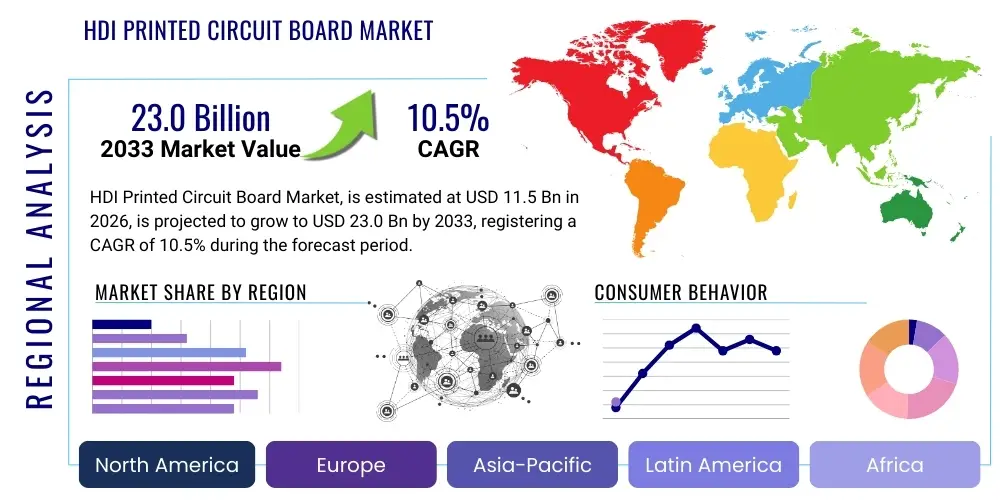

HDI Printed Circuit Board Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435639 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

HDI Printed Circuit Board Market Size

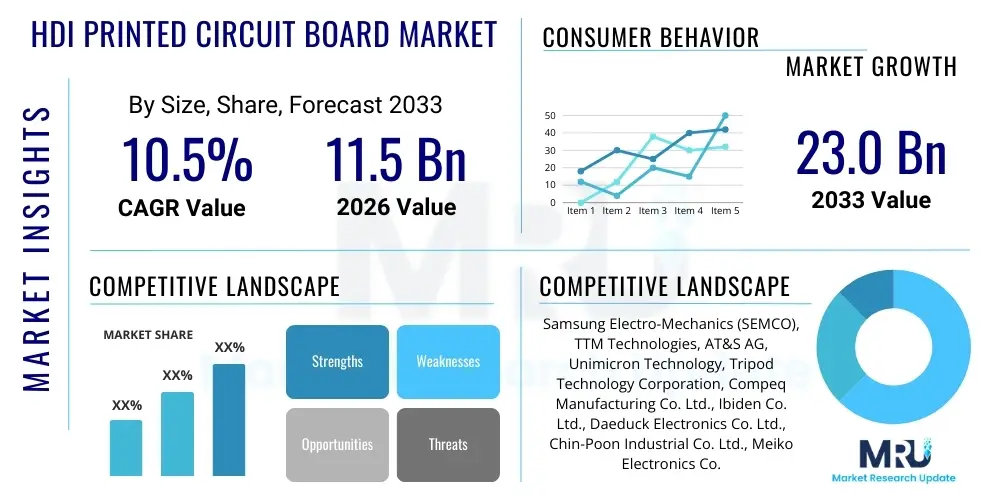

The HDI Printed Circuit Board Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.5% between 2026 and 2033. The market is estimated at USD 11.5 billion in 2026 and is projected to reach USD 23.0 billion by the end of the forecast period in 2033. This robust expansion is primarily driven by the continuous miniaturization of electronic devices, particularly in the consumer electronics and automotive sectors, demanding higher circuit density and improved electrical performance inherent to High-Density Interconnect (HDI) technology. Furthermore, the accelerating adoption of 5G infrastructure and advanced computing platforms necessitates complex PCB designs that only HDI configurations can reliably support, solidifying its market trajectory.

HDI Printed Circuit Board Market introduction

The High-Density Interconnect (HDI) Printed Circuit Board Market encompasses the manufacturing, distribution, and utilization of PCBs characterized by a higher wiring and component density compared to conventional PCBs. HDI technology uses features like microvias (less than 150 micrometers in diameter), blind and buried vias, and finer trace widths and spacing, enabling the creation of compact, lightweight, and highly functional electronic devices. This technology is critical for multilayer board fabrication, enhancing signal integrity, reducing electromagnetic interference (EMI), and maximizing real estate utilization within increasingly sophisticated gadgets. The primary product definition centers on complex substrate fabrication catering to high-speed digital and radio frequency applications, necessitating precision manufacturing processes and specialized materials.

Major applications of HDI PCBs span a broad spectrum of high-technology industries. Consumer electronics, including smartphones, tablets, and wearable technology, represent the largest application segment due to the paramount need for thin form factors and advanced functionality. The automotive industry is increasingly relying on HDI PCBs for sophisticated ADAS (Advanced Driver-Assistance Systems), infotainment units, and powertrain controls, where reliability under harsh conditions is mandatory. Furthermore, medical devices, aerospace systems, and high-performance computing (HPC) infrastructure also utilize these boards to achieve superior performance and reliability in mission-critical applications. The versatility of HDI solutions across diverse sectors underlines its pivotal role in the modern electronic ecosystem, driving consistent demand for technological advancements in material science and fabrication techniques.

The primary benefits of adopting HDI PCBs include significant size and weight reduction, which is crucial for portable devices, and vastly improved electrical performance due to shorter signal paths and controlled impedance characteristics. Key driving factors propelling this market include the global proliferation of IoT devices requiring compact processing power, the rapid deployment of 5G networks demanding high-frequency capabilities in infrastructure and end-user devices, and stringent regulatory requirements across safety-critical domains like medical and automotive electronics that mandate high reliability and traceability in componentry. These factors collectively ensure sustained investment in HDI manufacturing capacity expansion and technological innovation globally, supporting the anticipated double-digit growth rate throughout the forecast period.

HDI Printed Circuit Board Market Executive Summary

The HDI Printed Circuit Board Market is witnessing robust business trends marked by intense capital expenditure in Asia Pacific, particularly China, Taiwan, and South Korea, which dominate global production capabilities and technological advancements, focusing on advanced substrate materials like rigid-flex and high-frequency laminates to support 5G and millimeter-wave applications. Regional trends indicate that while manufacturing remains concentrated in APAC, demand growth is globally dispersed, with North America and Europe showing high adoption rates in specialized, high-reliability sectors such as aerospace/defense and high-end automotive systems. Segmentation trends highlight that the 4-6 layer segment currently holds the largest market share due to its optimal balance of cost-effectiveness and performance for mainstream consumer devices, though the adoption of 8-10+ layer and complex stacked microvia architectures is rapidly increasing, reflecting the ongoing shift toward ultra-high-density applications in server infrastructure and AI hardware.

AI Impact Analysis on HDI Printed Circuit Board Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the HDI PCB market frequently revolve around how AI hardware (such as specialized accelerators, GPUs, and TPUs) influences PCB complexity, materials required for thermal management, and the overall design cycle. Users are highly concerned about the necessity of ultra-low latency and high data throughput required for AI processing, which mandates extreme precision in trace routing and impedance control, areas where HDI excels. Furthermore, inquiries focus on the role of AI in optimizing the PCB manufacturing process itself—specifically, utilizing machine learning for yield enhancement, defect detection, and predictive maintenance within complex HDI fabrication lines. The key thematic summary suggests that AI is both a massive driver of demand for increasingly complex, high-layer-count HDI boards and an enabling technology for improving the efficiency and quality control necessary to meet these advanced manufacturing specifications.

- AI platforms necessitate extremely high-layer-count HDI boards (10+ layers) to accommodate dense component placement and complex interconnects for high-speed data buses.

- Demand for ultra-low loss materials (e.g., specific high-Tg laminates) is surging, driven by the need to minimize signal degradation in high-frequency AI compute environments.

- AI accelerates the implementation of advanced microvia structures (stacked and staggered) to manage the thermal and electrical demands of densely packaged AI processors.

- AI tools are being integrated into electronic design automation (EDA) software for optimizing routing, layer stack-up, and design-for-manufacturability (DFM) specifically for complex HDI layouts.

- Increased adoption of AI in quality control systems allows for automated, high-precision inspection of minute features characteristic of HDI PCBs, improving manufacturing yield rates.

DRO & Impact Forces Of HDI Printed Circuit Board Market

The dynamics of the HDI Printed Circuit Board market are fundamentally shaped by a confluence of accelerating drivers, persistent restraints, and significant opportunities, generating powerful impact forces on market expansion and competitive strategy. Key drivers include the relentless consumer demand for thinner and lighter electronic devices, coupled with the mandatory integration of complex modules like 5G modems and high-resolution sensors, all necessitating HDI architecture. Conversely, major restraints involve the high initial capital investment required for state-of-the-art HDI manufacturing equipment, the complexity and associated costs of advanced materials (e.g., specialized resins and copper foils), and the technical challenges related to maintaining high yields for boards featuring microvias and ultra-fine line technology. Opportunities are primarily centered around the nascent electric vehicle (EV) sector, the expansion of high-performance computing infrastructure (data centers and cloud services), and the increasing adoption of flexible HDI boards (rigid-flex) in niche high-reliability military and medical applications, paving the way for differentiated market entry and technological leadership.

Impact forces stemming from these elements determine market velocity and structural shifts. Technological advancement acts as a powerful accelerating force; the continuous innovation in laser drilling, plating processes, and material science directly addresses some of the manufacturing complexities, slowly eroding the restraint of high production costs over time. Geopolitical and supply chain risks, particularly concerning raw material sourcing and manufacturing concentration in Asia, exert a moderate restraining force, compelling OEMs and suppliers in Western markets to seek regional diversification or vertical integration strategies. The regulatory environment, favoring smaller, more energy-efficient electronics, acts as a long-term driver, rewarding manufacturers who can deliver compact, high-performance solutions consistent with global sustainability goals, thereby intensifying competition in core technology areas like thermal management within HDI stack-ups.

Strategic positioning within the market requires manufacturers to leverage opportunities derived from emerging technology platforms, such as the development of boards optimized for advanced packaging techniques like System-in-Package (SiP) and Chip-on-Flex (CoF), which utilize HDI fundamentals. The ability to manage stringent quality standards for mission-critical applications—like those in autonomous driving and advanced surgical equipment—is a critical impact factor differentiating premium suppliers from mass-market producers. Overall, the market remains highly technology-intensive, where R&D investment in materials and process automation directly dictates market share and long-term viability against competing technologies, thereby requiring sustained focus on both cost optimization and next-generation feature integration.

Segmentation Analysis

The HDI Printed Circuit Board market is comprehensively segmented based on technology type, application, and layer count, providing a granular view of market dynamics and specialized demand pockets. Technology segmentation primarily differentiates between standard HDI (1-2 layer build-up), advanced HDI (using stacked microvias and complex routing), and modified specialized versions like flexible HDI and rigid-flex HDI, each catering to distinct performance and form factor requirements. The layer count segmentation, including 4-6 layers, 8-10 layers, and 10+ layers, directly reflects the complexity and density demands of the end-user product, with higher layer counts correlating directly to sophisticated computing and networking infrastructure. Application segments define the major end-use sectors, revealing varying reliability standards, volume demands, and pricing sensitivities across consumer electronics, automotive, telecommunications, medical, and industrial electronics, allowing for targeted strategic marketing and resource allocation across the value chain to maximize returns on investment.

- By Technology:

- Standard HDI (1+N+1)

- Advanced HDI (i+N+i, Stacked Microvias)

- Modified HDI (Flexible HDI, Rigid-Flex HDI)

- By Layer Count:

- 4 to 6 Layers

- 8 to 10 Layers

- 10+ Layers

- By Application:

- Consumer Electronics (Smartphones, Wearables)

- Automotive (ADAS, Infotainment, Telematics)

- Telecommunications (5G Infrastructure, Network Equipment)

- Medical Devices (Imaging, Monitoring Systems)

- Industrial Electronics (Automation, Control Systems)

- Aerospace and Defense

Value Chain Analysis For HDI Printed Circuit Board Market

The value chain for the HDI PCB market is complex and highly specialized, commencing with upstream activities focused on the procurement and preparation of specialized raw materials. Upstream analysis involves suppliers of high-performance laminates (such as high-Tg FR4, polyimide, or specialized low-loss materials), copper foil, and chemical solutions crucial for etching and plating processes. These suppliers significantly influence the final cost and performance characteristics of the HDI board, necessitating close collaboration between laminate manufacturers and PCB fabricators to meet stringent performance requirements, particularly for high-frequency applications. Direct and indirect distribution channels play a pivotal role, with direct sales dominating relationships between major PCB manufacturers and Tier 1 electronic OEMs (Original Equipment Manufacturers) who demand custom designs and high volume, while indirect channels utilizing distributors or value-added resellers often serve smaller volume or specialized industrial customers requiring quick turnaround and localized technical support for various projects.

Mid-stream activities encompass the actual fabrication process, which is capital-intensive and technologically demanding, involving precision steps like microvia laser drilling, advanced plating for high aspect ratios, and complex photolithography for fine line circuits. Leading manufacturers often invest heavily in automation and cleanroom facilities to ensure high yields and consistent quality for the extremely small features inherent to HDI technology. Downstream analysis focuses on the integration of these boards into final electronic products, where EMS (Electronic Manufacturing Services) providers and OEMs undertake assembly, component placement, testing, and integration. The efficiency and reliability of the downstream assembly process, often involving advanced surface-mount technology (SMT) for ultra-fine pitch components, directly impacts the market success of the final electronic device, linking the quality of the HDI substrate to end-user performance metrics.

The efficiency of the overall value chain is highly dependent on streamlined logistics and just-in-time inventory management, given the rapid obsolescence cycle of consumer electronics which constitute a large market segment. Furthermore, intellectual property (IP) and proprietary manufacturing techniques—particularly related to stacked microvia formation and reliability testing—are crucial competitive differentiators within the fabrication segment. Successfully navigating the HDI value chain requires strategic partnerships at every stage, from securing preferred pricing on specialized laminates upstream to maintaining high-service reliability for major downstream OEM clients, ensuring continuous innovation in material compatibility and processing throughput to remain competitive in this dynamic and evolving technological landscape.

HDI Printed Circuit Board Market Potential Customers

The potential customers and primary end-users for HDI Printed Circuit Boards are concentrated in sectors requiring miniaturization, high performance, and exceptional reliability, making them critical components across several industry verticals. The largest buying segment comprises global consumer electronics giants, particularly manufacturers of flagship smartphones, tablets, and advanced wearables, where reducing physical footprint without sacrificing processing power is paramount. These high-volume buyers demand consistent quality, cost efficiency, and fast scaling capabilities from their HDI suppliers. Another significant segment includes Tier 1 and Tier 2 automotive suppliers and OEMs, purchasing HDI boards for complex electronic control units (ECUs), sensor fusion modules in ADAS, and advanced battery management systems (BMS) in electric vehicles, requiring boards that meet stringent reliability and safety standards like AEC-Q100 qualifications.

Further strategic customers include major telecommunication equipment providers utilizing HDI for 5G base stations, networking switches, and high-speed routers, demanding boards optimized for high frequency and low signal loss to handle massive data throughput. Additionally, the medical device industry represents a high-value customer base, using HDI for portable diagnostic imaging equipment, implantable devices, and complex monitoring systems, where compact size and unwavering reliability are non-negotiable requirements due to the life-critical nature of the applications. These diverse groups of buyers demonstrate a unified need for the advanced capabilities inherent in HDI technology, pushing manufacturers to continuously refine microvia technology, layer construction, and thermal dissipation solutions specific to their respective operational environments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 11.5 billion |

| Market Forecast in 2033 | USD 23.0 billion |

| Growth Rate | 10.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Samsung Electro-Mechanics (SEMCO), TTM Technologies, AT&S AG, Unimicron Technology, Tripod Technology Corporation, Compeq Manufacturing Co. Ltd., Ibiden Co. Ltd., Daeduck Electronics Co. Ltd., Chin-Poon Industrial Co. Ltd., Meiko Electronics Co. Ltd., Shinko Electric Industries Co. Ltd., Kingboard PCB Group, Wus Printed Circuit Co. Ltd., Fujikura Ltd., PCB Global, A.C.T. (American Circuit Technology), Viasystems Group (now part of TTM), Jabil Circuit, Zhen Ding Technology Holding Limited, Gold Circuit Electronics Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

HDI Printed Circuit Board Market Key Technology Landscape

The technological landscape of the HDI Printed Circuit Board market is characterized by continuous advancements aimed at achieving finer feature sizes, higher layer counts, and superior electrical performance, primarily driven by the increasing demands of high-speed data transmission and complex integration. A cornerstone technology is laser drilling, specifically utilizing CO2 or UV lasers, which is essential for creating the precise, small-diameter microvias (typically <150µm) required for interconnectivity between layers in the HDI structure. The transition from traditional mechanical drilling to laser ablation has significantly improved manufacturing throughput and reduced feature size limits. Furthermore, the development of sophisticated plating processes, such as electroless and electrolytic copper plating, is crucial for reliably filling these microvias and ensuring robust electrical conductivity and structural integrity across multiple stacked layers, a common feature in advanced HDI boards designed for modern mobile and server CPUs.

Material science innovation constitutes another critical technological domain. The push towards 5G and high-frequency applications mandates the use of ultra-low loss (ULL) dielectric materials, often proprietary resin systems (e.g., modified epoxies, polyimides, or PTFE-based materials) that minimize signal attenuation and maintain stable impedance characteristics at elevated frequencies (e.g., above 10 GHz). Thermal management technologies are also gaining prominence, particularly in HDI boards used for high-performance computing and automotive systems. This involves integrating specialized thermal vias, heavier copper features, and incorporating thermally conductive materials into the PCB stack-up to efficiently dissipate heat generated by densely packed components, ensuring reliable operation under sustained high power loads without compromising board integrity or performance specifications over the product's lifespan.

Finally, the evolution towards rigid-flex HDI and embedded component technology represents the frontier of technological development. Rigid-flex HDI combines the density benefits of HDI with the flexibility required for complex 3D assembly and motion-critical applications, particularly prevalent in medical wearables and sophisticated camera modules. Embedded component technology—where passive or active components are physically placed within the PCB layers—is gaining traction as it further reduces the board size, minimizes parasitic inductance, and enhances overall signal performance, pushing the boundaries of miniaturization and density integration achievable within the current manufacturing framework. These technological advancements collectively necessitate significant R&D investment and specialized expertise, cementing the HDI sector as a high-technology domain within the broader electronics manufacturing service industry.

Regional Highlights

The regional dynamics of the HDI Printed Circuit Board Market are characterized by a pronounced division between high-volume manufacturing hubs and primary demand centers, although consumption is rapidly increasing globally across all major regions due to widespread digitization and technological convergence. Asia Pacific (APAC) dominates the global market, accounting for the vast majority of both production capacity and revenue share. This dominance is driven by the presence of key manufacturing countries such as China, Taiwan, South Korea, and Japan, which house the world's largest consumer electronics and semiconductor fabrication ecosystems. APAC benefits from robust supply chain integration, favorable operational costs, and established technological leadership in advanced PCB manufacturing, supporting rapid deployment of next-generation HDI architectures for global export and domestic use, especially within the rapidly growing local automotive and telecommunications markets.

North America is a pivotal region primarily focused on the high-value, specialized segments of the HDI market, including aerospace and defense, high-performance computing (HPC), and cutting-edge medical electronics. While manufacturing scale is lower compared to APAC, North American demand for highly complex, low-volume, high-reliability HDI boards remains strong. This region is a major contributor to technological innovation, particularly in the development of low-loss materials and sophisticated design software, which are critical for supporting advanced server architectures and military-grade communication systems. The regional strategic focus is on security, quality assurance, and supporting stringent regulatory compliance standards, often leading to premium pricing for locally fabricated HDI solutions.

Europe represents a mature market with significant demand in the high-end automotive sector, leveraging HDI for advanced safety features and electrification components, alongside robust requirements from the industrial automation and medical technology sectors. European manufacturers often specialize in mid-to-high layer count HDI boards that emphasize long-term durability and resistance to harsh environmental conditions. The focus in this region is increasingly moving toward Industry 4.0 integration, driving demand for industrial IoT devices that require reliable, compact HDI solutions. Latin America and the Middle East & Africa (MEA) currently hold smaller market shares but are experiencing accelerated growth, driven by increasing smartphone penetration, investment in digital infrastructure (data centers and 5G), and the localized expansion of vehicle manufacturing and assembly operations, signaling future potential for both demand and localized manufacturing investment over the forecast period.

- Asia Pacific (APAC): Acts as the global manufacturing core; highest volume production for consumer electronics and telecommunications; significant R&D investment in high-frequency materials (China, Taiwan, South Korea).

- North America: Leading market for high-reliability applications (Aerospace/Defense, HPC, Medical); high demand for specialized, custom HDI configurations; focus on advanced design IP and security.

- Europe: Strong consumption driven by the premium automotive sector (ADAS, EVs) and industrial automation; emphasis on durability and compliance with strict EU environmental regulations.

- Latin America (LATAM): Emerging demand driven by mobile device assembly and expanding telecommunications infrastructure; gradual shift towards localized electronic manufacturing.

- Middle East & Africa (MEA): Growth stimulated by new data center projects, government-led digitalization initiatives, and initial phases of 5G rollout, increasing the need for network equipment utilizing HDI.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the HDI Printed Circuit Board Market.- Samsung Electro-Mechanics (SEMCO)

- TTM Technologies

- AT&S AG

- Unimicron Technology Corporation

- Tripod Technology Corporation

- Compeq Manufacturing Co. Ltd.

- Ibiden Co. Ltd.

- Daeduck Electronics Co. Ltd.

- Chin-Poon Industrial Co. Ltd.

- Meiko Electronics Co. Ltd.

- Shinko Electric Industries Co. Ltd.

- Kingboard PCB Group

- Wus Printed Circuit Co. Ltd.

- Fujikura Ltd.

- PCB Global

- A.C.T. (American Circuit Technology)

- Viasystems Group

- Jabil Circuit

- Zhen Ding Technology Holding Limited

- Gold Circuit Electronics Ltd.

Frequently Asked Questions

Analyze common user questions about the HDI Printed Circuit Board market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical advantage of using HDI PCBs over standard PCBs?

The primary advantage of High-Density Interconnect (HDI) PCBs is the capacity for significant miniaturization and density increase, achieved through the use of microvias (laser-drilled holes) and finer lines and spacing. This enables complex signal routing and placement of more components in a smaller area, critically improving electrical performance, reducing size, and lowering overall system weight, which is essential for modern portable electronics and high-speed data applications.

Which industry segment drives the highest volume demand for HDI PCB technology?

The Consumer Electronics segment, predominantly led by smartphone and wearable device manufacturers, drives the highest volume demand for HDI PCB technology. The constant pressure for slimmer designs, enhanced battery life, and integration of complex functions (like 5G modems and advanced sensor arrays) necessitates the adoption of cost-effective, high-layer count HDI boards featuring stacked microvias and rigid-flex designs.

How does 5G technology specifically impact the material requirements for HDI PCBs?

5G technology necessitates a shift toward specialized, ultra-low loss (ULL) dielectric materials in HDI PCBs. These materials are required to minimize signal attenuation and maintain signal integrity at the higher frequencies (mid-band and millimeter-wave) used by 5G networks. Furthermore, the boards require extremely tight impedance control and improved thermal management capabilities to handle the increased power density of 5G infrastructure and user equipment.

What are the main manufacturing challenges associated with producing Advanced HDI boards?

The main manufacturing challenges for Advanced HDI boards include achieving high yields for complex stacked microvia structures, maintaining dimensional stability for ultra-fine line widths (often below 50 µm), managing stringent process control for laser drilling and precise plating consistency, and overcoming the high capital expenditure associated with sophisticated cleanroom environments and automated laser ablation equipment necessary for volume production.

Which region currently leads in the production capacity of HDI Printed Circuit Boards?

Asia Pacific (APAC), particularly the cluster of manufacturing countries including China, Taiwan, South Korea, and Japan, currently leads in the global production capacity of HDI Printed Circuit Boards. This dominance is due to established supply chains, large-scale factory operations, and early investment in advanced PCB fabrication technologies, serving both local high-volume consumer markets and global export demands across all application sectors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager