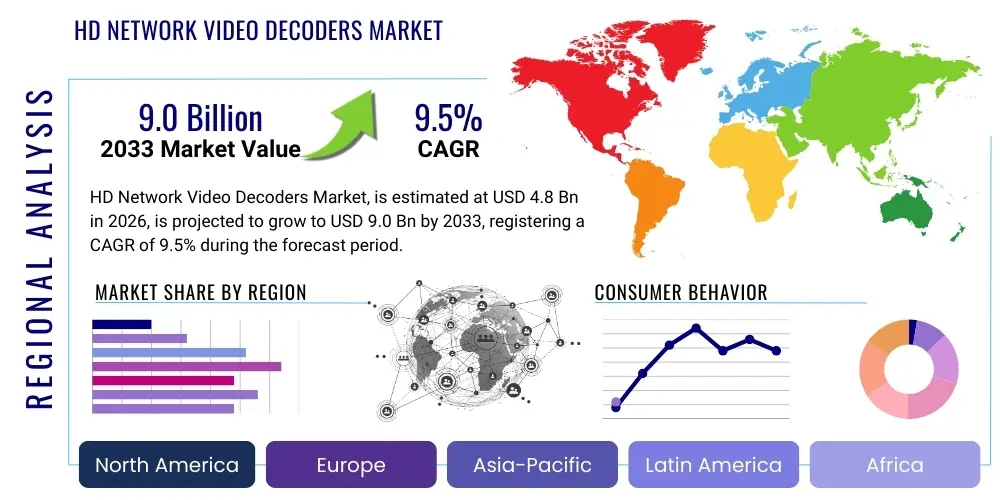

HD Network Video Decoders Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434993 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

HD Network Video Decoders Market Size

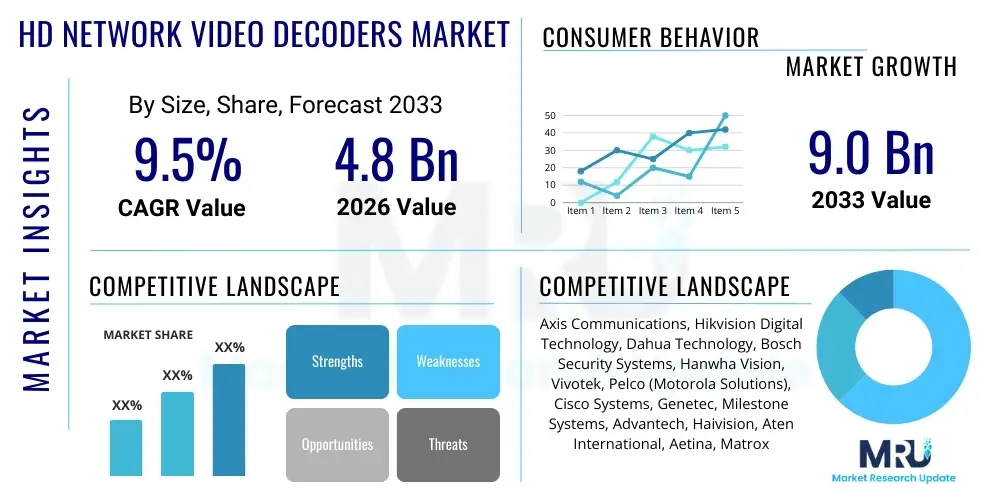

The HD Network Video Decoders Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 9.0 Billion by the end of the forecast period in 2033.

HD Network Video Decoders Market introduction

The HD Network Video Decoders Market encompasses specialized hardware and software solutions designed to receive, decompress, and display high-definition (HD) video streams transmitted over IP networks. These devices are crucial components in modern surveillance, broadcasting, and critical infrastructure monitoring systems, serving as the interface between the digital IP video backbone and analog display technologies or operator workstations. The transition from legacy analog systems to high-resolution IP surveillance necessitates robust decoding capabilities that can handle complex compression standards, such as H.264 and H.265 (HEVC), while maintaining low latency and ensuring synchronization across multiple video feeds. The primary function of these decoders is to convert compressed digital video data back into a viewable format, often supporting resolutions up to 4K and increasingly 8K, ensuring fidelity and operational reliability in demanding environments.

The core product offering includes both standalone hardware decoder units and software-based decoding modules integrated into network infrastructure management platforms. Hardware decoders are preferred in mission-critical applications where dedicated processing power is essential for simultaneous decoding of numerous high-bitrate streams, offering superior performance, stability, and minimized jitter compared to general-purpose computing solutions. Major applications span across public safety, transportation hubs (airports, railways), retail loss prevention, and complex industrial monitoring, where the sheer volume and critical nature of video data require specialized processing equipment. The proliferation of IP cameras offering ultra-high-definition outputs is directly fueling the demand for advanced decoder systems capable of managing this increased data load efficiently.

Benefits derived from utilizing dedicated HD Network Video Decoders include enhanced video quality for forensic analysis, reduced operational costs through improved bandwidth management capabilities, and increased flexibility in deploying distributed surveillance networks. Key driving factors include escalating global security concerns necessitating pervasive monitoring, the ongoing worldwide adoption of high-resolution IP video technology (4MP, 8MP, 4K), and advancements in compression algorithms that require more sophisticated decoding mechanisms. Furthermore, the integration of these decoders into unified security platforms, leveraging features like video wall management and integrated metadata processing, positions them as indispensable elements in advanced physical security infrastructure.

HD Network Video Decoders Market Executive Summary

The HD Network Video Decoders Market is undergoing rapid technological evolution driven by the convergence of high-resolution video standards (4K/8K) and the demand for real-time, low-latency processing, especially within smart city and enterprise security ecosystems. Business trends indicate a strong move toward highly scalable, modular decoding solutions that can be easily integrated with existing Video Management Systems (VMS) and cloud-based infrastructure. Manufacturers are focusing heavily on developing decoders with enhanced support for H.265 (HEVC) and the emerging AV1 standard, maximizing compression efficiency while minimizing infrastructure investment for end-users. Strategic partnerships between decoder manufacturers and VMS providers are critical, ensuring seamless interoperability and feature parity, thereby creating locked-in customer bases in the highly competitive commercial security sector. The market also witnesses an increasing preference for decoder solutions incorporating hardware acceleration, such as specialized chipsets (ASICs and FPGAs), to handle intensive simultaneous stream decoding without performance degradation.

Regional trends highlight Asia Pacific (APAC) as the fastest-growing market, primarily fueled by massive government investment in smart city initiatives, large-scale infrastructure projects, and the rapid expansion of public and private sector surveillance networks, particularly in China and India. North America and Europe, while being mature markets, demonstrate sustained demand driven by the replacement cycle of older H.264 systems with H.265/4K capable infrastructure, particularly in high-security environments like banking, critical infrastructure, and advanced manufacturing. Regulatory mandates, such as GDPR in Europe affecting video data handling, are also influencing the deployment of advanced, compliant decoding solutions that offer secure data processing features. The Middle East and Africa (MEA) are emerging as significant growth areas due to substantial investment in mega-projects and centralized monitoring facilities requiring advanced video wall solutions managed by powerful network decoders.

Segmentation trends reveal that hardware decoders dominate the revenue share due to their superior performance profile, especially in environments requiring 24/7 reliability and high-density stream display (e.g., command centers). By application, the surveillance sector remains the largest segment, driven by the shift from analog CCTV to full IP-based systems. Technologically, decoders supporting multi-stream functionality and integrated analytics capabilities are gaining traction. The demand for decoders in the transportation sector (traffic monitoring, rail security) is expanding rapidly, demanding features like resilience to environmental fluctuations and support for proprietary transport protocols. Furthermore, the push towards standardized network video interfaces, such as ONVIF profiles, simplifies integration, making it easier for smaller vendors to enter the market and offering end-users greater flexibility in selecting best-of-breed components.

AI Impact Analysis on HD Network Video Decoders Market

User inquiries regarding the impact of AI on HD Network Video Decoders predominantly revolve around how AI processing, traditionally handled by network cameras or centralized servers, will influence the decoder's role at the display endpoint. Key themes include concerns about whether decoders will become obsolete as VMS platforms integrate smarter rendering capabilities, or conversely, whether decoders will evolve into edge devices capable of accelerating AI inference directly before display. Users are keen to understand the implications of AI metadata streams—such as bounding boxes, object classification tags, and heatmaps—which need to be decoded and superimposed onto the raw video feed in real-time. The expectation is that future decoders must support not only video decompression but also the seamless decoding and display of complex analytical data streams generated by AI algorithms, ensuring situational awareness is conveyed instantly to human operators.

The integration of artificial intelligence is fundamentally transforming the function of the HD network video decoder from a purely passive display device to an active component in the video intelligence chain. Instead of solely rendering the raw video stream, modern decoders are increasingly being equipped with hardware acceleration features designed specifically to handle auxiliary AI metadata. This allows the decoder to offload tasks from the central server, such as real-time overlay visualization of detection events or specialized rendering requirements for specific AI outputs. This distributed processing capability improves system responsiveness, reduces overall network latency, and ensures that complex video walls can display enriched, actionable information without taxing the core VMS infrastructure. This evolution ensures the decoder remains a critical element in systems demanding high-performance video walls for security and operational centers.

- AI algorithms necessitate the decoding and superposition of complex metadata (e.g., facial recognition masks, license plate data) in real-time.

- Decoders are evolving to include specialized AI acceleration cores (e.g., NPUs) to handle localized inference tasks or metadata rendering at the display endpoint.

- The adoption of AI-driven video content analysis (VCA) increases the computational burden on display systems, driving demand for high-performance, specialized decoders.

- AI-enhanced decoding facilitates adaptive stream management, allowing decoders to intelligently adjust bitrates and resolution based on the content or detected events, optimizing bandwidth usage.

- Future decoders will need robust interoperability standards to seamlessly integrate and display analytic outcomes generated by diverse VMS and edge AI platforms.

DRO & Impact Forces Of HD Network Video Decoders Market

The dynamics of the HD Network Video Decoders Market are shaped by a complex interplay of internal and external forces categorized as Drivers, Restraints, and Opportunities (DRO). A primary Driver is the overwhelming industry shift towards Ultra HD (4K and 8K) resolutions across surveillance and professional AV applications, requiring specialized hardware capable of handling massive data streams and high pixel counts without latency. Furthermore, heightened global security and public safety concerns are accelerating infrastructure modernization across critical sectors, mandating the deployment of reliable, centralized video monitoring systems managed by high-density decoders. Simultaneously, the proliferation of IoT devices and edge computing generates unprecedented volumes of video data, positioning decoders as essential aggregation and display components in large-scale IP networks. These drivers collectively amplify the need for dedicated decoding power to maintain system performance and operational visibility.

However, the market growth is moderately Restrained by factors such as the significant initial capital investment required for deploying high-end hardware decoders, particularly compared to utilizing standard PC-based software decoding, which remains a viable, albeit less reliable, alternative for smaller deployments. Another constraint is the increasing complexity related to network bandwidth management and system integration, as managing hundreds of multi-megapixel streams requires robust network infrastructure and specialized IT expertise, which can deter smaller organizations. Furthermore, the rapid obsolescence cycle inherent in digital video technology means that customers often face frequent upgrade requirements to keep pace with new compression standards (e.g., H.266/VVC) and resolution jumps, increasing the total cost of ownership.

Opportunities for market expansion are significant, primarily stemming from the rapid uptake of smart city projects globally, which necessitate vast centralized control rooms relying heavily on video wall technology powered by HD network decoders. The ongoing standardization of IP video protocols and interfaces (like ONVIF Profile S/G/T) is simplifying integration processes, opening the door for greater market adoption across diverse verticals. Moreover, the increasing demand for customized video wall solutions in specialized environments, such as medical visualization, industrial inspection, and defense, presents lucrative niche markets. The integration of advanced features such as cybersecurity enhancements, redundancy capabilities, and edge-to-cloud compatibility further solidifies the long-term potential for specialized HD network video decoders.

Segmentation Analysis

The HD Network Video Decoders Market is segmented based on product type, compression standards supported, resolution capability, and end-user application. Product segmentation differentiates between dedicated hardware decoders, which offer superior performance and stability, and software/embedded decoders, which are integrated into VMS servers or edge devices. Segmentation by compression standards, particularly the move from H.264 to the more efficient H.265 (HEVC), is critical as it dictates the decoder's processing requirements and the density of streams it can handle. Resolution capability is a primary driver, with 4K decoders dominating the current market, rapidly giving way to emerging 8K solutions tailored for high-fidelity surveillance and broadcasting.

- By Type:

- Hardware Decoders (Standalone Units, Modular Cards)

- Software/Embedded Decoders

- By Compression Standard:

- H.264

- H.265 (HEVC)

- MPEG-4/MJPEG

- Other (e.g., AV1)

- By Resolution:

- Up to 1080p (Full HD)

- 4K (Ultra HD)

- 8K and Above

- By Application:

- Video Surveillance and Security

- Transportation (Airports, Railways, Traffic Monitoring)

- Broadcast and Media

- Industrial Monitoring

- Government and Defense

Value Chain Analysis For HD Network Video Decoders Market

The value chain for HD Network Video Decoders begins with the Upstream Analysis, dominated by suppliers of critical components, including high-performance semiconductor manufacturers (e.g., specialized CPUs, GPUs, FPGAs/ASICs tailored for video processing), memory components, and networking interface chips. These suppliers dictate the technological capability and raw material costs of the final product. Key activities in this stage involve sourcing highly efficient coding/decoding intellectual property (IP) cores and ensuring compliance with rapidly changing industry standards, particularly related to H.265 acceleration and cybersecurity mandates. Supplier relationships are critical, as the performance bottleneck often lies within the proprietary chipset developed for high-density simultaneous decoding. Manufacturers must maintain agile sourcing strategies to mitigate risks associated with supply chain volatility for advanced components.

The mid-stream segment involves the core Manufacturing and Assembly processes, where specialized decoder boards are designed, firmware is developed for network management, and units are rigorously tested for heat dissipation, latency performance, and interoperability (especially with major VMS platforms). Manufacturing often relies on outsourced Electronic Manufacturing Services (EMS) providers, while core intellectual property and quality assurance remain in-house. Downstream Analysis focuses heavily on Distribution Channel dynamics. Sales are primarily channeled through System Integrators (SIs) and Value-Added Resellers (VARs) specializing in physical security and large-scale IT networking projects. Direct sales are common for large government or defense contracts requiring bespoke solutions. SIs play a pivotal role in installation, configuration, and ongoing maintenance, making their training and partnership status critical for market penetration and customer satisfaction.

The ultimate goal of the value chain is reaching the End-Users, who are generally sophisticated buyers requiring comprehensive solutions rather than just hardware components. The Direct distribution model is favored when dealing with large enterprises or governmental agencies that purchase high volumes and require tailored support and security guarantees. The Indirect channel, leveraging VARs and SIs, is crucial for reaching small-to-medium enterprises (SMEs) and managing complex, multi-vendor installations in sectors like commercial real estate and retail. The increasing focus on service revenue, including ongoing software updates, security patches, and predictive maintenance contracts, adds a significant layer to the downstream value proposition, extending the relationship beyond the initial hardware sale and ensuring long-term profitability within the highly competitive market landscape.

HD Network Video Decoders Market Potential Customers

The primary End-Users and Buyers of HD Network Video Decoders are large institutions and enterprises that operate mission-critical, high-density video monitoring environments, where failure or latency is unacceptable. These include government and public safety entities, which utilize decoders for centralized command and control centers, managing vast networks of public surveillance cameras (e.g., traffic control, city-wide monitoring). The transportation sector, encompassing international airports, major railway terminals, and port authorities, represents a significant customer base, requiring robust decoders to manage extensive video walls that monitor high-traffic areas and secure perimeters in real-time. These buyers prioritize high throughput, redundancy, and seamless integration with existing operational technologies.

Another major vertical comprises large commercial enterprises, including banking and financial services, where high-resolution monitoring is essential for compliance and fraud prevention, and large retail chains that deploy expansive surveillance systems for loss prevention and business intelligence. Industrial users, particularly in energy, utilities, and manufacturing, require decoders for remote monitoring of dangerous or inaccessible areas, prioritizing ruggedized solutions and support for specialized industrial protocols alongside standard network video streams. These customers typically demand decoders capable of managing streams from diverse camera types, resolutions, and proprietary industrial systems, ensuring comprehensive operational visibility across dispersed geographical locations.

Furthermore, the professional Broadcast and Media industry constitutes a high-value, albeit smaller, customer segment. These users require decoders for video contribution and distribution, prioritizing extremely low latency, high color fidelity, and support for broadcasting standards (like SMPTE standards) in addition to IP network requirements. The common denominator among all potential customers is the necessity for reliable, dedicated processing power to efficiently convert highly compressed network video feeds into high-quality display outputs suitable for human observation or subsequent analytical processing, ensuring that the integrity of the captured HD data is preserved throughout the visualization process.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 9.0 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Axis Communications, Hikvision Digital Technology, Dahua Technology, Bosch Security Systems, Hanwha Vision, Vivotek, Pelco (Motorola Solutions), Cisco Systems, Genetec, Milestone Systems, Advantech, Haivision, Aten International, Aetina, Matrox Video, Barco, Christie Digital Systems, i-Pro, Senstar, NVidia |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

HD Network Video Decoders Market Key Technology Landscape

The technological landscape of the HD Network Video Decoders market is primarily defined by continuous advancements in video compression efficiency and the specialized silicon required for processing high-bitrate streams with minimal latency. A major technological focus is the transition from H.264 to H.265 (High Efficiency Video Coding - HEVC), which demands significantly greater processing power but offers up to 50% bandwidth reduction at the same video quality. Decoder manufacturers are heavily investing in dedicated hardware acceleration units, such as Application-Specific Integrated Circuits (ASICs) or Field-Programmable Gate Arrays (FPGAs), explicitly designed to perform H.265 decompression across multiple concurrent channels, distinguishing high-performance decoders from general-purpose CPUs. Furthermore, the emerging AV1 codec, backed by major tech firms, is gaining traction for its open-source, royalty-free nature and superior compression ratios, compelling decoder providers to plan for multi-codec support architectures.

Low latency technology is another critical differentiator, particularly in real-time monitoring and control room applications where split-second visibility is mandatory. Advanced decoders implement proprietary stream management protocols and optimizations in their internal pipelines to minimize decoding delay, often achieving glass-to-glass latency below 100 milliseconds. This requires sophisticated buffer management and jitter reduction algorithms tailored for unreliable or congested network environments. Interoperability remains a key challenge and technological necessity; adherence to global standards such as ONVIF profiles (S, G, and T) and proprietary API integration with leading Video Management Systems (VMS) platforms dictates market acceptance and deployment ease, ensuring that the decoder can seamlessly interpret and display streams from diverse camera vendors.

Current technological development also includes integrating features beyond mere decompression. Modern HD network video decoders often incorporate video wall management capabilities, allowing a single unit to drive multiple displays and manage complex display layouts (e.g., picture-in-picture, split screens) without requiring external video processors. Furthermore, the rising interest in edge computing and AI necessitates decoders that can handle decoded metadata streams, overlaying critical analytic information (like license plate recognition results or object tracking boxes) directly onto the video display in real-time. Cybersecurity features, including secure boot, encrypted stream handling, and adherence to emerging standards like FIPS compliance, are becoming essential technological requirements for government and critical infrastructure deployments, protecting the video endpoint from unauthorized access or manipulation.

Regional Highlights

- Asia Pacific (APAC): APAC is anticipated to be the fastest-growing region, driven by large-scale government investments in smart city infrastructure and public surveillance projects, particularly in countries like China, India, Japan, and South Korea. Rapid urbanization and the deployment of massive transportation networks (metros, high-speed rail) necessitate high-density, centralized monitoring centers, fueling demand for powerful hardware decoders capable of managing thousands of simultaneous streams.

- North America: North America holds a significant market share, characterized by high adoption rates of advanced 4K and 8K security systems across critical infrastructure, defense, and high-end commercial sectors. The maturity of the VMS ecosystem and strong regulatory compliance requirements (e.g., NIST, FIPS) push demand towards specialized, high-security decoding solutions with robust cybersecurity features and low-latency performance essential for emergency response applications.

- Europe: The European market demonstrates steady growth, driven primarily by the mandatory upgrade cycle to H.265/4K systems in commercial environments and compliance requirements related to privacy regulations (GDPR). Key demand sectors include retail, banking, and public venues, focusing on solutions that offer high integration flexibility with existing security and IT infrastructure, emphasizing modular decoder solutions for scalable control room environments.

- Latin America (LATAM): Growth in LATAM is stimulated by increasing security threats and ongoing infrastructure development, particularly in large urban centers in Brazil and Mexico. The market is price-sensitive but shows rising demand for professional-grade decoders as government and large corporate entities modernize their analog CCTV systems to sophisticated IP-based monitoring platforms.

- Middle East and Africa (MEA): MEA is experiencing significant expansion, propelled by substantial investment in new mega-cities (e.g., NEOM in Saudi Arabia) and major events, requiring cutting-edge, resilient video decoding infrastructure. High-end, customized video wall solutions for centralized monitoring centers (CMCs) and national security applications are major procurement drivers in this region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the HD Network Video Decoders Market.- Axis Communications

- Hikvision Digital Technology

- Dahua Technology

- Bosch Security Systems

- Hanwha Vision

- Vivotek

- Pelco (Motorola Solutions)

- Cisco Systems

- Genetec

- Milestone Systems

- Advantech

- Haivision

- Aten International

- Aetina

- Matrox Video

- Barco

- Christie Digital Systems

- i-Pro

- Senstar

- NVidia

Frequently Asked Questions

Analyze common user questions about the HD Network Video Decoders market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical difference between hardware and software video decoders?

Hardware decoders use dedicated, optimized silicon (ASICs/FPGAs) for video decompression, ensuring higher stream density, lower latency, and guaranteed stability, especially for 4K/H.265 streams. Software decoders rely on general-purpose CPUs/GPUs, which offer flexibility but often struggle with high-density, real-time decoding, resulting in higher latency and resource consumption.

How does H.265 (HEVC) adoption affect the demand for network video decoders?

H.265 significantly increases data compression efficiency but requires substantially more processing power for decoding. This transition drives demand for newer, high-performance hardware decoders specifically designed with accelerated H.265 engines to manage complex decompression while maintaining display frame rates and avoiding dropped frames in command center video walls.

Why are dedicated decoders essential for managing large-scale video walls?

Dedicated decoders are essential because they provide the necessary processing capability to simultaneously decode multiple high-resolution, high-bitrate streams (e.g., 64 channels of 4MP video) and synchronize them across many display panels with extremely low latency, a performance level unreachable by standard workstation PCs or VMS servers alone.

What role does cybersecurity play in the design of modern HD Network Video Decoders?

Cybersecurity is critical; modern decoders must include features like secure boot, encrypted video stream handling (e.g., HTTPS, SRTP), network segmentation capabilities, and firmware authentication to prevent unauthorized access, tampering, or the use of the decoder as an entry point for network attacks, particularly in critical infrastructure environments.

Which industry vertical is currently driving the highest investment in advanced decoding technology?

The Video Surveillance and Security sector, particularly within government, public safety, and critical infrastructure segments, is driving the highest investment. This is due to the exponential growth in high-resolution camera deployment (4K/8K) and the mandate for centralized command centers requiring flawless, real-time visualization of hundreds of video feeds simultaneously for operational awareness.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager