Heat Transfer Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435643 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Heat Transfer Equipment Market Size

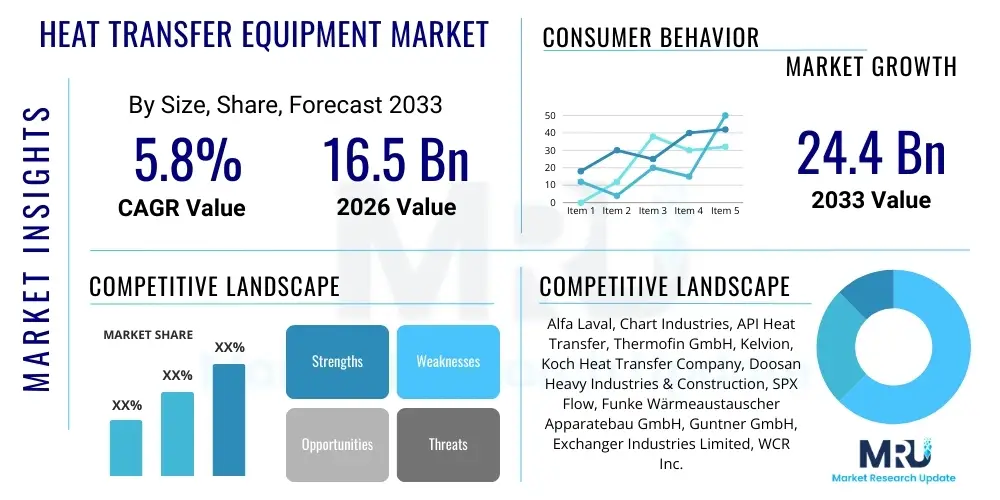

The Heat Transfer Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $16.5 Billion in 2026 and is projected to reach $24.4 Billion by the end of the forecast period in 2033.

Heat Transfer Equipment Market introduction

The Heat Transfer Equipment market encompasses a wide array of industrial devices designed to efficiently exchange thermal energy between two or more fluids, spanning liquids, gases, or vapors, across a solid boundary. These critical components are fundamental to maintaining thermal balance, controlling reaction temperatures, and recovering waste heat across nearly all major industrial sectors. Key products include shell and tube heat exchangers, plate heat exchangers, air-cooled heat exchangers, and cooling towers, each optimized for specific pressure, temperature, and fluid characteristics. The market's growth is inherently linked to global infrastructure spending and the operational expansion of energy-intensive industries such as petrochemicals, oil and gas, power generation, and specialized manufacturing.

Major applications for heat transfer equipment are diverse, supporting processes like chemical synthesis, steam generation in power plants, refrigeration cycles in HVAC systems, and crude oil refining. Their primary benefit lies in improving energy efficiency, reducing operational costs through heat recovery, and ensuring safe operational temperatures for sensitive industrial processes. The continuous push towards decarbonization and sustainable manufacturing practices further emphasizes the importance of high-efficiency heat exchangers, driving innovation in compact and robust designs that minimize energy wastage and optimize process throughput. Furthermore, the burgeoning demand for district heating and cooling systems, particularly in densely populated urban centers, provides a sustained avenue for market expansion.

Driving factors propelling market expansion include stringent environmental regulations mandating better energy conservation, necessitating the replacement of older, less efficient equipment with advanced models. The steady growth of the global chemical and petrochemical industry, particularly in Asia Pacific, requires substantial investments in large-scale heat transfer infrastructure. Additionally, technological advancements such as the integration of additive manufacturing (3D printing) for creating complex geometries, and the development of new fouling-resistant materials, are enhancing the performance and lifespan of heat exchangers, thus accelerating market adoption across demanding applications like nuclear power and concentrated solar power (CSP).

Heat Transfer Equipment Market Executive Summary

The Heat Transfer Equipment Market is poised for stable growth, fueled primarily by sustained investment in global energy infrastructure, coupled with the mandatory adoption of energy-efficient technologies to meet global climate targets. Business trends indicate a strong shift towards modular and compact heat exchanger designs, particularly Plate Heat Exchangers (PHEs), which offer superior thermal efficiency and reduced footprint compared to traditional Shell and Tube variants. This trend is driven by industries requiring quick deployment and operational flexibility, such as small-scale LNG and specialized chemical production. Furthermore, maintenance services and digital condition monitoring are emerging as crucial revenue streams for key players, moving the market dynamics beyond mere product sales towards comprehensive lifecycle management solutions.

Regional trends highlight the Asia Pacific (APAC) as the undisputed leader in market expansion, attributed to rapid industrialization, extensive refining capacity build-out, and significant investments in power generation infrastructure, particularly coal-fired and natural gas power plants in emerging economies like China and India. While North America and Europe demonstrate slower overall volume growth, these regions lead in adopting highly specialized and high-efficiency equipment driven by stringent emissions controls and the need for enhanced waste heat recovery in mature industrial clusters. The Middle East remains a vital market due to continuous investments in oil and gas upstream and downstream processing, demanding robust, high-pressure equipment.

Segment trends underscore the dominance of the Shell and Tube segment in terms of market size due to its reliability and suitability for high-temperature and high-pressure environments, especially in the Oil and Gas sector. However, the Plate Heat Exchanger segment is projected to exhibit the fastest growth rate, propelled by its rising use in HVAC, food and beverage processing, and data center cooling applications. Regarding end-use, the Chemical and Petrochemical sectors collectively represent the largest market share, as heat exchange is integral to nearly every stage of chemical synthesis and refining. The shift towards non-ferrous materials like titanium and specialized alloys is also notable, driven by the demand for corrosion resistance in highly aggressive media environments.

AI Impact Analysis on Heat Transfer Equipment Market

Common user questions regarding AI's impact on the Heat Transfer Equipment Market frequently revolve around how artificial intelligence and machine learning (ML) can enhance thermal design optimization, predict equipment failure, and improve overall operational efficiency. Users are keenly interested in the integration of AI for predictive maintenance (PdM), seeking to understand if AI-driven diagnostics can significantly reduce unplanned downtime and lower maintenance costs associated with fouling, corrosion, and pressure leaks. Furthermore, there is significant inquiry into AI’s role in computational fluid dynamics (CFD) and thermal simulation, specifically asking if ML algorithms can accelerate the design cycle for highly customized heat exchangers, minimizing the need for extensive physical prototyping. The central theme of user expectation is the transformation from reactive maintenance and traditional sizing methods to intelligent, real-time optimized operation and design.

The integration of AI directly influences the entire lifecycle of heat transfer equipment, starting from the initial conceptual design phase through to end-of-life replacement scheduling. AI algorithms are increasingly employed to analyze vast datasets relating to fluid properties, flow rates, operating conditions, and historical performance to suggest optimal geometries and material selections that maximize thermal efficiency while minimizing cost and footprint. This capability is particularly disruptive in complex systems like waste heat recovery units where operating parameters fluctuate widely. By leveraging unsupervised learning techniques, manufacturers can identify latent correlations between operational inputs and performance outputs, enabling the creation of 'digital twins' that precisely mirror the physical asset's behavior.

Operationally, AI’s greatest contribution is in the area of predictive fouling management and cleaning cycle optimization. Fouling—the accumulation of deposits on heat transfer surfaces—is a major impediment to efficiency, often requiring costly and disruptive shutdowns. ML models analyze real-time sensor data (such as inlet/outlet temperatures and pressure drops) to accurately predict the onset and rate of fouling accumulation. This allows operators to schedule cleaning exactly when necessary, rather than relying on fixed intervals, resulting in significant energy savings and sustained maximum performance. This proactive approach significantly enhances the reliability and longevity of critical heat transfer components across demanding sectors like refining and power generation.

- AI optimizes heat exchanger design by analyzing multivariate data to achieve maximum thermal efficiency and minimal material use.

- Predictive maintenance (PdM) powered by ML reduces unplanned downtime by forecasting fouling rates and mechanical failures.

- AI-driven monitoring enhances energy recovery systems by dynamically adjusting flow rates and temperatures based on real-time plant load.

- Generative design techniques using AI accelerate the development of complex, compact heat exchanger geometries (e.g., for microchannel devices).

- Digital twins utilize AI/ML models to simulate real-time performance, enabling 'what-if' scenarios for operational efficiency improvements.

- Automation in manufacturing processes, guided by AI, improves welding consistency and quality control in specialized high-pressure equipment.

DRO & Impact Forces Of Heat Transfer Equipment Market

The market is predominantly driven by the robust growth of energy-intensive industries and stringent global regulations aimed at curbing energy consumption and emissions. Restraints primarily involve the high capital expenditure required for specialized, high-alloy equipment, coupled with technical challenges related to thermal fouling and corrosion which necessitate frequent maintenance. Opportunities are centered on the rapid development of renewable energy infrastructure, such as concentrated solar power (CSP) and geothermal energy, and the increasing global adoption of district cooling and heating networks. These forces collectively shape the market's trajectory, compelling manufacturers to innovate constantly in material science and design methodologies to deliver highly efficient and durable products capable of withstanding severe operating conditions and maximizing lifecycle value.

Driving forces are strongly anchored in the expansion of oil and gas refining capacity, especially in emerging economies, and the continuous need for process intensification in the chemical industry. The imperative to recover waste heat, driven by escalating energy costs and government incentives, acts as a powerful catalyst for the adoption of highly efficient heat recovery steam generators (HRSGs) and compact heat exchangers. The necessity for advanced cooling solutions for energy storage systems and high-density data centers further provides stable growth momentum. Furthermore, replacement cycles in aging industrial plants in North America and Europe, often driven by safety upgrades and modernization mandates, contribute significantly to sustained demand for new equipment.

Key restraints include the complexity of selecting the optimal heat exchanger type for specific industrial processes, often involving difficult trade-offs between cost, efficiency, and maintenance accessibility. Fouling remains a critical technical challenge that reduces thermal efficiency over time and requires specialized, costly chemical or mechanical cleaning procedures, impacting the overall cost of ownership. The intense competition among regional and international players leads to significant price pressure, particularly in standardized product categories. Impact forces manifest through increasing regulatory scrutiny regarding emissions and efficiency standards, pushing technological innovation, while geopolitical instability in resource-rich regions can periodically affect investment decisions in large-scale refinery and power projects, temporarily dampening demand for large capital equipment.

Segmentation Analysis

The Heat Transfer Equipment Market is segmented based on Type, End-User Industry, Material, and Application, providing a granular view of market dynamics and adoption patterns across diverse industrial landscapes. This segmentation highlights the technological preferences and specific requirements of different sectors, such as the preference for reliable, high-pressure Shell and Tube exchangers in oil refining versus the adoption of compact, highly efficient Plate Heat Exchangers in HVAC and food processing. Understanding these segments is crucial for manufacturers to tailor product development and market strategies to address niche industrial demands, particularly those focused on specialized materials and high-performance designs.

- Type: Shell and Tube Heat Exchangers, Plate Heat Exchangers (Gasketed, Welded, Brazed), Air-Cooled Heat Exchangers (Fin-Fan Coolers), Cooling Towers, and Others (e.g., Regenerative, Scraped Surface).

- End-User Industry: Chemical and Petrochemical, Oil and Gas (Upstream, Midstream, Downstream), HVAC and Refrigeration, Power Generation (Thermal, Nuclear, Renewables), Food and Beverage, Pulp and Paper, Marine, and Others.

- Material: Steel (Carbon Steel, Stainless Steel), Non-Ferrous Alloys (Titanium, Nickel, Aluminum, Copper Alloys), Graphite, and Others (e.g., Ceramic, Polymer).

- Application: Condensing, Evaporating, Steam Generation, Process Heating, Process Cooling, and Heat Recovery.

Value Chain Analysis For Heat Transfer Equipment Market

The value chain for heat transfer equipment begins with upstream activities focused on the procurement and processing of raw materials, primarily specialized metallic alloys such as high-grade stainless steel, titanium, and nickel alloys, which are crucial for ensuring thermal performance and resistance to corrosion and high pressure. Key upstream players include major steel mills and specialized alloy producers whose innovations in metallurgy directly influence the cost and capabilities of the final product. Procurement strategies are complex, requiring long-term contracts and stringent quality control, as material failure can lead to catastrophic industrial incidents. Efficiency in this stage dictates the manufacturing costs, making supply chain resilience for critical raw materials a core competitive factor.

The manufacturing stage involves the precision engineering and assembly of components, including tube bundles, plates, fins, and shells. This middle segment of the value chain is characterized by high technical expertise, specialized welding techniques (especially for critical services), and advanced fabrication processes, often requiring certification according to international standards such as ASME and TEMA. Manufacturers must maintain high operational flexibility to produce both standardized, mass-produced units (like small plate exchangers) and highly customized, large-scale equipment (like specialized shell and tube units for refineries). The increasing adoption of automation and robotic welding technologies is enhancing throughput and consistency in this stage.

Downstream activities involve distribution, installation, commissioning, and critically, aftermarket services including maintenance, repair, and replacement (MRO). Distribution channels are mixed: large, highly customized projects often rely on direct sales and engineering procurement construction (EPC) firms, while standardized and smaller units utilize indirect channels through regional distributors, integrators, and specialized MRO providers. The aftermarket services segment is a growing profit center, driven by the longevity of the equipment and the need for periodic performance optimization and anti-fouling maintenance. Direct engagement with end-users allows manufacturers to gather vital operational data, informing future product design and maximizing customer satisfaction through specialized service contracts.

Heat Transfer Equipment Market Potential Customers

Potential customers for heat transfer equipment are diverse, encompassing nearly every segment of heavy and light industry where thermal management is necessary for process control. The primary end-users are large-scale industrial corporations operating in the energy sector, particularly those involved in Oil and Gas downstream operations (refineries and petrochemical complexes) where complex cracking, distillation, and heat recovery processes are central. These buyers prioritize equipment reliability, adherence to severe duty specifications, and long operational lifespans under high temperature and pressure conditions, often leading to procurement of customized Shell and Tube or specialized welded plate exchangers.

Another major customer cluster resides within the Power Generation sector, spanning conventional thermal power plants, nuclear facilities, and renewable energy projects like CSP. Power utilities require large condensers, feedwater heaters, and cooling towers for efficient steam cycle management and heat rejection. These procurement decisions are driven by strict performance guarantees, regulatory compliance regarding emissions (e.g., air-cooled condensers reducing water usage), and the ability of the equipment to handle fluctuating loads inherent in modern power grids. The growth of district heating and cooling networks in metropolitan areas represents a burgeoning customer base focused on large-capacity, energy-efficient plate heat exchangers.

Beyond the heavy industries, potential customers include the Food and Beverage industry, where heat exchangers are essential for pasteurization, sterilization, and chilling processes, requiring sanitary design standards (e.g., scraped surface or specialized plate exchangers). The HVAC and Refrigeration sector constitutes a vast customer base, demanding coils, condensers, and evaporators for residential, commercial, and industrial climate control. Finally, specialized buyers include data center operators, who require high-efficiency fluid cooling systems to manage heat load from dense computing racks, driving demand for advanced microchannel and customized liquid-to-air heat transfer solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $16.5 Billion |

| Market Forecast in 2033 | $24.4 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Alfa Laval, Chart Industries, API Heat Transfer, Thermofin GmbH, Kelvion, Koch Heat Transfer Company, Doosan Heavy Industries & Construction, SPX Flow, Funke Wärmeaustauscher Apparatebau GmbH, Guntner GmbH, Exchanger Industries Limited, WCR Inc., Vahterus Oy, Hisaka Works, Ltd., Mersen, Xylem Inc., Trans-Pecos Manufacturing, SWEP International AB, Johnson Controls International, Danfoss. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Heat Transfer Equipment Market Key Technology Landscape

The technological landscape of the Heat Transfer Equipment Market is characterized by a push towards superior thermal performance, minimized physical footprint, and enhanced resistance to harsh operating conditions. A pivotal development is the increased adoption of Plate Heat Exchanger (PHE) variations, including brazed, semi-welded, and fully welded models, which are replacing traditional Shell and Tube designs in applications where compactness and high heat recovery effectiveness are critical. The innovation lies in the geometry of the plates—using chevron, corrugated, or specialized dimple patterns—to induce higher turbulence and boost the overall heat transfer coefficient, thereby reducing the necessary exchange area for a given thermal duty. This efficiency drives their increased utilization in district heating/cooling and refrigeration systems.

Another significant trend is the utilization of advanced materials and surface enhancements to combat fouling and corrosion, which remain the primary drivers of performance degradation and maintenance costs. Manufacturers are increasingly employing non-ferrous, high-performance alloys such as titanium and specialty nickel-based alloys (e.g., Hastelloy) for exchangers operating with aggressive or corrosive fluids in sectors like chemical processing and seawater cooling. Furthermore, surface treatment technologies, including specialized coatings and nano-structured surfaces, are being researched and deployed to modify the fluid-solid interface, inhibiting the adhesion of fouling agents and extending the operational cycle between cleanings. These material advancements significantly enhance the lifecycle value, justifying the higher initial capital outlay.

The manufacturing process itself is undergoing a transformation with the integration of Additive Manufacturing (AM), or 3D printing. AM allows engineers to design and create heat exchangers with highly complex, internal geometries—such as lattice structures and micro-channels—that are impossible to produce using conventional subtractive methods. These complex designs significantly enhance the surface area to volume ratio, resulting in ultra-compact and lightweight heat exchangers ideal for niche applications in aerospace, high-performance computing, and mobile power generation. Alongside AM, the increasing sophistication of Computational Fluid Dynamics (CFD) software, often combined with Machine Learning optimization, allows for rapid virtual prototyping and performance validation, drastically cutting down the design cycle and improving the accuracy of thermal rating predictions before physical manufacturing begins.

Regional Highlights

- Highlight key countries or regions and their market relevance

Asia Pacific (APAC) Market Dominance: The APAC region commands the largest share of the global Heat Transfer Equipment Market and is projected to exhibit the fastest growth over the forecast period. This vigorous expansion is primarily fueled by rapid industrialization, extensive investments in critical infrastructure, and massive capacity expansions in the refining, petrochemical, and power generation sectors, particularly in China, India, and Southeast Asia. The region’s growing urban population simultaneously drives substantial demand for HVAC and refrigeration equipment, boosting the market for plate heat exchangers and air-cooled systems. Governments across the region are focusing on enhancing local manufacturing capabilities and energy independence, leading to a consistent pipeline of large-scale industrial projects requiring advanced heat transfer solutions for process heating and cooling. This sustained industrial momentum ensures APAC remains the cornerstone of global demand for both custom-engineered and mass-produced heat exchangers.

North America (NA) Focus on Efficiency and Modernization: The North American market is mature, characterized by stable but persistent demand driven primarily by replacement cycles, regulatory compliance, and modernization efforts in established industrial facilities. The primary market drivers here include the extensive shale oil and gas processing infrastructure, which requires specialized exchangers for gas compression and LNG production, and the significant push towards decarbonization. Strict environmental mandates and high energy costs encourage end-users to invest in high-efficiency heat recovery systems and equipment designed to minimize greenhouse gas emissions. The U.S. market, in particular, leads in the adoption of advanced monitoring technologies and digital service contracts, reflecting a high emphasis on maximizing equipment uptime and implementing predictive maintenance strategies within the chemical and power sectors. The demand is skewed towards specialized, high-performance equipment rather than high volume.

Europe’s Green Transition and District Energy: Europe represents a technologically advanced market driven strongly by the green energy transition and widespread adoption of integrated district heating and cooling networks. European regulations, such as those related to the European Green Deal, impose some of the world's strictest energy efficiency standards, compelling industries to adopt state-of-the-art heat recovery systems (e.g., Waste Heat Recovery Units or WHRUs) and compact plate exchangers for space-constrained industrial facilities. While manufacturing growth may be slower compared to APAC, the high value placed on efficiency, reliability, and low operational emissions ensures steady demand for premium, customized equipment manufactured using advanced alloys. The region is also a key innovation hub for geothermal energy systems and advanced heat pump technology, which are heavy users of specialized heat transfer interfaces.

Middle East and Africa (MEA) Upstream Investment: The MEA market growth is intrinsically tied to capital expenditure in the oil and gas sector, specifically expansion projects in crude oil production, refining, and natural gas liquefaction (LNG). Countries within the Gulf Cooperation Council (GCC) are investing heavily to increase their refining capacity and diversify their downstream chemical output, creating robust demand for large, rugged, and high-pressure shell and tube heat exchangers designed to operate reliably in harsh desert climates. Furthermore, massive investments in desalination plants across the region necessitate large-scale heat transfer solutions. While the African market presents unique logistical challenges, growth is emerging in infrastructure development, power generation (both thermal and solar), and mining operations, driving regional opportunities for suppliers capable of providing durable and easily maintainable equipment.

Latin America (LATAM) Economic Fluctuations and Industrial Needs: The Latin American market experiences demand fluctuations tied closely to commodity prices and regional economic stability, but offers significant underlying potential, especially in Brazil, Mexico, and Argentina. Core demand originates from the robust upstream oil and gas industry, mining operations, and the large-scale food and beverage processing sector. Investment in refining and petrochemical capabilities requires significant input of heat transfer equipment for complex distillation and cooling processes. While local content requirements can influence procurement, the necessity for efficient equipment to optimize export-oriented commodity production provides a consistent driver. The market is increasingly seeking cost-effective, yet reliable, solutions that can handle specific regional challenges such as high fouling fluids and varying operational standards.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Heat Transfer Equipment Market.- Alfa Laval

- Chart Industries

- API Heat Transfer

- Thermofin GmbH

- Kelvion

- Koch Heat Transfer Company

- Doosan Heavy Industries & Construction

- SPX Flow

- Funke Wärmeaustauscher Apparatebau GmbH

- Guntner GmbH

- Exchanger Industries Limited

- WCR Inc.

- Vahterus Oy

- Hisaka Works, Ltd.

- Mersen

- Xylem Inc.

- Trans-Pecos Manufacturing

- SWEP International AB

- Johnson Controls International

- Danfoss

Frequently Asked Questions

Analyze common user questions about the Heat Transfer Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Heat Transfer Equipment Market?

The market growth is primarily driven by escalating global demand for energy-efficient industrial solutions, stringent environmental regulations mandating waste heat recovery, and sustained capital expenditure in the chemical, petrochemical, and power generation sectors globally. Rapid industrialization in the Asia Pacific region is a central market accelerator.

How does fouling impact the performance and cost of heat exchangers?

Fouling, the accumulation of unwanted material on heat transfer surfaces, significantly reduces thermal efficiency, leading to higher energy consumption and increased operational costs. It necessitates frequent, expensive cleaning cycles and can cause pressure drops, limiting the equipment's lifespan and requiring advanced predictive maintenance technologies to manage effectively.

Which type of heat exchanger is projected to witness the fastest growth rate?

Plate Heat Exchangers (PHEs), including brazed and welded variants, are projected to show the fastest growth rate. This is attributed to their superior thermal efficiency, compact design, modularity, and increasing adoption across fast-growing sectors like HVAC, district energy systems, and specialized industrial refrigeration, offering high performance in a small footprint.

What role does the oil and gas industry play in the Heat Transfer Equipment Market?

The oil and gas industry is the largest end-user segment, driving demand for heavy-duty, customized heat exchangers, particularly Shell and Tube types, used in critical processes such as crude distillation, cracking, gas processing, and LNG liquefaction. Investments in refining capacity worldwide directly correlate with high-value equipment procurement in this market segment.

What emerging technological advancements are affecting the design of heat transfer equipment?

Key technological advancements include the integration of Additive Manufacturing (3D printing) for complex, high-efficiency geometries, the deployment of Artificial Intelligence (AI) for predictive maintenance and real-time operational optimization, and the development of advanced non-ferrous alloys offering superior corrosion and high-temperature resistance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- HVAC Heat Transfer Equipment Market Statistics 2025 Analysis By Application (Residential, Commercial), By Type (Plate Heat Exchangers, Finned Tube Coil), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Heat Transfer Equipment Market Statistics 2025 Analysis By Application (Petrochemical, Electric Power & Metallurgy, Shipbuilding, Mechanical, Central Heating, Food), By Type (Shell & Tube, Plate, Fin, Air Cooled), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Automobile Heat Transfer Equipment Market Statistics 2025 Analysis By Application (Passenger Car, Commercial Vehicle), By Type (HVAC Thermal Management, Powertrain Thermal Management), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager