Hay and Forage Rakes Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433858 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Hay and Forage Rakes Market Size

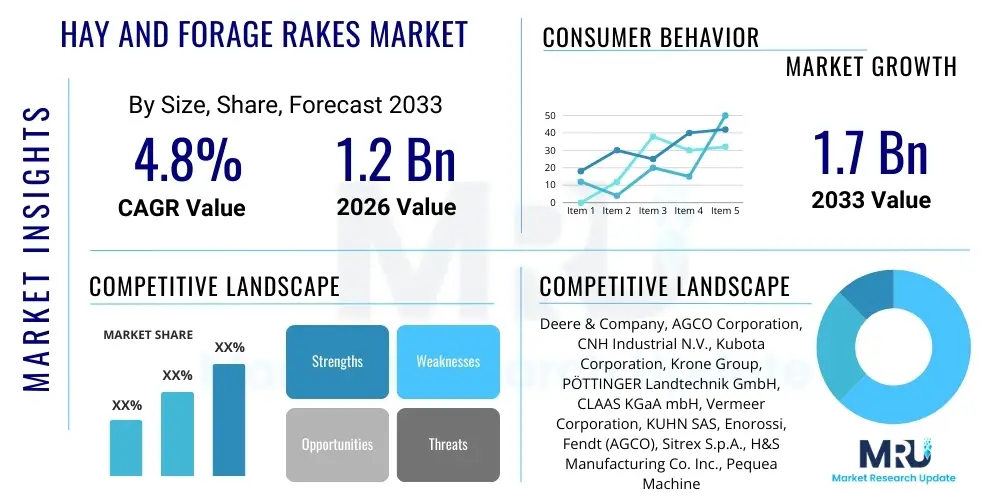

The Hay and Forage Rakes Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 1.7 Billion by the end of the forecast period in 2033.

Hay and Forage Rakes Market introduction

The Hay and Forage Rakes Market encompasses the manufacturing, distribution, and sale of agricultural machinery used primarily for gathering cut hay or forage crops into windrows. This machinery is critical in the haymaking process, preparing the material for baling or chopping by ensuring uniform drying and efficient collection. Modern hay and forage rakes vary widely in size, mechanism (wheel rakes, parallel-bar rakes, rotary rakes), and technological complexity, catering to operations ranging from small family farms to large commercial agricultural enterprises. The fundamental purpose is to minimize contamination and maximize the yield of high-quality feed, thereby enhancing livestock nutrition and farm profitability.

The core drivers of this market revolve around the global necessity for efficient agricultural production and the increasing adoption of mechanized farming techniques in developing economies. As global populations rise, the demand for high-quality meat and dairy products escalates, necessitating larger, more efficient hay production cycles. Furthermore, labor shortages in the agricultural sector are compelling farmers to invest in automated and high-capacity equipment, such as advanced rotary rakes with hydraulic control and precision guidance systems. The shift towards sustainable farming practices also influences market dynamics, with manufacturers focusing on rakes designed to minimize soil disturbance and maximize forage nutritional retention.

Major applications of hay and forage rakes include the preparation of alfalfa, timothy, clover, and various grass hays. The benefits derived from utilizing specialized rakes include reduced field time, lower operational costs, and superior hay quality due to gentler handling compared to older, less efficient methods. These driving factors, combined with continuous advancements in material science leading to more durable and lighter equipment, underpin the stable and moderate growth trajectory anticipated for the market through the forecast period.

Hay and Forage Rakes Market Executive Summary

The Hay and Forage Rakes Market is experiencing robust growth driven by favorable business trends focused on precision agriculture integration and equipment digitalization. Manufacturers are shifting towards offering smarter machinery that incorporates sensor technology for windrow monitoring and optimal moisture management. Business models are increasingly supported by aftermarket services, including spare parts and predictive maintenance agreements, boosting revenue stability. Regionally, North America and Europe maintain dominance due to high levels of agricultural mechanization, while the Asia Pacific (APAC) region, specifically India and China, is emerging as a significant growth hub, fueled by government subsidies promoting farm modernization and increasing the adoption rate of mid-sized farm machinery.

Segment trends indicate that the Rotary Rakes segment holds the largest market share due to their ability to handle delicate crops gently, reducing leaf loss and improving overall feed quality. However, the Wheel Rakes segment is expected to show the highest growth in emerging markets due to their simplicity, lower maintenance requirements, and relatively lower initial investment cost. Furthermore, in terms of ownership type, the individual farm segment remains the primary end-user, though the commercial farming and equipment rental services segment is expanding rapidly, providing smaller farmers access to high-end machinery without the large capital outlay associated with direct purchasing.

Overall market performance is underpinned by the constant need for technological upgrades to handle diverse crop types and weather conditions efficiently. Key players are focusing on mergers and acquisitions to expand their geographical footprint and diversify their product portfolios, especially integrating advanced hydraulics and robust materials to enhance equipment lifespan. The market outlook remains positive, conditional on stable agricultural commodity prices and continued government support for farm mechanization initiatives globally, positioning the industry for steady revenue accretion.

AI Impact Analysis on Hay and Forage Rakes Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Hay and Forage Rakes Market often center on how automation can improve forage quality, questions about the feasibility of autonomous raking operations, and concerns regarding the high cost of integrating such advanced systems. Users are seeking clarity on whether AI-driven systems can dynamically adjust raking parameters (such as height and speed) based on real-time field data, optimizing windrow density and reducing crop contamination. There is significant interest in predictive maintenance capabilities, utilizing AI to monitor equipment wear and prevent costly downtime during critical harvest periods. Furthermore, farmers want to understand the data generated by these smart systems—how it can be used for yield mapping and overall farm management efficiency.

The introduction of AI and associated technologies, such as machine learning and computer vision, is beginning to fundamentally shift the operational paradigm of hay and forage raking. While fully autonomous rakes are still in nascent stages, AI is currently deployed primarily in optimizing operational efficiency and enhancing output quality. Machine learning algorithms analyze sensor data, including crop density, moisture levels, and terrain topography, allowing the rake's control system to make immediate, precise adjustments. This ensures that the crop is handled minimally and gently, significantly reducing shatter losses and preserving the nutritional integrity of the forage—a critical factor for high-value hay production. This advanced control minimizes the variability traditionally associated with manual or mechanically simplistic raking processes.

This integration enhances the overall productivity of the equipment, moving it beyond a mere mechanical tool into a precision farming instrument. AI facilitates better fleet management, allowing large commercial operations to coordinate multiple pieces of equipment—tractors, rakes, balers—in real-time for seamless operation. Despite the high initial investment hurdle, the long-term benefits in fuel savings, reduced labor dependency, and substantially improved hay quality are driving early adoption among large-scale producers. Future developments are anticipated to focus on standardized interfaces and reduced system complexity to broaden AI accessibility to mid-sized farming operations.

- AI-enabled predictive maintenance forecasts component failure, minimizing unexpected operational downtime during peak seasons.

- Computer vision systems utilize AI to identify foreign objects (rocks, debris) and automatically lift the rake tines, preventing equipment damage and forage contamination.

- Machine learning algorithms optimize raking speed and height dynamically based on real-time crop moisture content and biomass density, enhancing windrow uniformity.

- Autonomous raking capabilities, guided by GPS and sensor fusion, reduce the reliance on skilled human operators, addressing agricultural labor shortages.

- Data integration with farm management software provides farmers detailed insights into field efficiency and nutrient preservation metrics.

DRO & Impact Forces Of Hay and Forage Rakes Market

The Hay and Forage Rakes Market is influenced by a powerful combination of driving factors, restraints, and strategic opportunities that collectively shape its growth trajectory. Key drivers include the escalating global demand for high-quality animal feed, necessitating faster and gentler forage handling, and the relentless pressure on farms to increase operational efficiency through comprehensive mechanization. Technological evolution, particularly in hydraulic systems, material sciences, and digital integration, also acts as a primary driving force, enabling the production of durable and smarter raking equipment. These positive forces are currently exerting a strong upward impact on market valuation.

Conversely, significant restraints temper the market's explosive growth potential. The most prominent constraint is the high initial capital investment required for purchasing modern, large-capacity hay rakes, especially for smaller farmers in emerging economies where access to credit might be limited. Furthermore, market vulnerability to fluctuating agricultural commodity prices (which directly affect farm income and subsequent equipment purchasing decisions) and dependency on weather patterns pose persistent challenges. The need for specialized maintenance training for sophisticated electronic and hydraulic rakes also acts as a bottleneck in regions lacking adequate technical support infrastructure.

Opportunities for growth are abundant, focusing primarily on geographical expansion into untapped markets such as Southeast Asia and Eastern Europe, where mechanization levels are comparatively low but rapidly improving. Strategic opportunities also lie in the development of modular and multipurpose raking systems adaptable to diverse cropping practices and farm sizes, along with focusing on the burgeoning market for specialized equipment rental and leasing services. Successfully leveraging these opportunities, particularly through technological innovation targeted at reducing operational costs, will determine the long-term success of market players.

Segmentation Analysis

The Hay and Forage Rakes Market is comprehensively segmented based on product type, operation mechanism, application, and distribution channel, providing a granular view of market dynamics and consumer preferences across various agricultural sectors. Product differentiation, especially between traditional parallel-bar rakes and modern rotary rakes, significantly influences purchasing decisions, dictated largely by farm size and the desired quality of forage output. Understanding these segment-specific trends is crucial for manufacturers to tailor their R&D investments and marketing strategies, ensuring that equipment meets the stringent requirements of modern farming, from small-scale dairy operations to large, commercial beef production enterprises requiring vast quantities of consistently high-quality feed.

The operational mechanism segmentation highlights the ongoing technological migration within the industry. While wheel rakes remain popular for their cost-effectiveness and robustness, the shift towards hydraulic-driven rotary and merger rakes underscores the demand for precision, reduced leaf shatter, and higher working widths, especially among large-scale mechanized farms in North America and Western Europe. Application-based segmentation confirms that hay harvesting remains the predominant usage, but the increasing requirement for silage and dedicated forage collection introduces specialized machinery needs, leading to market specialization within the broader category. The analysis confirms that investments are increasingly flowing towards segments that promise enhanced efficiency and superior crop preservation.

- By Product Type:

- Rotary Rakes

- Wheel Rakes

- Parallel-Bar Rakes (Basket Rakes)

- Merge Rakes (Belt Rakes/Tine Rakes)

- By Operation Mechanism:

- Pull-Type Rakes

- Mounted Rakes

- By Working Width:

- Less than 6 meters

- 6 to 10 meters

- More than 10 meters

- By Application:

- Hay Harvesting

- Silage Preparation

- Forage Crops

- By Sales Channel:

- Original Equipment Manufacturers (OEMs)

- Aftermarket

Value Chain Analysis For Hay and Forage Rakes Market

The value chain for the Hay and Forage Rakes Market begins with the upstream activities centered on the procurement and processing of raw materials, primarily specialized steel alloys, high-grade plastics, and complex hydraulic components. Suppliers of these materials wield moderate bargaining power, especially those providing proprietary wear-resistant steel necessary for tines and structural frames. Manufacturers rely heavily on efficient logistics and stringent quality control during the fabrication and assembly stages, often involving precision machining and robotic welding, to ensure the durability and reliability of the final product under harsh field conditions. Innovation at this stage focuses on weight reduction without compromising strength.

Downstream activities involve the distribution, sales, and comprehensive after-sales support networks. The distribution channel is predominantly characterized by a mix of direct sales to large commercial operations and reliance on extensive dealer networks serving individual and smaller farms. Dealers play a crucial role, providing necessary localized knowledge, financing options, and immediate maintenance services. The increasing complexity of modern rakes necessitates a robust after-sales framework, including certified technicians, prompt availability of original spare parts, and digital support services. The competitive advantage often shifts from the initial sale price to the total cost of ownership, heavily influenced by maintenance and parts availability.

Direct sales are favored for high-volume purchases or highly specialized equipment, establishing direct relationships between the manufacturer and the large farmer. However, the majority of the market transactions flow through indirect channels—authorized dealerships and distributors—due to the requirement for localized support and inventory management. E-commerce platforms are gaining traction, primarily for aftermarket parts and smaller, less complex components, but the sale of the full, large-scale machinery unit remains highly dependent on the physical demonstration and consultative selling provided by dealer networks. Effective inventory management across the distribution chain is vital to meet the seasonal demands inherent in agricultural equipment.

Hay and Forage Rakes Market Potential Customers

The primary end-users and buyers of hay and forage rakes are diverse, encompassing a wide spectrum of agricultural entities globally. The largest customer segment comprises individual farmers and agricultural cooperatives specializing in livestock feed production, including dairy, beef cattle, and equine operations. These customers prioritize equipment reliability, ease of maintenance, and the ability to produce high-quality forage with minimal nutrient loss, directly impacting their animal performance and profitability. Small to medium-sized farms often gravitate towards robust and simpler wheel rakes or smaller parallel-bar rakes that match their lower horsepower tractor capabilities.

A rapidly expanding segment involves large commercial farms and specialized custom harvesting operations. These clients require high-capacity, wide working width rotary or merger rakes, often incorporating advanced features like hydraulic steering, GPS compatibility, and integrated monitoring systems. For this high-end segment, the purchasing decision is driven by maximizing throughput, minimizing operational labor, and achieving absolute precision in windrow formation. These operations often treat equipment as a capital investment subject to rigorous depreciation and return-on-investment calculations, necessitating equipment with proven longevity and high resale value.

Furthermore, equipment rental and leasing companies constitute an increasingly important customer base. They purchase large fleets of diverse rakes to service the needs of small farmers who cannot afford outright ownership. Government agricultural development bodies, particularly in developing nations, also act as significant institutional buyers, procuring equipment through subsidized schemes aimed at modernizing domestic farming practices and boosting food security. Successful engagement with potential customers requires manufacturers to offer tailored financial solutions, reliable servicing, and clear demonstrations of the equipment's impact on forage quality and operational costs.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 1.7 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Deere & Company, AGCO Corporation, CNH Industrial N.V., Kubota Corporation, Krone Group, PÖTTINGER Landtechnik GmbH, CLAAS KGaA mbH, Vermeer Corporation, KUHN SAS, Enorossi, Fendt (AGCO), Sitrex S.p.A., H&S Manufacturing Co. Inc., Pequea Machine, ROC S.R.L. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hay and Forage Rakes Market Key Technology Landscape

The technological landscape of the Hay and Forage Rakes Market is defined by the ongoing transition towards precision farming methodologies, emphasizing higher efficiency, reduced crop damage, and enhanced operator comfort. A critical development involves the advancement of hydraulic systems, which now enable precise control over tines and working width directly from the tractor cab, allowing for on-the-go adjustments based on field conditions and crop volume. Furthermore, the integration of ISOBUS communication standards is prevalent, allowing universal compatibility between rakes from different manufacturers and various tractor models, streamlining farm operations and reducing the complexity of equipment integration for the end-user. This standardization is crucial for encouraging the adoption of sophisticated monitoring systems.

Material innovation is another vital technological area. Manufacturers are utilizing higher-tensile steel and specialized composites to reduce the overall weight of the equipment, decreasing the power requirements (and thus fuel consumption) of the tractor while maintaining necessary structural rigidity and durability. The design evolution of rake tines, particularly in rotary and merger rakes, focuses on reducing ground contact and lifting the forage gently, minimizing soil contamination (ash content) and leaf shatter. Merger rakes, which utilize belt conveyor systems instead of traditional tines, represent a significant technological leap for high-value forage, as they create perfectly shaped windrows without disrupting the crop structure, maximizing bale quality and density.

The emerging technological frontier includes smart raking systems incorporating GPS guidance and sensor arrays. GPS mapping assists in optimizing field passes, reducing overlap and improving fuel efficiency. Sensors, often coupled with artificial intelligence, monitor parameters such as ground pressure and crop volume in real-time, allowing automated adjustments to maintain a consistent windrow size irrespective of varying crop conditions across the field. This level of automation is essential for maximizing the efficiency of subsequent processes like baling or chopping, securing the market's trajectory towards fully integrated, data-driven agricultural equipment ecosystems.

Regional Highlights

North America: North America, led by the United States and Canada, represents the most mature and technologically advanced market for hay and forage rakes. This region exhibits high adoption rates of large-capacity, high-throughput machinery, particularly large rotary and merger rakes, driven by extensive commercial farming operations and high labor costs. The demand here is focused on precision agriculture features, ISOBUS compatibility, and robust durability to handle vast acreage efficiently. Investment is heavily directed towards replacement machinery and technological upgrades rather than basic mechanization expansion, ensuring sustained demand for premium equipment.

Europe: Europe holds a substantial market share, characterized by stringent regulations regarding forage quality and environmental impact. Western European countries like Germany, France, and Italy show a strong preference for highly efficient and sophisticated rotary rakes that minimize soil contamination and preserve nutrient content, catering to specialized dairy and beef markets. Eastern European nations are increasingly modernizing their agricultural base, driving demand for both new and refurbished equipment. The region is a key hub for manufacturing innovation, with strong emphasis on energy efficiency and reduced operational noise levels, often influenced by environmental policies.

Asia Pacific (APAC): The APAC region is projected to be the fastest-growing market, primarily fueled by rapid agricultural modernization in India, China, and Southeast Asian nations. This growth is strongly supported by governmental initiatives offering subsidies for farm equipment purchases and the gradual consolidation of fragmented landholdings. While the initial demand centers around simpler, more affordable wheel rakes (due to smaller average farm size and lower purchasing power), the increasing presence of large commercial farming enterprises is stimulating interest in mid-range rotary rakes. The region offers immense untapped potential for manufacturers willing to adapt equipment to local crop types and small-scale operational constraints.

Latin America: Latin America, particularly Brazil and Argentina, demonstrates strong demand due to its massive beef production industry and associated hay and forage requirements. The market is defined by cyclical purchases tied to commodity prices. Demand leans towards rugged, high-performance machinery capable of operating reliably across varied climatic conditions and large, uneven terrain. The adoption of advanced technology is slightly slower compared to North America and Europe but is accelerating, driven by the need to optimize resource utilization and compete in global meat and feed markets. Local manufacturing and assembly partnerships are key strategies for market entry.

Middle East and Africa (MEA): The MEA region remains a niche but developing market, characterized by challenging climate conditions and reliance on imported machinery. Demand is concentrated in regions with established irrigation infrastructure, such as parts of Saudi Arabia, Turkey, and South Africa. Growth is slow but steady, driven by governmental focus on achieving higher levels of food self-sufficiency. Manufacturers typically need to provide robust, heavy-duty equipment capable of handling dry, tough forage and extreme heat, often requiring tailored product specifications.

- North America: Leader in high-capacity merger and rotary rake adoption; focus on precision agriculture and technological replacement.

- Europe: Dominant market for environmentally compliant, quality-preserving rotary rakes; strong manufacturing base and innovation hub.

- Asia Pacific (APAC): Fastest-growing region driven by farm mechanization subsidies and increasing demand for mid-sized equipment in China and India.

- Latin America: Demand tied to large-scale beef and dairy industries; preference for robust, durable rakes suited for challenging terrains.

- Middle East and Africa (MEA): Niche market focused on addressing food security; slow adoption of specialized, heavy-duty raking technology.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hay and Forage Rakes Market.- Deere & Company

- AGCO Corporation

- CNH Industrial N.V.

- Kubota Corporation

- Krone Group

- PÖTTINGER Landtechnik GmbH

- CLAAS KGaA mbH

- Vermeer Corporation

- KUHN SAS

- Enorossi

- Fendt (AGCO)

- Sitrex S.p.A.

- H&S Manufacturing Co. Inc.

- Pequea Machine

- ROC S.R.L.

Frequently Asked Questions

Analyze common user questions about the Hay and Forage Rakes market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Hay and Forage Rakes Market?

The Hay and Forage Rakes Market is projected to exhibit a Compound Annual Growth Rate (CAGR) of 4.8% during the forecast period spanning 2026 to 2033, driven primarily by increasing global farm mechanization.

Which type of hay rake is most popular for large commercial farming operations?

Rotary rakes and specialized merger rakes are highly favored by large commercial operations due to their ability to provide high working widths, minimize crop damage (leaf shatter), and produce uniform windrows essential for high-density baling.

How does AI technology impact the efficiency of modern hay rakes?

AI technology enhances efficiency by integrating real-time sensor data (moisture, crop density) to dynamically adjust raking parameters, optimizing windrow quality, reducing soil contamination, and enabling predictive maintenance to minimize operational downtime.

Which geographical region is expected to demonstrate the highest growth in hay rake adoption?

The Asia Pacific (APAC) region is anticipated to show the highest growth rate, primarily attributed to extensive government subsidies promoting agricultural modernization and the shift towards higher-efficiency farming practices in countries like India and China.

What is the main restraining factor affecting the market growth?

The primary restraining factor is the high initial capital investment required for purchasing advanced, large-capacity hay and forage rakes, which limits adoption, especially among small and medium-sized farms in developing markets.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager