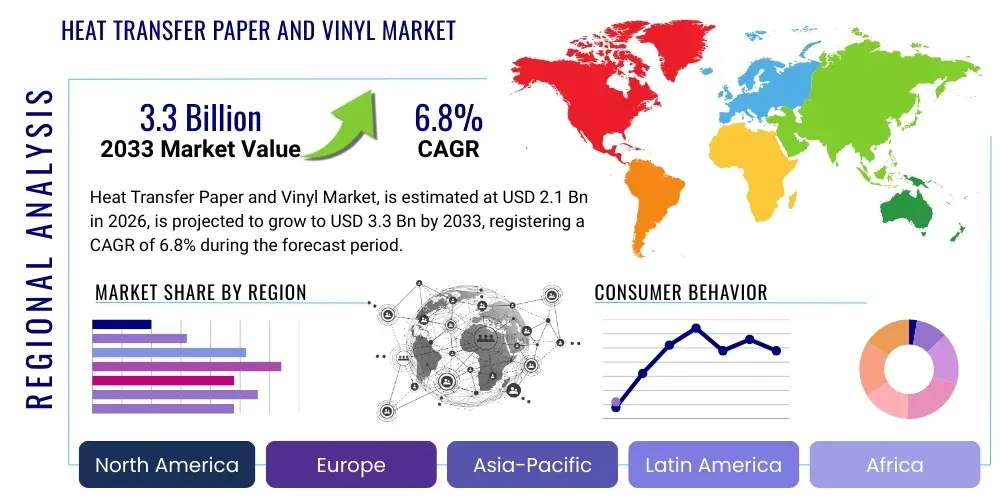

Heat Transfer Paper and Vinyl Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435433 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Heat Transfer Paper and Vinyl Market Size

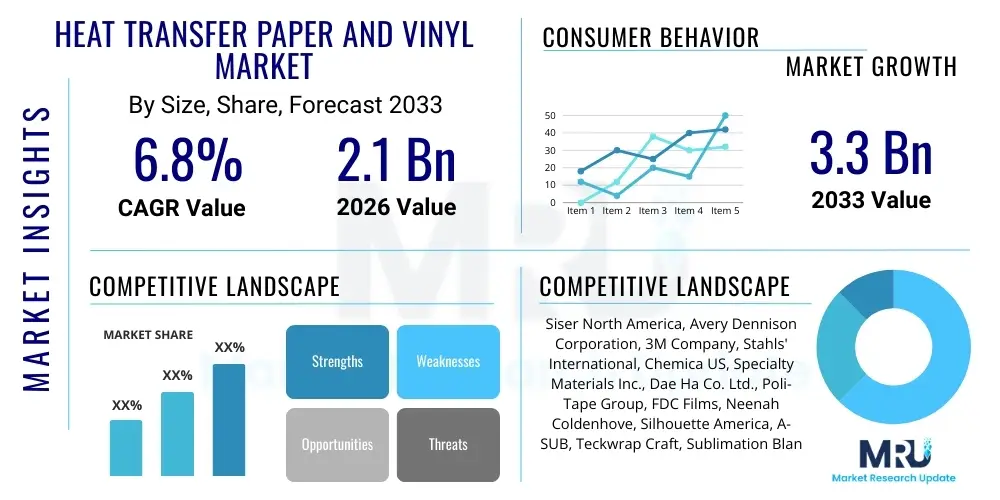

The Heat Transfer Paper and Vinyl Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 2.1 Billion in 2026 and is projected to reach USD 3.3 Billion by the end of the forecast period in 2033.

Heat Transfer Paper and Vinyl Market introduction

The Heat Transfer Paper and Vinyl Market encompasses specialized consumable materials utilized primarily for garment decoration, promotional item customization, and sophisticated textile printing across commercial and consumer segments. This sector is fundamentally defined by the production and distribution of two main product families: specialized transfer papers (designed for inkjet, laser, or sublimation printing) and highly engineered polymer films known as Heat Transfer Vinyl (HTV). These materials enable the permanent application of printed or cut graphic designs onto various textile substrates, including but not limited to cotton, polyester, nylon, and synthetic blends, through the precise application of controlled heat and pressure via a heat press machine. The core value proposition of these transfer media lies in providing flexible, high-resolution, and exceptionally durable customization solutions that support both high-volume industrial textile processes and low-volume, bespoke creation needs, essential for the modern on-demand manufacturing environment.

The functional efficacy of these materials relies heavily on proprietary chemical coatings and polymer technology. Heat transfer paper typically utilizes a wax or silicon-based release layer coated with specialized pigments or polymers that activate and bond to the fabric under heat. HTV, in contrast, is a multi-layered film comprising a protective carrier sheet (usually PET), a thin decorative layer (often Polyurethane or PVC), and a crucial heat-activated adhesive layer (hot melt adhesive). The versatility inherent in these products allows for superior aesthetic customization that traditional screen printing often cannot match efficiently for small batches, such as achieving reflective, holographic, or textured (flock) finishes. Major application areas span the global custom apparel industry, including fast fashion, team uniforms, corporate branding wear, and specialized protective workwear. Furthermore, the market extends into non-apparel items, such as personalized accessories, banner signage, and durable industrial textile marking, broadening the scope of demand beyond traditional garment decoration.

Market expansion is structurally supported by several macroscopic drivers. Firstly, the exponential growth of global e-commerce and subsequent development of print-on-demand services have lowered the entry barriers for customization businesses, creating massive demand for reliable, high-quality consumables. Secondly, continuous material science innovation, particularly in developing ultra-stretchable and low-tack HTV formulations, has addressed previous limitations concerning application on high-performance athletic wear, unlocking significant opportunities in the high-growth sportswear segment. Thirdly, the pervasive cultural trend favoring personalization and unique aesthetic expression, coupled with the accessibility of entry-level consumer cutting machines and heat presses, provides a continuous influx of DIY enthusiasts and small-scale entrepreneurs, ensuring sustained revenue generation across multiple distribution tiers globally. This interplay of technological advancement, cultural shifts, and streamlined business models underpins the market's projected robust CAGR through the forecast period.

Heat Transfer Paper and Vinyl Market Executive Summary

The Heat Transfer Paper and Vinyl Market exhibits dynamic evolution driven by intense competition, technological specialization, and shifts toward environmental compliance. Current business trends emphasize product differentiation through advanced material properties such as enhanced elasticity for performance fabrics, greater wash durability, and reduced application temperatures to accommodate sensitive textiles. Manufacturers are increasingly focused on vertical integration and strategic partnerships with software providers and equipment manufacturers (e.g., cutting machine firms) to offer end-to-end solutions that streamline the customization workflow for commercial users. A critical business focus involves optimizing the supply chain to manage the high volatility of polymer and adhesive raw material costs while simultaneously accelerating time-to-market for innovative specialty finishes, thereby maintaining competitive pricing structures essential for both the high-volume industrial and cost-sensitive SME segments.

Regional dynamics clearly highlight Asia Pacific (APAC) as the key growth engine, projected to surpass mature markets in growth velocity due to rapid industrial scaling in countries like China, India, and Vietnam, coupled with expanding domestic consumer bases demanding personalized textiles. North America and Europe, while growing at a steadier pace, maintain dominance in terms of market maturity, technological sophistication, and high average selling prices (ASPs) for premium specialty products. These regions are characterized by a strong regulatory push towards non-toxic and environmentally friendly transfer media, especially non-PVC HTV, compelling regional producers to lead innovations in sustainability. Furthermore, the strong presence of the independent crafting and DIY community in North America ensures a consistent high demand for diversified, easy-to-use retail transfer products, reinforcing regional market stability and value.

Segmentation trends confirm that the Heat Transfer Vinyl (HTV) category generates the majority of market revenue due to its superior performance attributes crucial for commercial applications. Within HTV, while standard Polyurethane (PU) vinyl remains the backbone, the Specialty Vinyl segment—encompassing metallic, glitter, holographic, and textured flock finishes—is exhibiting accelerated growth. This surge is driven by fashion industry demand for unique textile embellishments and the ability of small businesses to offer differentiated, high-margin products. Application analysis confirms that the Apparel and Garments sector retains its status as the most dominant end-use vertical, particularly within sportswear and customized uniforms. However, market diversification is notably occurring in non-apparel areas such as branded bags, unique footwear elements, and highly specific industrial textiles, suggesting a broadening scope for future revenue streams and reinforcing the flexibility of heat transfer technology across varied substrates.

AI Impact Analysis on Heat Transfer Paper and Vinyl Market

User queries regarding the integration of Artificial Intelligence (AI) and Machine Learning (ML) into the Heat Transfer Paper and Vinyl Market center on enhancing production efficiency, mitigating waste, and deeply personalizing the design-to-application workflow. Users are particularly interested in how AI can solve the complexity associated with multi-layered HTV applications, such as optimizing weeding time through predictive cutting algorithms and ensuring flawless alignment during the heat press stage. A significant area of concern and expectation revolves around predictive inventory management, where AI analyzes real-time sales data, seasonal fashion influences, and geographical trends to forecast demand for specific colors, finishes (e.g., neon vs. metallic), and roll sizes. This predictive capability directly informs manufacturers' raw material purchasing and production schedules, aiming to minimize costly overstocking or sudden stockouts of niche, high-demand products, thus optimizing the entire supply chain and improving profitability margins across the industry.

Furthermore, consumers and commercial decorators frequently question the potential of AI in augmenting the creative design process. This includes AI-powered tools that automatically assess a garment's material composition and recommend the optimal transfer media type, application temperature, and required pressure, eliminating guesswork and reducing costly application errors. AI is also expected to play a crucial role in manufacturing quality control. High-resolution cameras coupled with machine learning models are being deployed on production lines to detect even microscopic imperfections—such as uneven adhesive coating, slight color variation, or minor edge defects—on continuous rolls of vinyl or transfer paper. This automated, precision quality check ensures that only consistently flawless material reaches the customer, significantly reducing returns and enhancing brand reputation for reliability.

The overarching impact of AI is to shift the market towards hyper-efficiency and hyper-personalization. By automating complex technical decisions and optimizing logistics based on predictive intelligence, AI reduces labor costs, minimizes material waste inherent in trial-and-error processes, and enables manufacturers to respond instantly to rapid changes in consumer aesthetics. This sophistication elevates the entire heat transfer ecosystem, making it more competitive against other decorating methods like DTG (Direct-to-Garment) and traditional screen printing, especially in customized, small-batch fulfillment models. The integration of AI technologies is thus viewed not as a replacement for labor, but as a critical enhancement tool that maximizes precision and output quality from initial design concept through to final pressing onto the garment.

- AI-Driven Manufacturing Yield Optimization: Utilizing ML algorithms to fine-tune coating thickness and adhesion strength during the production of transfer media, maximizing material yield and consistency across large batches.

- Intelligent Cutting Path Generation: AI software analyzing complex graphic designs to generate the fastest and most material-efficient cutting paths for vinyl plotters, drastically reducing weeding time and material scrap.

- Predictive Application Parameter Setting: Automated recommendation systems that suggest precise heat press temperature, pressure, and dwell time based on the specific transfer media, substrate material, and local humidity, minimizing transfer failures.

- Real-time Supply Chain Optimization: AI models predicting geographic shifts in demand for niche vinyl types (e.g., reflective or holographic) based on social media trends and regional event schedules, enabling just-in-time inventory adjustments.

- Enhanced Design Visualization Tools: Incorporating ML into customer-facing design platforms to provide realistic 3D renderings of the final transferred graphic on specific textile textures, improving customer satisfaction and reducing post-sale complications.

DRO & Impact Forces Of Heat Transfer Paper and Vinyl Market

The market trajectory is significantly shaped by robust drivers, persistent restraints, and transformative opportunities that collectively constitute the key impact forces. Primary drivers include the global consumer obsession with product personalization, the accelerated adoption of digital printing technologies that pair seamlessly with heat transfer media, and the rapid expansion of the entrepreneurial e-commerce landscape facilitating highly customized, low-volume orders. These forces create a perpetual demand cycle for versatile, high-quality, and rapidly applicable media. This momentum is countered by significant restraints, chiefly the intense, often predatory, price competition driven by oversupply from certain Asian manufacturers, which pressures margins across all tiers. Furthermore, inherent technical limitations such as the "hand" or feel of the transferred material, especially on very thin or technical fabrics, and persistent concerns regarding long-term wash degradation compared to dye-based printing methods, continue to pose hurdles to market saturation in premium performance apparel segments.

Opportunities for disruptive growth are concentrated in sustainable innovation and application expansion. The imperative to minimize the environmental footprint is creating massive market potential for bio-based, non-PVC HTV formulations that achieve comparable or superior performance to traditional plastics. Another significant opportunity lies in specialized industrial applications, such as high-durability thermal transfer labels for automotive components, extreme weather outdoor gear, and antimicrobial transfers for medical uniforms, where standard decoration methods fail to meet required standards for chemical or heat resistance. These high-value niche segments offer significantly higher margins than general apparel decoration. The interplay of these forces ensures that while volume remains important, the future competitive advantage will increasingly be derived from specialized, high-performance, and environmentally conscious product offerings, necessitating substantial R&D investment from market leaders to maintain relevance.

The collective impact forces generate continuous pressure for improvement across the market value chain. The dominant impact is the acceleration of product life cycles: manufacturers must constantly innovate to release new specialty finishes and improved base materials (faster release times, better stretch) before their current lines become commoditized. The force of environmental responsibility mandates not only product reformulation but also optimized manufacturing processes that reduce chemical waste and energy consumption. Furthermore, the competitive impact force compels companies to refine their distribution models, leveraging digital platforms and rapid fulfillment capabilities to satisfy the just-in-time inventory needs of small commercial decorators. Success in navigating the Heat Transfer Paper and Vinyl market is contingent upon the strategic balancing of mass-market affordability pressures with the specialized technical demands of high-growth niche applications, all while adhering to global shifts toward sustainable material science.

Segmentation Analysis

The Heat Transfer Paper and Vinyl Market segmentation provides a critical framework for understanding varying demand patterns, technological preferences, and competitive positioning across diverse end-user groups. The distinction between Paper and Vinyl as product types defines entirely separate workflows and application outcomes; paper is favored for full-color images and low-cost promotions, while vinyl is utilized for vector-based graphics requiring superior durability and texture. Further stratification by finish (e.g., metallic, standard, glitter) captures the aesthetic specialization required by the fashion and craft segments. Analyzing the market based on End-User—from large Industrial Manufacturers requiring high-volume reliability to individual Independent Crafters prioritizing ease of use—is vital for manufacturers to tailor packaging, pricing, and distribution strategies effectively, recognizing the disparate purchasing behaviors and volume requirements within each category.

- By Product Type:

- Heat Transfer Paper (Light Fabric Paper, Dark Fabric Paper, Sublimation Paper, Laser Transfer Paper)

- Heat Transfer Vinyl (HTV) (Polyurethane (PU) Vinyl, Polyvinyl Chloride (PVC) Vinyl, Specialty Films)

- By Finish/Effect:

- Standard/Matte/Glossy

- Glitter & Flocking (Textured)

- Holographic & Metallic

- Glow-in-the-Dark, Reflective, & Photochromic

- 3D Puff & Specialty Texture Effects

- By Application:

- Apparel & Garments (T-shirts, Sportswear, Workwear, Uniforms)

- Accessories (Bags, Caps, Footwear, Headwear)

- Home Furnishings & Textile Decor (Pillows, Curtains, Banners)

- Promotional Items & Gifts (Mugs, Mousepads - primarily using sublimation paper)

- Industrial Marking & Safety Apparel

- By End-User:

- Commercial Printers & Large-Scale Decorators

- Small and Medium Enterprises (SMEs) & Local Print Shops

- Independent Crafters & DIY Users (Home-based businesses)

- Textile Manufacturers & Industrial Brands

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, U.K., France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, India, Japan, South Korea, Southeast Asia, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of LATAM)

- Middle East & Africa (UAE, Saudi Arabia, South Africa, Rest of MEA)

Value Chain Analysis For Heat Transfer Paper and Vinyl Market

The value chain begins with the sourcing of highly specialized chemical inputs, forming the core upstream segment. This stage involves procuring polymers such as high-grade Polyurethane (PU) and PET film for the carrier sheets, along with specific adhesive resins (hot melt adhesives) and proprietary release coatings. Upstream activities are capital-intensive, requiring advanced chemical engineering capabilities to ensure the raw materials meet stringent quality specifications regarding thermal stability, elastic properties, and consistent adhesion activation. Manufacturers must negotiate complex contracts with chemical suppliers, as price volatility in the petrochemical industry directly influences the cost of goods sold. Effective upstream management focuses on securing long-term supply agreements and leveraging proprietary formulation technologies to differentiate the material performance early in the chain.

The central manufacturing stage transforms these raw materials into finished transfer media. This involves precision coating techniques—such as gravure or slot die coating—to apply the adhesive and colored polymer layers with micron-level accuracy onto the carrier film. This stage is technologically demanding; achieving an even coat is crucial for preventing transfer failures and ensuring durability. Following coating, the material undergoes curing, slitting into specified widths (rolls or sheets), and rigorous internal quality assurance. Manufacturers then engage in two primary distribution methods: Direct and Indirect. Direct distribution channels involve selling high-volume, industrial-grade rolls directly to major commercial printers, sportswear brands, and large-scale distributors, offering custom widths and bulk pricing. This ensures speed and technical service for high-volume users.

Indirect distribution channels are essential for penetrating the highly fragmented SME and independent crafter markets. This pathway utilizes specialized wholesalers, regional resellers, and, crucially, massive e-commerce platforms (Amazon, dedicated craft sites). These intermediaries handle inventory management, localized logistics, and technical support for smaller volumes. The downstream segment of the value chain is completed by the end-users (decorators, crafters) who apply the product using cutting machines and heat presses. Value capture at this final stage is highly dependent on the quality and user-friendliness of the transfer media, as application failure results in material waste and labor loss for the end-user. Therefore, providing comprehensive technical documentation, tutorials, and reliable, fast-shipping logistical support across the indirect channel is paramount for maintaining brand loyalty and market share in the decentralized customization economy.

Heat Transfer Paper and Vinyl Market Potential Customers

The Heat Transfer Paper and Vinyl Market services a diverse clientele, broadly categorized into commercial, small business, and individual consumers, all seeking customizable textile solutions. Commercial printers and large-scale apparel decorators represent the highest value segment, purchasing industrial quantities of highly engineered HTV for mass production runs of corporate uniforms, promotional merchandise, and branded apparel lines. These customers demand stringent quality certifications, verifiable durability ratings (especially regarding wash cycles and abrasion), and materials optimized for high-speed application. Their purchasing decisions are driven by total cost of ownership (TCO), material consistency, and supplier reliability, necessitating strong technical support and bulk discount programs from manufacturers to service their substantial, consistent volume requirements.

The Small and Medium-sized Enterprise (SME) segment, encompassing local print shops, specialized boutique decorators, and online customized gift sellers, forms the largest volume of purchasers within the indirect distribution channel. These entrepreneurs rely heavily on the versatility of heat transfer media to offer a wide array of products, often necessitating diverse purchases of specialty vinyl (glitter, metallic, reflective) in smaller roll sizes. This group prioritizes ease of use, reliable availability through localized or online resellers, and price points that allow for competitive retail margins. Marketing efforts targeting SMEs must focus on illustrating material performance on novel substrates and providing accessible, practical application training to ensure successful adoption of niche products.

Independent crafters and DIY consumers constitute a rapidly growing demographic, driven by the popularity of creative hobbies and home-based personalization. This segment is characterized by high engagement with social media tutorials and community platforms, driving demand for retail-packaged sheets, starter kits, and highly aesthetic finishes. While purchasing lower volumes per transaction, their collective market spending is substantial and provides critical revenue stability, particularly during holiday seasons. Their needs center on ease of handling, simple weeding processes, compatibility with consumer-grade cutting machines (like Cricut or Silhouette), and strong retail brand presence, making major craft stores and dedicated e-commerce marketplaces essential distribution points for capturing this expansive segment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.1 Billion |

| Market Forecast in 2033 | USD 3.3 Billion |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Siser North America, Avery Dennison Corporation, 3M Company, Stahls' International, Chemica US, Specialty Materials Inc., Dae Ha Co. Ltd., Poli-Tape Group, FDC Films, Neenah Coldenhove, Silhouette America, A-SUB, Teckwrap Craft, Sublimation Blanks & Supply, Kliegman Bros Inc., Joto Paper Inc., RITRAMA S.p.A., Lotus Transfer Inc., ORAFOL Europe GmbH, Grafityp. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Heat Transfer Paper and Vinyl Market Key Technology Landscape

The technological evolution of the Heat Transfer Paper and Vinyl market is deeply rooted in sophisticated polymer science and precision manufacturing, concentrating on improving three core performance metrics: durability, feel (hand), and ease of application. Contemporary research focuses heavily on developing advanced Polyurethane (PU) formulations that achieve extreme stretch and rebound properties, enabling HTV application on highly elastic materials like spandex and specialized athletic compression wear without cracking or peeling, a significant historical challenge. Furthermore, nanocoating technologies are being deployed to enhance the pigment embedding process in transfer papers, leading to brighter, more UV-resistant colors that minimize fading over time. The optimization of the hot melt adhesive layer, ensuring a secure bond at lower application temperatures and faster press times, is a key technical objective for increasing production efficiency in industrial settings and preventing damage to sensitive polyester garments.

The application technology domain is equally crucial, driven by advancements in digital cutting and pressing machinery. State-of-the-art cutting plotters now incorporate high-resolution optical tracking systems and pneumatic pressure controls, allowing for precise contour cutting of complex printed designs and accurate handling of very thick specialty vinyls, minimizing material damage during the cutting process (weeding). The development of "smart" heat presses featuring pressure transducers and thermal uniformity mapping ensures that heat and pressure are applied perfectly evenly across the entire transfer area. This is vital for professional decorators who must guarantee consistent results across hundreds of garments in a single run, reducing human error and boosting reliability, thereby making the heat transfer process more predictable and automated.

A significant technological interplay involves the rise of hybrid textile decoration workflows. While direct-to-garment (DTG) printing offers high-detail capability, it often lacks the durability and specialized textures provided by HTV. Consequently, sophisticated decorators are integrating sublimation paper printing (for full-color graphics) with specialty HTV applications (for metallic accents or reflective safety elements) within a single design, optimizing the aesthetic output. Moreover, the increasing adoption of Direct-to-Film (DTF) technology, while technically distinct, exerts competitive pressure and simultaneously drives innovation in release liner development, challenging traditional heat transfer paper producers to enhance their product's resolution and soft hand characteristics to maintain market relevance against these emerging digital transfer methods.

Regional Highlights

- Asia Pacific (APAC): APAC is the leading market in terms of volume consumption and the fastest-growing region by value CAGR. This dominance is anchored by large manufacturing ecosystems in China, India, and Southeast Asia, which supply customized apparel globally. The domestic market growth is accelerated by robust e-commerce growth and a large, newly affluent middle class driving demand for fast fashion and personalized consumer goods. Key regional trends include mass production of affordable transfer paper and the aggressive adoption of HTV by export-oriented garment factories.

- North America: North America commands a substantial portion of the global market value, characterized by high adoption rates of premium and specialty vinyl products. The region benefits from a pervasive and well-established DIY crafting culture, supported by major retail chains and dedicated online communities. Commercial demand is strong in the sportswear and corporate branding sectors, necessitating high-performance, durable, and often eco-friendly HTV solutions. The U.S. is the single largest consumer market, driving innovation in material sustainability and sophisticated cutting machine integration.

- Europe: The European market is highly sophisticated and heavily influenced by strict environmental regulatory frameworks, most notably REACH compliance. This has fostered a strong preference and investment in sustainable, non-PVC, and certified eco-friendly transfer media. Key markets like Germany and the UK prioritize technical performance, demanding highly reflective materials for safety workwear and premium, thin-profile HTV for high-end fashion and design applications, balancing environmental responsibility with aesthetic quality and regulatory adherence.

- Latin America (LATAM): LATAM represents an accelerating market, with growth concentrated in Brazil and Mexico. The market is primarily fueled by local textile customization demands, the expansion of small and micro-businesses utilizing accessible digital printing methods, and rising disposable incomes. Affordability is a major purchasing consideration, leading to high utilization of cost-effective transfer paper, although the demand for durable, high-quality HTV is steadily increasing as the commercial printing sector matures and professionalization increases.

- Middle East and Africa (MEA): MEA is an emerging region displaying nascent growth, driven largely by infrastructure development and government spending, requiring durable and reflective transfers for high-visibility uniforms and safety gear in construction and energy sectors. Market stability is supported by growing retail and luxury sectors in the UAE and Saudi Arabia. Market challenges include complex logistics and the need for materials resilient to extreme heat and harsh climate conditions, driving demand for specialized, thermally stable adhesives and polymers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Heat Transfer Paper and Vinyl Market.- Siser North America

- Avery Dennison Corporation

- 3M Company

- Stahls' International

- Chemica US

- Specialty Materials Inc.

- Dae Ha Co. Ltd.

- Poli-Tape Group

- FDC Films

- Neenah Coldenhove

- Silhouette America

- A-SUB

- Teckwrap Craft

- Sublimation Blanks & Supply

- Kliegman Bros Inc.

- Joto Paper Inc.

- RITRAMA S.p.A.

- Lotus Transfer Inc.

- ORAFOL Europe GmbH

- Grafityp

Frequently Asked Questions

Analyze common user questions about the Heat Transfer Paper and Vinyl market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Heat Transfer Paper and Heat Transfer Vinyl (HTV)?

Heat Transfer Paper is generally used for printing complex images onto the material before transferring, offering lower durability and a thicker feel on the fabric, primarily targeting short-term promotional items. HTV is a solid, pre-colored film that must be cut using a machine and weeded, offering superior durability, stretch, and wash resistance, making it the preferred choice for professional apparel decoration and long-lasting garments.

Which product segment dominates the Heat Transfer Market globally?

The Heat Transfer Vinyl (HTV) segment holds the dominant market share by value, driven by its suitability for commercial-grade applications, sportswear, and high-quality personalized items requiring exceptional longevity and flexibility. Polyurethane (PU) HTV is increasingly replacing PVC formulations due to environmental and performance benefits.

What are the key drivers propelling market growth in the Asia Pacific region?

Market growth in the APAC region is primarily driven by the massive concentration of textile manufacturing bases, rapid economic development leading to increased domestic consumer demand for customized goods, and the proliferation of low-cost digital printing and heat transfer equipment facilitating entrepreneurial ventures.

How are environmental regulations impacting the Heat Transfer Vinyl market?

Strict environmental regulations, particularly in Europe and North America, are driving manufacturers to phase out Polyvinyl Chloride (PVC) based vinyls. This has accelerated research and development into sustainable, non-toxic, bio-based, and eco-friendly polyurethane (PU) alternatives, positioning green product lines as a major competitive necessity.

What is the role of technology in enhancing the efficiency of heat transfer applications?

Technology enhances efficiency through high-precision cutting machines that optimize material use and reduce weeding time, and advanced heat presses equipped with digital pressure and temperature sensors that ensure consistent, defect-free application. Furthermore, proprietary software aids in streamlining complex multi-layer designs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager