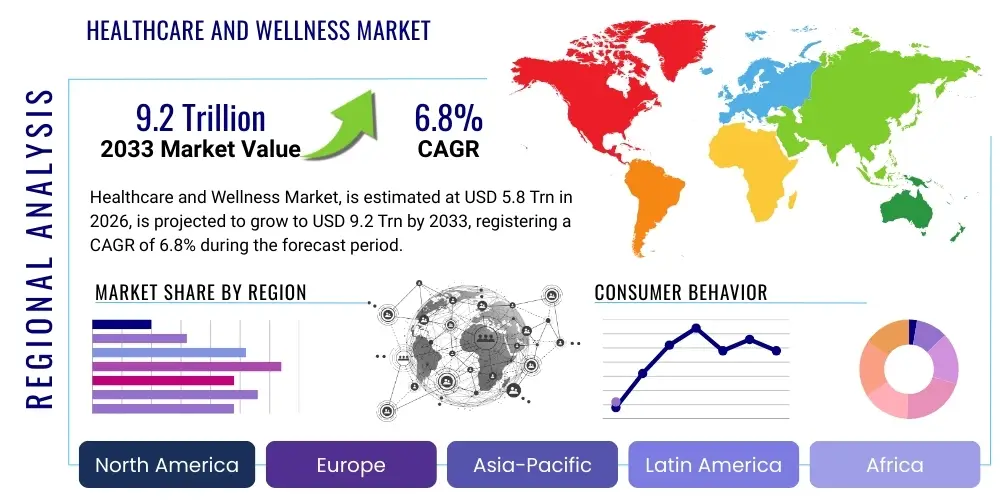

Healthcare and Wellness Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439180 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Healthcare and Wellness Market Size

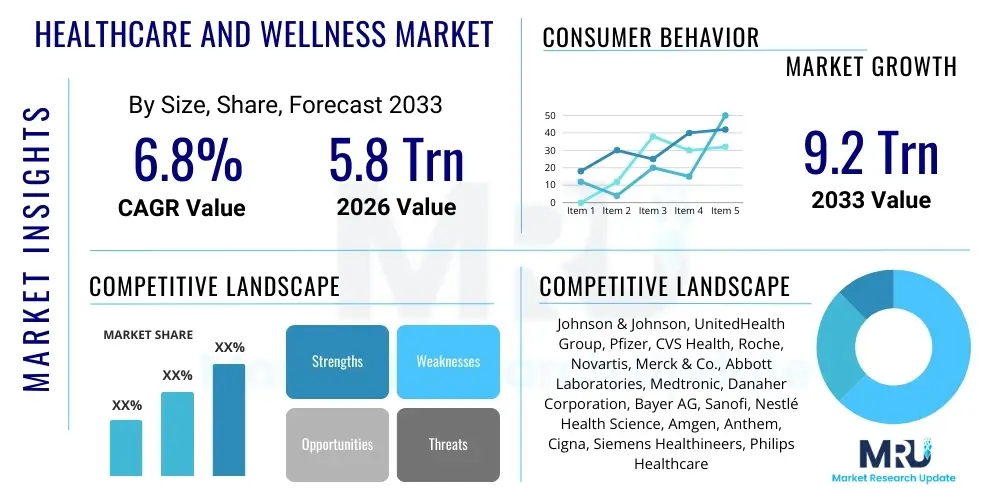

The Healthcare and Wellness Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 5.8 Trillion in 2026 and is projected to reach USD 9.2 Trillion by the end of the forecast period in 2033.

Healthcare and Wellness Market introduction

The Healthcare and Wellness Market encompasses a vast array of goods and services dedicated to maintaining and improving physical and mental health. This includes conventional medical services (hospitals, pharmaceuticals, medical devices) and the rapidly expanding wellness sector, which focuses on preventive care, nutrition, fitness, and alternative therapies. The core objective of this market is shifting from purely treating disease to promoting proactive well-being and longevity, driven by increasing consumer awareness and disposable incomes globally.

The product description within this market is multifaceted, covering everything from sophisticated diagnostic imaging equipment and patented therapeutic drugs to wearable fitness trackers and specialized dietary supplements. Major applications span acute care management, chronic disease prevention and management, mental health services, geriatric care, and personalized nutrition planning. The integration of digital technologies, such as telehealth platforms and remote monitoring systems, has further broadened the scope and accessibility of these applications, redefining the traditional patient-provider interaction model and enabling more continuous, data-driven health management.

Key benefits driving market adoption include enhanced quality of life, increased lifespan, reduction in long-term healthcare expenditure through prevention, and improved workplace productivity. The driving factors are intrinsically linked to demographic shifts, particularly the aging population in developed economies, coupled with a rising incidence of lifestyle-related chronic conditions like diabetes and cardiovascular diseases. Furthermore, technological innovation, regulatory support for digital health initiatives, and a consumer-led demand for personalized and transparent healthcare options are sustaining robust market expansion across all geographical regions.

Healthcare and Wellness Market Executive Summary

The Healthcare and Wellness Market is experiencing transformative business trends characterized by intense digital convergence and value-based care models. Key business trends involve vertical integration among providers, payers, and pharmacy benefit managers (PBMs) aimed at controlling costs and streamlining patient journeys. Investment is heavily concentrated in precision medicine, gene therapies, and digital therapeutics, indicating a strategic shift towards highly specialized and personalized interventions. Furthermore, sustainability and environmental, social, and governance (ESG) factors are increasingly influencing purchasing decisions among major healthcare institutions, driving demand for eco-friendly medical supplies and ethical supply chains.

Regionally, North America maintains market leadership due to substantial R&D expenditure, advanced regulatory frameworks facilitating rapid technology adoption, and high per capita healthcare spending. However, the Asia Pacific (APAC) region is demonstrating the highest growth trajectory, fueled by expanding middle-class populations, government investments in healthcare infrastructure, and rising adoption of telehealth, particularly in populous emerging economies like India and China. Europe continues to prioritize universal access, focusing on optimizing primary care networks and integrating sophisticated e-health records to manage aging demographic pressures efficiently.

Segmentation trends highlight the rapid expansion of the Digital Health and Wellness & Prevention segments. Digital therapeutics, which use software to treat medical conditions, are moving from niche applications to mainstream clinical pathways. Within the pharmaceutical sector, specialized biotechnology products are outpacing traditional small-molecule drugs in growth. The Services segment is dominated by the migration of care from costly inpatient settings to more affordable and convenient outpatient and home healthcare environments, underpinned by sophisticated remote patient monitoring (RPM) technologies, reflecting a fundamental reorganization of healthcare delivery around patient convenience and long-term wellness outcomes.

AI Impact Analysis on Healthcare and Wellness Market

Common user questions regarding AI's impact on the Healthcare and Wellness Market typically revolve around themes of job displacement, data security, accuracy in diagnostics, and the accessibility of personalized medicine. Users frequently inquire: "How accurately can AI diagnose rare diseases?" "Will AI replace human doctors, particularly radiologists?" "What are the regulatory hurdles for AI-driven drugs?" and "How is patient data protected when using AI algorithms?" These queries reflect a dual concern: excitement over efficiency gains and transformative medical breakthroughs balanced against ethical dilemmas concerning transparency, accountability, and the potential erosion of the human element in care delivery.

The analysis confirms that AI is not primarily seen as a replacement for human professionals but as an essential augmentation tool that enhances diagnostic precision and accelerates drug discovery timelines. The immediate impact is observable in automating administrative tasks, which alleviates burnout among clinical staff, and in sophisticated pattern recognition for early disease detection, improving patient outcomes significantly. Addressing the concerns about bias and transparency, leading market players are focusing heavily on developing explainable AI (XAI) models, ensuring that clinical decisions derived from algorithms can be understood and validated by human experts, thereby building trust in the deployment of these powerful tools across sensitive clinical environments.

In the wellness sector, AI is crucial for highly individualized health plans. Wearable devices leverage machine learning to analyze biometric data continuously, offering real-time feedback on sleep patterns, stress levels, and exercise performance. This shift moves personalized wellness from generic recommendations to hyper-specific, predictive interventions. The long-term expectation is that AI will drastically lower R&D costs, democratize specialist knowledge through accessible digital platforms, and enable true preventive care by identifying risk factors years before symptomatic onset, fundamentally restructuring the business and scientific frameworks of the entire healthcare ecosystem toward predictive maintenance.

- AI accelerates drug discovery and repurposing by rapidly analyzing large genomic and proteomic datasets.

- Enhances diagnostic accuracy and speed in radiology, pathology, and ophthalmology through image recognition algorithms.

- Optimizes hospital operations, including scheduling, resource allocation, and prediction of patient flow (e.g., length of stay).

- Facilitates personalized medicine by predicting patient response to specific treatments based on genetic and clinical profiles.

- Powers advanced remote patient monitoring (RPM) systems, identifying subtle changes in patient health status proactively.

- Drives the development of sophisticated digital therapeutics and mental health chatbots for accessible support.

- Automates claims processing, medical coding, and administrative tasks, improving financial efficiency for providers and payers.

DRO & Impact Forces Of Healthcare and Wellness Market

The Healthcare and Wellness Market is propelled by powerful technological drivers and demographic shifts, while simultaneously facing significant fiscal and regulatory restraints. Key drivers include the accelerated rate of digitization across care pathways, the imperative to manage the rising global burden of chronic diseases, and increased consumer empowerment demanding transparency and personalized services. Opportunities arise specifically from the unmet medical needs in emerging markets, the commercial viability of gene editing and cell therapies, and the expansion of preventative health insurance policies. However, the market faces strong headwinds from escalating healthcare costs, stringent regulatory approval processes for novel therapies, and pervasive challenges related to data privacy and cybersecurity breaches, which collectively influence market direction and investment decisions.

Drivers: The dominant market driver remains the shifting global demographic profile, specifically the rapid increase in the population segment over 65 years, which requires more intensive and long-term care solutions. Furthermore, advances in molecular biology and genomics are fueling the precision medicine revolution, allowing for targeted therapies that enhance efficacy and reduce side effects, thereby creating new premium market niches. Government initiatives aimed at promoting preventative care and addressing health equity, coupled with substantial private sector venture capital investment into disruptive health tech startups, provide continuous impetus for innovation and market penetration, especially in underserved segments.

Restraints: The primary restraint is the systemic financial pressure exerted by rising healthcare costs, making access unaffordable for large global populations and creating resistance from payers (governments and insurers) to adopt expensive new treatments. Regulatory complexity acts as a significant bottleneck, particularly in multi-jurisdictional clinical trials and the approval of novel digital medical devices, slowing time-to-market. Moreover, the shortage of specialized clinical workforce trained to utilize sophisticated technologies (like AI in radiology or advanced genomic sequencing) limits the full-scale implementation of next-generation solutions, particularly in rural or remote areas, hindering overall scalability.

Opportunities: Major opportunities reside in leveraging decentralized clinical trials, which utilize technology to recruit and monitor patients remotely, dramatically reducing trial costs and timelines. The burgeoning market for mental health services, often underserved and stigmatized, presents vast potential for digital intervention and specialized service expansion. Furthermore, the push towards integrating wellness and medical care, often termed "MedTail" (Medical-Retail), where healthcare services are offered in accessible retail settings, unlocks new distribution channels and consumer touchpoints, enhancing market reach and convenience.

Impact Forces: The core impact forces shaping the competitive landscape include political pressure for price transparency (leading to margin compression for manufacturers), consolidation through mergers and acquisitions (creating larger, more integrated health systems), and continuous technological disruption (forcing traditional providers to quickly adopt digital operating models). These forces collectively accelerate market evolution, rewarding companies that can demonstrate verifiable clinical and economic value while maintaining ethical data handling practices.

Segmentation Analysis

The Healthcare and Wellness Market is broadly segmented based on the type of product or service offered, the specific application area, and the end-user demographic. This multi-dimensional segmentation allows for granular analysis, highlighting that the market structure is complex, ranging from high-capital expenditure medical devices to low-cost, high-volume consumer wellness products. Key segments such as Pharmaceuticals and Healthcare Services traditionally command the largest revenue share, while disruptive segments like Digital Health and Personalized Nutrition are registering the most aggressive growth rates, driven by shifts toward preventive and consumer-centric health management models.

- By Sector: Pharmaceuticals, Medical Devices, Wellness & Prevention, Healthcare Services, Nutrition & Supplements, Digital Health.

- By Service: Inpatient Services, Outpatient Services, Telehealth Services, Home Healthcare Services, Emergency Medical Services.

- By Application: Chronic Disease Management, Infectious Disease Treatment, Preventive Care, Women’s Health, Pediatrics, Geriatric Care, Mental Health.

- By End User: Hospitals and Clinics, Wellness Centers and Spas, Pharmacies and Drug Stores, Homecare Settings, Research and Academic Institutions, Corporate Wellness Programs.

Value Chain Analysis For Healthcare and Wellness Market

The value chain for the Healthcare and Wellness Market is intricate, spanning research and development (R&D), manufacturing and supply, distribution, and final delivery of care. Upstream activities are dominated by intense R&D efforts, primarily driven by pharmaceutical and biotechnology companies focused on discovering novel therapeutics and by medical device firms innovating specialized equipment. This phase requires substantial capital investment and navigates complex intellectual property landscapes, forming the foundation of product value. Effective R&D processes, often incorporating AI and advanced analytics, are critical to ensuring a sustainable product pipeline that aligns with major disease burdens globally.

The midstream phase involves manufacturing, quality control, and sophisticated logistics management. Manufacturing needs to comply with stringent regulatory standards (e.g., FDA, EMA) which dictates high operating costs. Distribution channels are highly varied: pharmaceuticals typically utilize specialized third-party logistics (3PL) providers for cold chain management, while wellness products leverage both direct-to-consumer (DTC) models and mass retail channels. Direct distribution (e.g., hospital purchases of capital equipment) focuses on technical sales and long-term service contracts, whereas indirect distribution (pharmacies, online retailers) emphasizes volume and supply chain efficiency, requiring distinct strategic approaches.

Downstream activities center on service delivery and patient engagement. This includes hospitals, clinics, and increasingly, digitally enabled telehealth platforms and home healthcare providers. The transition toward value-based care mandates that stakeholders focus on patient outcomes rather than service volume, profoundly affecting reimbursement models. The final component involves payer organizations (insurers and government entities) who determine access and remuneration. Efficiency in the entire chain is maximized by integrating data systems across all stages, from product development to patient adherence monitoring, ensuring seamless flow of information and minimizing operational friction.

Healthcare and Wellness Market Potential Customers

Potential customers, or end-users/buyers, in the Healthcare and Wellness Market are diverse, ranging from large institutional purchasers and government bodies to individual consumers. Institutional customers, such as integrated delivery networks (IDNs), large private hospital chains, and government-run health systems (e.g., NHS in the UK), represent high-volume buyers for pharmaceuticals, capital medical equipment, and large-scale software solutions. Their purchasing decisions are driven primarily by factors such as demonstrable clinical efficacy, long-term total cost of ownership, and contractual service level agreements, focusing heavily on outcomes and population health management mandates.

Payer organizations, including private health insurance companies, managed care organizations, and public sector schemes like Medicare and Medicaid, are crucial buyers of services and gatekeepers of access. They procure health services on behalf of their covered populations, negotiating drug prices, setting reimbursement rates for procedures, and increasingly investing in preventative wellness programs to mitigate high-cost acute events. Their procurement strategy is centered on risk management, cost containment, and achieving quality metrics defined by governmental or accreditation bodies.

The third major customer group is the individual consumer (patient). With the rise of high-deductible health plans and the expansion of the out-of-pocket wellness segment, consumers are making direct purchasing decisions regarding supplements, fitness memberships, digital health apps, and elective medical procedures. This segment demands convenience, transparency in pricing, personalized experiences, and products that offer tangible improvements in lifestyle and immediate well-being. Marketing to this segment requires significant emphasis on brand trust, social proof, and seamless omnichannel engagement strategies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.8 Trillion |

| Market Forecast in 2033 | USD 9.2 Trillion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Johnson & Johnson, UnitedHealth Group, Pfizer, CVS Health, Roche, Novartis, Merck & Co., Abbott Laboratories, Medtronic, Danaher Corporation, Bayer AG, Sanofi, Nestlé Health Science, Amgen, Anthem, Cigna, Siemens Healthineers, Philips Healthcare, Teva Pharmaceutical Industries, Takeda Pharmaceutical. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Healthcare and Wellness Market Key Technology Landscape

The technological foundation of the Healthcare and Wellness Market is undergoing rapid evolution, shifting toward connectivity, precision, and decentralization. A core technological pillar is the advancement in genomic sequencing and bioinformatics, enabling precision oncology and rare disease treatment through gene editing technologies like CRISPR. Furthermore, the convergence of Artificial Intelligence (AI) and Machine Learning (ML) is transforming research efficiency, diagnostic accuracy, and patient management, moving the industry toward predictive rather than reactive care models. The integration of high-resolution medical imaging systems with cloud computing facilitates instantaneous sharing of complex diagnostic data across geographically dispersed clinical teams, optimizing collaboration and speeding up critical decisions.

Another crucial element of the technological landscape is the proliferation of digital health solutions, prominently featuring Telemedicine platforms and Remote Patient Monitoring (RPM) tools. These technologies leverage IoT (Internet of Things) sensors, wearables, and mobile connectivity to gather continuous, real-world data on patient health metrics outside traditional clinical settings. This decentralization of monitoring is vital for managing chronic conditions, reducing hospital readmissions, and providing care accessibility to remote populations. Cybersecurity technologies, including advanced encryption and blockchain solutions, are simultaneously becoming mandatory investments to protect the highly sensitive and regulated health data generated by these connected devices.

The pharmaceutical sector is heavily reliant on continuous manufacturing techniques and advanced robotics to improve drug quality and supply chain resilience. Simultaneously, the medical device segment is seeing breakthroughs in miniaturization, battery technology, and robotics, enabling minimally invasive surgical procedures and highly sophisticated implantable devices. Overall, the market's technological trajectory is defined by interconnected ecosystems—from electronic health records (EHRs) serving as centralized data hubs to patient-facing applications—all aimed at optimizing the workflow for clinicians and enhancing the agency and experience for the consumer.

Regional Highlights

Geographical market performance reveals significant variations driven by economic maturity, regulatory environments, and prevailing health burdens. North America, encompassing the US and Canada, currently dominates the Healthcare and Wellness Market in terms of revenue share. This leadership position is underpinned by massive corporate and government spending on advanced pharmaceuticals, complex medical devices, and digital health infrastructure. The region benefits from a highly competitive, innovation-driven ecosystem, robust intellectual property protection, and high consumer acceptance of expensive, specialized treatments and preventative technologies, particularly within the US market where private insurance schemes fuel high expenditure per capita.

Europe represents a mature and stable market characterized by universal healthcare systems that emphasize cost-effectiveness and accessibility. Western European countries, notably Germany, France, and the UK, are focusing on adopting integrated care models, leveraging digital tools (e.g., e-prescribing, standardized EHRs) to manage large, aging populations efficiently. While the pace of technology adoption can sometimes be slower due to cautious regulatory bodies and centralized procurement, the region demonstrates strong growth in niche areas like personalized nutrition and mental wellness, reflecting high levels of social awareness and government support for public health initiatives beyond traditional acute care.

The Asia Pacific (APAC) region is projected to experience the fastest market growth during the forecast period. This acceleration is attributed to rapidly expanding economies, significant investments in hospital infrastructure, and increasing penetration of health insurance in countries like China, India, and Southeast Asia. The region faces substantial challenges related to infectious diseases and increasing incidence of chronic conditions tied to urbanization, driving strong demand for accessible and scalable solutions, particularly in telehealth and generic pharmaceuticals. Furthermore, the region is becoming a pivotal manufacturing hub for generic drugs and medical disposables, enhancing its strategic importance in the global supply chain.

- North America (NA): Market leader driven by high R&D spending, advanced biopharma development, and comprehensive digital health integration.

- Europe (EU): Focus on integrated public health systems, geriatric care management, and regulatory emphasis on device safety and data protection (GDPR compliance).

- Asia Pacific (APAC): Highest growth region fueled by population size, infrastructure expansion, rising disposable income, and increasing adoption of affordable telehealth solutions.

- Latin America (LATAM): Developing infrastructure, reliance on imported medical technology, and growing demand for private healthcare services, particularly in major economies like Brazil and Mexico.

- Middle East and Africa (MEA): Significant investment in specialized medical cities and high-end care facilities (particularly in the GCC nations) offset by varying degrees of access and infrastructure limitations across the broader African continent.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Healthcare and Wellness Market.- Johnson & Johnson

- UnitedHealth Group

- Pfizer Inc.

- CVS Health Corporation

- Roche Holding AG

- Novartis International AG

- Merck & Co., Inc.

- Abbott Laboratories

- Medtronic plc

- Danaher Corporation

- Bayer AG

- Sanofi S.A.

- Nestlé Health Science

- Amgen Inc.

- Anthem, Inc. (now Elevance Health)

- Cigna Corporation

- Siemens Healthineers AG

- Koninklijke Philips N.V. (Philips Healthcare)

- Teva Pharmaceutical Industries Ltd.

- Takeda Pharmaceutical Company Limited

- Gilead Sciences, Inc.

- Becton, Dickinson and Company (BD)

- Thermo Fisher Scientific Inc.

- Stryker Corporation

- Boston Scientific Corporation

- AstraZeneca plc

- Bristol-Myers Squibb Company

- Eli Lilly and Company

- Intuitive Surgical, Inc.

- Teladoc Health, Inc.

Frequently Asked Questions

Analyze common user questions about the Healthcare and Wellness market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary growth driver for the Healthcare and Wellness Market?

The primary growth driver is the global demographic shift, specifically the rapid increase in the aging population (65 years and older), which necessitates advanced chronic disease management solutions, specialized geriatric care services, and sustained high-demand for pharmaceuticals and complex medical devices to improve quality of life and longevity. Additionally, increasing consumer focus on preventive wellness and personalized health technologies significantly contributes to non-traditional market growth.

How is digital transformation reshaping traditional healthcare service delivery?

Digital transformation is fundamentally shifting service delivery from centralized hospital settings to decentralized, consumer-centric environments. Key changes include the widespread adoption of telehealth for remote consultations, the utilization of Remote Patient Monitoring (RPM) systems for chronic care outside the clinic, and the integration of AI-driven diagnostic tools that enhance efficiency and lower the operational overhead associated with traditional, in-person care models. This shift improves access and reduces costs for routine care.

Which market segment holds the highest growth potential for investors?

The Digital Health segment, particularly within AI-powered diagnostics, digital therapeutics, and personalized nutrition platforms, holds the highest growth potential. These technologies address systemic inefficiencies, offer scalability, and align directly with the market's trajectory towards preventive, data-driven, and highly individualized health management. Biopharma specializing in gene therapies and precision oncology also presents extremely high-value growth due to unmet clinical needs and premium pricing structures.

What major regulatory challenges are affecting market expansion?

Major regulatory challenges include the stringent and often lengthy approval processes for novel medical devices and pharmaceuticals, particularly in complex areas like regenerative medicine. Furthermore, fragmentation in data privacy regulations across different regions (e.g., GDPR in Europe, HIPAA in the US) complicates the global deployment and scaling of digital health solutions that rely on cross-border data transfer, necessitating careful compliance strategies which can increase operational costs significantly.

How does value-based care influence the competitive landscape?

Value-based care (VBC) mandates a shift in focus from the volume of services delivered (fee-for-service) to demonstrable patient outcomes and cost reduction. This influences the competitive landscape by rewarding manufacturers and providers who can prove their solutions offer superior efficacy, long-term cost savings, and high patient satisfaction. Companies must now integrate their products with broader health systems, focusing on data sharing and collaboration rather than just product sales to secure long-term contracts with major payers and integrated delivery networks (IDNs).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager