Healthcare Education Solutions Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438631 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Healthcare Education Solutions Market Size

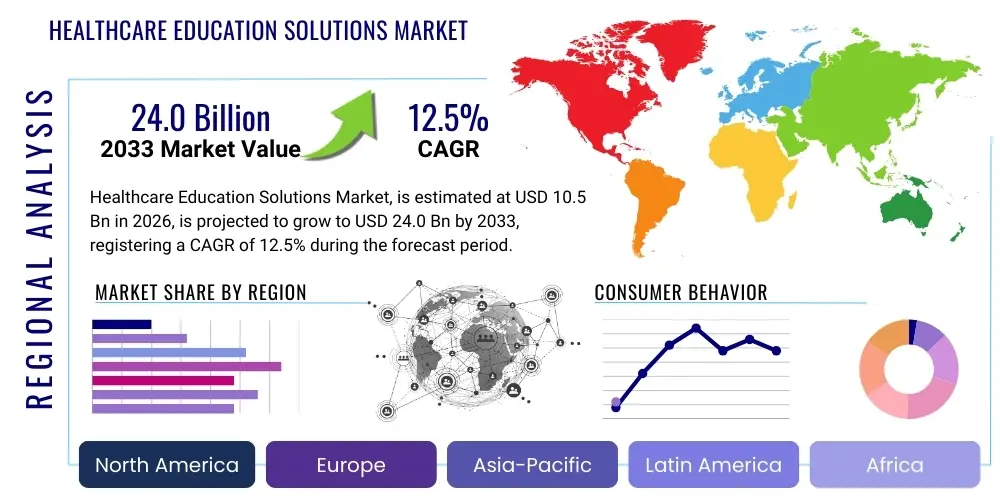

The Healthcare Education Solutions Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 10.5 Billion in 2026 and is projected to reach USD 24.0 Billion by the end of the forecast period in 2033. This robust expansion is primarily driven by the escalating demand for highly skilled healthcare professionals, coupled with rapid technological integration, including advanced simulation tools, virtual reality (VR), and artificial intelligence (AI), which are fundamentally transforming traditional medical training methodologies. The emphasis on continuous professional development (CPD) and compliance with stringent regulatory standards across developed and emerging economies further fuels this substantial market valuation increase.

Healthcare Education Solutions Market introduction

The Healthcare Education Solutions Market encompasses a comprehensive suite of tools, software, services, and platforms designed to facilitate the training, education, and continuous professional development of medical students, nurses, allied health professionals, and established practitioners. These solutions leverage digital technologies to offer immersive and flexible learning experiences that move beyond conventional classroom settings. Key offerings include learning management systems (LMS), simulation software, electronic health record (EHR) training modules, digital anatomicals, and collaborative educational platforms. The primary objective is to enhance clinical competency, improve patient safety outcomes, and ensure compliance with evolving global health standards.

Major applications of these solutions span academic institutions, hospitals and health systems, corporate training departments, and various government agencies focused on public health preparedness. The benefits derived from adopting these technologies are multifaceted, encompassing reduced training costs, improved accessibility to specialized medical knowledge regardless of geographical location, and the ability to practice complex procedures in a risk-free, controlled environment. Furthermore, these platforms enable personalized learning pathways tailored to individual professional needs, addressing skill gaps more effectively than standardized instruction methods.

Driving factors for this market include the global shortage of healthcare workers requiring scalable and efficient training models, the necessity for existing professionals to continually upskill due to rapid medical advancements, and supportive government initiatives promoting digitalization in educational sectors. Additionally, the post-pandemic shift towards remote learning and hybrid educational models has cemented the requirement for robust, reliable, and engaging digital education tools. The push towards value-based healthcare also necessitates improved clinical decision-making, which advanced education solutions are uniquely positioned to deliver.

Healthcare Education Solutions Market Executive Summary

The global Healthcare Education Solutions Market exhibits strong growth momentum, characterized by significant business trends focusing on merger and acquisition activities aimed at consolidating technology providers and expanding geographic reach, particularly in the realm of immersive technologies like VR/AR for surgical training. Key industry players are increasingly investing in cloud-based platforms to ensure scalability and ease of integration within existing hospital IT infrastructure, moving away from on-premise solutions. Business models are shifting towards subscription-based services (SaaS) and pay-per-use models, making high-fidelity simulation more accessible to smaller academic centers and clinics, thereby broadening the customer base and ensuring recurring revenue streams.

Regionally, North America remains the dominant market leader, fueled by advanced technological adoption, high healthcare expenditure, and a mature ecosystem of academic medical centers and private training companies. However, the Asia Pacific (APAC) region is projected to register the fastest CAGR, driven by massive government investments in healthcare infrastructure expansion, rising demand for medical professional training in populous nations like India and China, and increasing adoption of affordable digital solutions. Europe continues its steady growth, largely focused on standardizing professional certification and mandatory continuous medical education (CME) through digital platforms.

Segment trends highlight the dominance of the academic institution segment due to the foundational training requirements for entry-level professionals. However, the corporate sector, specifically hospitals and pharmaceutical companies, is growing rapidly, driven by the need for mandatory compliance training and specialized product education. Technology-wise, simulation and training software are key segments, but the highest growth rate is expected in virtual and augmented reality (VR/AR) solutions, which offer highly realistic, practical application training without risk to patients, marking a crucial evolution in clinical skill development.

AI Impact Analysis on Healthcare Education Solutions Market

User inquiries regarding AI's influence in healthcare education solutions predominantly center on its capacity for personalization, efficiency, and automated assessment. Common questions explore how AI can create adaptive learning paths tailored to an individual student's knowledge gaps, whether AI-driven chatbots or virtual tutors can effectively replace human instructors, and concerns surrounding data privacy when leveraging large datasets of student performance for algorithmic optimization. Users are particularly interested in AI's role in high-fidelity simulation and objective performance feedback, seeking validation that AI can reduce bias and enhance the rigor of clinical skills evaluation. The underlying consensus is that AI is viewed not as a replacement, but as an indispensable accelerator for personalized, data-driven competency development in the medical field.

The integration of artificial intelligence is fundamentally redefining instructional design and delivery in medical education. AI algorithms are now deployed to analyze student performance data across various educational modules, including quizzes, simulation exercises, and practical examinations. This analysis allows learning management systems (LMS) to automatically identify areas where a student struggles and dynamically adjust the curriculum, providing targeted supplemental materials or challenging scenarios. This adaptive learning approach ensures resources are allocated optimally, maximizing the efficiency of the training process and significantly shortening the time required for competency attainment.

Furthermore, AI significantly enhances the capabilities of simulation training and assessment. In surgical simulation environments, AI can track minute details of a trainee's movements, instrument handling, and decision-making processes, providing immediate, objective, and detailed feedback that surpasses human observation capabilities. This objectivity is critical in high-stakes fields like surgery and emergency medicine. Predictive analytics powered by AI also allows institutions to forecast which students might be at risk of falling behind or failing certification exams, enabling early intervention strategies and ensuring a higher overall success rate for medical education programs globally.

- AI-driven Adaptive Learning Pathways: Customizing curriculum speed and content based on real-time student performance metrics.

- Automated Assessment and Grading: Utilizing machine learning for objective evaluation of clinical documentation and simulation outcomes.

- Intelligent Tutoring Systems (ITS): Providing on-demand, virtual mentorship and clarification for complex medical concepts.

- Predictive Analytics: Identifying students at risk of performance issues or burnout for proactive educational support.

- Enhanced Simulation Fidelity: AI optimizing scenario variables in simulations (e.g., patient response to treatment) for maximum realism.

- Efficient Content Curation: AI tools organizing vast libraries of medical literature and case studies for rapid access and relevance.

DRO & Impact Forces Of Healthcare Education Solutions Market

The market's trajectory is primarily driven by the imperative need to bridge the global skill gap among healthcare professionals and the mandatory nature of continuous professional education (CME) required for maintaining licensure. These drivers are tempered by significant restraints, chiefly the high initial capital investment required for implementing sophisticated simulation centers and advanced digital infrastructure, as well as institutional resistance to integrating new pedagogical methodologies. However, ample opportunities exist in developing specialized, niche training programs utilizing emerging technologies like augmented reality (AR) for complex clinical skills, and expanding SaaS models into underserved geographical regions, promising high scalability and market penetration. These forces collectively dictate the adoption rate, shaping an environment where technological feasibility must be balanced against budgetary constraints and regulatory mandates.

Key drivers include the dramatic technological leap in medical procedures necessitating continuous upskilling, and the increasing patient volume worldwide demanding a larger, more competent workforce. The COVID-19 pandemic acted as a powerful accelerator, forcing the rapid adoption of digital tools for remote training and examination, validating the efficacy and necessity of these solutions. Furthermore, regulatory bodies are increasingly mandating proficiency in digital health tools (such as EHRs), thereby integrating technology training directly into core curricula. These factors generate consistent upward pressure on market growth, encouraging both educational institutions and clinical settings to modernize their training infrastructure.

Restraints include the standardization challenge inherent in global healthcare practices, making it difficult to deploy universally applicable content. Another significant barrier is the complexity associated with verifying the return on investment (ROI) of advanced education technologies, which often have high procurement costs but provide intangible benefits related to patient safety and competency improvement. Opportunities are robust in the development of modular, micro-credentialing programs that address immediate, specialized skill needs (e.g., robotic surgery or specific device usage). Moreover, the potential for partnerships between tech developers and major pharmaceutical/device manufacturers to co-create product-specific training modules represents a high-growth area for specialized educational services.

Segmentation Analysis

The Healthcare Education Solutions Market is extensively segmented across multiple dimensions, including component type (solutions and services), delivery mode, technology platform, and end-user. The segmentation provides granular insights into which offerings are experiencing the highest demand and where investment is being concentrated. Services, particularly implementation, technical support, and content development services, form a crucial revenue stream, supporting the deployment and maintenance of complex software solutions. Geographically, segmentation reveals significant differences in adoption rates, with high-income nations prioritizing high-fidelity simulation, while developing markets focus on scalable, low-cost digital content delivery methods like mobile learning.

Analysis of the end-user segments indicates that academic institutions remain the largest consumer base, due to their responsibility for initial medical training. However, the corporate end-user segment, comprising hospitals, healthcare systems, and corporate training centers, is demonstrating faster growth. This accelerated growth is attributed to the urgent requirement for hospitals to conduct mass training on new equipment, manage ongoing compliance requirements, and ensure staff proficiency in rapidly evolving clinical protocols. The market is thus characterized by large foundational spending from universities, complemented by dynamic, high-frequency, specialized spending from clinical enterprises seeking immediate operational improvements.

- Component:

- Solutions (LMS, Simulation, Content Authoring Tools)

- Services (Consulting, Implementation, Support & Maintenance, Content Development)

- Delivery Mode:

- Classroom-based

- E-learning (Mobile learning, Webinars, Video-based)

- Blended Learning

- Technology Platform:

- Simulation (Manikins, Virtual Patients)

- Learning Management Systems (LMS)

- AR/VR/Mixed Reality (XR)

- M-learning (Mobile Learning)

- End-User:

- Academic Institutions (Universities, Medical & Nursing Schools)

- Healthcare Providers (Hospitals, Clinics, Specialty Centers)

- Corporate (Pharmaceutical & Biotech Companies, Medical Device Manufacturers)

Value Chain Analysis For Healthcare Education Solutions Market

The value chain for healthcare education solutions begins with upstream activities involving content creation and technology development. This stage includes specialized content developers (medical writers, instructional designers), software developers creating platforms (LMS, simulation engines), and hardware manufacturers providing physical training aids (manikins, VR headsets). Key competitive differentiation at this stage lies in the medical accuracy of content and the technological sophistication (fidelity and realism) of the simulation or digital platform. Collaboration between medical experts and technical developers is critical here to ensure the resulting solutions are both pedagogically sound and technologically robust, setting the foundation for high-quality educational delivery.

Midstream activities focus on integration, distribution, and customization. Integrators specialize in adapting generic platforms to specific institutional requirements, ensuring seamless deployment within hospital IT environments and compliance with regulatory standards (like HIPAA or GDPR). Distribution channels are highly fragmented, involving direct sales teams for large enterprise solutions (like high-fidelity simulation labs) and indirect distribution through channel partners, resellers, or online marketplaces for standardized e-learning modules. Effective distribution relies heavily on strategic partnerships with established academic bodies and major clinical organizations to gain trust and market share.

Downstream activities center on the end-user experience, support, and continuous refinement. This stage includes ongoing technical support, user training, and crucially, continuous content updates to reflect the latest clinical guidelines and medical breakthroughs. Direct channels are vital for managing high-value, complex installations, allowing for specialized technical maintenance and training services. Indirect channels, particularly digital marketplaces, handle the volume of modular educational content and focus on rapid deployment and easy accessibility for individual practitioners seeking CME credits, completing the cycle by providing feedback for upstream product improvements.

Healthcare Education Solutions Market Potential Customers

The primary consumers and end-users of Healthcare Education Solutions are categorized into three major groups: academic institutions, clinical providers, and specialized corporate entities. Academic institutions, including medical, nursing, and allied health schools, represent the foundational customer base, requiring comprehensive, scalable solutions to train large cohorts of entry-level professionals. Their purchasing decisions prioritize high curriculum coverage, robust assessment features, and long-term technical support, often involving large capital expenditures for infrastructure setup.

Clinical providers, such as hospitals, integrated delivery networks (IDNs), and large specialty clinics, constitute the second major customer group. Their demand is driven by operational necessity—onboarding new staff, ensuring mandatory compliance training (e.g., patient handling, infection control), and specialized technical training related to new medical devices or surgical techniques. These providers seek modular, just-in-time training solutions that minimize disruption to clinical workflow and offer demonstrable improvements in patient care outcomes and regulatory adherence.

The third group, specialized corporate entities (pharmaceutical, biotech, and medical device companies), utilizes these educational platforms for product training, sales force enablement, and outreach to external medical professionals (CME provision). These customers require highly specialized content delivery that integrates product knowledge with clinical application, focusing heavily on engaging digital formats and rigorous tracking capabilities to demonstrate compliance and educational effectiveness to regulatory agencies and marketing teams.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 10.5 Billion |

| Market Forecast in 2033 | USD 24.0 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Laerdal Medical, Siemens Healthineers, Philips Healthcare, CAE Healthcare, GE Healthcare, 3D Systems (Simbionix), Medtronic (Covidien), HealthStream, Inc., Elsevier Education, EBSCO Health, Becton, Dickinson and Company (BD), Surgical Science Sweden AB, Mentice AB, Vyaire Medical, Education Management Solutions (EMS), Apollo Education Group, Coursera (Healthcare vertical), IBM Watson Health, Oculus (Meta) for Healthcare, Osso VR. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Healthcare Education Solutions Market Key Technology Landscape

The technology landscape is dominated by the convergence of high-fidelity simulation and advanced digital platforms designed for maximal immersion and scalability. Learning Management Systems (LMS) serve as the backbone, providing centralized control over curriculum delivery, assessment tracking, and compliance reporting. Modern LMS platforms are increasingly cloud-based, offering robust APIs for integration with hospital EHRs and external content libraries. The evolution of these systems focuses on incorporating intuitive user interfaces and mobile accessibility, catering to busy professionals who require just-in-time learning resources at the point of care.

Simulation technology remains a cornerstone, moving beyond basic manikins to encompass complex, full-body patient simulators capable of reacting physiologically to interventions (pharmacological effects, vital sign changes). The most disruptive segment is the rapid maturation of Virtual Reality (VR), Augmented Reality (AR), and Mixed Reality (MR), collectively termed Extended Reality (XR). These technologies provide highly realistic, spatially accurate training environments for surgical procedures, anatomy dissection, and complex team-based crisis management (e.g., operating room scenarios). XR solutions significantly reduce costs associated with traditional physical lab time and consumables while offering standardized, repeatable scenarios for consistent evaluation.

Crucially, the market is also adopting sophisticated data analytics and machine learning tools. These technologies analyze vast amounts of educational interaction data, leading to the development of personalized learning engines and objective performance metrics. Tele-education platforms, especially those supporting synchronous and asynchronous virtual clinical interactions and remote supervision, are expanding access to specialist medical mentorship globally. This blend of immersive visualization, centralized management, and intelligent data analysis defines the current state-of-the-art in healthcare professional development, driving both pedagogical effectiveness and operational efficiency for institutions.

Regional Highlights

- North America: Dominates the global market share due to high technology penetration, significant healthcare spending, and stringent professional certification requirements mandating CME credits. The US market benefits from a high concentration of advanced academic medical centers and strong private sector investment in specialized training simulation companies, particularly in surgical and robotic technology training.

- Europe: Characterized by stable growth, driven by regional initiatives aimed at standardizing medical education across member states (EU). Key focus areas include e-learning platforms for mandated compliance (GDPR, safety protocols) and investment in high-fidelity simulation centers, particularly in Nordic countries and the UK. Germany and France are key consumers, prioritizing quality assurance and technical skill verification.

- Asia Pacific (APAC): Exhibits the highest growth potential (CAGR) globally. This rapid expansion is fueled by massive infrastructure development, increasing urbanization leading to greater healthcare access demands, and government policies supporting digitalization in education across nations like China, India, and Australia. The demand here focuses on scalable, affordable digital content solutions to train a rapidly growing workforce.

- Latin America (LATAM): Growing steadily, primarily driven by investments in addressing regional health inequalities and improving basic medical training access. The market typically adopts cost-effective e-learning solutions and mobile platforms, with key adoption centers in Brazil and Mexico focusing on primary care and public health education.

- Middle East and Africa (MEA): Emerging market segment focusing on specialized, high-cost solutions in affluent Gulf Cooperation Council (GCC) countries (e.g., Saudi Arabia, UAE), which invest heavily in world-class simulation centers to attract and train international medical talent. The African continent shows increasing interest in mobile health (mHealth) education to reach remote professionals.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Healthcare Education Solutions Market.- Laerdal Medical

- Siemens Healthineers

- Philips Healthcare

- CAE Healthcare

- GE Healthcare

- 3D Systems (Simbionix)

- Medtronic (Covidien)

- HealthStream, Inc.

- Elsevier Education

- EBSCO Health

- Becton, Dickinson and Company (BD)

- Surgical Science Sweden AB

- Mentice AB

- Vyaire Medical

- Education Management Solutions (EMS)

- Apollo Education Group

- Coursera (Healthcare vertical)

- IBM Watson Health

- Oculus (Meta) for Healthcare

- Osso VR

Frequently Asked Questions

Analyze common user questions about the Healthcare Education Solutions market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the high growth rate of the Healthcare Education Solutions Market?

The central driver is the global disparity between the rapid advancement of medical knowledge and technology (e.g., robotic surgery, advanced diagnostics) and the existing skill level of the healthcare workforce. This necessitates mandatory, frequent Continuous Medical Education (CME) and specialized training delivered through scalable, accessible digital solutions, validating the high CAGR.

How is Extended Reality (XR), including VR and AR, transforming clinical skills training?

XR technologies create highly immersive, risk-free training environments for complex procedures such as surgery and emergency response. This transformation allows medical professionals to practice high-stakes interventions repeatedly, improving muscle memory and decision-making accuracy without impacting patient safety, thereby accelerating competency acquisition far beyond traditional methods.

Which end-user segment is showing the fastest adoption rate for healthcare education solutions?

While academic institutions remain the largest market consumers overall, the fastest-growing segment is Healthcare Providers (hospitals and IDNs). This growth is fueled by the critical need for rapid staff onboarding, managing system-wide compliance requirements, and immediate upskilling related to new clinical protocols and medical device training, demanding highly modular and integrated solutions.

What role does Artificial Intelligence (AI) play in personalizing healthcare education?

AI utilizes sophisticated algorithms to analyze individual learner performance data across various modules and simulations. It then customizes the learning path, adjusting content difficulty and resource allocation in real-time, focusing specifically on identified knowledge gaps. This adaptive learning approach ensures maximized training efficiency and tailored competency development for each student.

What are the main financial challenges associated with adopting high-fidelity simulation solutions?

The primary financial challenge is the high initial capital expenditure required for purchasing advanced manikins, sophisticated software licenses, and setting up dedicated simulation facilities. Institutions also face ongoing operational costs related to technical maintenance, specialized content licensing, and the constant need to upgrade hardware and software to maintain realism and fidelity.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager