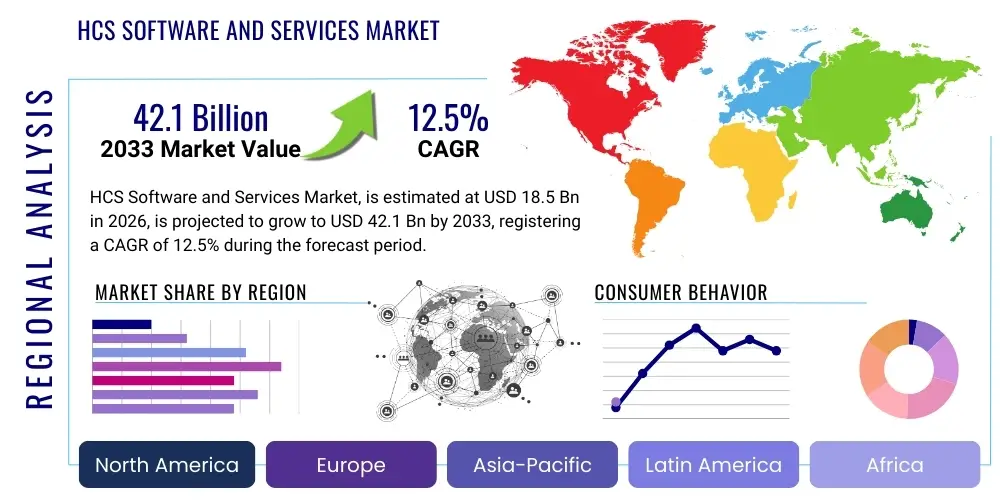

HCS Software and Services Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438086 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

HCS Software and Services Market Size

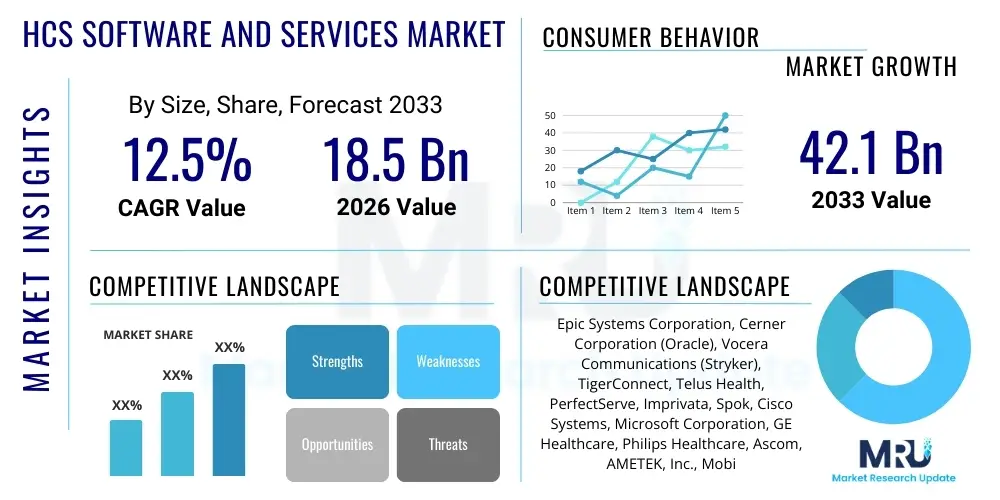

The HCS Software and Services Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 18.5 Billion in 2026 and is projected to reach USD 42.1 Billion by the end of the forecast period in 2033.

HCS Software and Services Market introduction

The Healthcare Communication Systems (HCS) Software and Services Market encompasses a comprehensive suite of digital tools designed to optimize operational efficiency, enhance clinical workflow coordination, and improve patient engagement within the healthcare ecosystem. These systems primarily integrate secure messaging platforms, clinical collaboration software, alarm and alert management tools, patient-centric communication portals, and sophisticated data analytics capabilities. The core objective of HCS solutions is to ensure seamless, real-time information exchange among diverse stakeholders, including physicians, nurses, administrators, and patients, thereby mitigating communication breakdowns that often lead to medical errors or delayed treatment protocols. The demand for these integrated platforms is being fundamentally driven by the escalating need for interoperability across disparate health information technology (HIT) infrastructure, mandated regulatory compliance focusing on patient data security (such as HIPAA and GDPR), and the global shift toward value-based care models that necessitate continuous, accurate performance monitoring.

Products within this market range from enterprise-level clinical collaboration platforms, which provide centralized communication hubs, to specialized mobile applications facilitating secure text messaging and voice-over IP (VoIP) communication within hospital walls. Major applications span critical areas such as care coordination during patient transitions, management of clinical alarms to reduce alert fatigue among staff, telemedicine integration, and robust patient engagement strategies through automated reminders and health education delivery. The tangible benefits realized by adopting advanced HCS solutions include demonstrably faster response times during critical medical events, optimization of resource utilization by reducing manual communication overhead, and significant improvements in overall patient satisfaction scores due to enhanced transparency and access to care teams.

Key driving factors propelling the market forward include the rapid adoption of electronic health records (EHRs) requiring strong communication middleware, the proliferation of Internet of Medical Things (IoMT) devices generating vast amounts of data needing immediate action, and the continuous necessity for enhanced cybersecurity measures in healthcare settings. Furthermore, the global expansion of decentralized healthcare delivery models, encompassing remote patient monitoring (RPM) and home healthcare services, relies heavily on robust HCS platforms to maintain consistent quality of care outside traditional clinical environments. These technological shifts, coupled with demographic pressures requiring more efficient healthcare service delivery for aging populations, solidify the indispensable role of HCS software and services in the modern medical landscape.

HCS Software and Services Market Executive Summary

The global HCS Software and Services Market is currently experiencing a dynamic phase characterized by accelerated digital transformation and strategic consolidation, driven primarily by the urgent need for enhanced clinical decision support and improved cross-departmental communication efficiency. Business trends indicate a pronounced pivot towards cloud-based and Software-as-a-Service (SaaS) deployment models, offering scalability and reduced capital expenditure compared to traditional on-premise solutions. Major vendors are focusing intensely on integrating advanced artificial intelligence (AI) and machine learning (ML) capabilities into their communication platforms, specifically targeting predictive analytics for workflow optimization, automated routing of critical alerts, and intelligent prioritization of communication traffic to combat clinical burnout and enhance operational resilience. Strategic alliances and mergers and acquisitions (M&A) remain prevalent, as larger technology firms seek to acquire specialized communication niche providers to offer comprehensive, end-to-end clinical workflow management suites that span the entire care continuum.

Regional trends highlight North America’s dominance, primarily fueled by stringent regulatory frameworks promoting digital data sharing, high healthcare expenditure, and the early, widespread adoption of advanced EHR systems necessitating robust interoperability solutions. However, the Asia Pacific (APAC) region is demonstrating the most rapid growth trajectory, driven by massive governmental investments in healthcare infrastructure modernization, increasing digital literacy, and the rapid expansion of private healthcare services across developing economies like China, India, and Southeast Asian nations. Europe maintains a steady growth rate, dictated by the ongoing efforts to establish a unified European Health Data Space and the widespread adherence to General Data Protection Regulation (GDPR) mandates, which strongly influence how communication platforms handle sensitive patient information, prioritizing secure, encrypted messaging protocols.

Segmentation trends reveal significant growth within the clinical collaboration and secure messaging segment, driven by the replacement of outdated communication methods like pagers and unsecured personal devices with enterprise-grade, compliant platforms. Furthermore, the services component, particularly implementation, integration, and managed services, is experiencing high demand as healthcare organizations require specialized expertise to integrate complex HCS software with legacy IT systems, ensuring seamless data flow across multiple clinical and administrative systems. The end-user segment analysis confirms that large hospital networks and integrated delivery networks (IDNs) remain the primary consumers, although ambulatory care centers and long-term care facilities are increasingly investing in sophisticated communication tools to manage dispersed patient populations and improve remote connectivity with specialists, signaling a diversification of the customer base towards smaller, specialized providers.

AI Impact Analysis on HCS Software and Services Market

User inquiries regarding AI's role in the HCS market frequently center on its ability to enhance clinical efficiency without compromising the human element of care. Common questions explore how AI can effectively filter the overwhelming volume of clinical alerts (alert fatigue), whether predictive analytics can accurately forecast staffing needs or patient deterioration events, and what the ethical and security implications are for using machine learning models on highly sensitive communication data. Users seek clarification on the tangible return on investment (ROI) derived from AI-powered communication solutions, specifically focusing on measurable reductions in administrative time and improvements in patient safety metrics. The key themes emerging from this analysis revolve around automation, predictive capability, interoperability enhancement, and algorithmic bias mitigation, indicating a high expectation for AI to transform reactive communication into proactive, intelligent workflow management.

AI's primary influence is the shift from passive data transmission to active, intelligent communication routing. By applying natural language processing (NLP) to clinical documentation and communication logs, AI engines can rapidly extract critical context, prioritize messages based on urgency and relevance, and automatically route tasks to the appropriate care team member, often bypassing manual triage steps. This capability is paramount in high-stakes environments such as emergency departments and intensive care units, where seconds matter. For example, machine learning algorithms can analyze real-time patient monitoring data from IoMT devices to detect subtle patterns indicative of sepsis or cardiac distress, automatically triggering high-priority alerts through the HCS platform to the designated care team before a catastrophic event occurs. This predictive capability significantly enhances patient safety protocols and allows for earlier, often life-saving, intervention, fundamentally changing the nature of clinical communication from responsive to anticipatory.

However, the integration of AI also presents major challenges concerning data governance and model explainability. Healthcare organizations are keenly focused on ensuring that AI algorithms used within HCS platforms are transparent, auditable, and adhere to strict privacy standards. Concerns regarding algorithmic bias—where historical patient data used for training models inadvertently leads to unequal outcomes for certain demographic groups—necessitate careful implementation and continuous validation of AI systems. Successful integration requires robust data infrastructure, standardized data formats (e.g., FHIR), and comprehensive training for clinical staff to trust and effectively utilize AI-driven insights delivered through their communication interfaces, ensuring these technologies serve as powerful augmentations rather than complex obstacles to quality care delivery.

- AI-driven alert prioritization and intelligent routing reduce cognitive load and combat alert fatigue among clinical staff.

- Natural Language Processing (NLP) enhances the analysis of unstructured communication data, improving context extraction and searchability within HCS archives.

- Machine Learning (ML) models enable predictive staffing needs and anticipate patient deterioration events, triggering proactive communication protocols.

- Automation of administrative communication tasks, such as appointment confirmations and routine follow-ups, freeing up clinical time.

- Enhanced security features via AI-powered anomaly detection, identifying and flagging unusual communication patterns that may indicate a breach.

DRO & Impact Forces Of HCS Software and Services Market

The trajectory of the HCS Software and Services Market is shaped by a robust set of dynamic forces: drivers emphasizing clinical efficiency and digitalization, restraints related to implementation complexity and high regulatory hurdles, and opportunities presented by emerging technologies and shifting care models. The primary drivers revolve around the non-negotiable demand for improved interoperability, enabling seamless exchange between EHRs, lab systems, and medical devices using standards like HL7 and FHIR, and the critical need for secure, compliant messaging to replace outdated communication methods. Conversely, significant restraints include the exceptionally high initial capital expenditure required for system overhaul and integration, particularly for large, established healthcare systems burdened by legacy IT infrastructure, alongside the perpetual challenge of mitigating data privacy and cybersecurity risks associated with sharing sensitive patient information across multiple platforms. This interplay creates an environment where market participants must balance aggressive innovation with meticulous adherence to international and regional health regulations.

A key opportunity area lies in the expansion of HCS capabilities to support emerging virtual health and remote monitoring ecosystems. As healthcare delivery decentralizes, sophisticated communication platforms that connect clinicians with patients outside traditional hospital settings—facilitating virtual consultations, remote device monitoring, and asynchronous communication—present lucrative growth avenues. Furthermore, the integration of HCS with supply chain management systems and operational analytics platforms allows healthcare administrators to optimize resource allocation and improve operational throughput, demonstrating a clear path towards non-clinical value generation. The most significant impact forces acting upon the market are rapid technological obsolescence, where vendors must continuously update their offerings to remain competitive with the latest advancements in mobile computing and cloud architecture, and profound governmental influence, where policy changes regarding data access, reimbursement structures, and patient safety directly dictate adoption rates and feature requirements for HCS solutions.

The persistent challenge of clinician resistance to change also acts as a powerful restraint; the introduction of new communication workflows requires extensive training and change management protocols to ensure high user adoption, as systems that are perceived as cumbersome or disruptive to existing routines are often underutilized. Consequently, vendors are increasingly prioritizing user experience (UX) and interface design to ensure intuitive usability across various devices (desktops, tablets, smartphones) and diverse clinical roles. Addressing these dual challenges—technical integration complexity and human adoption hurdles—is crucial for realizing the full transformative potential of HCS platforms, allowing the market to capitalize on the overarching driver of improving patient outcomes through optimized, instantaneous clinical communication.

Segmentation Analysis

The HCS Software and Services Market is meticulously segmented across multiple dimensions to accurately reflect the diversity of products, deployment methods, technological applications, and end-user needs present within the healthcare industry. These segmentations are critical for market participants to tailor their offerings and strategies, recognizing the distinct requirements of different stakeholders, whether they be a large academic medical center needing full enterprise integration or a small, specialized clinic requiring a basic, secure messaging application. Analyzing these segments provides deep insights into current consumption patterns and future growth areas, particularly the rapid shift towards specialized application software and subscription-based service models.

- By Component:

- Software (Clinical Collaboration Platforms, Secure Messaging Systems, Alert & Alarm Management, Nurse Call Systems, Patient Engagement Portals)

- Services (Implementation & Integration Services, Consulting Services, Managed Services, Training & Support)

- By Deployment Model:

- On-Premise

- Cloud-Based (SaaS)

- Hybrid

- By Application:

- Clinical Workflow Management (Care Coordination, Task Assignment, Staff Scheduling)

- Administrative Workflow Management (Admissions/Discharge, Billing Communication)

- Patient Engagement (Appointment Reminders, Education, Telehealth)

- By End User:

- Hospitals and Integrated Delivery Networks (IDNs)

- Ambulatory Care Centers and Clinics

- Long-Term Care Facilities and Skilled Nursing Facilities

- Diagnostic Laboratories and Research Institutions

Value Chain Analysis For HCS Software and Services Market

The HCS Software and Services value chain begins with upstream providers, comprising core software developers, hardware manufacturers (for specialized communication devices and infrastructure components like servers and networking equipment), and foundational technology vendors specializing in security, cloud computing architecture, and data analytics tools. These upstream entities focus on continuous R&D to incorporate the latest advancements in interoperability standards (FHIR), mobile technology, and secure data encryption protocols. Midstream activities involve the crucial steps of system integration and customization, performed by specialized system integrators, Value-Added Resellers (VARs), and the vendors themselves, who tailor the standardized HCS platforms to meet the unique operational and regulatory requirements of individual healthcare organizations. Effective midstream integration is paramount, as HCS must flawlessly interface with a complex mix of existing Electronic Health Record (EHR) systems, Radiology Information Systems (RIS), and legacy monitoring equipment.

The distribution channel is multifaceted, relying heavily on both direct and indirect sales strategies. Direct sales are typically preferred for large-scale enterprise deployments within major hospital systems, where customization and long-term service agreements are required, fostering a direct relationship between the HCS vendor and the client. Indirect distribution, leveraging VARs and channel partners, is more common for reaching smaller clinics, ambulatory centers, and regional markets, allowing vendors to scale their outreach without maintaining a massive internal sales force. These indirect partners often provide localized support and domain-specific expertise essential for successful deployment in diverse international settings. Downstream activities focus on the delivery, adoption, and continuous support provided to the end-users, primarily large Integrated Delivery Networks (IDNs), community hospitals, and specialized care facilities.

The final crucial component of the value chain involves continuous feedback loops and post-implementation services. Healthcare is a highly dynamic environment, necessitating ongoing software updates, security patching, and scaling services, which fall under the managed services segment. This feedback, gathered from clinical users, informs the upstream R&D cycle, driving product enhancements that address real-world workflow challenges, such as reducing the number of clicks required for critical actions or improving mobile accessibility. Ultimately, the efficiency of this value chain is determined by the seamless collaboration between the software developers and the integration specialists, ensuring that the final HCS solution delivers measurable improvements in clinical outcomes and operational efficiency at the point of care.

HCS Software and Services Market Potential Customers

The primary consumers of HCS Software and Services are organizations requiring highly reliable, secure, and coordinated communication across multidisciplinary teams operating in time-sensitive environments. Foremost among potential customers are large Integrated Delivery Networks (IDNs) and multi-facility hospital systems, which necessitate enterprise-wide platforms capable of standardizing communication protocols, ensuring interoperability between affiliated hospitals and outpatient centers, and managing centralized patient data access across geographical locations. These large entities often demand comprehensive suites that include patient engagement tools, advanced clinical collaboration features, and sophisticated analytics dashboards to monitor compliance and performance across the network.

Secondary high-potential customers include specialized medical facilities such as cancer treatment centers, cardiac rehabilitation centers, and psychiatric hospitals. These niche providers require tailored HCS solutions that address specific workflow challenges, such as rapid consultation requests with external specialists or secure handling of highly sensitive patient conversations, prioritizing privacy features tailored to their patient population's needs. Furthermore, the burgeoning sector of Long-Term Care (LTC) facilities and Skilled Nursing Facilities (SNFs) represents an accelerating customer base, driven by regulatory pressures to improve resident monitoring and communication with remote physicians and patient families, often requiring mobile-first, easy-to-deploy cloud solutions.

Governmental healthcare agencies and military health services also constitute significant potential customers, demanding HCS platforms that meet extremely high standards for security clearance, resilience, and scalability to handle mass casualty events or distributed population health management. Finally, the rise of large employer-sponsored health clinics and corporate wellness providers, aiming to manage employee health proactively, presents a growing segment that utilizes basic HCS components for secure health communication, appointment scheduling, and remote triage services, indicating a broadening acceptance of these digital communication tools beyond traditional acute care settings.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 18.5 Billion |

| Market Forecast in 2033 | USD 42.1 Billion |

| Growth Rate | CAGR 12.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Epic Systems Corporation, Cerner Corporation (Oracle), Vocera Communications (Stryker), TigerConnect, Telus Health, PerfectServe, Imprivata, Spok, Cisco Systems, Microsoft Corporation, GE Healthcare, Philips Healthcare, Ascom, AMETEK, Inc., Mobile Heartbeat, Halo Health, QliqSOFT, Pulsara, Hyland Software, Eceptionist |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

HCS Software and Services Market Key Technology Landscape

The HCS Software and Services market is fundamentally reliant on several advanced technologies that underpin secure, scalable, and real-time communication capabilities. Cloud computing is perhaps the most transformative technological foundation, enabling rapid deployment, elastic scalability, and reduced infrastructure maintenance costs, shifting the operational burden from the healthcare provider to the HCS vendor. This shift to Software-as-a-Service (SaaS) architectures facilitates instant updates and ensures that all users are operating on the latest, most secure version of the communication platform, which is crucial for maintaining compliance in a rapidly evolving regulatory environment. The integration of mobile computing technologies, specifically robust mobile applications designed for various operating systems (iOS and Android), ensures that care teams can access critical patient data and communicate securely from any location within or outside the facility, supporting fluidity in clinical decision-making and enhancing mobility.

Another pivotal technological advancement is the adoption of the Fast Healthcare Interoperability Resources (FHIR) standard. While not a communication technology itself, FHIR protocols significantly simplify the crucial task of ensuring that HCS platforms can reliably exchange data—such as patient vitals, lab results, and medication orders—with diverse Electronic Health Record (EHR) systems and medical devices. This standardization is overcoming historical integration challenges that often paralyzed HCS deployment projects. Complementary to this, the proliferation of the Internet of Medical Things (IoMT) generates massive streams of real-time clinical data; HCS platforms are leveraging edge computing capabilities to process and filter this data locally before routing only actionable, high-priority alerts to the designated care team members via secure push notifications, thereby minimizing network latency and maximizing response speed.

Finally, the focus on data security has elevated blockchain technology as a promising, albeit nascent, tool within the HCS landscape. While full-scale blockchain adoption is limited, vendors are exploring its decentralized, immutable ledger capabilities to enhance the security and audibility of patient data exchange records and access logs, potentially providing a tamper-proof verification system for communication integrity. Furthermore, advancements in 5G networking are set to dramatically improve the reliability and speed of mobile HCS applications, enabling high-definition telehealth consultations and instantaneous transmission of large medical images or video clips across clinical teams, further cementing the move towards highly responsive, data-intensive communication environments.

Regional Highlights

Regional variations in market maturity, regulatory environments, and technological adoption rates significantly influence the HCS Software and Services Market landscape. North America, encompassing the United States and Canada, remains the largest market share holder globally. This dominance is attributed to high healthcare expenditure, the mandatory shift towards digital health records driven by government initiatives (like HITECH in the US), and the established presence of major HCS vendors and sophisticated IDNs. The region exhibits high demand for AI-integrated solutions focused on reducing readmission rates and optimizing complex clinical workflows. Europe is characterized by stringent data privacy laws, particularly GDPR, which mandates high levels of security and accountability in clinical communication platforms, driving demand for advanced secure messaging and encrypted data handling services. Key growth drivers include the integration efforts across the EU to create a seamless digital health market and the strong focus on preventative care and patient engagement through digital channels.

- North America (USA, Canada): Market leader driven by robust IT infrastructure, widespread EHR adoption, and strong regulatory pressure promoting interoperability and patient safety. High focus on advanced clinical analytics and AI-driven predictive communication solutions.

- Europe (UK, Germany, France): Mature market emphasizing compliance with GDPR and local data residency laws. Strong investment in clinical collaboration tools and secure mobile communication to support multi-site hospital networks and regional health information exchange initiatives.

- Asia Pacific (APAC) (China, India, Japan, Australia): Fastest-growing region due to significant government investment in modernizing healthcare infrastructure, increasing digital penetration in populous countries, and rising private sector participation. Demand is high for scalable, cloud-based HCS solutions suitable for mass deployment and remote connectivity.

- Latin America (LATAM): Emerging market characterized by fragmented healthcare systems and rising adoption of mobile health technologies. Growth is focused on foundational HCS software components like basic secure messaging and patient appointment management to improve service accessibility.

- Middle East and Africa (MEA): Growth driven by large-scale governmental projects (e.g., Saudi Vision 2030) aiming to establish state-of-the-art medical cities and enhance quality of care. Demand is primarily for integrated clinical systems and advanced alarm management solutions to meet international accreditation standards.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the HCS Software and Services Market.- Epic Systems Corporation

- Cerner Corporation (Oracle)

- Vocera Communications (Stryker)

- TigerConnect

- Telus Health

- PerfectServe

- Imprivata

- Spok

- Cisco Systems

- Microsoft Corporation

- GE Healthcare

- Philips Healthcare

- Ascom

- AMETEK, Inc.

- Mobile Heartbeat

- Halo Health

- QliqSOFT

- Pulsara

- Hyland Software

- Eceptionist

Frequently Asked Questions

Analyze common user questions about the HCS Software and Services market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the most significant ROI driver for investing in HCS Software?

The most significant Return on Investment (ROI) driver is the tangible reduction in communication errors, which minimizes liability and improves patient safety outcomes, coupled with increased clinical efficiency due to automated workflows and decreased response times during critical events.

How do HCS solutions ensure compliance with HIPAA and GDPR regulations?

HCS solutions ensure compliance through mandatory end-to-end encryption for all data in transit and at rest, secure user authentication protocols, auditable communication logs, and features for automatic deletion or archiving of messages based on regulatory requirements for privacy and data retention.

Is cloud-based deployment more secure than on-premise for healthcare communication systems?

While both models can be secure, cloud-based HCS often benefits from the provider's dedicated, specialized cybersecurity infrastructure, continuous security patching, and advanced threat detection capabilities that are difficult for individual healthcare organizations to maintain internally, offering superior scalability and often, better resilience.

How is AI fundamentally changing the role of clinical collaboration software?

AI is transforming clinical collaboration by shifting it from simple message exchange to intelligent workflow orchestration. AI uses predictive analytics and NLP to prioritize alerts, route tasks automatically to the optimal responder, and filter noise, ensuring clinicians receive only actionable, timely, and context-rich information.

What are the primary challenges when integrating HCS with existing EHR systems?

Primary challenges include overcoming the proprietary nature of older EHR platforms, ensuring reliable data mapping and normalization across different systems, and adhering to diverse interoperability standards (legacy HL7 vs. modern FHIR) necessary to maintain real-time, bidirectional data synchronization for clinical context.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager