Hearing Protector Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432124 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Hearing Protector Market Size

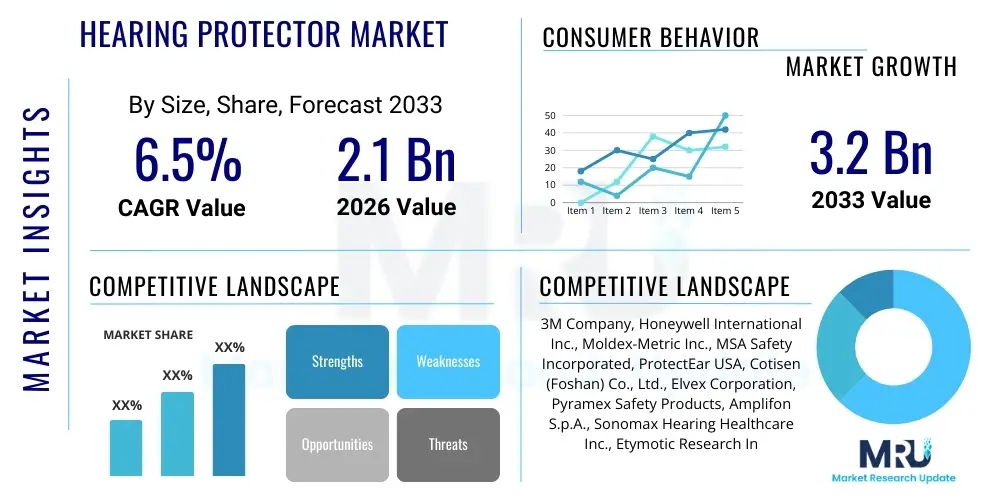

The Hearing Protector Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 2.1 Billion in 2026 and is projected to reach USD 3.2 Billion by the end of the forecast period in 2033.

Hearing Protector Market introduction

The Hearing Protector Market encompasses devices and systems designed to mitigate the effects of excessive noise exposure, thereby preventing Noise-Induced Hearing Loss (NIHL). These products, which include passive devices like standard foam earplugs and active systems such as electronic earmuffs, are critical components of occupational health and safety (OHS) programs across heavily industrialized sectors. The primary function of hearing protectors is to reduce the sound pressure level reaching the inner ear, allowing workers and individuals exposed to hazardous noise environments to maintain auditory health and communication capabilities. Regulatory mandates established by bodies like OSHA (Occupational Safety and Health Administration) and the European Agency for Safety and Health at Work are foundational drivers, enforcing the necessity of high-quality, certified protective equipment.

Product descriptions within this market span a range of Noise Reduction Ratings (NRR) and application specifications. Disposable foam earplugs represent the highest volume segment due to their low cost and ease of use, particularly in high-turnover industrial environments. Conversely, advanced reusable earmuffs and custom-molded earplugs cater to specialized needs, offering enhanced comfort, durability, and often integrating electronic features such as level-dependent attenuation or built-in communication systems. Major applications are concentrated in manufacturing, construction, mining, aerospace, and defense sectors, where sustained exposure to loud machinery, impact noise, and high-decibel environments is routine, necessitating stringent protective measures.

The benefits derived from effective hearing protection extend beyond compliance and injury prevention; they significantly improve worker concentration, reduce fatigue, and contribute to overall industrial productivity. Driving factors include the increasing global awareness of occupational health hazards, the rising incidence of tinnitus and hearing impairment among aging populations, and continuous technological advancements focused on improving user comfort and compliance, suchably through lighter materials, personalized fit, and smart integration capabilities. These market dynamics emphasize a shift from basic attenuation solutions to sophisticated, ergonomic, and communication-enabled protective gear, enhancing both safety and operational efficiency.

Hearing Protector Market Executive Summary

The global Hearing Protector Market is characterized by robust growth, primarily fueled by stringent governmental regulations on occupational noise exposure and increased investment in worker safety across emerging economies. Current business trends indicate a strong movement toward premium, technology-integrated products, such as electronic hearing protection that offers superior situational awareness and communication functionalities, moving away from reliance solely on passive attenuation. Key manufacturers are focusing on mergers and acquisitions to consolidate market share and expand their portfolio of custom-molded solutions, which promise higher comfort and superior fit, directly addressing historical issues related to non-compliance in industrial settings. Furthermore, sustainability is emerging as a design factor, leading to research into reusable, biodegradable, and long-lasting materials for earplugs and earmuff components, aligning with corporate social responsibility goals.

Regionally, North America and Europe maintain dominance, driven by well-established safety standards and mature industrial infrastructure, necessitating immediate and continuous investment in protective equipment. However, the Asia Pacific (APAC) region exhibits the highest projected growth rate due to rapid industrialization, particularly in construction and manufacturing hubs like China and India, coupled with the gradual adoption and enforcement of Western-style safety protocols. This shift is creating significant opportunities for both local and international manufacturers to establish robust distribution networks. Emerging regional trends also include localized product customization to suit diverse climatic conditions and specific industrial noise profiles prevalent in regions like the Middle East and Latin America.

Segment trends highlight the significant market dominance of the Earmuffs category in terms of revenue, driven by their robustness and the ease with which electronic features can be integrated, making them suitable for heavy industry and military applications. Conversely, disposable earplugs maintain leadership in terms of volume consumption. The End-User segment analysis shows that the Manufacturing and Construction sectors remain the largest consumers, though the Military and Defense segment is increasingly critical due to demand for advanced tactical hearing protection capable of simultaneous noise suppression and clear radio communication. Technological convergence between standard industrial protection and high-end tactical gear is blurring segment lines, pushing innovation toward modular, multi-functional protective systems capable of adapting to varied acoustic environments.

AI Impact Analysis on Hearing Protector Market

Common user inquiries regarding the impact of Artificial Intelligence (AI) on the Hearing Protector Market generally revolve around three core themes: personalized noise cancellation capabilities, integration with broader industrial Internet of Things (IIoT) safety platforms, and the potential for real-time monitoring and predictive safety analysis. Users frequently ask if AI can enable hearing protectors to differentiate between dangerous impulse noise and essential auditory cues (like voices or alarms), a critical safety enhancement. Furthermore, there is strong interest in how machine learning algorithms can analyze vast datasets of worker noise exposure profiles to recommend optimal protection levels and improve long-term compliance strategies. This synthesis of user concerns indicates a significant market expectation for AI to transform hearing protection from a passive safety measure into an intelligent, dynamic health and communication tool.

AI's primary influence is moving passive hearing protection systems toward active, adaptive intelligence. Machine learning algorithms are crucial for developing dynamic sound filtering, where the protective device can instantly analyze the frequency and intensity of ambient sound and apply precise, customized attenuation without blocking speech clarity. This is particularly vital in complex industrial environments where continuous human-to-human communication is necessary for safe operation. For instance, AI can be trained on specific machinery noise signatures, allowing the device to actively suppress only the hazardous elements while amplifying external safety warnings, maximizing both protection and situational awareness, an ongoing challenge in traditional hearing safety.

Beyond individual device performance, AI is transforming safety management at the enterprise level. By integrating smart hearing protectors with centralized safety dashboards, AI can monitor aggregate worker exposure data in real-time, identifying high-risk areas or shifts where average noise doses exceed regulatory limits. This predictive analysis allows OHS managers to intervene proactively, adjust work schedules, implement engineering controls, or mandate higher-NRR protection before an irreversible hearing injury occurs. The adoption of AI-driven analytics, therefore, shifts the focus from reactive incident reporting to a comprehensive, proactive acoustic risk management framework, significantly improving long-term auditory health outcomes and regulatory compliance efficiency.

- AI enables personalized, adaptive noise attenuation based on real-time acoustic environment analysis.

- Machine learning optimizes noise filtering to preserve critical speech and warning signals while suppressing hazardous frequencies.

- Predictive analytics use aggregated noise exposure data from smart devices to identify and mitigate high-risk industrial zones.

- AI integration facilitates seamless connectivity of hearing protectors with wider IIoT and industrial safety management systems.

- Algorithm-driven monitoring enhances long-term worker compliance by providing objective usage data and personalized fit recommendations.

- Development of smart earplugs utilizing neural networks for superior impulse noise detection and suppression.

DRO & Impact Forces Of Hearing Protector Market

The trajectory of the Hearing Protector Market is strongly influenced by a convergence of regulatory drivers, ergonomic challenges, and technological opportunities, shaping the competitive landscape and driving product innovation. Primary drivers include the global expansion of stringent occupational health and safety standards, particularly the lowering of permissible exposure limits (PELs) in industrialized nations, compelling organizations to invest continuously in certified protection equipment. Restraints are primarily centered around user compliance issues, often stemming from discomfort, poor fit, and interference with communication, which manufacturers must address through advanced ergonomic designs and material science improvements. Opportunities lie significantly in the integration of smart, connected technologies—such as Bluetooth connectivity, communication features, and environmental sensing—into hearing protectors, transforming them into multi-functional protective communication systems.

Impact forces within the market are predominantly driven by competitive rivalry and the bargaining power of major industrial customers. The competitive intensity is high, forcing manufacturers to differentiate through Noise Reduction Rating (NRR) superiority, comfort levels, and pricing strategy, especially in the high-volume disposable earplug segment. The threat of substitutes, while present in the form of engineering controls (like soundproofing machinery), is limited because personal protective equipment (PPE) remains a mandatory last line of defense. However, the bargaining power of buyers, especially large multinational corporations purchasing bulk quantities for thousands of employees, is substantial, often leading to pressure on pricing and demands for customized, integrated safety solutions that meet specific corporate standards.

Furthermore, external factors like increasing public litigation related to workplace hearing loss and the growing focus on preventative healthcare globally exert significant force. These pressures incentivize corporations to adopt best-in-class protection technologies rather than merely complying with minimum statutory requirements, accelerating the adoption of premium active hearing protectors. Technological impact forces are particularly transformative, pushing the market towards higher-fidelity auditory experiences within protected environments. This is leading to rapid obsolescence of purely passive systems and favoring manufacturers who successfully integrate sophisticated digital signal processing (DSP) and adaptive noise control algorithms into their product offerings, ensuring sustained market relevance and long-term compliance effectiveness.

Segmentation Analysis

The Hearing Protector Market segmentation provides a detailed structural analysis based on product type, end-user industry, and technology, offering granular insights into consumption patterns and growth pockets. Segmentation by product type—encompassing disposable earplugs, reusable earplugs, banded protectors, and earmuffs—is crucial for understanding manufacturing scalability and pricing elasticity, with earmuffs often commanding premium pricing due to integrated features. Analysis by end-user, including critical sectors like Manufacturing, Construction, Oil & Gas, Aviation, and Military, reveals the varying demands for NRR levels, durability, and communication integration specific to distinct operational hazards. This structural breakdown is essential for strategic market positioning and targeted product development efforts by manufacturers.

The Disposable Earplugs segment, typically made of polyurethane foam or vinyl, holds the largest volume share due to their widespread application, low unit cost, and high disposability rate in large industrial workforces. However, the Earmuffs segment, specifically the electronic or active noise reduction (ANR) sub-segment, is projected to register the fastest value growth, driven by demand for advanced safety features and adherence to higher regulatory standards in complex noise environments. Manufacturers are optimizing segmentation strategies by developing hybridized products, such as custom-molded reusable earplugs that offer the NRR performance of passive plugs combined with the comfort and communication features typically associated with electronic earmuffs, bridging the gap between convenience and advanced protection.

- By Product Type:

- Disposable Earplugs (Foam, Silicone)

- Reusable Earplugs (Pre-molded, Custom-molded)

- Earmuffs (Passive, Electronic/Active Noise Reduction)

- Banded Hearing Protectors

- By End-User Industry:

- Manufacturing (Automotive, Heavy Machinery)

- Construction

- Oil & Gas and Mining

- Military and Defense

- Aviation and Transportation

- Healthcare and Pharmaceuticals

- Entertainment and Sports Shooting

- By Technology:

- Passive Hearing Protection

- Active/Electronic Hearing Protection (Level-Dependent, ANR)

Value Chain Analysis For Hearing Protector Market

The value chain of the Hearing Protector Market begins with upstream activities focused on raw material procurement, encompassing specialized polymers (polyurethane, PVC, silicone), advanced acoustic components (microphones, speakers, DSP chips), and specialized ergonomic materials. Key suppliers for electronic components often dictate the pace of technological innovation, particularly concerning battery life and digital signal processing quality for active noise cancellation features. Upstream challenges often involve ensuring a sustainable supply of high-grade, non-allergenic materials that meet strict international health and safety material composition standards. Efficient management of these inputs is critical for maintaining cost control, especially for high-volume disposable products where margins are thin.

Midstream activities involve core manufacturing, assembly, rigorous quality control testing (measuring NRR compliance and durability), and certification processes mandated by global bodies such as ANSI, CE, and CSA. Direct distribution channels, where manufacturers sell directly to large industrial end-users (e.g., major automotive plants, military procurement agencies), ensure maximum control over product delivery and service integration, often involving custom safety consulting. Indirect distribution channels, relying on specialized safety distributors, general industrial suppliers, and e-commerce platforms, are crucial for reaching smaller enterprises and individual consumers. The choice of channel significantly impacts market penetration, pricing, and the ability to offer localized technical support and training on proper usage and fitting, which is essential for ensuring product efficacy and compliance.

Downstream analysis focuses on the end-user adoption and post-sale services. For industrial consumers, the critical downstream activities include safety manager training, fitting programs, compliance auditing, and replacement scheduling. The demand for customized solutions, particularly in reusable and electronic segments, drives service revenue. Potential customers (End-Users) demand products that are not only highly protective but also comfortable and easily integrated with other PPE (helmets, respirators). Manufacturers who invest in robust, digitally-enabled customer feedback loops—allowing for continuous product improvement based on real-world industrial usage data—are better positioned to capture and retain market share across highly regulated sectors globally.

Hearing Protector Market Potential Customers

Potential customers for the Hearing Protector Market are defined by their exposure to hazardous noise levels that exceed mandated occupational limits (typically 85 dBA Time-Weighted Average). The primary and largest cohort of customers are industrial enterprises operating in heavy manufacturing, including steel production, aerospace, and automotive assembly lines, where continuous operation of heavy machinery generates significant noise pollution. These organizations prioritize regulatory compliance, seeking bulk purchases of certified, durable, and cost-effective protective gear, often requiring personalized fitting solutions to maximize NRR efficacy and minimize liability associated with workplace hearing loss claims.

A second crucial customer segment involves the construction, infrastructure, and mining industries. Workers in these environments face unique challenges, including impulse noise (drilling, blasting) and variable, transient noise levels, demanding hearing protectors that offer adaptive or level-dependent attenuation capabilities. For these customers, durability, visibility (often requiring high-visibility colors), and integration with hard hats and other head protection are key purchasing criteria. Moreover, the Military and Defense sector represents a high-value customer base, requiring highly sophisticated, tactical communication hearing protection capable of integrating with radio systems while providing ballistic noise suppression, emphasizing performance and mission critical communication clarity over cost considerations.

Additionally, a rapidly expanding customer base includes professional musicians, sound engineers, and recreational users (e.g., motor sports, shooting sports enthusiasts). While smaller in volume compared to industrial segments, these consumers seek highly specialized, uniform attenuation products, such as filtered earplugs, that reduce noise intensity without distorting the frequency response, ensuring audio fidelity remains intact. This segment drives innovation in custom-molded, high-comfort, and aesthetically discreet solutions, indicating a broadening market appeal beyond traditional occupational safety applications and requiring specialized retail and e-commerce distribution strategies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.1 Billion |

| Market Forecast in 2033 | USD 3.2 Billion |

| Growth Rate | CAGR 6.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3M Company, Honeywell International Inc., Moldex-Metric Inc., MSA Safety Incorporated, ProtectEar USA, Cotisen (Foshan) Co., Ltd., Elvex Corporation, Pyramex Safety Products, Amplifon S.p.A., Sonomax Hearing Healthcare Inc., Etymotic Research Inc., Starkey Hearing Technologies, Hellberg Safety AB, David Clark Company, Westone Laboratories Inc., Sensear Pty Ltd., E.A.R. Inc., CavCom Inc., NoiseBuster LLC, Radians Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hearing Protector Market Key Technology Landscape

The technology landscape in the Hearing Protector Market is rapidly evolving, driven by the shift from basic physical attenuation to sophisticated digital acoustic management. A cornerstone technology is Digital Signal Processing (DSP), which powers most modern electronic earmuffs and earplugs. DSP algorithms enable features like level-dependent sound restoration, allowing users to hear weak sounds (like speech) clearly while instantaneously clipping hazardous loud noises. This capability is critical for enhancing worker safety by ensuring both protection and situational awareness. Another significant development involves Active Noise Reduction (ANR) or Active Noise Cancellation (ANC), predominantly used in premium earmuffs, which utilizes phase inversion techniques to actively neutralize low-frequency, sustained droning noises, providing superior protection, especially in environments like aircraft cockpits or heavy machinery operations.

Material science innovation also plays a vital role, particularly in the development of advanced polymer and foam compounds for disposable and reusable earplugs. Manufacturers are focusing on hypoallergenic, heat-sensitive foams that conform perfectly to the ear canal, maximizing the seal and therefore the achievable NRR, directly addressing the common issue of protection leakage caused by poor fit. Furthermore, connectivity technologies, primarily Bluetooth Low Energy (BLE), are now standard in high-end protectors, enabling seamless connection to mobile devices for communication and entertainment, turning the hearing protector into a personalized audio hub within a safe acoustic envelope. This convergence of protection and connectivity significantly improves worker compliance as the devices offer added utility beyond mere safety.

The latest technological frontier involves miniaturization and customization, facilitated by 3D printing and advanced scanning techniques for custom-molded hearing protection. This process allows manufacturers to create highly accurate, personalized ear protectors that offer optimal comfort and the highest possible NRR for passive protection. Additionally, the incorporation of micro-electromechanical systems (MEMS) microphones and sensors is enabling the next generation of smart hearing devices capable of logging noise exposure data, monitoring usage time, and even providing real-time feedback on the quality of the earplug seal. These integrated features are crucial for OHS managers seeking data-driven compliance validation and comprehensive risk assessment tools.

Regional Highlights

- North America: This region maintains its market leadership position, largely due to extremely strict governmental regulations enforced by agencies like OSHA and MSHA (Mine Safety and Health Administration), necessitating universal compliance across all industrial sectors. The United States and Canada represent mature markets characterized by high adoption rates of advanced, electronic hearing protection systems, especially within manufacturing and the tactical defense sectors. Regional growth is further supported by a strong innovation ecosystem, leading to rapid integration of smart technology (IIoT integration, communication features) into protective gear, driving high average selling prices.

- Europe: The European market is highly regulated under the European Union directives (e.g., EN 352 standards), focusing heavily on ergonomic design and standardized testing protocols. Western European countries, particularly Germany and the UK, exhibit high demand for reusable and custom-molded hearing protectors, emphasizing sustainability and long-term worker comfort. Central and Eastern Europe are experiencing accelerated growth as their industrial bases modernize and align with EU safety standards, creating significant opportunities for both basic and advanced PPE suppliers.

- Asia Pacific (APAC): APAC is poised for the most rapid market expansion, driven by massive infrastructure projects, burgeoning manufacturing capabilities, and increasingly effective enforcement of local safety laws, particularly in China, India, and Southeast Asia. While the market is currently dominated by high-volume, low-cost disposable earplugs, rising worker welfare standards and foreign investment are spurring demand for medium-to-high-end earmuffs and advanced electronic systems. Japan and Australia lead in the adoption of technology-intensive hearing safety solutions.

- Latin America (LATAM): Growth in LATAM is concentrated in key industrial nations such as Brazil and Mexico, fueled primarily by the expansion of mining, oil and gas, and automotive manufacturing. The market here is sensitive to economic fluctuations and is characterized by a strong emphasis on cost-effectiveness, favoring reusable earplugs and passive earmuffs. However, increasing standardization efforts and international corporate presence are slowly pushing the demand toward higher-quality, certified products.

- Middle East and Africa (MEA): The MEA market growth is intrinsically linked to major investments in construction, energy (oil and gas), and petrochemical industries, particularly in the GCC countries. The harsh environmental conditions (heat, dust) necessitate durable, high-comfort designs. Market dynamics are driven by large governmental contracts for infrastructure and defense, leading to a focus on robust industrial and tactical hearing protection solutions that can withstand extreme operational environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hearing Protector Market.- 3M Company

- Honeywell International Inc.

- Moldex-Metric Inc.

- MSA Safety Incorporated

- ProtectEar USA

- Cotisen (Foshan) Co., Ltd.

- Elvex Corporation

- Pyramex Safety Products

- Amplifon S.p.A.

- Sonomax Hearing Healthcare Inc.

- Etymotic Research Inc.

- Starkey Hearing Technologies

- Hellberg Safety AB

- David Clark Company

- Westone Laboratories Inc.

- Sensear Pty Ltd.

- E.A.R. Inc.

- CavCom Inc.

- NoiseBuster LLC

- Radians Inc.

Frequently Asked Questions

Analyze common user questions about the Hearing Protector market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Hearing Protector Market?

The most significant driver is the increasing enforcement of stringent occupational health and safety (OHS) regulations worldwide, particularly concerning permissible noise exposure limits (PELs) set by organizations like OSHA and the EU, compelling industries to mandate certified protective equipment.

How does Active Noise Reduction (ANR) technology compare to traditional passive hearing protection?

ANR technology utilizes electronics and phase cancellation to actively neutralize specific low-frequency noise components, offering superior protection against continuous droning sounds, whereas passive protection relies solely on physical materials (foam, plastic) to block sound across all frequencies.

Which end-user segment contributes most significantly to hearing protector demand?

The Manufacturing and Construction sectors collectively represent the largest segment in terms of volume and revenue, driven by the pervasive use of heavy, loud machinery and the resulting high number of workers exposed to hazardous noise levels daily.

What challenges hinder market adoption and user compliance?

Key challenges include user discomfort, poor fit leading to reduced effectiveness, and interference with essential communication or auditory cues, which manufacturers are addressing through custom molding and integrated electronic communication features.

What is the role of digitalization in the future of hearing protection?

Digitalization allows for the development of smart, connected hearing protectors capable of real-time monitoring of noise exposure, data logging for compliance reports, and integration of adaptive sound processing (AI) for enhanced situational awareness.

Are custom-molded hearing protectors better than disposable earplugs?

Custom-molded protectors generally offer superior long-term comfort, personalized fit, and often achieve a higher effective NRR due to the perfect seal, making them advantageous for consistent long-duration use, despite their higher initial cost compared to disposable options.

How is the military and defense segment influencing product innovation?

The military segment drives demand for highly advanced tactical hearing protection, forcing innovation in robust, multi-functional systems that incorporate simultaneous communication capabilities, precise impulse noise suppression, and integration with helmet systems.

What is Noise Reduction Rating (NRR) and why is it important?

NRR is a standard measurement indicating the effectiveness of a hearing protection device in reducing noise exposure, measured in decibels (dB). It is crucial as regulatory bodies require employers to ensure workers use protection with an NRR appropriate for the specific workplace noise level.

How does AI contribute to predictive safety management in industrial settings?

AI analyzes aggregated noise exposure data collected from smart protectors to identify patterns, pinpoint high-risk work zones or operational procedures, and enable OHS managers to implement preventative engineering or administrative controls before workers experience overexposure.

Which regional market is forecast to exhibit the fastest growth?

The Asia Pacific (APAC) region is projected to show the fastest market growth, fueled by rapid industrialization, large-scale infrastructure development, and the increasing adoption and enforcement of occupational safety standards across emerging economies like India and China.

What is the significance of the shift toward reusable hearing protection?

The shift toward reusable and custom-molded protection reflects corporate goals for sustainability, cost-efficiency over the long term, and improved worker compliance due to enhanced comfort and durability compared to single-use disposable foam options.

What are the primary raw materials used in hearing protector manufacturing?

Key raw materials include specialized polymers such as polyurethane and silicone for earplugs, ABS plastics for earmuff shells, and advanced acoustic foams and textiles for internal sound dampening and cushion seals.

How do manufacturers ensure the NRR claimed for their products is accurate?

Manufacturers must adhere to rigorous international testing standards, such as ANSI S3.19 (US) or EN 352 (Europe), utilizing controlled laboratory environments and specific test methodologies to accurately determine and certify the Noise Reduction Rating of the device.

What is level-dependent hearing protection?

Level-dependent protection is a type of electronic hearing protector that automatically adjusts attenuation based on the ambient noise level, allowing sound below a safe threshold to be heard or even amplified, while instantaneously suppressing noise that exceeds the hazardous limit.

Do hearing protectors affect worker productivity?

High-quality hearing protectors, especially electronic ones that maintain speech clarity, generally improve worker productivity by reducing noise-induced fatigue, improving concentration, and enabling critical communication without requiring the removal of the protective device.

What role do e-commerce channels play in the market?

E-commerce channels are increasingly vital for reaching individual consumers (musicians, hobbyists, recreational shooters) and smaller businesses, facilitating easier access to specialized products and detailed fitting information, thereby broadening the market reach beyond bulk industrial procurement.

How are environmental concerns impacting product design?

Environmental concerns are driving R&D toward sustainable materials, including biodegradable foams and long-lasting, highly durable reusable components, reducing the waste generated by billions of disposable earplugs used annually in industrial settings.

What are the challenges of hearing protection in the Oil & Gas sector?

The Oil & Gas sector presents challenges including extreme temperatures, explosive environments (requiring intrinsically safe devices), high levels of continuous machine noise, and the necessity for communication systems integrated into intrinsically safe, robust hearing protection units.

What is the difference between passive and active earmuffs?

Passive earmuffs provide protection solely through materials that block sound waves, while active (electronic) earmuffs contain microphones, speakers, and electronics that either provide active noise cancellation (ANR) or level-dependent amplification/attenuation.

How does the threat of litigation influence corporate investment in hearing protection?

The significant financial and legal risks associated with workplace hearing loss claims motivate companies to invest proactively in premium, high-compliance hearing protection systems and advanced monitoring technology to demonstrate due diligence and minimize potential liability.

Which company holds a major market share in disposable earplugs?

Companies like 3M Company and Moldex-Metric Inc. are traditionally recognized as having strong market positions in the high-volume disposable earplug segment due to extensive global distribution networks and proven product effectiveness.

Why is personalized fit critical for optimal hearing protection?

A personalized or custom fit is critical because any gap or poor seal between the protector and the ear canal allows sound leakage, drastically reducing the effective NRR, making the device much less protective than its laboratory-tested rating suggests.

What new features are being integrated into smart hearing protectors?

New features include spatial awareness technology for sound localization, integrated radio communication systems, environmental sensors (temperature, pressure), and connectivity to smartphone apps for personalized acoustic profile adjustments and data visualization.

How do varying climatic conditions affect hearing protector choice?

In hot or humid climates, users prefer lighter, less obstructive protection like canal caps or specialized ventilated earmuffs to mitigate sweating and discomfort, which otherwise leads to low usage compliance and potential heat stress.

What distinguishes Uniform Attenuation Plugs from standard foam earplugs?

Uniform Attenuation Plugs (often used by musicians) utilize specialized acoustic filters to reduce sound levels equally across all frequencies, preserving the natural sound quality, unlike standard foam plugs which typically block high frequencies more aggressively.

Is there a regulatory trend towards lowering PELs globally?

Yes, there is a clear trend, especially in developed economies, where scientific understanding of noise-induced damage is leading regulators to consider or implement lower permissible exposure limits, increasing the demand for highly effective protective gear.

How is the aerospace industry's demand for protection unique?

Aerospace demands highly specialized protection for ground crew exposed to extremely loud jet engine noise (requiring maximum NRR), and pilots who require ANR systems that filter engine noise while ensuring clear, uninterrupted cockpit communication.

What are the main segments covered in the Hearing Protector Market segmentation?

The segmentation primarily covers Product Type (Earplugs, Earmuffs), End-User Industry (Manufacturing, Construction, Military), and Technology (Passive and Active/Electronic).

How do manufacturers address the hygiene concerns related to reusable earplugs?

Manufacturers address hygiene concerns by using medical-grade, easily washable silicone or thermoplastic elastomers, and by providing storage cases and cleaning solutions, emphasizing that regular maintenance is essential for safe, long-term reuse.

What impact does the construction of megaprojects have on the market?

Large-scale construction and infrastructure megaprojects generate substantial short-term demand for high volumes of robust hearing protection, particularly earmuffs and durable reusable earplugs, due to the sustained exposure to loud machinery and drilling operations.

What is the competitive landscape like in the electronic hearing protection segment?

The electronic segment is characterized by high competitive rivalry focused on innovation, particularly in integrating better battery life, superior DSP capabilities, seamless wireless connectivity, and achieving a high level of water and dust resistance for challenging environments.

Why is communication integration a critical feature in new products?

Communication integration is vital because workers often need to communicate critical safety instructions or operational updates in loud environments; electronic protectors allow this without compromising protection by using internal microphones and speakers.

How do technology trends affect the pricing structure of hearing protectors?

Technology trends create a bifurcated market: passive protection remains highly competitive and low-cost, while the integration of advanced electronics (DSP, ANR, communication) drives the cost and profitability significantly higher for premium, active devices.

What is the role of auditory fitness for duty programs?

Auditory fitness for duty programs utilize hearing protectors integrated with monitoring sensors to track actual noise dose received by the worker, ensuring they meet regulatory exposure standards and are fit for continued work in noisy environments.

Which factors contribute to North America's dominance in the market?

North America's dominance is attributed to a mature industrial base, stringent, well-enforced federal safety standards, high awareness among both employers and employees regarding NIHL risks, and early adoption of technology-integrated PPE solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager