high-speed interface design. For these customers, the services often represent a turn-key solution, integrating hardware, firmware, and production readiness support.

Another major customer base comprises semiconductor companies, including both fabless enterprises and Integrated Device Manufacturers (IDMs). Fabless companies rely heavily on external design services to accelerate the development of their next-generation chip architectures, especially during cycles of high demand or when venturing into new complex domains like 3D stacked memory or heterogeneous multi-core processor design. IDMs, while possessing significant internal resources, utilize external services to augment teams during peak workload periods, manage non-core IP development, or gain access to highly specialized verification techniques that streamline the sign-off process. These engagements are often project-based and focus intensely on high-tech capabilities, driving demand for engineers with expertise in advanced EDA toolflows and specific process technologies.

Finally, Tier 1 component suppliers and emerging technology startups constitute a rapidly growing segment of potential customers. Tier 1 suppliers in the automotive and industrial sectors require custom hardware design to meet stringent regulatory standards (like ISO 26262 for functional safety) and specific interface requirements mandated by their OEM clients. Startups, particularly those focused on specialized AI, quantum computing hardware, or next-generation sensor technology, rely almost entirely on outsourced engineering and design firms to quickly translate novel concepts into manufacturable prototypes, conserving their limited capital expenditure while benefiting from established industry best practices regarding design-for-manufacturability (DFM) and comprehensive pre-silicon verification methodologies. The need for specialized compliance expertise and access to high-cost lab equipment further drives these varied customer bases toward professional service providers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 125.5 Billion |

| Market Forecast in 2033 | USD 225.8 Billion |

| Growth Rate | CAGR 8.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Tata Elxsi, Wipro, HCL Technologies, Capgemini, Infosys, Tech Mahindra, L&T Technology Services, GlobalFoundries, Synopsys, Cadence Design Systems, Siemens EDA, Texas Instruments, Intel (PSG), Qualcomm, Broadcom, AVL, Altran (Capgemini Engineering), Bertrandt, Harman International, Tietoevry. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hardware Engineering and Design Services Market Key Technology Landscape

The technological landscape underpinning the Hardware Engineering and Design Services Market is defined by advanced methodologies necessary to handle next-generation system requirements, moving far beyond simple circuit design. Key technologies include advanced Electronic Design Automation (EDA) tools, which are increasingly incorporating Artificial Intelligence (AI) and machine learning algorithms to automate complex tasks such as physical layout, timing closure optimization, and power integrity analysis, significantly boosting design efficiency and yield predictability. Another cornerstone is the specialized technology stack associated with high-speed digital and mixed-signal design, crucial for implementing 5G/6G modem architectures, PCIe Gen 5/6 interfaces, and high-performance memory controllers (HBM), all of which demand precise signal integrity and power delivery network analysis capabilities that require specialized simulation and verification tools.

Furthermore, the market relies heavily on enabling technologies for heterogeneous integration, particularly chiplet architectures and 3D stacking techniques, which are vital for constructing advanced Systems-on-Chip (SoCs) that transcend the limits of Moore's Law. These technologies necessitate new levels of collaboration and verification across multiple dies and packaging layers, driving demand for specialized services in inter-die communication standards (like UCIe) and thermal co-design. The proliferation of embedded security requirements across all applications mandates the use of technologies such as physically unclonable functions (PUFs), secure boot mechanisms, and hardware root-of-trust implementation, which require deep, specialized expertise in cryptographic hardware acceleration and secure architecture definition provided by design service firms.

The transition toward functional safety and reliability, particularly in the automotive and industrial sectors, necessitates extensive use of formalized verification technologies, including formal methods and advanced fault injection testing. This ensures compliance with stringent standards such as ISO 26262 (Automotive Functional Safety) and IEC 61508. Service providers leveraging these specialized software and hardware-in-the-loop (HIL) testing platforms are highly valued. Finally, the growing importance of ultra-low-power design for IoT and wearable devices drives technological investment in specialized analog design techniques, energy harvesting integration, and advanced power management IC (PMIC) design, rounding out a technology landscape that is continually evolving to meet demanding performance, efficiency, and safety benchmarks.

Regional Highlights

Regional dynamics in the Hardware Engineering and Design Services Market reflect a strategic balance between high-value architectural expertise and scaled engineering capacity, driven by local industrial focus and technological maturity. North America, anchored by the Silicon Valley ecosystem and major defense and aerospace industries, dominates in terms of high-value Intellectual Property (IP) creation, cutting-edge semiconductor architecture definition, and advanced EDA tool development. The region leads in demand for services related to high-performance computing, specialized AI chips, and complex data center infrastructure, characterized by high spending on consultation, verification, and early-stage design exploration, demanding premium service pricing and access to highly specialized, scarce engineering talent focused on future technology nodes.

Asia Pacific (APAC) holds the largest market share by volume and revenue, primarily driven by its vast manufacturing base, the concentration of consumer electronics OEMs, and the rapid expansion of indigenous semiconductor capabilities, especially in China, Taiwan, and South Korea. This region excels in scalable engineering services, productization support, high-volume manufacturing optimization (Design for Manufacturing/Test), and comprehensive product sustenance engineering. The aggressive deployment of 5G infrastructure and substantial government investments in semiconductor self-sufficiency further fuel the demand for large-scale, cost-effective design teams specializing in connectivity, baseband processing, and memory controller design, positioning APAC as the indispensable hub for execution and volume production enablement.

Europe represents a highly specialized market, strong in the Automotive, Industrial Automation, and Medical Technology sectors. Demand is heavily concentrated on services related to functional safety (ISO 26262, IEC 61508), robust embedded systems design, and complex industrial control hardware. Countries like Germany and France are central to advanced automotive R&D, requiring high-assurance verification and certification services, often integrating complex sensor fusion and control systems. Latin America, the Middle East, and Africa (MEA) are emerging regions, where demand is currently focused on telecommunications infrastructure deployment and localized adaptation of consumer devices, primarily relying on imported expertise and localizing designs for regional compliance and market requirements, offering future growth potential as digital transformation accelerates.

- North America: Center for high-value IP development, AI acceleration architecture, and leading-edge semiconductor design (e.g., 3nm/2nm process nodes). High demand from cloud providers, military/defense, and large fabless companies.

- Asia Pacific (APAC): Largest market share driven by manufacturing scale, consumer electronics, and automotive production. Strong focus on DFM, volume engineering, and 5G deployment in countries like China, Taiwan, and South Korea.

- Europe: Specialized market driven by strict functional safety standards (Automotive, Industrial). Expertise required in embedded systems, reliable hardware design, and complex regulatory compliance.

- Latin America, Middle East, and Africa (MEA): Emerging market with increasing demand linked to telecommunications expansion (4G/5G rollout) and localized electronic assembly, relying heavily on outsourced foundational design.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hardware Engineering and Design Services Market.- Tata Elxsi

- Wipro

- HCL Technologies

- Capgemini (Capgemini Engineering)

- Infosys

- Tech Mahindra

- L&T Technology Services (LTTS)

- GlobalFoundries (Design Services Division)

- Synopsys (DesignWare and Professional Services)

- Cadence Design Systems (Verification and IP Services)

- Siemens EDA (Professional Services)

- Texas Instruments

- Intel (Programmable Solutions Group - PSG)

- Qualcomm

- Broadcom

- AVL

- Bertrandt

- Harman International

- Tietoevry

- Alten Group

Frequently Asked Questions

Analyze common user questions about the Hardware Engineering and Design Services market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driving factor for the growth of hardware engineering outsourcing?

The primary driver is the dramatic increase in System-on-Chip (SoC) design complexity, particularly at advanced semiconductor nodes (e.g., 7nm and below), which mandates prohibitively expensive EDA tools and highly specialized, scarce engineering expertise that most companies cannot maintain internally, thereby necessitating professional outsourcing.

How is Artificial Intelligence (AI) influencing hardware design services?

AI is influencing the market in two ways: by augmenting the design process through AI-enhanced EDA tools that optimize power, area, and performance (PPA), and by creating massive demand for design services dedicated to building custom, domain-specific AI accelerator hardware (e.g., TPUs and NNPs).

Which application segment is expected to show the highest growth rate?

The Automotive application segment is projected to exhibit the highest growth, fueled by the global shift towards Electric Vehicles (EVs), the implementation of advanced driver-assistance systems (ADAS), and the requirement for functional safety compliant (ISO 26262) hardware architectures and secure domain controllers.

What is the most critical restraint facing the hardware engineering market?

The most critical restraint is the acute shortage of highly specialized engineering talent, particularly in niche areas like advanced analog/mixed-signal RF design, robust hardware security implementation, and expertise required for complex verification and validation (V&V) of designs below 7nm.

What role does Verification and Validation (V&V) play in outsourced hardware design?

V&V is the largest and fastest-growing service segment; its role is critical in ensuring designs are bug-free, compliant with safety standards, and function correctly prior to expensive silicon fabrication, minimizing risk and ensuring first-pass success in complex, mission-critical hardware deployments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager