Healthcare Management Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435450 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Healthcare Management Systems Market Size

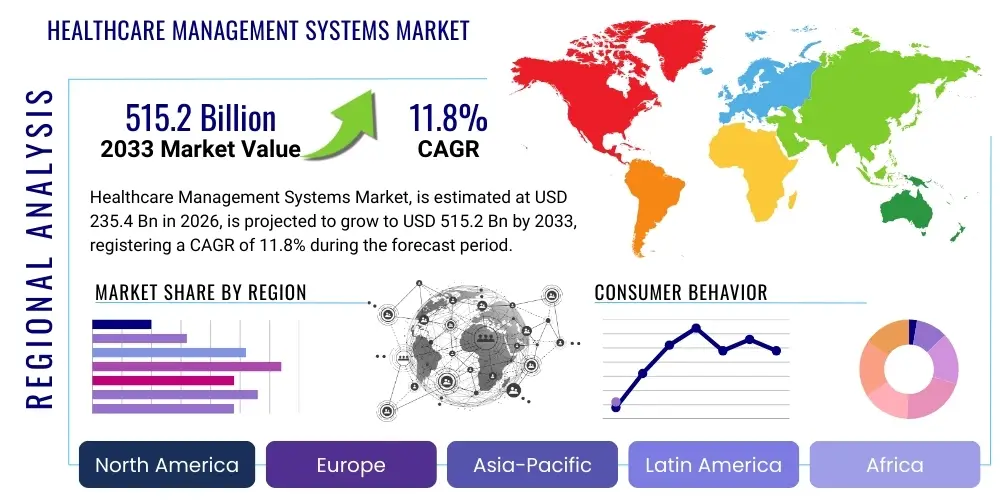

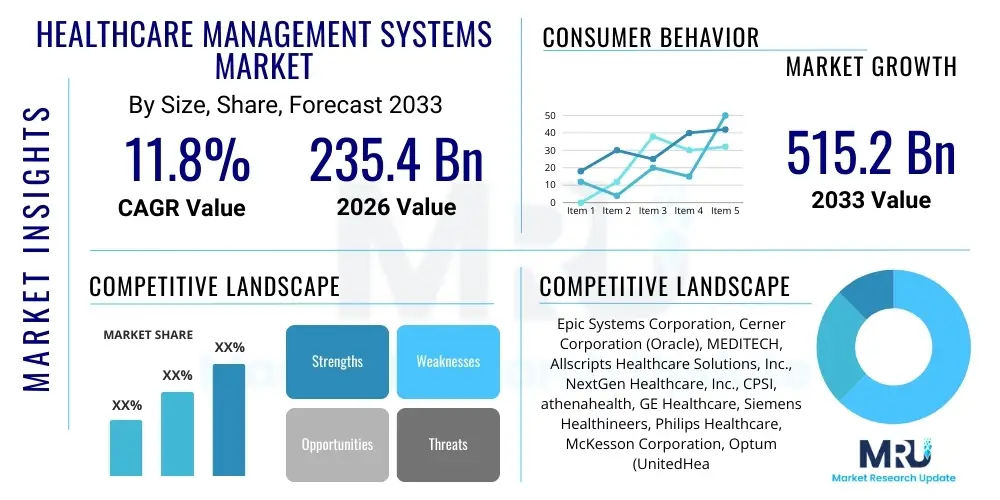

The Healthcare Management Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.8% between 2026 and 2033. The market is estimated at USD 235.4 billion in 2026 and is projected to reach USD 515.2 billion by the end of the forecast period in 2033.

Healthcare Management Systems Market introduction

The Healthcare Management Systems (HMS) Market encompasses integrated IT solutions designed to manage administrative, clinical, and financial operations within healthcare facilities. These systems are crucial for streamlining workflows, enhancing patient care quality, improving operational efficiency, and ensuring regulatory compliance. Key products include Electronic Health Records (EHR) systems, Revenue Cycle Management (RCM) solutions, Practice Management Systems (PMS), and specialized departmental solutions like Laboratory Information Systems (LIS) and Radiology Information Systems (RIS). The foundational goal of HMS adoption is to facilitate the digital transformation of the healthcare industry, moving away from paper-based records toward seamless, interoperable digital environments. This transition supports better data-driven decision-making and enhances communication across the continuum of care, involving providers, payers, and patients.

Major applications of Healthcare Management Systems span hospital operations, ambulatory care services, long-term care facilities, and specialized clinics. EHR systems form the core of clinical applications, providing secure storage and rapid access to patient histories, while RCM solutions optimize the financial cycle from patient registration to final payment processing, significantly reducing leakage and improving claim accuracy. Benefits derived from widespread HMS adoption are manifold, including reduced medical errors due to better data accessibility, cost savings through automated administrative tasks, and superior patient engagement facilitated by patient portals and digital communication tools. Furthermore, HMS solutions are indispensable for adhering to complex mandates such as HIPAA in the US and GDPR in Europe, ensuring patient data privacy and security, which is a significant factor driving continuous investment in robust, scalable platforms.

Driving factors propelling the robust growth of this market include the global mandate for digitized health records, increasing government initiatives promoting eHealth and mHealth platforms, and the surging need to manage massive volumes of clinical data efficiently, often termed 'big data in healthcare.' The shift toward value-based care models, which necessitate accurate performance measurement and reporting, further accelerates the demand for sophisticated analytic capabilities integrated within HMS. Moreover, the rapid proliferation of telehealth and remote patient monitoring services requires a centralized management system that can securely integrate data from disparate sources, making cloud-based and mobile-enabled HMS solutions the preferred choice for modern healthcare organizations seeking enhanced flexibility and scalability.

Healthcare Management Systems Market Executive Summary

The Healthcare Management Systems (HMS) market is undergoing rapid evolution, characterized by a fundamental shift towards cloud-based deployments and sophisticated interoperable platforms that support integrated care delivery. Current business trends show a strong emphasis on mergers and acquisitions among established vendors to consolidate market share and acquire specialized technology, particularly in areas like AI-driven predictive analytics and advanced RCM capabilities. The COVID-19 pandemic significantly accelerated the adoption curve for telehealth and remote patient monitoring, permanently increasing the requirement for flexible, scalable HMS architectures. Providers are increasingly seeking solutions that offer comprehensive clinical and financial integration, moving away from fragmented, departmental-specific systems towards unified enterprise platforms that optimize the entire patient journey and institutional performance.

Regionally, North America maintains the dominant market share, primarily due to the stringent regulatory landscape mandating EHR adoption, high levels of healthcare IT expenditure, and the presence of numerous key market players innovating advanced solutions. However, the Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR), fueled by expanding healthcare infrastructure in developing economies like India and China, increasing governmental focus on digital health initiatives, and rising awareness regarding the benefits of centralized patient data management. European countries are also showing steady growth, driven by investments in national eHealth infrastructure projects and efforts to harmonize patient data standards across the European Union, necessitating robust cross-border HMS interoperability.

Segment trends highlight the continued dominance of the Electronic Health Records (EHR) segment within the component type category, as EHR forms the core backbone of digital clinical operations. The deployment segment is witnessing a pronounced shift towards cloud-based solutions, which offer lower capital expenditure, easier maintenance, and enhanced accessibility compared to traditional on-premise systems, making them particularly attractive to smaller clinics and ambulatory centers. Furthermore, the end-user segment is being led by hospitals and integrated delivery networks (IDNs), which have the greatest need for large-scale enterprise solutions to manage complex patient populations and multiple service locations. Analytics and business intelligence modules, often bundled within HMS platforms, are becoming critical segments due to the growing demand for population health management and value-based care reporting.

AI Impact Analysis on Healthcare Management Systems Market

Common user questions regarding AI’s influence on the Healthcare Management Systems market revolve primarily around three core themes: the potential for AI to dramatically enhance clinical decision support and diagnostic accuracy; the practical concerns surrounding data privacy, algorithmic bias, and security when integrating AI into sensitive patient data systems; and the expectation that AI will automate complex administrative tasks like coding, billing, and scheduling, leading to significant operational cost reduction. Users frequently inquire about the reliability of AI models in diverse clinical settings and the required infrastructure changes necessary for seamless integration with existing legacy HMS platforms. The key expectation is that AI will transform HMS from mere record-keeping systems into proactive, predictive tools capable of forecasting patient health risks and optimizing resource allocation within the hospital environment.

The integration of Artificial Intelligence and Machine Learning (ML) technologies is fundamentally reshaping the capabilities and value proposition of Healthcare Management Systems. AI algorithms are increasingly being embedded into RCM modules to predict payment delays, automate complex medical coding, and identify potential claim denials before submission, thereby maximizing revenue integrity. In the clinical sphere, AI augments EHR systems by providing sophisticated clinical decision support (CDS) alerts based on real-time data analysis, assisting physicians in drug interaction monitoring, personalized treatment planning, and early detection of deteriorating patient conditions, moving healthcare toward highly predictive and personalized service delivery models. This adoption necessitates HMS vendors to focus heavily on creating APIs and interfaces that allow third-party AI models to securely interact with core patient data.

This technological shift is not without challenges. Ensuring the explainability and transparency of AI decisions (XAI) within clinical settings remains a major concern, as healthcare professionals need to trust and understand the outputs generated by these complex models before relying on them for patient treatment. Furthermore, the sheer volume and variability of data required to train effective healthcare AI models demand robust data governance frameworks within HMS to ensure quality and compliance. Despite these hurdles, AI integration is expected to drive significant market growth by offering unparalleled efficiencies, turning raw patient data into actionable intelligence, and enabling HMS platforms to evolve into smart, self-optimizing ecosystems that cater directly to the strategic priorities of modern healthcare organizations, including lowering costs and improving patient outcomes.

- AI-powered Clinical Decision Support (CDS) enhances diagnostic accuracy and reduces medical errors.

- Automation of Revenue Cycle Management (RCM) tasks, including coding, claims submission, and denial management.

- Integration of predictive analytics within EHR for forecasting patient deterioration and managing chronic diseases.

- Requirement for enhanced data security and governance protocols (explainability and bias mitigation).

- Optimization of hospital resource allocation, scheduling, and bed management through operational AI.

DRO & Impact Forces Of Healthcare Management Systems Market

The Healthcare Management Systems (HMS) market is driven by compelling factors centered on efficiency, compliance, and clinical quality, while facing significant resistance related to implementation complexity and security risks. A primary driver is the global mandate for digital records and interoperability, exemplified by initiatives like the 21st Century Cures Act in the US, which forces providers to adopt systems capable of seamless data exchange. This is coupled with the immense opportunities arising from the shift to value-based care, where HMS provides the essential tools for performance tracking, outcome reporting, and population health management, allowing providers to thrive under new payment models. However, the high initial capital investment required for large-scale enterprise HMS implementation, compounded by the steep learning curve for staff and resistance to change, acts as a substantial restraint, particularly for smaller facilities or those in resource-constrained environments.

Key impact forces shaping the competitive landscape include technological advancements, particularly the widespread migration to cloud-based platforms and the integration of emerging technologies like blockchain for secure data exchange, significantly influencing vendors' product roadmaps. Restraints also include perpetual concerns over data privacy breaches and cybersecurity threats, which compel providers to invest heavily in resilient security features, increasing the total cost of ownership (TCO) for HMS solutions. Despite these challenges, the market opportunity is vast, fueled by the expansion into untapped emerging markets in Asia and Latin America, where digitalization of healthcare systems is still in nascent stages, and the increasing demand for specialized software catering to fields like precision medicine and genomics, requiring tailored HMS modules for complex data management.

The impact forces determine the speed and direction of market growth. Policy and regulatory impact forces, such as government incentives for certified EHR use or new data sharing requirements, provide powerful accelerants for adoption. Economically, the need to reduce escalating healthcare costs globally drives the demand for efficiency-enhancing HMS tools like sophisticated RCM and supply chain management modules. The competitive environment is characterized by large, established vendors battling disruptive startups specializing in modular, AI-driven solutions. Successfully navigating the restraints, such as developing user-friendly interfaces to overcome training resistance and ensuring airtight security, will be critical for vendors aiming for long-term market leadership and sustained growth in this highly dynamic sector.

Segmentation Analysis

The Healthcare Management Systems market is broadly segmented based on Component Type, Deployment Mode, System Type, and End-User, reflecting the diverse needs of the global healthcare ecosystem. Component analysis distinguishes between the core software solutions (EHR, RCM, PMS), hardware (servers, network equipment), and accompanying services (implementation, training, maintenance). Deployment modes are shifting rapidly from traditional on-premise installations to highly scalable, cost-effective cloud-based and web-based platforms. System types delineate between clinical solutions (EHR, CPOE) and non-clinical/administrative solutions (RCM, SCM, BI), recognizing the integrated nature of modern healthcare operations. Finally, end-users include hospitals, ambulatory care centers, diagnostic laboratories, and payers, each demanding tailored functionalities to manage their unique operational complexities and regulatory compliance requirements.

- Component Type: Software, Hardware, Services.

- Deployment Mode: On-Premise, Cloud-Based, Web-Based.

- System Type: Clinical Solutions (EHR, CPOE, PACS), Non-Clinical/Administrative Solutions (RCM, SCM, HCM, BI).

- End-User: Hospitals, Ambulatory Care Centers, Diagnostic Laboratories, Payers, Pharmacies.

Value Chain Analysis For Healthcare Management Systems Market

The value chain for the Healthcare Management Systems market begins with upstream activities dominated by core technology providers, including software developers specializing in database management, application programming interfaces (APIs), and cybersecurity platforms, alongside infrastructure vendors supplying cloud services (AWS, Azure, Google Cloud). Research and development activities in this segment focus heavily on developing advanced interoperability standards (like FHIR), integrating AI/ML capabilities, and ensuring compliance with rapidly changing global health regulations. The ability of upstream providers to deliver scalable, secure, and user-friendly foundational technology directly impacts the quality and flexibility of the final HMS product, establishing them as critical enablers for innovation within the market.

Midstream activities involve the core HMS vendors, who integrate the foundational technology and software components to design, develop, and market comprehensive enterprise solutions. This stage includes intensive product customization, rigorous testing, system integration, and critical implementation services. Distribution channels are varied, incorporating direct sales models for large hospital systems and Integrated Delivery Networks (IDNs) which require bespoke solutions and long-term consulting. Indirect distribution often relies on strategic partnerships with local IT consultants, system integrators, and value-added resellers (VARs) who can provide localized support, particularly in regional or international markets where local regulatory knowledge is paramount for successful system deployment and adoption.

Downstream analysis focuses on the end-users—the healthcare providers and payers—who implement and utilize these systems. Hospitals and large health networks represent the major buyers, requiring complex enterprise-wide EHR and RCM solutions. Ambulatory centers and smaller clinics often prefer modular, cloud-based practice management and electronic medical record (EMR) systems due to lower infrastructure demands. The final stage involves extensive post-implementation support, maintenance, and regular updates to ensure system security and functionality evolve with technological progress and regulatory changes. The effectiveness of the HMS system is ultimately measured by its ability to improve patient safety, streamline clinical documentation, and optimize the financial health of the adopting organization, thereby closing the loop of the value chain through demonstrated clinical and economic outcomes.

Healthcare Management Systems Market Potential Customers

The primary purchasers and beneficiaries of Healthcare Management Systems are large institutional providers, primarily hospitals and Integrated Delivery Networks (IDNs), which require comprehensive, enterprise-level solutions to manage complex, multi-site operations and vast patient data volumes. These organizations are driven by the necessity for clinical integration, efficient resource utilization, and meeting quality metrics related to value-based care. The significant financial investments required for these systems mean that IDNs and major academic medical centers constitute the largest revenue stream for HMS vendors, demanding high-level security, interoperability with existing technologies, and advanced analytics capabilities tailored for population health management.

The second major segment includes Ambulatory Care Centers (ACCs), physician practices, and specialized clinics. These users often prioritize easy-to-use, scalable, and cost-effective solutions, preferring cloud-based deployment models that minimize internal IT overhead. Their needs typically focus on Practice Management Systems (PMS), specialized Electronic Medical Records (EMR) for specific disciplines, and patient engagement tools. As the industry shifts toward outpatient care, the importance of this segment is rapidly increasing, driving demand for modular, discipline-specific HMS features that facilitate efficient workflow within a high-throughput, non-hospital setting.

A growing segment of potential customers includes Payers (insurance companies), government health agencies, and pharmaceutical companies. Payers utilize HMS-related data analytics and systems for claims processing, fraud detection, risk management, and population health initiatives, often requiring specialized modules that interface directly with provider data. Government health bodies adopt large-scale HMS for national health information exchange (HIE) projects and public health monitoring, emphasizing security, scalability, and standardized data reporting formats. These diverse customer groups illustrate the broad applicability of HMS technology beyond the traditional hospital setting, extending its reach across the entire healthcare continuum to support administrative, financial, and public health objectives.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 235.4 Billion |

| Market Forecast in 2033 | USD 515.2 Billion |

| Growth Rate | 11.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Epic Systems Corporation, Cerner Corporation (Oracle), MEDITECH, Allscripts Healthcare Solutions, Inc., NextGen Healthcare, Inc., CPSI, athenahealth, GE Healthcare, Siemens Healthineers, Philips Healthcare, McKesson Corporation, Optum (UnitedHealth Group), Microsoft Corporation, Salesforce (Veeva Systems), Greenway Health, L.L.C., Infor Inc., Cognizant, Wipro Limited, Hyland Software, eClinicalWorks. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Healthcare Management Systems Market Key Technology Landscape

The technology landscape of the Healthcare Management Systems market is rapidly transforming, moving beyond conventional server-based systems to highly resilient and interconnected platforms. Cloud computing technology stands as the most critical infrastructure driver, offering scalability, disaster recovery capabilities, and enhanced accessibility essential for distributed care models like telehealth and remote monitoring. Major HMS vendors are aggressively transitioning their legacy software suites to SaaS (Software as a Service) models, facilitating easier maintenance, automatic updates, and significantly reduced capital expenditure for end-users. Furthermore, the adoption of Fast Healthcare Interoperability Resources (FHIR) standards is pivotal, ensuring seamless and secure exchange of clinical and administrative data between disparate HMS, provider organizations, and national health information exchanges, addressing the long-standing challenge of data siloes.

Beyond cloud and interoperability standards, emerging technologies are defining the next generation of HMS capabilities. Artificial Intelligence (AI) and Machine Learning (ML) are being integrated at the core level to perform functions such as predictive analytics for identifying high-risk patients, automating complex administrative tasks like prior authorizations, and enhancing cybersecurity monitoring. Another significant trend is the utilization of Application Programming Interfaces (APIs), which are crucial for developing modular HMS environments. Modern healthcare organizations require specialized tools that integrate smoothly with their core EHR, and robust APIs enable rapid integration of third-party specialty modules, patient engagement platforms, and consumer health applications, creating a customized digital ecosystem.

Blockchain technology, while still nascent, holds substantial promise in specific areas of the HMS market, primarily related to securing patient medical records and managing supply chain logistics. Distributed ledger technology offers an immutable and transparent way to record data transactions, which can significantly enhance data security, streamline clinical trial data management, and improve the accuracy of credentialing for healthcare professionals. Lastly, the ubiquitous nature of mobile technology necessitates that all modern HMS offerings feature robust mobile access capabilities, enabling clinicians to access and input data securely via tablets and smartphones at the point of care, thereby improving workflow efficiency and ensuring data timeliness across the entire operational footprint of the healthcare organization.

Regional Highlights

The global Healthcare Management Systems market exhibits distinct growth patterns and maturity levels across major geographic regions. North America currently dominates the market, primarily driven by strong government incentives (such as Meaningful Use initiatives), high IT adoption rates in healthcare facilities, and the presence of leading HMS vendors. The necessity for advanced RCM solutions due to complex insurance structures and the rapid integration of telehealth services post-pandemic further solidify the region's leading position. The United States, in particular, allocates significant healthcare expenditure to digital solutions, maintaining the largest market share.

Europe represents the second-largest market, characterized by government-led eHealth initiatives aimed at creating integrated national health information infrastructures. Countries like the United Kingdom (NHS digitalization), Germany, and France are major investors, focusing heavily on interoperability and data privacy compliance (GDPR). The market growth is stable, though sometimes slower than North America, due to varied regulatory standards across member states and complex public procurement processes for large-scale IT projects. The emphasis here is on longitudinal patient record management and cross-border data exchange systems.

The Asia Pacific (APAC) region is forecasted to be the fastest-growing market globally throughout the forecast period. This rapid expansion is attributed to massive investments in healthcare infrastructure development, rising medical tourism, increasing government focus on mandatory EHR adoption (especially in populous nations like India and China), and a growing middle class demanding higher quality, digitized healthcare services. Low implementation costs and the immediate adoption of cloud technology bypass some of the legacy system issues faced by Western markets. Latin America and the Middle East and Africa (MEA) are also emerging as high-potential markets, driven by urbanization and the need to modernize outdated healthcare IT infrastructure, particularly through low-cost, mobile-first HMS solutions.

- North America: Market leader; driven by stringent regulatory mandates, high healthcare IT spending, and advanced RCM adoption.

- Europe: Steady growth; focusing on national eHealth records, GDPR compliance, and regional harmonization of patient data standards.

- Asia Pacific (APAC): Highest CAGR; propelled by infrastructure expansion, government digital health initiatives, and rapid cloud adoption in China and India.

- Latin America (LATAM): Emerging market potential; driven by the need for healthcare modernization and increasing private sector investment in IT.

- Middle East and Africa (MEA): Growth tied to urbanization, establishment of specialized medical cities, and IT investment in countries like Saudi Arabia and UAE.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Healthcare Management Systems Market.- Epic Systems Corporation

- Cerner Corporation (Oracle)

- MEDITECH

- Allscripts Healthcare Solutions, Inc.

- NextGen Healthcare, Inc.

- CPSI (Computer Programs and Systems, Inc.)

- athenahealth

- GE Healthcare

- Siemens Healthineers

- Philips Healthcare

- McKesson Corporation

- Optum (UnitedHealth Group)

- Microsoft Corporation

- Salesforce (Veeva Systems)

- Greenway Health, L.L.C.

- Infor Inc.

- Cognizant

- Wipro Limited

- Hyland Software

- eClinicalWorks

Frequently Asked Questions

Analyze common user questions about the Healthcare Management Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver for the growth of the Healthcare Management Systems market?

The primary driver is the accelerating global mandate for the digitalization of health records and the regulatory shift toward value-based care models, which necessitates sophisticated IT systems for performance measurement, outcome reporting, and enhanced clinical documentation accuracy.

How is cloud technology influencing HMS deployment?

Cloud technology is rapidly becoming the preferred deployment mode, particularly for ambulatory centers and mid-sized hospitals, due to its ability to offer reduced operational costs, enhanced scalability, automatic updates, and crucial support for remote patient monitoring and telehealth services.

What are the biggest challenges faced by the Healthcare Management Systems industry?

Major challenges include ensuring robust data security and mitigating the high risk of cyberattacks, managing complex interoperability standards between disparate systems, and overcoming the significant initial capital investment and training requirements for healthcare staff.

Which region is expected to show the highest growth rate in the HMS market?

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) due to expanding healthcare infrastructure, government-led digital transformation initiatives, and increasing adoption of modern IT solutions in countries like China, India, and Japan.

How does AI contribute to the efficiency of Healthcare Management Systems?

AI significantly enhances HMS efficiency by automating critical administrative functions, such as medical coding and claims processing (RCM automation), providing predictive analytics for operational optimization, and integrating sophisticated clinical decision support directly into Electronic Health Records (EHR).

The comprehensive analysis of the Healthcare Management Systems Market reveals a sector undergoing profound transformation, driven by technological imperatives and regulatory pressures aimed at optimizing patient care delivery and ensuring financial sustainability for healthcare organizations globally. The transition to highly interoperable, cloud-based architectures is redefining competitive advantages, placing a premium on vendors who can deliver integrated solutions encompassing clinical excellence, robust financial management, and advanced data analytics. Market maturity varies significantly by region, with North America leading innovation adoption and APAC exhibiting the most aggressive growth trajectory, reflecting global commitment to digitized healthcare infrastructure development. The persistent influence of AI and machine learning will continue to augment the capabilities of these systems, turning static records into dynamic, predictive tools essential for navigating the complex future of medical services.

Future projections indicate that success in the HMS market will hinge on resolving critical concerns related to data governance, algorithmic transparency, and seamless integration across the continuum of care. As value-based models replace fee-for-service, the demand for precise, real-time performance tracking tools embedded within HMS platforms will intensify. Strategic investments in specialized modules catering to genomics, precision medicine, and population health management are expected to drive niche market expansion. Furthermore, cybersecurity and resilience against breaches will remain paramount, requiring continuous vendor innovation in protective measures. The ability of vendors to simplify user interfaces and reduce implementation complexity will be key determinants of adoption rates, especially in smaller ambulatory settings. The convergence of consumer digital health tools with enterprise HMS represents a growing area of focus, promoting greater patient engagement and self-management of chronic conditions through centralized digital records.

The competitive landscape is marked by strategic maneuvering, including mergers, acquisitions, and extensive strategic partnerships, designed to broaden product portfolios and geographic reach. Major players are increasingly focusing on vertical integration, offering end-to-end solutions that cover everything from patient acquisition to final billing. Disruptive entrants, particularly those leveraging open-source technologies and modular API frameworks, are challenging the dominance of traditional enterprise vendors by offering flexible, specialized solutions. The overall market trajectory confirms a sustained double-digit growth rate, underpinned by the indispensable role of HMS in modern healthcare infrastructure. Regulatory bodies worldwide are expected to continue pushing for greater interoperability and data transparency, securing the long-term necessity and evolution of robust Healthcare Management Systems.

This report highlights the foundational shifts impacting the sector, noting that capital expenditure allocation is increasingly favoring strategic IT upgrades over purely physical infrastructure expansion in mature markets. For investors and stakeholders, the key takeaway is the non-optional nature of digital transformation; robust HMS is no longer a competitive advantage but a foundational requirement for operational viability and regulatory compliance. The long-term growth prospects are highly favorable, driven by demographic changes (aging populations), the rise of chronic diseases requiring persistent digital monitoring, and the ongoing quest for cost efficiencies in global healthcare delivery systems. Successful market penetration relies on providing scalable, secure, and technologically advanced solutions that can adapt quickly to evolving clinical workflows and regulatory environments.

The analysis of the Value Chain reveals that differentiation often occurs at the service layer, where specialized consulting, implementation support, and system optimization services provide significant value beyond the core software product. Upstream innovation in cloud native architecture and interoperability standards, particularly FHIR, ensures system longevity and flexibility. Downstream user adoption is heavily influenced by the ease of integration into existing clinical processes and the immediate impact on documentation burden for clinicians. Furthermore, the role of data standardization bodies and health information exchanges (HIEs) is gaining prominence, acting as critical intermediaries that facilitate the large-scale transfer and utilization of patient data, thereby enhancing the functional value of centralized HMS installations. The market’s future is intrinsically linked to overcoming the data siloing issue through technology and policy alignment.

Considering the regional dynamics, the rapid infrastructure build-out in APAC presents unique opportunities for vendors specializing in highly adaptable, less resource-intensive systems designed for diverse cultural and linguistic environments. In contrast, North American vendors must continually focus on compliance and enhancing complex RCM functionalities to address sophisticated billing requirements. The ongoing threat of cybersecurity breaches requires vendors to position their solutions not just as efficiency tools but as critical defense mechanisms against unauthorized data access, making embedded security features a major purchasing criterion. The influence of large technology firms (such as Google, Amazon, and Microsoft) entering the healthcare space as infrastructure and AI providers further pressurizes traditional HMS vendors to innovate or collaborate, reshaping the competitive equilibrium.

The market for non-clinical solutions, especially Revenue Cycle Management (RCM) and Business Intelligence (BI) platforms, is experiencing accelerated growth as providers prioritize financial health and operational optimization. These systems leverage data collected via EHRs to identify revenue leakage, improve coding accuracy, and forecast financial performance, directly linking technological investment to tangible economic return. This growing complexity requires HMS solutions to incorporate sophisticated machine learning models capable of handling massive transactional volumes and regulatory changes in real time. The integration of workforce management modules within HMS is also gaining traction, addressing the significant operational challenge of physician and nurse burnout by streamlining scheduling and administrative duties, proving the systems' impact extends far beyond pure patient records management.

In summary, the Healthcare Management Systems market is positioned for robust, sustained expansion, fundamentally driven by the global imperative to utilize digital technology for better, more affordable healthcare. Key investment areas for the next decade will focus on AI integration, comprehensive cloud migration, and achieving true enterprise-wide interoperability. The market analysis underscores that vendors who successfully combine clinical utility with robust financial and administrative functionality, while maintaining stringent security protocols, will be best placed to capture the projected USD 515.2 billion market value by 2033, serving as indispensable partners in the ongoing transformation of global healthcare delivery.

The market’s strong reliance on regulatory frameworks means that government decisions on interoperability standards, data sharing mandates, and incentive programs will continue to dictate short-term adoption cycles. For example, the regulatory push for price transparency and open APIs in the US market is creating new demands for HMS features that integrate seamlessly with consumer-facing tools. This trend reinforces the necessity for vendors to offer highly flexible platforms rather than monolithic closed systems. The increasing prevalence of chronic conditions further demands robust population health management tools integrated within the core HMS, enabling proactive care coordination, risk stratification, and patient engagement at scale, moving the focus from treating illness to maintaining wellness. The market's structural evolution reflects a clear movement towards integrated, patient-centric ecosystems supported by advanced analytics.

The differentiation strategy for mid-tier vendors often involves specializing in niche segments, such as mental health systems, dental management, or long-term care facilities, where the specific clinical and regulatory needs are unmet by large enterprise-wide solutions. This specialization allows for deep functional expertise and customized workflows, providing a strong value proposition to focused end-user segments. Furthermore, the global shortage of skilled healthcare IT professionals is influencing vendor strategies, leading to greater emphasis on systems that are intuitive, require minimal customization post-installation, and include integrated self-help or AI-driven troubleshooting tools. This focus on reducing the implementation burden and total cost of ownership is particularly crucial for attracting clients in emerging markets with limited IT resources. The continued evolution of the HMS platform into a foundational digital utility is undeniable, driving stable long-term growth across all geographical and segment boundaries.

Investment trends highlight a preference for companies focusing on disruptive AI applications, particularly those demonstrating measurable improvements in clinical outcomes or significant reductions in RCM cycle times. Private equity and venture capital funds are heavily backing startups that develop modular, API-first solutions designed to integrate seamlessly with existing legacy EHR systems, offering specific functionalities without requiring a complete overhaul of the client's established infrastructure. This 'best-of-breed' approach, facilitated by modern interoperability standards like FHIR, is gaining traction over traditional single-vendor enterprise purchases. The competitive dynamic is therefore shifting towards ecosystem building and strategic partnerships, rather than simple product competition. Successfully navigating the regulatory complexity and maintaining state-of-the-art cybersecurity compliance are prerequisites for sustained market relevance, positioning security and privacy features as competitive differentiators in procurement decisions.

The evolution of patient expectations also significantly influences HMS development. Modern patients, accustomed to digital services in other sectors, demand user-friendly patient portals, mobile access to medical records, and integrated communication tools (e.g., secure messaging with providers). HMS vendors must continually invest in consumer-facing technologies to enhance the patient experience and satisfy regulatory requirements for patient data access. The growing importance of interoperability ensures that patient data can follow them across different providers and settings, supporting coordinated care. This necessitates that core EHR vendors dedicate substantial R&D resources to developing robust APIs and participating actively in regional and national Health Information Exchanges (HIEs), which are foundational for achieving high-level clinical integration and minimizing redundancy in testing and documentation. These forces ensure that technological advancement remains central to market growth and product differentiation over the forecast period.

The impact of the COVID-19 pandemic catalyzed permanent changes in the HMS landscape, accelerating the adoption of virtual care solutions and emphasizing the need for flexible, resilient IT infrastructure. Providers now require HMS platforms that can pivot rapidly to support large-scale remote consultations, decentralized patient data input, and integrated public health reporting. This shift has cemented the strategic importance of telehealth and remote patient monitoring modules within core HMS offerings, turning them from optional features into essential components. The market analysis confirms that future growth will disproportionately favor systems that are inherently cloud-native, mobile-enabled, and equipped with sophisticated analytics capable of handling real-time data streams from wearable devices and remote monitoring tools, thereby supporting a proactive, rather than reactive, approach to health management across diverse patient populations globally. The long-term outlook remains highly positive, driven by the global consensus on the necessity of digital healthcare transformation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager