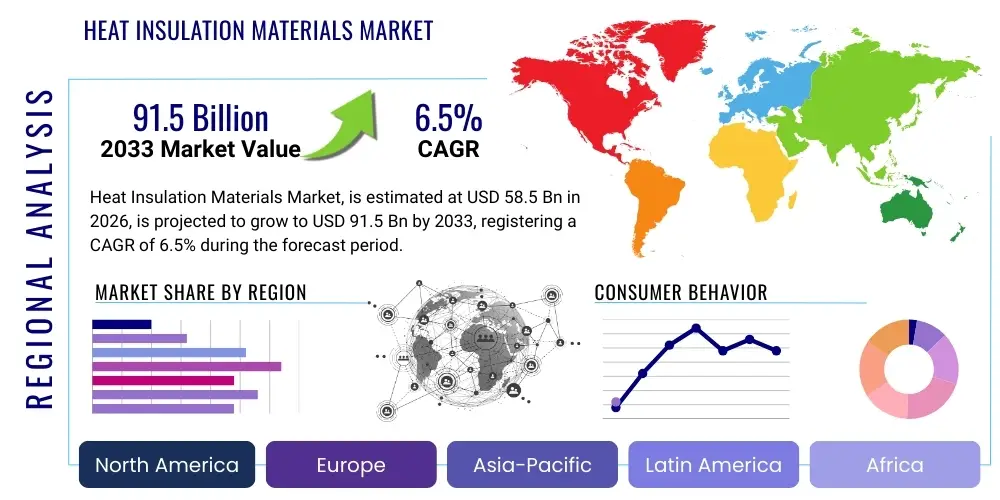

Heat Insulation Materials Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436985 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Heat Insulation Materials Market Size

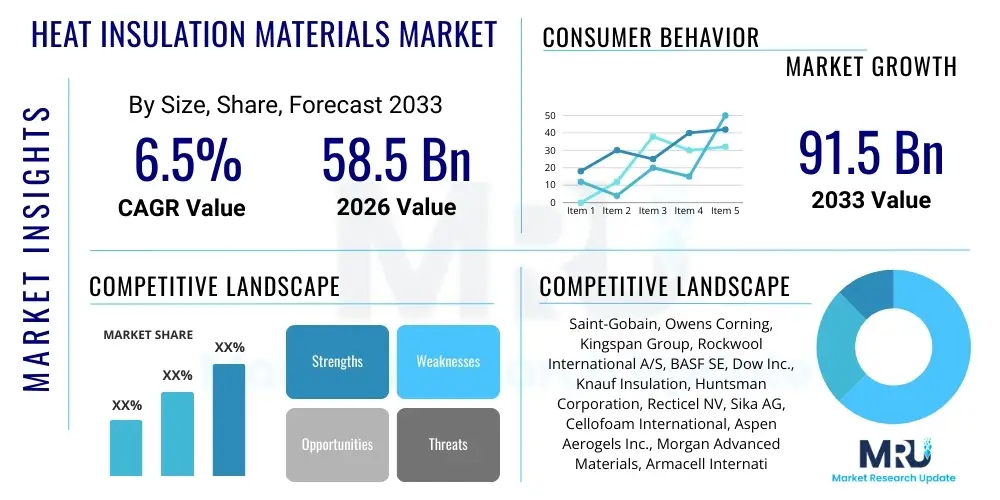

The Heat Insulation Materials Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 58.5 Billion in 2026 and is projected to reach USD 91.5 Billion by the end of the forecast period in 2033.

Heat Insulation Materials Market introduction

The Heat Insulation Materials Market encompasses a diverse range of products designed to reduce heat transfer between objects or areas, primarily targeting energy efficiency and thermal comfort across various end-use sectors. These materials, which include mineral wool, polyurethane (PU), expanded polystyrene (EPS), extruded polystyrene (XPS), and fiberglass, function by trapping air or gas within their structures, significantly impeding convective and conductive heat flow. Their effectiveness is quantitatively measured by thermal conductivity (k-value) and R-value, with lower k-values indicating superior insulating performance. The core application areas span residential and commercial construction, HVAC systems, industrial processes, automotive manufacturing, and aerospace, driven by global mandates focused on decarbonization and achieving net-zero energy building standards.

The escalating global concern regarding climate change and the resultant governmental imposition of stringent energy efficiency codes are the primary propellers of market expansion. Modern construction techniques increasingly rely on high-performance insulation to minimize heating and cooling demands, thereby reducing operational carbon footprints. Furthermore, the robust growth in industrialization, particularly in the Asia Pacific region, necessitates highly efficient thermal management solutions for process heating and cooling in sectors such as oil and gas, chemicals, and power generation. The longevity, fire safety ratings, and sustainability profile of insulation materials are becoming crucial purchasing criteria, leading to significant research and development investments aimed at enhancing material characteristics, particularly towards bio-based and recyclable alternatives.

The market benefits significantly from the increasing prevalence of renovation and retrofitting activities in mature economies like North America and Europe, where aging infrastructure demands upgraded thermal performance to meet current energy standards. The development of advanced insulation technologies, such as vacuum insulated panels (VIPs) and aerogels, offers solutions for applications where space constraints are critical, providing superior insulation thickness ratios. Despite challenges related to raw material price volatility, especially petrochemical feedstocks required for plastic foams, the fundamental demand driven by mandatory energy savings ensures sustained market traction. Manufacturers are focusing on optimizing production processes to improve cost-effectiveness and reduce the environmental impact associated with material sourcing and disposal.

- Product Description: Materials used to resist heat flow (e.g., fiberglass, PU, mineral wool, aerogels).

- Major Applications: Building & Construction (Residential, Commercial), Industrial (Oil & Gas, Chemicals), HVAC, Automotive, Appliances.

- Benefits: Reduced energy consumption, lower utility costs, improved thermal comfort, reduced carbon emissions, noise reduction.

- Driving factors: Strict government regulations on energy conservation, growing demand for green buildings, rising urbanization, and industrial expansion.

Heat Insulation Materials Market Executive Summary

The global Heat Insulation Materials Market is poised for significant expansion, characterized by a fundamental shift toward sustainable and high-performance solutions driven by regulatory imperatives in energy efficiency across major economies. Business trends indicate strong vertical integration among leading players to secure raw material supply chains, especially for petrochemical derivatives essential for foam insulation production. Strategic mergers, acquisitions, and collaborative research initiatives focusing on developing non-combustible and environmentally benign materials, such as bio-based foams and high-density mineral wool, define the competitive landscape. Furthermore, the increasing adoption of pre-fabricated and modular construction techniques is necessitating the development of standardized, easy-to-install insulation systems, streamlining installation processes and reducing on-site labor costs.

Regional dynamics highlight the Asia Pacific (APAC) as the epicenter of new construction growth, fueled by rapid infrastructural development, urbanization, and industrial capacity expansion in nations like China and India, making it the fastest-growing market segment. Conversely, North America and Europe are mature markets primarily driven by renovation projects, stringent energy performance mandates (such as the Energy Performance of Buildings Directive in the EU), and consumer preference for premium, sustainable insulation solutions. The stringent building codes in Europe mandate specific thermal conductivity targets, leading to high adoption rates of advanced materials like Vacuum Insulated Panels (VIPs) in urban infill projects where wall thickness must be minimized. The Middle East and Africa (MEA) region is exhibiting robust growth, propelled by large-scale commercial developments and the necessity for effective cooling solutions to counteract extreme ambient temperatures, emphasizing the demand for high-temperature resistance materials.

Segmentation analysis reveals the Mineral Wool segment (fiberglass and rock wool) maintaining market dominance due to its superior fire resistance, sound absorption capabilities, and widespread applicability in both residential and industrial settings. However, the Polyurethane (PU) and Polyisocyanurate (PIR) foams segment is projected to exhibit the highest growth rate, particularly in the commercial roofing and wall insulation sectors, owing to their excellent R-value per inch, offering superior thermal performance in limited space. The Building and Construction application segment remains the largest end-user, but the industrial sector, driven by complex process temperature control needs in LNG facilities and chemical processing plants, represents a high-value niche requiring specialized, often ceramic-based, insulation materials capable of enduring extreme thermal cycles and corrosive environments.

AI Impact Analysis on Heat Insulation Materials Market

User queries regarding the intersection of Artificial Intelligence (AI) and the Heat Insulation Materials Market predominantly center on how AI can optimize material synthesis, enhance quality control during manufacturing, and improve the energy performance predictability of installed systems. Common concerns revolve around AI's capability to manage raw material volatility by predicting supply chain disruptions, the role of machine learning (ML) in developing novel, superior insulating compounds (e.g., optimizing pore structure in aerogels), and the application of AI in building energy management systems (BEMS) to fine-tune insulation requirements based on real-time climate data and occupancy patterns. Users seek clarity on whether AI adoption will significantly lower the cost of high-performance materials like VIPs and whether predictive modeling can extend the lifespan and integrity of installed insulation systems by identifying potential thermal bridges or moisture ingress before physical deterioration occurs.

AI is strategically employed in the R&D phase to accelerate the discovery and testing of new high-performance insulation materials. By leveraging machine learning algorithms, researchers can analyze vast datasets of material properties (chemical composition, density, thermal conductivity) to predict the performance of novel molecular structures, significantly reducing the time and expense associated with traditional laboratory experimentation. This predictive capability is crucial for developing sustainable, bio-based alternatives that match or exceed the performance of fossil fuel-derived foams. Furthermore, AI-driven process optimization in manufacturing facilities is leading to reduced waste, lower energy consumption during production (e.g., curing processes), and enhanced consistency in material density and structural integrity, crucial for maintaining insulation quality standards.

In the application phase, AI algorithms are integral to advanced building simulations and Digital Twin creation. These tools utilize complex environmental inputs (solar radiation, wind patterns, interior thermal load) to precisely calculate the optimal type, thickness, and placement of insulation materials within a structure, far exceeding the capabilities of static, traditional engineering calculations. This leads to hyper-personalized insulation strategies that maximize energy savings and occupant comfort. Moreover, AI-powered image recognition and thermal drone surveys are being deployed for post-installation inspection, rapidly identifying installation defects, thermal bridging, or degradation in existing building envelopes, allowing for targeted maintenance interventions and ensuring long-term thermal performance integrity, thereby securing the return on investment for end-users.

- AI-driven optimization of material chemical formulations to achieve target R-values and flame resistance.

- Predictive maintenance schedules for industrial insulation systems using sensor data and ML algorithms.

- Supply chain risk prediction and dynamic raw material sourcing management based on global market fluctuations.

- Automated quality control systems (vision inspection) to detect imperfections during foam expansion or mineral fiber matting.

- Enhanced building energy modeling (BEM) to prescribe optimal insulation thickness and material type based on lifecycle cost analysis.

- Development of smart insulation materials embedded with sensors whose thermal properties are dynamically adjusted by AI controls.

DRO & Impact Forces Of Heat Insulation Materials Market

The market dynamics are defined by a powerful interplay between strict regulatory enforcement (Drivers), high raw material volatility (Restraints), and significant technological advancements (Opportunities), all magnified by pervasive environmental and energy security concerns (Impact Forces). The primary driving force is the global legislative shift toward mandating higher energy performance standards in both new and existing buildings, exemplified by revised national building codes and initiatives like the European Union’s Energy Performance of Buildings Directive (EPBD) which pushes for nearly zero-energy buildings (NZEBs). This regulatory environment ensures a baseline demand irrespective of economic cycles. Conversely, a major restraint is the significant reliance on petrochemical derivatives (MDI, TDI, styrene) for foam insulation production, leading to unpredictable cost structures and supply chain vulnerabilities, which complicate long-term pricing strategies for manufacturers and contractors. Furthermore, the complexity and cost of installing high-performance materials like VIPs and aerogels remain a barrier to mass-market penetration, particularly in developing economies where cost sensitivity is higher.

Opportunities for market growth are vast, centered predominantly on the development and commercialization of bio-based insulation materials (e.g., mycelium, cellulose, recycled content foams) that align with circular economy principles and address consumer demand for non-toxic, sustainable products. Specific technological opportunities lie in enhancing the fire safety profiles of polyurethane and polystyrene foams through advanced flame retardants, and in the commercial scaling of next-generation materials like Phase Change Materials (PCMs) integrated into conventional insulation to provide dynamic thermal buffering, improving comfort and reducing peak energy loads. Investment in automated installation technologies, such as spray foam robotics, also presents an opportunity to mitigate labor shortages and enhance application precision, further accelerating project timelines and reducing waste on construction sites.

The principal impact forces shaping this market include the sustained global focus on carbon emissions reduction and energy independence, which elevates insulation from a simple building component to a critical tool for national energy security and environmental compliance. The construction sector’s contribution to global CO2 emissions compels stakeholders to prioritize materials with low embodied energy. Secondary forces include the increasing frequency and severity of extreme weather events, which necessitate resilient building envelopes capable of withstanding high winds, flooding, and rapid temperature fluctuations, thus driving demand for durable, moisture-resistant insulation solutions. These forces collectively ensure that innovation in thermal performance remains a high priority, overriding many of the cost constraints associated with high-quality material adoption.

Segmentation Analysis

The Heat Insulation Materials Market is systematically segmented based on material type, application, and end-use, allowing for precise market sizing and strategic targeting across diverse industry verticals. Material segmentation provides insight into the dominance of traditional, cost-effective options versus the accelerating adoption of premium, high-efficiency technologies. The core of the market remains centered around bulk insulation materials such as mineral wool and plastic foams due to their balance of cost, performance, and familiarity in standard construction practices. However, increasing regulatory scrutiny on fire safety and sustainability is steadily shifting preference towards advanced hybrid solutions and materials like rigid mineral wool boards and low-lambda foams, particularly in urban, high-density environments where safety standards are non-negotiable.

Application segmentation reveals the overwhelming market share held by the Building and Construction sector, covering insulation for walls, roofs, floors, and HVAC ductwork, essential for meeting thermal efficiency standards in both residential and commercial structures. The Industrial sector, while smaller in volume, holds critical importance due to the specialized and high-temperature requirements of processes in sectors such as petrochemicals, power generation, and specialized cold chain logistics. These applications demand high-performance materials like ceramic fibers, perlite, and calcium silicate, which are specifically designed to withstand extreme thermal loads and chemical exposure, requiring specialized fabrication and installation expertise.

Further granularity is provided by end-use segmentation, differentiating between residential and commercial construction, which have distinct purchasing criteria (cost vs. R-value and longevity). The forecast period shows significant growth in the commercial refurbishment segment, driven by mandates to upgrade existing commercial property stock to achieve higher energy ratings for valuation purposes. Additionally, the increasing complexity of HVAC and refrigeration systems requires tailored insulation solutions to prevent condensation, maintain system efficiency, and comply with evolving refrigerant handling regulations, ensuring that the ancillary application segments grow in tandem with core construction activities.

- By Material Type:

- Mineral Wool (Glass Wool, Rock Wool)

- Plastic Foams (Polyurethane (PU) & Polyisocyanurate (PIR), Expanded Polystyrene (EPS), Extruded Polystyrene (XPS))

- Cellular Glass

- Calcium Silicate

- Aerogels

- Ceramic Fiber

- Others (Natural Fibers, Perlite, VIPs)

- By Application:

- Wall Insulation

- Roof Insulation

- Floor Insulation

- HVAC Insulation

- Process/Industrial Insulation

- Others (Pipe Insulation, Tank Insulation)

- By End-Use Industry:

- Building & Construction (Residential, Commercial)

- Industrial (Oil & Gas, Chemicals, Power Generation, Refineries)

- HVAC & Appliances

- Automotive & Transportation

Value Chain Analysis For Heat Insulation Materials Market

The value chain for the Heat Insulation Materials Market is extensive and complex, beginning with the upstream procurement of specialized raw materials, followed by intricate manufacturing processes, and concluding with highly specialized distribution and installation services. The upstream analysis reveals significant reliance on raw material suppliers, including petrochemical companies for MDI, TDI, and styrene required for plastic foams, as well as mining and processing companies for basalt, slag, and silica sand used in mineral wool production. Price volatility in these raw material markets poses a consistent challenge, forcing insulation manufacturers to engage in strategic hedging or long-term contracts to ensure stable input costs. Integration between feedstock suppliers and insulation producers is becoming more common, aiming to secure competitive advantages and optimize material quality from the source, especially for materials requiring high purity or specific physical characteristics.

The midstream stage involves the core manufacturing process, where diverse technologies are utilized, ranging from energy-intensive melting processes for mineral wool to precise chemical reaction and foaming processes for polymer insulations. This stage is characterized by significant capital expenditure for plant setup and substantial operational costs related to energy consumption and waste management. Innovation at this stage focuses on improving manufacturing efficiency, reducing the thickness required for a given R-value (lambda reduction), and developing non-toxic production techniques. Quality control is paramount, ensuring that the final products meet stringent regional thermal and fire safety certifications, which often requires significant investment in standardized testing facilities and certification processes that are specific to regional building codes, such as those in Europe (CE mark) and North America (ASTM standards).

The downstream distribution channel is critical, often involving a tiered structure that includes large national distributors, specialized insulation wholesalers, and direct sales to major construction contractors or industrial end-users. Direct sales are common for highly customized or technical products, such as those used in LNG facilities or large commercial HVAC projects, where application engineering support is essential. For residential and smaller commercial projects, indirect channels leverage local building supply houses and specialized contractors who offer bundled services encompassing supply, cutting, and installation. Effective distribution requires robust logistics capabilities due to the often bulky, low-density nature of insulation materials, necessitating regionally placed warehouses to minimize transportation costs and lead times, particularly important in time-sensitive construction projects. Ultimately, the competence of the installation contractor heavily influences the final performance of the insulation system, highlighting the necessity for strong training and accreditation programs throughout the channel.

Heat Insulation Materials Market Potential Customers

The primary end-users and buyers of heat insulation materials span four major economic sectors: Building & Construction, Industrial Operations, HVAC & Appliances Manufacturing, and Automotive & Transportation. Within the Building & Construction sector, the customer base is bifurcated into residential developers and homeowners (seeking cost-effective, easy-to-install solutions primarily focused on comfort and utility savings) and commercial developers, infrastructure builders, and institutional entities (prioritizing longevity, superior fire ratings, high R-values, and compliance with strict commercial energy mandates). These large-scale buyers typically engage directly with manufacturers or specialized national distributors to secure bulk orders and specialized technical support for complex designs such as curtain wall systems and green roofs.

The Industrial sector represents a high-value customer segment, comprising entities in oil and gas processing, chemical manufacturing, power generation plants (conventional and nuclear), and food processing. These customers require highly specialized thermal insulation capable of operating under extreme conditions, often involving high temperatures, chemical corrosion, or cryogenic environments (e.g., LNG storage and transport). Procurement decisions in this sector are driven by safety regulations, maintenance costs, thermal stability, and material lifespan rather than initial cost. These buyers often require custom-fabricated insulation jackets and pipe systems, engaging engineering, procurement, and construction (EPC) firms as intermediaries who select and specify the appropriate technical materials (e.g., calcium silicate, cellular glass, specialized ceramic fibers).

The HVAC and Appliance Manufacturing segment includes major global producers of refrigeration units, ovens, water heaters, and climate control systems. For these customers, insulation materials must be space-efficient, lightweight, and meet specific fire and smoke density requirements applicable to enclosed systems. The adoption of advanced, thin-profile insulation, such as VIPs or specialized mineral wool felts, is crucial for improving the energy star ratings of consumer appliances. Furthermore, the transportation sector, encompassing automotive, rail, and marine applications, utilizes insulation for thermal management, noise reduction, and enhancing passenger comfort, with emphasis on lightweight, durable materials that can withstand mechanical vibration and variable environmental conditions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 58.5 Billion |

| Market Forecast in 2033 | USD 91.5 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Saint-Gobain, Owens Corning, Kingspan Group, Rockwool International A/S, BASF SE, Dow Inc., Knauf Insulation, Huntsman Corporation, Recticel NV, Sika AG, Cellofoam International, Aspen Aerogels Inc., Morgan Advanced Materials, Armacell International S.A., 3M Company, Beijing New Building Material (BNBM) Group, URSA Insulation S.A., Polyglass S.p.A., Johns Manville, Continental Structural Plastics. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Heat Insulation Materials Market Key Technology Landscape

The technological landscape of the heat insulation materials market is undergoing rapid evolution, driven by the dual goals of maximizing thermal performance while minimizing environmental impact and material thickness. Traditional insulation technologies, such as fiberglass and expanded polystyrene, continue to benefit from incremental improvements in manufacturing processes that reduce the lambda value (thermal conductivity) through tighter fiber packing or optimized cell structure. However, the most significant transformative developments are occurring in advanced material science, particularly with the commercial scaling of technologies that offer performance superior to conventional materials. Vacuum Insulated Panels (VIPs), for example, represent a breakthrough, providing up to ten times the insulation performance of conventional materials by utilizing a near-vacuum core encased in a high-barrier envelope. Although currently higher in cost, VIPs are crucial for applications requiring ultra-thin insulation, such as high-rise urban buildings, refrigerated transport, and high-efficiency appliance manufacturing, where minimizing wall thickness is essential for maximizing usable space.

Another major technological focus is the refinement and cost reduction of Aerogels, which are highly porous, lightweight solids derived from a gel in which the liquid component has been replaced by gas. Aerogels offer exceptionally low thermal conductivity, often lower than that of still air, making them ideal for high-performance industrial and complex geometric insulation applications, particularly in petrochemical and aerospace sectors where extreme temperature stability is required. Manufacturers are concentrating on developing cost-effective production methods, such as atmospheric drying, to move aerogels beyond niche, high-cost applications. Simultaneously, significant research is being dedicated to developing phase change materials (PCMs) that can be integrated into insulation boards or plasters. PCMs work by absorbing and releasing large amounts of latent heat during phase transitions (e.g., solid to liquid), effectively delaying the transfer of heat through a wall assembly, which dynamically enhances the thermal mass of light construction and significantly improves thermal comfort stability within a structure during peak heating or cooling periods.

Furthermore, the industry is witnessing a technological pivot towards sustainability through the development of bio-based and recyclable materials. This includes the formulation of rigid polyurethane foams utilizing bio-polyols derived from natural oils instead of petroleum, reducing dependence on fossil fuels and lowering the embodied carbon of the final product. Similarly, the advancement in recycling technologies for materials like EPS and mineral wool aims to create truly circular economy products, reducing landfill waste. Digitalization is also a critical technological layer; Building Information Modeling (BIM) platforms now incorporate highly specific data on insulation material performance, enabling engineers and architects to model and predict the exact thermal behavior and lifecycle cost of different insulation solutions with unprecedented accuracy, leading to more informed and efficient material specifications across the entire project lifecycle.

Regional Highlights

Regional dynamics play a paramount role in shaping the demand patterns and regulatory environment of the Heat Insulation Materials Market, largely reflecting variances in climate, construction practices, and governmental energy mandates. North America, characterized by its mature regulatory framework (e.g., IECC and ASHRAE standards), maintains a significant market share. The demand here is fundamentally driven by renovation and retrofitting activities targeting energy efficiency upgrades in older buildings, particularly in regions with extreme climate fluctuations requiring robust heating and cooling solutions. The U.S. market emphasizes large-scale mineral wool and foam board usage in commercial construction, with a growing focus on high R-value spray foam insulation for residential attic and wall applications due to ease of sealing and superior air barrier performance, coupled with tax incentives for energy-efficient home improvements.

Europe stands out due to its extremely stringent energy performance mandates, notably the requirement for new buildings to be nearly zero-energy (NZEB) and ambitious renovation wave strategies aimed at upgrading millions of existing homes. This legislative push drives high demand for premium, complex insulation systems, including high-density mineral wool, cellular glass, and polyurethane/PIR boards with superior fire ratings. Germany, France, and the UK are key markets, where material selection is often governed by factors beyond R-value, such as embodied carbon, recyclability, and compliance with national fire classifications (e.g., Euroclass ratings), significantly boosting the adoption of certified green building materials and technologies like external insulation composite systems (ETICS).

The Asia Pacific (APAC) region is forecasted to be the engine of market growth, primarily fueled by unprecedented urbanization and massive infrastructure investment across China, India, and Southeast Asian nations. Unlike the mature markets, APAC demand is dominated by new construction, necessitating high volumes of cost-effective insulation, primarily EPS, XPS, and basic fiberglass, though the adoption of advanced materials is accelerating in tier-one cities driven by localized energy codes and international building standards being implemented in high-end commercial projects. Furthermore, rapid industrialization necessitates large quantities of high-temperature industrial insulation for newly built power plants, chemical complexes, and refinery expansions. Conversely, Latin America and the Middle East & Africa (MEA) present evolving markets. MEA specifically requires durable insulation tailored for high ambient temperatures and severe solar load, pushing demand for reflective insulation products and specialized polyisocyanurate materials for effective cooling management in the region’s expanding commercial and hospitality sectors.

- North America: Focus on residential retrofitting, stringent commercial building codes (ASHRAE), high adoption of spray foam and fiberglass insulation.

- Europe: Driven by NZEB mandates and Renovation Wave initiative; high demand for certified, fire-safe, and sustainable materials (PIR, high-density mineral wool).

- Asia Pacific (APAC): Highest growth market due to massive new construction, urbanization, and industrial expansion; primary consumers of EPS/XPS and industrial insulation.

- Latin America: Emerging market growth driven by industrial expansion, focusing on energy cost reduction in manufacturing.

- Middle East & Africa (MEA): Critical demand for high-performance insulation to counteract extreme heat and reduce cooling energy consumption in commercial infrastructure.

- Key Countries: U.S., Germany, China, India, Japan, Brazil, Saudi Arabia.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Heat Insulation Materials Market.- Saint-Gobain

- Owens Corning

- Kingspan Group

- Rockwool International A/S

- BASF SE

- Dow Inc.

- Knauf Insulation

- Huntsman Corporation

- Recticel NV

- Sika AG

- Cellofoam International

- Aspen Aerogels Inc.

- Morgan Advanced Materials

- Armacell International S.A.

- 3M Company

- Beijing New Building Material (BNBM) Group

- URSA Insulation S.A.

- Polyglass S.p.A.

- Johns Manville

- Continental Structural Plastics

Frequently Asked Questions

Analyze common user questions about the Heat Insulation Materials market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Heat Insulation Materials Market?

The primary factor is the global proliferation of stringent government regulations and building codes mandating higher energy efficiency and thermal performance standards for both new construction and existing building retrofits, thereby forcing developers and homeowners to invest in superior insulation products to reduce long-term operational carbon emissions.

How do mineral wool and plastic foam insulation materials compare in terms of performance?

Mineral wool (fiberglass and rock wool) generally offers excellent fire resistance and superior acoustic performance, making it preferred for safety-critical applications. Plastic foams (PU/PIR/XPS/EPS) typically offer a better R-value per inch, meaning they provide higher thermal resistance for a thinner application, making them advantageous where space conservation is a priority.

What role do advanced materials like Aerogels and VIPs play in the market?

Aerogels and Vacuum Insulated Panels (VIPs) are crucial for high-performance, space-constrained, and specialized applications, such as cold chain logistics, aerospace, and urban building facades. They provide significantly higher insulation efficiency compared to conventional materials, allowing for thinner walls and superior energy ratings, despite their higher initial cost.

Which geographical region exhibits the highest growth potential for insulation materials?

The Asia Pacific (APAC) region, driven by rapid urbanization, massive infrastructure development, and industrial expansion in countries like China and India, is expected to exhibit the highest Compound Annual Growth Rate (CAGR) due to the sheer volume of new construction projects initiated during the forecast period.

What are the key sustainability trends impacting material selection in the insulation market?

Sustainability trends are focusing heavily on reducing the embodied energy of materials, leading to increased demand for bio-based foams (using bio-polyols), natural fiber insulation (cellulose, hemp), and products with high recycled content. Emphasis is also placed on materials with verified low Global Warming Potential (GWP) and high recyclability at end-of-life.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager