Heat Recovery Wheels Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431557 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Heat Recovery Wheels Market Size

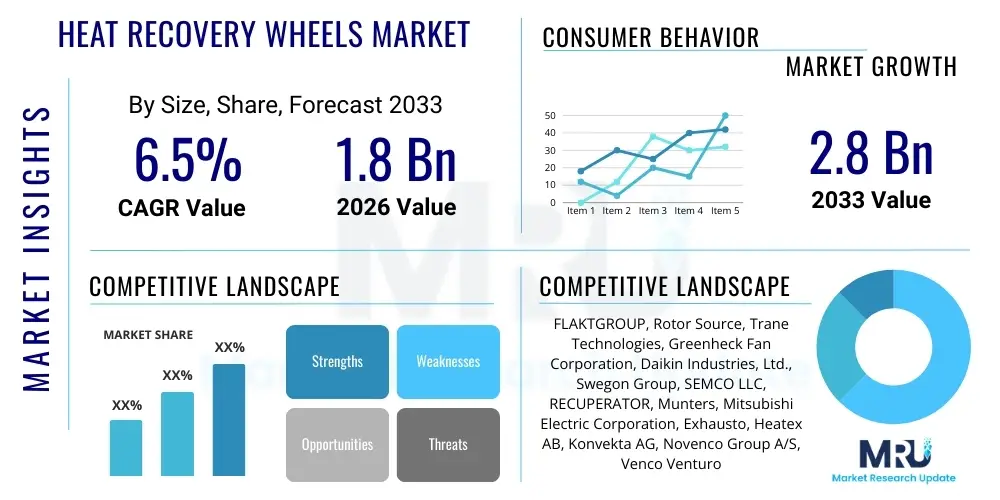

The Heat Recovery Wheels Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 2.8 Billion by the end of the forecast period in 2033.

Heat Recovery Wheels Market introduction

The Heat Recovery Wheels Market encompasses the manufacturing, distribution, and utilization of rotary heat exchangers designed to recover thermal energy (both sensible and latent) from exhaust air streams and transfer it to incoming fresh air streams. These devices are crucial components in modern Heating, Ventilation, and Air Conditioning (HVAC) systems, significantly improving energy efficiency in commercial, industrial, and increasingly, high-performance residential buildings. The fundamental principle revolves around a continuously rotating wheel matrix that cycles between the warm exhaust air and the cold supply air, maximizing thermal exchange while minimizing cross-contamination.

Heat recovery wheels, often termed enthalpy wheels when they recover both sensible heat and latent heat (moisture), address critical operational needs across various sectors. Major applications include hospitals, schools, offices, data centers, manufacturing facilities, and laboratories where maintaining high Indoor Air Quality (IAQ) and precise temperature control is paramount. The primary benefits derived from the deployment of these wheels include substantial reductions in energy consumption, lower peak demand loads on HVAC equipment, and compliance with stringent energy codes and environmental regulations aimed at building decarbonization.

Key driving factors propelling market expansion include the escalating global focus on energy conservation, mandated building efficiency standards (such as those promulgated by ASHRAE and European directives), and the continuous need for enhanced ventilation rates post-pandemic. Furthermore, technological advancements leading to increased wheel efficiencies, better contamination control mechanisms, and the integration of smart control systems are making heat recovery wheels more attractive investments for building owners seeking long-term operational cost savings and improved occupant well-being.

Heat Recovery Wheels Market Executive Summary

The Heat Recovery Wheels Market is currently experiencing robust growth, primarily driven by governmental mandates emphasizing energy efficiency in new construction and retrofitting projects globally. Business trends indicate a shift towards high-performance materials like specialized polymers and treated aluminum to enhance both sensible and latent heat recovery capabilities, minimizing maintenance requirements and maximizing durability. Investment is concentrated on developing highly efficient enthalpy wheels capable of managing humidity levels in addition to temperature, addressing climate variability and specific IAQ requirements across diverse geographical locations. Strategic acquisitions and partnerships focusing on integrating HRW technology within comprehensive air handling units (AHUs) are defining the competitive landscape, pushing manufacturers to offer modular, scalable solutions.

Regionally, North America and Europe remain the dominant markets, largely due to established regulatory frameworks, high energy costs, and widespread adoption of stringent building codes like Passive House and LEED certification standards. However, the Asia Pacific (APAC) region is demonstrating the fastest growth trajectory, fueled by rapid urbanization, significant infrastructure investment, and emerging environmental policies in countries like China and India, focusing particularly on large commercial complexes and industrial zones. The Middle East and Africa (MEA) region shows increasing adoption, particularly in areas requiring high sensible cooling load management, utilizing HRWs to precondition incoming hot, dry air efficiently.

Segment trends highlight the dominance of enthalpy wheels (recovering both sensible and latent heat) over sensible-only wheels, reflecting the increasing need for humidity control in modern airtight buildings, optimizing occupant comfort and preventing mold growth. Commercial applications, including corporate offices and educational institutions, constitute the largest end-user segment due to mandatory ventilation requirements and focus on occupant productivity. Furthermore, the industrial segment is exhibiting substantial expansion, particularly in pharmaceutical, automotive, and food processing sectors that require precise control over process air temperature and humidity for quality assurance and regulatory compliance.

AI Impact Analysis on Heat Recovery Wheels Market

Common user questions regarding AI’s impact on the Heat Recovery Wheels market center on optimizing system performance, predicting maintenance needs, and integrating HRWs seamlessly into smart building management systems (BMS). Users frequently ask how AI can enhance the operational lifespan of the wheels, prevent performance degradation due to fouling, and dynamically adjust rotation speed based on real-time environmental data (e.g., occupancy, outdoor air quality, energy prices). The key thematic expectations are reduced energy waste through predictive control, proactive maintenance scheduling instead of fixed schedules, and deeper integration into holistic smart HVAC ecosystems, moving beyond simple thermodynamic exchange towards intelligent energy management decisions.

AI algorithms, particularly machine learning models, are positioned to revolutionize the operational efficiency and reliability of heat recovery wheels. By analyzing vast amounts of historical and real-time operational data—including temperature differential, pressure drop across the wheel, fan speed, and outside air conditions—AI can predict when fouling is beginning to impact efficiency. This capability allows for condition-based maintenance (CBM) rather than reactive or time-based servicing, significantly reducing downtime and maximizing the wheel's energy recovery potential throughout its lifecycle. Furthermore, AI enables ultra-precise adjustment of variable frequency drives (VFDs) controlling the wheel's rotation speed, ensuring the optimal balance between heat recovery rate and fan energy consumption based on fluctuating building demands and minimizing parasitic losses.

The future application of AI extends to designing and sizing heat recovery wheel systems. Generative design tools leveraging AI can rapidly simulate thousands of potential configurations (material composition, matrix geometry, coating type) under specific regional climate profiles, optimizing the wheel design for maximum seasonal efficiency (Seasonal Energy Efficiency Ratio - SEER). For manufacturers, AI-driven quality control in the fabrication process ensures uniformity and performance consistency, while for end-users, AI models offer automated compliance reporting against energy performance benchmarks. This transformative shift elevates HRWs from passive energy-saving components to active, intelligent elements within the larger climate control infrastructure.

- AI-driven Predictive Maintenance (PdM) reduces downtime and extends wheel lifespan by anticipating fouling and mechanical wear.

- Optimized Rotation Speed Control minimizes parasitic energy consumption by dynamically adjusting wheel speed based on real-time loads and ambient conditions.

- Enhanced Fault Detection and Diagnostics (FDD) swiftly identifies performance anomalies resulting from seal degradation or motor issues.

- AI integration into Building Management Systems (BMS) facilitates holistic energy optimization across the entire HVAC infrastructure.

- Generative Design assists manufacturers in creating high-efficiency wheel geometries tailored to specific climatic requirements.

DRO & Impact Forces Of Heat Recovery Wheels Market

The Heat Recovery Wheels Market growth is significantly propelled by regulatory DRIVERS focused on environmental stewardship and energy efficiency in the built environment, counterbalanced by RESTRAINTS such as high initial investment costs and perceived complexity of maintenance. Vast OPPORTUNITIES arise from the retrofitting potential in aging commercial buildings and the expansion into niche applications requiring stringent air quality standards, such as pharmaceuticals and microelectronics manufacturing. These elements combine to exert substantial IMPACT FORCES, pushing manufacturers toward innovation in material science, seal technology, and smart integration capabilities to overcome cost barriers and maximize long-term operational savings.

Key drivers include rapidly increasing global energy prices, which heighten the economic incentive for maximizing efficiency; stricter ventilation standards (e.g., LEED, WELL Building Standard) demanding high rates of fresh air exchange while maintaining thermal stability; and government subsidies or tax credits encouraging the adoption of energy recovery technologies. However, the market faces restraints, notably the logistical challenges associated with installing large HRW units in existing buildings with constrained plenum space, the susceptibility of the wheel media to fouling in polluted environments, and the inherent risk of cross-contamination if seals are poorly maintained, which remains a key concern for critical applications like healthcare.

The opportunities are expansive, particularly in developing economies where rapid construction offers a greenfield for installing high-efficiency systems from the outset. Further opportunities exist in the specialization of media materials, such as antimicrobial coatings and advanced polymer matrices, enhancing performance and IAQ protection. The increasing demand for net-zero energy buildings and passive housing models intrinsically relies on highly efficient heat recovery solutions, creating a long-term, stable demand trajectory. The combined impact forces necessitate that market participants focus intensely on reducing the Total Cost of Ownership (TCO) through enhanced durability, simplified maintenance procedures, and guaranteed performance metrics, making the HRW solution demonstrably superior to conventional ventilation.

Segmentation Analysis

The Heat Recovery Wheels Market is segmented based on critical technical and application parameters, providing a detailed understanding of varying consumer needs and technological requirements across different sectors. Key segmentation criteria include the type of heat recovery mechanism (sensible vs. enthalpy), the material used for the wheel matrix (aluminum, polymers, treated fabrics), and the primary end-user application (commercial, industrial, residential). This granular analysis helps manufacturers tailor product specifications, focusing resources on high-growth segments such as the high-efficiency enthalpy wheel sector, which caters heavily to the growing demand for comprehensive indoor climate management.

The dominance of the commercial segment stems from large building footprints and regulatory mandates requiring centralized HVAC systems with energy recovery capabilities. Conversely, the industrial segment demands specialized HRWs capable of handling corrosive or high-temperature exhaust streams, driving innovation in material science and protective coatings. The residential segment, while smaller, is projected for significant growth, particularly in cold climate regions adopting high-performance building envelope standards, necessitating compact, high-efficiency residential ventilation units incorporating micro-HRWs.

Technological differentiation is also critical; sensible heat wheels are preferred in dry climates or applications where moisture transfer is undesirable, while enthalpy wheels are increasingly adopted in mixed and humid climates to reduce the latent cooling or heating load. The material segment reflects a trade-off between cost, efficiency, and longevity, with aluminum remaining popular for sensible heat transfer due to its high conductivity, while specialized polymer-based materials dominate the enthalpy market due to superior moisture absorption and desorption properties.

- By Type:

- Sensible Heat Recovery Wheels

- Enthalpy Heat Recovery Wheels

- By Material:

- Aluminum

- Polymer

- Treated Fabric/Desiccant Coated Media

- Others (e.g., Stainless Steel for industrial use)

- By Application:

- Commercial (Offices, Schools, Hospitals, Retail)

- Industrial (Manufacturing, Food Processing, Automotive, Pharmaceuticals)

- Residential (Single-family homes, Multi-family complexes)

- By Configuration:

- Standard Diameter

- Custom/Modular Design

Value Chain Analysis For Heat Recovery Wheels Market

The Heat Recovery Wheels value chain begins with the UPSTREAM analysis, focusing on the sourcing and processing of raw materials, primarily aluminum, specialized polymers, and desiccant coatings (such as silica gel or molecular sieves). Raw material suppliers provide the basic components necessary for fabricating the wheel matrix, seals, and casing. Ensuring a stable supply of high-grade materials, particularly specialized desiccant media necessary for high-performance enthalpy wheels, is crucial for maintaining production quality and cost control. Efficiency gains at this stage often involve optimizing material formulation to improve heat and moisture transfer effectiveness while ensuring fire resistance and structural integrity.

The manufacturing and ASSEMBLY stage involves core intellectual property, including proprietary wheel geometry designs, advanced manufacturing techniques (e.g., precision winding or stacking), and the application of coatings. Manufacturers of HRWs differentiate themselves through energy transfer effectiveness (efficiency percentage), pressure drop minimization, sealing technology, and the integration of variable speed drive systems. Distribution channels are highly dependent on the target end-user: direct sales are common for large industrial or custom projects, while commercial and residential markets rely heavily on specialized HVAC distributors, original equipment manufacturers (OEMs) of air handling units, and mechanical engineering contractors (MECs).

DOWNSTREAM activities involve installation, commissioning, and aftermarket services. Installation is typically performed by certified HVAC contractors who integrate the wheel into the larger AHU or ductwork system. The long-term profitability of the market is increasingly tied to after-sales support, including parts replacement (seals, bearings), media cleaning services, and routine maintenance, which ensure the wheel maintains its specified performance over its operational life. The direct channel leverages specialized engineering firms that consult on large, complex projects, ensuring precise sizing and integration, while the indirect channel through wholesale distribution provides broad market access for standardized commercial units and smaller residential systems.

Heat Recovery Wheels Market Potential Customers

The primary potential customers and buyers of Heat Recovery Wheels span several sectors, driven by the common imperative of reducing HVAC operational costs and meeting stringent IAQ standards. Commercial building owners and facility managers constitute the largest end-user segment, particularly those managing large-scale office buildings, higher education campuses, and governmental facilities where large volumes of fresh air exchange are mandatory and energy consumption is a major operating expense. Hospitals and healthcare facilities represent another critical segment, demanding the highest level of performance due to strict regulatory requirements concerning air cleanliness, cross-contamination prevention, and precise climate control for patient care areas and operating rooms.

Industrial users form a rapidly growing cohort, including manufacturers in sectors such as automotive paint booths, pharmaceutical clean rooms, food and beverage processing, and specialized textile manufacturing. These applications require dedicated process ventilation systems where recovering heat from contaminated or humid exhaust air is essential for process efficiency and environmental compliance. The potential buyers in this sector are often industrial engineers or plant operations managers focused on return on investment (ROI) derived from energy savings and guaranteed process stability.

Finally, the Original Equipment Manufacturers (OEMs) of Air Handling Units (AHUs) represent a pivotal class of customers. These OEMs purchase HRWs as integrated components to offer packaged, high-efficiency HVAC solutions to their own customer base. For the residential sector, the customers are primarily residential builders and HVAC installers specializing in high-performance or certified energy-efficient housing (e.g., Passive House or Zero Energy Ready homes), where energy recovery ventilators (ERVs) featuring small-scale enthalpy wheels are fundamental to the building design philosophy.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 2.8 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | FLAKTGROUP, Rotor Source, Trane Technologies, Greenheck Fan Corporation, Daikin Industries, Ltd., Swegon Group, SEMCO LLC, RECUPERATOR, Munters, Mitsubishi Electric Corporation, Exhausto, Heatex AB, Konvekta AG, Novenco Group A/S, Venco Venturo Industries, CETAL SAS, Core Corporation, Airxchange, Inc., Hoval, Aircycle. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Heat Recovery Wheels Market Key Technology Landscape

The technological landscape of the Heat Recovery Wheels market is characterized by continuous innovation focused on maximizing energy recovery efficiency, minimizing pressure drop, and ensuring minimal cross-contamination. A primary technological focus remains on the development of advanced media materials. For sensible wheels, manufacturers are exploring specialized aluminum alloys and proprietary coatings to enhance thermal conductivity while offering robust resistance to corrosion and fouling. For enthalpy wheels, the innovation lies in desiccant materials—moving towards high-performance molecular sieves and advanced polymer films that offer superior moisture transfer rates across wider temperature and humidity ranges, significantly improving performance in varied climate conditions without excessive sorbent carryover or degradation.

Another crucial technological development involves sealing mechanisms and purge sections. Effective sealing is paramount to prevent cross-leakage between the supply and exhaust air streams, a critical requirement, especially in healthcare and laboratory environments. Advanced labyrinth seals, brushes, and specialized flexible edge seals made of durable, low-friction materials are being adopted. Furthermore, the implementation of sophisticated purge sections, where a small amount of clean supply air is directed across the segment returning from the exhaust stream, actively minimizes the transfer of pollutants or odors. The design of the wheel matrix geometry—including flute height and configuration (e.g., laminar versus turbulent flow patterns)—is continuously optimized through computational fluid dynamics (CFD) modeling to maximize heat transfer surface area while simultaneously reducing airside pressure drop, thereby saving fan energy.

Integration with intelligent controls represents the third pillar of technological advancement. Modern HRW systems are equipped with Variable Frequency Drives (VFDs) that allow the wheel speed to be modulated precisely in response to dynamic building load conditions, optimizing recovery effectiveness versus fan energy consumption in real time. This is facilitated by sophisticated sensors monitoring temperature, humidity, and pressure differentials. The move towards IoT-enabled HRWs allows for remote monitoring, predictive maintenance alerts, and seamless communication with Building Management Systems (BMS), transforming the wheel from a static component into a fully dynamic and controllable part of the smart building ecosystem.

Regional Highlights

North America maintains a prominent position in the Heat Recovery Wheels Market, driven by strict energy codes, particularly in states like California and New York, and a mature HVAC infrastructure emphasizing high-efficiency solutions. The region benefits from strong governmental support for sustainable building initiatives and a high adoption rate of sophisticated energy management systems in commercial spaces. Demand is particularly robust for high-performance enthalpy wheels to manage the large temperature and humidity swings experienced across various climate zones, from the humid South to the cold North, ensuring both energy savings and optimal Indoor Air Quality (IAQ).

Europe is characterized by highly progressive energy performance directives, such as the Energy Performance of Buildings Directive (EPBD) and various national mandates targeting near-zero energy buildings (NZEB). This regulatory environment strongly favors mandatory installation of heat recovery systems in new constructions and deep renovations. Central European countries, Scandinavia, and the UK are key markets, focusing heavily on sensible and high-efficiency enthalpy wheels to mitigate heat loss during long heating seasons. The European market leads in the adoption of small, decentralized HRW units for residential and small commercial applications, often emphasizing very low leakage rates and advanced filtration.

The Asia Pacific (APAC) region is projected to be the fastest-growing market, propelled by rapid urbanization, massive infrastructure development, and increasing energy security concerns, particularly in China, Japan, and India. While initial adoption was centered on large commercial complexes and industrial facilities (e.g., electronics manufacturing and automotive plants), the rising middle class and increasing awareness of IAQ are driving growth in the mid-market commercial and high-end residential sectors. Government initiatives to control air pollution and mandate energy conservation are accelerating the market transition, though price sensitivity and the need for localized product specifications tailored to high-dust or high-humidity environments remain key challenges.

Latin America and the Middle East & Africa (MEA) currently represent smaller but significantly expanding markets. In the MEA, demand is specifically concentrated on sensible heat wheels used to precondition hot, outside air before it enters the cooling coil, drastically reducing the required capacity of chillers—a massive energy saving in consistently hot climates. Saudi Arabia, UAE, and Qatar are major consumers due to large-scale construction projects and high cooling demands. Latin America's growth is more localized, focused on rapidly developing economies like Brazil and Mexico, where commercial construction is booming and energy efficiency is increasingly prioritized to manage volatile utility costs.

- North America: Market leader driven by strict ASHRAE standards, high energy costs, and extensive retrofit activities. Focus on enthalpy performance and integration with smart BMS.

- Europe: High adoption rates mandated by NZEB and EPBD directives. Strong emphasis on low leakage, high sensible efficiency, and decentralized ventilation solutions.

- Asia Pacific (APAC): Fastest growing region fueled by rapid urbanization, infrastructure investment, and rising energy efficiency mandates in commercial and industrial sectors.

- Middle East & Africa (MEA): Growth concentrated in large commercial and data center projects, primarily utilizing sensible wheels for pre-cooling/dehumidification to reduce massive cooling loads.

- Latin America: Emerging market focusing on commercial construction in key urban centers, driven by cost savings and increasing sustainability mandates.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Heat Recovery Wheels Market.- FLAKTGROUP

- Rotor Source

- Trane Technologies

- Greenheck Fan Corporation

- Daikin Industries, Ltd.

- Swegon Group

- SEMCO LLC

- RECUPERATOR

- Munters

- Mitsubishi Electric Corporation

- Exhausto

- Heatex AB

- Konvekta AG

- Novenco Group A/S

- Venco Venturo Industries

- CETAL SAS

- Core Corporation

- Airxchange, Inc.

- Hoval

- Aircycle

Frequently Asked Questions

Analyze common user questions about the Heat Recovery Wheels market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between sensible and enthalpy heat recovery wheels?

A sensible heat recovery wheel transfers only heat (thermal energy), changing the temperature of the incoming air. An enthalpy wheel, conversely, transfers both sensible heat and latent heat (moisture or humidity), making it highly effective for managing indoor humidity levels and reducing latent cooling/heating loads.

How do heat recovery wheels minimize the risk of cross-contamination?

Cross-contamination is minimized through the design of advanced perimeter and radial seals that separate the supply and exhaust air streams. Additionally, incorporating a purge section uses a small amount of pressurized clean air to flush the wheel segment moving from the exhaust side back to the supply side, ensuring pollutant carryover is negligible, often below 0.1%.

What are the typical energy savings achieved by implementing Heat Recovery Wheels?

Properly sized and maintained HRWs typically achieve thermal efficiency ranging from 60% to over 85%. This translates to significant HVAC energy savings, often reducing the size and capacity requirements for heating and cooling equipment by 30% to 60%, resulting in substantial utility cost reductions and reduced peak demand charges.

What material is most commonly used for high-efficiency enthalpy wheels?

High-efficiency enthalpy wheels predominantly utilize specialized desiccant-coated polymer or treated fabric matrices. These materials are coated with desiccants like silica gel or molecular sieves, enabling the wheel to absorb and release moisture effectively, thereby facilitating efficient latent heat transfer without compromising structural longevity.

Is retrofitting a heat recovery wheel into an existing HVAC system feasible?

Yes, retrofitting is feasible and common, especially in commercial buildings targeting efficiency upgrades. However, it requires careful engineering assessment to ensure sufficient space within the existing air handling unit or ductwork for the wheel, motor, and access for maintenance, and that fan capacity adjustments can be made to handle the added static pressure drop.

The extensive analysis of the Heat Recovery Wheels Market underscores its pivotal role in the global transition towards sustainable building practices and energy independence. The convergence of strict regulatory frameworks, escalating energy costs, and continuous technological refinements in material science and smart controls ensures a positive outlook for the market throughout the forecast period. Manufacturers who invest in AEO-compliant product design, focusing on modularity, high-efficiency latent heat recovery, and seamless integration with intelligent building platforms, are poised to capture maximum market share and solidify their position as leaders in the high-performance HVAC sector. The growing sophistication of air quality requirements across commercial and industrial segments mandates that heat recovery solutions not only save energy but also actively contribute to healthier, safer indoor environments. The future growth will be driven by the ability of these technologies to meet net-zero targets globally while providing demonstrated, long-term operational resilience and minimized maintenance demands. Furthermore, the burgeoning demand from Asia Pacific, coupled with the necessity for retrofitting older infrastructure in developed markets, guarantees sustained investment and innovation across the entire value chain, from raw material sourcing to smart application deployment.

The focus on predictive maintenance, powered by AI, represents a paradigm shift from traditional operational models, promising to unlock previously unattainable levels of reliability and efficiency. This shift, combined with the increasing adoption of highly selective desiccant materials, addresses the historic concerns around cross-contamination and performance degradation, making HRWs indispensable components in critical applications like hospitals and data centers. As the global construction industry continues its evolution toward sustainability certifications like LEED Platinum and WELL, the integration of energy recovery ventilation components becomes less of an optional add-on and more of a foundational necessity. Strategic investment in manufacturing automation and local supply chain optimization will be critical for companies aiming to meet the accelerating demand and remain cost-competitive, particularly against the backdrop of fluctuating commodity prices and geopolitical trade complexities. This sustained momentum confirms the Heat Recovery Wheels market as a crucial component of the global effort to reduce the carbon footprint of the built environment and enhance global energy security, solidifying its projected CAGR and market valuation through 2033.

The dynamic interplay between global energy policies and localized climate demands dictates specialized product development. For instance, manufacturers must develop highly robust systems capable of operating efficiently in the high-dust environments prevalent in some parts of APAC and the MEA, requiring enhanced filtration and self-cleaning capabilities. Simultaneously, the European market's preference for decentralized systems necessitates miniaturization and increased quiet operation characteristics. These diverse regional demands underscore the importance of flexible production and localized distribution strategies. The market is also seeing increasing penetration in niche areas, such as maritime ventilation systems and specialized agricultural facilities (vertical farms), where controlled climate and energy recovery are essential for operational viability. This continuous diversification of end-user applications expands the total addressable market and mitigates risk associated with reliance on traditional commercial construction cycles. The emphasis on lifecycle cost rather than upfront expenditure is fundamentally changing procurement decisions, favoring suppliers who can provide verifiable, high-efficiency data and long-term performance guarantees, reinforcing the value proposition of premium heat recovery wheel solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager