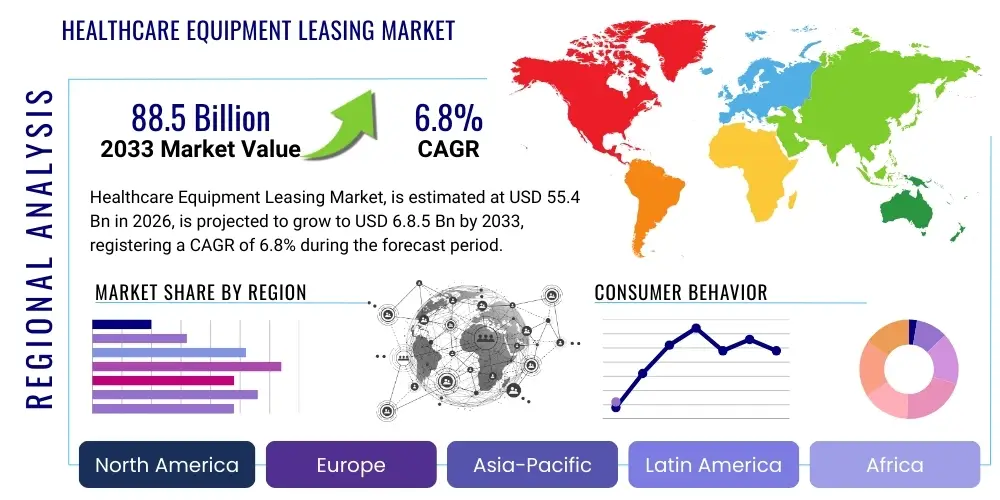

Healthcare Equipment Leasing Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439157 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Healthcare Equipment Leasing Market Size

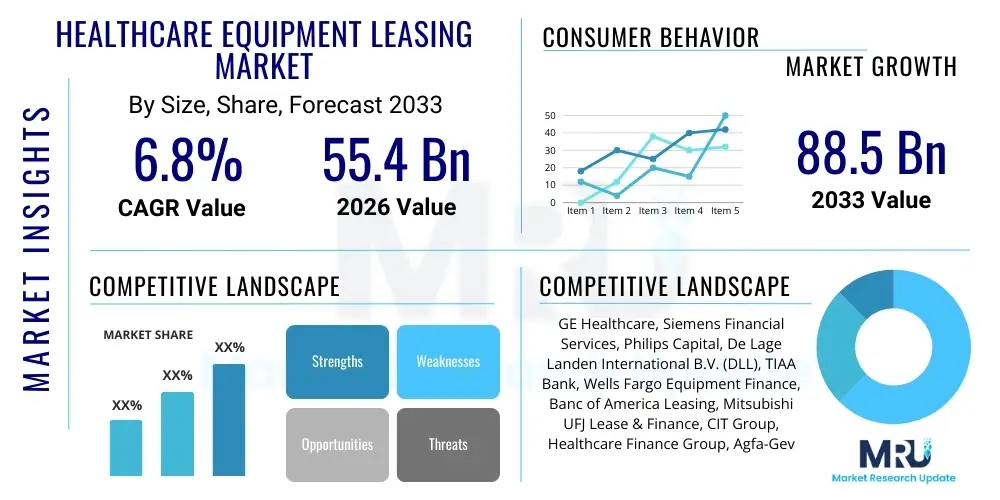

The Healthcare Equipment Leasing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $55.4 Billion USD in 2026 and is projected to reach $88.5 Billion USD by the end of the forecast period in 2033.

Healthcare Equipment Leasing Market introduction

The Healthcare Equipment Leasing Market encompasses financial services provided to healthcare institutions, such as hospitals, diagnostic labs, and clinics, enabling them to acquire necessary medical technology—ranging from sophisticated MRI machines and robotic surgery systems to basic patient monitoring devices—without the heavy upfront capital expenditure associated with outright purchase. This market facilitates the rapid adoption of high-cost, state-of-the-art equipment, which is crucial for maintaining competitive advantages and improving patient outcomes in an environment driven by technological innovation and evolving regulatory standards. Leasing models, including operating leases and capital leases, offer flexibility in managing cash flow, allowing providers to allocate resources more effectively toward core operational priorities.

The primary applications of equipment leasing span across major healthcare sectors, including diagnostic imaging (CT scanners, ultrasounds), surgical and therapeutic interventions (laser equipment, surgical robots), and IT infrastructure critical for electronic health records (EHR) and telehealth services. The intrinsic benefit of leasing lies in mitigating obsolescence risk; as technology cycles shorten, leasing arrangements enable facilities to upgrade equipment periodically, ensuring access to the latest generation of devices without the burden of disposing of depreciated assets. This strategy is particularly vital in specialized fields like oncology and cardiology, where technological advancements are continuous and directly impact treatment efficacy.

Driving factors for market expansion include the global increase in chronic disease prevalence requiring advanced diagnostic tools, the imperative for healthcare providers to modernize aging infrastructure, and favorable economic conditions that incentivize debt financing over equity financing. Furthermore, the shift toward value-based care models necessitates efficiency, making leasing an attractive financial mechanism for maximizing operational capacity while minimizing balance sheet strain. The complexity and high cost of modern medical devices, coupled with constrained budgets, solidify leasing as a strategic financial necessity rather than merely an optional procurement method across both developed and developing economies.

Healthcare Equipment Leasing Market Executive Summary

The global Healthcare Equipment Leasing Market exhibits robust business trends driven by financial innovation and increasing technological complexity within the healthcare sector. Key trends include the rise of flexible, usage-based leasing models (pay-per-use) and the integration of managed services and maintenance contracts directly into leasing agreements, thereby offering comprehensive solutions rather than just financing. Financial institutions and specialized leasing companies are increasingly partnering with Original Equipment Manufacturers (OEMs) to provide bundled offerings, streamlining the acquisition process for end-users. The movement toward digital health and telehealth further stimulates the demand for IT infrastructure leasing, pushing market players to diversify their portfolios beyond traditional heavy medical machinery.

Regionally, North America remains the dominant market, characterized by high adoption rates of advanced medical technologies and sophisticated healthcare financing structures. However, the Asia Pacific (APAC) region is projected to experience the fastest growth, fueled by massive government investments in healthcare infrastructure expansion, rising medical tourism, and a burgeoning private healthcare sector in countries like China and India. European growth is steady, supported by private hospital consolidation and the continuous need for technological refreshes across national health services. These regional differences mandate customized leasing solutions that account for varying regulatory environments, financing costs, and equipment lifecycles across diverse geographies.

In terms of segmentation, the Operating Lease segment holds a significant share due to its off-balance-sheet treatment, appealing to providers aiming to maintain favorable financial ratios. Among equipment types, Diagnostic Imaging Equipment leasing dominates due to its high unit cost and frequent technological turnover. The End-User segment sees Hospitals as the primary revenue generator, given their large-scale equipment requirements, but Specialized Clinics and Diagnostic Centers represent high-growth areas as healthcare delivery decentralizes. Understanding these segment trends is crucial for market participants looking to tailor their capital solutions to specific customer needs and risk profiles.

AI Impact Analysis on Healthcare Equipment Leasing Market

User inquiries regarding AI's influence in healthcare equipment leasing frequently revolve around the potential for enhanced asset valuation, predictive maintenance integration, and the impact of AI-powered diagnostic tools on equipment utilization rates. Key concerns include how AI-driven longevity predictions might affect lease residuals and amortization schedules, and whether AI-powered equipment justifies higher lease premiums due to increased operational efficiency and diagnostic accuracy. Users also anticipate AI being instrumental in automating leasing processes, including credit scoring and contract generation, aiming for faster, more accurate deployment of capital. Overall, the summarized user expectation is that AI will transform leasing from a traditional financing function into a sophisticated, data-driven asset management service.

- AI enhances predictive maintenance, allowing lessors to accurately model equipment longevity and reduce unexpected downtime costs.

- AI algorithms improve risk assessment and credit scoring for healthcare providers, leading to customized and more competitive leasing rates.

- Integration of AI in diagnostic equipment (e.g., automated image analysis) accelerates technological obsolescence, driving faster equipment upgrade cycles and boosting leasing demand.

- Leasing firms can utilize AI for dynamic pricing and residual value forecasting based on real-time usage data captured from leased smart equipment.

- AI-powered tools streamline contract management and compliance verification, reducing administrative friction in the leasing ecosystem.

DRO & Impact Forces Of Healthcare Equipment Leasing Market

The Healthcare Equipment Leasing Market is primarily driven by the escalating cost and complexity of advanced medical technology, forcing healthcare providers globally to seek non-dilutive financing alternatives to manage substantial capital investments. Concurrently, the increasing focus on managing financial risks, particularly avoiding equipment obsolescence in rapidly evolving fields like molecular diagnostics and surgical robotics, powerfully reinforces the value proposition of leasing. However, the market faces significant restraints, chiefly related to stringent regulatory environments surrounding healthcare financing and high interest rate fluctuations, which can elevate the overall cost of capital for lessors and subsequently increase lease payments for end-users. The primary opportunity lies in the rapid expansion of healthcare infrastructure in emerging economies and the development of specialized leasing products tailored to smaller clinical settings and ambulatory surgery centers, capitalizing on the decentralization trend in healthcare delivery. These forces collectively shape the competitive dynamics, prioritizing leasing models that offer flexibility, predictable costs, and integrated asset management.

Drivers

The continuous technological advancements in medical device manufacturing necessitate frequent equipment upgrades, particularly in high-acuity areas such as cardiology, oncology, and neurology. Hospitals, seeking to remain competitive and improve patient outcomes, cannot afford the long downtime and significant capital outlay associated with outright purchases every few years. Leasing provides an effective mechanism to cycle through technology quickly, ensuring facilities always have access to the latest diagnostic and therapeutic tools. This demand is further amplified by the global rise in non-communicable diseases, requiring more complex, high-cost screening and treatment equipment.

Financial flexibility and efficient capital management are paramount for modern healthcare systems operating under constrained budgets. Leasing shifts large, unpredictable capital expenditures (CapEx) to predictable, manageable operational expenditures (OpEx), which is highly favorable for private equity-backed hospital systems and public health services alike. Furthermore, operating leases allow institutions to keep equipment liabilities off the balance sheet, maintaining stronger financial ratios, which is a key driver for institutions seeking advantageous credit ratings or strategic mergers and acquisitions. The economic benefit of predictable monthly payments is a powerful incentive overriding traditional purchase models.

- Increasing capital constraints and budget limitations in healthcare organizations.

- Rapid technological obsolescence of sophisticated medical devices.

- Shift from CapEx to OpEx models for financial optimization.

- Rising demand for advanced diagnostic and therapeutic services globally.

Restraints

One major restraint is the stringent regulatory complexity associated with healthcare financing, especially concerning compliance with accounting standards (such as ASC 842 and IFRS 16) which redefine operating leases and often require them to be recorded on the balance sheet. Navigating these complex global and regional accounting rules requires specialized expertise from lessors, increasing administrative overhead. Additionally, the variability in insurance reimbursement policies for services delivered using leased equipment can create uncertainty regarding the return on investment for the lessee, dampening leasing enthusiasm in certain specialized segments.

Economic volatility, particularly fluctuations in global interest rates and credit markets, poses a significant risk to the leasing industry. When interest rates rise, the cost of funding the equipment purchase for the lessor increases, translating directly into higher lease payments for healthcare providers. This financial pressure can temporarily slow down procurement cycles or push providers toward low-cost, refurbished equipment alternatives. Furthermore, the inherent risk of equipment damage or excessive wear and tear often leads to expensive insurance requirements or high security deposits, which act as a barrier for smaller, independent clinics.

- Complexity and ambiguity in global accounting standards for lease classification.

- Sensitivity of leasing costs to macroeconomic factors like interest rate changes.

- Perceived higher total cost of ownership over the long term compared to purchasing.

- Regulatory scrutiny and compliance requirements for specialized medical equipment leasing.

Opportunities

The vast, untapped potential in emerging economies presents a significant opportunity. Countries in Asia Pacific and Latin America are rapidly building out private and public healthcare infrastructure, but lack the capital reserves for mass outright purchases of high-end equipment. Leasing offers these nascent markets a sustainable path to modernization. Lessors who can adapt their models to accommodate local currency risks and develop affordable, entry-level leasing programs are poised for substantial growth in these regions.

Another major opportunity lies in the specialization of leasing products, moving beyond simple financing to integrated service packages. Offering bundled solutions that include leasing, maintenance, technical support, software upgrades, and even staffing solutions for highly complex equipment (Managed Equipment Services or MES) creates tremendous value for healthcare providers. Furthermore, the burgeoning demand for portable, remote patient monitoring devices and telehealth infrastructure opens a lucrative niche for IT equipment leasing tailored to distributed care models and home healthcare services.

- Expanding healthcare infrastructure in developing economies, particularly in APAC and MEA.

- Growing demand for integrated Managed Equipment Services (MES) and bundled contracts.

- Focus on leasing specialized IT and telehealth infrastructure supporting remote care.

- Development of flexible, usage-based leasing models (e.g., per-scan or per-procedure).

Impact Forces

The combination of high technological obsolescence (Driver) and capital constraints (Driver) creates a powerful positive impact force, making leasing an indispensable tool for staying competitive. This necessity outweighs the immediate negative impact of regulatory complexity (Restraint) for large hospital networks. The most impactful external force is interest rate volatility, which directly influences the affordability and competitiveness of leasing products, potentially shifting market preference temporarily toward outright purchase during periods of low-interest rates. The long-term trajectory, however, is shaped by the consistent need for rapid technological deployment, cementing leasing’s critical role.

Segmentation Analysis

The Healthcare Equipment Leasing Market is systematically segmented based on Type, Equipment Type, and End-User, allowing market participants to precisely target customer needs and financial structures. Type segmentation distinguishes between Operating Leases and Financial Leases, with providers increasingly favoring operating leases for their balance sheet benefits. Equipment Type segmentation reflects the diverse landscape of medical technology, dominated by expensive diagnostic and therapeutic systems. The End-User analysis focuses on the institutional scale, recognizing hospitals as the largest consumers while acknowledging the rapid growth potential in specialized clinics and ambulatory settings.

This segmented view allows lessors to customize amortization schedules, maintenance packages, and contractual terms to align with the specific lifespan and utilization rates of different equipment categories. For instance, diagnostic imaging equipment, which requires frequent technological upgrades, is often better suited for shorter-term operating leases, whereas essential, long-life support equipment might be procured via financial leases. The shift toward specialized segments, such as oncology centers and orthopedic clinics, demands highly tailored financing products that address specific clinical revenue cycles and regulatory burdens associated with those specialties.

- By Type: Operating Lease, Financial Lease (Capital Lease).

- By Equipment Type: Diagnostic Imaging Equipment (MRI, CT, Ultrasound), Therapeutic Equipment (Radiation Therapy, Dialysis Machines), Patient Monitoring Equipment, Surgical Equipment, IT Infrastructure (EHR Systems, Telehealth Platforms), Durable Medical Equipment (DME).

- By End-User: Hospitals (Private and Public), Diagnostic Centers and Labs, Clinics and Physician Offices, Ambulatory Surgery Centers, Others (Rehabilitation Facilities, Home Healthcare).

Value Chain Analysis For Healthcare Equipment Leasing Market

The value chain for healthcare equipment leasing is complex, involving multiple specialized entities from upstream manufacturing to downstream financing and asset disposition. Upstream analysis focuses on the relationship between Original Equipment Manufacturers (OEMs) and lessors. OEMs (like GE, Siemens, Philips) are crucial as they define the technology, cost, and residual value of the assets. A strong partnership between the OEM and the lessor (often the OEM's captive finance division or a specialized independent lessor) streamlines the sales process, ensuring competitive pricing and consistent equipment supply. Indirect distribution channels, often involving brokers and dealers, play a role in connecting mid-tier lessors with smaller healthcare facilities.

The core of the value chain involves the financing and deployment stage, where specialized financial institutions underwrite the lease, structure the contract, and manage the asset throughout its life. This stage includes sophisticated risk management, credit analysis, and adherence to stringent healthcare and financial regulations. Downstream analysis focuses on the end-user (healthcare provider) and the eventual asset disposition. High-quality asset management, including maintenance and eventual refurbishment or remarketing of the used equipment, is critical for maximizing residual value and reducing the total cost of ownership for the lessor.

Distribution channels are categorized into direct and indirect methods. Direct channels involve captive leasing arms of OEMs or large financial institutions dealing directly with major hospital networks. This channel ensures high contract volumes and simplified negotiations. Indirect channels involve independent leasing brokers or equipment vendors who bundle the leasing offer with the equipment sale, typically catering to smaller clinics or regional diagnostic centers. The increasing digitalization of the leasing process, utilizing online platforms and automated application systems, is enhancing efficiency across all distribution modes, reducing transaction time, and improving customer experience.

Healthcare Equipment Leasing Market Potential Customers

The primary end-users and buyers of healthcare equipment leasing services are large integrated hospital systems, which require vast quantities of high-cost equipment across multiple specialties and locations. These systems often engage in multi-year, multi-million dollar master lease agreements to ensure continuous technological refresh across their networks. Public hospitals, constrained by governmental budgeting cycles, are also significant customers, utilizing leasing to bypass immediate capital appropriation hurdles.

A rapidly growing segment of potential customers includes specialized, single-specialty clinics, such as ambulatory surgery centers (ASCs), orthopedic practices, and highly specialized diagnostic centers. These entities prioritize efficiency and low operational costs. Leasing allows them to access premium equipment necessary for complex procedures without the heavy financial burden that could impede their quick setup and scaling. Furthermore, the emerging market of home healthcare providers and small physician offices represents a strong future customer base, particularly for leasing smaller, portable diagnostic and monitoring equipment required for distributed care models.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $55.4 Billion USD |

| Market Forecast in 2033 | $88.5 Billion USD |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | GE Healthcare, Siemens Financial Services, Philips Capital, De Lage Landen International B.V. (DLL), TIAA Bank, Wells Fargo Equipment Finance, Banc of America Leasing, Mitsubishi UFJ Lease & Finance, CIT Group, Healthcare Finance Group, Agfa-Gevaert NV, Stryker Corporation, Medtronic PLC, Canon Medical Systems, BNP Paribas Leasing Solutions, U.S. Bank, KeyCorp, Cisco Systems Capital. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Healthcare Equipment Leasing Market Key Technology Landscape

The technological landscape driving the healthcare equipment leasing market is centered around high-precision diagnostic and therapeutic modalities, alongside the sophisticated IT infrastructure required to manage these systems. High-end equipment like 7T MRI machines, PET-CT scanners, and advanced radiation oncology systems (e.g., proton therapy) represent substantial capital demands, making leasing the preferred acquisition route. Furthermore, the trend toward equipment connectivity and the Internet of Medical Things (IoMT) is crucial; connected devices generate vast amounts of data regarding usage, performance, and maintenance needs, which lessors leverage for predictive analytics and accurate residual value forecasting.

The adoption of robotic surgery systems and minimally invasive therapeutic tools is also transforming the market. These systems are not only expensive but require continuous software updates and dedicated training, making integrated leasing packages (which include training and service) highly attractive. Lessors are increasingly focusing on the lifecycle management of these complex, software-dependent assets. Financial technology (FinTech) advancements, such as blockchain for secure contract management and AI-driven platforms for automating credit decisions, are enhancing the operational efficiency of leasing companies themselves, allowing for faster response times and customized financing structures.

The burgeoning field of telehealth necessitates leasing of specialized IT infrastructure, including high-definition cameras, secure servers, networking gear, and remote patient monitoring kits. Lessors are developing specialized finance programs to facilitate the rapid scaling of these decentralized technologies, often including provisions for rapid scaling and hardware refreshes. Cloud-based Electronic Health Record (EHR) systems, while often subscription-based, frequently require associated server and network hardware financing that falls under the leasing umbrella, further diversifying the technological portfolio required by market players.

Regional Highlights

- North America: North America, led by the United States, holds the largest market share due to its highly developed and capital-intensive healthcare system. The market is characterized by the presence of major captive finance companies associated with global OEMs and sophisticated independent lessors. High expenditure on healthcare, widespread adoption of advanced technologies like surgical robotics and molecular imaging, and favorable regulations encouraging private healthcare investment solidify this region's dominance. The imperative for U.S. hospitals to adhere to new accounting standards (ASC 842) has accelerated the demand for nuanced operating lease structures that optimize balance sheets.

- Europe: The European market displays mature growth, driven by the ongoing modernization efforts within national health services (NHS in the UK, public systems in Germany and France) and consolidation within the private hospital sector. Economic constraints in several Eurozone countries make leasing an essential tool for securing necessary high-value equipment without impacting government austerity measures. Focus areas include financing diagnostic equipment and IT solutions required for pan-European health data integration and compliance with GDPR regulations.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region. This explosive growth is underpinned by substantial increases in public and private investment in healthcare infrastructure, particularly in populous countries like China, India, and Southeast Asia. The region’s need to rapidly bridge the gap in medical technology access makes leasing exceptionally viable. However, lessors must contend with diverse regulatory frameworks, fluctuating currency risks, and varied local banking regulations, requiring highly localized financing strategies and robust risk mitigation policies.

- Latin America (LATAM): The LATAM market is marked by moderate growth, primarily concentrated in Brazil, Mexico, and Chile. The demand is driven by the expansion of private clinics and hospitals catering to a growing middle class. Economic instability in some nations, however, necessitates flexible leasing terms, often involving inflation adjustments or structured payments tied to local currency performance. Leasing in LATAM is focused on providing essential and mid-range diagnostic and imaging equipment.

- Middle East and Africa (MEA): Growth in MEA is highly localized, with significant investment in advanced healthcare facilities in the Gulf Cooperation Council (GCC) countries (Saudi Arabia, UAE) fueled by oil wealth and ambitious national visions (e.g., Saudi Vision 2030). These regions prioritize state-of-the-art equipment, often leased through international financial institutions. The African market, while smaller, offers long-term growth potential through humanitarian and development-focused leasing programs aimed at enhancing public health systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Healthcare Equipment Leasing Market.- GE Healthcare

- Siemens Financial Services

- Philips Capital

- De Lage Landen International B.V. (DLL)

- TIAA Bank

- Wells Fargo Equipment Finance

- Banc of America Leasing

- Mitsubishi UFJ Lease & Finance

- CIT Group

- Healthcare Finance Group

- Agfa-Gevaert NV

- Stryker Corporation

- Medtronic PLC

- Canon Medical Systems

- BNP Paribas Leasing Solutions

- U.S. Bank

- KeyCorp

- Cisco Systems Capital

- Mercantile Bank

- JPMorgan Chase Commercial Banking

Frequently Asked Questions

Analyze common user questions about the Healthcare Equipment Leasing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between an Operating Lease and a Financial Lease in healthcare?

An Operating Lease (or true lease) is typically a shorter-term arrangement treated as an operating expense, keeping the asset off the lessee’s balance sheet, which is desirable for financial reporting. A Financial Lease (or capital lease) is long-term, essentially functions as an installment purchase, and requires the asset and liability to be recorded on the balance sheet, reflecting ownership characteristics.

How does the high rate of technological obsolescence impact healthcare equipment leasing trends?

Rapid obsolescence drives higher demand for leasing, especially operating leases. Providers favor leasing to avoid owning equipment that quickly loses value. Lessors mitigate this risk by building shorter lease terms and robust residual value forecasting into their contracts, facilitating frequent, predictable technology upgrades for their clients.

Which equipment type dominates the leasing market, and why?

Diagnostic Imaging Equipment (MRI, CT, PET scanners) dominates the leasing market. These systems have extremely high unit costs, often exceeding millions of dollars, require sophisticated installation, and are subject to frequent generational advancements, making outright purchase financially unfeasible for most healthcare institutions.

What is Managed Equipment Services (MES) and how is it growing in the market?

MES is an advanced leasing model where the lessor provides not just the equipment financing, but also comprehensive services, including asset management, maintenance, technical support, clinical staff training, and often guaranteed uptime. MES is growing rapidly as healthcare systems seek to outsource non-core functions and achieve guaranteed operational reliability and predictable costs.

Why is the Asia Pacific region expected to exhibit the fastest growth in healthcare equipment leasing?

The APAC region’s accelerated growth is due to substantial government and private sector investment aimed at expanding and modernizing outdated healthcare infrastructure. Leasing provides a crucial financing pathway for rapidly deploying high-cost technology across a large, underserved population without requiring immediate, massive upfront capital outlays, particularly in developing economies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager