Hearing Aid Batteries Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432395 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Hearing Aid Batteries Market Size

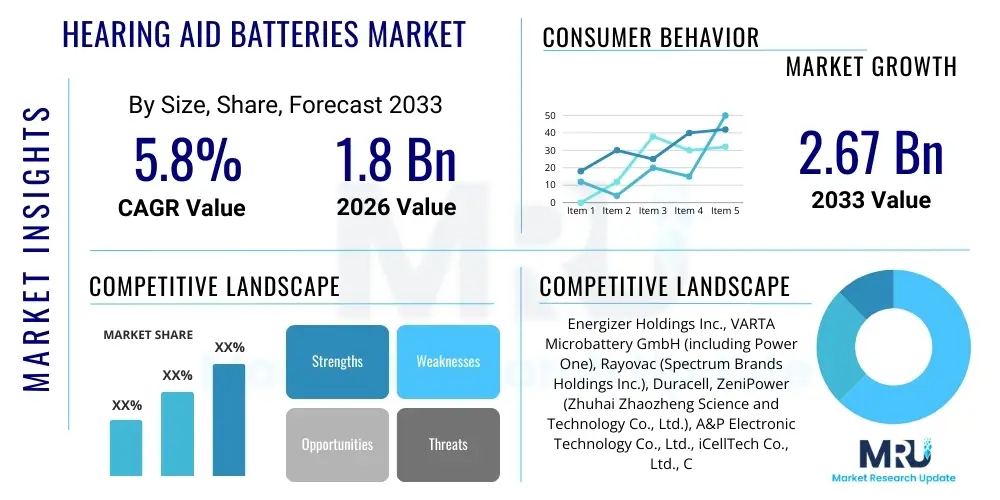

The Hearing Aid Batteries Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 2.67 Billion by the end of the forecast period in 2033.

Hearing Aid Batteries Market introduction

The Hearing Aid Batteries Market encompasses the global sales of miniature power sources specifically designed for use in hearing devices. These critical components are engineered to deliver stable voltage and high energy density within extremely small form factors, essential for powering sophisticated digital signal processing chips, specialized microphones, and high-fidelity receivers inherent in modern amplification technology. The primary product offering continues to be the zinc-air battery, which dominates the disposable segment due to its superior energy density derived from utilizing atmospheric oxygen as a cathode material, ensuring prolonged operational life necessary for continuous auditory support. This sustained reliance on zinc-air chemistry, standardized into internationally recognized sizes (10, 13, 312, 675), forms the structural backbone of the volume market, catering largely to traditional device users and those prioritizing cost-effectiveness and readily available replacement solutions across global distribution networks.

However, the market is currently undergoing a significant transformation driven by the accelerated adoption of rechargeable lithium-ion cells. This technological shift is fundamentally altering consumer expectations, moving demand away from frequent replacement toward convenience and environmental sustainability. Lithium-ion batteries facilitate advanced features, such as continuous Bluetooth connectivity, integrated telecoil systems, and complex environmental noise cancellation, which require high peak power output and consistent current delivery—capabilities that rechargeable systems handle more efficiently than traditional primary cells. The major applications of these batteries span the entire spectrum of hearing correction, including advanced Behind-The-Ear (BTE), In-The-Ear (ITE), and the cosmetically driven Completely-In-Canal (CIC) devices, each demanding tailored power characteristics based on size constraints and processing loads. The core benefits derived from specialized hearing aid batteries include their exceptional reliability under varying temperatures and humidity, their tailored discharge curves optimized for audiological electronics, and increasingly, their compliance with strict international regulations regarding mercury and heavy metal content.

The driving factors propelling market expansion are deeply rooted in global demographic trends and sustained technological evolution. The most impactful driver is the rapidly aging global population; as life expectancy increases worldwide, the incidence of age-related hearing loss escalates proportionally, creating an ever-expanding pool of potential hearing aid users. Concurrently, heightened consumer awareness, proactive public health campaigns promoting early diagnosis, and the introduction of more aesthetically pleasing and effective hearing devices have lowered the adoption barrier. Furthermore, recent regulatory actions, notably the proliferation of Over-The-Counter (OTC) hearing aids in key markets, are significantly improving accessibility and affordability, thereby broadening the consumer base dramatically and solidifying the market's robust trajectory through the forecast period, necessitating corresponding innovations in miniature power management solutions.

Hearing Aid Batteries Market Executive Summary

The global Hearing Aid Batteries Market is positioned for robust growth, driven primarily by favorable demographic trends and aggressive technological advancements, particularly within the secondary (rechargeable) battery segment. Business trends are characterized by fierce competition among key manufacturers focusing on improving energy density and reducing the environmental footprint of their products. Manufacturers are strategically investing heavily in research and development to address the increasing power requirements imposed by modern digital hearing aids that incorporate features like wireless charging, AI-driven sound processing, and integration with health monitoring sensors. A critical strategic element involves establishing stronger vertical integration, where battery suppliers collaborate closely with audiology device OEMs to customize power cells, ensuring optimal performance and seamless device integration, thus mitigating risks associated with incompatible power sources or premature performance degradation in high-value products.

Regional trends continue to underscore the dominance of established healthcare markets in North America and Europe, which together account for the majority of current market value due to mature adoption rates, comprehensive insurance coverage, and high consumer awareness. However, the future growth narrative is heavily weighted toward the Asia Pacific region, which is projected to achieve the highest CAGR, propelled by expanding middle-class populations, increased healthcare access, and large, aging demographics in countries like China and India. This regional shift mandates that global manufacturers adapt their distribution strategies to address both the highly centralized clinical model prevalent in Western markets and the rapidly expanding retail and online channels gaining prominence in Asian economies, often prioritizing mass-market, cost-effective disposable solutions while simultaneously seeding the market with premium rechargeable options.

Segment trends decisively indicate a foundational duality in the market structure. While the disposable segment, dominated by mercury-free zinc-air batteries in Size 312 and 13, continues to command the largest market volume due to replacement cycles, the rechargeable battery type is capturing disproportionately high value share and demonstrating superior growth rates. This dynamic is directly linked to the higher average selling price (ASP) of rechargeable-compatible hearing aids and the integrated nature of lithium-ion power solutions, which are less frequently replaced than primary cells. The distribution channel analysis highlights the increasing role of e-commerce platforms, offering competitive pricing and convenience for bulk purchasers of disposable batteries, yet audiology clinics remain essential for the initial supply and professional counsel, particularly regarding the specification and maintenance of high-end rechargeable devices and specialized power needs such as those for cochlear implants.

AI Impact Analysis on Hearing Aid Batteries Market

Analysis of common user questions regarding the interaction between Artificial Intelligence and the Hearing Aid Batteries Market reveals a central concern about energy optimization versus feature enhancement. Users frequently ask: Will the powerful AI chips needed for sophisticated environmental analysis and directional audio processing drain my battery faster? How can AI actually help my battery last longer? There is a significant user expectation that AI should not merely enhance audio processing quality but must also contribute proactively to power conservation. Key industry and consumer discussions center on AI's ability to create highly granular, predictive models of energy consumption based on real-time acoustic input, wireless connectivity status, and user-specific usage profiles. The prevailing sentiment is that AI represents the necessary technological counter-balance to increased hardware processing needs, ensuring battery life remains manageable and predictable for the end-user.

The primary influence of Artificial Intelligence is not within the battery's chemistry, but rather within the Battery Management System (BMS) and the overall device firmware. AI algorithms enable sophisticated power rationing by learning and predicting when high-demand features, such as Bluetooth streaming or complex noise reduction algorithms, are required. For instance, if the AI detects the user is in a quiet, stable environment, it can dynamically throttle back the power allocated to high-performance processing cores. This micro-management of power flow ensures that energy is used only when absolutely necessary, drastically improving the effective runtime of both disposable zinc-air cells and secondary lithium-ion power packs. This intelligent load balancing extends battery life significantly, addressing the industry challenge of integrating powerful digital features within miniaturized form factors that have limited battery capacity.

Furthermore, AI is increasingly being leveraged in the manufacturing quality assurance and supply chain segments. In production, AI-powered computer vision systems analyze hundreds of millions of data points generated during the assembly of complex battery components, instantly identifying microscopic defects or inconsistencies that could lead to premature failure or reduced capacity, ensuring higher quality control standards across large batches. Within the commercial distribution phase, AI-driven analytics can optimize inventory management by predicting demand spikes, ensuring distributors maintain adequate stock of high-demand sizes (like 312) and reducing the risk of expired zinc-air batteries reaching the consumer. This comprehensive application of AI, from predictive power consumption to optimized supply, fundamentally increases the reliability and efficiency of the power ecosystem supporting modern audiological devices.

- AI-driven Power Optimization: Enhances battery life by dynamically managing energy consumption based on environmental audio complexity, optimizing digital signal processing power usage.

- Predictive Maintenance Integration: Algorithms analyze discharge curves in rechargeable units to forecast battery replacement needs, maximizing user uptime and service intervals.

- Manufacturing Quality Control: AI vision systems improve consistency and reliability during miniature battery assembly, minimizing defect rates related to cell sealing and electrode alignment.

- Enhanced Rechargeable Management: AI optimizes specific charging and discharging profiles for Lithium-ion cells, preventing capacity fade and extending the overall cycle life of the power pack.

- Personalized Energy Profiling: Analyzes individual usage patterns (e.g., streaming frequency, hours of use) to inform the design requirements for future battery capacity specifications tailored for high-demand user groups.

- Supply Chain Demand Forecasting: Uses machine learning to predict regional demand for specific battery sizes, optimizing logistics and ensuring fresh stock availability for zinc-air cells.

DRO & Impact Forces Of Hearing Aid Batteries Market

The market environment for Hearing Aid Batteries is shaped by compelling and often contradictory forces defining the DRO (Drivers, Restraints, Opportunities) framework. Key drivers include the overwhelming demographic reality of global population aging, which provides a consistent, non-cyclical demand base for hearing correction. Furthermore, technological leaps in hearing aid miniaturization and performance, coupled with the societal normalization of hearing aid use, encourage higher device adoption rates, thereby escalating the demand for reliable power sources. A significant opportunity lies in the ongoing technological transition towards rechargeable solutions. This allows manufacturers to move away from commodity-based zinc-air pricing towards value-added, integrated power systems, which command premium pricing and create recurring service revenue opportunities associated with specialized charging accessories and replacement rechargeable modules. This shift also aligns strongly with global environmental mandates, providing a strong competitive edge for manufacturers focusing on sustainability.

However, substantial restraints temper the market's full potential. Intense price competition, particularly in the established, high-volume disposable zinc-air segment, continually compresses profit margins, forcing manufacturers to operate with highly streamlined supply chains and massive economies of scale. Technical restraints include the physical limits of increasing energy density in miniature cells without compromising safety, particularly critical for lithium-ion systems intended for devices placed inside the ear canal. Moreover, despite improvements, the inconsistent performance and finite shelf life of zinc-air batteries—often susceptible to premature activation in high humidity—remain a persistent consumer complaint and a technical challenge that manufacturers must constantly mitigate through superior sealing and packaging technologies. Regulatory complexity, specifically adhering to divergent national standards for mercury content and battery disposal across international markets, adds significant compliance costs and logistical hurdles.

The resulting impact forces delineate strategic market direction. Market Pull factors are strong, driven by regulatory changes such as the introduction of Over-The-Counter (OTC) hearing aid categories, which are expected to dramatically expand the consumer base through retail channels, driving immediate volume growth in size 312 and 13 disposable cells. The Technology Push factors center on material science innovation, focusing on developing solid-state electrolytes or enhanced polymer chemistries to achieve next-generation power densities and charging speeds for rechargeable devices. The confluence of these forces indicates that while disposable batteries will remain the volume backbone, the future profitability and technological leadership of the market will increasingly depend on successful innovation and commercialization within the integrated rechargeable power solutions segment, requiring substantial R&D expenditure and strategic intellectual property development.

Segmentation Analysis

The segmentation of the Hearing Aid Batteries Market is crucial for understanding the diverse underlying market dynamics and targeting specific customer needs based on device type, usage patterns, and purchasing preference. Segmenting by battery type clearly delineates the long-established, high-volume disposable market (zinc-air) from the rapidly expanding, high-value rechargeable market (lithium-ion and emerging chemistries), reflecting the technological bifurcation in the industry. Size segmentation (10, 13, 312, 675) is functionally defined by the physical constraints of the hearing aid casing, where smaller, cosmetically appealing devices require tiny cells (Size 10) and larger, more powerful devices require greater capacity (Size 675). The precise market share distribution across these sizes is directly proportional to the global popularity and adoption rate of various hearing aid form factors.

Distribution channel segmentation highlights the pathways through which products reach the end-user, differentiating between professional clinical dispensing, traditional retail pharmacy sales, and modern e-commerce dominance. Audiology clinics retain importance for high-end device sales and initial rechargeable battery supplies, offering expert consultation that justifies higher price points. Conversely, retail stores and online platforms capture the large, recurring replacement market for disposable batteries, competing fiercely on price, bulk packaging, and logistical efficiency. Finally, application segmentation links battery type and size directly to the hearing aid style (BTE, ITE, CIC), allowing manufacturers to tailor packaging and marketing efforts to the specific functional demands of each device category, especially crucial for high-drain cochlear implant batteries which often rely exclusively on Size 675 or custom rechargeable packs.

- By Battery Type:

- Disposable (Primary Zinc-Air): High volume, standardized sizes, low initial cost. Dominates replacement market.

- Rechargeable (Secondary Lithium-ion, other): High growth value, premium segment, integrated systems, focuses on convenience and sustainability.

- By Size:

- Size 10 (Yellow Tab): Used in small Completely-in-Canal (CIC) and mini-Receiver-in-Canal (RIC) aids; lowest capacity.

- Size 13 (Orange Tab): Used in standard Behind-the-Ear (BTE) aids; mid-to-high capacity.

- Size 312 (Brown Tab): Most common size; used in smaller BTE, ITE, and many advanced RIC devices.

- Size 675 (Blue Tab): Highest capacity; utilized for power BTE aids, severe hearing loss, and cochlear implant processors.

- Other Sizes: Including specialized or proprietary rechargeable packs used by select OEMs.

- By Distribution Channel:

- Audiology Clinics & Hospitals: Professional dispensing, high margin, initial supply for new devices, trusted source.

- Retail Stores (Pharmacies, Supermarkets): High volume, essential for impulse and routine replacement purchases of disposable cells.

- Online Stores: Fastest growing channel, competitive pricing, convenience for bulk buying, increasingly important for OTC hearing aid accessory sales.

- By Application:

- Behind-the-Ear (BTE): Uses sizes 13 and 675; often supports higher power demands.

- In-the-Ear (ITE) / In-the-Canal (ITC): Uses sizes 312 and 13; balancing size constraints with moderate power needs.

- Completely-in-Canal (CIC): Primarily uses Size 10; requires extreme miniaturization and careful power management.

- Cochlear Implants and other Hearing Devices: Requires high-capacity Size 675 or specialized, often custom-designed rechargeable packs.

Value Chain Analysis For Hearing Aid Batteries Market

The upstream segment of the Hearing Aid Batteries value chain is highly specialized, demanding rigorous quality control over raw materials. For zinc-air cells, this involves sourcing high-purity electrolytic zinc powder, highly porous air-cathode catalysts, and sophisticated sealing and electrolyte compounds. Manufacturers must secure stable, long-term contracts for these materials, as any inconsistency directly impacts the shelf life and performance stability of the final product. For rechargeable lithium-ion cells, the upstream focus shifts to securing reliable supplies of lithium compounds, graphite, and cathode materials (e.g., NCA or NCM), requiring intense geopolitical awareness and diversified sourcing strategies to mitigate supply chain disruption risk. The manufacturing process itself involves highly automated, precise assembly in controlled environments to prevent contamination, which is paramount for ensuring battery safety and longevity, driving significant capital expenditure in clean room facilities and proprietary cell assembly technologies.

Midstream activities involve the core manufacturing, testing, and packaging phases. Cell manufacturers not only produce the primary cell but also engage in intensive quality testing to meet stringent audiological standards, focusing on discharge characteristics under load and environmental stability. Packaging is a critical differentiation point, particularly for zinc-air batteries, which require specialized blister packs and air-tight seals (the colored tabs) to prevent premature activation. Branding and regulatory compliance—ensuring adherence to standards like IEC 60086-2 for primary cells and various UN/IATA transport regulations for lithium-ion—add complexity and necessary layers of verification before the product moves to distribution. Innovation at this stage includes incorporating proprietary material coatings to enhance capacity retention and improve high-drain performance needed for wireless communication features.

The downstream segment covers distribution and end-user engagement, which are segmented by channel strategy. Direct sales involve long-term contractual agreements where battery companies supply OEMs (e.g., Starkey, Phonak, Oticon) with integrated power solutions, often co-branded or private-labeled, ensuring seamless compatibility and a controlled user experience. Indirect distribution routes involve wholesalers supplying professional audiology clinics, which serve as crucial educational and dispensing points. The fastest-growing downstream area is the direct-to-consumer online channel, driven by consumer demand for bulk, cost-effective replacement packs, leveraging efficient logistics and SEO-optimized retail listings. Effective management of the downstream channel requires careful inventory rotation to ensure that disposable cells maintain maximum shelf life when purchased by the consumer, directly impacting satisfaction and brand reputation.

Hearing Aid Batteries Market Potential Customers

The primary cohort of potential customers consists of the global population aged 65 and above, which constitutes the demographic most affected by presbycusis and thus represents the largest segment utilizing hearing aids. This segment exhibits constant, non-negotiable demand for replacement power sources. Within this group, customers are highly segmented based on device type: those with traditional, affordable BTE aids typically seek high-volume, reliable zinc-air cells (sizes 13 and 312), prioritizing cost-effectiveness and accessibility. Conversely, older, affluent users opting for the latest technology often represent the core market for rechargeable devices, valuing convenience, integrated charging solutions, and advanced features supported by lithium-ion cells, often purchasing through specialized audiology centers where professional advice is paramount.

Secondary but highly valuable customer segments include younger individuals and children who rely on high-power devices, such as cochlear implants or powerful BTE aids, often necessitating the largest Size 675 batteries or robust proprietary rechargeable systems. These customers prioritize performance stability and durability, given the critical function of the devices in education and communication. Additionally, B2B customers form a cornerstone of the market. This includes thousands of independent and chain audiology clinics that stock inventory for immediate dispensing, large governmental healthcare providers (e.g., veteran administrations) purchasing through tender processes, and increasingly, major retail chains (pharmacies, big-box stores) that serve as the retail front for the exploding OTC hearing aid market, requiring bulk supply arrangements and sophisticated packaging logistics tailored for mass consumption.

Targeting these diverse customer groups requires a multi-pronged approach. For the clinical segment, manufacturers must emphasize technical reliability, regulatory compliance, and consistent supply, often requiring specialized training for audiologists. For the mass retail and online consumers, the focus shifts to consumer-friendly packaging, clear size coding (color tabs), competitive pricing, and building strong brand trust through clear product claims regarding performance and environmental friendliness (e.g., mercury-free status). The evolution towards self-administered hearing care via OTC devices is creating a new customer segment that is highly price-sensitive but demands simplicity and reliable performance from batteries purchased directly from non-clinical sources, demanding a shift in marketing focus toward consumer education and accessible product data.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 2.67 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Energizer Holdings Inc., VARTA Microbattery GmbH (including Power One), Rayovac (Spectrum Brands Holdings Inc.), Duracell, ZeniPower (Zhuhai Zhaozheng Science and Technology Co., Ltd.), A&P Electronic Technology Co., Ltd., iCellTech Co., Ltd., Camelion Battery, Panasonic Corporation, Sony Corporation, Toshiba Corporation, Renata AG, NEXcell, Microcell Corporation, Global Technology Systems Inc., Eunicell International Battery Co. Ltd., Shandong Huamai Technology Co., Ltd., Shenzhen PKCELL Battery Co. Ltd., Zhongyin (Ningbo) Battery Co., Ltd., Ultralife Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hearing Aid Batteries Market Key Technology Landscape

The core technological landscape of the Hearing Aid Batteries Market is defined by the continual refinement of established zinc-air chemistry alongside the aggressive evolution of rechargeable lithium-ion systems. In the zinc-air domain, innovation focuses heavily on material science to achieve higher intrinsic energy density and consistent power output across the battery's life cycle, crucial for supporting high instantaneous current draw requirements of digital hearing aids. Critical improvements include the development of proprietary, high-surface-area zinc powder formulations, the incorporation of advanced catalysts in the air cathode structure to optimize oxygen exchange, and the deployment of enhanced PTFE membranes to regulate moisture and prevent premature cell dry-out, thereby significantly extending both operational life and non-activated shelf life while strictly maintaining mercury-free compliance mandated globally.

The secondary battery technology segment is dominated by specialized micro-lithium-ion cells, engineered for safety and maximum cycle life (typically aiming for 3 to 5 years of daily use). Technological progress here involves leveraging advanced lithium metal oxide cathodes (like Lithium Cobalt Oxide or Nickel Manganese Cobalt) for high power density and integrating sophisticated, miniature Battery Management Systems (BMS) that are often embedded within the device casing itself. These BMS components are essential for precise thermal management, short-circuit protection, and optimizing charge termination protocols to prevent performance degradation caused by overcharging or deep discharge. Fast-charging capability, allowing for a full day's charge in under three hours, is a major focus area, addressing critical user convenience demands and strengthening the competitive position against disposable alternatives.

Future technological advancements are exploring beyond standard lithium-ion, with significant R&D invested in solid-state battery technology. Solid-state electrolytes promise improved safety profiles (non-flammable) and potentially higher volumetric energy density, enabling further miniaturization of hearing aids without sacrificing runtime. Additionally, customized wireless power transfer and inductive charging technologies are becoming standard, requiring compatible receiver coils and optimized battery chemistry that can efficiently handle rapid, contactless charging protocols. This continuous technological arms race dictates that manufacturers must not only optimize the electrochemical performance but also ensure mechanical robustness to withstand the demanding conditions of daily device use, including resistance to accidental moisture exposure and physical shock, ensuring the power source remains reliable throughout the device's operational tenure.

Regional Highlights

North America's dominance in the Hearing Aid Batteries Market is multifaceted, stemming from high disposable income levels, well-established private and public insurance coverage for hearing devices, and a cultural affinity for adopting the latest technology swiftly. The United States, in particular, drives market innovation, acting as a crucial launchpad for premium rechargeable hearing aids and associated integrated power solutions. The significant recent regulatory liberalization allowing Over-The-Counter (OTC) hearing aid sales has initiated a large-scale market expansion in the low-to-moderate loss segment, leading to surging retail channel demand for standard-sized disposable batteries (especially Size 312). Manufacturers operating here prioritize robust distribution logistics to serve both specialized audiology clinics and the burgeoning mass retail market, focusing on compliance with strict FDA and environmental standards regarding battery safety and composition.

Europe represents a mature market characterized by exceptionally high penetration rates, underpinned by strong government support and subsidized healthcare systems in countries such as Germany, the UK, and France, which often provide financial assistance for battery costs. While traditional zinc-air batteries have long held sway due to accessibility and historical prevalence, the continent is experiencing a rapid structural shift towards rechargeable technologies, heavily influenced by the European Union's ambitious sustainability goals and Waste Electrical and Electronic Equipment (WEEE) directives, which favor low-waste solutions. European manufacturers, particularly VARTA, are key players in rechargeable microbattery innovation, focusing on long cycle life and high-performance cells tailored for sophisticated European-made hearing devices, ensuring the region remains a vital hub for technological development and high-value sales.

The Asia Pacific (APAC) region is forecasted to be the engine of future market growth, primarily driven by demographic momentum. Countries like Japan and South Korea already possess high per-capita adoption rates, similar to Western markets, but the massive, rapidly aging populations of China and India represent immense untapped potential. As healthcare infrastructure and per-capita spending improve, the adoption of hearing aids is accelerating significantly. Currently, the APAC market is highly price-sensitive, translating into a strong preference for affordable disposable zinc-air cells. However, increasing wealth in urban centers is stimulating demand for premium, imported rechargeable devices. Strategic challenges in APAC include navigating fragmented distribution channels and tailoring product packaging and instructions to highly diverse linguistic and cultural environments, requiring localized manufacturing and robust regional partnership strategies to capitalize on the rapid expansion.

- North America: Market leader, driven by high adoption of premium rechargeable technology, robust reimbursement, and regulatory expansion via the OTC hearing aid market, ensuring high volume and value stability.

- Europe: Mature, high-penetration market with substantial governmental support; rapid transition to rechargeable solutions influenced by EU sustainability mandates and strong local battery innovation centers.

- Asia Pacific (APAC): Highest CAGR forecast due to rapid healthcare expansion and vast aging populations in China and India; currently dominated by price-sensitive disposable zinc-air cells, but rechargeable demand is increasing in affluent urban areas.

- Latin America (LATAM): Growth is steady but challenged by economic instability; market concentrates in urban centers (Brazil, Mexico), relying heavily on cost-effective disposable batteries distributed primarily through clinical channels.

- Middle East and Africa (MEA): Nascent market, with significant value concentrated in GCC countries due to high healthcare spending; volume remains small, with reliance on imported products and size 675 for high-power medical devices.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hearing Aid Batteries Market.- Energizer Holdings Inc.

- VARTA Microbattery GmbH (including Power One)

- Rayovac (Spectrum Brands Holdings Inc.)

- Duracell

- ZeniPower (Zhuhai Zhaozheng Science and Technology Co., Ltd.)

- A&P Electronic Technology Co., Ltd.

- iCellTech Co., Ltd.

- Camelion Battery

- Panasonic Corporation

- Sony Corporation

- Toshiba Corporation

- Renata AG

- NEXcell

- Microcell Corporation

- Global Technology Systems Inc.

- Eunicell International Battery Co. Ltd.

- Shandong Huamai Technology Co., Ltd.

- Shenzhen PKCELL Battery Co. Ltd.

- Zhongyin (Ningbo) Battery Co., Ltd.

- Ultralife Corporation

- Hefei Bada Battery Co. Ltd.

- Maxell, Ltd.

Frequently Asked Questions

Analyze common user questions about the Hearing Aid Batteries market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Hearing Aid Batteries Market?

The primary driver is the rapid global increase in the geriatric population, which directly correlates with the rising prevalence of age-related hearing loss (presbycusis) and consequently, higher demand for hearing correction devices and their essential power sources. Additionally, broader access to affordable Over-The-Counter (OTC) devices is fueling market expansion.

Are rechargeable hearing aid batteries replacing traditional zinc-air batteries?

Rechargeable lithium-ion batteries are rapidly gaining market share and value, especially in premium and high-tech hearing aids, due to convenience and sustainability. However, disposable zinc-air batteries remain dominant in terms of high volume sales and are crucial for specific device types, existing user bases, and budget-conscious segments globally.

How does battery size (10, 13, 312, 675) relate to hearing aid type and power demand?

Battery size dictates device compatibility and power capacity. Size 10 is for miniature devices (CIC), Size 312 is the most common for standard BTE/RIC aids, Size 13 provides moderate power, and Size 675 offers the highest capacity, essential for severe loss or cochlear implant processors requiring maximum continuous energy delivery.

What impact does Artificial Intelligence (AI) have on battery performance in modern hearing aids?

AI does not alter the battery chemistry but significantly impacts performance by optimizing the integrated power management system (BMS). AI algorithms dynamically reduce power consumption for digital processing based on ambient noise complexity, effectively extending the device's operational runtime and ensuring stable voltage output for high-demand features.

What are the main technical limitations restraining market growth in the disposable battery segment?

The main technical limitations are the finite shelf life of zinc-air chemistry, which requires careful sealing and packaging, and the inherent volatility of the disposable segment due to intense price competition, alongside environmental concerns regarding waste and recycling complexity for these single-use cells.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Hearing Aid Batteries Market Size Report By Type (312 Type, 675 Type, 13 Type, Other), By Application (Behind-the-ear (BTE) Hearing Aids, In-the-ear (ITE) Hearing Aids, Other), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Hearing Aid Batteries Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Primary Batteries, Secondary Batteries), By Application (Hospital, Household), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager