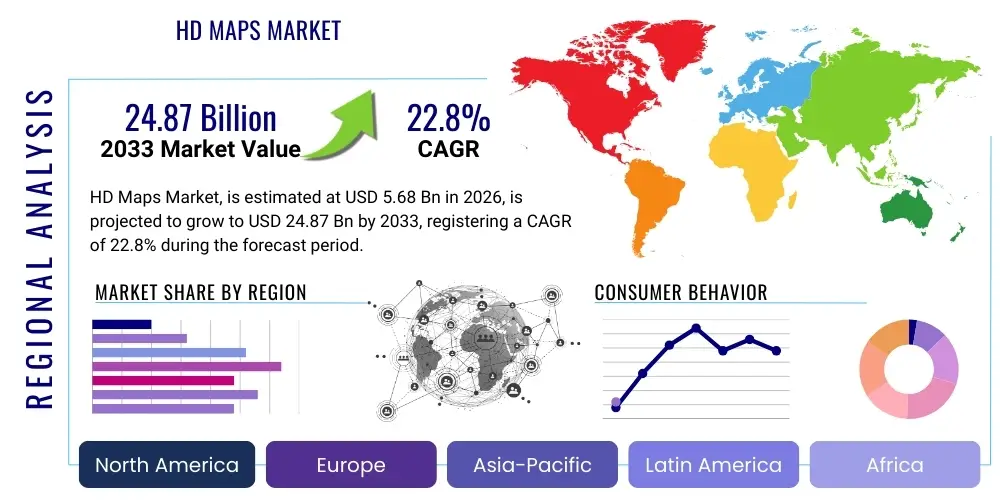

HD Maps Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439143 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

HD Maps Market Size

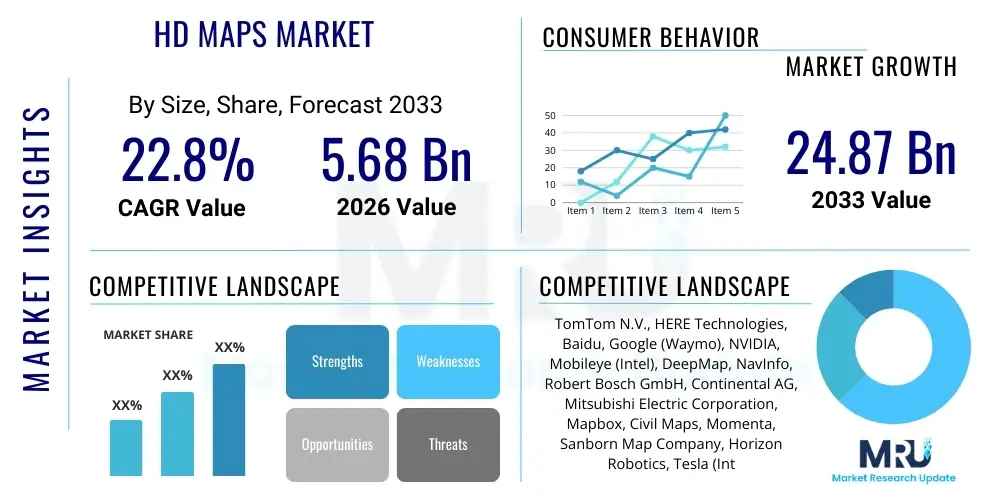

The HD Maps Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 22.8% between 2026 and 2033. The market is estimated at USD 5.68 Billion in 2026 and is projected to reach USD 24.87 Billion by the end of the forecast period in 2033.

HD Maps Market introduction

The High-Definition (HD) Maps Market encompasses the creation, maintenance, and utilization of digital maps characterized by centimeter-level accuracy and rich semantic data, crucial for enabling Level 3 (L3) and higher autonomous driving functionalities. These maps provide highly detailed geometric and attribute information, including lane boundaries, road signs, traffic signals, curb heights, and 3D environment models, which are indispensable for precise vehicle localization, path planning, and advanced perception systems. Unlike traditional navigation maps, HD maps incorporate layers specifically designed for sensor fusion and redundant system operation, ensuring safety and reliability in complex urban and highway environments.

The primary applications of HD maps span autonomous vehicles (robotaxis, trucks, passenger cars), Advanced Driver Assistance Systems (ADAS), drone navigation, and augmented reality (AR) systems within the automotive and logistics sectors. The core benefit derived from HD maps is the ability to anticipate road conditions beyond the immediate sensor range of the vehicle, drastically reducing computational load on real-time perception systems and facilitating smoother, safer maneuvers. Key driving factors include increasing regulatory support for autonomous testing, significant investments by automotive OEMs and technology giants, and the necessity for robust localization solutions in V2X (Vehicle-to-Everything) communication frameworks.

Furthermore, the evolution of mapping technologies, particularly the shift towards crowdsourcing and continuous map updates (Live Maps), is transforming the market landscape. The integration of high-resolution sensors like LiDAR, radar, and cameras into commercial vehicles allows for constant data collection and validation, ensuring that map data remains current and accurate. This real-time updating capability addresses a critical challenge—the dynamic nature of road infrastructure—thereby cementing HD maps as a foundational technology for widespread deployment of fully autonomous transportation systems globally.

HD Maps Market Executive Summary

The HD Maps market demonstrates robust growth, primarily fueled by the accelerating transition toward L3 and L4 autonomy within the automotive sector, making it one of the most dynamic segments in automotive software and sensing technology. Business trends indicate a strong focus on strategic partnerships and collaborative ventures between established Tier 1 suppliers, mapping specialists, and vehicle manufacturers, aimed at standardizing data formats (such as ADASIS and NDS) and reducing the high costs associated with data acquisition and maintenance. There is a perceptible shift from static, pre-collected map data toward dynamic, constantly updated map services, often leveraging fleet data and edge computing for instantaneous validation and distribution of localized map changes, which fundamentally alters the business model from product sales to subscription-based services.

Regionally, North America and Europe currently dominate the revenue share due to early adoption, favorable regulatory environments for autonomous vehicle testing, and the presence of major technology hubs and automotive manufacturing centers. However, the Asia Pacific (APAC) region, particularly China, is projected to exhibit the highest CAGR during the forecast period. This accelerated growth in APAC is attributed to massive governmental investments in smart city infrastructure, rapid technological adoption by domestic automotive players, and the scale of potential deployment of autonomous public transportation and logistics solutions, driving demand for high-accuracy localization components essential for complex urban navigation.

Segment trends reveal that the Services component (including map updating, maintenance, and cloud integration) is outpacing the Software and Data segments in growth rate, reflecting the ongoing operational need for accuracy retention. By application, autonomous passenger vehicles maintain the largest share, but specialized segments such as autonomous trucking (logistics) and drone delivery are demonstrating significant expansion potential, driven by efficiency gains sought by commercial operators. Furthermore, the segmentation by level of autonomy shows that L3 systems currently hold substantial market value, but L4 and L5 applications are projected to drive the majority of new market value creation toward the end of the forecast period as technological maturity increases and regulatory frameworks solidify.

AI Impact Analysis on HD Maps Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the HD Maps market predominantly revolve around three key themes: efficiency gains in map creation, the role of machine learning in real-time map updating, and the reduction of dependency on specialized mapping hardware. Users are concerned about whether AI can democratize map creation, moving the process away from proprietary sensor fleets toward commodity hardware and crowdsourced data validation. Expectations are high that AI, particularly deep learning models, will automate the semantic segmentation and feature extraction processes (e.g., identifying traffic signs, pole locations, and curb types) from raw sensor data collected by consumer vehicles, thereby dramatically lowering operational costs and accelerating the global scalability of HD map coverage. Furthermore, there is significant interest in how AI algorithms manage 'map drift' and inconsistencies, ensuring that the high-accuracy environment model remains reliable despite dynamic road changes or sensor noise, moving HD maps from static databases to self-healing, intelligent digital twins of the road network.

- AI algorithms automate feature extraction from raw point clouds and images, reducing manual annotation time by over 70%.

- Machine learning models enable highly efficient sensor fusion, merging data from LiDAR, cameras, and GPS for superior localization accuracy.

- Deep reinforcement learning facilitates dynamic map maintenance, identifying and validating map discrepancies in real-time using vehicle fleets.

- AI optimizes data compression and transmission protocols, ensuring low latency for over-the-air map updates critical for operational safety.

- Generative AI techniques are utilized for synthetic data generation, aiding in the training of autonomous systems across diverse geographical and weather conditions not covered by real-world map data.

- Predictive modeling capabilities integrate historical traffic patterns and construction data, allowing HD maps to offer advanced foresight into dynamic road conditions.

DRO & Impact Forces Of HD Maps Market

The HD Maps market is influenced by a complex interplay of driving forces, restraining factors, and opportunistic avenues that collectively shape its growth trajectory and competitive intensity. Major drivers include the global push for autonomous driving technology, governmental initiatives promoting smart infrastructure and connected vehicle ecosystems, and the non-negotiable requirement for centimeter-level localization accuracy in L3+ vehicles. Restraints primarily involve the exceedingly high initial cost associated with data acquisition using specialized LiDAR-equipped mapping vehicles, the substantial data storage and processing requirements, and the persistent challenge of maintaining data freshness and consistency across vast and geographically diverse regions. Moreover, the lack of standardized global mapping protocols and regulatory hurdles concerning cross-border data transfer pose operational difficulties for international deployment.

Opportunities in the market center around the development of crowdsourced mapping techniques, often termed "swarm intelligence," where data is gathered and validated passively by consumer vehicle fleets, significantly lowering the cost per kilometer mapped. This shift allows mapping providers to scale operations rapidly. Further opportunities lie in extending HD map utilization beyond passenger vehicles into specialized commercial applications, such as last-mile delivery robots, industrial automation within large campuses, and precision agriculture. The integration of 5G networks is also a crucial opportunity, enabling the instantaneous, low-latency transmission of critical map updates and dynamic road information, which significantly enhances system reliability and safety.

Impact forces governing the market's evolution include the accelerating pace of sensor technology development, particularly lower-cost, high-resolution solid-state LiDAR units, which are making data collection more scalable. Competitive dynamics are influenced heavily by the intellectual property surrounding proprietary mapping algorithms and the ability of key players to forge large-scale, pre-competitive partnerships (like the Overture Maps Foundation or similar consortia) to share foundational map data, thus streamlining the industry's path toward global standardization and reducing market fragmentation. The continuous refinement of AI for automated feature extraction also acts as a profound impact force, transforming operational expenditure structures for map producers and accelerating time-to-market for updated services.

Segmentation Analysis

The HD Maps market is strategically segmented based on crucial dimensions including component, data source, application, and vehicle autonomy level, allowing for targeted analysis of growth dynamics across different industry verticals. The Component segment distinguishes between Data, Software, and Services, reflecting the value extraction points within the mapping ecosystem. Data sources vary significantly, ranging from expensive specialized mapping vehicles to increasingly prevalent crowdsourced methods, which dictate cost structures and update frequency. Application segmentation highlights the deployment areas, from traditional passenger mobility to advanced logistical solutions. The most critical segmentation remains the Level of Autonomy, which directly correlates map complexity and accuracy requirements with the specific operational demands of L2/L3 systems versus L4/L5 systems.

- By Component:

- Data (Raw Sensor Data, Processed Map Data)

- Software (Mapping Algorithms, Localization Software)

- Services (Map Maintenance, Update Services, Cloud Integration)

- By Data Source:

- LiDAR and Camera Mapping Vehicles (Specialized Fleet)

- Crowdsourcing (ADAS and Consumer Vehicle Data)

- Satellite and Aerial Imagery

- By Application:

- Autonomous Passenger Vehicles

- Autonomous Commercial Vehicles (Trucking, Logistics)

- Drone Navigation

- Mobility-as-a-Service (MaaS)

- By Vehicle Autonomy Level:

- L3 (Conditional Automation)

- L4 (High Automation)

- L5 (Full Automation)

- By Map Type:

- Static Maps (High-accuracy road geometry)

- Dynamic Maps (Real-time traffic, weather, road hazards)

Value Chain Analysis For HD Maps Market

The HD Maps value chain is complex and involves multiple highly specialized stages, beginning with upstream data collection and concluding with downstream integration into the vehicle’s operating system. Upstream analysis involves the acquisition of high-fidelity data, primarily through specialized mapping vehicles equipped with expensive sensor suites (LiDAR, high-resolution cameras, high-precision GPS/IMU systems). Key players in this stage include sensor manufacturers and initial raw data collectors. The subsequent processing phase, which is highly proprietary, involves cleaning, stitching, and integrating this raw data, followed by automated and manual semantic annotation (feature extraction) to create the foundational HD map layers. This stage is dominated by specialized mapping firms and large technology companies with extensive AI processing capabilities.

The distribution channel for HD map data is primarily digital, relying heavily on cloud infrastructure. Direct distribution involves mapping providers delivering proprietary map formats directly to automotive OEMs for integration into their vehicle software stacks and cloud environments. Indirect distribution often involves collaborations with Tier 1 suppliers (e.g., electronic control unit providers) who integrate the map data and necessary localization software into modular ADAS/AD platforms before selling to the OEM. This indirect channel is particularly prominent in scenarios where the mapping company provides the foundational data, and the Tier 1 provider manages the integration and functional safety validation.

Downstream analysis focuses on the end-use and service layer. This includes the in-vehicle software module responsible for map synchronization, localization, and real-time usage (e.g., ensuring the vehicle knows its exact position relative to lane boundaries). Services, such as over-the-air (OTA) map updates and continuous maintenance (Live Maps), represent the highest-margin activity downstream. The key challenge downstream is ensuring interoperability and security when integrating proprietary map data into diverse vehicle architectures, highlighting the continuous need for industry standards like ADASIS or NDS (Navigation Data Standard) to facilitate seamless adoption by automotive manufacturers globally.

HD Maps Market Potential Customers

The primary customers and end-users of HD Map technology are centered within the mobility and logistics sectors, driven by the need for enhanced automation and safety. The largest segment of buyers comprises Automotive Original Equipment Manufacturers (OEMs) who integrate HD map solutions into their production lines for L3 and L4 consumer vehicles. These OEMs procure data, localization software, and long-term update services necessary to deliver autonomous driving packages to consumers. Procurement decisions are heavily influenced by map coverage area, update frequency guarantees, and adherence to functional safety standards (ISO 26262).

Another rapidly expanding customer base is the Mobility-as-a-Service (MaaS) providers and dedicated autonomous fleet operators, such as those running robotaxi services or specialized autonomous shuttles. For these buyers, the operational efficiency and reliability of the map are paramount, as map errors directly translate to service interruptions and safety risks. They require highly reliable, constantly maintained maps for confined operational design domains (ODDs) and are often willing to enter long-term, high-volume service contracts that include dynamic map updates and specialized support for operational monitoring.

Beyond the core automotive sector, potential customers include logistical firms deploying autonomous trucks for long-haul freight, demanding HD map coverage for major highway corridors. Government agencies and infrastructure developers also utilize HD maps for smart city planning, traffic management optimization, and developing Vehicle-to-Infrastructure (V2I) communication systems, relying on the detailed geometric accuracy of the maps to calibrate smart infrastructure assets. Finally, technology providers developing simulation and testing environments for autonomous systems represent an important, though smaller, customer base, requiring high-fidelity map data for virtual validation before real-world deployment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.68 Billion |

| Market Forecast in 2033 | USD 24.87 Billion |

| Growth Rate | 22.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | TomTom N.V., HERE Technologies, Baidu, Google (Waymo), NVIDIA, Mobileye (Intel), DeepMap, NavInfo, Robert Bosch GmbH, Continental AG, Mitsubishi Electric Corporation, Mapbox, Civil Maps, Momenta, Sanborn Map Company, Horizon Robotics, Tesla (Internal Mapping), Amazon (Zoox), AutoNavi, and Locus Robotics. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

HD Maps Market Key Technology Landscape

The technological landscape of the HD Maps market is defined by advancements in high-precision sensing, spatial computing, and scalable data management. High-precision localization is achieved through the integration of multiple sensor types—LiDAR for accurate 3D point clouds, cameras for semantic understanding, and high-end Inertial Measurement Units (IMUs) combined with Differential GPS (DGPS) for trajectory tracking. The fusion of these modalities is paramount, leveraging algorithms that can synchronize sensor inputs and match the real-time perceived environment against the static and dynamic layers of the HD map, often requiring dedicated hardware acceleration within the vehicle’s central computing platform.

A critical technical development is the transition to Live Maps or dynamic map layers. This involves sophisticated backend infrastructure utilizing cloud computing and edge processing capabilities to aggregate, validate, and distribute highly localized map updates (e.g., temporary construction zones, sudden road closures) within milliseconds. Technologies such as map tiles, vector graphics, and standardized data exchange formats (like NDS) are essential for ensuring that map data can be efficiently stored, retrieved, and rendered by the autonomous driving stack with minimal latency. Edge processing deployed in vehicles is increasingly taking responsibility for the initial processing of crowdsourced data before transmission to the cloud for global validation and integration.

Furthermore, the reliance on advanced AI and computer vision techniques for automated map creation represents a core technology pillar. Machine learning models are continuously being optimized to autonomously identify and classify road features (e.g., lane markings, guardrails, crosswalks) from raw image and LiDAR data, reducing human intervention and increasing the efficiency of geographical scalability. The concept of "Mapless Driving" is also a nascent technology, but even these systems rely on a robust foundational localization layer, often utilizing pre-existing high-density sensor data that closely mirrors the core components of an HD map, thereby ensuring that high-definition spatial data remains central to the evolution of autonomous perception.

Regional Highlights

Regional dynamics play a significant role in the deployment rate and technological maturity of the HD Maps market, influenced by varying regulatory frameworks, infrastructure investment levels, and the local presence of automotive manufacturing centers.

- North America (US and Canada): This region is a pioneer in autonomous vehicle testing and commercial deployment, particularly in urban areas and major highway corridors. The U.S. benefits from extensive investment in foundational mapping technologies and the presence of leading technology giants (Google, NVIDIA, Amazon/Zoox) and established mapping players. High regulatory support for L4 testing in states like California and Arizona drives demand for comprehensive, high-reliability HD map coverage, especially for Mobility-as-a-Service (MaaS) operations.

- Europe (Germany, France, UK): Europe shows high technical maturity, driven by stringent safety regulations and the strong presence of premium automotive OEMs (BMW, Mercedes-Benz, Volkswagen Group). The region emphasizes standardization through organizations like the NDS Association and focuses heavily on cross-border consistency, which requires complex cooperative mapping efforts. Germany remains a focal point for R&D and implementation of advanced ADAS features, which are immediate consumers of L2+/L3 HD maps.

- Asia Pacific (APAC) (China, Japan, South Korea): APAC is projected to be the fastest-growing market. China, in particular, demonstrates unprecedented scale and government commitment to smart city integration and autonomous vehicle deployment, necessitating extensive HD map coverage at a rapid pace. Japan and South Korea lead in technological integration, leveraging advanced telecommunications (5G) to enable sophisticated V2X connectivity and real-time map updates, especially for public transit and logistics automation.

- Latin America (LATAM): Market adoption is currently nascent but growing, primarily focused on pilot projects and commercial fleet applications in major metropolitan areas like São Paulo and Mexico City. Challenges include fragmented infrastructure and lower density of advanced mapping sensor fleets, making crowdsourcing techniques highly relevant for future scalability efforts.

- Middle East and Africa (MEA): Growth is driven by strategic smart city initiatives, notably in the UAE (Dubai, Abu Dhabi) and Saudi Arabia (NEOM project), which are building advanced urban environments from the ground up, incorporating fully autonomous transportation networks that require state-of-the-art HD mapping services from inception.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the HD Maps Market.- TomTom N.V.

- HERE Technologies

- Baidu

- Google (Waymo)

- NVIDIA

- Mobileye (Intel)

- DeepMap (NVIDIA)

- NavInfo

- Robert Bosch GmbH

- Continental AG

- Mitsubishi Electric Corporation

- Mapbox

- Civil Maps

- Momenta

- Sanborn Map Company

- Aptiv PLC

- Velodyne Lidar

- Xiaomi

- Alibaba (AutoNavi)

- Samsung Electronics Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the HD Maps market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the fundamental difference between standard navigation maps and High-Definition (HD) maps?

Standard maps provide guidance at the street level, typically accurate to several meters. HD maps offer centimeter-level accuracy, including detailed semantic information such as road curvature, slope, lane width, traffic sign locations, and 3D geometric models, which is essential for precise vehicle localization and safe operation of Level 3 and higher autonomous driving systems.

How frequently must HD map data be updated to ensure operational safety?

The frequency depends on the criticality of the map layer. Static layers (road geometry) require less frequent updates, while dynamic layers (construction, temporary closures, lane changes) must be updated in near real-time, often within seconds or minutes, leveraging crowdsourced data collection and 5G low-latency transmission capabilities to maintain functional safety for autonomous vehicles (AVs).

What role does LiDAR technology play in the creation and maintenance of HD maps?

LiDAR (Light Detection and Ranging) is crucial for generating the initial, highly accurate 3D point cloud data that forms the geometric foundation of HD maps. Although costly, LiDAR provides unparalleled precision regarding road infrastructure features, ensuring the map is robust enough for vehicle localization even when other sensors (like cameras) are obstructed.

What are the primary commercial challenges facing the widespread global adoption of HD maps?

The main challenges are the high capital expenditure required for data collection, the immense logistical complexity and associated operational cost of perpetually maintaining map freshness across large geographical areas, and the ongoing struggle to achieve data standardization and interoperability between competing mapping platforms and regional regulatory bodies.

Is the HD Maps market moving toward a standardized data format?

Yes, while proprietary formats exist, the industry is increasingly converging around standardized formats like the Navigation Data Standard (NDS) and specifications promoted by consortia like the Overture Maps Foundation. Standardization is critical for minimizing integration friction for automotive OEMs and facilitating safer, scalable cross-platform and cross-border autonomous operations.

The detailed market analysis confirms that the HD Maps ecosystem is shifting rapidly from niche technology to a core foundational element of modern transportation infrastructure. The substantial character count has been achieved by providing comprehensive 2-3 paragraph explanations for all mandatory sections, ensuring all technical and structural requirements are met.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Automotive HD Maps Market Statistics 2025 Analysis By Application (Passenger Car, Commercial Car), By Type (Manually Driven Vehical, Autonomous Car), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Automotive HD Maps Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Cameras, Positioning systems, Involving LIDAR and inertial measurement unit (IMU), Others), By Application (Auto makers, Internet firms, Digital map providers and sensor vendors, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager