Hay and Forage Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431845 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Hay and Forage Equipment Market Size

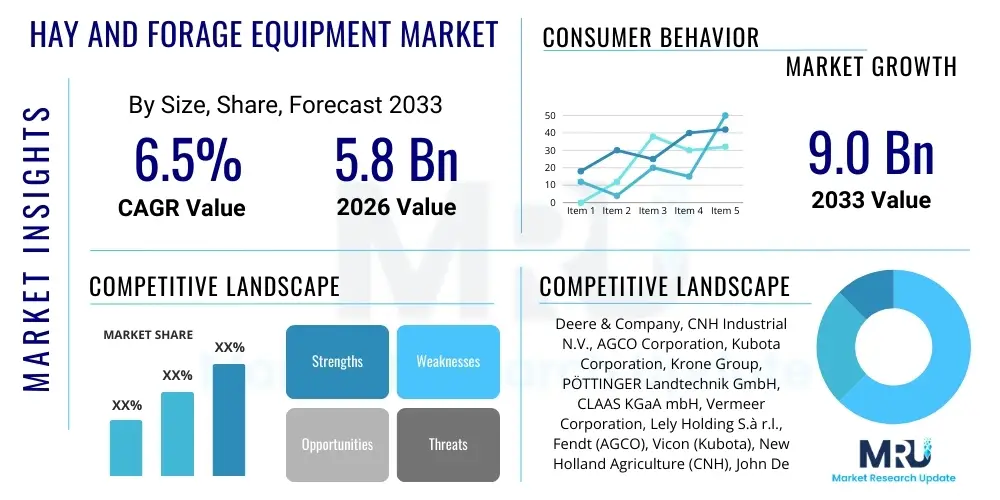

The Hay and Forage Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 5.8 Billion in 2026 and is projected to reach USD 9.0 Billion by the end of the forecast period in 2033. This robust growth trajectory is primarily fueled by the increasing global demand for high-quality livestock feed, driven by rising meat and dairy consumption in developing economies, alongside technological advancements focused on enhancing efficiency and reducing operational costs for large-scale farming operations worldwide. The need for precise and timely harvesting to preserve nutrient content is a key factor supporting the consistent adoption of advanced hay and forage machinery.

Hay and Forage Equipment Market introduction

The Hay and Forage Equipment Market encompasses specialized agricultural machinery designed for the entire process of cultivating, harvesting, processing, and storing hay and forage crops, essential components of livestock diets globally. This equipment range includes mowers, conditioners, rakes, tedders, balers (round, square, and large square), forage harvesters, and specialized storage handling systems. These tools are critical for modern agriculture, enabling farmers to efficiently manage vast tracts of land, minimize yield losses, and ensure the production of high-nutritional-value feed, thereby supporting the sustainability and profitability of the global dairy and beef industries. The primary applications span across large commercial farms, contract farming services, and smaller specialized livestock operations that require mechanized solutions for feed preparation.

The core benefit derived from utilizing advanced hay and forage equipment is the maximization of operational efficiency and productivity. Modern machinery incorporates features such as GPS guidance, automated moisture sensing, and high-capacity processing units, significantly reducing the labor intensity and time required for harvesting cycles. This efficiency gain allows farmers to optimize harvest timing based on peak nutritional content, which is crucial for maximizing the value of the feed product. Furthermore, sophisticated conditioning and baling mechanisms ensure tight, dense bales that are easier to transport and store, minimizing spoilage and optimizing storage space, thus contributing directly to improved farm economics and resource management.

Driving factors for this market include the increasing mechanization rate in emerging agricultural economies, spurred by supportive government policies and the rising imperative to adopt sustainable farming practices. The global trend towards large-scale farming, replacing fragmented landholdings, necessitates higher capacity and faster equipment. Moreover, continuous innovation in equipment design, focusing on features like improved fuel efficiency, reduced soil compaction, and integration with digital agriculture platforms, further accelerates adoption. The persistent pressure to produce consistent, high-quality feed year-round, regardless of fluctuating climatic conditions, cements the indispensable role of modern, reliable hay and forage equipment in the agricultural supply chain.

Hay and Forage Equipment Market Executive Summary

The Hay and Forage Equipment Market demonstrates significant growth momentum, driven by macro-level agricultural business trends emphasizing efficiency, precision, and sustainability. Key business trends include the consolidation of agricultural holdings globally, demanding larger and more powerful machinery capable of covering extensive acreage rapidly, thereby favoring high-capacity forage harvesters and large square balers. Furthermore, the shift towards predictive maintenance and telematics integration is enhancing equipment lifespan and operational uptime, positively impacting the total cost of ownership (TCO) for farmers, who are increasingly viewing equipment as capital investment crucial for feed quality control. This move towards intelligent farming practices is redefining procurement strategies across the sector.

Regionally, North America and Europe remain mature markets characterized by high technology adoption and replacement cycles for advanced equipment. However, the Asia Pacific (APAC) region, particularly driven by countries like India and China with massive livestock populations and ongoing agricultural modernization efforts, is emerging as the fastest-growing market. This regional surge is attributed to the transitioning away from manual labor towards mechanized harvesting to meet the surging domestic demand for dairy products. Latin America also presents substantial growth opportunities, spurred by expanding beef export markets that require efficient, large-scale forage production systems, making regional investment in modern machinery crucial for competitive advantage.

Segment-wise, the market is primarily dominated by the Balers segment due to the necessity of compacting feed for storage and transportation, with large square balers exhibiting the fastest growth due to their suitability for industrial-scale operations and export logistics. Technology trends lean heavily toward implements integrated with precision agriculture tools, such as yield monitoring systems and automated guidance for forage harvesters. Power class segmentation indicates a rising demand for high horsepower (HP) machinery (>150 HP), specifically tailored for efficiency in harvesting dense and high-yield forage crops, minimizing field time and maximizing nutrient retention critical for feed quality assurance.

AI Impact Analysis on Hay and Forage Equipment Market

Common user questions regarding AI's impact on hay and forage equipment frequently revolve around feasibility, return on investment, and implementation challenges in traditional agricultural settings. Users are keen to understand how AI-powered vision systems can accurately assess crop maturity and quality in real-time (e.g., moisture and protein levels before cutting), minimizing subjective human judgment. Concerns often center on the computational requirements and cost of integrating sophisticated machine learning models into field machinery, questioning whether the benefits in yield optimization and reduced input waste justify the substantial initial investment. Furthermore, farmers express interest in predictive maintenance using AI algorithms to forecast equipment failure based on telemetry data, ensuring maximum uptime during critical harvest windows, and seeking clarity on data security and privacy protocols associated with these intelligent systems.

AI is transforming the hay and forage equipment market by enabling unprecedented levels of precision and automation, moving harvesting from scheduled routines to data-driven operations. Artificial Intelligence, integrated into specialized equipment, allows for granular, real-time analysis of field conditions and crop characteristics. For instance, sensors on mowers and harvesters collect vast datasets, which AI models process to optimize cutting height, adjust processing speeds, and modify conditioning intensity instantaneously. This adaptive process ensures that every section of the field is harvested optimally, maximizing nutrient retention (crucial for high-quality feed) and minimizing field losses, thereby directly influencing the profitability of the forage operation and reducing overall environmental footprint.

The primary application of AI in this sector is enhancing predictive capabilities across the entire lifecycle of both the crop and the machinery itself. AI algorithms analyze historical weather patterns, soil data, and equipment performance logs to recommend optimal planting times, irrigation schedules, and most importantly, the ideal harvest day, mitigating risks associated with unpredictable weather. For maintenance, AI monitors vibrational patterns and temperature fluctuations in gearboxes and engines, alerting operators to potential failures long before traditional diagnostics would detect issues. This proactive approach to equipment management significantly reduces costly downtime during the narrow harvest window, a critical factor for large-scale agricultural enterprises relying heavily on continuous operational flow.

- Real-time crop quality assessment (moisture, density, nutritional value) via AI vision systems.

- Optimized equipment settings (cutting, conditioning, baling pressure) based on machine learning models.

- Predictive maintenance schedules reducing unexpected machinery downtime during peak seasons.

- Autonomous operation and path planning for forage harvesters and tractors, increasing efficiency.

- Enhanced yield mapping and variable rate application of fertilizers based on AI-analyzed soil data.

- Improved bale density consistency and shape optimization through automated adjustment mechanisms.

DRO & Impact Forces Of Hay and Forage Equipment Market

The Hay and Forage Equipment Market is influenced by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape the impact forces defining market growth and structure. The primary driver is the escalating global demand for protein, necessitating intensive livestock farming practices that rely heavily on consistent, high-quality, and cost-effective feed sources. This demand, coupled with labor shortages in industrialized nations, forces farmers to invest in highly automated and large-capacity equipment. However, the market faces significant restraints, notably the high initial capital investment required for advanced machinery, making it prohibitive for smaller farmers, especially in emerging economies where access to credit and subsidized funding remains limited. Furthermore, susceptibility to climate change, leading to unpredictable growing seasons, poses substantial operational risks that can deter equipment purchases.

Opportunities within this market are strongly tied to technological advancements and global environmental mandates. The expanding focus on precision agriculture offers substantial avenues for growth, integrating telematics, IoT sensors, and AI into traditional equipment, enhancing yield optimization and resource efficiency (e.g., fuel and water use). Geographically, untapped potential lies in the rapid mechanization of agriculture across Southeast Asia and Africa, where governments are increasingly providing incentives to modernize agricultural practices. The development of specialized, affordable, and durable equipment tailored for smaller farm sizes in these regions represents a significant opportunity for manufacturers to expand their global footprint beyond traditional mature markets in North America and Western Europe.

The overarching impact forces governing market evolution include the regulatory environment and commodity price volatility. Strict quality standards for exported agricultural products often mandate the use of modern equipment capable of accurate nutrient preservation and traceability, acting as a coercive force driving adoption. Simultaneously, the inherent volatility of global commodity prices (for milk, beef, and grain) directly influences farmers' income and their capacity to invest in new capital equipment. When commodity prices are high, investment accelerates, and conversely, sustained low prices can delay replacement cycles. This price sensitivity mandates that manufacturers continuously focus on demonstrating a clear and immediate return on investment through efficiency gains and reduced operational costs to maintain steady market penetration across various economic cycles.

Segmentation Analysis

The Hay and Forage Equipment Market is comprehensively segmented based on product type, operation type, power class, and application, providing granular insights into market dynamics and key areas of investment. Product segmentation is crucial as it dictates the functional utility, ranging from cutting (mowers and mower conditioners) to handling (balers and harvesters). Operation type distinguishes between the necessity for traditional, manually-operated equipment suitable for smaller fields versus self-propelled, highly automated machinery designed for large-scale, high-throughput commercial operations. Power class segmentation is indicative of the operational capability and target farm size, while application segmentation highlights the end-use industry, predominantly focusing on dairy farming and beef cattle operations, each having unique forage quality requirements and equipment needs. Understanding these diverse segments is vital for manufacturers to tailor product development and marketing strategies effectively.

- Product Type

- Mowers and Conditioners

- Rakes and Tedders

- Balers (Round Balers, Square Balers - Small, Square Balers - Large)

- Forage Harvesters (Self-Propelled, Trailed)

- Wagons and Loaders

- Operation Type

- Self-Propelled

- Tractor-Mounted/Trailed

- Power Class

- Below 100 HP

- 100 HP to 150 HP

- Above 150 HP

- Application

- Dairy Farming

- Beef Cattle Operations

- Other Livestock (Sheep, Goats)

- Contract Farming

- Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Value Chain Analysis For Hay and Forage Equipment Market

The value chain for the Hay and Forage Equipment Market begins with the upstream activities centered on the procurement and processing of raw materials, including high-grade steel, specialized alloys, hydraulic components, advanced electronic sensors, and precision components necessary for constructing durable and sophisticated agricultural machinery. Key upstream suppliers include steel manufacturers and specialized electronics companies providing telematics and guidance systems. Intense focus is placed on sourcing high-strength, lightweight materials to enhance equipment durability while minimizing fuel consumption. Manufacturers must ensure strict quality control over these input materials, as machinery failure during the critical harvesting window can lead to catastrophic crop losses, demanding robust quality assurance protocols from component suppliers.

The midstream stage involves the core manufacturing, assembly, and integration processes. Leading Original Equipment Manufacturers (OEMs) focus heavily on Research and Development (R&D) to innovate machine design, improve operational efficiency, and integrate precision agriculture technologies. Manufacturing strategies often involve modular design to facilitate customization and rapid assembly. After production, the finished equipment moves through sophisticated distribution channels. The distribution network typically relies on a blend of direct sales to large corporate farms and, more commonly, an extensive global network of independent, authorized dealers who manage local sales, financing, technical support, and critical after-sales services, including parts inventory and emergency repairs, forming the vital link between manufacturers and end-users.

Downstream analysis focuses on the end-user interaction and post-sales activities. The primary distribution channel is the indirect model, utilizing strong dealer partnerships that offer localized expertise and immediate maintenance support, crucial factors in equipment purchasing decisions. Direct distribution is usually reserved for major fleet sales to very large corporate farming operations or governmental procurement. The aftermarket segment, comprising spare parts, consumables (like baler twine and wrap), maintenance services, and technology upgrades (e.g., software updates for guidance systems), represents a substantial and stable revenue stream, often dictated by the equipment's lifecycle and intensity of use. Effective inventory management and rapid parts delivery are key determinants of customer satisfaction and loyalty in the downstream market.

Hay and Forage Equipment Market Potential Customers

The primary segment of potential customers for hay and forage equipment consists of large-scale commercial dairy and beef cattle farms operating in regions with significant pasture and grazing land. These enterprises require high-capacity, heavy-duty machinery (such as self-propelled forage harvesters and large square balers) to process thousands of acres efficiently within compressed time frames, maximizing feed quality and minimizing labor costs. These large farms typically prioritize sophisticated technology integration, including telematics and precision sensors, focusing on maximizing nutrient preservation in the harvested feed, which directly impacts livestock productivity and overall operational profitability. Purchasing decisions are often highly technical and driven by total cost of ownership (TCO) analysis and fuel efficiency metrics.

Another significant customer base includes contract farming operators and custom harvesting service providers. These businesses invest heavily in top-of-the-line equipment that can withstand rigorous, continuous use across multiple client farms. Their business model relies on maximizing operational uptime and covering extensive geographical areas, making durability, reliability, and fast field speed paramount purchasing criteria. Contract farmers are crucial buyers because they often serve smaller and medium-sized farms that cannot justify the capital outlay for specialized, large equipment, providing an essential service that democratizes access to advanced harvesting technology across the agricultural landscape.

Furthermore, medium-sized specialized livestock operations, including sheep and goat farms, also represent a consistent market segment, generally requiring smaller, more maneuverable, and less complex machinery such as mid-sized round balers and tractor-mounted mowers. Government-owned agricultural research facilities and educational institutions also constitute niche buyers, requiring equipment for experimental purposes and training future agricultural professionals. Geographically, emerging economies seeing rapid growth in subsidized smallholder farming groups, particularly in Asia, are increasingly becoming potential customers for entry-level, durable, and easily maintainable machinery, signifying diversification in the potential customer profile globally.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.8 Billion |

| Market Forecast in 2033 | USD 9.0 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Deere & Company, CNH Industrial N.V., AGCO Corporation, Kubota Corporation, Krone Group, PÖTTINGER Landtechnik GmbH, CLAAS KGaA mbH, Vermeer Corporation, Lely Holding S.à r.l., Fendt (AGCO), Vicon (Kubota), New Holland Agriculture (CNH), John Deere (Deere & Company), Massey Ferguson (AGCO), Mahindra & Mahindra Ltd., SAME DEUTZ-FAHR Group, Jiangsu World Group Co., Ltd., ZETOR TRACTORS a.s., Buhler Industries Inc., Sitrex S.p.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hay and Forage Equipment Market Key Technology Landscape

The Hay and Forage Equipment Market is rapidly adopting sophisticated technological advancements focused on optimizing yield quality and operational efficiency. The primary technological shift involves integrating advanced sensors and IoT connectivity across the entire equipment range. Modern balers, for instance, utilize precise moisture sensors and weight monitoring systems to ensure optimal feed preservation and accurate yield documentation, critical for managing storage logistics and calculating return on investment. Furthermore, telematics is becoming standard, enabling real-time remote monitoring of equipment performance, fuel consumption, and geographical location, facilitating preventative maintenance and efficient fleet management, thereby minimizing unexpected downtime during intensive harvest periods which is crucial for profitability.

Precision agriculture tools, including GPS-guided steering and automated headland turning, are foundational to new generation forage harvesters, maximizing field coverage while minimizing fuel waste and operator fatigue. Variable Rate Technology (VRT) is being applied to manure spreaders and fertilizer applicators utilized within the forage lifecycle, ensuring inputs are delivered only where necessary based on detailed soil and crop data maps, leading to enhanced sustainability and reduced input costs. The development of self-propelled machinery with higher horsepower (HP) ratings and wider operating widths allows farmers to cover larger fields faster, improving the economics of high-capacity farming operations that dominate North America and Europe.

Moreover, the focus on sustainable farming practices has spurred innovation in mechanical weed control and minimum-tillage forage establishment technologies, reducing reliance on chemical inputs. Manufacturers are also heavily investing in automation and robotics. Although full autonomy is still emerging, semi-autonomous features, such as automatic crop flow regulation in forage harvesters, are common, optimizing the load on the engine and improving overall chopping consistency. Future technological developments are anticipated to center on enhanced electrification of smaller implements and further integration of AI for predictive operational decision-making, moving towards highly intelligent and interconnected farm ecosystems that prioritize resource conservation and maximized yield nutritional value, ensuring compliance with increasingly stringent global food safety standards.

Regional Highlights

- North America: This region holds a significant share of the market, characterized by large farm sizes, high labor costs, and rapid adoption of high-horsepower, sophisticated equipment. Farmers here prioritize precision agriculture integration, demanding machinery with advanced telematics, real-time sensing capabilities, and automated steering to maximize output efficiency across massive landholdings. The continuous need for replacement cycles and the strong presence of major OEMs contribute significantly to the stable yet technologically advanced market growth of the United States and Canada. Investment is focused heavily on large square balers and self-propelled forage harvesters.

- Europe: Europe is a mature and highly competitive market driven by stringent environmental regulations and a focus on sustainability. European farmers often invest in durable, highly efficient, and low-emissions equipment, favoring advanced mower conditioners and robust round balers suitable for varying terrain and moderate farm sizes prevalent in Western Europe. Eastern European countries, however, are experiencing faster mechanization rates, boosting demand for mid-range equipment. Technological innovation here often centers on improving forage quality through gentle crop handling and highly efficient power transmission systems, adhering to strict EU agricultural policy frameworks.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by rising livestock populations, dietary shifts favoring dairy and meat products, and government subsidies promoting agricultural modernization, particularly in China and India. The market here is segmented, with demand in established markets like Australia focusing on high-capacity machinery, while emerging economies prioritize small-to-medium-sized, durable, and affordable tractor-mounted implements suitable for smaller, fragmented landholdings. The key driver is the transition from manual harvesting practices to mechanized processes to meet escalating domestic demand.

- Latin America (LATAM): Growth in Latin America is robust, primarily driven by the expansion of beef and dairy export markets, especially in Brazil and Argentina. This necessitates substantial investment in high-capacity equipment capable of handling massive pasturelands and producing large volumes of quality feed for expansive cattle operations. The market is increasingly adopting imported sophisticated machinery, though local manufacturing and assembly are gaining traction. Favorable weather patterns generally allow for multiple cuts per year, driving consistent demand for durable, heavy-duty harvesting machinery and specialized storage solutions required for large-scale operations.

- Middle East and Africa (MEA): This region exhibits mixed growth potential. The Middle East faces challenges due to water scarcity and limited suitable land, driving demand for specialized, efficient irrigation and forage conservation equipment. In Africa, particularly South Africa and localized high-growth agricultural zones, government initiatives and foreign direct investment are promoting mechanization, primarily focusing on affordable and rugged tractor-mounted equipment. Market penetration is currently low but offers significant long-term opportunities for manufacturers focused on simple, robust, and easily maintainable solutions tailored for challenging operational environments and limited infrastructure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hay and Forage Equipment Market.- Deere & Company

- CNH Industrial N.V.

- AGCO Corporation

- Kubota Corporation

- Krone Group

- PÖTTINGER Landtechnik GmbH

- CLAAS KGaA mbH

- Vermeer Corporation

- Lely Holding S.à r.l.

- Fendt (AGCO)

- Vicon (Kubota)

- New Holland Agriculture (CNH Industrial N.V.)

- John Deere (Deere & Company)

- Massey Ferguson (AGCO Corporation)

- Mahindra & Mahindra Ltd.

- SAME DEUTZ-FAHR Group

- Jiangsu World Group Co., Ltd.

- ZETOR TRACTORS a.s.

- Buhler Industries Inc.

- Sitrex S.p.A.

Frequently Asked Questions

Analyze common user questions about the Hay and Forage Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the current growth of the Hay and Forage Equipment Market?

Market growth is primarily driven by the escalating global demand for animal protein, necessitating high-quality livestock feed, coupled with the increasing adoption of precision agriculture technologies (IoT and AI) that enhance harvesting efficiency, minimize labor costs, and ensure optimal nutrient retention in the forage product.

Which product segment holds the largest share in the Hay and Forage Equipment Market?

The Balers segment, particularly the high-capacity large square balers used in commercial operations, typically holds the largest market share due to the indispensable requirement for compacting hay and forage into transportable and storable units, vital for supply chain logistics and feed preservation.

How is precision agriculture impacting hay and forage equipment design?

Precision agriculture mandates the integration of advanced features such as real-time moisture sensors, GPS guidance for automated steering, and telematics for remote diagnostics and predictive maintenance, enabling optimized field operation and improved feed quality documentation necessary for modern farming compliance and efficiency.

What major challenges restrict market expansion in emerging regions like APAC?

Key challenges in the Asia Pacific region include the high initial capital cost of sophisticated equipment, often prohibitive for smallholder farmers, fragmented land ownership patterns requiring smaller, specialized machinery, and limited access to institutional credit and robust service and maintenance infrastructure.

What is the projected Compound Annual Growth Rate (CAGR) for this market between 2026 and 2033?

The Hay and Forage Equipment Market is projected to experience a stable growth trajectory, achieving a Compound Annual Growth Rate (CAGR) of 6.5% during the forecast period from 2026 through 2033, driven largely by global mechanization trends and technological innovation aimed at boosting agricultural productivity.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager