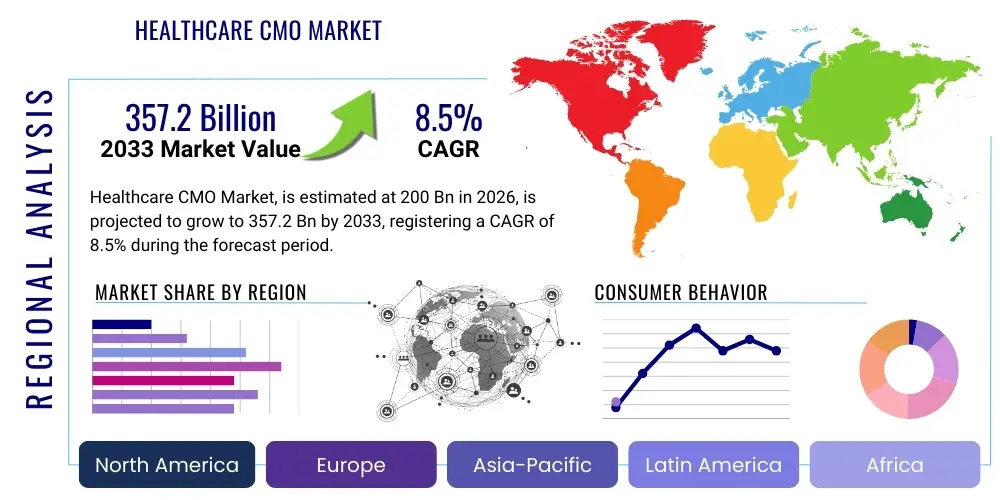

Healthcare CMO Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440523 | Date : Jan, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Healthcare CMO Market Size

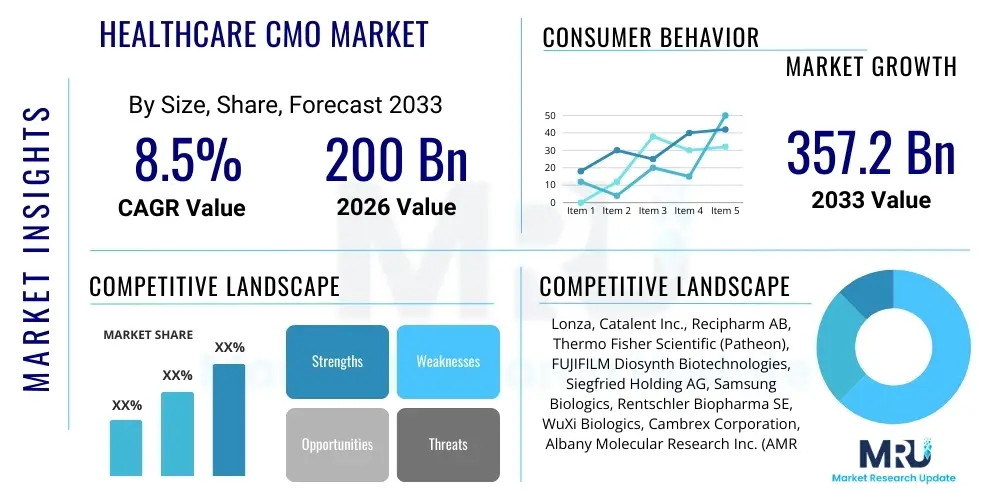

The Healthcare CMO Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 200 Billion in 2026 and is projected to reach USD 357.2 Billion by the end of the forecast period in 2033.

Healthcare CMO Market introduction

The Healthcare Contract Manufacturing Organization (CMO) market is a vital component of the global pharmaceutical and biopharmaceutical ecosystem, encompassing companies that offer specialized manufacturing services to clients across the drug development and commercialization lifecycle. These services extend from the intricate production of active pharmaceutical ingredients (APIs) and advanced intermediates to drug formulation, sterile fill-finish operations, finished dosage form (FDF) manufacturing, packaging, and comprehensive analytical testing. The core value proposition of CMOs lies in providing external expertise, state-of-the-art facilities, and scalable manufacturing solutions, thereby enabling pharmaceutical and biotechnology companies to outsource complex or capital-intensive aspects of their production while focusing on their core competencies like research and development, clinical trials, and commercialization strategies.

Major applications of healthcare CMO services span a broad spectrum of therapeutic areas and product types. This includes the manufacturing of small molecule drugs, which remain a cornerstone of pharmaceutical treatments, alongside the rapidly expanding biologics sector encompassing monoclonal antibodies, recombinant proteins, and vaccines. Furthermore, CMOs play a critical role in the production of sterile injectables, high-potency APIs (HPAPIs), and advanced therapy medicinal products (ATMPs) such as cell and gene therapies, which require highly specialized infrastructure and regulatory expertise. The benefits for clients engaging with CMOs are manifold, including significant cost efficiencies by avoiding substantial capital investments in manufacturing facilities, accelerated time-to-market due to streamlined processes and existing infrastructure, access to advanced manufacturing technologies, and robust support for navigating complex global regulatory landscapes and quality assurance requirements, ultimately mitigating operational risks.

The market's robust growth is propelled by several overarching driving factors. A primary driver is the continuous and escalating global investment in pharmaceutical research and development, resulting in a burgeoning pipeline of new drug candidates that often require specialized manufacturing capabilities beyond the scope of in-house facilities. The increasing complexity of modern drug molecules, particularly biologics and ATMPs, further necessitates the advanced technical expertise and equipment typically found in specialized CMOs. Additionally, the strategic imperative for pharmaceutical companies to optimize their supply chains, reduce operational costs, and achieve greater flexibility in production capacity strongly favors outsourcing. Patent expirations of blockbuster drugs globally are also stimulating the production of generics and biosimilars, creating substantial demand for cost-effective and high-volume manufacturing solutions that CMOs are well-positioned to provide. Furthermore, the rise of "virtual" pharmaceutical companies, which possess strong R&D capabilities but lack manufacturing infrastructure, solidifies the reliance on CMO partners.

Healthcare CMO Market Executive Summary

The Healthcare CMO market is undergoing a period of dynamic expansion, characterized by significant business trends that reflect the evolving needs of the pharmaceutical and biotechnology industries. A prominent trend is the ongoing consolidation within the CMO sector, where larger players are acquiring smaller, specialized firms to broaden their service portfolios, enhance technological capabilities, and expand their geographical footprint. This consolidation aims to offer clients integrated, end-to-end solutions, simplifying the outsourcing process from early-stage development through commercial manufacturing. Furthermore, CMOs are increasingly specializing in niche areas such as high-potency API production, sterile fill-finish for injectables, and advanced therapy manufacturing, demanding specific expertise and facilities. The drive towards digitalization and automation, including the adoption of Industry 4.0 principles, is also a critical business trend, enabling greater efficiency, real-time monitoring, and enhanced quality control across manufacturing operations.

Regionally, the market exhibits varied growth trajectories and dominance. North America and Europe continue to hold substantial market shares, primarily due to their established pharmaceutical industries, significant R&D investments, stringent regulatory environments fostering high-quality manufacturing, and the presence of numerous innovative biotech companies. These regions are characterized by a preference for technologically advanced and specialized CMO services. However, the Asia Pacific (APAC) region is rapidly emerging as the fastest-growing market, driven by favorable government policies supporting local manufacturing, lower operating costs, a burgeoning skilled workforce, and increasing healthcare expenditure. Countries like India and China are becoming global hubs for both API and finished dosage form manufacturing, attracting considerable investment and strategic partnerships from global pharmaceutical giants seeking to diversify their supply chains and tap into growing regional demand. Latin America and the Middle East & Africa also present nascent opportunities, spurred by efforts to enhance local drug production and improve healthcare access.

Segmentation trends within the Healthcare CMO market underscore shifts in therapeutic focus and manufacturing complexity. The biologics manufacturing segment is experiencing explosive growth, reflecting the expanding pipeline of biological drugs, biosimilars, and vaccines that require highly specialized and often complex cell culture and purification capabilities. Sterile injectable manufacturing, particularly for biologics and oncology drugs, also continues to be a high-growth area, driven by the need for aseptic processing and advanced fill-finish technologies. While small molecule API manufacturing remains foundational, there is an increasing demand for specialized chemistry and HPAPI capabilities. From an end-user perspective, both large pharmaceutical corporations leveraging CMOs for capacity and expertise, and small to mid-sized biotechnology firms relying on CMOs for their entire manufacturing needs, contribute significantly to market demand. The ongoing shift towards personalized medicine and advanced therapies is further segmenting the market, creating a demand for CMOs capable of handling highly specialized, smaller-batch productions with stringent quality requirements.

AI Impact Analysis on Healthcare CMO Market

The pervasive influence of Artificial Intelligence (AI) on the Healthcare CMO market is a significant area of user inquiry, centering on its potential to revolutionize drug discovery, manufacturing efficiency, and quality control. Users are keen to understand how AI can streamline complex processes, reduce errors, and accelerate time-to-market for new drugs, while also considering the challenges related to data integration, regulatory compliance, and the need for a skilled workforce capable of leveraging these advanced tools. The discourse often revolves around AI's ability to enhance predictive analytics for process optimization, automate routine tasks, and offer novel insights into manufacturing challenges, thereby transforming the traditional operational paradigms within CMOs. Key themes include AI's role in optimizing resource allocation, improving product consistency, and supporting the development of advanced therapies, all while navigating data security and ethical considerations.

- AI-driven predictive maintenance optimizes equipment uptime by forecasting potential failures, significantly reducing costly unplanned downtimes and maximizing production schedules.

- Enhanced process monitoring and control through AI algorithms improve product consistency and quality by analyzing real-time data to identify and correct deviations proactively.

- Accelerated drug discovery and development by AI-powered target identification, lead optimization, and in-silico screening, shortening the preclinical phase for CMO clients.

- Improved supply chain management and logistics efficiency through AI-based forecasting of demand and supply, optimizing inventory levels and reducing waste for CMOs.

- Automated quality control and inspection systems using computer vision and machine learning minimize human error in visual inspections and increase throughput for batch release.

- Personalized medicine manufacturing facilitated by AI for small-batch, patient-specific production, enabling agile and precise manufacturing of advanced therapies.

- Data analytics and machine learning enable better understanding of complex biological processes and fermentation kinetics, optimizing yields and product purity.

- Streamlined regulatory compliance through AI-assisted documentation, automated report generation, and predictive analytics for audit preparedness, reducing administrative burden.

- Optimized resource allocation and scheduling in manufacturing facilities using AI algorithms to balance equipment usage, personnel, and material flow, maximizing overall efficiency.

- Reduction in material waste and energy consumption via AI-driven process optimization that identifies inefficiencies and suggests improvements in resource utilization.

- Enhanced cybersecurity for sensitive client data and intellectual property through AI-powered threat detection and prevention systems, crucial for trust in outsourcing.

DRO & Impact Forces Of Healthcare CMO Market

The Healthcare CMO market is profoundly shaped by a confluence of drivers, restraints, opportunities, and broader impact forces that collectively dictate its growth trajectory and operational landscape. Key drivers include the escalating global pharmaceutical R&D expenditure, which fuels the demand for specialized manufacturing services as an increasing number of complex drug candidates enter development. The pervasive trend among pharmaceutical companies to strategically outsource non-core activities is another significant catalyst, allowing them to achieve crucial cost efficiencies, reduce capital outlay, and gain access to niche expertise and advanced manufacturing technologies without internal investment. The rising complexity of new drug modalities, such as biologics, gene therapies, and cell therapies, inherently necessitates highly sophisticated manufacturing capabilities and stringent regulatory compliance, often found within specialized CMOs. Additionally, the continuous wave of patent expirations of blockbuster drugs continues to drive the generic and biosimilar markets, requiring agile and cost-effective manufacturing solutions from CMO partners. The growing number of virtual pharmaceutical and biotechnology companies with limited in-house manufacturing capabilities also significantly contributes to the outsourcing trend, as they rely entirely on CMOs for their production needs.

Conversely, the market faces several significant restraints that challenge its sustained growth and operational fluidity. Stringent and ever-evolving global regulatory environments, coupled with varying quality standards across different regions, pose considerable compliance challenges for CMOs, demanding continuous investment in quality management systems and personnel training. Intellectual property (IP) concerns remain a critical hurdle, as pharmaceutical companies are often hesitant to share proprietary information and sensitive process details with third-party manufacturers, fearing potential data breaches or competitive disadvantages. Furthermore, the inherent complexities of technology transfer between clients and CMOs, including the validation of processes and analytical methods, can lead to delays and increased costs. The substantial capital investments required for establishing and maintaining advanced manufacturing infrastructure, such as sterile fill-finish lines or biologics facilities, can limit market entry and expansion for smaller CMOs. Moreover, maintaining consistent quality control, ensuring supply chain transparency, and managing potential raw material sourcing issues across multiple sites and diverse global partners present ongoing operational and logistical challenges.

Opportunities for growth are abundant and strategically important for long-term market expansion within the Healthcare CMO landscape. The burgeoning demand for advanced therapies (cell and gene therapies), orphan drugs targeting rare diseases, and personalized medicine offers lucrative avenues for CMOs capable of developing highly specialized, flexible, and often smaller-batch manufacturing platforms. Expansion into emerging markets, particularly in Asia Pacific, Latin America, and parts of the Middle East, provides new geographies for growth due to lower operating costs, increasing healthcare investments, and growing pharmaceutical consumption. Technological advancements, including the widespread adoption of continuous manufacturing, single-use systems, digitalization (Industry 4.0), and Process Analytical Technology (PAT), present significant opportunities for CMOs to enhance efficiency, reduce costs, improve quality, and offer more innovative and competitive solutions. The increasing focus on sustainability and green manufacturing practices also presents a competitive edge for CMOs adopting eco-friendly processes and reducing environmental footprints. Strategic partnerships, joint ventures, and mergers and acquisitions are also key opportunities for market players to expand their service portfolios, acquire new technologies, and strengthen their geographical footprint, thereby consolidating market position and enhancing capabilities.

Segmentation Analysis

The Healthcare CMO market is extensively segmented to provide a granular understanding of its diverse operational facets, enabling precise market analysis and strategic planning. This segmentation broadly categorizes services based on the type of manufacturing or support provided, the specific form of the drug product, and the client demographic utilizing these crucial services. Such detailed categorization helps in identifying specific growth pockets, discerning evolving client needs, and understanding the technological and regulatory nuances impacting each sub-segment within the complex pharmaceutical manufacturing landscape. Each segment often demands distinct expertise, capital investment, and operational protocols, reflecting the varied requirements of modern drug development and commercialization.

- By Service Type:

- Active Pharmaceutical Ingredient (API) Manufacturing

- Small Molecule API: Production of the chemical active ingredient for traditional drugs.

- Biologic API: Manufacturing of large, complex biological molecules like proteins and antibodies.

- High-Potency API (HPAPI): Specialized manufacturing for highly potent compounds, requiring advanced containment.

- Finished Dosage Form (FDF) Manufacturing

- Solid Dosage Form: Includes tablets, capsules, and powders, which are common and widely consumed.

- Liquid Dosage Form: Encompasses syrups, suspensions, and solutions for oral, topical, or parenteral administration.

- Semi-Solid Dosage Form: Covers creams, gels, and ointments, primarily for topical applications.

- Injectable Dosage Form: Manufacturing of products for parenteral administration in vials, pre-filled syringes, and ampoules.

- Sterile Fill-Finish: Aseptic filling and finishing of sterile drug products, critical for injectables and biologics.

- Lyophilization: Freeze-drying services to enhance stability and shelf-life of sensitive drug products.

- Packaging Services

- Primary Packaging: Direct contact packaging such as blisters, bottles, and pouches.

- Secondary Packaging: External packaging like cartons, labels, and inserts.

- Tertiary Packaging: Palletization and bulk shipping containers for transportation.

- Analytical & Quality Control (QC) Services

- Raw Material Testing: Ensuring quality and compliance of incoming raw materials.

- In-Process Testing: Monitoring critical quality attributes during manufacturing.

- Finished Product Release Testing: Comprehensive testing to confirm product meets specifications before release.

- Stability Testing: Assessing drug product stability over time under various conditions.

- Drug Product Development

- Formulation Development: Designing and optimizing drug formulations for efficacy and stability.

- Process Development: Optimizing manufacturing processes for scalability and efficiency.

- Medical Device Manufacturing: Production of various medical devices, from diagnostics to implants, often requiring specialized cleanroom facilities.

- Active Pharmaceutical Ingredient (API) Manufacturing

- By End User:

- Pharmaceutical Companies: Large and mid-sized firms outsourcing various stages of drug manufacturing.

- Biopharmaceutical Companies: Focus on biologics, biosimilars, and advanced therapies.

- Generic Drug Companies: Seeking cost-effective, high-volume manufacturing for off-patent drugs.

- Virtual Pharmaceutical Companies: Rely entirely on CMOs for all manufacturing needs due to minimal in-house infrastructure.

- Research & Academic Institutions: Outsourcing small-scale production for preclinical or early-stage clinical studies.

- By Region:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Value Chain Analysis For Healthcare CMO Market

The value chain for the Healthcare CMO market is a complex network of interconnected activities and stakeholders, extending from the initial sourcing of raw materials to the ultimate delivery of finished pharmaceutical products. This intricate chain begins with crucial upstream activities, which primarily involve a diverse ecosystem of suppliers providing essential components for drug manufacturing. These include manufacturers of active pharmaceutical ingredients (APIs) and excipients, specialized packaging material providers, and advanced equipment and technology vendors. The reliability, quality, and regulatory compliance of these upstream partners are paramount, as they directly influence the integrity and safety of the final drug product. CMOs typically invest significant resources in rigorous supplier qualification and auditing processes to ensure a stable, high-quality, and compliant supply chain, recognizing that any disruption or quality issue at this stage can have profound downstream implications on production timelines, product quality, and regulatory approval.

Downstream activities in the value chain primarily center on the symbiotic relationship between the CMO and its direct clients, which are predominantly pharmaceutical and biopharmaceutical companies. These clients engage CMOs for a wide array of services, including early-stage drug development, manufacturing of clinical trial materials, and large-scale commercial production. The success of these downstream partnerships hinges on effective communication, transparency, and a deep, shared understanding of project goals, quality standards, and regulatory expectations. CMOs strive to evolve beyond mere service providers to become strategic partners, offering not only manufacturing capacity but also invaluable expertise in process optimization, analytical development, regulatory navigation, and comprehensive supply chain management. The quality, efficiency, and timeliness of the CMO's output are directly critical to the client's ability to successfully bring new products to market, maintain supply continuity, and ultimately sustain market share and profitability.

The distribution channel within the Healthcare CMO value chain predominantly operates through direct agreements between the CMO and its pharmaceutical or biopharmaceutical client. Upon completion of manufacturing and quality release, products are typically shipped directly from the CMO's facility to the client's designated warehousing, distribution centers, or further processing sites. The client then assumes responsibility for the subsequent distribution to end-users such as hospitals, pharmacies, clinics, or directly to patients. While CMOs may manage certain logistical aspects, particularly for highly specialized or temperature-sensitive products requiring cold chain management, the overarching distribution strategy and market access remain the purview of the client. Direct channels ensure efficient transfer of manufactured goods, minimizing intermediaries. Indirect distribution, though less common for finished products immediately leaving the CMO, might involve specialized third-party logistics (3PL) providers for complex international shipping or specific regional distribution networks, especially when the CMO serves a global client base or specific therapeutic areas like vaccines, where intricate global logistics are essential for product integrity and timely delivery to diverse markets. The emphasis across all distribution methods is on maintaining product quality, ensuring regulatory compliance, and delivering products safely and efficiently to their next destination within the supply chain.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 200 Billion |

| Market Forecast in 2033 | USD 357.2 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Lonza, Catalent Inc., Recipharm AB, Thermo Fisher Scientific (Patheon), FUJIFILM Diosynth Biotechnologies, Siegfried Holding AG, Samsung Biologics, Rentschler Biopharma SE, WuXi Biologics, Cambrex Corporation, Albany Molecular Research Inc. (AMRI), Vetter Pharma-Fertigung GmbH & Co. KG, Piramal Pharma Solutions, Pfizer CentreOne, AbbVie Contract Manufacturing, Baxter BioPharma Solutions, Aenova Group, Fareva, CordenPharma, Curia Global, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Healthcare CMO Market Key Technology Landscape

The Healthcare CMO market is continuously evolving, driven by significant advancements in manufacturing technologies aimed at enhancing efficiency, ensuring product quality, and increasing operational flexibility. One of the most impactful developments is the increasing adoption of continuous manufacturing processes, which offer substantial benefits over traditional batch manufacturing, including a smaller physical footprint, reduced operating costs, and significantly enhanced product consistency. This technology allows for an uninterrupted flow of production, enabling faster scale-up from development to commercial volumes and greater responsiveness to fluctuating market demands, which is particularly crucial for high-volume products. The seamless integration of Process Analytical Technology (PAT) further complements continuous manufacturing by providing real-time monitoring and control of critical quality attributes (CQAs), ensuring consistent product quality throughout the entire manufacturing process and minimizing the need for extensive post-production testing. These innovations are fundamentally reshaping the efficiency, reliability, and cost-effectiveness of pharmaceutical production.

Another crucial technological trend transforming the CMO landscape is the widespread utilization of single-use systems (SUS), especially prominent in biopharmaceutical manufacturing. SUS, which include disposable bioreactors, mixing bags, tubing assemblies, and purification components, dramatically reduce the need for laborious cleaning and sterilization validation processes. This significantly minimizes the risks of cross-contamination between different products or batches and accelerates changeover times, making manufacturing operations much more agile and cost-effective. The inherent flexibility of SUS is highly advantageous for CMOs managing diverse product portfolios, from small-batch clinical trial materials to commercial production runs. Furthermore, advanced aseptic processing techniques, incorporating isolator and restricted access barrier systems (RABS) technologies, are becoming the gold standard for sterile injectable manufacturing. These systems create highly controlled, sterile environments, ensuring the utmost levels of product sterility and safety, which is paramount in the production of parenteral drugs, biologics, and vaccines.

Digitalization and the application of Industry 4.0 principles are profoundly transforming the operational excellence of Healthcare CMOs. This encompasses the comprehensive integration of automation, robotics, advanced sensor technologies (Internet of Things - IoT), and sophisticated data analytics platforms across all manufacturing activities. Automated systems enhance precision, significantly reduce human error, and improve throughput for tasks ranging from material handling and formulation to filling, inspection, and packaging. IoT sensors collect vast amounts of real-time data on equipment performance, environmental conditions, and process parameters. When this data is analyzed using Artificial Intelligence (AI) and machine learning algorithms, it enables predictive maintenance, comprehensive process optimization, and proactive problem-solving before issues escalate. Furthermore, the implementation of blockchain technology is emerging as a tool for enhancing supply chain transparency and traceability, providing an immutable record of product movement and authenticity. These digital tools collectively contribute to greater operational transparency, robust traceability, improved regulatory compliance, and overall manufacturing excellence, allowing CMOs to offer more robust, compliant, and competitive services to their pharmaceutical clients.

Regional Highlights

- North America: This region consistently holds a dominant share of the Healthcare CMO market, driven by the presence of a well-established and innovation-driven pharmaceutical and biotechnology industry, coupled with significant R&D investments. The high demand for complex biologics, sterile injectables, and advanced therapies, alongside a strong trend of outsourcing from major pharmaceutical companies seeking specialized capabilities and cost efficiencies, propels market growth. A robust venture capital landscape also fuels biotech startups, creating a consistent pipeline of demand for CMO services, particularly in the US and Canada.

- Europe: Europe represents another key market with a strong legacy of pharmaceutical innovation and a highly skilled workforce, particularly in countries like Germany, Switzerland, Ireland, and the UK. These nations are hubs for specialized CMO services, excelling in areas such as sterile manufacturing, high-potency APIs, and complex small molecules. The region benefits from supportive government initiatives for biotechnology, a strong focus on advanced manufacturing techniques, including continuous processing, and a sophisticated regulatory environment that encourages high-quality production standards.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region in the Healthcare CMO market over the forecast period. This accelerated growth is primarily fueled by competitive manufacturing costs, increasing government support and incentives for the pharmaceutical and biotechnology sectors, and a large, rapidly developing talent pool. Countries such as India and China are emerging as global manufacturing hubs for both APIs and finished drug products, attracting significant foreign investment and fostering robust domestic CMO expansion. Japan and South Korea also contribute with advanced technology and biopharmaceutical manufacturing capabilities.

- Latin America: The Latin American market is experiencing steady and promising growth, driven by expanding healthcare access, increasing pharmaceutical consumption among a growing population, and local government initiatives aimed at promoting domestic drug manufacturing to reduce reliance on imports. While generally smaller in scale compared to North America or Europe, the region offers unique opportunities for CMOs focusing on generic drugs, over-the-counter products, and catering to specific regional market needs, often through strategic partnerships with local entities.

- Middle East & Africa (MEA): The MEA region is at a nascent but evolving stage of development in the Healthcare CMO market, showing significant potential for future growth. This is primarily due to rising healthcare expenditure, increasing prevalence of chronic diseases, and strategic initiatives by governments to diversify economies and enhance local manufacturing capabilities within the pharmaceutical sector. While still reliant on imports, there is a growing trend of establishing local production facilities and forming strategic alliances with global CMOs to meet escalating pharmaceutical demand and reduce dependence on external supply chains.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Healthcare CMO Market.- Lonza

- Catalent Inc.

- Recipharm AB

- Thermo Fisher Scientific (Patheon)

- FUJIFILM Diosynth Biotechnologies

- Siegfried Holding AG

- Samsung Biologics

- Rentschler Biopharma SE

- WuXi Biologics

- Cambrex Corporation

- Albany Molecular Research Inc. (AMRI)

- Vetter Pharma-Fertigung GmbH & Co. KG

- Piramal Pharma Solutions

- Pfizer CentreOne

- AbbVie Contract Manufacturing

- Baxter BioPharma Solutions

- Aenova Group

- Fareva

- CordenPharma

- Curia Global, Inc.

Frequently Asked Questions

What is a Healthcare CMO and why are they important?

A Healthcare Contract Manufacturing Organization (CMO) provides comprehensive manufacturing services to pharmaceutical, biopharmaceutical, and medical device companies, covering the entire product lifecycle from API production and drug formulation to finished dosage forms and packaging. They are crucial for accelerating drug development, ensuring high-quality manufacturing, providing specialized expertise for complex molecules, and enabling clients to reduce capital expenditure by outsourcing critical production needs, thus accelerating market entry and ensuring supply chain flexibility.

How does AI impact the Healthcare CMO market?

AI significantly impacts the Healthcare CMO market by enhancing operational efficiency, improving product quality, and accelerating development timelines. AI applications include predictive maintenance for equipment, optimized process monitoring, accelerated drug discovery and development through data analytics, improved supply chain management, and automated quality control systems. This leads to reduced errors, lower costs, and increased throughput, particularly for complex and personalized therapies.

What are the primary drivers for growth in the Healthcare CMO market?

Key drivers include increasing global pharmaceutical R&D spending, the strategic trend of outsourcing non-core manufacturing activities for cost efficiency and access to specialized technologies, the rising complexity of new drug modalities like biologics and advanced therapies, and the continuous wave of patent expirations fueling generic and biosimilar drug production. The emergence of numerous virtual pharmaceutical companies with limited in-house manufacturing capabilities also critically contributes to market expansion.

Which regions are leading the Healthcare CMO market?

North America and Europe currently dominate the Healthcare CMO market due to their mature pharmaceutical industries, significant R&D investments, advanced manufacturing infrastructure, and stringent regulatory environments. However, the Asia Pacific region is projected to be the fastest-growing market, driven by competitive operating costs, increasing government support for biotechnology, and a growing pool of skilled labor, particularly in countries like India and China.

What types of services do Healthcare CMOs typically offer?

Healthcare CMOs offer a wide range of services including Active Pharmaceutical Ingredient (API) manufacturing (e.g., small molecule, biologic, high-potency API), Finished Dosage Form (FDF) manufacturing (e.g., solid, liquid, injectable, sterile fill-finish, lyophilization), comprehensive packaging services (primary, secondary, tertiary), analytical and quality control (QC) testing, and drug product development (formulation and process development). Some also extend to medical device manufacturing.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager