Headlight Tester Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432810 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Headlight Tester Market Size

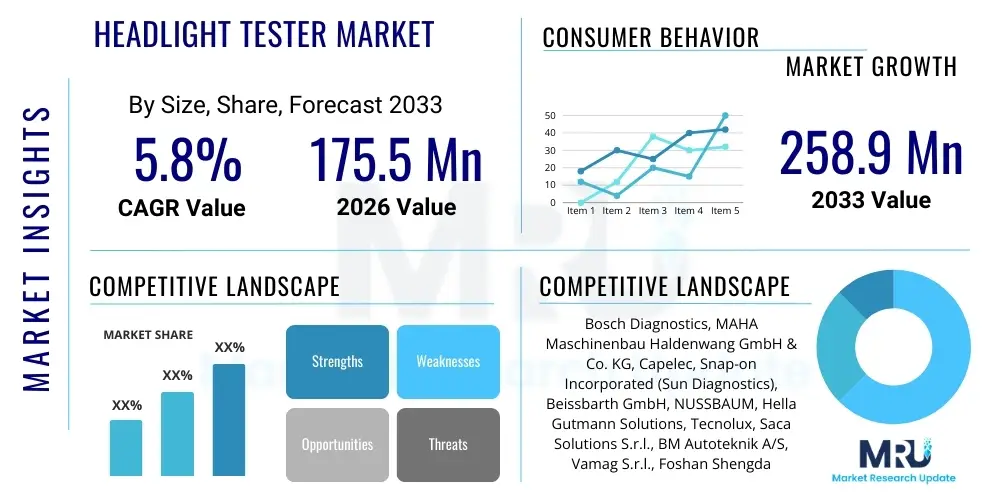

The Headlight Tester Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 175.5 Million in 2026 and is projected to reach USD 258.9 Million by the end of the forecast period in 2033.

Headlight Tester Market introduction

The Headlight Tester Market encompasses devices and systems used primarily in vehicle inspection stations, repair garages, and original equipment manufacturing (OEM) facilities to accurately measure, align, and verify the photometric characteristics of vehicle headlights. These testers are essential for ensuring compliance with strict governmental safety standards, which dictate parameters such as beam intensity, cutoff line precision, and horizontal and vertical aim. The core product offering ranges from traditional mechanical and screen-based testers to sophisticated digital, camera-based, and automated systems capable of handling modern adaptive driving beam (ADB) and LED matrix headlights. The increasing complexity of automotive lighting systems, driven by advanced safety features and electrification trends, necessitates high-precision testing equipment.

Key applications of headlight testers include mandatory technical vehicle inspection (TVI) programs globally, post-accident repair verification, routine maintenance, and quality control during vehicle assembly. The transition from older halogen and Xenon headlights to advanced LED and laser lighting systems has accelerated the demand for computerized testing solutions that can manage complex beam patterns and multiple light sources simultaneously. Benefits derived from utilizing accurate headlight testers include enhanced road safety by preventing glare and ensuring adequate illumination, reduction in accident rates linked to poorly aligned headlights, and maintenance of regulatory compliance, thereby avoiding vehicle recalls or inspection failures. The market's evolution is heavily influenced by international standards harmonization efforts and the continuous technological innovation within the automotive lighting sector.

Driving factors for this market include stringent governmental regulations concerning vehicle roadworthiness, particularly in developed regions such as Europe and North America, where periodic inspections are mandatory. Furthermore, the global expansion of the automotive aftermarket, coupled with the rapid growth in vehicle parc (total number of vehicles in use), fuels the demand for reliable inspection and repair equipment. Technological advancements, such as the integration of advanced camera systems (CCD technology) for high-accuracy digital measurements and the development of testers compatible with future autonomous vehicle (AV) lighting requirements, are further stimulating market growth. The ongoing investment in inspection infrastructure across emerging economies also represents a significant growth vector.

Headlight Tester Market Executive Summary

The Headlight Tester Market is poised for stable expansion, primarily driven by mandatory vehicle safety regulations and the sustained technological shift toward advanced digital and automated testing solutions. Business trends indicate a strong move away from analog testers toward CCD/CMOS camera-based systems, which offer higher precision, speed, and compatibility with complex adaptive lighting technologies now standard in new vehicles. Key market participants are focusing on developing portable, multi-functional devices that can integrate seamlessly with existing workshop management software and inspection networks, addressing the increasing need for data logging and compliance traceability. Strategic mergers, acquisitions, and partnerships aimed at expanding geographical reach and bolstering technological portfolios, especially in software integration, are prevalent across the competitive landscape.

Regionally, Europe maintains its dominance due to exceptionally strict vehicle inspection mandates (e.g., EU Directives) and a mature automotive aftermarket infrastructure. Asia Pacific, particularly China and India, is emerging as the fastest-growing region, fueled by rapid motorization, improving vehicle inspection frameworks, and massive investments in automotive manufacturing and servicing facilities. North America shows steady demand, influenced by state-level inspection variability and the high adoption rate of sophisticated diagnostic equipment in professional service centers. These regional dynamics highlight a dual market requirement: high-end automated solutions in developed markets and robust, cost-effective digital solutions in developing economies seeking to upgrade their infrastructure.

In terms of segmentation trends, the CCD Camera-Based Headlight Tester segment is exhibiting the highest growth rate, largely supplanting traditional mirror-box and screen testers due to its superior accuracy and ability to analyze complex LED and matrix beam patterns. Application-wise, the official Vehicle Inspection Stations (VIS) segment remains the largest consumer, mandated by government safety regulations, though the Automotive Garages and Workshops segment is also expanding rapidly, driven by increased complexity in repair and maintenance tasks. The portability factor is influencing product types, with mobile and trolley-mounted units gaining traction over fixed installation systems, offering greater flexibility and efficiency for larger service centers and mobile inspection units.

AI Impact Analysis on Headlight Tester Market

Analysis of common user questions regarding AI's influence on the Headlight Tester Market reveals key themes centered around automation, regulatory compliance for autonomous vehicles (AVs), and predictive maintenance capabilities. Users frequently inquire about how AI can enhance the accuracy and speed of testing complex lighting systems like Adaptive Driving Beams (ADB) and how machine vision algorithms can objectively evaluate subjective criteria such as light distribution quality and glare assessment, which are challenging for traditional systems. Furthermore, there is significant interest in the integration of AI-powered analytics for identifying latent defects, predicting component failures (e.g., LED matrix element degradation), and ensuring the dynamic compliance of headlights used in Level 3 and Level 4 autonomous vehicles, where lighting performance is critical for sensor functionality and safety redundancies. The overarching expectation is that AI will transform headlight testing from a static, pass/fail measurement process into a dynamic, intelligent diagnostic procedure.

The implementation of Artificial Intelligence and advanced machine learning (ML) algorithms is set to revolutionize the calibration and testing protocols for automotive lighting systems. AI can process vast amounts of photometric data captured by CCD cameras in real-time, enabling highly accurate analysis of complex, variable beam patterns that are often missed by human operators or basic software. For instance, ML models can be trained on datasets of compliant and non-compliant beam characteristics, allowing the tester to instantly diagnose minute deviations from regulatory standards, especially those related to dynamic performance. This reduces measurement subjectivity and significantly increases throughput in high-volume inspection environments, such as official inspection centers. Additionally, AI facilitates the development of self-calibrating testers, minimizing the downtime and maintenance costs associated with periodic equipment verification.

Furthermore, AI plays a crucial role in future-proofing headlight testing equipment for the era of autonomous mobility. Autonomous vehicles rely heavily on advanced sensor suites (LiDAR, camera, radar) where light output consistency and beam pattern stability are paramount, not just for visibility but also for sensor functionality. AI systems integrated within headlight testers can simulate various real-world driving scenarios (e.g., different load conditions, weather impacts) to test the adaptive behavior of smart lighting systems, ensuring they perform optimally under dynamic conditions as required by evolving AV regulations. This capability extends beyond simple alignment checks to holistic performance validation, establishing AI as a critical component for maintaining the operational safety and regulatory compliance of next-generation vehicles.

- AI enables highly accurate, real-time analysis of complex Adaptive Driving Beam (ADB) patterns.

- Machine vision algorithms reduce subjective error in glare and light distribution assessment.

- Predictive maintenance capabilities identify degrading LED or electronic components before failure.

- Automated compliance verification simplifies testing procedures for dynamic, intelligent lighting systems.

- Integration with Vehicle-to-Infrastructure (V2I) systems for aggregated compliance reporting.

- AI facilitates self-calibration and remote diagnostic capabilities for headlight testing equipment.

- Supports advanced simulation and validation of lighting performance in autonomous vehicle ecosystems.

DRO & Impact Forces Of Headlight Tester Market

The Headlight Tester Market is strongly influenced by a combination of stringent regulatory drivers, technological restraints, significant growth opportunities, and complex impact forces shaping its trajectory. The primary driver is the global mandate for vehicle safety and environmental compliance, necessitating regular and precise technical vehicle inspections (TVI). Regulatory bodies worldwide are tightening standards for light intensity, glare control, and beam cutoff, particularly in response to the proliferation of powerful LED and high-intensity discharge (HID) lighting systems. This regulatory pressure compels inspection centers and garages to continuously upgrade their equipment to modern digital testers capable of measuring these highly precise specifications. The increasing adoption of advanced and complex lighting technologies, such as matrix LED and adaptive headlights that dynamically change beam patterns, further drives the need for sophisticated, camera-based testing solutions that can accurately diagnose and calibrate these systems, providing a perpetual upgrade cycle for testing equipment.

However, the market faces significant restraints, chiefly related to the high initial capital expenditure required for sophisticated digital testers compared to legacy analog units. Small-scale garages and workshops, particularly in developing regions, often defer the adoption of high-precision CCD camera systems due to cost constraints, preferring to rely on older, less accurate equipment that barely meets minimum regulatory thresholds. Furthermore, the lack of standardized global protocols for testing adaptive lighting systems presents a technological and regulatory challenge. Differences in regional standards (e.g., ECE regulations in Europe versus NHTSA regulations in the US) complicate manufacturing and deployment strategies for multinational equipment providers. The complexity of operating and maintaining advanced digital testers also necessitates specialized training for technicians, creating a barrier to entry for widespread adoption in low-skill labor markets.

Opportunities abound, particularly in the integration of tester data with cloud-based fleet management and inspection reporting systems, enhancing traceability and centralized compliance monitoring. The massive projected growth in the global vehicle parc, especially in rapidly motorizing nations in Asia Pacific and Latin America, provides a substantial untapped market for infrastructure modernization and equipment sales. Furthermore, the increasing repair frequency of complex, expensive lighting units in the aftermarket presents a unique opportunity for specialized service providers utilizing high-end diagnostic testers. The transition toward autonomous vehicles will mandate entirely new, specialized testing procedures for ensuring sensor integration and reliable light performance, opening a lucrative avenue for innovation and market entry for manufacturers developing future-proof testing platforms. Key impact forces include the speed of technological evolution in automotive lighting (forcing rapid obsolescence of older testers), the effectiveness of government enforcement of inspection mandates, and the shift toward digital workshops prioritizing integrated diagnostic solutions.

A significant impact force is the trend towards predictive vehicle maintenance and data connectivity. Modern headlight testers are increasingly being integrated into the Internet of Things (IoT) framework within workshops, allowing for automated data upload, centralized fault analysis, and remote software updates. This digitalization improves operational efficiency and ensures compliance consistency across large networks of inspection sites. The competitive environment is also impacted by consolidation, as leading manufacturers seek to acquire specialized software firms to enhance their diagnostic capabilities. This drives up the baseline expectation for equipment functionality, moving the market away from simple photometric devices toward comprehensive diagnostic tools that interact directly with the vehicle's electronic control units (ECUs). The regulatory landscape, specifically the push for harmonizing standards for lighting (such as the widespread acceptance of ADB technology), represents a crucial, accelerating force, mandating that all new equipment be capable of handling these complex safety-critical systems.

Segmentation Analysis

The Headlight Tester Market is segmented based on critical technical, operational, and application criteria, providing a structured view of market demand and technological preferences across various end-user groups. Key segmentation factors include the technology used (mirror-based, digital CCD/CMOS), the form factor (fixed installation, mobile/trolley), and the primary end-use application (official inspection, aftermarket repair, OEM manufacturing). Understanding these segments is vital for manufacturers to tailor product specifications, pricing strategies, and distribution channels to meet the diverse needs of regulatory agencies, franchised dealerships, independent garages, and automotive production lines. The digital transformation sweeping the automotive service industry is heavily favoring segments utilizing high-accuracy sensor technology.

The segmentation by technology reveals a clear market transition, where the highly accurate and data-rich CCD camera-based segment is experiencing rapid adoption, often replacing the older, less reliable mirror and screen-based systems. This shift is driven by the necessity to comply with increasingly strict beam pattern requirements of advanced lighting systems (e.g., dynamic bending lights). Furthermore, the form factor segmentation is critical for optimizing workflow efficiency; fixed installations are dominant in high-volume, centralized inspection facilities, while mobile, trolley-mounted testers are gaining favor among general repair shops and dealership service bays that require flexibility and minimal floor space commitment.

Application-based segmentation emphasizes the difference in purchasing motivations and compliance requirements. Official government Vehicle Inspection Stations (VIS) prioritize regulatory compliance, robust construction, and high throughput capability, often purchasing fixed or heavy-duty mobile units. Conversely, Automotive Garages and Workshops look for ease of use, integration with diagnostic tools, and affordability, often choosing mid-range digital testers. The OEM segment demands the highest precision for end-of-line quality control, leading them to invest in fully automated, integrated production line systems capable of millisecond testing cycles. This complex interaction of technology, mobility, and application drives specialization within the vendor landscape.

- By Type

- Digital Headlight Testers (CCD Camera/CMOS Sensor Based)

- Mirror/Screen Based Headlight Testers (Analog/Traditional)

- Laser-Assisted Headlight Testers

- By End-User Application

- Vehicle Inspection Stations (TVI/MOT Testing)

- Automotive Garages and Workshops

- Automotive OEM and Manufacturing Facilities (End-of-Line Testing)

- Dealership Service Centers

- By Portability

- Fixed/Rail-Mounted Systems

- Mobile/Trolley-Mounted Systems

- By Sales Channel

- Direct Sales (OEM and Large VIS Contracts)

- Distributors/Aftermarket Sales

Value Chain Analysis For Headlight Tester Market

The value chain for the Headlight Tester Market begins with upstream activities involving the sourcing and integration of high-precision components, primarily sophisticated optical sensors (CCD/CMOS cameras), precision mechanical parts, and advanced microprocessors necessary for real-time data processing. Key upstream suppliers include specialized manufacturers of imaging sensors, optical lens systems, and embedded systems software developers. The quality and availability of these components directly impact the accuracy and performance of the final testing unit. Manufacturers must maintain robust supply chain relationships to ensure the reliability and cutting-edge nature of their equipment, especially concerning the rapid advancements in digital imaging technology required for complex LED testing.

Midstream activities are dominated by the core manufacturing, assembly, software development, and quality assurance processes. Leading manufacturers in the Headlight Tester Market focus heavily on calibrating the optical path and developing proprietary algorithms to interpret beam characteristics according to diverse international standards (e.g., ECE R48, SAE J1383). The manufacturing phase involves precision engineering to ensure the stability and durability of the tester in demanding workshop environments. Significant intellectual property lies in the software used for measurement, data logging, and connectivity, which determines the equipment's functionality and its ability to interface with workshop management systems (WMS) and government inspection databases. Rigorous testing and certification processes are mandatory to meet metrological and safety standards.

Downstream distribution channels involve getting the final product to diverse end-users. Direct sales are common for large government contracts (Vehicle Inspection Stations) and major automotive OEMs, often involving tailored installation and long-term service agreements. Indirect distribution relies heavily on regional distributors, equipment wholesalers, and specialized automotive tool suppliers who manage inventory, local marketing, and after-sales support for independent garages and workshops. Effective training and technical support are critical downstream factors, as the complexity of digital testers requires ongoing assistance. The after-sales service revenue stream, including calibration, maintenance, and software updates, constitutes a vital part of the downstream value capture for manufacturers.

Headlight Tester Market Potential Customers

The potential customer base for the Headlight Tester Market is diverse yet concentrated around entities responsible for vehicle safety, maintenance, and manufacturing quality assurance. The largest segment of end-users consists of government-mandated Vehicle Inspection Stations (VIS), including national and regional testing authorities (e.g., MOT testing centers in the UK, TÜV stations in Germany, or state inspection facilities in the US). These customers are non-negotiable purchasers driven entirely by regulatory compliance, demanding high throughput, certified accuracy, and robust data reporting capabilities. Their buying cycles are typically aligned with government tender processes or regulatory upgrade mandates, making them the most stable demand source for high-end fixed and rail-mounted digital systems.

Another major customer group includes Automotive Garages, Independent Workshops, and Franchised Dealership Service Centers. These end-users are driven by the necessity to perform accurate adjustments and repairs following collision damage, component replacement, or routine maintenance, especially as complex LED and adaptive lighting systems become standard. For these customers, factors such as equipment portability (trolley-mounted units), ease of use, integration with diagnostic trouble codes (DTCs), and affordability relative to operational budget are key purchasing criteria. The rapid growth of the global vehicle parc guarantees sustained demand from this aftermarket service sector.

Finally, Automotive Original Equipment Manufacturers (OEMs) and Tier 1 lighting system suppliers form a specialized customer segment. These entities require highly precise, automated, and often customized headlight testing equipment for quality control at the end of the assembly line (End-of-Line testing). Their demand is characterized by extremely high accuracy requirements, rapid measurement cycles, and full integration into the production management system. As the complexity of automotive lighting increases, particularly with the transition to matrix and digital light projection technologies, the OEM segment will continue to invest heavily in the most advanced, high-specification testing platforms to ensure zero-defect product delivery.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 175.5 Million |

| Market Forecast in 2033 | USD 258.9 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bosch Diagnostics, MAHA Maschinenbau Haldenwang GmbH & Co. KG, Capelec, Snap-on Incorporated (Sun Diagnostics), Beissbarth GmbH, NUSSBAUM, Hella Gutmann Solutions, Tecnolux, Saca Solutions S.r.l., BM Autoteknik A/S, Vamag S.r.l., Foshan Shengda Automobile Testing Equipment Co., Ltd., Shenzhen Autodiagnos Tech Co., Ltd., Texa S.p.A., Stertil-Koni. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Headlight Tester Market Key Technology Landscape

The technology landscape of the Headlight Tester Market is rapidly shifting towards advanced digital imaging and software-centric solutions to cope with the sophistication of modern automotive lighting. The dominant technology is the Charge-Coupled Device (CCD) or Complementary Metal-Oxide-Semiconductor (CMOS) camera sensor, which captures the headlight beam pattern digitally. Unlike legacy mirror-based systems that rely on visual estimation or simple analog measurements, digital testers provide high-resolution photometric data, enabling precise measurement of the cut-off line, intensity, and complex beam distribution required by regulatory standards for LED and Xenon headlights. This CCD technology allows for automated alignment checks, minimizing human error and significantly improving testing throughput in high-volume inspection environments. Furthermore, digital outputs simplify data logging and integration with computerized inspection reporting systems.

A significant technological development is the incorporation of sophisticated machine vision and image processing algorithms specifically designed to analyze Adaptive Driving Beam (ADB) systems and matrix LEDs. These algorithms must be capable of recognizing and testing multiple dynamic light segments simultaneously and ensuring that the headlamp's reaction to simulated driving conditions (e.g., detecting an oncoming vehicle) is compliant. This requires high refresh rates and complex computational power embedded within the tester unit. Manufacturers are also integrating laser assistance systems to provide ultra-precise positioning and alignment of the tester relative to the vehicle, further reducing setup time and maximizing measurement accuracy, especially critical for wheel-alignment sensitive testing procedures.

Connectivity and integration are central to the modern technology landscape. Contemporary headlight testers are equipped with Wi-Fi, Ethernet, and Bluetooth capabilities, allowing them to communicate directly with Vehicle Control Units (VCUs) via OBD ports, facilitating automated adjustment routines required for advanced vehicle maintenance. They also integrate with broader workshop management systems (WMS) and government inspection databases (e.g., MOT or TÜV databases) for seamless compliance reporting and traceability. The future direction involves cloud-based calibration services and over-the-air (OTA) software updates, ensuring that testing equipment remains current with the latest vehicle models and evolving international lighting standards without requiring physical service visits, thereby extending the operational lifespan and reliability of the equipment.

Regional Highlights

- Europe: Europe remains the leading market for Headlight Testers, underpinned by stringent and mandatory periodic technical inspection (PTI) schemes implemented across the European Union (EU) and associated countries, enforced by directives such as the EU Roadworthiness Package. Countries like Germany, France, and the UK have highly mature aftermarket and VIS infrastructures, necessitating continuous investment in high-precision, ECE R48 compliant testing equipment. The region shows the highest adoption rate of advanced CCD-based and fully automated testers due to high labor costs and the prevalence of sophisticated, often premium vehicles equipped with complex ADB and matrix lighting technologies. Regulatory consistency and the focus on road safety drive premium pricing and consistent upgrade cycles here.

- North America: The North American market, comprising the US and Canada, exhibits strong demand, although regulatory requirements are more decentralized, often varying by state or province. Demand is high for advanced, integrated diagnostic solutions, particularly within franchised dealerships and large independent repair shops, driven by the high volume of collision repair work and insurance mandates for quality assurance. The US market is characterized by a high concentration of technologically advanced testers compatible with SAE and NHTSA standards. The recent regulatory acceptance and impending deployment of ADB technology in the US are projected to trigger a significant wave of equipment upgrades across inspection and repair facilities to handle these dynamic systems.

- Asia Pacific (APAC): APAC is the fastest-growing market, primarily fueled by rapid urbanization, massive motorization rates, and the subsequent implementation or strengthening of national vehicle safety inspection mandates, notably in China, India, and Southeast Asian nations. While the market initially utilized basic, cost-effective testers, there is a strong trend toward modernization and digitalization, driven by foreign investment in automotive manufacturing and increasing regulatory enforcement. China, with its vast vehicle parc and developing inspection network, represents the largest opportunity, demanding a blend of high-volume, fixed inspection systems and affordable, reliable mobile units for widespread deployment in emerging rural inspection centers.

- Latin America (LATAM): The LATAM region presents a growing but price-sensitive market. Demand is driven by local government initiatives to formalize and professionalize vehicle inspection standards, particularly in countries like Brazil, Mexico, and Argentina. The primary challenge is the capital cost associated with modern digital equipment. However, the requirement for basic, functional, and durable digital testers is rising as regulatory oversight increases. Manufacturers often focus on providing robust, lower-cost digital solutions optimized for challenging operational environments and requiring minimal complex maintenance or advanced software integration.

- Middle East and Africa (MEA): MEA is an emerging market with heterogeneous growth. Demand is concentrated in the Gulf Cooperation Council (GCC) countries (UAE, Saudi Arabia), where high volumes of premium vehicles necessitate sophisticated maintenance equipment, and mandatory testing is strictly enforced. The increasing investment in infrastructure and establishing regional hubs for automotive servicing are driving initial market adoption. In contrast, the African continent represents a nascent market where regulatory enforcement is still developing, limiting current demand largely to large governmental fleet maintenance centers and premium import dealership networks, primarily seeking reliable, rugged equipment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Headlight Tester Market.- Bosch Diagnostics

- MAHA Maschinenbau Haldenwang GmbH & Co. KG

- Capelec

- Snap-on Incorporated (Sun Diagnostics)

- Beissbarth GmbH

- NUSSBAUM

- Hella Gutmann Solutions

- Tecnolux

- Saca Solutions S.r.l.

- BM Autoteknik A/S

- Vamag S.r.l.

- Foshan Shengda Automobile Testing Equipment Co., Ltd.

- Shenzhen Autodiagnos Tech Co., Ltd.

- Texa S.p.A.

- Stertil-Koni

- ATT S.r.l.

- Hofmann Megaplan

- CEMB S.p.A.

- Sherpa Autoprüftechnik GmbH

- Launch Tech Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Headlight Tester market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for digital CCD-based headlight testers?

The primary factor driving demand is the mandatory testing of complex, new-generation lighting systems, such as LED, Xenon, and Adaptive Driving Beam (ADB) headlights. Traditional mirror-based testers lack the necessary accuracy and computational ability to precisely measure the cut-off line, intensity variations, and multiple dynamic segments required by modern regulatory standards, making digital CCD systems essential for compliance and reliable diagnostics.

How will autonomous vehicle technology influence future headlight tester specifications?

Autonomous vehicle (AV) technology will necessitate testers capable of validating the dynamic performance and stability of lighting systems, as headlights are crucial for both human visibility and sensor functionality (LiDAR/camera systems). Future testers must ensure compliance not only with photometric standards but also with communication protocols and real-time operational reliability under simulated dynamic driving conditions, shifting the focus towards holistic system validation rather than simple alignment checks.

Which geographical region shows the highest potential for market growth in the forecast period?

The Asia Pacific (APAC) region, particularly driven by large economies like China and India, is projected to show the highest market growth rate. This acceleration is due to rapid growth in the vehicle parc, increasing governmental focus on implementing and enforcing mandatory vehicle safety inspections, and significant investments being made to modernize existing inspection infrastructure with digital testing technology.

What is the main challenge faced by smaller independent garages in adopting advanced headlight testing equipment?

The main challenge is the high initial capital investment required for purchasing certified, high-precision digital CCD or CMOS-based headlight testers, especially compared to the operational budgets of smaller independent garages. Coupled with the need for specialized technician training to operate and calibrate these sophisticated devices, cost serves as a significant barrier to widespread adoption in the aftermarket segment.

What are the key differences between Fixed/Rail-Mounted and Mobile/Trolley-Mounted headlight testers?

Fixed/Rail-Mounted testers are designed for high-volume, centralized Vehicle Inspection Stations (VIS) where high throughput and precise positioning are paramount, offering robust, dedicated testing lanes. Mobile/Trolley-Mounted testers, in contrast, offer flexibility, ease of movement across multiple service bays in a garage or workshop, and lower installation costs, making them ideal for repair facilities and smaller service centers where space and flexibility are crucial operational considerations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Headlight Tester Market Statistics 2025 Analysis By Application (Light Vehicles, Heavy Vehicles, Two-wheelers), By Type (Manual Headlight Tester, Automatic Headlight Tester, Other), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Headlight Tester Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Automatic Headlight Tester, Manual Headlight Tester, Others), By Application (Two-wheelers, Heavy Vehicles, Light Vehicles), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager