Healthcare Facility Stools Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438396 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Healthcare Facility Stools Market Size

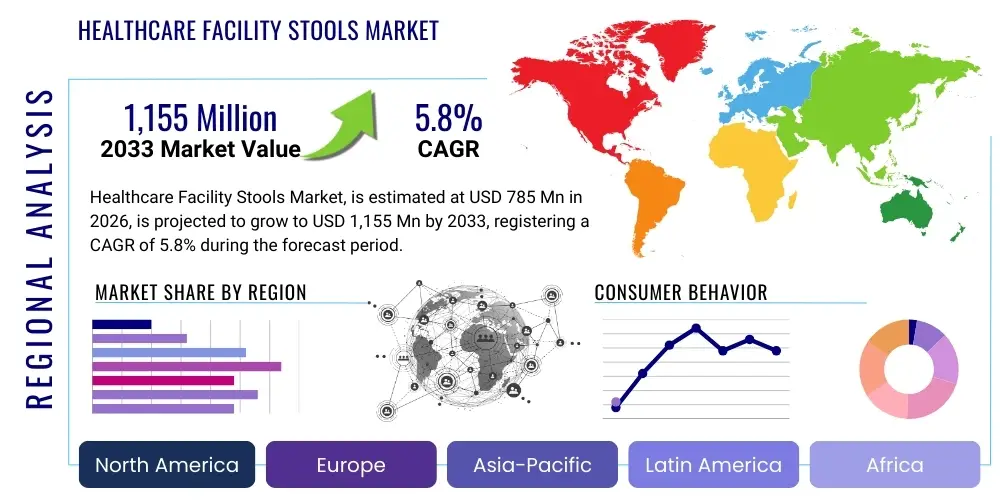

The Healthcare Facility Stools Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $785 Million in 2026 and is projected to reach $1,155 Million by the end of the forecast period in 2033.

Healthcare Facility Stools Market introduction

The Healthcare Facility Stools Market encompasses the manufacturing, distribution, and sale of specialized seating solutions designed for use by medical professionals within various healthcare environments such as hospitals, clinics, dental offices, laboratories, and ambulatory surgical centers. These stools are distinct from general office seating due to stringent requirements related to hygiene, durability, ergonomic support, and mobility. Key features often include seamless designs for easy cleaning, resistance to chemical disinfectants, pneumatic height adjustment mechanisms, and specialized wheel casters suitable for clinical flooring. The demand for these products is intrinsically linked to global healthcare expenditure, infrastructure expansion, and the increasing focus on occupational health and safety (OHS) for clinical staff.

Major applications of healthcare facility stools span a wide spectrum of medical disciplines. They are critically used in operating rooms where surgical teams require static yet adjustable seating for long procedures, dental and orthodontic practices for precision work, and laboratories where technicians need stability while performing intricate tasks under microscopes or near specialized equipment. The essential benefit derived from these specialized stools is the reduction of musculoskeletal strain and fatigue among healthcare providers, thereby enhancing precision, focus, and overall operational efficiency. Furthermore, modern designs prioritize infection control, employing materials that inhibit microbial growth and withstand aggressive sterilization protocols.

The market is primarily driven by demographic shifts, notably the rapidly aging global population, which necessitates an expansion of acute and long-term care facilities, consequently increasing the requirement for medical furniture. Additionally, the proliferation of specialized outpatient clinics and diagnostic imaging centers contributes significantly to demand. Regulatory mandates enforcing ergonomic workplace standards in developed economies further accelerate the adoption of high-quality, adjustable seating solutions. Technological advancements, such as the incorporation of advanced materials like antimicrobial polymers and the integration of highly responsive pneumatic systems, are key factors sustaining market growth.

Healthcare Facility Stools Market Executive Summary

The Healthcare Facility Stools Market is characterized by robust growth, propelled primarily by increasing investment in ambulatory care settings and the escalating global demand for specialized ergonomic furniture that meets rigorous infection control standards. Business trends indicate a strong shift toward highly customizable and modular seating solutions, catering specifically to niche medical specialties such as ophthalmology and dentistry, which require unique posture support. Furthermore, sustainability and lifecycle management are emerging as crucial purchasing criteria, influencing manufacturers to adopt eco-friendly materials and design products with prolonged durability. Regional trends show North America and Europe dominating the premium segment due to established regulatory requirements and high ergonomic awareness, while the Asia Pacific region exhibits the highest growth trajectory, fueled by large-scale public and private healthcare infrastructure projects and expanding medical tourism sectors. Segment trends highlight that the adjustable height stools and saddle stools segments are experiencing accelerated adoption, driven by their superior ergonomic benefits compared to fixed-height alternatives, reflecting a professional emphasis on preventing work-related musculoskeletal disorders.

AI Impact Analysis on Healthcare Facility Stools Market

User queries regarding the impact of Artificial Intelligence (AI) on the Healthcare Facility Stools Market largely center around how data integration can enhance ergonomics, maintenance, and usage patterns. Common questions include whether AI can optimize stool design based on real-time usage data, if smart stools can monitor provider posture and provide alerts, and how predictive maintenance using sensor data can reduce downtime in critical clinical settings. Users are keen to understand the shift from simple furniture to integrated smart assets. This analysis reveals that while AI does not directly manufacture the stool, it profoundly influences the value proposition through data-driven design optimization, predictive maintenance scheduling based on asset utilization, and the development of intelligent, sensor-equipped stools that provide real-time ergonomic feedback to clinicians and facility management, improving overall workplace safety and efficiency.

- Data-Driven Ergonomics: AI algorithms analyze movement and posture data collected via integrated sensors in 'smart stools' to identify stress points and inform future design iterations, ensuring optimal musculoskeletal support.

- Predictive Maintenance: Utilization of machine learning (ML) models to monitor pneumatic lift performance, caster wear, and structural integrity, flagging potential failures before they occur, minimizing clinical disruption.

- Asset Management and Tracking: Integration of RFID or IoT sensors linked to AI platforms for real-time inventory management, utilization rates, and automated location tracking within large hospital networks.

- Infection Control Optimization: AI processes data from cleaning logs and proximity sensors to ensure stools are routinely sanitized, particularly those moved between high-risk zones, aiding compliance with hygiene protocols.

- Workflow Efficiency Mapping: Analysis of clinical staff sitting patterns and movement trajectories during procedures to optimize floor layout and placement of essential equipment, including seating arrangements.

DRO & Impact Forces Of Healthcare Facility Stools Market

The market dynamics are fundamentally shaped by the growing global focus on patient care quality and clinician well-being, coupled with aggressive expansion in outpatient service provision. Key drivers include the mandatory implementation of ergonomic standards in clinical environments across developed nations and the continuous replacement cycle necessitated by rigorous sanitation requirements that degrade material integrity over time. However, growth is tempered by significant restraints, primarily the high capital expenditure associated with purchasing premium, chemically resistant, and fully adjustable ergonomic stools, especially in budget-constrained public health systems. The pervasive risk of contamination also mandates specific design requirements, adding complexity and cost to the manufacturing process. The confluence of these forces—drivers pushing for quality and restraints limiting affordability—defines the competitive landscape, where manufacturers must balance high performance with cost-effectiveness.

Opportunities for market expansion are strongly concentrated in the rapidly developing economies of Asia Pacific and Latin America, where massive governmental and private investments are fueling the construction of modern healthcare facilities, often skipping older technologies directly into advanced solutions. Furthermore, niche applications, such as specialized seating for microsurgery and robotic surgery control rooms, present high-margin growth avenues, requiring highly customized solutions. The increasing trend towards non-hospital care settings, including corporate wellness centers and highly specialized rehabilitation facilities, also represents an untapped market segment requiring durable, clinically-grade seating. Innovations in material science, leading to lighter, stronger, and inherently antimicrobial polymers, offer a distinct opportunity to reduce weight, improve hygiene, and extend product lifespan simultaneously.

The impact forces influencing the market are substantial. Technological forces drive rapid innovation in pneumatic mechanisms and structural materials, directly impacting product differentiation and pricing. Economic forces, particularly the volatility in raw material costs (e.g., steel, chrome, specialized plastics), dictate manufacturing margins and final consumer prices. Regulatory forces, stemming from bodies like OSHA, ISO, and country-specific health and safety administrations, are perhaps the most powerful, mandating specific load capacities, stability requirements, cleanability standards, and ergonomic dimensions. These mandatory standards compel continuous product re-engineering and ensure that only compliant products enter the highly regulated clinical environment, maintaining a high barrier to entry for non-specialized manufacturers.

- Drivers (D): Expansion of Ambulatory Surgical Centers (ASCs), increasing prevalence of chronic diseases requiring long-term care, stringent occupational health and safety regulations promoting ergonomics, and high frequency of furniture replacement due to infection control protocols.

- Restraints (R): High initial procurement costs for specialized ergonomic and antimicrobial stools, budget constraints in public healthcare systems, market saturation in certain mature European and North American segments, and long purchasing cycles in large institutional settings.

- Opportunities (O): Untapped demand in emerging markets (APAC, LATAM), development of smart, sensor-integrated ergonomic stools, growing use in specialized fields (telemedicine hubs, dental labs), and incorporation of sustainable and recyclable materials.

- Impact Forces: Technological advancements in material science and pneumatic systems, strict regulatory compliance requirements (ISO 13485, FDA), escalating healthcare infrastructure spending, and professional awareness regarding clinician physical well-being.

Segmentation Analysis

The Healthcare Facility Stools Market is rigorously segmented based on product type, material composition, and end-user application, reflecting the diverse functional needs across various clinical environments. Understanding these segments is crucial for manufacturers to target their R&D and marketing efforts effectively. Product-wise, the market is segmented into categories such as adjustable height stools, saddle stools, and step stools, each serving a distinct clinical necessity, with adjustable height models holding the largest revenue share due to their versatility across multiple procedures and clinician heights. Material segmentation distinguishes between stools made primarily of stainless steel, chrome-plated metal, and medical-grade polymers, driven by specific hygiene and durability requirements, particularly in high-moisture or chemical-exposure zones like laboratories.

End-user segmentation clearly outlines the primary consumption centers. Hospitals, including both large-scale acute care facilities and specialized hospitals, remain the largest consumers, driven by their extensive number of operating rooms, patient examination areas, and laboratory testing centers. However, the fastest growth is being observed in specialized clinics and ambulatory surgical centers (ASCs). These outpatient facilities require high mobility and compact designs, favoring saddle stools and highly maneuverable caster-equipped models. Dental offices constitute a specific, highly demanding sub-segment, necessitating stools with very precise, fine-tuned height and back adjustments to support prolonged static postures required during intricate procedures.

The interplay between segmentation categories often dictates purchasing decisions. For instance, an orthopedic surgeon's stool (end-user: hospital operating room) would require robust stainless steel construction (material) and often a saddle seat configuration (product type) to ensure stability and minimize pressure points during extended surgeries. Conversely, a general examination room in a clinic might opt for a durable, easily cleaned polymer stool with basic adjustable height features. Market stakeholders must continuously analyze shifting preference patterns—such as the increasing preference for saddle stools among physical therapists and dentists due to improved spinal alignment—to maintain competitive advantage and ensure product offerings align with evolving ergonomic science.

- By Product Type:

- Adjustable Height Stools (Pneumatic, Screw-Adjusted)

- Fixed Height Stools

- Saddle Stools (Ergonomic spine support)

- Step Stools (Single-step, Double-step, Safety-rail models)

- Backless Stools

- By Material:

- Stainless Steel Stools (High chemical resistance, operating rooms)

- Chrome-Plated Metal Stools (Cost-effective, general examination)

- Medical-Grade Polymer/Plastic Stools (Lightweight, easy sterilization)

- Vinyl and Upholstery (Specialized ergonomic padding)

- By End-User:

- Hospitals (Public & Private)

- Ambulatory Surgical Centers (ASCs)

- Specialized Clinics (Physiotherapy, Dialysis Centers)

- Dental Offices and Clinics

- Research Laboratories and Diagnostic Centers

- Long-Term Care Facilities

Value Chain Analysis For Healthcare Facility Stools Market

The value chain for the Healthcare Facility Stools Market begins with upstream activities involving raw material procurement, primarily sourcing high-grade stainless steel, aluminum alloys, medical-grade plastics (PVC, polyurethane), and specialized components like pneumatic gas cylinders, casters, and antimicrobial upholstery foam. Suppliers in this segment must adhere to strict quality controls regarding material purity and durability, as clinical use requires extreme resistance to disinfectants and heavy daily use. Manufacturing involves precision engineering, assembly, and rigorous testing for stability and load-bearing capacity, often requiring certification under ISO standards like ISO 13485 for medical device quality management. High manufacturing complexity stems from integrating sophisticated ergonomic features and seamless designs essential for preventing microbial harboring.

The downstream flow involves meticulous distribution channels that bridge the gap between specialized manufacturers and diverse end-users. Direct sales channels are frequently employed for large institutional buyers, such as major hospital networks or government tenders, facilitating direct negotiation, customization requests, and bulk logistics. Indirect distribution, leveraging specialized medical equipment distributors and regional resellers, plays a critical role in reaching smaller private clinics, dental practices, and individual procurement centers. These distributors often provide value-added services, including installation, maintenance contracts, and advice on regulatory compliance, making them essential conduits for market penetration, particularly in fragmented regional markets.

The efficiency of the distribution channel is heavily influenced by logistical requirements, including the need for safe handling of bulk items and rapid response capabilities for replacement orders, particularly for critical areas like operating rooms. Regulatory compliance, encompassing tariffs, customs clearances, and local healthcare procurement guidelines, adds significant friction, especially for cross-border transactions. Manufacturers are increasingly focusing on streamlined inventory management and strategic warehouse placement to minimize lead times. Furthermore, digital channels are gaining traction, allowing customers to visualize and customize ergonomic features online, although the final procurement often requires B2B interaction due to the necessity of installation and large contractual agreements.

Healthcare Facility Stools Market Potential Customers

The primary customers for healthcare facility stools are institutions and professional practices requiring durable, hygienic, and ergonomically sound seating solutions for their clinical and operational staff. Hospitals, both state-owned and private, constitute the largest segment of end-users. Within a hospital setting, diverse departments—ranging from surgery and radiology to laboratories and patient examination rooms—require specialized stools, often leading to large-volume contracts and long-term procurement partnerships. The purchasing criteria for hospitals are heavily influenced by centralized purchasing organizations (CPOs) that prioritize cost efficiency, conformity to rigorous hygiene standards, and proven product longevity to ensure a low total cost of ownership over the product lifecycle.

Beyond hospitals, ambulatory care centers (ASCs) and specialized outpatient clinics represent a rapidly growing customer base. These facilities prioritize mobility, compact design, and ease of relocation, favoring models with advanced casters and lighter materials suitable for high-traffic environments where space is at a premium. Dental practices form another significant niche, requiring highly specialized saddle stools that alleviate pressure on the lower back and shoulders during long procedures, often demanding specific color coordination and upholstery resistant to common dental chemicals and instruments. The rapid global expansion of ASCs due to increasing patient preference for outpatient procedures directly translates into substantial market opportunity for stool manufacturers.

Furthermore, ancillary health sectors, including academic medical research institutions, diagnostic imaging centers, and veterinary hospitals, serve as valuable, albeit secondary, customers. Research laboratories require stable, chemical-resistant stools for technicians working with microscopes or sensitive instruments. Long-term care facilities and nursing homes are also increasing their demand for durable, easy-to-clean step stools and adjustable seating to aid staff during patient handling and non-surgical procedures. Manufacturers must tailor their sales strategies to address the unique buying cycles, quality thresholds, and budgetary constraints inherent to each of these diverse customer segments, emphasizing compliance and ergonomic superiority.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $785 Million |

| Market Forecast in 2033 | $1,155 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BioFit Engineered Products, Midmark Corporation, Brewer Company, Salli Systems, Blickman Industries, Ritter Medical, Lakeside Manufacturing, Inc., Active seating specialists, DentalEZ, AFC Industries, Clinton Industries, Custom Comfort Medical, Dentsply Sirona, Steris Corporation, Invacare Corporation, Stryker Corporation, Herman Miller Healthcare, Steelcase Health, KOKEN MFG. CO., INC., Merivaara. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Healthcare Facility Stools Market Key Technology Landscape

The technology landscape within the Healthcare Facility Stools Market is characterized by continuous refinement in two key areas: sophisticated ergonomic engineering and advancements in material science focused on infection control. Ergonomic technology centers on the development of highly reliable, fine-tuning pneumatic systems that allow clinicians to make precise height adjustments swiftly and silently, critical in surgical environments. Further innovation includes multi-directional adjustment mechanisms that support dynamic seating postures, such as those found in premium saddle stools designed to naturally align the user's spine and pelvis, reducing long-term occupational injury risk. The integration of advanced pressure mapping technology during the design phase ensures even weight distribution across the seating surface, contributing significantly to user comfort during protracted procedures.

Material technology is heavily geared towards combating Hospital-Acquired Infections (HAIs). This involves the mandatory use of medical-grade, non-porous upholstery (often specialized vinyl or polyurethane) that resists absorption and can withstand harsh chemical disinfectants without degradation or cracking. A major technological focus is on seamless construction techniques, eliminating crevices and joints where pathogens can accumulate, thus dramatically improving cleanability. Furthermore, manufacturers are increasingly incorporating antimicrobial additives directly into plastic and vinyl components, providing an inherent layer of protection that inhibits the growth of bacteria, fungi, and mold on the surface of the stool, a significant technological step forward from traditional materials.

Emerging technologies include the integration of Internet of Things (IoT) capabilities into specialized stools. These "smart stools" incorporate sensors to monitor variables such as sitting duration, posture shifts, and weight distribution. This data is leveraged for automated alerts regarding prolonged static posture, which can be crucial for staff welfare programs, and also provides valuable utilization metrics for facilities management, optimizing resource allocation. Another critical technology is the development of ultra-stable caster systems engineered specifically for clinical floors, minimizing noise pollution and ensuring reliable mobility across different surfaces, including those with subtle level changes, crucial for maintaining focus in sensitive environments like operating theaters.

Regional Highlights

The global distribution of the Healthcare Facility Stools Market exhibits significant regional variations in terms of adoption rates, product preferences, and regulatory influence, shaping distinct market dynamics across continents. North America, encompassing the United States and Canada, holds the dominant market share, primarily driven by high expenditure on healthcare infrastructure, mandatory enforcement of ergonomic workplace standards (e.g., OSHA guidelines), and the robust presence of large, well-funded hospital networks and ASCs that prioritize premium, technologically advanced seating solutions. The demand here is characterized by a strong preference for specialty stools—like those designed for dental procedures and microsurgery—which offer integrated features and certified ergonomic designs.

Europe represents a mature market, demonstrating stable growth influenced by public healthcare systems focused intensely on occupational health and safety (OHS) for medical personnel. Countries such as Germany, the UK, and France show high adoption of locally manufactured, high-quality stools compliant with strict European Union directives regarding medical devices and workplace ergonomics. The trend in Europe leans towards sustainable manufacturing practices and products with extended warranties and low lifecycle costs. Furthermore, the strong integration of universal healthcare mandates frequent updates to facility standards, ensuring a consistent replacement cycle for medical furniture, maintaining steady market velocity.

Asia Pacific (APAC) is projected to be the fastest-growing region throughout the forecast period. This exponential growth is fueled by massive infrastructure development projects, increasing accessibility to medical services in populous nations like China and India, and the rising trend of medical tourism that necessitates world-class facility standards. While price sensitivity remains a factor in certain segments, the burgeoning private sector in APAC is rapidly adopting premium ergonomic stools to match Western standards. The Middle East and Africa (MEA) and Latin America (LATAM) markets are emerging, characterized by increasing government investment in public health and a growing need for basic yet durable, hygienic stools, particularly in rapidly expanding urban healthcare centers.

- North America: Market leader; driven by high healthcare spending, stringent ergonomic regulations, high adoption of premium saddle and adjustable stools, and growth in specialty medical centers.

- Europe: Stable growth; focus on occupational health standards, preference for locally sourced, high-durability products, and strong regulatory environment emphasizing EU medical device compliance.

- Asia Pacific (APAC): Highest CAGR; propelled by exponential infrastructure growth (especially in China, India, Southeast Asia), increasing public health expenditure, and expansion of private hospitals catering to medical tourism.

- Latin America (LATAM): Emerging market; driven by urbanization and modernization of healthcare facilities, increased private investment, and focus on basic, durable, and cost-effective seating solutions.

- Middle East and Africa (MEA): Developing market; linked closely to oil revenue and government spending on large-scale hospital projects, with a growing demand for internationally certified medical furniture.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Healthcare Facility Stools Market.- BioFit Engineered Products

- Midmark Corporation

- Brewer Company

- Salli Systems

- Blickman Industries

- Ritter Medical

- Lakeside Manufacturing, Inc.

- Active seating specialists

- DentalEZ

- AFC Industries

- Clinton Industries

- Custom Comfort Medical

- Dentsply Sirona

- Steris Corporation

- Invacare Corporation

- Stryker Corporation

- Herman Miller Healthcare

- Steelcase Health

- KOKEN MFG. CO., INC.

- Merivaara

Frequently Asked Questions

Analyze common user questions about the Healthcare Facility Stools market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand for ergonomic healthcare stools?

The primary driving factor is the increasing recognition of occupational health risks among clinical staff, leading to stricter governmental and institutional mandates for ergonomic equipment. These mandates aim to reduce musculoskeletal disorders associated with long hours of static or repetitive clinical work.

How do saddle stools differ from traditional adjustable stools in clinical settings?

Saddle stools feature a specialized, saddle-shaped seat that encourages an upright posture, naturally aligning the spine and distributing weight more effectively. This contrasts with traditional adjustable stools, which offer height customization but may not provide the same degree of integrated spinal support, making saddle stools preferred for precision tasks like dentistry or surgery.

What materials are essential for stools used in high-infection risk areas?

Stools used in high-infection risk areas must be constructed from non-porous, medical-grade materials such as seamless vinyl, specialized polyurethane, or stainless steel. These materials are chosen for their resistance to aggressive chemical disinfectants and their ability to inhibit microbial growth, ensuring compliance with strict hygiene protocols.

Which geographic region exhibits the fastest growth rate in this market?

The Asia Pacific (APAC) region is forecasted to exhibit the fastest Compound Annual Growth Rate (CAGR). This acceleration is attributed to massive investments in healthcare infrastructure development, rapidly expanding private hospital networks, and increasing accessibility to modern medical facilities across major economies like India and China.

How is AI technology impacting the design and function of medical seating?

AI technology is beginning to impact medical seating through the integration of IoT sensors into 'smart stools.' These systems collect data on user posture and utilization, which AI analyzes to inform next-generation ergonomic designs, optimize asset tracking, and provide predictive maintenance alerts for crucial components like pneumatic lifts.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager