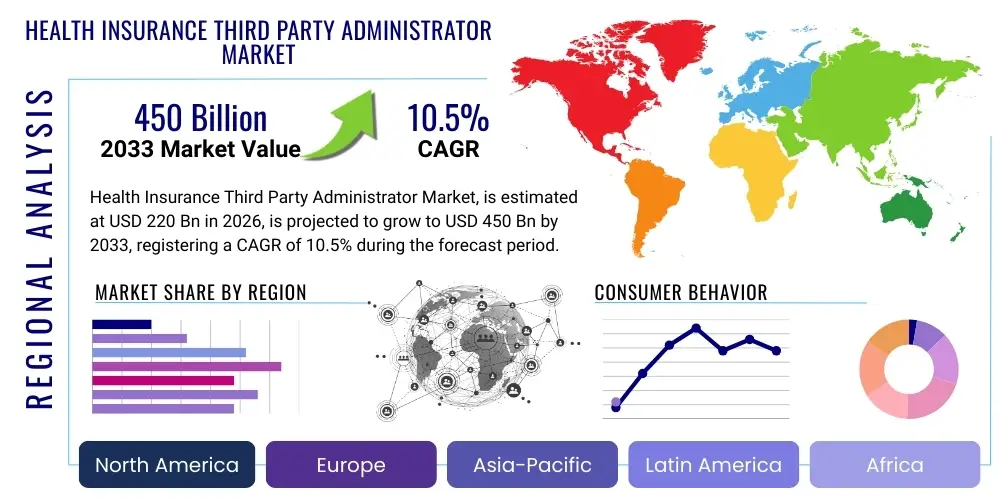

Health Insurance Third Party Administrator Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437653 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Health Insurance Third Party Administrator Market Size

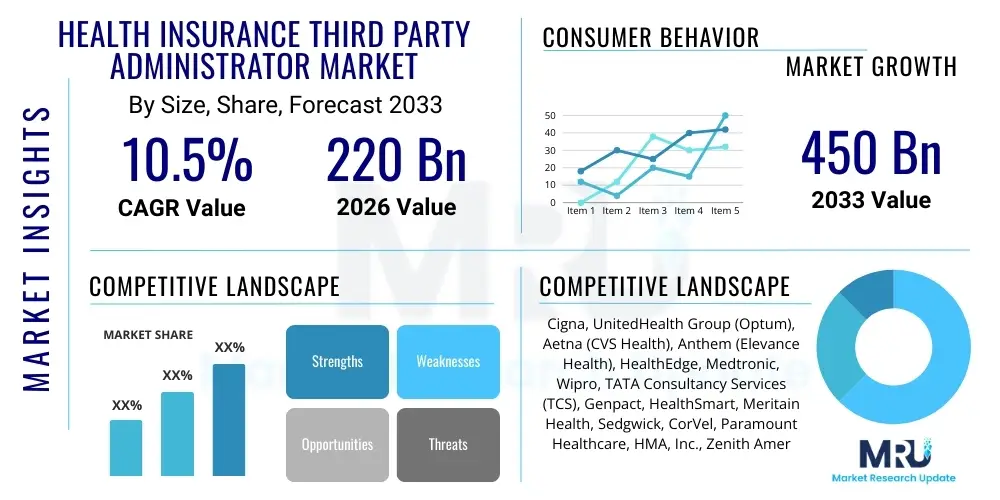

The Health Insurance Third Party Administrator Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.5% between 2026 and 2033. The market is estimated at USD 220 Billion in 2026 and is projected to reach USD 450 Billion by the end of the forecast period in 2033.

Health Insurance Third Party Administrator Market introduction

The Health Insurance Third Party Administrator (TPA) Market encompasses specialized entities that manage administrative services—such as claims processing, enrollment, premium collection, and utilization review—on behalf of insurance companies or self-insured employers. TPAs act as vital intermediaries, streamlining complex administrative workflows that primary insurance providers often seek to outsource to reduce operational costs and enhance service efficiency. The primary driver for adopting TPA services is the increasing complexity of healthcare regulations, coupled with the desire of employers to shift toward self-funded health plans, requiring robust infrastructure for claims adjudication and risk management, which TPAs are uniquely positioned to provide.

TPA services are categorized broadly into core claim management, network management, and supplementary services like wellness programs and disease management. Major applications span across employer-sponsored group health plans, government schemes (where applicable), and individual insurance policies. The product description of TPA offerings centers on proprietary software platforms and skilled human capital capable of handling high volumes of transactions while maintaining compliance with local healthcare and privacy laws, such as HIPAA in the United States or equivalent data protection standards globally. These services are crucial for ensuring timely and accurate payouts, minimizing fraudulent claims, and optimizing healthcare provider networks, thereby improving the overall financial health of the insurance scheme.

The benefits derived from leveraging TPAs include significant cost reduction for insurers and self-funded organizations, access to specialized expertise in claims scrubbing and fraud detection, and the ability for the insurer to focus resources on core underwriting and product development. Driving factors sustaining market momentum include the continuous rise in healthcare expenditure worldwide, the corresponding push for efficiency gains in insurance administration, and the shift towards value-based care models, which necessitate intricate data management and coordination capabilities that TPAs increasingly offer. Furthermore, technological integration, particularly through digitalization and cloud-based platforms, is enabling TPAs to deliver superior service quality and scalability, further cementing their indispensable role in the modern health insurance ecosystem.

Health Insurance Third Party Administrator Market Executive Summary

The Health Insurance Third Party Administrator market is characterized by robust growth driven fundamentally by the expansion of self-funded employee benefit programs, especially in North America, and the accelerating trend of digital transformation across the insurance value chain. Business trends indicate a strong move toward specialization, where TPAs are either focusing on specific disease states (e.g., chronic illness management) or particular administrative functions (e.g., complex claims appeal processing). Mergers and acquisitions remain a crucial strategy for leading players to consolidate market share, acquire advanced technological capabilities, and expand geographical footprints into emerging markets in Asia Pacific and Latin America. Strategic partnerships between TPAs and cutting-edge health tech firms are redefining service delivery, placing data analytics and AI at the forefront of operational efficiency.

Regional trends reveal North America maintaining market dominance, attributed to high healthcare expenditure, the complexity of the regulatory environment, and the prevalence of self-insured corporate models requiring sophisticated administrative oversight. However, the Asia Pacific region is demonstrating the highest growth trajectory, primarily fueled by increasing health insurance penetration, supportive governmental policies promoting universal health coverage, and the rapid outsourcing of non-core functions by local insurance providers seeking international best practices. European markets exhibit maturity, with growth focused on specialized ancillary services and leveraging pan-European regulations to standardize administrative procedures across multiple countries.

Segment trends underscore the prominence of the Claims Processing segment, which accounts for the largest share due to its direct linkage to core insurance functions and the necessity of highly accurate and fast adjudication. Furthermore, the Managed Care Services segment is projected to show accelerated growth, reflecting the broader industry shift towards preventative and coordinated care models designed to control costs before they escalate. By End-User, self-insured employers remain the largest clientele, valuing the customization and transparency TPAs offer over fully insured plans. Technological integration, particularly platforms offering real-time data access and personalized customer interfaces, is becoming a key differentiator across all operational segments, compelling TPAs to continually invest in their digital infrastructure to maintain competitive edge.

AI Impact Analysis on Health Insurance Third Party Administrator Market

User queries regarding the impact of Artificial Intelligence (AI) on the TPA market frequently revolve around themes of job displacement, potential for regulatory compliance automation, and the efficacy of AI in detecting sophisticated claim fraud. Key expectations center on AI’s ability to drastically reduce manual processing time in claims adjudication, thereby lowering administrative costs and accelerating payment cycles. Users are also keen to understand how machine learning can transform utilization review—moving from retrospective analysis to predictive modeling—to proactively manage healthcare resource allocation and ensure appropriateness of care. Concerns primarily address data privacy within AI systems, the inherent bias in training data potentially leading to inequitable claim outcomes, and the need for rigorous auditing frameworks to ensure AI-driven decisions meet established legal and ethical standards for insurance benefits administration.

- Automated Claims Adjudication: AI accelerates initial claim processing, reducing turnaround time from days to minutes, utilizing Natural Language Processing (NLP) to interpret clinical notes and match them against policy terms.

- Fraud Detection and Prevention: Machine learning algorithms analyze vast datasets for anomalous billing patterns and provider behavior, identifying potentially fraudulent activities with higher accuracy than traditional rule-based systems.

- Predictive Utilization Review: AI forecasts potential high-cost medical events and recommends early intervention or appropriate care settings, shifting TPA focus from cost reaction to cost prevention.

- Enhanced Customer Service: Integration of AI-powered chatbots and virtual assistants handles routine inquiries regarding coverage and claim status, improving member satisfaction and reducing call center load.

- Compliance and Auditing Automation: AI monitors changes in regional and federal healthcare regulations, automatically updating claims processing rules to ensure continuous compliance and reduce legal exposure.

DRO & Impact Forces Of Health Insurance Third Party Administrator Market

The TPA market operates under a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively forming significant Impact Forces that dictate strategic direction and competitive intensity. Primary drivers include the global expansion of corporate self-insured programs, regulatory mandates emphasizing transparency and standardized claim reporting, and the necessity for insurance companies to achieve economies of scale through outsourcing. Restraints primarily involve stringent data privacy regulations (e.g., GDPR, HIPAA), which increase compliance complexity and operating costs for TPAs, alongside the inherent resistance from established insurers to fully relinquish administrative control over sensitive functions. Opportunities are largely concentrated around digital innovation—specifically, leveraging cloud infrastructure, blockchain for secure data exchange, and advanced analytics for personalized health benefit design—allowing TPAs to offer highly customized and technology-enabled service packages.

One major driving force is the escalating administrative burden associated with managing modern healthcare plans. As medical treatments become more specialized and benefit structures grow more convoluted (involving high deductibles, health savings accounts, and complex co-insurance tiers), the required administrative expertise surpasses the capacity of many primary insurers or self-funded entities. TPAs, by specializing solely in administration, offer scalable, expert solutions that absorb this complexity, translating directly into operational savings for their clients. This specialization also extends to provider network management, where TPAs use sophisticated analytical tools to negotiate favorable rates and build efficient networks, a crucial cost-control mechanism for plan sponsors.

Conversely, a critical restraint is the need for massive capital expenditure in technology infrastructure to stay compliant and competitive. TPAs must continuously update their legacy systems to integrate new technologies like AI and secure data exchange protocols. Furthermore, the perception of TPAs as solely cost-cutters, rather than strategic partners, can limit their revenue potential for offering higher-value services such as integrated wellness programs or sophisticated risk modeling. The intensity of competition, characterized by frequent pricing pressures and the need for global certification standards, further acts as a constraining force on smaller, regional TPA firms. The impact forces compel market participants towards consolidation and technological differentiation to secure long-term viability and justify premium service offerings.

- Drivers:

- Growing adoption of self-funded health insurance plans by corporate employers.

- Increasing complexity of global healthcare regulations necessitating specialized compliance expertise.

- Demand for operational efficiency and cost reduction among insurance carriers.

- Technological advancements facilitating digitalization of claims processing and member services.

- Restraints:

- High capital investment required for regulatory compliance and advanced cybersecurity measures.

- Data privacy concerns and stringent requirements (e.g., HIPAA, GDPR) restricting international data flow.

- Difficulty in integrating disparate legacy systems across different client organizations.

- Competitive pricing pressure driven by market consolidation.

- Opportunities:

- Expansion into niche markets such as dental, vision, and mental health administration.

- Integration of AI and machine learning for predictive analytics in utilization management.

- Development of blockchain technology for enhanced security and transparency in claims data exchange.

- Growth in developing economies with increasing penetration of health insurance products.

- Impact Forces:

- The accelerating rate of digital adoption fundamentally restructures TPA cost models.

- Regulatory scrutiny heightens the barrier to entry, favoring large, compliant entities.

- The shift toward value-based care mandates deeper integration of data analytics into TPA service offerings.

Segmentation Analysis

The Health Insurance Third Party Administrator market is comprehensively segmented across several key dimensions, including Service Type, End User, and Geographic Region, providing a detailed lens into market dynamics and growth pockets. The segmentation highlights the diverse needs of clients, ranging from basic claim processing to complex, integrated care management programs. Service Type segmentation, encompassing administrative services, network management, and supplementary services, reveals where technological investment is most critical. Furthermore, the End User categorization differentiates between self-insured employers, fully insured entities, and governmental health schemes, each requiring distinct regulatory compliance frameworks and service customization levels. This granular approach is vital for TPAs developing targeted offerings and for investors assessing areas of highest potential return, underscoring the market's shift towards bespoke, client-centric administrative solutions.

- By Service Type:

- Claims Processing

- Enrollment and Member Management

- Premium and Commission Management

- Managed Care Services (Utilization Review, Case Management)

- Value-Added Services (Wellness Programs, Disease Management)

- By End User:

- Self-Insured Employers

- Insurance Companies (Fully Insured Plans)

- Government Health Programs

- By Region:

- North America (U.S., Canada)

- Europe (Germany, U.K., France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, Japan, India, South Korea, Rest of Asia Pacific)

- Latin America (Brazil, Mexico, Rest of Latin America)

- Middle East and Africa (GCC Countries, South Africa, Rest of MEA)

Value Chain Analysis For Health Insurance Third Party Administrator Market

The TPA value chain is characterized by a high degree of service integration, beginning with upstream activities focused on securing core technologies and regulatory compliance expertise, extending through core administrative operations, and culminating in downstream interactions with healthcare providers and plan members. Upstream analysis focuses on the procurement of advanced IT infrastructure, secure cloud hosting, and licensing of sophisticated analytics and workflow automation software necessary for high-volume processing. Key strategic decisions at this stage involve partnerships with specialized software vendors and substantial investment in cybersecurity protocols to manage the risk associated with handling protected health information (PHI). Maintaining a roster of skilled actuaries, legal experts, and certified claims professionals is also a foundational upstream necessity.

The core TPA operations form the midstream of the value chain, encompassing essential functions such as policy enrollment, accurate premium reconciliation, and, most critically, claims adjudication. Efficiency in this stage determines profitability and client retention. Downstream analysis focuses on the critical interface points: the relationship with the distribution channel, which often involves insurance brokers and consultants who advise clients on selecting TPA services, and direct interaction with the ultimate beneficiaries—the plan members and the healthcare providers. TPAs must ensure seamless communication and rapid response times with providers regarding claim status and payment, while maintaining intuitive digital portals for member access to benefits information and ID cards.

Distribution channels are categorized into direct and indirect methods. Direct distribution involves TPAs contracting immediately with large self-insured corporations or government entities, leveraging their scale and customized service offerings. Indirect distribution predominantly involves partnerships with established insurance brokers, benefits consultants, and carriers (who outsource specific functions). The trend toward digitalization means the operational delivery of TPA services is now heavily influenced by technology platforms, essentially making the secure digital portal and mobile application a critical, continuous distribution touchpoint. The strategic goal across the entire value chain is to continuously optimize processes, minimizing leakage through fraud or administrative errors, thereby maximizing the value delivered to the plan sponsor and ensuring compliance throughout the entire claim lifecycle.

Health Insurance Third Party Administrator Market Potential Customers

The primary end-users and buyers of Health Insurance TPA services are highly diversified, but predominantly center on entities that seek to mitigate administrative overhead and regulatory risk associated with managing large-scale health benefit plans. The most significant customer segment comprises self-insured corporate employers across various industries—ranging from technology and manufacturing to finance and professional services. These employers utilize TPAs to gain control over their healthcare spending, achieve greater customization of benefits, and access specialized data analytics to understand their employee health trends without having to build internal expertise in complex insurance administration.

Another crucial customer segment involves traditional insurance carriers and managed care organizations (MCOs). While these entities are primary insurers, they frequently outsource specialized functions—such as catastrophic claims management, specific regulatory reporting requirements, or administration for ancillary products (dental, vision)—to TPAs, allowing them to focus resources on underwriting and risk aggregation. This outsourcing trend is especially prominent when carriers enter new geographical markets or launch experimental product lines where they lack established administrative infrastructure.

Furthermore, governmental health schemes, including state and federal programs (e.g., Medicare/Medicaid programs in the US or similar national health service administration globally), represent a growing and highly regulated segment. These government entities require TPAs with robust security clearance, strict compliance track records, and the capacity to handle vast populations efficiently. The growing demand for standardized, efficient claim processing and the implementation of massive public health insurance programs in emerging economies solidify these governmental programs as significant future buyers of sophisticated TPA administrative services and technological platforms.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 220 Billion |

| Market Forecast in 2033 | USD 450 Billion |

| Growth Rate | 10.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Cigna, UnitedHealth Group (Optum), Aetna (CVS Health), Anthem (Elevance Health), HealthEdge, Medtronic, Wipro, TATA Consultancy Services (TCS), Genpact, HealthSmart, Meritain Health, Sedgwick, CorVel, Paramount Healthcare, HMA, Inc., Zenith American Solutions, CoreSource, Allied National, PayFlex, Maestro Health |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Health Insurance Third Party Administrator Market Key Technology Landscape

The technological landscape supporting the Health Insurance TPA market is undergoing rapid evolution, moving away from fragmented, on-premise legacy systems toward integrated, cloud-native platforms. The crucial technology focus today centers on achieving straight-through processing (STP), where claims are processed end-to-end without human intervention, significantly reducing processing costs and enhancing accuracy. This is underpinned by Robotic Process Automation (RPA) for routine data entry and workflow management, and sophisticated integration middleware to ensure seamless communication between TPA systems, provider EHRs (Electronic Health Records), and client policy databases. Cloud computing providers offer the necessary scalability and security infrastructure to handle explosive growth in data volumes associated with comprehensive health plans and regulatory reporting requirements.

Advanced data analytics and Artificial Intelligence (AI) form the strategic core of modern TPA technology. Machine learning models are deployed not only for high-precision fraud detection but also for predictive modeling in utilization management, determining the necessity and appropriateness of high-cost treatments before they occur, thus controlling plan expenditures proactively. Furthermore, the integration of telehealth services and wearable technology data into TPA systems allows for real-time monitoring and personalized health interventions. These technologies enable TPAs to transition from being reactive claims processors to proactive health management partners, providing valuable insights back to the employers and insurers regarding population health risks and benefit utilization efficiency.

Blockchain technology is emerging as a disruptive force, particularly in securing the integrity and privacy of shared claims data across multiple stakeholders—providers, members, and payors. While still in nascent stages of deployment, blockchain offers potential solutions for immutable record-keeping and streamlined credentialing processes, drastically reducing reconciliation complexities. Additionally, the increasing demand for high-quality member experience is driving investments in digital portals and mobile applications, utilizing API-driven architectures to deliver transparent, personalized access to benefit information, deductible tracking, and real-time claim status updates. TPAs that successfully master the deployment of these integrated, secure, and user-friendly digital tools will secure a substantial competitive advantage in attracting and retaining large self-insured clients in the coming decade.

- Key Technologies:

- Cloud Computing (AWS, Azure, Google Cloud) for scalability and data storage.

- Artificial Intelligence (AI) and Machine Learning (ML) for fraud detection and predictive utilization review.

- Robotic Process Automation (RPA) for automating data capture and repetitive administrative tasks.

- Blockchain for secure, distributed ledger technology enhancing data integrity and interoperability.

- Application Programming Interfaces (APIs) enabling seamless integration with EHR systems and third-party wellness platforms.

- Advanced Data Analytics and Business Intelligence (BI) tools for population health risk stratification.

- Cybersecurity frameworks (e.g., zero-trust architecture) to protect Protected Health Information (PHI).

Regional Highlights

- North America: Market Dominance and Regulatory Complexity

North America, particularly the United States, represents the largest and most mature market for Health Insurance TPAs, accounting for a substantial percentage of global revenue. This dominance is intrinsically linked to the high prevalence of employer-sponsored health coverage and the widespread adoption of self-insured models, which necessitate sophisticated third-party administration for claims processing and regulatory adherence (HIPAA, ERISA). The market here is characterized by highly sophisticated technological integration, aggressive M&A activity among major players, and intense focus on compliance automation. The demand is heavily skewed toward integrated services that combine claims adjudication with utilization management and pharmacy benefits administration (PBA), seeking a holistic approach to cost control. Market growth is sustained by the continuous drive to manage escalating healthcare costs through data-driven efficiency and fraud reduction measures.

- High penetration of self-funded employee benefit programs.

- Strict regulatory landscape (HIPAA, ACA) requiring specialized TPA expertise.

- Rapid adoption of AI and ML for claim accuracy and fraud detection.

- Europe: Maturity and Focus on Harmonization

The European TPA market is mature but highly segmented, primarily driven by the private health insurance sector and certain corporate benefits schemes, as public healthcare systems typically manage their own administration. Growth in this region is spurred by cross-border insurance policies and the need for standardized administrative procedures compliant with GDPR and varied national health regulations. The market is witnessing increased demand for TPAs specializing in international health plans and expatriate benefits administration. European TPAs often prioritize seamless integration across complex pan-European provider networks, emphasizing data security and localized compliance expertise as key value propositions. The U.K. and Germany are central hubs, with emerging opportunities in Eastern European countries as private insurance markets develop.

- Focus on specialized private health and international expatriate insurance administration.

- Strong emphasis on GDPR compliance and data sovereignty requirements.

- Growth driven by corporate outsourcing of ancillary health benefits.

- Asia Pacific (APAC): Highest Growth Trajectory and Digital Leapfrogging

The APAC region is projected to register the fastest growth rate globally, propelled by rapidly increasing health insurance penetration, supportive government initiatives promoting universal health coverage, and the expanding middle class’s capacity to afford private health plans. Countries like India, China, and Southeast Asian nations are undergoing massive infrastructural development in their healthcare ecosystems. Crucially, APAC markets often bypass traditional TPA infrastructure, directly adopting modern digital and mobile-first platforms (digital leapfrogging). The demand here is for scalable, low-cost administrative solutions that can handle massive volumes of new insured individuals efficiently. TPAs are essential in these regions for developing and managing provider networks where standardized healthcare infrastructure is still evolving.

- Fastest market growth driven by high insurance penetration and urbanization.

- Strong governmental support for health insurance schemes requiring outsourced administration.

- Preference for mobile-first and cloud-based TPA solutions.

- Latin America (LATAM): Emerging Opportunities in Privatization

The LATAM market is characterized by structural reforms aimed at increasing the role of private insurance and managed care. Countries such as Brazil and Mexico are seeing growth as employers and individuals seek supplementary private coverage alongside public systems. TPAs are increasingly utilized by local insurance companies to inject global best practices in claims management and utilization review, mitigating rising medical inflation. Challenges include economic volatility and fragmented regulatory environments, requiring TPAs to demonstrate significant adaptability and localized expertise in billing and provider contracting.

- Driven by privatization trends in healthcare and rising medical costs.

- Need for specialized expertise in managing local regulatory compliance and currency fluctuations.

- Middle East and Africa (MEA): Mandatory Insurance and High-Net-Worth Segments

Growth in the MEA region, particularly in the GCC countries (UAE, Saudi Arabia), is fueled by mandatory health insurance requirements for expatriate and resident populations. These mandates create a huge administrative volume that local insurers are outsourcing to TPAs. The region demands high-quality, international-standard services for high-net-worth clientele alongside scalable solutions for mass-market compulsory insurance plans. Africa presents varied opportunities, largely focused on corporate and institutional insurance administration, requiring solutions capable of operating in areas with limited digital connectivity.

- Strong growth due to mandatory health insurance policies in Gulf Cooperation Council (GCC) states.

- Demand for robust, secure systems for managing high-value international claims.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Health Insurance Third Party Administrator Market.- UnitedHealth Group (Optum)

- Cigna Corporation

- Aetna (CVS Health)

- Anthem (Elevance Health)

- HealthSmart

- Meritain Health (Aetna Subsidiary)

- Sedgwick

- CorVel Corporation

- Wipro Limited

- TATA Consultancy Services (TCS)

- Genpact

- HealthEdge

- CoreSource (Trustmark Subsidiary)

- Medtronic

- PayFlex (Aetna Subsidiary)

- Zenith American Solutions

- Maestro Health

- HMA, Inc.

- Allied National

- Paramount Healthcare

Frequently Asked Questions

Analyze common user questions about the Health Insurance Third Party Administrator market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a Third Party Administrator (TPA) in health insurance?

A TPA’s primary function is to manage the administrative tasks of a health insurance plan, most commonly claims processing, enrollment, and utilization review, on behalf of self-insured employers or insurance carriers. They provide the necessary infrastructure and expertise to handle complex financial and legal compliance requirements, allowing the plan sponsor to focus on core business operations.

How does the adoption of AI impact the cost efficiency for TPAs and clients?

AI significantly enhances cost efficiency by automating labor-intensive tasks like claims adjudication (Straight-Through Processing) and improving the accuracy of fraud detection. This automation reduces operating costs for the TPA and minimizes financial leakage for the client (the plan sponsor), leading to faster claim settlements and ultimately lower administrative fees for the health plan.

Which geographical region exhibits the fastest growth potential in the TPA market?

The Asia Pacific (APAC) region is projected to show the fastest growth potential. This is driven by low current insurance penetration, substantial public investment in healthcare infrastructure, rapid digitalization, and increasing corporate demand for outsourcing administrative complexity in emerging economies like India and Southeast Asia.

What are the main regulatory challenges faced by international TPAs?

International TPAs must navigate fragmented global data privacy and security regulations, such as HIPAA, GDPR, and country-specific PHI protection laws. Ensuring cross-border data transfer compliance and adapting core IT systems to adhere to varied local reporting and claims submission standards constitutes the most significant regulatory challenge and operational overhead.

Why are self-insured employers the largest segment of TPA clientele?

Self-insured employers seek TPAs to gain greater control over healthcare plan design, improve cost transparency, and customize benefits according to their workforce needs. TPAs provide the crucial administrative infrastructure, data analytics, and expertise required to manage the financial risks and claims operations of a self-funded plan without the employer needing internal insurance administrative departments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager