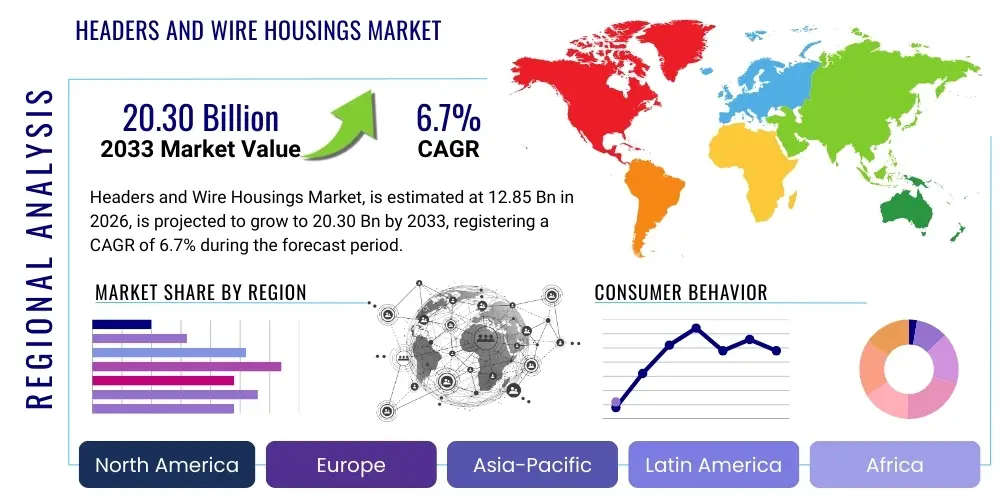

Headers and Wire Housings Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440580 | Date : Jan, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Headers and Wire Housings Market Size

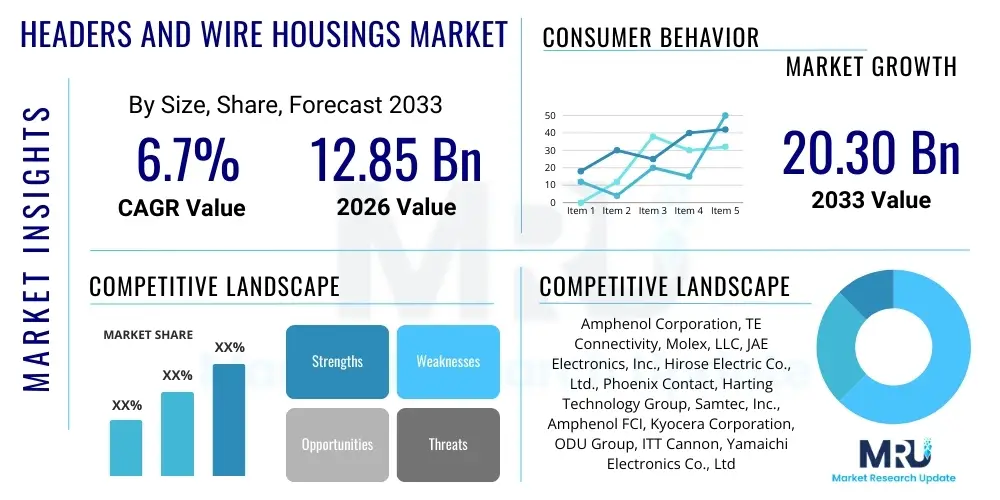

The Headers and Wire Housings Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.7% between 2026 and 2033. The market is estimated at USD 12.85 Billion in 2026 and is projected to reach USD 20.30 Billion by the end of the forecast period in 2033.

Headers and Wire Housings Market introduction

The Headers and Wire Housings Market encompasses a critical segment of the electronics industry, providing essential components for creating secure, reliable, and efficient electrical connections within a myriad of electronic systems. These components facilitate the transmission of power, signals, and data across various circuit boards and modules. Headers typically refer to male pin connectors mounted on a PCB, while wire housings are the female receptacles that terminate wires, forming a separable connection. Their core functionality lies in enabling modular design, simplifying assembly, maintenance, and repair, while ensuring robust electrical integrity. The pervasive need for seamless interconnectivity across burgeoning technological landscapes makes these components indispensable.

The primary applications for headers and wire housings span diverse sectors including automotive, consumer electronics, industrial automation, telecommunications, and medical devices. In automotive applications, they are vital for engine control units, infotainment systems, lighting, and safety systems, particularly with the rise of electric vehicles and advanced driver-assistance systems (ADAS). For consumer electronics, these components enable the compact and efficient design of smartphones, laptops, wearables, and smart home devices. Industrial applications leverage their robustness for robotics, control systems, and factory automation, ensuring reliable operation in harsh environments. The key benefits include enhanced reliability, secure and vibration-resistant connections, ease of manufacturing and field servicing, space efficiency, and cost-effectiveness in mass production. These advantages collectively drive their widespread adoption across industries requiring precision and dependability in their electrical architectures.

Major driving factors for the Headers and Wire Housings Market include the continuous growth of the global electronics industry, fueled by increasing demand for smart devices and IoT integration. The pervasive trend of miniaturization in electronic components necessitates compact and high-density connectors, pushing innovation in header and housing designs. Furthermore, the rapid expansion of electric vehicles (EVs) and hybrid electric vehicles (HEVs) significantly boosts demand for robust and high-current connectors. The escalating adoption of industrial automation and robotics, coupled with the rollout of 5G technology, further amplifies the need for advanced interconnectivity solutions that can handle higher data rates and more complex signaling requirements. These macro-trends provide a strong impetus for sustained market growth.

Headers and Wire Housings Market Executive Summary

The Headers and Wire Housings Market is experiencing dynamic growth, propelled by the relentless expansion of global electronics manufacturing and the increasing complexity of modern electronic systems. Business trends indicate a strong focus on innovation in materials science, leading to more durable, miniaturized, and high-performance connectors capable of operating in extreme conditions. Consolidation among key players and strategic partnerships are also prominent, aimed at expanding product portfolios and geographical reach. Furthermore, there is a growing emphasis on custom solutions and modular designs to meet specific industry demands, alongside the adoption of smart manufacturing processes for improved efficiency and quality control. Sustainability initiatives are also influencing product design, with a move towards recyclable materials and energy-efficient production methods.

Regionally, the Asia Pacific (APAC) continues to dominate the market, driven by its robust manufacturing base, particularly in China, Japan, South Korea, and Taiwan, which are major hubs for consumer electronics, automotive, and industrial production. The rapid urbanization and increasing disposable income in countries like India and Southeast Asian nations are also contributing to significant demand. North America and Europe are experiencing steady growth, fueled by strong investments in advanced automotive technologies, industrial automation, and the medical sector, alongside significant research and development activities in high-speed and high-frequency applications. Latin America and the Middle East & Africa regions are emerging as potential growth areas, with increasing industrialization and technological adoption. Each region presents unique market dynamics and opportunities shaped by local economic conditions, technological advancements, and regulatory environments.

Segmentation trends reveal a clear shift towards fine-pitch connectors and high-density solutions, driven by the miniaturization of electronic devices. Wire-to-board and wire-to-wire configurations remain crucial, with increasing demand for sealed and robust variants for harsh environment applications in automotive and industrial sectors. The automotive segment is experiencing substantial growth, particularly for high-current and shielded connectors required for electric vehicles and ADAS. Consumer electronics continue to drive demand for ultra-compact and surface-mount technology (SMT) compatible connectors. In the industrial sector, ruggedized connectors with enhanced durability and resistance to vibrations and temperature extremes are paramount. The telecommunications segment, spurred by 5G infrastructure development, demands high-speed and high-frequency connectors capable of handling increased bandwidth, underscoring a broad and diversified market evolution.

AI Impact Analysis on Headers and Wire Housings Market

Users frequently inquire about how Artificial Intelligence will fundamentally reshape the Headers and Wire Housings market, particularly regarding manufacturing efficiency, product design, supply chain resilience, and the emergence of new market demands. Key themes revolve around AI's potential to automate complex design processes, optimize production lines for predictive maintenance and quality control, and streamline global supply chains to mitigate disruptions. There's also significant interest in how AI-driven smart devices and systems will influence the specifications and demand for next-generation interconnect solutions, requiring higher precision, faster data rates, and more integrated functionalities. Users are keen to understand if AI will lead to the development of "smart" connectors capable of self-diagnosis or predictive failure, fundamentally altering the product lifecycle and market dynamics. The overarching expectation is that AI will be a transformative force, enhancing existing operations and fostering entirely new product categories within the interconnect domain.

- Automated design and simulation platforms, significantly reducing development cycles and prototyping costs.

- Predictive maintenance analytics for manufacturing equipment, minimizing downtime and increasing production efficiency.

- AI-powered visual inspection systems, enhancing quality control and defect detection rates beyond human capabilities.

- Optimized supply chain management through AI forecasting and logistics, improving inventory and reducing lead times.

- Enabling "smart" connectors for AI-driven devices, requiring higher density, speed, and integrated diagnostic features.

- Personalized product configuration and rapid prototyping based on AI analysis of specific customer requirements.

- AI-driven material science research, leading to development of advanced, more durable, and sustainable connector materials.

DRO & Impact Forces Of Headers and Wire Housings Market

The Headers and Wire Housings Market is shaped by a complex interplay of drivers, restraints, opportunities, and various impact forces that influence its growth trajectory and competitive landscape. Key drivers include the relentless expansion of the global electronics industry, fueled by increasing demand for smart devices, Internet of Things (IoT) connectivity, and advanced digital infrastructure. The automotive sector's pivot towards electrification and autonomous driving systems significantly boosts demand for high-performance and robust interconnect solutions. Furthermore, the pervasive trend of miniaturization across all electronic applications necessitates compact, high-density, and fine-pitch headers and wire housings, compelling continuous innovation in design and manufacturing processes. These factors collectively create a robust and expanding demand base for these essential components, pushing market growth.

However, the market also faces several notable restraints. Volatility in raw material prices, particularly for plastics, copper, and specialized alloys, can impact manufacturing costs and profit margins. Stringent regulatory standards, especially in automotive, medical, and aerospace industries, impose demanding requirements for product quality, reliability, and environmental compliance, increasing development complexities and costs. The inherent design complexity involved in creating highly integrated, high-speed, and high-density connectors presents significant engineering challenges. Additionally, the high initial capital investment required for advanced manufacturing equipment and sophisticated testing facilities can be a barrier for new entrants, leading to market consolidation among established players. These restraints require strategic mitigation to ensure sustained market expansion.

Despite these challenges, substantial opportunities exist within the Headers and Wire Housings Market. The ongoing global rollout of 5G technology is creating immense demand for high-frequency, high-speed, and low-latency connectors for telecommunications infrastructure and compatible end-user devices. The rapid evolution of advanced driver-assistance systems (ADAS) and autonomous driving platforms in the automotive sector presents a lucrative niche for specialized, high-reliability, and ruggedized connectors. Furthermore, the burgeoning renewable energy sector, including solar and wind power, requires robust interconnects for power management and control systems. Advancements in medical device technology, particularly in portable and wearable health monitoring systems, also open new avenues for miniaturized and biocompatible headers and housings. These opportunities, coupled with technological advancements and market diversification, offer significant potential for market players. External impact forces such as geopolitical stability, trade policies, and global economic cycles also exert significant influence on supply chain stability and market demand.

Segmentation Analysis

The Headers and Wire Housings Market is extensively segmented to provide a detailed understanding of its diverse components and applications, allowing for precise market analysis and strategic planning. This comprehensive segmentation typically includes classifications by product type, pitch size, connection type, the specific application of the component, and the end-use industry it serves. Such granular categorization is critical for identifying specific growth drivers, market niches, and competitive landscapes within various sub-segments. Each segment exhibits unique characteristics driven by distinct technological requirements, regulatory standards, and demand patterns, collectively shaping the overall market dynamics. Analyzing these segments provides invaluable insights for manufacturers, suppliers, and investors looking to capitalize on specific opportunities and mitigate risks across the value chain.

- Product Type:

- Pin Headers: Single-row, Double-row, Triple-row, Right-angle, Straight, SMT, Through-hole, Shrouded, Unshrouded

- Box Headers: Ejector Headers, Latched Box Headers, Shrouded Headers (without ejector)

- Wire-to-Board Housings: Crimp-style Housings, IDC-style Housings, Spring Clamp Housings, Screw Terminal Housings, High-current Housings

- Wire-to-Wire Housings: Sealed Housings, Unsealed Housings, Crimp-style Wire-to-Wire, IDC-style Wire-to-Wire

- Modular Headers and Housings: Custom-designed, Configurable Systems

- Pitch Size:

- Fine Pitch (0.5mm, 0.8mm, 1.0mm, 1.25mm, 1.27mm)

- Standard Pitch (1.5mm, 2.0mm, 2.5mm, 2.54mm, 3.0mm, 3.96mm)

- Large Pitch (5.0mm, 5.08mm, 7.62mm, 10.16mm, Power Connectors above 10mm)

- Connection Type:

- Crimp Connectors: Hand Crimp, Automated Crimp

- Insulation Displacement Connectors (IDC): Ribbon Cable Connectors

- Solder Connectors: Through-hole Technology (THT), Surface Mount Technology (SMT)

- Press-Fit Connectors: Compliant Pin Connectors

- Spring Loaded/Pogo Pin Connectors

- Application:

- Signal Transmission: Low-speed, High-speed Data, Analog Signals

- Power Transmission: Low-current, High-current

- Data Transmission: Ethernet, USB, HDMI, PCIe, LVDS

- Hybrid (Combined Signal and Power)

- End-Use Industry:

- Automotive: Infotainment, Engine Control Units (ECUs), Lighting Systems, Body Electronics, Safety Systems, EV/HEV Power & Charging

- Consumer Electronics: Smartphones, Tablets, Laptops, Wearables, Home Appliances, Gaming Consoles, IoT Devices, Audio/Video Equipment

- Industrial: Automation Equipment, Robotics, Control Systems, Test & Measurement Equipment, Smart Factory Infrastructure, Power Distribution

- Telecommunications: Routers, Switches, Base Stations, Networking Equipment, 5G Infrastructure, Data Center Equipment

- Medical: Diagnostic Equipment, Monitoring Devices, Surgical Instruments, Wearable Medical Devices, Implantable Devices

- Aerospace & Defense: Avionics, Communication Systems, Radar Systems, Guidance Systems, Missiles & Spacecraft

- Datacom: Servers, Storage Systems, Data Centers, Networking Hardware

- Energy: Solar Inverters, Wind Turbines, Smart Grid Infrastructure, Battery Management Systems, Electric Vehicle Charging Stations

- Building & Home Automation: Smart Lighting, Security Systems, HVAC Control, Access Control

Value Chain Analysis For Headers and Wire Housings Market

The value chain for the Headers and Wire Housings Market is a multi-tiered process, beginning with the acquisition and processing of raw materials. Upstream analysis involves suppliers of specialized plastics (such as nylon, PBT, LCP) for housing insulation, various metals (like copper alloys, brass, phosphor bronze) for pins and terminals, and plating materials (gold, tin, nickel) for enhancing conductivity and corrosion resistance. These raw material providers form the foundational layer, dictating the quality and cost of initial inputs. Component manufacturers then transform these materials into precision-engineered parts through complex processes like injection molding, stamping, and plating, requiring significant investment in machinery and expertise. The efficiency and reliability of these upstream activities are crucial for the overall quality and cost-effectiveness of the final connector products.

Moving downstream, the manufactured headers and wire housings are supplied to original equipment manufacturers (OEMs), contract manufacturers (CMs), and system integrators across various industries. These customers incorporate the connectors into their electronic assemblies for products ranging from consumer gadgets to industrial machinery. The distribution channel plays a vital role in connecting manufacturers with these diverse end-users. Direct sales are common for large OEMs that require customized solutions, technical support, and significant volumes, fostering direct relationships and partnerships. Conversely, an extensive network of distributors, both global and regional, caters to smaller to medium-sized enterprises (SMEs), providing off-the-shelf products, inventory management, and technical assistance. This indirect channel ensures broader market penetration and accessibility for a wide range of customers.

Both direct and indirect distribution channels are essential for market reach. Direct sales facilitate deep integration with key customers, enabling collaborative design and swift response to specific requirements, which is crucial for high-value or highly customized solutions. Indirect channels, through distributors and online platforms, offer convenience, speed, and a vast product catalog, serving a wider array of customers who might not require direct manufacturer engagement. This dual-channel approach optimizes market coverage and customer service, balancing customized solutions with broad market availability. Post-sales support, including technical assistance, warranty services, and product lifecycle management, further enhances customer satisfaction and strengthens brand loyalty, completing the value chain by ensuring long-term product performance and client relationships.

Headers and Wire Housings Market Potential Customers

The Headers and Wire Housings Market caters to a broad and diverse range of potential customers, primarily encompassing manufacturers and assemblers of electronic systems across numerous industries. The automotive sector represents a significant end-user base, with vehicle manufacturers, Tier 1 and Tier 2 suppliers, and specialized EV component producers requiring connectors for engine control units, infotainment systems, ADAS, lighting, and power distribution for electric powertrains. The continuous innovation in automotive electronics, coupled with the shift towards electrification, makes this segment a high-growth area for interconnect solutions. These customers prioritize durability, reliability under harsh conditions, and compliance with stringent automotive standards.

Consumer electronics companies constitute another major segment, including manufacturers of smartphones, tablets, laptops, smart home devices, wearables, gaming consoles, and various household appliances. These companies constantly seek miniaturized, high-density, and cost-effective headers and wire housings to enable compact designs and advanced functionalities. The rapid product cycles and competitive nature of this industry drive demand for fast-to-market solutions and continuous innovation in connector technology. Similarly, industrial sector players, such as manufacturers of factory automation equipment, robotics, control systems, and test and measurement instruments, are critical customers. They demand ruggedized, high-performance connectors that can withstand vibrations, extreme temperatures, and other harsh environmental factors typical of industrial settings, ensuring reliable operation and longevity.

Furthermore, telecommunications equipment providers, including manufacturers of network infrastructure (routers, switches, base stations), 5G components, and data center hardware, are significant buyers, requiring high-speed, high-frequency, and robust connectors for data and signal integrity. The medical device industry, encompassing producers of diagnostic equipment, monitoring devices, surgical instruments, and wearable health tech, also represents a critical customer base, with unique demands for biocompatibility, reliability, and precision in miniaturized form factors. Aerospace and defense contractors, energy sector companies (solar, wind, smart grid), and building automation firms round out the diverse portfolio of potential customers, each with specialized requirements for headers and wire housings that are crucial for their respective product functionalities and operational efficiencies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 12.85 Billion |

| Market Forecast in 2033 | USD 20.30 Billion |

| Growth Rate | 6.7% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Amphenol Corporation, TE Connectivity, Molex, LLC, JAE Electronics, Inc., Hirose Electric Co., Ltd., Phoenix Contact, Harting Technology Group, Samtec, Inc., Amphenol FCI, Kyocera Corporation, ODU Group, ITT Cannon, Yamaichi Electronics Co., Ltd., CUI Devices, JST Mfg. Co., Ltd., Weidmüller Interface GmbH & Co. KG, Würth Elektronik, Northern Technologies Inc., Smiths Interconnect, Delphi Technologies (part of BorgWarner) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Headers and Wire Housings Market Key Technology Landscape

The Headers and Wire Housings Market is characterized by a rapidly evolving technological landscape driven by the relentless demand for higher performance, greater miniaturization, and enhanced reliability in electronic interconnects. Surface Mount Technology (SMT) remains a dominant manufacturing technique, enabling automated assembly and producing compact, high-density connectors suitable for modern PCBs. Alongside SMT, Through-Hole Technology (THT) persists for applications requiring greater mechanical strength or higher current loads. Miniaturization techniques are constantly advancing, leading to fine-pitch connectors and ultra-compact designs that allow for higher component density on circuit boards, critical for consumer electronics and portable medical devices. These innovations are crucial for meeting the spatial constraints of contemporary electronic systems.

High-speed data transmission designs are another critical area of technological focus, with advancements in material science and connector geometry aimed at reducing signal integrity issues such as crosstalk, impedance mismatch, and insertion loss. This is particularly important for applications in 5G telecommunications, high-performance computing, and advanced driver-assistance systems (ADAS), which demand flawless data transfer at ever-increasing speeds. Furthermore, the development of robust material science is essential for creating headers and wire housings that can withstand harsh environments, including extreme temperatures, vibrations, humidity, and chemical exposure. Specialized plastics with enhanced thermal stability and metal alloys offering superior conductivity and corrosion resistance are continuously being engineered to meet the demanding requirements of industrial, automotive, and aerospace applications.

Automation in manufacturing processes, including robotic assembly and advanced injection molding techniques, is improving production efficiency, consistency, and cost-effectiveness. This automation is complemented by sophisticated testing and inspection technologies, such as automated optical inspection (AOI) and X-ray inspection, which ensure product quality and reliability by detecting even minute defects. Additionally, the integration of smart features, such as integrated sensors for temperature or vibration monitoring, is beginning to emerge in some high-end connectors, paving the way for predictive maintenance and enhanced system diagnostics. These technological advancements collectively contribute to the market's ability to support the ever-growing complexities and performance demands of the global electronics industry, ensuring robust and future-proof interconnect solutions.

Regional Highlights

- Asia Pacific (APAC): The largest and fastest-growing market, primarily due to its position as a global manufacturing hub for consumer electronics, automotive components, and industrial equipment. Countries like China, Japan, South Korea, and Taiwan lead in production and consumption, driven by high domestic demand, robust export activities, and significant investments in advanced manufacturing and R&D. India and Southeast Asian nations are emerging as key growth areas with increasing industrialization and technological adoption.

- North America: A mature market characterized by strong demand from high-tech industries such as aerospace and defense, automotive (especially EV technology), medical devices, and data centers. The region benefits from substantial R&D investments, a focus on high-performance and specialized connectors, and a strong emphasis on automation and smart manufacturing.

- Europe: A significant market driven by robust automotive, industrial automation, telecommunications, and medical sectors. Germany, France, and the UK are key contributors, characterized by advanced manufacturing capabilities and a strong commitment to sustainable and high-quality product development. Emphasis on industrial IoT and Industry 4.0 further fuels demand.

- Latin America: An emerging market with growing industrialization and increasing foreign direct investment in manufacturing. Countries like Brazil and Mexico are leading the demand, particularly in the automotive and consumer electronics sectors. The market here is characterized by a growing appetite for cost-effective and reliable interconnect solutions.

- Middle East and Africa (MEA): A developing market witnessing increasing infrastructure development, urbanization, and technology adoption. Growth is primarily driven by investments in telecommunications, energy, and nascent automotive manufacturing sectors. The region presents long-term growth opportunities as industrialization progresses and electronic product consumption rises.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Headers and Wire Housings Market.- Amphenol Corporation

- TE Connectivity

- Molex, LLC

- JAE Electronics, Inc.

- Hirose Electric Co., Ltd.

- Phoenix Contact

- Harting Technology Group

- Samtec, Inc.

- Amphenol FCI

- Kyocera Corporation

- ODU Group

- ITT Cannon

- Yamaichi Electronics Co., Ltd.

- CUI Devices

- JST Mfg. Co., Ltd.

- Weidmüller Interface GmbH & Co. KG

- Würth Elektronik

- Northern Technologies Inc.

- Smiths Interconnect

- Delphi Technologies (part of BorgWarner)

Frequently Asked Questions

Analyze common user questions about the Headers and Wire Housings market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are headers and wire housings, and what is their primary function?

Headers are male pin connectors typically mounted on a Printed Circuit Board (PCB), while wire housings are female receptacles that terminate wires, forming a separable electrical connection. Their primary function is to provide reliable and efficient electrical interconnection between different components or modules in electronic systems, facilitating power, signal, and data transmission.

Which industries are the primary consumers of headers and wire housings?

The primary consumers include the automotive industry (for ECUs, ADAS, EVs), consumer electronics (smartphones, laptops, IoT devices), industrial automation (robotics, control systems), telecommunications (5G infrastructure, networking equipment), and medical devices (diagnostic, monitoring equipment).

What are the key factors driving the growth of the Headers and Wire Housings Market?

Key growth drivers include the continuous expansion of the global electronics industry, increasing demand for miniaturized devices, the rapid adoption of electric vehicles, proliferation of IoT and industrial automation, and the global rollout of 5G technology, all requiring advanced interconnectivity solutions.

What technological trends are significantly impacting the Headers and Wire Housings Market?

Significant technological trends include advancements in miniaturization (fine-pitch connectors), high-speed data transmission designs, robust material science for harsh environments, increased automation in manufacturing, and sophisticated testing techniques. The emergence of smart, AI-enabled connectors is also a growing trend.

How is Artificial Intelligence (AI) influencing the Headers and Wire Housings Market?

AI is transforming the market by enabling automated design and simulation, enhancing predictive maintenance in manufacturing, optimizing supply chain logistics, improving quality control through vision systems, and driving the demand for advanced interconnects in AI-powered smart devices and systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager