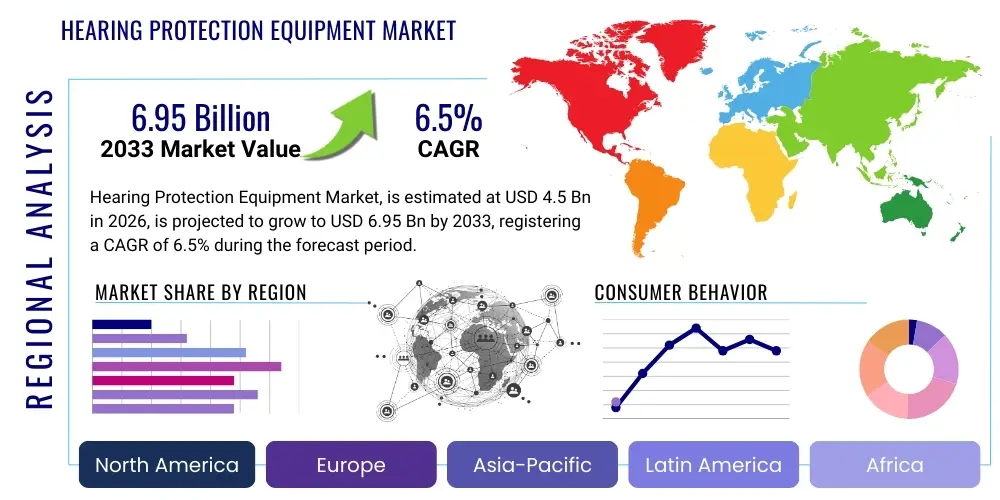

Hearing Protection Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437702 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Hearing Protection Equipment Market Size

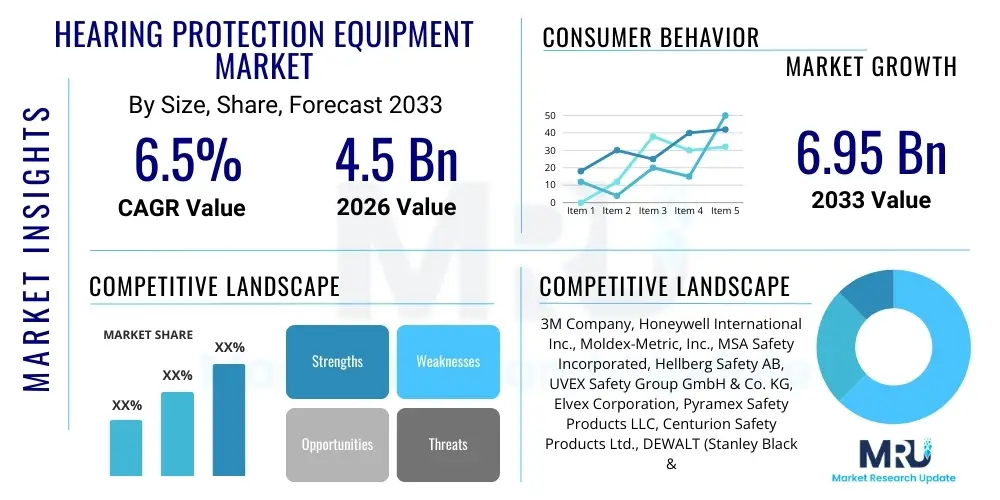

The Hearing Protection Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 4.5 billion in 2026 and is projected to reach USD 6.95 billion by the end of the forecast period in 2033.

Hearing Protection Equipment Market introduction

The Hearing Protection Equipment (HPE) market encompasses devices designed to mitigate noise-induced hearing loss (NIHL) in environments where noise levels exceed safe thresholds, typically above 85 decibels (dBA). These essential safety products, ranging from passive attenuation devices like foam earplugs and passive earmuffs to advanced electronic and communication headsets, are critical components of occupational safety protocols across numerous heavy and light industries. The primary objective of these products is to reduce the volume of sound reaching the inner ear while maintaining the clarity of speech and warning signals, which is particularly vital in complex industrial settings such as manufacturing floors, construction sites, and aviation operations. The foundational technology relies on materials with high acoustic absorption properties and ergonomic design principles to ensure consistent and comfortable wear over extended periods, addressing the long-standing challenge of compliance among industrial workers.

Major applications for HPE include heavy manufacturing, where stamping, machining, and assembly processes generate significant acoustic hazards; the construction sector, characterized by intermittent high-impact noise from tools and machinery; and the mining and oil and gas industries, facing exposure to continuous noise from drilling rigs and ventilation systems. Furthermore, specialized applications exist within defense, law enforcement, and recreational shooting, demanding equipment capable of impulse noise suppression and often incorporating communication capabilities. The inherent benefits of utilizing high-quality hearing protection are substantial, extending beyond mere regulatory compliance to include improved worker focus, reduced stress levels, and ultimately, the preservation of long-term auditory health, which translates directly into lower healthcare costs and reduced liability for employers. The growing global enforcement of occupational safety standards by bodies like OSHA, EN, and ISO is a fundamental structural driver promoting the continuous adoption and technological advancement within this market segment.

Driving factors propelling market growth include the rising global incidence of recognized NIHL cases, necessitating stricter workplace safety measures and increased worker training regarding noise hazards. Technological advancements, particularly the introduction of electronic and smart hearing protection devices offering features like active noise cancellation (ANC), sound amplification of ambient warnings, and integrated Bluetooth connectivity, are making compliance more appealing and practical for end-users. The continuous expansion of global industrial infrastructure, particularly in developing economies across Asia Pacific, further escalates the demand for reliable personal protective equipment (PPE), of which hearing protection remains a critical subset, ensuring the market maintains a robust expansion trajectory throughout the forecast period.

Hearing Protection Equipment Market Executive Summary

The global Hearing Protection Equipment (HPE) market is characterized by a strong convergence of regulatory pressure and technological innovation, defining current business trends. Industrially, the transition towards 'smart' hearing protection, integrating features such as dose monitoring and communication systems, is accelerating, moving the market beyond simple passive attenuation towards proactive, connected safety solutions. Companies are heavily investing in material science to improve comfort and fit, which remains the single largest impediment to compliance. Regionally, North America and Europe currently dominate the market share due to mature regulatory frameworks, mandatory compliance requirements, and high levels of worker safety awareness; however, the Asia Pacific region is forecast to exhibit the fastest growth rate, fueled by unprecedented expansion in manufacturing capacity, construction activities, and mining operations across countries like China and India, prompting local governments to adopt more rigorous safety mandates comparable to Western standards. This geographical shift signals a substantial opportunity for manufacturers to localize production and distribution strategies.

Analyzing segment trends reveals that while disposable earplugs maintain a high volume share due to their low cost and widespread adoption in light industrial settings, the earmuffs segment generates the highest revenue, especially those incorporating advanced features like active noise reduction (ANR) and high Noise Reduction Rating (NRR) capabilities required in extreme noise environments such as aerospace and heavy machinery maintenance. Furthermore, custom-molded ear protection is gaining significant traction, particularly in professional environments (e.g., aviation ground crew, military, high-end manufacturing) where personalized fit guarantees comfort and maximum attenuation, consequently boosting compliance rates and offering superior profit margins for specialized manufacturers. The market structure is moderately consolidated, with a few global leaders setting technological and regulatory compliance standards, yet ample scope remains for specialized firms focusing on niche applications, such as high-fidelity music plugs or specialized impulse noise suppressors, to thrive through differentiation.

Overall, the executive insight points to a resilient market driven structurally by non-discretionary safety spending and cyclical industrial expansion. Strategic focus areas for market participants include developing lightweight, comfortable, and hygienic reusable products; expanding presence in emerging Asian markets through strategic partnerships; and capitalizing on the integration of HPE with broader Industrial Internet of Things (IIoT) safety platforms. The continued pressure to reduce occupational injuries and the increasing sophistication of safety management systems worldwide ensure sustained investment in high-quality hearing protection solutions, positioning the market for steady, above-average growth throughout the projection period, with premium, connected devices becoming the primary value driver.

AI Impact Analysis on Hearing Protection Equipment Market

Common user questions regarding AI's influence on the Hearing Protection Equipment (HPE) market frequently revolve around its practical application in real-time safety management and device customization. Users inquire about how AI can move beyond simple noise cancellation to truly anticipate hazards: "Can AI predict when noise exposure thresholds will be breached?" "How will AI integrated into smart earplugs improve fit and ensure compliance automatically?" "Is AI being used to map complex noise environments in real-time to optimize protection protocols?" The overarching themes are predictability, personalization, and seamless integration into broader safety ecosystems. Users expect AI to reduce human error in safety adherence and provide data-driven insights for preventative measures, moving the HPE industry from a reactive approach to a proactive, predictive safety posture.

The primary impact of Artificial Intelligence in the HPE market is manifested through predictive analytics and intelligent sound management systems. AI algorithms can be deployed within advanced communication earmuffs or smart earplugs to continuously monitor the surrounding acoustic environment, analyzing sound patterns and identifying the specific signatures of hazardous noise sources. This real-time analysis allows the device to instantaneously adjust its attenuation settings, ensuring optimal protection without over-attenuation, which is crucial for hearing warning signals. Furthermore, AI facilitates the development of personalized protection solutions; by analyzing high-resolution 3D scans of a user's ear canal, AI models can refine the design of custom-molded earplugs, achieving a level of fit and comfort previously unattainable, thereby dramatically improving the rate of long-term user compliance in high-risk occupations.

Beyond the individual device level, AI is transforming institutional safety management. Machine learning models process vast datasets collected from connected PPE to identify high-risk zones, track worker compliance patterns, and predict potential safety lapses across entire industrial sites. For example, if data indicates specific teams are routinely removing protection or exposure levels are consistently spiking in certain areas, the AI system alerts safety managers immediately, allowing for targeted intervention, preventative maintenance on noisy machinery, or reassessment of personal protective strategies. This data-driven, holistic approach ensures that investments in hearing protection are maximally effective and integrated seamlessly into an organization's overall occupational health program.

- Real-time Noise Profile Mapping: AI analyzes ambient soundscapes to dynamically adjust NRR (Noise Reduction Rating) levels.

- Predictive Compliance Monitoring: Algorithms track wear patterns and usage adherence, flagging non-compliant behaviors automatically.

- Enhanced Customization: AI optimizes 3D printing parameters for custom earplugs based on biometric and acoustic data, ensuring perfect anatomical fit.

- Intelligent Communication Pass-Through: AI differentiates critical human speech and warning alarms from harmful background noise, allowing safe communication.

- Proactive Maintenance Scheduling: Correlating noise spikes with machine activity to predict equipment failure or maintenance needs, reducing noise at the source.

DRO & Impact Forces Of Hearing Protection Equipment Market

The dynamics of the Hearing Protection Equipment (HPE) market are strongly influenced by a robust interplay of Drivers (D), Restraints (R), and Opportunities (O), alongside significant impact forces stemming from industry structure. The market is fundamentally driven by stringent regulatory frameworks globally, such as those imposed by the Occupational Safety and Health Administration (OSHA) in the US and the European Agency for Safety and Health at Work (EU-OSHA), which mandate the provision and use of certified hearing protection in noisy workplaces. This non-discretionary compliance spending forms the bedrock of market demand. Simultaneously, increased general awareness among workers and employers regarding the debilitating long-term effects of Noise-Induced Hearing Loss (NIHL) acts as a crucial societal driver, pushing demand toward higher quality, more comfortable, and technologically advanced solutions. However, market growth is often restrained by persistent challenges related to user compliance, where discomfort, interference with communication, and perceived inconvenience lead workers to intermittently or completely forgo wearing protection, thereby diminishing the effectiveness of safety programs and necessitating continuous retraining and monitoring efforts by employers.

Opportunities for significant market expansion are centered on technological advancements, particularly the maturation of smart hearing protection that integrates active noise cancellation (ANC), electronic sound management, and communication features. The ability to provide effective protection without isolating the user from necessary communication or ambient warnings represents a key area of differentiation and value creation. Furthermore, the burgeoning demand for personalized fit through 3D scanning and additive manufacturing (3D printing) offers manufacturers premium pricing potential and improves compliance rates substantially. Geographically, the industrialization boom across Asia Pacific presents a major long-term opportunity, as previously unregulated or lightly regulated industrial sectors begin adopting modern, stringent safety standards, necessitating massive initial and recurring procurement of HPE. These drivers and opportunities collectively outweigh the restraints, ensuring a positive growth outlook for the sector.

Analyzing the impact forces using Porter’s framework highlights a few structural characteristics: The Threat of New Entrants is moderate; while manufacturing simple passive protection (earplugs) is low-barrier, developing certified, technologically advanced electronic earmuffs requires substantial R&D and regulatory navigation, creating barriers. The Bargaining Power of Buyers (primarily large industrial organizations and bulk distributors) is relatively high, as they purchase in large volumes and often demand competitive pricing and long-term contracts based on proven compliance effectiveness and comfort metrics. Conversely, the Bargaining Power of Suppliers (raw materials like specialized acoustic polymers and electronic components) is moderate to low, though specialized components for active protection can grant some leverage. Competitive Rivalry is high, driven by numerous established global manufacturers vying for large corporate safety contracts and constantly introducing improved products focused on comfort, NRR optimization, and smart features. Finally, the Threat of Substitution is low; while engineering controls (reducing noise at the source) are preferred, hearing protection remains the essential last line of defense, meaning substitution is unlikely in the immediate term for high-noise environments.

Segmentation Analysis

The Hearing Protection Equipment (HPE) market segmentation provides a critical view of product adoption, regional demand variations, and strategic customer targeting. The market is primarily segmented based on the Type of protection offered, the End-Use Industry application, the Technology integrated, and the Distribution Channel utilized. This granularity is essential for manufacturers to tailor their product development efforts, focusing on specific performance metrics, such as NRR levels required for heavy manufacturing versus the high-fidelity acoustic response needed for musicians or communication clarity required in aviation. The segmentation by type—disposable vs. reusable, passive vs. active—reflects the trade-off between cost-effectiveness and advanced functionality, influencing procurement strategies among diverse client bases, from large mining companies prioritizing durability to food processing plants focused on hygiene and disposability.

Segmentation by End-Use Industry is particularly telling, as regulatory mandates differ significantly across sectors. Industries such as construction and heavy manufacturing are volumetric consumers of standard, robust protection, given their large workforces and consistent high noise levels. In contrast, sectors like military/defense and oil & gas often require specialized, premium products that offer both high attenuation and sophisticated communication capabilities, driving demand for electronic and custom-molded solutions. The ongoing trend towards industrial digitalization is also influencing the Technology segment, with Active Noise Cancellation (ANC) and sound amplification technologies gaining rapid acceptance due to their ability to solve the compliance issue by enhancing situational awareness, which is often compromised by traditional, entirely passive protection methods. This strategic segmentation allows companies to analyze market dynamics, allocate resources efficiently, and capitalize on high-growth niche applications, such as specialized recreational and consumer markets outside of traditional occupational settings.

- By Type:

- Earplugs (Foam, Pre-molded, Custom-molded, Reusable, Disposable)

- Earmuffs (Passive Earmuffs, Electronic Earmuffs)

- Bands

- By Technology:

- Passive Hearing Protection

- Active/Electronic Hearing Protection (Level-Dependent, Active Noise Cancellation (ANC))

- By End-Use Industry:

- Manufacturing (Heavy and Light)

- Construction

- Mining and Oil & Gas

- Aviation and Aerospace

- Defense and Military

- Healthcare

- Others (Recreational, Music, DIY)

- By Distribution Channel:

- Offline (Distributors, Industrial Supply Stores, Retail)

- Online (E-commerce Platforms, Company Websites)

Value Chain Analysis For Hearing Protection Equipment Market

The value chain for the Hearing Protection Equipment market is complex, spanning from the procurement of specialized acoustic materials to the final distribution to end-users in highly regulated industrial environments. The upstream analysis involves the sourcing of raw materials, primarily specialized polymers, viscoelastic foams, acoustic dampening materials, and, for electronic devices, advanced micro-electronic components, batteries, and communication chips. The quality and certified performance of these raw materials are paramount, as they directly determine the product's Noise Reduction Rating (NRR) and comfort. Key upstream activities involve R&D into new lightweight, durable, and hypoallergenic materials, alongside strict quality control procedures to ensure compliance with global safety standards. Given the specificity of components for electronic devices, supplier relationships in the microelectronics sector are crucial for maintaining a competitive edge in the smart protection segment.

The manufacturing stage involves highly specialized processes, including precision injection molding for earplugs and earmuff cups, assembly of electronic circuits (PCB integration), acoustic tuning, and ergonomic design validation. Manufacturing facilities must adhere to strict quality assurance protocols (ISO standards) and product certification requirements (e.g., ANSI S3.19, EN 352). Distribution channels are bifurcated into direct and indirect routes. Direct distribution involves large B2B contracts with major industrial corporations, government agencies (military), and large infrastructure projects, often facilitated by dedicated sales teams and technical support. Indirect channels rely heavily on a global network of industrial safety equipment distributors, wholesalers, and specialized PPE retailers who manage inventory and provide local market access, particularly to SMEs and individual consumers.

The downstream analysis focuses on the end-user interaction and after-sales support, which includes training on proper usage and fitting—a critical factor influencing compliance effectiveness. Direct sales offer greater control over product education and feedback collection, which informs subsequent product iteration. The rise of e-commerce platforms has facilitated the sale of standardized products (disposable plugs, consumer earmuffs) directly to smaller businesses and individuals. However, complex, high-value electronic and custom-molded equipment still heavily relies on specialized industrial distributors who can provide on-site fitting services and maintenance. The entire value chain is currently being optimized through digital tools, improving inventory management, tracking product performance in the field, and providing data back to R&D teams to continuously improve comfort, attenuation, and user experience.

Hearing Protection Equipment Market Potential Customers

The potential customer base for Hearing Protection Equipment is vast and highly segmented, primarily defined by the legal requirement to protect workers from occupational noise exposure. The most significant end-users are concentrated within heavy industries characterized by continuous, high-decibel operations. These institutional buyers include large multinational manufacturing firms—particularly those involved in automotive assembly, heavy machinery, and metal fabrication—where noise levels routinely exceed 90 dBA. These customers require bulk procurement of durable, certified earmuffs and high-attenuation earplugs, prioritizing NRR, comfort, and ease of deployment. Another critical segment is the construction and infrastructure sector, involving exposure to intermittent, intense noise from drills, jackhammers, and heavy vehicle traffic. This segment often demands highly durable, weatherproof protection, often favoring electronic earmuffs that integrate communication capabilities for coordination across large job sites, positioning them as high-value, recurring buyers.

Beyond traditional industrial sectors, niche markets represent highly attractive, high-margin customers. This includes the military and defense sectors, which demand specialized communications headsets that protect against impulse noise (gunfire, explosions) while enabling crystal-clear radio communication, often justifying the highest price points for specialized active protection technology. Similarly, the aviation industry, particularly ground crew and maintenance personnel, constitutes essential buyers due to extreme noise environments near jet engines, requiring highly specialized, often custom-molded solutions integrated with cockpit communication systems. These professional, highly regulated environments prioritize performance and reliability over marginal cost savings, making them prime targets for premium, technological solutions.

Finally, the growing consumer and recreational markets form an expanding customer segment. This includes professional musicians, concertgoers, motorcycle riders, competitive and recreational shooters, and individuals involved in DIY activities (woodworking, home renovations). While compliance is voluntary, these customers seek specialized products—like high-fidelity earplugs that attenuate sound evenly without muffling, or tactical earmuffs for shooting—demonstrating a strong willingness to pay for customized protection that preserves sound quality or enhances situational awareness, indicating a promising area for brand expansion and consumer-focused product development outside the mandatory occupational sphere.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 billion |

| Market Forecast in 2033 | USD 6.95 billion |

| Growth Rate | CAGR 6.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3M Company, Honeywell International Inc., Moldex-Metric, Inc., MSA Safety Incorporated, Hellberg Safety AB, UVEX Safety Group GmbH & Co. KG, Elvex Corporation, Pyramex Safety Products LLC, Centurion Safety Products Ltd., DEWALT (Stanley Black & Decker), PlugUp, Custom Protect Ear, SensGard, Stihl, Mellow Acoustic Equipment |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hearing Protection Equipment Market Key Technology Landscape

The technological landscape of the Hearing Protection Equipment (HPE) market is rapidly evolving, shifting from purely passive attenuation towards integrated, smart, and dynamic solutions designed to improve both safety and user experience. A major advancement involves Active Noise Reduction (ANR) and Active Noise Cancellation (ANC) technologies, particularly in earmuffs and specialized communication headsets. These systems utilize sophisticated microphones to analyze ambient noise in real-time and generate an inverse sound wave to cancel out low-frequency background noise. This allows for superior protection in specific environments, such as airplane cockpits or heavy vehicle operation, and crucially enables level-dependent hearing protection, where critical situational sounds (like alarms or human voices) can be amplified or passed through safely while harmful peak noises are instantaneously suppressed, solving the long-standing issue of workers feeling isolated by traditional protective gear.

Another transformative technology is the integration of wireless communication and smart monitoring capabilities, turning HPE into sophisticated Personal Protective Equipment (PPE) hubs. Bluetooth and mesh network connectivity allows seamless, hands-free communication across work teams without compromising acoustic seal integrity. More importantly, embedded sensors monitor the actual noise dose received by the wearer throughout the shift, transmitting this data wirelessly to safety management systems. This integration leverages the Industrial Internet of Things (IIoT) to provide objective data on compliance and exposure risk, moving away from subjective assessments. Manufacturers are focusing on miniaturization of electronic components, improved battery life, and robust device enclosures to ensure these smart features are practical and durable in harsh industrial environments.

Furthermore, the utilization of 3D printing (Additive Manufacturing) technology is fundamentally reshaping the market for custom-molded earplugs. High-resolution ear canal scanning, combined with computer-aided design, allows for the production of anatomically perfect ear inserts made from medical-grade silicone or polymers. This precision ensures maximal attenuation, optimal comfort for extended wear, and significantly boosts compliance rates among professionals who require protection for their entire working day. Advanced material science also contributes significantly, with research focused on developing superior viscoelastic materials and acoustic filters that provide high Noise Reduction Ratings (NRR) in passive equipment while maintaining ventilation to reduce heat and moisture buildup, addressing key user comfort complaints which traditionally lead to non-compliance.

Regional Highlights

Regional dynamics significantly influence the adoption, types, and technological sophistication of Hearing Protection Equipment (HPE). North America, particularly the United States and Canada, represents a mature and highly regulated market, driven predominantly by stringent governmental safety standards established by OSHA (Occupational Safety and Health Administration) and related state agencies. Market growth in this region is less about expansion of workforce and more about the adoption of premium, high-technology solutions, such as electronic communication earmuffs and custom-molded earplugs, which enhance worker efficiency and reduce long-term liability costs for employers. The presence of major manufacturing, aerospace, and military sectors ensures sustained high demand, making this region a leader in adopting advanced, integrated PPE solutions and often setting the global benchmark for safety performance and certification standards.

Europe, driven by the EU-OSHA framework and country-specific directives (e.g., German, UK, Scandinavian standards), also holds a significant market share. The European focus tends to be highly concentrated on worker ergonomics, long-term health, and environmental sustainability. This preference translates into high demand for reusable, durable, and certified products that minimize waste and maximize user comfort. Eastern European countries, currently undergoing significant industrial modernization, are rapidly increasing their adoption rates of standard HPE. The region demonstrates strong demand for innovative passive protection materials alongside robust penetration of electronic hearing protection, particularly in complex industrial machinery operations and infrastructure projects, necessitating advanced noise management solutions.

Asia Pacific (APAC) is projected to be the fastest-growing market during the forecast period. This rapid expansion is fundamentally linked to the region’s explosive industrialization, massive infrastructure development (e.g., roads, railways, power plants), and the decentralization of global manufacturing bases into countries like China, India, and Southeast Asia. While historical compliance standards lagged behind the West, increasing governmental focus on occupational health and safety, driven by international pressure and local regulations (e.g., China’s tightening safety mandates), is creating massive volume demand. Initially, the APAC market focused on cost-effective disposable earplugs and passive earmuffs; however, rising foreign investment and the establishment of sophisticated manufacturing plants are accelerating the demand for electronic, high-performance HPE solutions that meet global corporate standards, representing the largest opportunity for new market penetration.

- North America: Dominant market share due to stringent OSHA regulations, high industrial awareness, and early adoption of advanced electronic and communication headsets. Focus on premium products and liability reduction.

- Europe: High market maturity and consistent growth, emphasizing ergonomics, user comfort (leading to high custom-molded adoption), and adherence to EU safety directives (EN standards).

- Asia Pacific (APAC): Highest CAGR, driven by rapid industrial expansion, manufacturing growth, construction boom, and the gradual tightening of local occupational safety laws in major economies like China and India.

- Latin America (LATAM): Developing market with growing awareness, primarily driven by mining and oil & gas sectors. Compliance is often inconsistent but improving, creating moderate growth potential for standard passive equipment.

- Middle East and Africa (MEA): Growth centered on large-scale infrastructure projects, oil & gas exploration, and regional manufacturing hubs. Demand is highly project-dependent, favoring robust, high-durability protection suitable for extreme climates.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hearing Protection Equipment Market.- 3M Company

- Honeywell International Inc.

- Moldex-Metric, Inc.

- MSA Safety Incorporated

- Hellberg Safety AB

- UVEX Safety Group GmbH & Co. KG

- Elvex Corporation

- Pyramex Safety Products LLC

- Centurion Safety Products Ltd.

- DEWALT (Stanley Black & Decker)

- PlugUp

- Custom Protect Ear

- Sensear Pty Ltd.

- Stihl

- Mellow Acoustic Equipment

- G&F Industrial Products Co. Ltd.

- Peltor (part of 3M)

- Radians, Inc.

- Oticon A/S

- Phonak Communications AG

Frequently Asked Questions

Analyze common user questions about the Hearing Protection Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What factors are primarily driving the growth of the Hearing Protection Equipment market?

Market growth is predominantly driven by increasingly stringent global occupational health and safety regulations (e.g., OSHA, EN standards) that mandate noise control in industrial workplaces. Secondary drivers include heightened awareness of Noise-Induced Hearing Loss (NIHL) and the rapid adoption of technologically advanced, smart hearing protection devices that improve user compliance and communication.

What is the main challenge limiting the widespread effectiveness of hearing protection?

The primary restraint is persistent user non-compliance, often stemming from discomfort, poor fit, and the feeling of isolation caused by traditional passive devices, which hinders necessary communication and situational awareness. Manufacturers are addressing this by focusing on comfort, customization (3D printing), and integrating level-dependent electronic features.

How is Active Noise Cancellation (ANC) technology different from standard passive hearing protection?

Passive protection physically blocks sound waves using materials, providing consistent attenuation across all frequencies. ANC technology, used in electronic earmuffs, actively generates an inverse sound wave to electronically cancel out low-frequency noise in real-time. This allows high-frequency critical sounds (like speech or alarms) to be passed through or amplified safely, significantly improving situational awareness while maintaining protection.

Which geographic region is expected to show the fastest growth rate for HPE adoption?

The Asia Pacific (APAC) region is projected to exhibit the fastest Compound Annual Growth Rate (CAGR). This acceleration is fueled by massive industrialization, construction booms, and the modernization and enforcement of occupational safety regulations across major emerging economies like China, India, and Southeast Asian nations.

What role does 3D printing play in modern hearing protection solutions?

3D printing is crucial for manufacturing custom-molded earplugs. By using digital scans of a worker's ear canal, 3D printing ensures an exact anatomical fit, which maximizes comfort, optimizes the Noise Reduction Rating (NRR) achieved, and dramatically increases the likelihood of consistent long-term use and safety compliance in professional environments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager