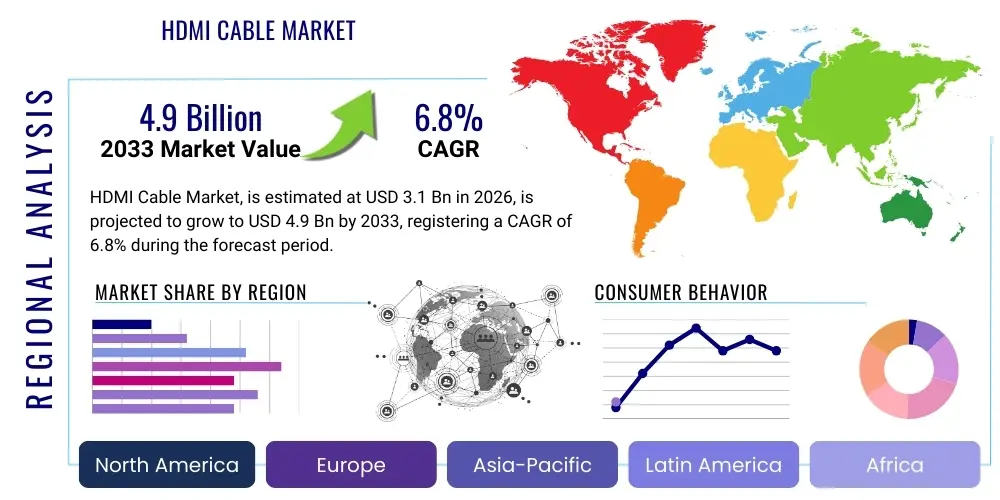

HDMI Cable Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435836 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

HDMI Cable Market Size

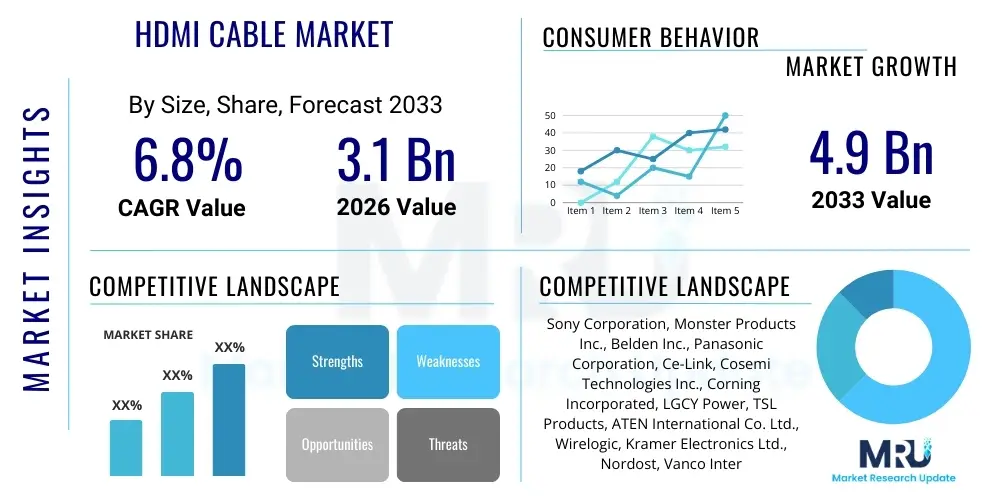

The HDMI Cable Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 3.1 Billion in 2026 and is projected to reach USD 4.9 Billion by the end of the forecast period in 2033.

HDMI Cable Market introduction

The High-Definition Multimedia Interface (HDMI) cable market encompasses essential connectivity solutions designed for transmitting high-bandwidth digital video and audio data from a source device (such as a Blu-ray player, gaming console, or set-top box) to a display device (like a television, monitor, or projector). The product range includes traditional passive copper cables, high-speed active copper cables, and advanced active optical cables (AOCs) which utilize fiber optics for significantly longer transmission distances and higher bandwidth capabilities, crucial for the latest 4K and 8K resolution standards. HDMI has become the universally accepted standard for consumer electronics due to its ability to consolidate video, multi-channel audio, and control signals into a single, user-friendly connector, thereby simplifying home theater and professional audiovisual setups.

Major applications driving the demand for HDMI cables span across consumer electronics, commercial installations, and specialized industrial uses. In the consumer space, the proliferation of ultra-high-definition (UHD) TVs, premium gaming consoles (supporting 120Hz refresh rates and Variable Refresh Rate – VRR), and streaming media devices necessitate high-performance HDMI 2.1 cables. Commercially, applications include digital signage, conference rooms utilizing collaborative displays, and corporate infrastructure requiring reliable long-distance signal transmission. Benefits associated with HDMI technology include superior image quality, support for advanced audio formats like Dolby Atmos and DTS:X, and features such as the Audio Return Channel (ARC) and Enhanced Audio Return Channel (eARC), which streamline system architecture.

The primary driving factors propelling market growth are the pervasive global adoption of 4K and 8K display technologies, the exponential rise in demand for bandwidth-intensive content (including competitive eSports and professional video editing), and the ongoing requirement for faster data transfer rates mandated by HDMI 2.1 specifications (up to 48 Gbps). Furthermore, the increasing complexity of home entertainment systems, coupled with professional markets migrating towards large-scale video walls and immersive display solutions in retail and hospitality sectors, ensures sustained demand for reliable, high-specification HDMI connectivity solutions capable of minimizing latency and signal degradation over distance. The continuous push toward integrated smart home ecosystems also reinforces the necessity of sophisticated cabling infrastructure.

HDMI Cable Market Executive Summary

The HDMI Cable Market is currently experiencing robust momentum driven primarily by the transition from standard HD to ultra-high-definition content across both residential and commercial sectors. Key business trends include the rapid market entry and subsequent acceptance of Active Optical Cables (AOCs) to overcome distance limitations faced by traditional copper wiring, particularly in large venue installations and high-end residential custom integrations. Furthermore, manufacturers are focusing heavily on developing certified Ultra High Speed HDMI cables to ensure compliance with the demanding requirements of HDMI 2.1, which supports critical features like Dynamic HDR and advanced gaming modes. Strategic partnerships between cable producers and consumer electronics OEMs are becoming increasingly vital to ensure seamless compatibility and market penetration of new standards.

Regionally, the Asia Pacific (APAC) continues to dominate the market growth trajectory, fueled by large-scale manufacturing of consumer electronics in countries like China, South Korea, and Japan, alongside a surging middle class with high disposable income accelerating the adoption of premium display technologies. North America and Europe remain key mature markets, characterized by high infrastructure spending on corporate AV installations and a strong early adoption rate of cutting-edge gaming technology, which necessitates the highest specifications of HDMI connectivity. Emerging markets in Latin America and the Middle East and Africa (MEA) are seeing accelerated growth driven by urbanization and rapid deployment of digital broadcasting services and associated necessary display equipment.

Segment trends reveal that the HDMI 2.1 segment is the fastest-growing category, quickly displacing older standards due to mandatory requirements for current-generation gaming consoles and high-performance monitors. By product type, Active Optical Cables (AOCs) are capturing significant market share in the commercial segment where distances often exceed standard copper cable limitations, providing future-proofing capabilities. The application segment growth is dominated by the professional AV segment, including sectors such as media production, medical imaging, and educational technology, where uncompromising signal integrity and low latency are critical operational requirements. This shift towards professional applications underscores the market's trajectory towards high-value, high-performance cabling solutions.

AI Impact Analysis on HDMI Cable Market

Analysis of common user questions regarding AI's impact on HDMI cables indicates three primary areas of concern and interest: optimizing cable manufacturing and quality control, leveraging predictive maintenance in large commercial installations, and how AI-driven smart devices will influence the demand for higher specification cables. Users frequently ask if AI can detect manufacturing defects in real-time or predict potential signal integrity issues before deployment. Key expectations center around AI facilitating automated testing processes to ensure every cable meets stringent HDMI 2.1 and future standards, thereby reducing failure rates and enhancing brand reliability. Furthermore, there is significant interest in how AI-powered smart home and IoT ecosystems will require increasingly robust, high-speed connectivity to handle complex, decentralized data processing, driving demand for premium HDMI solutions capable of supporting higher refresh rates and deeper color depth necessary for augmented and virtual reality applications managed by AI.

- AI implementation optimizes manufacturing processes, leading to reduced material waste and increased production efficiency for high-specification cables.

- AI-driven automated quality control systems enhance fault detection during production, ensuring higher compliance with stringent HDMI 2.1 specifications (48 Gbps).

- Predictive analytics facilitated by AI can monitor signal performance in large-scale commercial deployments, alerting users to potential cable degradation or failure points proactively.

- AI algorithms assist in supply chain and inventory management, optimizing the distribution of specialized cables (e.g., AOCs) based on real-time consumer demand trends.

- Integration of smart devices relying on machine learning increases the computational load and data throughput requirements, consequently boosting demand for high-bandwidth HDMI cables (8K content transmission).

DRO & Impact Forces Of HDMI Cable Market

The market dynamics are significantly influenced by a combination of strong drivers, technological limitations acting as restraints, and emerging opportunities shaping future growth. The primary driver is the pervasive adoption of advanced display technologies such as 4K and 8K televisions and projectors globally, compelling consumers and businesses to upgrade their existing connectivity infrastructure to support the required bandwidth. Another major driver is the explosive growth in competitive gaming (eSports) and the release of new gaming consoles that mandate HDMI 2.1 for features like 4K@120Hz and Variable Refresh Rate (VRR), making legacy cables obsolete for power users. Furthermore, the commercial sector's increased reliance on digital signage, video conferencing, and medical imaging systems that demand error-free, high-resolution video streams acts as a fundamental underlying driver for quality HDMI cable procurement.

However, the market faces significant restraints, primarily centered around technical limitations and competitive pressure. The maximum reliable distance for passive copper HDMI cables is limited (typically around 50 feet for high-speed transmission), which necessitates the adoption of more expensive active or fiber-optic solutions for longer runs, increasing overall installation costs. Additionally, increasing competition from alternative wireless video transmission technologies (like WiGig and various proprietary streaming protocols) poses a potential threat, especially in consumer and short-range commercial applications where ease of installation outweighs the need for maximum bandwidth reliability. Price volatility of raw materials, particularly copper, can also intermittently impact manufacturing costs and consumer pricing strategies, dampening demand in price-sensitive segments.

Opportunities for market expansion are substantial, particularly in the realm of specialized and long-distance connectivity. The rise of Active Optical Cables (AOCs) presents a key opportunity, allowing HDMI cables to penetrate long-haul commercial and industrial installations previously dominated by other interfaces like DisplayPort or SDI. Furthermore, the development of specialized ruggedized HDMI cables for harsh industrial environments, military applications, and portable field broadcasting offers new high-value revenue streams. The continuous evolution of consumer electronics towards even higher resolutions (e.g., 10K concepts) and higher refresh rates ensures a perpetual replacement cycle, requiring constant innovation in cable material science and signaling technology. The shift toward hybrid infrastructure (combining fiber and copper) presents a significant growth avenue for specialized manufacturers.

Segmentation Analysis

The HDMI Cable market is thoroughly segmented based on critical characteristics including product type, cable length, application, and geographical region. Understanding these segments is vital for identifying core growth areas and strategic investment opportunities. The segmentation by product type reflects the technological evolution from basic standards to cutting-edge solutions, with copper cables serving basic needs and AOCs addressing high-performance, long-distance requirements. Segmentation by application highlights the distinct needs of consumer electronics, which prioritize cost-effectiveness and compact design, versus professional AV and industrial segments, which emphasize resilience, reliability, and guaranteed performance metrics for mission-critical operations. The dominance of the consumer electronics segment in volume contrasts with the higher revenue generated per unit in the professional and commercial sectors.

- By Product Type:

- Standard HDMI Cable

- High-Speed HDMI Cable

- Premium High-Speed HDMI Cable

- Ultra High Speed HDMI Cable (HDMI 2.1)

- Active Optical Cable (AOC)

- By Cable Length:

- Up to 10 Feet

- 10 to 50 Feet

- 50 to 100 Feet

- Above 100 Feet (Long Haul)

- By Application:

- Consumer Electronics (TVs, Gaming Consoles, Blu-ray)

- Commercial (Digital Signage, Hospitality, Retail)

- Professional AV (Broadcast, Media Production, Conferencing)

- Industrial & Medical (Imaging Systems, Factory Automation)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For HDMI Cable Market

The value chain for the HDMI Cable market begins with upstream analysis, involving the sourcing and processing of core raw materials, predominantly copper, specialized plastic polymers for insulation and jacketing, and increasingly, fiber optic components (glass or plastic fibers, optical transceivers for AOCs). Key activities in the upstream segment include material refinement and the manufacturing of specialized conductors and shielding materials crucial for maintaining signal integrity at high bandwidths. Suppliers in this stage wield significant influence over manufacturing costs, especially given the volatility of copper prices and the specialized nature of optical components required for premium cables. Effective inventory management and strategic long-term procurement contracts are essential for manufacturers to mitigate risks associated with material price fluctuations and ensure stable supply.

The midstream involves the core manufacturing process, where raw materials are assembled, soldered, molded, and terminated into the final HDMI cable products. This stage requires substantial capital investment in highly accurate machinery for wire drawing, twisting, shielding, and connector assembly, particularly for complex Ultra High Speed cables that demand precision engineering to meet strict impedance tolerances. Distribution channels, forming the crucial link between production and end-users, are segmented into direct and indirect routes. Direct distribution often involves large-scale contracts with OEM clients (e.g., TV manufacturers) or major system integrators for commercial projects. Indirect distribution relies heavily on global retail channels, e-commerce platforms, and specialized electronic distributors, where branding, packaging, and certification (e.g., HDMI Forum compliance) play a significant role in consumer purchasing decisions.

Downstream analysis focuses on the end-use applications and the ultimate customer interaction. The end-users primarily include consumers upgrading their home theaters, professional installers commissioning large-scale AV systems, and specialized industrial clients. The downstream segment is characterized by high demand for quality assurance and technical support, especially for complex installations involving long cable runs where Active Optical Cables are utilized. The competitive landscape at this end is intense, with significant differentiation based on brand reputation, warranty length, and performance verification. Success in the downstream market is determined by the ability to provide reliable, certified products that deliver maximum performance for current and anticipated high-resolution, high-frame-rate content.

HDMI Cable Market Potential Customers

The potential customer base for HDMI cables is broad and rapidly expanding, primarily categorized into consumer electronics buyers and various professional/commercial end-users. Consumers constitute the largest volume market, driven by recurring upgrade cycles related to new display purchases (4K, 8K, HDR TVs) and the launch of next-generation gaming consoles (PlayStation 5, Xbox Series X/S). This demographic seeks cables offering the latest specifications (HDMI 2.1) at competitive price points, often prioritizing guaranteed high refresh rate support for enhanced gaming experiences. Furthermore, the proliferation of specialized media streamers, soundbars requiring eARC functionality, and complex multi-source home theater setups significantly boosts the necessity for multiple high-quality, certified cables within a single household.

The commercial sector represents a high-value customer segment, encompassing hospitality (hotels, restaurants), retail (digital signage, video walls), and corporate offices (conference rooms, collaborative workspaces). These institutional buyers prioritize durability, long-term reliability, and specialized features such as plenum ratings for fire safety compliance in commercial buildings. High-end commercial installations frequently require Active Optical Cables (AOCs) to transmit high-resolution content over distances exceeding 100 feet, making system integrators and specialized AV installation firms key decision-makers and purchasers in this segment. Reliability and minimal downtime are non-negotiable requirements, driving demand for premium, professionally installed solutions.

The third major group includes specialized industrial and medical buyers, who utilize HDMI cables in mission-critical applications such as high-resolution medical imaging devices (MRI, X-ray displays), industrial automation control panels, and broadcasting studio equipment. For these end-users, signal integrity, electromagnetic interference (EMI) resistance, and robust mechanical construction are paramount. These specialized segments demand customized, often ruggedized, cables designed to withstand harsh operating environments, temperature extremes, or continuous flex, representing the highest margin opportunities for specialized cable manufacturers focusing on niche, performance-driven solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.1 Billion |

| Market Forecast in 2033 | USD 4.9 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sony Corporation, Monster Products Inc., Belden Inc., Panasonic Corporation, Ce-Link, Cosemi Technologies Inc., Corning Incorporated, LGCY Power, TSL Products, ATEN International Co. Ltd., Wirelogic, Kramer Electronics Ltd., Nordost, Vanco International, CE-Link Technology Inc., Shenzhen E-Tech Digital Technology Co., Ltd., Nexans, Phoenix Contact, Microchip Technology Inc., Molex. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

HDMI Cable Market Key Technology Landscape

The technological landscape of the HDMI cable market is fundamentally defined by the continuous evolution of HDMI specifications, primarily driven by the HDMI Forum. The adoption of the HDMI 2.1 standard represents the most critical current technological shift, enabling unprecedented bandwidth capabilities up to 48 Gbps. This technology supports uncompressed 8K video at 60Hz and 4K video at 120Hz, alongside advanced features like Enhanced Audio Return Channel (eARC), Dynamic HDR, and Variable Refresh Rate (VRR), which are essential for high-fidelity audio and stutter-free gaming experiences. The technical challenge lies in manufacturing copper cables that can reliably transmit this high data rate over practical consumer distances, leading to significant innovation in shielding and conductor geometry to minimize signal loss and cross-talk.

A major advancement shaping the market's future is the widespread commercialization and technological refinement of Active Optical Cables (AOCs). AOCs utilize fiber optic strands instead of traditional copper wire for the signal transmission pathway, integrating electrical-to-optical conversion circuitry within the connectors themselves. This technology overcomes the severe distance limitations inherent in copper, allowing error-free transmission of 48 Gbps data over runs extending hundreds of meters, making them indispensable for large commercial installations, data centers, and high-end residential custom integration. Further technological refinement in AOCs is focused on miniaturization of the transceivers and reducing power consumption while maintaining robust performance across various environmental conditions.

Furthermore, the integration of advanced chipset technologies within active copper cables and signal repeaters is vital for extending the useful range of copper-based solutions. These integrated circuits perform signal equalization and amplification to compensate for attenuation over distance, ensuring the signal integrity required for modern high-resolution displays. Manufacturers are also focusing on material science, employing higher-grade oxygen-free copper and advanced shielding materials like triple-layer foil and braid designs to combat electromagnetic interference (EMI), which is particularly problematic in densely wired environments. The convergence of superior materials, optical transmission, and intelligent electronic compensation circuitry defines the competitive technological edge within the HDMI cable industry.

Regional Highlights

The global HDMI cable market exhibits significant regional variances in terms of maturity, adoption rates of new technology, and application focus. North America stands as a mature market characterized by high consumer disposable income and early adoption of high-specification products, particularly within the professional AV and high-end gaming sectors. The demand here is strongly influenced by custom integrators and the robust corporate infrastructure market, where HDMI 2.1 and Active Optical Cables (AOCs) are increasingly mandated for new large-scale conference rooms, media production facilities, and home cinema installations. Stringent building codes also drive demand for specialized cables, such as plenum-rated versions, ensuring that revenue per unit is comparatively higher than in mass-market regions. The presence of major technology hubs and high penetration of streaming services requiring reliable bandwidth ensures consistent demand for premium connectivity solutions.

Asia Pacific (APAC) represents the fastest-growing and largest volume market globally, primarily due to the region’s dual role as a manufacturing powerhouse for consumer electronics (China, South Korea, Japan) and a rapidly expanding end-user base. Rapid urbanization, increasing household income, and aggressive adoption of digital technologies, particularly 4K broadcasting and 5G network expansion, are key growth catalysts. Countries such as India and Southeast Asian nations are undergoing massive infrastructure upgrades, driving substantial demand for affordable yet compliant HDMI solutions for set-top boxes and entry-level smart TVs. This region is critical for mass-market copper cable production but is simultaneously witnessing exponential growth in AOC adoption for new data centers and massive stadium and exhibition venues requiring long-haul signal transmission.

Europe mirrors North America in terms of market maturity but shows distinct application preferences, with a strong emphasis on professional broadcasting, telecommunications, and high-fidelity audio systems. German and UK markets are especially strong consumers of certified, high-quality HDMI cables due to consumer preference for durability and performance assurance. Regulations like the European Union's push for eco-friendly electronics also subtly influence cable material selection and manufacturing processes. Latin America and the Middle East & Africa (MEA) are emerging markets experiencing strong growth, fueled by the expansion of terrestrial and satellite digital television services and increased foreign investment in retail and hospitality sectors, necessitating new digital signage and display infrastructures. While current adoption skews towards high-speed copper cables, the rapid development of large urban centers points toward future high demand for long-distance AOC solutions.

- North America: High revenue share, driven by rapid HDMI 2.1 adoption in high-end gaming and robust demand from professional AV integrators and corporate installations; focus on plenum-rated and certified cables.

- Asia Pacific (APAC): Largest volume market; propelled by massive consumer electronics manufacturing base and soaring consumer demand for 4K/8K displays in countries like China and India; witnessing high infrastructure investment.

- Europe: Mature market characterized by strong quality consciousness and adherence to professional AV standards; high demand in broadcasting, medical imaging, and high-fidelity audio-visual setups.

- Latin America (LATAM): Emerging growth market driven by increasing penetration of digital broadcasting and modernization of retail and corporate infrastructure; rapid urbanization fuels initial copper cable demand.

- Middle East & Africa (MEA): Growth stimulated by large-scale commercial projects, particularly in hospitality (Dubai, Qatar) and new smart city developments requiring extensive long-distance connectivity solutions like AOCs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the HDMI Cable Market.- Sony Corporation

- Monster Products Inc.

- Belden Inc.

- Panasonic Corporation

- Ce-Link

- Cosemi Technologies Inc.

- Corning Incorporated

- LGCY Power

- TSL Products

- ATEN International Co. Ltd.

- Wirelogic

- Kramer Electronics Ltd.

- Nordost

- Vanco International

- CE-Link Technology Inc.

- Shenzhen E-Tech Digital Technology Co., Ltd.

- Nexans

- Phoenix Contact

- Microchip Technology Inc.

- Molex

- Luxshare Precision Industry Co., Ltd.

- Shenzhen VENTION Technology Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the HDMI Cable market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between HDMI 2.0 and HDMI 2.1 cables?

The primary difference is bandwidth capacity. HDMI 2.0 supports up to 18 Gbps, enabling 4K video at 60Hz. HDMI 2.1 (Ultra High Speed) supports up to 48 Gbps, which is mandatory for advanced features like uncompressed 8K video at 60Hz, 4K at 120Hz, Dynamic HDR, and Variable Refresh Rate (VRR) essential for next-generation gaming and high-fidelity displays.

Why are Active Optical Cables (AOCs) gaining popularity in the HDMI market?

AOCs are gaining popularity because they use fiber optics for signal transmission, effectively eliminating the distance limitations inherent in traditional copper cables. AOCs can reliably transmit full 48 Gbps bandwidth over hundreds of meters without signal loss, making them ideal for large commercial installations, data centers, and extensive home theater setups.

Which application segment holds the largest market share for HDMI cables?

The Consumer Electronics application segment currently holds the largest volume market share, driven by the sheer number of HDMI-enabled devices such as televisions, gaming consoles, set-top boxes, and streaming devices purchased globally. However, the Professional AV segment often commands higher revenue due to the use of specialized, premium-priced Active Optical and long-haul certified cables.

What are the key restraint factors limiting the growth of the copper HDMI cable segment?

The key restraint is the technical difficulty and cost associated with transmitting ultra-high bandwidths (48 Gbps) reliably over long distances (typically beyond 50 feet) using passive copper conductors. This physical limitation necessitates the costly migration to fiber-optic solutions (AOCs) for large-scale or long-distance projects, restraining copper segment growth in high-performance applications.

How does the growth of 8K display technology impact future demand for HDMI cables?

The growing adoption of 8K display technology necessitates a mandatory shift toward Ultra High Speed HDMI 2.1 cables. Older cable specifications cannot support the enormous bandwidth required for native 8K content, guaranteeing a continuous replacement and upgrade cycle across both consumer and commercial markets, thereby driving overall market value.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager