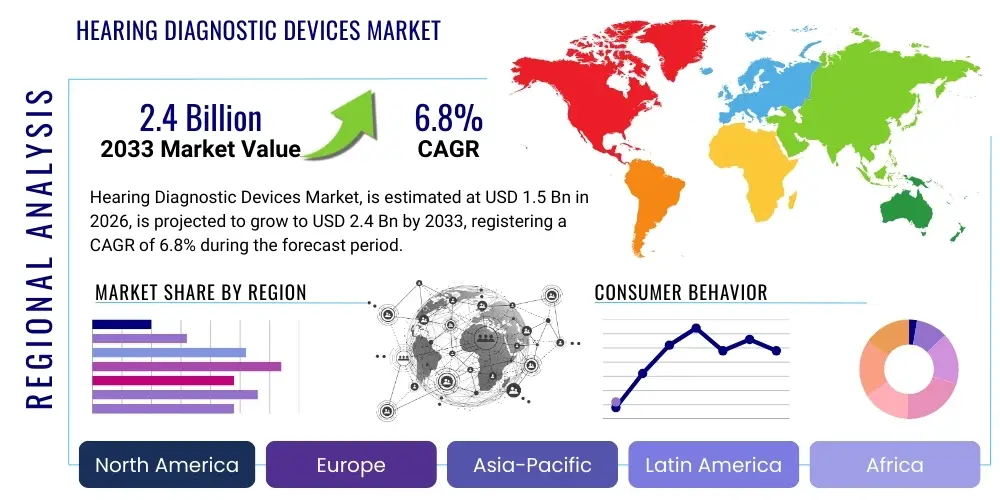

Hearing Diagnostic Devices Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437662 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Hearing Diagnostic Devices Market Size

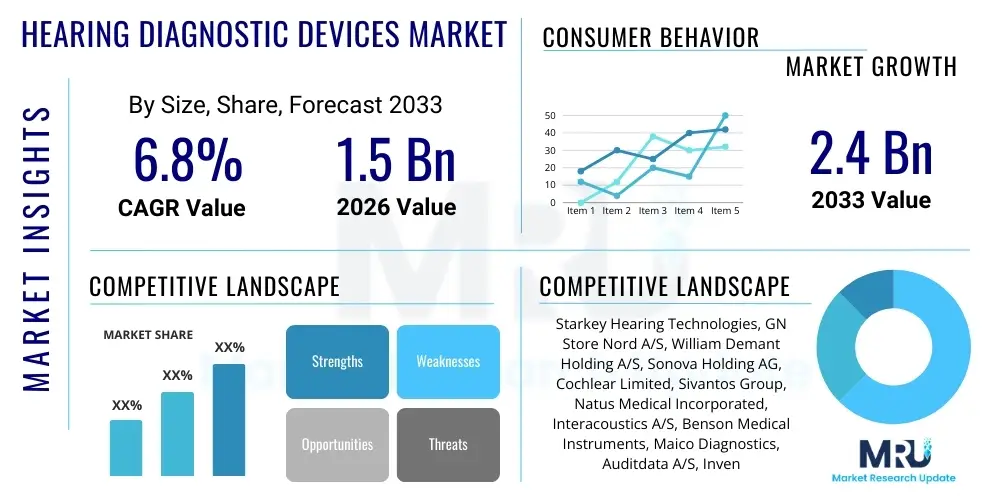

The Hearing Diagnostic Devices Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.4 Billion by the end of the forecast period in 2033. This substantial growth is fundamentally driven by the escalating global prevalence of hearing loss, particularly among the aging population, coupled with increasing governmental mandates and public health initiatives promoting early diagnosis and intervention. The continuous technological advancements in diagnostic equipment, leading to higher accuracy, portability, and ease of use, are further contributing to market expansion, enabling hearing healthcare professionals to conduct comprehensive assessments across various clinical settings efficiently.

Hearing Diagnostic Devices Market introduction

The Hearing Diagnostic Devices Market encompasses instruments and systems utilized for screening, evaluating, and diagnosing various auditory disorders and levels of hearing impairment. These devices are critical tools employed by audiologists, otolaryngologists, and hearing healthcare providers to objectively measure the auditory system's function, ranging from the outer ear to the auditory cortex. Key product segments include advanced audiometers, sophisticated tympanometers, specialized Otoacoustic Emission (OAE) devices, and Auditory Brainstem Response (ABR) systems. The primary applications span newborn hearing screening, occupational health monitoring, clinical diagnostics, and comprehensive audiological assessments for patients across all age groups, ensuring that accurate data is captured to inform subsequent treatment decisions, such as the fitting of hearing aids or surgical interventions.

The core benefit derived from these devices is the facilitation of timely and precise diagnosis, which is crucial for maximizing treatment efficacy and improving the quality of life for individuals suffering from hearing loss. Early identification, particularly in pediatric populations, prevents developmental delays related to speech and language. The market is propelled by several robust driving factors, notably the rising global geriatric demographic—a cohort highly susceptible to age-related hearing deterioration (presbycusis). Moreover, increased noise pollution exposure in urban and industrial environments contributes to noise-induced hearing loss, necessitating regular diagnostic screening. Furthermore, heightened public awareness campaigns and improved insurance coverage for hearing healthcare services in developed economies are substantially accelerating the adoption of these diagnostic technologies across hospital and clinic settings.

Hearing Diagnostic Devices Market Executive Summary

The Hearing Diagnostic Devices Market is experiencing robust expansion, fundamentally underpinned by demographic shifts and technological convergence. Key business trends indicate a strong move toward developing highly portable, wireless, and software-integrated diagnostic solutions that enhance workflow efficiency in diverse clinical and non-clinical environments. Manufacturers are strategically focusing on mergers, acquisitions, and collaborations to integrate advanced sensor technologies and data analytics capabilities into their product offerings, aiming to solidify market position and expand geographical reach, especially in high-growth emerging economies. The competitive landscape is characterized by established global leaders continually innovating in areas like automated diagnostic protocols and remote testing capabilities, responding directly to the growing demand for accessible and convenient hearing healthcare.

Regionally, North America maintains the leading market share, driven by advanced healthcare infrastructure, high awareness levels, and significant R&D investment, though the Asia Pacific (APAC) region is projected to register the fastest CAGR over the forecast period. This rapid growth in APAC is attributed to vast, underserved patient populations, increasing healthcare expenditure, and governmental initiatives focused on establishing comprehensive national hearing screening programs. Segmentally, the Audiometers segment continues to dominate the product type landscape due to its foundational role in standard hearing assessments. Simultaneously, the Portable Devices segment is demonstrating accelerated adoption, particularly favored by outreach programs and smaller clinical practices, reflecting a broader trend towards decentralized healthcare provision.

AI Impact Analysis on Hearing Diagnostic Devices Market

Common user questions regarding AI in hearing diagnostics frequently revolve around the potential for automated screening accuracy, the feasibility of remote diagnosis without specialized technicians, and the ethical implications of using deep learning models for personalized treatment recommendations. Users are keenly interested in how AI can streamline data interpretation—reducing the burden on audiologists—and whether AI-driven algorithms can detect subtle auditory anomalies missed by conventional methods. The collective expectation is that AI will democratize access to hearing diagnostics, making initial assessments faster, more cost-effective, and reproducible, particularly in regions facing significant shortages of skilled healthcare professionals. Key concerns often focus on data privacy, regulatory compliance of AI-powered diagnostic tools, and ensuring algorithms are trained on diverse datasets to prevent diagnostic bias across different patient demographics.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is fundamentally transforming the landscape of hearing diagnostic devices, moving them toward enhanced automation and predictive capabilities. AI algorithms are increasingly being employed to analyze large volumes of audiometric data, including pure-tone thresholds, speech recognition scores, and electrophysiological responses (like ABR and OAE data), enabling rapid and automated interpretation of complex results. This not only significantly reduces the time required for diagnosis but also minimizes inter-examiner variability, thereby improving the consistency and reliability of diagnostic outcomes across different clinical settings. Furthermore, AI facilitates the development of intelligent decision support systems that assist clinicians in differential diagnosis, linking observed symptoms and diagnostic findings to potential underlying etiologies with greater precision than traditional methods.

The strategic application of AI is also paramount in advancing teleaudiology and remote diagnostic services. AI-powered platforms allow patients to undergo preliminary hearing screenings using consumer-grade devices or specialized mobile applications, with the collected data automatically analyzed by sophisticated algorithms to flag potential hearing issues requiring follow-up. This capability extends the reach of diagnostics to geographically isolated or underserved populations. Additionally, AI contributes to the optimization of hearing aid fitting and personalization by predicting optimal settings based on a patient's unique hearing profile, lifestyle, and acoustic environments, moving beyond generalized prescriptions toward highly individualized audiological interventions. The development of AI-based noise reduction and signal processing in hearing aids is intrinsically linked to the diagnostic data analyzed by these advanced systems.

- AI-powered automation of diagnostic screening and data interpretation, reducing clinician workload.

- Enhanced diagnostic accuracy through deep learning models capable of identifying subtle auditory pathology biomarkers.

- Facilitation of teleaudiology and remote hearing assessments, increasing accessibility for rural populations.

- Development of predictive models for prognosis and personalized treatment planning, including optimal hearing aid settings.

- Integration of AI into mobile applications for initial, high-throughput consumer hearing testing and referral management.

DRO & Impact Forces Of Hearing Diagnostic Devices Market

The Hearing Diagnostic Devices Market is heavily influenced by a confluence of driving forces (D), restrictive challenges (R), and compelling opportunities (O). The primary drivers include the escalating global burden of hearing impairment, driven by aging populations and noise exposure, and continuous advancements in digital health and sensor technology leading to more sophisticated and user-friendly devices. Restraints largely center on the high initial cost of advanced diagnostic equipment, leading to slower adoption rates in low- and middle-income countries, alongside the shortage of skilled audiologists and trained technical personnel, especially in rural areas, limiting the effective deployment and utilization of high-end systems. Opportunities are significant, rooted in the potential expansion of mandatory newborn hearing screening programs globally, the rapid growth of the teleaudiology sector, and the integration of diagnostic capabilities into consumer electronics and wearable technology, broadening the scope of market penetration. These forces collectively shape the competitive dynamics and growth trajectory of the market, necessitating strategic maneuvering by key players to capitalize on technological momentum while mitigating economic and human resource constraints.

The driving impact forces are primarily technological innovation and regulatory support. Innovations focus on developing lightweight, portable, and multi-functional devices that can perform a variety of tests using a single platform, enhancing clinical efficiency. Furthermore, favorable reimbursement policies in established markets, particularly North America and Europe, incentivize healthcare providers to invest in modern diagnostic systems. The growing public health focus on non-communicable diseases, which often include hearing loss as a significant co-morbidity, ensures sustained institutional funding for diagnostic services. On the other hand, a critical restraining factor is the complex and stringent regulatory landscape governing medical devices, which can prolong time-to-market for new technologies and increase compliance costs, particularly for novel AI-integrated devices. Moreover, intense price competition, especially in entry-level screening device segments, exerts downward pressure on profit margins for manufacturers.

The most transformative opportunities lie in leveraging the convergence of mobile technology and cloud computing. The shift towards connected healthcare enables remote calibration, maintenance, and data management for diagnostic devices, optimizing operational efficiency. The integration of diagnostic sensors into routine wellness checks and primary care settings represents an untapped market potential. The development of specialized devices catering to pediatric audiology, addressing the unique challenges of testing infants and young children, presents a high-value niche. Successfully navigating the high cost of implementation and addressing the training gap through scalable educational programs are vital for converting these opportunities into tangible market growth, especially in emerging economies where penetration remains low despite high need.

Segmentation Analysis

The Hearing Diagnostic Devices Market is comprehensively segmented based on product type, portability, and end-user, reflecting the diverse clinical needs and technological architectures within the sector. Product segmentation helps differentiate between the core instruments used for objective and subjective hearing tests, crucial for understanding where R&D efforts are concentrated. Portability segmentation highlights the critical industry shift towards mobile and point-of-care testing solutions, driven by the need for increased accessibility outside traditional audiology clinics. End-user analysis reveals consumption patterns and purchasing power across various healthcare settings, identifying key institutional buyers like hospitals and specialized ENT clinics, which are major volume consumers of sophisticated, fixed diagnostic suites.

The dominant product segment comprises traditional audiometers, essential for subjective pure-tone and speech audiometry, serving as the benchmark for clinical assessment. However, objective diagnostic tools, such as Otoacoustic Emission (OAE) and Auditory Brainstem Response (ABR) systems, are rapidly gaining ground due to their necessity in newborn screening programs and diagnostics for non-cooperative patients, contributing significantly to future revenue growth. The segmentation by portability emphasizes the commercial viability of portable and handheld devices, which are increasingly preferred by mobile health units and small private practices due to their reduced footprint and lower operational complexity compared to bulky, standalone clinical systems. This trend underscores the market’s response to decentralization.

- By Product:

- Audiometers (Clinical, Diagnostic, Screening)

- Tympanometers

- Otoacoustic Emission (OAE) Devices

- Auditory Brainstem Response (ABR) / Auditory Steady-State Response (ASSR) Systems

- Acoustic Immittance Instruments

- Software and Integrated Systems

- By Portability:

- Standalone / Fixed Systems

- Portable / Handheld Devices

- By End-User:

- Hospitals and Clinics (ENT Departments)

- Diagnostic Centers

- Academic and Research Institutes

- Homecare and Teleaudiology Centers

- By Region:

- North America (U.S., Canada)

- Europe (Germany, U.K., France, Italy, Spain, Rest of Europe)

- Asia Pacific (Japan, China, India, South Korea, Australia, Rest of APAC)

- Latin America (Brazil, Mexico, Rest of Latin America)

- Middle East and Africa (GCC Countries, South Africa, Rest of MEA)

Value Chain Analysis For Hearing Diagnostic Devices Market

The value chain for the Hearing Diagnostic Devices Market spans critical stages, beginning with fundamental R&D and raw material sourcing, moving through precision manufacturing and assembly, culminating in complex distribution, end-user deployment, and post-sales service. Upstream activities involve sourcing high-fidelity electronic components, advanced sensor technologies, and specialized acoustic materials. Strategic partnerships with component suppliers are crucial for maintaining quality and managing cost. Intense R&D investment is centered on developing novel algorithms for signal processing and miniaturization techniques, essential for advancing product functionality and portability. Successful value capture at this stage relies heavily on intellectual property protection and engineering expertise in integrating complex medical-grade technology.

Midstream activities involve the precision manufacturing and stringent quality control of the diagnostic instruments. Assembly processes must adhere to global medical device regulations (e.g., FDA, CE marking), requiring certified manufacturing facilities and detailed validation protocols. The downstream segment is defined by distribution and end-user engagement. Distribution channels are typically specialized, utilizing a mix of direct sales forces for major institutional clients (hospitals) and indirect channels (authorized distributors and dealers) for reaching smaller clinics and private practices. Given the technical complexity of these devices, comprehensive pre-sales consultation and extensive post-sales support, including calibration, maintenance, and software updates, constitute a significant portion of the value added downstream. Direct distribution often provides manufacturers with greater control over branding and pricing, while indirect channels offer expansive geographical reach, particularly in nascent markets.

The market relies on specialized distribution channels, where direct sales are favored for high-value, complex systems requiring specialized training and installation, ensuring direct feedback loops between the end-user (audiologist) and the manufacturer's R&D team. Indirect channels, including medical equipment distributors and specialized audiology supply companies, are vital for servicing the fragmented small clinic and private practice segments. The increasing adoption of teleaudiology platforms is introducing new digital distribution pathways, particularly for associated software, cloud services, and remote maintenance tools, thereby optimizing the final stage of the value chain and enhancing accessibility to timely technical support and continuous software improvements.

Hearing Diagnostic Devices Market Potential Customers

The primary end-users and potential customers in the Hearing Diagnostic Devices Market are diverse, ranging from large-scale public healthcare institutions to highly specialized private clinical practices. Hospitals, particularly those with dedicated Ear, Nose, and Throat (ENT) departments and comprehensive audiology units, represent the largest segment of potential customers. These institutions require high-throughput, standalone diagnostic systems capable of servicing a diverse patient demographic, including complex pediatric and geriatric cases. Furthermore, major academic medical centers and university research labs are key buyers of high-end, research-grade devices necessary for conducting advanced neuro-audiological studies and clinical trials, often driving the demand for the latest ABR and ASSR technologies.

Specialized independent audiology clinics and private ENT physician practices constitute the second major customer base. These entities frequently prefer portable and scalable solutions that offer flexibility without requiring extensive dedicated space, focusing on diagnostic efficiency and patient throughput for routine assessments and follow-ups. The growing trend of corporate and occupational health centers also provides a substantial customer segment, as they require screening audiometers and OAE devices to monitor employees exposed to high levels of industrial noise, ensuring compliance with occupational safety regulations and proactive hearing conservation programs. These industrial customers prioritize durability, ease of use, and integration with robust health data management systems.

The emerging segments of potential customers include teleaudiology service providers and home healthcare agencies. Teleaudiology centers utilize portable, connected devices and cloud-based software to conduct remote testing and consultation, broadening the market reach beyond traditional brick-and-mortar clinics. Additionally, government public health departments focusing on universal newborn hearing screening represent a consistent, high-volume customer for standardized OAE and ABR screening systems. Targeting these customers requires strategies centered around cost-effectiveness, ease of operation by non-specialized staff (for screening), and seamless integration with national health data registries, maximizing the public health impact of widespread diagnostic deployment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.4 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Starkey Hearing Technologies, GN Store Nord A/S, William Demant Holding A/S, Sonova Holding AG, Cochlear Limited, Sivantos Group, Natus Medical Incorporated, Interacoustics A/S, Benson Medical Instruments, Maico Diagnostics, Auditdata A/S, Inventis, Medtronic plc, Siemens Healthineers, Grason-Stadler (GSI), Otometrics (now Natus Medical), Path Medical GmbH, Intelligent Hearing Systems. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hearing Diagnostic Devices Market Key Technology Landscape

The technology landscape of the Hearing Diagnostic Devices Market is rapidly evolving, moving away from purely analog measurements toward sophisticated digital and networked systems. A pivotal technological shift involves the integration of high-resolution digital signal processing (DSP) chips, which significantly enhance the clarity and accuracy of audiometric stimuli presentation and response recording. Modern devices leverage advanced noise cancellation algorithms to ensure reliable testing even in non-soundproof environments, broadening the practical applicability of portable units. Furthermore, the convergence with internet of medical things (IoMT) standards is enabling devices to connect seamlessly to Electronic Health Records (EHRs) and cloud platforms for centralized data management, secure storage, and instantaneous access by healthcare professionals located remotely.

Another dominant trend is the proliferation of electrophysiological testing technologies, specifically the refinement of Auditory Brainstem Response (ABR) and Auditory Steady-State Response (ASSR) systems. These technologies utilize complex algorithms to extract reliable neurological responses from noisy background electroencephalography (EEG) data, offering objective measures of hearing thresholds, which are crucial for infants and challenging-to-test populations. Continuous technological improvement focuses on faster testing times for ABR, minimizing the need for sedation, and increasing the specificity of diagnostic markers derived from these neural responses. This refinement is critical for identifying subtle cochlear or neural pathway damage that might be missed by pure-tone audiometry alone, pushing the boundaries of early and accurate diagnosis.

Moreover, the integration of user-friendly interfaces, often supported by touchscreen technology and intuitive software, simplifies complex testing protocols, making sophisticated diagnostic tools more accessible to a wider range of healthcare providers, not just specialized audiologists. Wireless connectivity (Bluetooth, Wi-Fi) is becoming standard, facilitating cable-free data transfer and device control, streamlining workflow in busy clinics. The development of miniaturized sensors and specialized transducers has been essential for creating the highly portable OAE and screening audiometer devices, which are driving the point-of-care segment. Furthermore, standardization in data output formats is allowing different manufacturers' devices to communicate effectively, supporting integrated audiological suites and comprehensive patient management systems, which is a major focus for large institutional customers seeking operational efficiency.

Regional Highlights

- North America: This region holds the largest market share, characterized by high healthcare spending, widespread adoption of advanced digital diagnostic equipment, and robust mandatory newborn hearing screening mandates. The presence of major market players and well-established reimbursement structures provides a stable platform for technological adoption. High awareness levels regarding age-related and noise-induced hearing loss further fuel demand for regular screening and sophisticated diagnostic services. The U.S., in particular, dominates this regional market due to significant R&D investments in neuro-audiology and integrated healthcare systems.

- Europe: Europe is a mature market exhibiting steady growth, supported by universal healthcare coverage and comprehensive regulatory frameworks (e.g., MDR compliance) ensuring high standards for medical device quality. Key markets like Germany, the U.K., and France prioritize precision diagnostics and are early adopters of portable and teleaudiology solutions. The region's aging demographic significantly contributes to the sustained demand for diagnostic devices to manage presbycusis and related disorders.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, driven by immense untapped market potential, improving healthcare infrastructure, and rising disposable incomes. Countries like China and India are rapidly increasing public health expenditure, particularly for early childhood health initiatives, leading to the rapid deployment of hearing screening devices. However, market growth is often challenged by fragmented distribution networks and varying regulatory standards across different nations, requiring manufacturers to adopt localized market strategies.

- Latin America (LATAM): The LATAM market is in a growth phase, marked by increasing investments in modernizing public hospitals and expanding coverage for specialized care. Brazil and Mexico are leading the way, seeing rising demand for both fixed clinical audiometers and cost-effective portable screeners. Economic volatility and pricing sensitivity remain key factors influencing purchasing decisions, often favoring value-based device offerings over the highest-end technologies.

- Middle East and Africa (MEA): This region is characterized by heterogeneous market development. GCC countries (UAE, Saudi Arabia) possess significant purchasing power and advanced infrastructure, driving demand for premium diagnostic suites. Conversely, growth in Africa is heavily reliant on international aid and public sector initiatives aimed at combating infectious disease-related hearing loss, demanding durable, easy-to-use, and often portable diagnostic equipment suitable for low-resource settings.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hearing Diagnostic Devices Market.- Natus Medical Incorporated

- Interacoustics A/S (part of William Demant Holding A/S)

- Grason-Stadler (GSI) (part of Natus Medical)

- Maico Diagnostics (part of Demant A/S)

- Benson Medical Instruments

- Inventis srl

- Auditdata A/S

- Starkey Hearing Technologies

- GN Store Nord A/S

- William Demant Holding A/S

- Sonova Holding AG

- Cochlear Limited

- Sivantos Group (now part of WS Audiology)

- Medtronic plc

- Siemens Healthineers

- Path Medical GmbH

- Intelligent Hearing Systems

- Vivosonic Inc.

- Eckstein Medical Research (EMR)

- Neurosoft Ltd.

Frequently Asked Questions

Analyze common user questions about the Hearing Diagnostic Devices market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Hearing Diagnostic Devices Market?

The primary driving factor is the rapid increase in the global geriatric population, which inherently leads to a higher prevalence of age-related hearing loss (presbycusis), necessitating regular and sophisticated audiological diagnostic services globally.

How is technological innovation impacting the design of new hearing diagnostic devices?

Technological innovation is focused on miniaturization, portability, and digitalization. This includes integrating AI for automated interpretation, developing faster ABR systems to reduce testing time without sedation, and ensuring seamless connectivity with EHRs via IoMT standards.

Which segment of the market is expected to witness the highest growth rate?

The portable/handheld devices segment is projected to exhibit the highest CAGR, driven by the increasing adoption of teleaudiology, mobile healthcare outreach programs, and the demand for cost-effective, decentralized diagnostic screening in remote or primary care settings.

What major challenges restrict market expansion in emerging economies?

Market expansion in emerging economies is primarily restricted by the high initial cost of advanced diagnostic equipment, leading to accessibility issues, combined with a significant shortage of specialized, trained audiology personnel required to operate and maintain the complex systems effectively.

What role does the Auditory Brainstem Response (ABR) system play in the diagnostic landscape?

ABR systems provide objective measurements of auditory function crucial for assessing infants and non-cooperative patients, offering precise threshold estimations and identifying potential neurological auditory pathway disorders, thereby serving as a critical tool for early intervention programs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager