Health And Wellness Products Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432609 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Health And Wellness Products Market Size

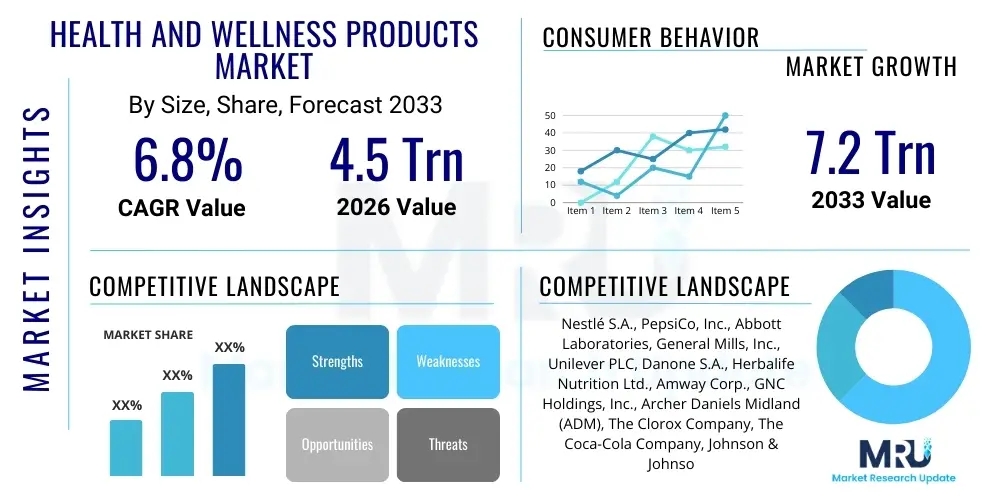

The Health And Wellness Products Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.5 Trillion in 2026 and is projected to reach USD 7.2 Trillion by the end of the forecast period in 2033.

Health And Wellness Products Market introduction

The global Health and Wellness Products Market encompasses a vast array of goods and services designed to enhance physical and mental well-being, mitigate diseases, and promote preventative health strategies. This expansive domain includes functional foods, dietary supplements, fortified beverages, natural and organic personal care items, fitness equipment, and various wellness services like specialized tourism and mental health applications. The primary impetus driving this market expansion is the profound shift in global consumer behavior towards proactive health management, fueled by rising awareness regarding lifestyle-related diseases and the pursuit of longevity. Products within this sector are increasingly positioned not merely as remedies, but as essential components of daily living, integrating nutritional, physical, and mental health benefits.

Major applications of health and wellness products span across nutritional gap filling, performance enhancement, cosmetic improvement, and chronic disease prevention. Functional foods, for instance, are widely applied in improving gut health through probiotics and prebiotics, while dietary supplements target specific deficiencies such as Vitamin D or Omega-3 fatty acids. The increasing adoption of self-care and personalized nutrition tools further diversifies the application landscape. The market benefits significantly from globalization and digitalization, enabling specialized niche products—such as plant-based protein powders or personalized vitamin packs—to reach consumers globally, thereby fostering innovation in product formulation and delivery methods across urban and increasingly rural demographics.

Key driving factors include rapidly escalating healthcare costs in developed economies, prompting consumers to invest in preventative measures, and the pervasive influence of social media and wellness influencers promoting healthier lifestyles. Technological advancements, such as wearable health trackers and genetic testing kits, are contributing to personalized wellness solutions, making health management quantifiable and highly individualized. Furthermore, supportive regulatory environments in regions like North America and Europe, which encourage the use of natural and clinically-validated ingredients, solidify the market's robust growth trajectory, transforming health and wellness from a luxury niche into a mainstream consumer necessity.

Health And Wellness Products Market Executive Summary

The Health And Wellness Products Market demonstrates robust growth underpinned by strong business trends centered on personalization, sustainability, and technological integration. Leading corporations are heavily investing in research and development to create novel functional ingredients derived from natural and sustainable sources, responding directly to consumer demand for clean labels and eco-friendly packaging. Strategic mergers and acquisitions are common, as traditional food and beverage giants seek to integrate specialized supplement and organic product portfolios, ensuring broader market penetration and immediate access to innovative product pipelines. Furthermore, the shift towards direct-to-consumer (DTC) models, leveraging e-commerce platforms and subscription services, has revolutionized distribution, offering enhanced consumer interaction and tailored product offerings, thereby optimizing supply chain efficiencies.

Regionally, North America maintains its dominance due to high consumer spending power, established regulatory frameworks, and advanced technological adoption in health monitoring and fitness. However, the Asia Pacific (APAC) region is poised for the highest growth rate, driven by significant urbanization, rising disposable incomes, and the growing influence of Western dietary habits coupled with traditional Eastern wellness practices. Countries like China and India are experiencing massive adoption of dietary supplements and fortified foods as middle-class populations increasingly prioritize disease prevention. European markets are characterized by a strong emphasis on organic certifications and strict quality control, pushing manufacturers towards premium, clinically-backed products, particularly within the sports nutrition and clean-beauty segments.

Segment trends reveal that the functional foods and beverages category holds the largest market share, specifically non-alcoholic functional drinks infused with adaptogens, probiotics, and nootropics, appealing to consumers seeking cognitive and immune support. The digital wellness segment, encompassing meditation apps, virtual fitness classes, and tele-health services, is exhibiting exponential growth, accelerated significantly by post-pandemic remote lifestyles. Conversely, the sustainability trend is profoundly impacting the personal care segment, with a pronounced consumer migration towards products free from parabens, sulfates, and synthetic chemicals, pushing mainstream brands to reformulate their core offerings and prioritize ingredient transparency, driving market innovation across all product categories.

AI Impact Analysis on Health And Wellness Products Market

User inquiries regarding AI's influence in the Health and Wellness Products Market frequently center on personalization, diagnostics, and supply chain efficiency. Common questions include: "How can AI customize my supplement regimen?", "Will AI replace human nutritionists?", and "Can AI-driven diagnostics prevent diseases early?" These questions reveal high expectations regarding AI's ability to move beyond generalized health recommendations toward hyper-personalized solutions based on individual biomarkers, genetics, and lifestyle data captured through wearables. Users also express concern over data privacy, the accuracy of AI-driven health recommendations, and the potential for increased costs associated with advanced personalized product manufacturing, signaling a need for transparent data usage policies and evidence-based AI validation within the wellness space.

The integration of Artificial Intelligence and Machine Learning (ML) is fundamentally transforming the product development and consumer experience in the health and wellness sector. AI algorithms are now capable of analyzing vast datasets comprising genetic information, microbiome composition, activity levels, and dietary habits to formulate truly customized product recommendations, such as personalized vitamin stacks or tailored meal plans. This shift from mass-market products to 'N=1' personalization is a key differentiator, enhancing consumer efficacy and loyalty. Furthermore, AI optimizes the formulation process by predicting ingredient interactions and stability, accelerating time-to-market for novel functional ingredients and ensuring product claims are scientifically verifiable, thereby bolstering consumer trust in complex wellness products.

AI also plays a critical role in market forecasting, demand sensing, and supply chain optimization. By analyzing real-time sales data, social media trends, and regional health outbreaks, AI models can accurately predict shifts in consumer demand, allowing manufacturers to adjust production schedules and inventory levels rapidly, minimizing waste and ensuring product availability. In the retail sector, AI-powered chatbots and virtual assistants provide immediate, accurate advice on product usage and efficacy, serving as scalable educational tools that enhance the consumer's purchasing journey, translating sophisticated health information into actionable insights and driving sales conversion rates across online platforms.

- AI-driven Personalization: Customization of nutrition, supplements, and fitness programs based on biological and lifestyle data.

- Predictive Diagnostics: Early identification of nutritional deficiencies or potential health risks, leading to proactive product consumption.

- R&D Acceleration: Use of ML to analyze existing scientific literature and ingredient data to discover and formulate novel functional compounds.

- Optimized Supply Chain: AI-based demand forecasting reduces inventory costs and improves product freshness, especially for perishable functional foods.

- Enhanced Consumer Engagement: Deployment of intelligent chatbots and virtual nutritionists for 24/7 personalized health advice and product selection support.

- Wearable Data Integration: AI platforms process continuous data streams from health wearables (e.g., sleep, heart rate variability) to adjust wellness product usage recommendations dynamically.

DRO & Impact Forces Of Health And Wellness Products Market

The dynamics of the Health and Wellness Products Market are defined by powerful driving forces centered on demographic shifts and increasing consumer health literacy. The global aging population is a major driver, as older adults seek products that support mobility, cognitive function, and chronic disease management, boosting demand for joint health supplements and anti-aging remedies. Simultaneously, the pervasive consumer desire for preventative health measures, often stemming from increased media coverage of health crises and lifestyle diseases, motivates proactive purchasing of immune-boosting and stress-reducing products. These drivers collectively create a fertile ground for sustained market expansion, pushing companies to continually innovate functional product categories that address specific, evolving consumer health needs, often validated by clinical evidence.

However, the market faces significant restraints, primarily related to regulatory scrutiny and the challenge of consumer skepticism regarding product efficacy. The supplement sector, in particular, often grapples with issues of misleading claims and low-quality ingredients, necessitating constant efforts by credible manufacturers to ensure transparency and secure third-party certifications, which adds complexity and cost to operations. Furthermore, the premium pricing associated with many organic, natural, and specialized wellness products can act as a barrier to entry for lower-income demographics, limiting mass market adoption despite the universal desire for better health outcomes. Addressing these restraints requires standardization across the industry and effective communication of verified scientific backing.

Significant opportunities lie in leveraging digital platforms for personalized medicine and expanding into emerging regional markets. The rapid proliferation of genetic testing and microbiome analysis offers a gateway for companies to provide highly targeted, science-backed nutritional solutions that command premium pricing and strong brand loyalty. Expanding distribution networks, particularly in APAC and Latin America, where economic development is rapidly increasing the consumer base capable of affording these products, represents substantial untapped potential. The increasing focus on mental wellness and stress management also opens new product categories, such as nootropics and therapeutic digital apps, providing diversified growth avenues beyond traditional physical health products. These forces collectively shape a competitive landscape defined by innovation, stringent quality demands, and digital enablement.

Segmentation Analysis

The Health and Wellness Products Market is rigorously segmented based on product type, function, distribution channel, and geography, allowing for precise market analysis and targeted strategic planning. The product type segmentation captures the diversity of offerings, ranging from tangible goods like packaged foods and supplements to experience-based services such as wellness tourism and fitness centers. Functional segmentation categorizes products based on their primary intended benefit, such as nutritional support, weight management, or immunity boosting, reflecting the specific consumer motivation behind the purchase. This detailed segmentation aids stakeholders in understanding consumer preferences and identifying high-growth niche markets within the broader wellness ecosystem, particularly focusing on rapidly expanding areas like gut health and personalized nutrition.

Within the product segmentation, the functional foods and beverages category typically dominates the market, benefiting from ease of integration into daily routines and high recurrence of purchase. This segment includes fortified dairy products, energy drinks with added vitamins, and packaged snacks containing fiber or protein. Conversely, the dietary supplements segment, though smaller, exhibits high-value growth, particularly in specialized areas like botanical extracts and condition-specific supplements targeting sleep, stress, or joint health. The distribution landscape is evolving rapidly, with the online channel gaining substantial traction due to convenience, broader product range availability, and the ability to offer detailed product information and user reviews, critical factors in the purchase decision for health-conscious consumers.

Geographical segmentation reveals stark differences in consumer spending and product preferences, requiring multinational corporations to tailor their marketing and product portfolios accordingly. While Western markets show maturity and focus on advanced, personalized solutions, emerging markets are still heavily focused on basic nutritional supplementation and foundational preventative health measures. Overall, the market segmentation highlights a clear trend towards convergence, where technology (e.g., apps and wearables) increasingly intersects with physical products (e.g., smart fitness gear and personalized protein bars), creating new hybrid market opportunities that blur traditional segment boundaries and cater to holistic wellness goals, driving the total market value upward.

- By Product Type:

- Functional Foods & Beverages (Probiotic Drinks, Fortified Cereals, Protein Bars)

- Dietary Supplements (Vitamins, Minerals, Herbal Supplements, Specialty Supplements)

- Natural & Organic Personal Care Products (Skincare, Haircare, Cosmetics)

- Health & Wellness Equipment (Fitness Equipment, Monitoring Devices)

- Wellness Tourism & Services (Spas, Retreats, Fitness Centers)

- By Function:

- Nutritional Management

- Weight Management & Active Nutrition

- Immunity & Preventive Health

- Beauty & Anti-Aging

- Stress Management & Sleep Support

- By Distribution Channel:

- Offline (Pharmacies, Supermarkets, Specialty Stores)

- Online (E-commerce Portals, Company Websites, Subscription Services)

Value Chain Analysis For Health And Wellness Products Market

The value chain for the Health and Wellness Products Market is complex, beginning with upstream activities focused on sourcing high-quality, often exotic, and clinically proven raw materials. Upstream analysis involves rigorous quality control, sustainable sourcing practices for botanicals, and significant investment in biotechnology for the production of advanced ingredients like specialized probiotics, peptides, and highly bioavailable nutrient forms. Supplier relationships are critical, often involving long-term contracts with farms or specialized chemical manufacturers to ensure ingredient purity and consistency, paramount considerations given the consumer focus on 'clean label' and ingredient provenance. The scientific validation phase, including clinical trials and efficacy testing, is a major component of the upstream value chain, translating raw ingredients into marketable, science-backed claims for final products.

Midstream activities involve sophisticated manufacturing, processing, and packaging, adhering to strict Good Manufacturing Practices (GMP) and, frequently, specialized certifications such as organic, non-GMO, or vegan standards. Innovation in delivery systems, such as slow-release capsules, enhanced absorption formats, and convenient ready-to-drink formulations, significantly adds value during this stage. The downstream component focuses on distribution and retailing. The distribution channel is bifurcated into direct and indirect routes. Indirect channels, which include large retailers, pharmacy chains, and specialized health food stores, rely on established logistics networks and often require products to meet specific planogram standards and slotting fees. These channels provide broad visibility and accessibility to the general public.

The direct distribution channel, characterized by e-commerce platforms, company-owned websites, and subscription box services, has gained immense importance, offering higher margins and direct access to consumer data. This direct route facilitates personalized marketing and targeted product promotions, enhancing customer lifetime value. Furthermore, the advisory component, often provided through trained staff in specialty stores or via online nutritional consultations, adds substantial value downstream by educating consumers and justifying the premium pricing of many health and wellness products. Efficient logistics, maintaining product integrity (especially for temperature-sensitive probiotics), and rapid fulfillment are non-negotiable requirements for successful distribution in this highly competitive market landscape.

Health And Wellness Products Market Potential Customers

Potential customers for the Health and Wellness Products Market are broadly segmented based on demographics, lifestyle, and specific health objectives, moving far beyond traditional health enthusiasts to encompass mainstream consumers seeking preventative care. The largest and most lucrative segment includes affluent, middle-aged consumers (35-65 years old) in developed economies, often referred to as 'proactive longevity seekers,' who are highly motivated to maintain healthspan, manage stress, and invest heavily in anti-aging supplements, specialized functional foods, and high-end fitness services. These buyers prioritize quality, scientific validation, and brand reputation, willingly paying a premium for products with certified origins and proven efficacy, viewing wellness spending as an investment rather as than an expense, defining a primary target demographic for market players.

A second major customer group comprises the younger generation (Millennials and Gen Z), who are primarily driven by aesthetics, performance, and ethical consumption. These 'conscious wellness advocates' seek plant-based, sustainable, and ethically sourced products, driving demand for vegan protein, natural cosmetics, and mental wellness apps. They are heavily influenced by social media and rely on peer reviews, favoring DTC brands and personalized subscription models. Furthermore, specific sub-segments such as athletes and active individuals constitute key buyers for sports nutrition, protein supplements, and advanced recovery tools, constantly seeking products that optimize physical performance and recovery times, often integrating technology like smart watches into their health regimen to track progress and product impact accurately.

Finally, patients managing chronic conditions and individuals with specific dietary needs (e.g., gluten intolerance, dairy allergy) form a crucial, needs-driven segment. These 'therapeutic consumers' rely heavily on fortified and specialized foods, medical nutrition products, and targeted dietary supplements recommended by healthcare professionals. Their purchasing decisions are often non-discretionary and highly loyal to prescribed brands. Therefore, market penetration strategies must address this segment through collaborations with dietitians, pharmacists, and medical practitioners, ensuring products meet stringent safety and efficacy standards necessary for clinical recommendation and sustained therapeutic use.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Trillion |

| Market Forecast in 2033 | USD 7.2 Trillion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nestlé S.A., PepsiCo, Inc., Abbott Laboratories, General Mills, Inc., Unilever PLC, Danone S.A., Herbalife Nutrition Ltd., Amway Corp., GNC Holdings, Inc., Archer Daniels Midland (ADM), The Clorox Company, The Coca-Cola Company, Johnson & Johnson, Bayer AG, Tivity Health, Inc., L'Oréal S.A., The Nature's Bounty Co., GlaxoSmithKline PLC, Kellogg Company, DuPont de Nemours, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Health And Wellness Products Market Key Technology Landscape

The technological landscape driving the Health and Wellness Products Market is characterized by the confluence of biotechnology, digital health, and advanced manufacturing processes. Biotechnology plays a crucial role in creating next-generation functional ingredients, including synthesized proteins, bio-engineered microbial strains for gut health (probiotics), and highly pure, bioavailable forms of vitamins and minerals. Fermentation technology, specifically, is being utilized to produce sustainable, high-efficacy ingredients like precision-fermented collagen alternatives and specific fatty acids, reducing reliance on animal or resource-intensive agricultural inputs. Furthermore, advanced encapsulation techniques are used to protect sensitive ingredients, such as enzymes and delicate botanicals, ensuring they remain active until they reach the intended absorption site within the body, thereby maximizing the therapeutic potential of the end product.

Digital technology is equally foundational, primarily through the proliferation of wearable devices, smart sensors, and mobile health applications (mHealth). These tools enable consumers to track biomarkers, sleep quality, activity levels, and dietary intake continuously, generating massive datasets that fuel the personalization trend. Connectivity between these devices and personalized nutrition platforms allows for real-time adjustment of supplement recommendations or diet plans, closing the feedback loop between consumption and outcome. This data-driven approach is further augmented by genomic and microbiome testing services, providing the deep biological insights necessary for ultra-personalized wellness regimens. Finally, sophisticated e-commerce infrastructures, leveraging AI for targeted marketing and efficient logistics, ensure that personalized products can be efficiently manufactured and delivered directly to the consumer, completing the digital transformation of the wellness supply chain and enhancing accessibility across geographical boundaries.

Regional Highlights

North America currently holds the largest share of the Health and Wellness Products Market, primarily driven by high consumer awareness regarding preventative healthcare and strong purchasing power. The United States, in particular, showcases significant demand for performance-driven products, including sports nutrition supplements and functional beverages aimed at cognitive enhancement. The region benefits from a well-established infrastructure for research and development, particularly in biotechnology and digital health, fostering rapid innovation in personalized nutrition and wearable technology. Furthermore, the proactive involvement of consumers in managing chronic conditions, combined with widespread availability of both premium and mass-market wellness products across diverse retail channels, solidifies North America's leadership position, setting global trends for product formulation and marketing strategies. Canada also contributes significantly, with a growing focus on natural health products and stringent regulatory standards ensuring high product quality.

Europe represents a mature market characterized by a strong consumer preference for natural, organic, and certified clean-label products. Countries in Western Europe, such as Germany, the UK, and France, exhibit high demand for botanical extracts, premium organic foods, and sustainable personal care products. European consumers tend to prioritize environmental responsibility and ingredient transparency, leading manufacturers to invest heavily in ethical sourcing and sustainable packaging solutions. Strict regulatory oversight by agencies like the European Food Safety Authority (EFSA) ensures high standards of efficacy and safety, albeit sometimes slowing product introduction. The regional market growth is steady, driven by an aging population seeking health maintenance products and a youth demographic increasingly adopting functional foods for mood and energy management, maintaining a focus on high-quality, scientifically supported ingredients.

The Asia Pacific (APAC) region is projected to be the fastest-growing market globally, fueled by rapid economic development, escalating disposable incomes, and the modernization of healthcare systems. Countries like China and India are undergoing massive dietary transitions, leading to increased adoption of Western-style health and wellness products, particularly dietary supplements and fortified foods addressing nutritional deficiencies prevalent in urban populations. Furthermore, APAC uniquely integrates traditional medicine practices (e.g., Ayurveda, Traditional Chinese Medicine) with modern supplements, creating a unique hybrid market dynamic for functional ingredients like turmeric, ginseng, and specialty mushrooms. Urbanization and increased stress levels also drive demand for digital wellness services and stress management products, making APAC a critical strategic focus area for global market expansion due to its immense and rapidly expanding consumer base.

Latin America is experiencing emerging growth, primarily concentrated in Brazil and Mexico, driven by increasing health consciousness and rising awareness of lifestyle diseases such as diabetes and obesity. The demand here is largely focused on weight management products, basic vitamins, and high-protein functional foods. Market penetration is often challenging due to economic volatility and fragmented distribution systems, but the sheer size of the population and the cultural emphasis on physical appearance and fitness provide substantial long-term growth potential. Local manufacturers often focus on leveraging native ingredients and establishing strong brand presence in regional retail chains, gradually introducing more sophisticated products as consumer education and purchasing power increase across different socio-economic strata.

The Middle East and Africa (MEA) market is still in the nascent stages but shows promising growth, particularly in the GCC countries (Gulf Cooperation Council), driven by high per capita income and prevalent health issues such as Vitamin D deficiency and high rates of chronic non-communicable diseases. Consumer spending in this region is high for premium, imported wellness products, specifically supplements and specialized functional foods. Regulatory environments are tightening to ensure product safety, supporting consumer confidence. African markets are more segmented, with South Africa showing the highest maturity in wellness spending, whereas other sub-regions focus primarily on basic nutritional supplements and access to foundational healthcare, presenting opportunities for affordable, large-scale fortification programs to address widespread public health concerns across the continent.

- North America: Market leader focused on personalization, sports nutrition, and advanced digital health integration. Key growth in anti-aging and cognitive health supplements driven by high spending capacity.

- Asia Pacific (APAC): Fastest-growing region, characterized by rapid urbanization, rising middle class, and convergence of traditional and modern wellness products. Massive potential in China and India for mass-market supplements.

- Europe: Mature market emphasizing stringent quality standards, organic certification, ethical sourcing, and clean-label requirements. Strong demand for sustainable personal care and functional beverages.

- Latin America (LATAM): Emerging growth focused on foundational nutrition and weight management, with Brazil and Mexico as primary economic drivers. Challenges posed by distribution complexities and economic volatility.

- Middle East & Africa (MEA): High demand for premium imported supplements and functional products in wealthy Gulf nations; basic nutrition focus in developing African markets. Growth driven by improving health literacy.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Health And Wellness Products Market.- Nestlé S.A.

- PepsiCo, Inc.

- Abbott Laboratories

- General Mills, Inc.

- Unilever PLC

- Danone S.A.

- Herbalife Nutrition Ltd.

- Amway Corp.

- GNC Holdings, Inc.

- Archer Daniels Midland (ADM)

- The Clorox Company

- The Coca-Cola Company

- Johnson & Johnson

- Bayer AG

- Tivity Health, Inc.

- L'Oréal S.A.

- The Nature's Bounty Co.

- GlaxoSmithKline PLC (now Haleon)

- Kellogg Company

- DuPont de Nemours, Inc.

Frequently Asked Questions

Analyze common user questions about the Health And Wellness Products market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the massive growth in the personalized nutrition segment of the Health and Wellness Market?

The personalized nutrition segment is primarily driven by advancements in genomic testing, microbiome analysis, and the widespread adoption of wearable technology, which provide unprecedented levels of data about individual biological needs. This data allows companies to formulate hyper-specific supplements and meal plans that promise higher efficacy than generic products, catering directly to consumers seeking optimal health outcomes based on their unique genetic makeup and lifestyle factors, shifting focus from generalized recommendations to targeted, measurable results.

How is the focus on sustainability impacting product development in health and wellness?

Sustainability profoundly impacts product development by shifting consumer demand towards clean labels, ethically sourced ingredients, and eco-friendly packaging. Manufacturers are increasingly prioritizing plant-based and precision-fermented ingredients to reduce environmental footprints, eliminate harmful chemicals, and ensure supply chain transparency. Brands achieving certified sustainable status often gain a competitive edge, particularly among younger, environmentally conscious consumers who view ecological responsibility as integral to overall wellness.

Which product categories are showing the fastest growth rate in the Asia Pacific (APAC) region?

The fastest-growing product categories in APAC are dietary supplements, particularly those focused on immune health, digestive wellness (probiotics), and anti-aging remedies, largely fueled by rising disposable incomes and rapid health literacy among the burgeoning middle class. Functional beverages, often integrating traditional Asian medicinal herbs with modern scientific formulations, are also experiencing accelerated adoption as convenient options for proactive daily health maintenance.

What are the primary regulatory challenges facing manufacturers in the dietary supplement segment?

Primary challenges include navigating inconsistent global regulations concerning product claims and ingredient approval, particularly the necessity of providing robust scientific evidence to support health benefits. Regulatory bodies in key markets, such as the FDA and EFSA, are increasing scrutiny on quality, purity, and manufacturing practices (GMP), forcing companies to invest significantly in clinical trials and quality assurance to maintain consumer trust and avoid product recalls or legal penalties related to unsubstantiated marketing claims.

What role do technology and e-commerce play in the distribution of health and wellness products?

Technology and e-commerce are pivotal, enabling manufacturers to bypass traditional retail barriers and establish highly efficient direct-to-consumer (DTC) distribution models. Online platforms utilize AI for personalized product recommendations, subscription services for convenience, and sophisticated logistics for rapid delivery. This digital shift enhances market reach, particularly for niche personalized products, and provides essential consumer data for continuous product refinement and optimized inventory management, driving overall market efficiency and consumer satisfaction.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager