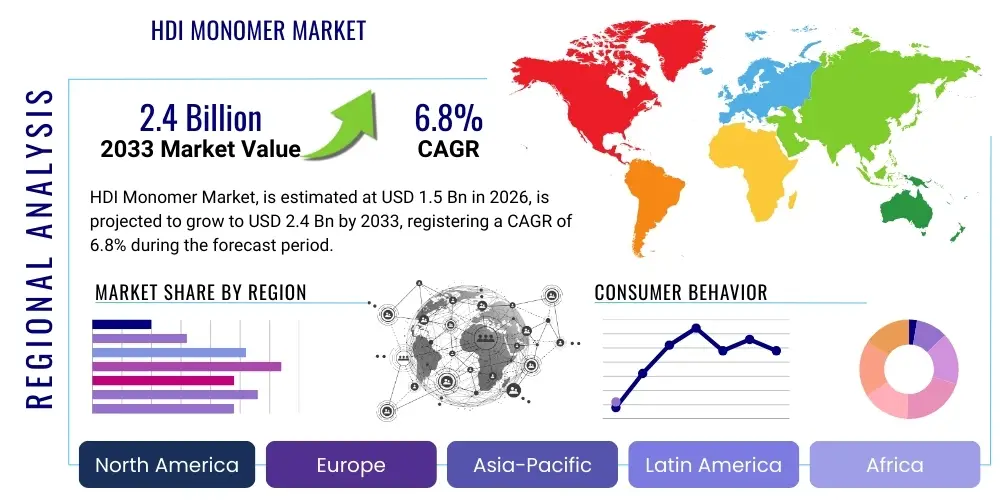

HDI Monomer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435390 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

HDI Monomer Market Size

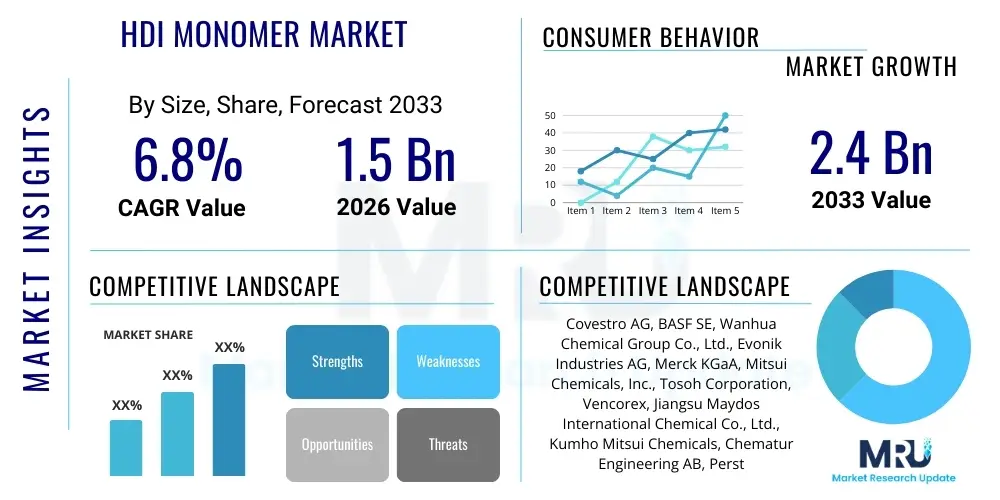

The HDI Monomer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.4 Billion by the end of the forecast period in 2033.

HDI Monomer Market introduction

Hexamethylene Diisocyanate (HDI) monomer is a crucial aliphatic diisocyanate recognized for its superior performance characteristics, particularly its excellent weather resistance, high transparency, and exceptional durability when incorporated into polyurethane systems. As a key raw material, HDI is predominantly utilized in the creation of high-performance polyurethane (PU) coatings, adhesives, sealants, and elastomers, which find extensive applications across demanding industries such as automotive refinish, aerospace, high-end consumer electronics, and construction. The monomer’s unique chemical structure, featuring two reactive isocyanate groups separated by a flexible hexane chain, enables the formulation of polyurethanes with superior non-yellowing properties, making it indispensable in applications where UV stability and aesthetic retention are paramount.

The primary benefit driving the widespread adoption of HDI monomer is its capability to produce light-stable polyurethanes. Unlike aromatic isocyanates, which degrade and yellow rapidly upon exposure to sunlight, HDI-based coatings maintain their color and gloss retention over extended periods, making them ideal for exterior applications. This technical superiority positions HDI monomer as the preferred building block for premium industrial coatings, including two-component polyurethane (2K PU) systems used for vehicles and protective finishes on infrastructure. Furthermore, the development of waterborne HDI derivatives is enhancing its market reach by addressing stringent volatile organic compound (VOC) emission regulations globally, supporting a shift towards sustainable chemical manufacturing.

Driving factors for the robust growth of the HDI monomer market include the rapidly expanding global automotive industry, particularly the demand for aesthetic and durable clear coats and protective layers. Concurrently, the increasing focus on advanced infrastructure and high-performance adhesives in the construction sector, alongside the growing use of specialized elastomers in medical and electronic devices, further fuels consumption. The continuous technological advancements in polymerization techniques aimed at producing oligomers and prepolymers with lower free monomer content also contribute to market expansion by improving product safety and handling characteristics, making HDI derivatives more attractive for a broader range of high-specification applications.

HDI Monomer Market Executive Summary

The HDI Monomer Market is experiencing robust expansion, fundamentally driven by the escalating global demand for high-performance, weather-resistant coatings and elastomers across key sectors such as automotive, construction, and specialized industrial manufacturing. Business trends indicate a strategic focus among major producers on backward integration into raw material supply, particularly the manufacture of hexamethylenediamine (HMD), to secure cost efficiencies and supply chain resilience. Furthermore, innovation is concentrated on the development of low-VOC and bio-based HDI derivatives, responding to global regulatory pressures favoring environmental sustainability and safer chemical alternatives, thereby opening new application avenues in sustainable coatings and green building materials.

Regionally, the Asia Pacific (APAC) stands as the dominant and fastest-growing market, primarily fueled by the rapid expansion of automotive production hubs in China, India, and Southeast Asia, coupled with massive infrastructure investments requiring durable protective coatings. North America and Europe, while mature markets, maintain significant consumption due to strict quality standards in aerospace and premium automotive refinish segments, alongside robust adoption of advanced polyurethane systems complying with strict EU REACH and US EPA regulations. The demand dynamics are heavily influenced by geopolitical trade policies affecting feedstock pricing and the localized availability of high-purity production facilities.

Segment trends reveal that the Coatings application segment retains the largest market share, specifically the demand for clear coats and protective layers in automotive and aerospace industries, valued for HDI's non-yellowing properties. The market is also witnessing rapid growth in the Adhesives and Sealants segment, driven by their increasing use in structural bonding in electric vehicles (EVs) and high-rise construction, necessitating high-strength, durable bonding agents. By Derivative Type, the trimer (polyisocyanurate) continues to dominate the derivative landscape due to its versatility and wide usage in high-solid coatings formulations, followed by the biuret and prepolymer forms designed for specific elasticity and viscosity requirements.

AI Impact Analysis on HDI Monomer Market

User queries regarding the impact of Artificial Intelligence (AI) on the HDI Monomer Market frequently center around three primary themes: optimization of complex chemical synthesis processes, predictive maintenance for large-scale production facilities, and enhanced materials informatics for new derivative discovery. Users are keenly interested in how AI can streamline the highly energy-intensive and precise phosgenation or non-phosgene manufacturing routes, specifically seeking efficiency gains to lower production costs and reduce hazardous waste. Furthermore, significant concern exists around leveraging machine learning models to rapidly predict the performance characteristics (e.g., curing time, UV stability, viscosity) of novel HDI-based polyurethane formulations, thereby dramatically shortening the R&D cycle for specialty chemical products tailored to specific end-user requirements like electric vehicle battery coatings or aerospace components. The expectation is that AI will transform the traditionally slow and experimental process of polymer science into a data-driven, accelerated engineering discipline.

- AI-driven optimization of reaction parameters to maximize yield and purity of HDI monomer synthesis, reducing energy consumption in highly exothermic processes.

- Implementation of predictive analytics for equipment failure detection in isocyanate production plants, minimizing unplanned downtime and enhancing operational safety.

- Machine learning algorithms accelerating the discovery and formulation of new HDI oligomers and prepolymers with improved characteristics, such as lower viscosity or enhanced elasticity.

- AI-enabled demand forecasting models improving supply chain management for Hexamethylenediamine (HMD) feedstock and finished HDI products, optimizing inventory levels globally.

- Use of AI for quality control by analyzing spectroscopic data in real-time to ensure batch consistency and compliance with stringent purity standards required for specialized applications like optical coatings.

DRO & Impact Forces Of HDI Monomer Market

The dynamics of the HDI Monomer Market are shaped by a strong interplay between the superior performance benefits offered by the product, increasing regulatory scrutiny, and high barriers to entry related to complex manufacturing technologies. Key market drivers include the sustained demand from the automotive sector for durable, aesthetically pleasing clear coats and the burgeoning growth of specialized industrial applications requiring excellent weatherability and chemical resistance, which HDI derivatives uniquely provide. However, growth is substantially restrained by the volatile pricing and supply stability of key raw materials, particularly hexamethylenediamine (HMD) and phosgene gas (used in conventional routes), coupled with the significant capital investment and highly technical expertise required to operate safe and compliant HDI production facilities. These high costs limit the number of global players, creating an oligopolistic market structure.

Opportunities for market penetration and differentiation primarily revolve around the transition towards sustainable chemistry. The development and commercialization of non-phosgene manufacturing technologies (such as the urethane route or oxidative carbonylation) present a major opportunity to mitigate environmental and safety risks associated with phosgene use, thereby attracting investment and satisfying corporate sustainability goals. Furthermore, the rapidly evolving electric vehicle (EV) market presents a specific opportunity; specialized HDI-based coatings are critical for thermal management and protection of battery packs and internal components, requiring bespoke high-performance polyurethane systems that command premium pricing and demand. The push for waterborne and high-solid coatings formulations in regulated markets offers further specialized growth avenues.

The market is subjected to strong impact forces stemming from regulatory mandates and feedstock price volatility. Stringent environmental regulations, such as the European Union's REACH framework and various VOC emission standards globally, exert a powerful force, pushing manufacturers towards developing lower-monomer content prepolymers and waterborne systems, favoring innovation. Simultaneously, the impact of crude oil price fluctuations affects the petrochemical derivatives used in HDI production, creating cost pressures that manufacturers often struggle to absorb, subsequently impacting end-product pricing and adoption rates in price-sensitive markets. The competitive landscape is intensely focused on patent protection and technological superiority, where the ability to produce ultra-low free HDI oligomers serves as a crucial competitive differentiator and a key determinant of market influence.

Segmentation Analysis

The HDI Monomer market segmentation provides a comprehensive view of consumption patterns, driven primarily by derivative type and end-use application specificity. The market is broadly categorized based on the chemical form in which HDI is primarily consumed, including pure monomer, trimer, biuret, and prepolymers, each serving distinct functional requirements in end-user industries. The segmentation by application reflects the diverse utility of HDI, ranging from thin-film protective coatings requiring UV stability to high-strength structural adhesives demanding superior elasticity and durability. This granular analysis is essential for manufacturers to tailor product portfolios and R&D efforts towards high-growth, high-value segments, optimizing production capacity allocation based on regional demand concentration and regulatory compliance needs across different product categories.

- By Derivative Type:

- HDI Monomer (Pure)

- HDI Trimer (Polyisocyanurate)

- HDI Biuret

- HDI Prepolymers

- By Application:

- Coatings (Automotive OEM, Automotive Refinish, Industrial Protective Coatings, Architectural Coatings)

- Adhesives and Sealants (Structural Adhesives, Flexible Sealants)

- Elastomers (Cast Elastomers, Thermoplastic Polyurethane - TPU)

- Others (Medical devices, Specialized Films)

- By End-Use Industry:

- Automotive and Transportation

- Construction

- Aerospace

- Medical

- Electronics

- Textiles and Footwear

Value Chain Analysis For HDI Monomer Market

The value chain for the HDI Monomer market is characterized by a high degree of integration and technical complexity, beginning with the highly capital-intensive upstream segment. Upstream activities center on the production of Hexamethylenediamine (HMD) and phosgene (in conventional routes), derived primarily from petrochemical feedstocks like crude oil and natural gas. Major HDI producers often integrate backward to secure stable, high-purity HMD supply, which is critical as HMD purity directly influences the quality and performance of the resulting HDI monomer. This stage requires significant chemical expertise and adherence to stringent safety protocols, particularly concerning the handling and storage of hazardous intermediates like phosgene, which acts as a substantial barrier to new market entrants.

The midstream phase involves the core manufacturing process—the reaction of HMD with phosgene or alternative non-phosgene reactants to produce the raw HDI monomer. This intermediate product is then further processed, reacted, and formulated downstream into various derivatives such as HDI trimer (isocyanurate), biuret, and prepolymers. This derivatization step is where significant value is added, as specialized derivatives are tailored to meet specific performance criteria, such as viscosity for spray applications or curing speed for industrial lines. Research and Development focused on creating ultra-low free monomer derivatives is central to maintaining competitive advantage at this stage, meeting increasing regulatory demands for safer handling products.

Downstream activities involve the incorporation of these HDI derivatives into final polyurethane systems, predominantly sold to formulators and major industrial end-users in the Coatings, Adhesives, and Elastomers sectors. Distribution channels are typically specialized: high-volume HDI monomer and commodity derivatives are often handled through direct sales agreements with major global coating manufacturers (e.g., PPG, AkzoNobel), leveraging technical support and bulk logistics. Conversely, specialized, smaller-volume prepolymers or custom formulations might utilize indirect distribution networks involving regional specialty chemical distributors who provide localized technical service, inventory management, and smaller batch sizes, crucial for the fragmented automotive refinish and specialized construction markets.

HDI Monomer Market Potential Customers

Potential customers for HDI Monomer are fundamentally rooted in industries requiring premium, durable, and highly weather-resistant surface protection and structural integrity. The most significant customer base resides in the automotive sector, encompassing both Original Equipment Manufacturers (OEMs) and the vast automotive refinish market, which relies heavily on HDI trimer and biuret derivatives for non-yellowing clear coats that maintain gloss and color retention under harsh environmental conditions. These customers prioritize quality consistency and compliance with rigorous industry standards regarding longevity and impact resistance. The demand from OEMs is further amplified by the shift towards electric vehicles, which require specialized polyurethane coatings for internal electronic components and battery casings, demanding chemical resistance and thermal stability.

Another major segment includes large-scale industrial coatings formulators and construction chemical producers. These customers purchase HDI derivatives for high-performance protective industrial coatings used on bridges, pipelines, and aerospace structures where corrosion prevention and UV stability are paramount. In the construction industry, HDI-based sealants and adhesives are increasingly utilized for high-rise buildings and modern architectural designs due to their flexible, yet strong, bonding capabilities and resistance to weathering. These end-users typically require large volumes and standardized products, often engaging in long-term supply contracts directly with major HDI producers to ensure supply security and quality consistency for their complex project requirements.

Furthermore, specialized segments such as medical device manufacturing and high-end electronics represent niche, yet high-value, potential customers. Medical applications utilize HDI-based polyurethanes for biocompatible coatings, surgical glues, and flexible tubing, demanding extremely high purity and regulatory compliance. Electronics manufacturers utilize specialized HDI elastomers for sealing and encapsulating sensitive components, requiring materials with specific dielectric properties and thermal resilience. These customers often demand custom-synthesized prepolymers with extremely low free monomer content, reflecting a premium segment where performance specifications far outweigh cost considerations, driving innovation in advanced derivative forms and specialized formulating techniques.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.4 Billion |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Covestro AG, BASF SE, Wanhua Chemical Group Co., Ltd., Evonik Industries AG, Merck KGaA, Mitsui Chemicals, Inc., Tosoh Corporation, Vencorex, Jiangsu Maydos International Chemical Co., Ltd., Kumho Mitsui Chemicals, Chematur Engineering AB, Perstorp Holding AB, LyondellBasell Industries N.V., Dow Inc., Nippon Polyurethane Industry Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

HDI Monomer Market Key Technology Landscape

The technological landscape of the HDI Monomer market is defined by the ongoing dual-track approach focusing on optimizing established phosgenation methods while simultaneously scaling up cleaner, non-phosgene alternatives. Historically, HDI production has relied heavily on the highly efficient but hazardous phosgenation route, involving the reaction of hexamethylenediamine (HMD) with phosgene. Major technological efforts in this traditional route are concentrated on enhancing reactor design, improving process safety through closed-loop systems, and increasing catalytic efficiency to maximize yield and minimize the environmental footprint and occupational hazards associated with handling phosgene gas. Optimization of fractional distillation techniques is also critical for achieving the high purity levels required for premium applications, particularly for electronic and optical coatings, maintaining competitive superiority in cost-effectiveness.

A significant shift in the technological paradigm is driven by the imperative to adopt non-phosgene synthesis routes. The urethane route, for example, involves reacting HMD with dimethyl carbonate or urea derivatives, offering a much safer and environmentally friendlier process by eliminating the need for phosgene. While these non-phosgene technologies currently face challenges related to higher complexity, greater energy requirements, and difficulties in achieving cost parity with optimized phosgenation plants, substantial R&D investments are being channeled into developing novel catalytic systems and continuous flow chemistry techniques to overcome these limitations. The success of scaling non-phosgene technologies is viewed as a long-term critical factor for sustained growth, particularly as regulatory pressure on hazardous chemicals continues to intensify across developed economies.

Beyond the monomer synthesis itself, advanced technology also plays a crucial role in the derivatization stage. Innovations in oligomer synthesis technology are focused on producing HDI trimers and biurets with consistently lower residual free HDI monomer content (often below 0.1%). Techniques such as thin-film evaporation and specialized reactor designs are employed to achieve this, making the final products safer for industrial handling and meeting the increasingly stringent health and safety standards in markets like Europe. Furthermore, the development of water-dispersible HDI derivatives requires advanced emulsification and polymerization techniques to create stable aqueous systems (waterborne PUs), addressing the growing market demand for low Volatile Organic Compound (VOC) coating solutions and expanding the material's application scope in sustainable architectural and industrial coatings.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and most rapidly expanding market for HDI Monomer, driven primarily by the colossal growth in the automotive production sector, particularly in China, Japan, South Korea, and India. The region's expanding construction and infrastructure development also creates immense demand for durable, weather-resistant protective coatings and high-performance adhesives. Manufacturers in this region benefit from lower operating costs and a less stringent regulatory environment concerning chemical intermediates compared to the EU or North America, although regulations are rapidly converging towards global standards. The local presence of major coating producers and the increasing trend towards localized production of chemical intermediates further solidify APAC's market dominance, making it the central hub for future capacity expansion and technological adoption, especially in high-solid and solvent-free formulations critical for regional emission targets.

- North America: North America represents a mature, high-value market, characterized by stringent performance requirements in end-use industries such as aerospace, automotive refinish, and high-end industrial maintenance. Consumption is stable, focusing heavily on premium-grade HDI derivatives with ultra-low free monomer content, essential for meeting demanding occupational safety standards and high-quality aesthetic outcomes. The market is driven by technological adoption, with a strong preference for waterborne and bio-based polyurethane systems, aligning with EPA regulations and corporate sustainability mandates. Investment in this region is concentrated on process safety improvements and leveraging digital technologies for supply chain efficiency and product customization, targeting specialized, high-margin niche applications rather than bulk commodity sales.

- Europe: The European HDI Monomer market is profoundly shaped by the REACH regulation, driving a continuous need for innovation toward safer and environmentally compliant products. This region leads in the adoption of non-phosgene production technologies and the development of advanced low-monomer prepolymers and waterborne dispersion technologies to minimize VOC emissions. While automotive and construction sectors remain significant consumers, the focus is on achieving circular economy goals, promoting bio-based and sustainable HDI feedstocks. Regulatory scrutiny and high operational costs present inherent challenges, yet they also create a competitive advantage for companies that successfully navigate these requirements, enabling them to capture the high-value market share generated by compliance and sustainability leadership.

- Latin America (LATAM): LATAM is an emerging market for HDI monomer, with demand primarily fueled by the recovery and expansion of the Brazilian and Mexican automotive manufacturing sectors and ongoing infrastructural projects. The market faces challenges related to economic volatility and reliance on imports for specialized derivatives. However, as local industries mature and global manufacturers establish production bases, the consumption of high-performance coatings is expected to rise steadily. The focus remains on cost-effective supply solutions while slowly integrating globally recognized quality and environmental standards into localized industrial processes.

- Middle East and Africa (MEA): The MEA region exhibits specialized demand patterns, particularly in the Middle East, driven by extensive oil and gas infrastructure requiring highly durable, chemically resistant protective coatings to withstand harsh desert and coastal environments. HDI derivatives are critical for corrosion protection in pipelines, refineries, and offshore platforms. In Africa, consumption is nascent but growing, linked to urbanization and new construction activities. The market growth is reliant on foreign investment and the establishment of local formulation capabilities to serve the large-scale energy and construction projects characterizing the regional economic landscape, prioritizing performance and extreme longevity.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the HDI Monomer Market.- Covestro AG

- BASF SE

- Wanhua Chemical Group Co., Ltd.

- Evonik Industries AG

- Merck KGaA

- Mitsui Chemicals, Inc.

- Tosoh Corporation

- Vencorex

- Jiangsu Maydos International Chemical Co., Ltd.

- Kumho Mitsui Chemicals

- Chematur Engineering AB

- Perstorp Holding AB

- LyondellBasell Industries N.V.

- Dow Inc.

- Nippon Polyurethane Industry Co., Ltd.

- Bayer MaterialScience AG (now part of Covestro)

- DIC Corporation

- Huntsman Corporation

- SKC Co., Ltd.

- INEOS Group Holdings S.A.

Frequently Asked Questions

Analyze common user questions about the HDI Monomer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary applications of HDI Monomer?

HDI Monomer is predominantly used to produce aliphatic polyisocyanates, which are key components in high-performance polyurethane (PU) systems. Its primary applications include automotive clear coats, protective industrial coatings, advanced adhesives and sealants, and specialty elastomers, owing to its superior UV stability and non-yellowing characteristics.

Why is HDI preferred over MDI or TDI in certain coatings?

HDI is an aliphatic diisocyanate, offering excellent light fastness and resistance to yellowing upon UV exposure. Aromatic isocyanates like MDI or TDI yellow quickly outdoors. Therefore, HDI derivatives are essential for exterior applications such as automotive refinish and protective architectural coatings where aesthetic durability is critical.

What are the key drivers for market growth in the Asia Pacific region?

The APAC market growth is fueled by massive expansion in the automotive manufacturing sector, rapid infrastructural development, and increasing industrialization in countries like China and India, leading to high demand for durable, high-specification protective and aesthetic coatings.

How do environmental regulations impact the production of HDI Monomer?

Environmental regulations, particularly regarding VOC emissions (e.g., in Europe and North America), force manufacturers to innovate towards lower-monomer content prepolymers and waterborne HDI derivatives, stimulating investment in non-phosgene synthesis routes to enhance process safety and sustainability.

Which derivative of HDI Monomer holds the largest market share?

The HDI Trimer (polyisocyanurate) typically holds the largest market share. It is widely utilized in high-solid and two-component polyurethane (2K PU) coatings formulations due to its low viscosity, high functionality, and excellent cross-linking capabilities, providing superior hardness and chemical resistance.

The HDI Monomer Market is experiencing a pivotal transition driven by technological advancement and stringent regulatory landscapes, positioning it for consistent, premium growth throughout the forecast period. The market structure, dominated by a few integrated global players, emphasizes strategic competence in maintaining high product purity and developing next-generation, environmentally compliant derivatives. As global manufacturing hubs, particularly in APAC, continue to scale operations requiring advanced coating solutions, the demand for HDI's unique performance attributes—specifically UV stability and durability—will remain inelastic, underscoring its indispensable role in the specialty chemical sector. The continuous investment in non-phosgene manufacturing technologies serves not only as a response to regulatory pressure but also as a long-term strategy for operational resilience and sustainable differentiation in the highly competitive global diisocyanate industry.

Future market expansion is heavily contingent upon successfully addressing the inherent volatility in raw material supply chains, especially HMD, and the further integration of AI-driven optimization tools to streamline complex chemical synthesis. Specialized applications, such as high-performance coatings for the rapidly expanding electric vehicle battery market and innovative use in medical devices requiring biocompatible polyurethane systems, are expected to provide premium growth opportunities, offsetting potential price pressures in commodity coating segments. Successful market players will be those who master the production of ultra-low free HDI content products while achieving cost-efficiency through optimized processes and strategic global capacity deployment.

Regional dynamics illustrate a clear bifurcation: volume growth centered in the industrializing economies of Asia Pacific, and high-value, specialized innovation concentrated in the regulated and quality-conscious markets of Europe and North America. This necessitates a localized marketing and R&D strategy, focusing on compliance and sustainability in the West and efficiency and scale in the East. Ultimately, the HDI Monomer market trajectory is intrinsically linked to global industrial output, particularly in automotive and construction, ensuring sustained demand for products that guarantee long-term asset protection and superior aesthetic performance in demanding applications worldwide.

The strategic implications of the forecasted growth suggest that mergers, acquisitions, and joint ventures aimed at consolidating raw material supply (HMD) and acquiring advanced derivatization technology will be prevalent among key competitors seeking to solidify their market positions and enhance global distribution networks. The focus on specialty prepolymers and waterborne formulations represents the highest potential return on investment, aligning with the global movement towards safer and less environmentally invasive industrial chemistry practices. The adoption of advanced process control and digital twins, often influenced by AI-impact analysis, will ensure production safety and consistency, further elevating the competitive barriers to entry in this specialized chemical segment, making operational excellence synonymous with market leadership in the HDI monomer space.

Analysis of the technological landscape confirms that while the established phosgenation technology currently dominates due to cost-effectiveness, the strategic pivot toward non-phosgene routes, despite higher initial capital requirements, is an unavoidable long-term trend driven by sustainability mandates and occupational safety imperatives. This transition will require significant cross-industry collaboration between chemical producers, engineering firms, and end-use formulators to develop integrated, cost-competitive solutions. Furthermore, the ability of HDI producers to maintain consistently high-purity monomer supply is foundational, influencing the performance of downstream polyurethane products used in critical applications such as aerospace sealants and high-end consumer electronics coatings, where failure tolerance is near zero. Investment in sophisticated analytical equipment and quality assurance protocols is therefore non-negotiable for market participants aiming for premium positioning.

The demand for specialized HDI derivatives, particularly those used in structural adhesives for new energy vehicles (NEVs), represents a dynamic growth area. As vehicle designs move toward lightweight, multi-material architectures, the reliance on high-strength, flexible bonding solutions increases dramatically, pushing the need for advanced HDI prepolymers with specific rheological and mechanical properties. This segment demands rapid material qualification and customized formulations, creating significant opportunities for chemical companies that can leverage agile R&D capabilities and rapid prototyping. The interplay between chemical performance and end-user engineering requirements is tightening, making technical service and specialized application support a vital component of the competitive offering in the HDI Monomer market.

Addressing the restraint imposed by raw material volatility necessitates robust supply chain risk management, including geographical diversification of HMD sourcing and the implementation of long-term indexed supply contracts. Companies demonstrating resilience in managing these upstream cost pressures are better positioned to maintain stable pricing and volume commitments to major downstream customers, thereby strengthening market share. The complexity of the HDI value chain, extending from basic petrochemicals to highly customized coatings and adhesives, underscores the need for deep vertical integration or highly secured partnerships to mitigate disruptions and ensure quality continuity across all stages of production and application. This strategic control over the value chain is a hallmark of leading market players, distinguishing them from smaller, less diversified competitors.

In summary, the HDI Monomer Market is set for robust expansion, fundamentally supported by its irreplaceable role in high-performance polyurethane chemistry. While facing technical and regulatory challenges, strategic investments in sustainable production technology and targeted innovation in specialized derivatives will define market leadership. The synergy between growing demand from high-growth industries (like EVs and high-end construction) and continuous efforts to enhance environmental compliance ensures a structurally sound and expanding market trajectory throughout the forecast period, emphasizing quality, safety, and specialized performance.

The impact forces stemming from regulatory evolution, such as the increasing global scrutiny of isocyanate exposure limits and residual monomer content, require continuous adaptation and significant capital expenditure on plant upgrades and purification technologies. This regulatory environment effectively serves as a filter, favoring large, well-resourced chemical giants capable of meeting evolving standards. Conversely, this also creates a strong opportunity for novel technology licensing, particularly for non-phosgene routes, allowing specialized engineering firms to partner with chemical producers seeking to transition legacy facilities into compliant, modern manufacturing sites. The necessity for these high-cost adaptations maintains high barriers to entry, reinforcing the oligopolistic nature of the global HDI supply base.

Further elaboration on the regional nuances reveals that while APAC drives volume, the future of material innovation often originates in Europe. European research efforts are leading the charge in developing bio-based HDI precursors derived from renewable resources, responding to consumer and corporate demand for materials with reduced carbon footprints. Although these bio-based alternatives are currently premium priced and face scaling challenges, their eventual commercial viability represents a significant long-term opportunity for redefining the market and capturing the rapidly growing segment of environmentally conscious consumers and industrial buyers. This global divergence in regional priorities—volume vs. sustainability—necessitates highly flexible manufacturing and supply chain strategies for truly global players.

The increasing complexity in segmentation, particularly within the coatings application, highlights the specialization required. For instance, the transition from traditional solvent-based coatings to high-solids and waterborne HDI systems is not merely a formulation change but requires tailored HDI derivatives that maintain reactivity and stability in different media. Formulators demand specific HDI oligomers (like allophanates or asymmetrical trimers) that enable lower viscosity at high solids content or ensure long pot life in aqueous dispersions. This technical complexity ensures that the monomer market remains a highly specialized sector, rewarding deep material science expertise and proprietary polymerization techniques over simple bulk chemical production. This specificity drives the premium pricing associated with high-performance HDI derivatives.

Finally, the long-term competitive dynamics will increasingly rely on the integration of digital tools. The application of sophisticated simulation software in R&D to model the behavior of new HDI polymers under extreme conditions (thermal cycling, chemical exposure) drastically reduces the time and cost associated with physical experimentation. Furthermore, the use of blockchain technology to trace the purity and origin of specialized HDI batches—critical for aerospace and medical customers—is becoming a differentiator, providing end-users with unparalleled transparency and quality assurance. Therefore, technological excellence in synthesis, formulation, and digitalization will be the pillars of sustained competitive advantage in the HDI Monomer market.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager