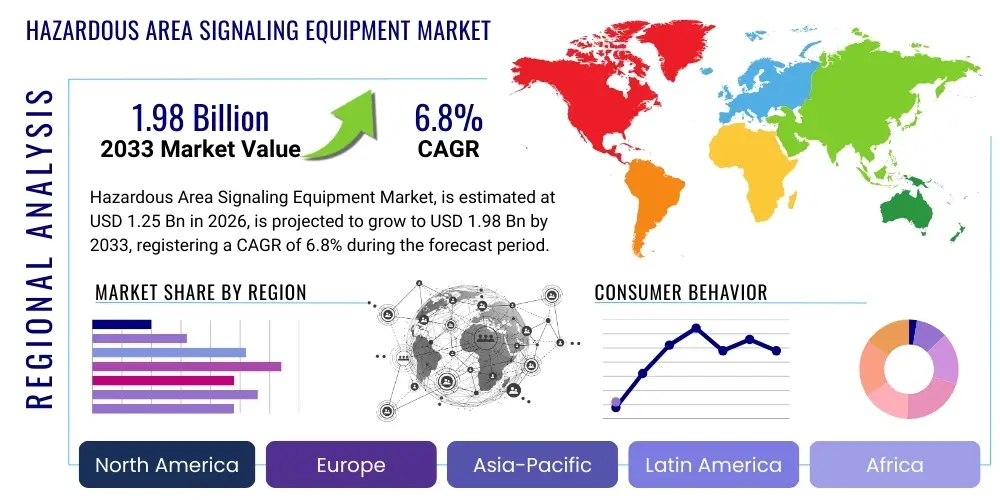

Hazardous Area Signaling Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438278 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Hazardous Area Signaling Equipment Market Size

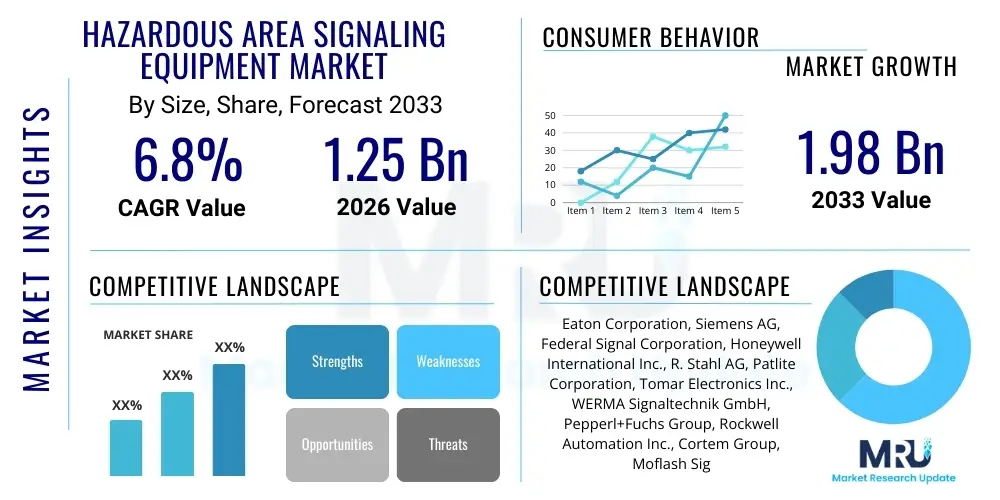

The Hazardous Area Signaling Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $1.25 Billion in 2026 and is projected to reach $1.98 Billion by the end of the forecast period in 2033. This consistent growth trajectory is primarily driven by increasingly stringent global industrial safety regulations, mandating the use of certified equipment in environments prone to explosion risks due to flammable gases, vapors, mists, or combustible dusts. The mandatory periodic replacement and upgrade cycles for existing installed equipment across legacy industries, such as Oil & Gas and Chemical Processing, further contribute significantly to market expansion throughout the forecast period.

Hazardous Area Signaling Equipment Market introduction

The Hazardous Area Signaling Equipment Market encompasses devices designed to provide audible, visual, or combined alarms and notifications in environments classified as potentially explosive (Ex zones) according to international standards such as ATEX (Europe) and IECEx (Global). These environments are typically found in heavy industrial sectors where the presence of volatile substances necessitates specialized, explosion-proof, and intrinsically safe equipment to prevent ignition. The primary objective of this equipment is to alert personnel to potential dangers, operational status changes, or emergency situations, ensuring prompt evacuation or corrective action, thereby protecting human life and assets.

Product descriptions within this segment include a wide array of devices such as explosion-proof beacons, sounders, alarm panels, pushbuttons, and communication interfaces, all certified to operate safely under specified hazardous conditions (Zone 0, 1, 2, or 20, 21, 22). Major applications span across critical infrastructure, including offshore oil platforms, petrochemical refineries, chemical storage facilities, pharmaceutical manufacturing plants, and grain processing facilities. The key benefits derived from utilizing this specialized equipment include enhanced safety compliance, substantial reduction in incident rates, and guaranteed operational continuity in high-risk settings. Primary driving factors sustaining market demand include global infrastructure expansion in the energy sector, stringent enforcement of occupational safety laws by organizations like OSHA and regional equivalents, and continuous technological innovation focusing on improved reliability and connectivity.

Hazardous Area Signaling Equipment Market Executive Summary

The market exhibits robust growth underpinned by strong business trends centered on digitalization and compliance complexity. Manufacturers are increasingly focusing on developing signaling equipment compliant with the highest Safety Integrity Level (SIL) standards, incorporating diagnostic functionalities, and integrating wireless communication capabilities to facilitate remote monitoring and maintenance in inaccessible or dangerous zones. Regional trends highlight the Asia Pacific (APAC) region as the fastest-growing market, fueled by massive industrialization projects, particularly in chemical processing and liquefied natural gas (LNG) infrastructure in nations like China and India, where regulatory frameworks are rapidly tightening. Conversely, established markets like North America and Europe prioritize the replacement of older, analog systems with high-efficiency, digitally integrated solutions that minimize energy consumption and maintenance overhead. Segment trends indicate a rising preference for combined visual and audible signaling devices, often utilizing high-intensity LED technology and multi-tone sounders, optimized for specific industrial noise and visibility conditions, ensuring maximum effectiveness during emergencies. Furthermore, the oil and gas sector remains the dominant segment, though diversification into food processing (handling combustible dust) and marine applications presents significant new avenues for revenue generation.

AI Impact Analysis on Hazardous Area Signaling Equipment Market

Common user questions regarding AI's impact on hazardous area signaling equipment center around four main themes: enhanced predictive maintenance capabilities, reduction of false alarms, optimization of response protocols, and the integration of smart sensors into traditional alarm infrastructure. Users are keen to understand how machine learning algorithms can analyze data streams (e.g., vibration, temperature, gas concentration) from surrounding industrial equipment to predict failure events before they occur, thus moving signaling from a reactive emergency measure to a proactive diagnostic tool. Furthermore, a significant concern is how AI can differentiate between genuine emergency conditions and routine operational noise or environmental disturbances, thereby dramatically reducing the frequency of costly and disruptive false alarms, which often lead to complacency among site personnel.

The integration of artificial intelligence and machine learning is fundamentally transforming the function and effectiveness of hazardous area signaling systems. AI systems, coupled with IoT sensors, can analyze environmental data in real-time, cross-referencing gas leak rates, pressure fluctuations, and human activity patterns against established safety thresholds. This proactive analysis allows signaling equipment to be activated intelligently, not just upon a threshold breach, but based on a high probability of an impending catastrophic event. For example, in petrochemical facilities, AI can correlate data from multiple points—such as localized equipment overheating and simultaneous minor gas detections—to trigger a Level 2 alert (preparation) rather than waiting for the traditional Level 3 breach (immediate evacuation), significantly improving response time and safety outcomes. This shift moves the equipment from merely a notification device to an essential component of the plant’s integrated safety management system, driving demand for technologically sophisticated, network-enabled signaling units.

- AI integration enables predictive maintenance, forecasting potential equipment failures based on operational data analysis, minimizing system downtime.

- Machine learning algorithms significantly reduce false alarm occurrences by analyzing complex environmental patterns and validating alerts across multiple sensor inputs.

- AI-driven optimization allows signaling systems to tailor alarms (tone, frequency, intensity) based on real-time environmental noise levels and personnel location within the hazardous zone.

- Increased demand for smart, network-connected signaling devices that can feed diagnostic data into central AI safety platforms (Industrial Internet of Things - IIoT).

- AI facilitates the seamless integration of signaling systems with automated emergency shutdown (ESD) systems, ensuring coordinated, instantaneous response to critical events.

DRO & Impact Forces Of Hazardous Area Signaling Equipment Market

The Hazardous Area Signaling Equipment Market is powerfully influenced by a combination of regulatory impetus (Drivers), high certification costs (Restraints), strategic infrastructure upgrades (Opportunities), and the overarching need for loss prevention (Impact Forces). The dominant driver is the perpetual evolution and strict enforcement of international safety standards, compelling industrial operators to adopt certified, explosion-proof signaling solutions regardless of capital expenditure concerns. Restraints primarily involve the substantial costs associated with obtaining and maintaining international certifications (e.g., ATEX, UL, CSA, IECEx) for specialized equipment, alongside the lengthy product development cycles required to meet these rigorous standards, potentially limiting rapid technological adoption. Opportunities stem from the increasing global investment in renewable energy infrastructure, such as hydrogen production and advanced battery storage facilities, which also constitute hazardous areas, opening new application verticals beyond traditional fossil fuels. These dynamics are shaped by the fundamental impact force of preventing human casualty and major asset destruction, making signaling equipment a non-negotiable safety investment.

A major driving force is the global focus on asset integrity management and the proactive adoption of safety culture within large corporations. The aftermath of significant industrial incidents, such as refinery explosions or chemical spills, invariably results in the tightening of regional safety mandates, creating immediate compliance demand for high-reliability signaling systems. Furthermore, the replacement market for obsolete, non-compliant, or deteriorating analog equipment in mature economies acts as a steady driver. Conversely, a significant restraint is the technological fragmentation across different regions regarding specific hazardous zone classifications and required compliance methodologies, which necessitates market players to invest heavily in multi-standard product lines, increasing overall manufacturing complexity and final product cost, often posing a challenge for small-to-midsize industrial clients in emerging economies who seek cost-effective solutions.

The convergence of wireless networking technologies and intrinsically safe design presents a robust opportunity. Wireless signaling devices significantly reduce installation costs and complexity compared to traditional hard-wired systems, especially in remote or retrofit installations, enabling easier expansion and scalability of safety coverage within complex industrial footprints. Impact forces are also evident in the insurance industry, which increasingly mandates high-specification safety equipment, including advanced signaling solutions, as a prerequisite for coverage or reduced premiums, thereby creating a powerful external economic incentive for adoption. This symbiotic relationship between safety mandates and financial incentives ensures sustained demand, regardless of short-term economic fluctuations in core industrial sectors.

Segmentation Analysis

The Hazardous Area Signaling Equipment Market is comprehensively segmented based on product type, technology, connectivity, industry vertical, and hazardous zone classification (ATEX/IECEx Zones). This segmentation allows for precise targeting and customization, reflecting the diverse and highly specific operational requirements across different end-use industries. Product types range from simple visual beacons to complex public address and general alarm (PAGA) systems, each designed with unique explosion protection methods, such as flameproof enclosures or intrinsic safety barriers. The increasing sophistication in segment offerings reflects a market maturity driven by the need for site-specific solutions that address unique challenges posed by varying levels of ambient noise, lighting conditions, and specific chemical hazards, ensuring optimal warning delivery during emergencies.

Segmentation by industry vertical is crucial, as the chemical processing sector demands highly corrosive-resistant housings, while the mining sector requires robust, intrinsically safe equipment capable of operating reliably under mechanical stress and exposure to methane or coal dust. Technological segmentation highlights the shift from incandescent/xenon lights to highly efficient LED-based visual signals, offering longevity, reduced power consumption, and improved visibility. The ongoing move towards network-enabled signaling equipment, particularly those utilizing industrial protocols like Modbus or Ethernet/IP, underscores the trend towards centralized monitoring and diagnostics, which enhances system reliability and reduces manual intervention costs across all major application segments.

- Product Type:

- Audible Signals (Horns, Sirens, Buzzers, Bells, Public Address Systems)

- Visual Signals (Beacons, Strobe Lights, Status Lamps, Rotating Lights)

- Combined Signals (Audible and Visual Units)

- Control Devices (Pushbuttons, Pull Stations, Alarm Panels, Interface Modules)

- Technology:

- Xenon Flash Tube Technology

- LED Technology (High Intensity and Low Power)

- Incandescent/Halogen Lamps

- Connectivity:

- Wired Systems (Copper, Fiber Optic)

- Wireless Systems (Mesh Networks, Proprietary Protocols)

- Industry Vertical:

- Oil & Gas (Upstream, Midstream, Downstream)

- Chemical and Petrochemical

- Mining (Coal, Metal, Non-Metal)

- Pharmaceutical and Biotechnology

- Food & Beverage (Grain Handling, Sugar Refining)

- Marine and Offshore

- Energy & Power Generation

- Hazardous Zone Classification:

- Zone 0/20 (Continuous Hazard)

- Zone 1/21 (Likely Hazard)

- Zone 2/22 (Unlikely Hazard)

Value Chain Analysis For Hazardous Area Signaling Equipment Market

The value chain for hazardous area signaling equipment is complex, beginning with the highly specialized procurement of raw materials, moving through stringent manufacturing and certification processes, and culminating in specialized distribution and high-value post-sales services. Upstream analysis involves sourcing robust, specialized materials, including corrosion-resistant aluminum alloys, stainless steel for explosion-proof enclosures, impact-resistant polymers (e.g., polycarbonate), and highly reliable electronic components, such as high-output LEDs and sophisticated microprocessors designed for intrinsically safe circuits. The procurement phase is highly selective due to strict material compatibility requirements with harsh, explosive atmospheres and regulatory obligations related to material traceability and quality control, making partnerships with specialized suppliers essential for maintaining certification integrity.

The core manufacturing stage involves precision engineering to meet explosion protection requirements (Ex d, Ex e, Ex i), which includes pressure containment, specialized sealing techniques, and intrinsic safety design. This stage is followed by mandatory third-party testing and certification (ATEX/IECEx/UL/CSA), a time-consuming and costly step that is critical for market entry. Downstream analysis focuses on specialized distribution channels; unlike conventional industrial components, hazardous area signaling equipment is often sold through highly trained, accredited distributors or specialized engineering procurement and construction (EPC) firms who possess the technical expertise to integrate these systems into complex facility safety architectures. Direct sales are common for large, customized infrastructure projects or governmental contracts, where manufacturers work closely with the end-user or main contractor to design bespoke PAGA or alarm systems.

The distribution channel is typically bifurcated into direct sales to major EPCs and indirect sales through value-added resellers (VARs) and regional distributors. Indirect channels offer localized inventory, technical support, and installation services crucial for retrofit projects and maintenance contracts. Post-sales support, encompassing mandatory recalibration, periodic inspection, and system upgrades, forms a high-margin segment of the value chain, driven by the longevity and critical safety function of the equipment. The strict regulatory environment ensures a continuous service revenue stream, as operators must routinely verify the operational integrity and certification status of all installed signaling devices to remain compliant with local occupational safety standards and international insurance requirements.

Hazardous Area Signaling Equipment Market Potential Customers

The potential customer base for hazardous area signaling equipment is exceptionally broad, spanning any industrial operation where combustible materials (gases, dust, fibers) are present in sufficient concentration to pose an explosion risk. The primary end-users or buyers are typically large corporate entities operating within the heavy industry sectors, specifically those managing continuous process operations. Key purchasing entities include safety managers, procurement departments of Engineering Procurement and Construction (EPC) firms responsible for building new facilities, and maintenance/operations managers overseeing the routine replacement and upgrade cycles of existing plant infrastructure. These buyers prioritize product reliability, adherence to specific regional hazardous zone certifications, and the total cost of ownership, often favoring systems with extended operational lifecycles and minimal maintenance requirements, given the difficulty and danger associated with accessing equipment in live hazardous zones.

The Oil & Gas industry, particularly in upstream drilling and downstream refining operations, represents the largest customer segment due to the inherent flammability of hydrocarbons. Buyers in this sector require signaling equipment capable of withstanding extreme environmental conditions (e.g., high humidity, corrosive salt spray on offshore platforms) while maintaining intrinsic safety and explosion-proof ratings (e.g., NEMA 4X or IP66/67 ratings). Furthermore, the chemical and petrochemical industries are critical customers, demanding highly specific signaling solutions resistant to particular chemical vapors and capable of integration with highly sensitive gas detection systems. These customers frequently engage in long-term contracts with specialized equipment providers to ensure continuity of supply and immediate access to certified replacement parts, minimizing operational downtime associated with safety system failures.

Emerging potential customers include operators of data centers utilizing specialized cooling gases, facilities involved in advanced battery manufacturing where flammable electrolytes are handled, and producers of alternative fuels such as hydrogen and bio-methane. These newer industries are rapidly adopting stringent safety standards, mirroring those in traditional Oil & Gas, driving the demand for state-of-the-art, network-enabled signaling solutions. Institutional buyers, such as government entities managing public utilities, ports, and naval facilities, also represent substantial potential, particularly for specialized marine-certified signaling equipment, where adherence to classification society rules (e.g., DNV, ABS) is paramount, creating distinct purchase criteria compared to land-based industrial clients.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.25 Billion |

| Market Forecast in 2033 | $1.98 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Eaton Corporation, Siemens AG, Federal Signal Corporation, Honeywell International Inc., R. Stahl AG, Patlite Corporation, Tomar Electronics Inc., WERMA Signaltechnik GmbH, Pepperl+Fuchs Group, Rockwell Automation Inc., Cortem Group, Moflash Signalling Ltd., Ex-tech Signalling, BARTEC Group, E2S Warning Signals, Pfannenberg GmbH, Auer Signal GmbH, Intertec Instrumentation, Crydom Co., K&H Anlagenbau GmbH |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hazardous Area Signaling Equipment Market Key Technology Landscape

The technological landscape of hazardous area signaling equipment is rapidly advancing, focusing primarily on achieving higher reliability, reduced power consumption, enhanced connectivity, and superior safety ratings. A critical technological shift involves the widespread adoption of high-intensity Light Emitting Diodes (LEDs) to replace older Xenon and incandescent lamps in visual signaling devices. LED technology offers dramatically extended lifespan (up to 100,000 hours), significantly lower power draw, and instant illumination, which are crucial advantages in environments where maintenance access is difficult and power supply may be constrained. Furthermore, LEDs allow for more versatile signaling patterns and color spectrums, improving message clarity under varying atmospheric conditions, such as dense fog or dust clouds commonly found in hazardous industrial settings.

Another pivotal technological development is the implementation of intrinsically safe wireless communication protocols, allowing signaling devices to be integrated into centralized plant monitoring systems without the requirement for extensive, costly, and complex cabling infrastructure. Wireless mesh networks are being deployed, facilitating reliable data transmission even in facilities with significant physical barriers. These systems often incorporate self-diagnostic capabilities, continuously monitoring the operational status, battery life, and communication health of the signaling unit. Compliance with high Safety Integrity Levels (SIL 2 and SIL 3) is increasingly becoming standard practice, requiring sophisticated electronic redundancy, self-testing features, and robust fault reporting mechanisms built directly into the signaling devices to ensure guaranteed function during a critical safety event, driving innovation in electronic circuit design and software validation.

Moreover, modern signaling equipment is moving toward interoperability with the Industrial Internet of Things (IIoT). This involves incorporating standardized digital interfaces, such as Modbus TCP/IP or industrial Ethernet, allowing real-time data exchange with Safety Instrumented Systems (SIS), Distributed Control Systems (DCS), and Emergency Shutdown (ESD) systems. This advanced connectivity enables the signaling system to receive contextual information from gas detectors, fire sensors, and process control feedback, optimizing alarm procedures based on the severity and location of the incident. This technological convergence ensures that signaling systems are no longer isolated warning components but rather intelligent, networked endpoints within a facility's integrated, digital safety ecosystem, enhancing overall operational intelligence and emergency response effectiveness.

Regional Highlights

The global Hazardous Area Signaling Equipment Market exhibits diverse regional dynamics driven by varying levels of industrial maturity, differing regulatory regimes, and economic growth rates across key geographical areas. North America and Europe represent mature markets characterized by stringent safety regulations (OSHA, ATEX directives, national standards), necessitating mandatory compliance and driving demand for high-end, certified replacement and retrofit systems. These regions prioritize sophisticated, highly reliable solutions incorporating advanced diagnostic features and adhering to the highest SIL ratings, particularly within the established Oil & Gas fields of Texas and the North Sea, and the advanced chemical manufacturing hubs in Germany and the Netherlands.

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate during the forecast period. This growth is directly attributable to rapid industrialization, large-scale capital investments in new petrochemical complexes, LNG terminals, and massive expansion of mining activities across developing economies like China, India, and Southeast Asia. As regulatory enforcement in these nations strengthens and harmonizes with international standards (IECEx), the demand for certified signaling equipment escalates significantly. Furthermore, domestic manufacturing capabilities are increasing in APAC, potentially driving down costs, but international players benefit substantially from the reputation and guaranteed compliance associated with established Western certifications.

The Middle East and Africa (MEA) region, dominated by hydrocarbon extraction and processing, represents a stable and high-value market. Demand here is strongly correlated with capital expenditure in new upstream projects and maintenance cycles within existing, often decades-old, mega-refineries and terminals. Latin America, particularly Brazil and Mexico, presents a growing opportunity, driven by national energy sector reforms and increased foreign investment in mining and heavy industrial sectors, necessitating substantial investments in safety infrastructure. In all emerging regions, the market is characterized by a strong preference for durable equipment that can withstand severe environmental stress (high temperatures, sand, humidity) while meeting global safety compliance benchmarks.

- North America: Market maturity; high demand driven by replacement cycles and adherence to NFPA, UL, and CSA standards; dominance in high-tech solutions incorporating wireless connectivity and diagnostic features.

- Europe: Governed by strict ATEX and national safety directives; emphasis on intrinsically safe (Ex i) and flameproof (Ex d) equipment; strong presence in chemical and pharmaceutical manufacturing.

- Asia Pacific (APAC): Fastest-growing region; driven by rapid industrial expansion, increasing adherence to IECEx standards, and substantial investments in energy infrastructure (LNG, petrochemicals) in China and India.

- Middle East and Africa (MEA): Stable growth linked to large-scale, long-term oil and gas projects; demand for extremely rugged, corrosion-resistant equipment suitable for harsh desert and marine environments.

- Latin America: Emerging market growth fueled by liberalization of energy sectors, growth in mining operations, and regulatory harmonization initiatives, particularly in Brazil and Chile.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hazardous Area Signaling Equipment Market.- Eaton Corporation

- Siemens AG

- Federal Signal Corporation

- Honeywell International Inc.

- R. Stahl AG

- Patlite Corporation

- Tomar Electronics Inc.

- WERMA Signaltechnik GmbH

- Pepperl+Fuchs Group

- Rockwell Automation Inc.

- Cortem Group

- Moflash Signalling Ltd.

- Ex-tech Signalling

- BARTEC Group

- E2S Warning Signals

- Pfannenberg GmbH

- Auer Signal GmbH

- Intertec Instrumentation

- Crydom Co.

- K&H Anlagenbau GmbH

Frequently Asked Questions

Analyze common user questions about the Hazardous Area Signaling Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers for growth in the Hazardous Area Signaling Equipment Market?

The primary growth drivers are increasingly stringent global safety regulations (like ATEX and IECEx), mandatory compliance requirements across high-risk industries (Oil & Gas, Chemical), and the continuous replacement of older, analog equipment with modern, connected, and highly efficient LED and wireless signaling solutions that offer improved reliability and diagnostics.

How is the market segmented based on hazardous area classification?

The market is primarily segmented based on the risk level defined by international standards: Zone 0/20 (continuous hazard), Zone 1/21 (likely hazard), and Zone 2/22 (unlikely hazard). This classification determines the specific explosion protection technique (e.g., flameproof enclosure or intrinsic safety) required for the signaling equipment.

What is the impact of wireless technology on hazardous area signaling?

Wireless technology enables easier and cheaper installation of signaling systems in existing facilities (retrofits), reduces cabling complexity, and facilitates centralized monitoring and diagnostics (IIoT integration). Intrinsically safe wireless devices maintain high safety standards while improving system scalability and reducing maintenance costs in inaccessible areas.

Which geographical region holds the largest market share and which is the fastest growing?

North America and Europe currently hold significant market shares due to established industrial bases and strict regulatory environments. However, the Asia Pacific (APAC) region is projected to be the fastest-growing market, driven by rapid industrial infrastructure development and increasing adoption of mandatory IECEx safety standards.

What criteria must hazardous area signaling equipment meet to ensure safety?

Equipment must meet rigorous international certification standards (ATEX in Europe, IECEx globally, UL/CSA in North America) proving it utilizes appropriate protection methods (such as explosion containment or intrinsic safety) to prevent ignition of flammable atmospheres. High Safety Integrity Levels (SIL) are often required to guarantee operational reliability in critical situations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager