Heater Blower Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432859 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Heater Blower Market Size

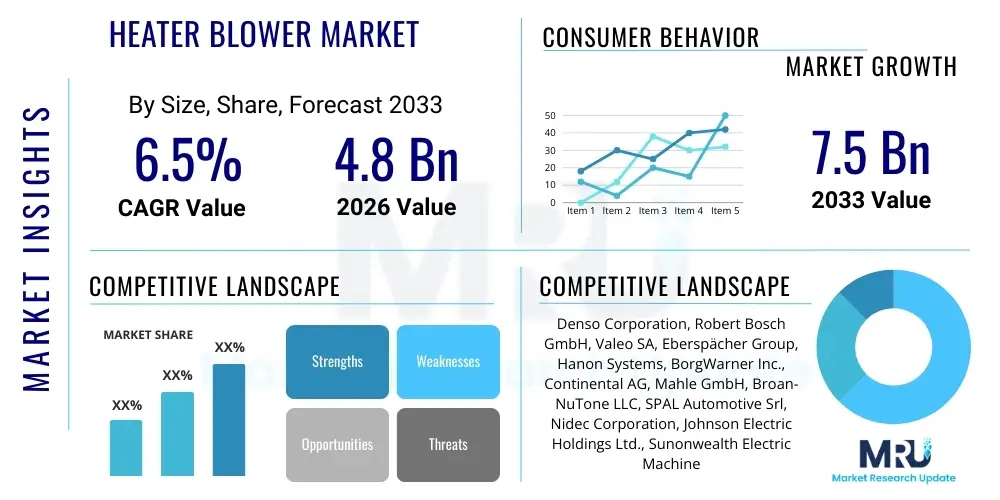

The Heater Blower Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 7.5 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally supported by the escalating global production of passenger and commercial vehicles, coupled with stringent regulatory standards related to cabin comfort and climate control efficiency. The automotive sector remains the primary consumer, driving demand for high-efficiency, low-noise blower motors designed for integration into complex HVAC systems. Furthermore, the expansion of industrial heating applications, particularly in sectors requiring localized and precise air circulation management, contributes significantly to market valuation.

Heater Blower Market introduction

The Heater Blower Market encompasses the manufacturing, distribution, and utilization of electrically operated blower systems specifically designed to circulate air through heating, ventilation, and air conditioning (HVAC) cores in various environments, predominantly automotive cabins and fixed structure heating units. These blowers are critical components ensuring thermal regulation, defrosting capabilities, and maintaining air quality within enclosed spaces. They function by drawing air into the HVAC unit and forcing it over either a heater core or an evaporator coil, distributing conditioned air efficiently. Modern heater blowers are engineered for quiet operation, energy efficiency, and high durability, often employing brushless DC (BLDC) motors for enhanced performance metrics and longevity.

Product descriptions within this market span several types, including centrifugal (squirrel cage) blowers and axial blowers. Centrifugal blowers are widely used in automotive HVAC due to their ability to produce high pressure and move air against resistance, making them ideal for channeling air through complex ductwork. Axial blowers, while less common in primary HVAC roles, are sometimes used for supplementary cooling or specialized industrial heat dissipation. Major applications extend across passenger vehicles (sedans, SUVs), commercial vehicles (trucks, buses), off-highway vehicles, and fixed installations such as residential furnaces, commercial air handling units, and industrial drying equipment. The versatility of these components ensures widespread market relevance across diverse end-use sectors prioritizing climate control.

Key benefits derived from advanced heater blower systems include improved thermal comfort, enhanced safety through rapid window defrosting, and optimization of overall vehicle or system energy consumption. Driving factors propelling market expansion include the surging global demand for automobiles, especially in emerging economies where vehicle ownership is rising. Additionally, legislative mandates promoting energy efficiency and reductions in noise pollution necessitate the adoption of sophisticated blower technologies, such as variable speed control and high-efficiency materials, further stimulating innovation and market growth. The shift towards electric vehicles (EVs) is also a significant driver, requiring optimized thermal management systems, including high-performance blowers, to preserve battery range.

Heater Blower Market Executive Summary

The Heater Blower Market is undergoing a rapid evolution characterized by a strong convergence of electrification trends and heightened efficiency requirements, particularly within the dominant automotive sector. Business trends indicate a marked shift towards brushless DC (BLDC) motor technology, replacing older brushed motor designs due to their superior lifespan, reduced maintenance needs, and significantly improved energy efficiency—a critical factor for electric vehicle battery management. Furthermore, the market is seeing increased consolidation, with major Tier 1 automotive suppliers investing heavily in sophisticated thermal management portfolios. Suppliers are focusing on modular designs that allow for easy integration across different vehicle platforms, thereby streamlining manufacturing processes and reducing per-unit costs. Customization capabilities, catering to specific noise and vibration, harshness (NVH) requirements mandated by luxury vehicle manufacturers, also represent a significant business focus.

Regional trends reveal Asia Pacific (APAC) as the undisputed leader in both consumption and production, driven by massive automotive manufacturing bases in China, India, and Japan. This region exhibits the highest growth rate due to expanding middle-class populations and increasing vehicle penetration. North America and Europe, while mature markets, emphasize technological advancement, focusing on premium, high-specification blowers compliant with stringent environmental and efficiency regulations, particularly Euro 7 and CAFE standards. The integration of smart sensors for predictive maintenance and optimized performance is more pronounced in these developed regions. Conversely, Latin America and the Middle East & Africa (MEA) are characterized by robust aftermarket demand and increasing adoption of entry-level and mid-range HVAC systems in newly industrialized areas.

Segmentation trends highlight the dominance of the Automotive application segment, though the industrial and residential HVAC segments are showing consistent, steady growth, fueled by urbanization and the demand for smarter home climate control systems. Within technology, Centrifugal Blowers maintain the largest market share due to their proven reliability and suitability for complex ducting required in passenger vehicles. However, the Aftermarket segment is proving resilient, offering substantial opportunities for component replacement and upgrades as the average age of the global vehicle fleet increases. The ongoing evolution of thermal management in hybrid and electric vehicles is creating a crucial sub-segment, driving the demand for specialized, high-voltage blower systems capable of managing the cooling demands of power electronics and battery packs alongside cabin climate control.

AI Impact Analysis on Heater Blower Market

User queries regarding AI's influence primarily revolve around predictive maintenance, optimization of energy consumption in real-time, and enhanced HVAC control algorithms within connected vehicles and smart buildings. Common concerns include the complexity of integrating AI-driven sensors into existing thermal systems, the cybersecurity risks associated with networked HVAC components, and the potential for AI to dictate the operational parameters of the blower itself. Users are keenly interested in how machine learning can analyze vast datasets—such as ambient temperature, solar load, occupancy levels, and driving patterns—to modulate blower speed and direction autonomously, thereby maximizing passenger comfort while minimizing energy waste. This analysis confirms that AI is perceived not merely as a component addition but as an enabling layer for systemic efficiency improvements and personalized climate delivery.

- AI algorithms facilitate predictive maintenance by analyzing motor vibration, current draw, and operational sound profiles to forecast potential blower failure, reducing costly unplanned downtime.

- Machine learning models optimize energy usage by dynamically adjusting blower speed based on real-time environmental data (solar intensity, interior temperature) and learned user preferences, crucial for maximizing EV range.

- AI-driven sensor fusion integrates data from humidity, CO2, and particle sensors, allowing the blower system to regulate fresh air intake and filtration cycles automatically, enhancing cabin air quality.

- Generative Design (GD) tools, powered by AI, are used by manufacturers to optimize the impeller and housing aerodynamics, resulting in quieter operation and higher air movement efficiency before physical prototyping.

- Enhanced diagnostics and troubleshooting are enabled by AI, allowing service technicians to identify complex electrical or mechanical faults in the blower assembly more quickly and accurately.

DRO & Impact Forces Of Heater Blower Market

The Heater Blower Market is shaped by a confluence of accelerating market demands (Drivers), systemic hurdles (Restraints), and untapped growth avenues (Opportunities), which collectively dictate the trajectory of innovation and market penetration. The primary driver is the global increase in automotive production, particularly the shift toward high-end vehicles incorporating multi-zone climate control systems, necessitating multiple blower units per vehicle. Simultaneously, the stringent focus on minimizing vehicle emissions and enhancing fuel economy compels manufacturers to adopt lightweight, high-efficiency BLDC blower designs. Conversely, the market faces significant restraints, including the high initial cost associated with advanced BLDC motors and integrated control electronics compared to traditional brushed motors, particularly challenging in price-sensitive emerging markets. Furthermore, the inherent volatility of raw material prices (copper, steel, magnets) necessary for motor production introduces uncertainty into manufacturing costs. Opportunities, however, abound through the rapid electrification of the automotive industry, creating new demand for high-voltage and exceptionally reliable thermal management blowers tailored specifically for battery and power electronics cooling loops, opening up premium specialized product lines.

Impact Forces are predominantly centered on regulatory mandates and technological standardization. Governmental regulations regarding energy consumption, noise pollution (NVH standards), and indoor air quality exert powerful pressure on manufacturers to innovate. For instance, European and North American regulations driving the phase-out of less efficient components directly impact product design cycles. The bargaining power of large Tier 1 suppliers and major automotive OEMs remains high, as they dictate specifications, pricing, and volume commitments, often leading to competitive pricing pressure down the supply chain. Substitute products, while not direct replacements for core heater blowers, include advanced solid-state thermal modules and alternative heat pump technologies in vehicles, which could potentially reduce the reliance on conventional resistive heating and its associated air movement components, forcing blower manufacturers to integrate closely with overall thermal system design.

The driving forces are continuously amplified by consumer expectations for superior in-cabin experience, demanding extremely low operational noise and instantaneous climate response times, pushing the envelope for aerodynamic and electronic control refinements. The continuous miniaturization of components while maintaining performance is also a critical force, allowing for easier integration into increasingly space-constrained vehicle designs. Strategic opportunities include leveraging the growing global infrastructure investment in commercial and industrial HVAC systems, particularly in regions prone to extreme temperatures, where robust and high-capacity blower systems are essential for operational continuity. Addressing the aftermarket with easily installable, energy-efficient replacement units that offer superior performance compared to older OEM parts presents a substantial, immediate growth avenue that bypasses the typically longer automotive product development cycles.

Segmentation Analysis

The Heater Blower Market segmentation provides a granular view of diverse product categories, end-use applications, technological standards, and geographical influences that shape overall market dynamics. This analysis dissects the market based on critical parameters, allowing stakeholders to identify high-growth niches, allocate resources efficiently, and tailor their product development strategies to meet specific sectoral demands. The primary segment differentiators include the type of motor used (brushed vs. brushless), the blower design (centrifugal vs. axial), the primary application area (automotive, residential, industrial), and the sales channel (OEM vs. Aftermarket). Each segment exhibits unique characteristics related to performance requirements, cost sensitivity, and regulatory compliance, defining their individual growth potentials over the forecast period.

- By Product Type:

- Centrifugal Blower

- Axial Blower

- Mixed Flow Blower

- By Technology:

- Brushed DC Motor Blower

- Brushless DC (BLDC) Motor Blower

- By Application:

- Automotive

- Passenger Vehicles

- Commercial Vehicles

- Industrial Heating and Cooling

- Residential HVAC Systems

- Others (Off-highway, Marine)

- Automotive

- By Sales Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket

Value Chain Analysis For Heater Blower Market

The value chain for the Heater Blower Market begins upstream with raw material suppliers providing essential components such as specialized plastics (for housings and impellers), various metals (for shafts and structural supports), and sophisticated magnetic materials (for motors, particularly rare earth magnets for BLDC systems). This upstream phase is crucial, as the quality and cost volatility of these inputs directly impact the final product pricing and performance characteristics, especially lightweighting initiatives. Key players in this stage are specialized chemical and materials manufacturers, and magnet providers. Component manufacturers then transform these materials into critical sub-components, including dedicated motor windings, electronic control units (ECUs), sensor assemblies, and precision bearings. Efficiency and precision in the upstream manufacturing stage are non-negotiable, given the high rotational speeds and low noise requirements of modern blowers.

The intermediate stage involves the specialized manufacturing and assembly of the complete heater blower unit by major Tier 1 and Tier 2 suppliers. This phase incorporates sophisticated design processes, focusing on computational fluid dynamics (CFD) to optimize air flow and acoustics, and advanced testing protocols to ensure reliability under extreme thermal and vibration conditions. Suppliers in this stage often specialize in either standard brushed units or high-performance BLDC systems tailored for specific OEM requirements. The distribution channel analysis is bifurcated: Direct channels primarily serve Original Equipment Manufacturers (OEMs), where blowers are delivered directly to large assembly lines for integration into vehicles or HVAC systems based on tightly controlled supply contracts and just-in-time (JIT) logistics. Indirect channels focus predominantly on the aftermarket, utilizing extensive networks of wholesale distributors, specialized automotive parts retailers, and independent service garages to reach end-consumers needing replacement parts.

Downstream analysis focuses on the end-users and service providers. The largest end-user group is the global automotive manufacturing sector (OEMs), followed by commercial and residential HVAC system installers. Aftermarket distribution necessitates robust logistics and inventory management, as a wide variety of blower models must be stocked to cover different vehicle makes, models, and years. Potential customers, including professional mechanics and DIY enthusiasts, rely on the accessibility and quality assurance provided by indirect channel partners. The market structure emphasizes the strong link between quality control at the manufacturing level and consumer trust downstream, especially in safety-critical applications like automotive defrosting systems. The trend towards integrated modules often consolidates the control unit and blower into a single assembly, simplifying downstream installation but increasing the complexity of upstream component sourcing.

Heater Blower Market Potential Customers

Potential customers for the Heater Blower Market are highly diverse, spanning sectors where controlled air movement is essential for thermal management, safety, and operational efficiency. The primary and largest customer segment resides in the automotive industry, encompassing global Original Equipment Manufacturers (OEMs) of passenger vehicles, heavy-duty trucks, buses, and specialized vehicles (e.g., agricultural machinery, construction equipment). These customers demand high-volume production, adherence to stringent quality standards (like IATF 16949), robust environmental durability, and complex electronic integration capabilities. The shift towards hybrid and electric vehicles is creating a new customer dynamic within OEMs, focused specifically on suppliers who can provide high-voltage, low-vibration blower systems essential for managing critical battery and power electronics cooling loops alongside traditional cabin climate control.

The secondary, yet rapidly expanding, customer base includes manufacturers and integrators of commercial and residential Heating, Ventilation, and Air Conditioning (HVAC) systems. This group ranges from large global HVAC corporations producing central air handling units and furnaces to smaller, specialized companies manufacturing air purifiers, dehumidifiers, and localized heating systems. For these customers, the primary drivers are energy efficiency ratings (such as SEER ratings), noise levels acceptable for indoor environments, and long-term reliability. Industrial sector customers, including those in manufacturing, chemical processing, and data centers, purchase blowers for specialized applications such as forced air cooling of machinery, drying processes, and climate control in cleanrooms, requiring industrial-grade components built for continuous operation in harsh environments.

The tertiary segment, critical for revenue stability and aftermarket growth, involves wholesale distributors, authorized parts resellers, and independent automotive repair shops globally. These customers represent the replacement market, purchasing individual blower units for servicing and repair activities. Their purchasing decisions are highly influenced by price point, availability, breadth of product coverage (fitment across different vehicle models), and ease of installation. Furthermore, governmental and municipal entities are also significant customers, procuring heater blowers for public transit systems (trains, subway cars) and specialized public service vehicle fleets (ambulances, fire trucks), where reliability and robust performance under emergency conditions are paramount requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 7.5 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Denso Corporation, Robert Bosch GmbH, Valeo SA, Eberspächer Group, Hanon Systems, BorgWarner Inc., Continental AG, Mahle GmbH, Broan-NuTone LLC, SPAL Automotive Srl, Nidec Corporation, Johnson Electric Holdings Ltd., Sunonwealth Electric Machine Industry Co. Ltd., Revcor Inc., Airflow Systems, Inc., Behr Hella Service GmbH, Mitsuba Corporation, Panasonic Automotive Systems, Marelli (Calsonic Kansei), Gentherm Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Heater Blower Market Key Technology Landscape

The technological landscape of the Heater Blower Market is undergoing a rapid transition driven primarily by the global focus on energy efficiency, noise reduction, and the necessity for robust integration into complex electronic systems. The most critical technological shift is the widespread adoption of Brushless DC (BLDC) motors, increasingly replacing conventional Brushed DC motors. BLDC technology offers superior advantages including a longer operational lifespan due to the elimination of brush wear, higher efficiency in converting electrical energy into mechanical power, and more precise, variable speed control, which is essential for sophisticated thermal management algorithms. This transition is especially pronounced in the Electric Vehicle (EV) segment, where minimizing energy draw from the battery is paramount for maximizing driving range, thereby mandating highly efficient, electronically commutated motors. Furthermore, the integration of advanced sensors and embedded motor control units (MCUs) into the blower assembly allows for real-time diagnostics and integration with centralized vehicle control networks.

Aerodynamic innovation represents another foundational technology area. Manufacturers are continuously utilizing computational fluid dynamics (CFD) simulations to optimize the impeller and scroll housing designs. The goal is to achieve maximum air flow and static pressure generation while minimizing the undesirable noise and vibration, or Noise, Vibration, and Harshness (NVH) characteristics. Modern impellers often feature asymmetrical blade designs and specialized surface treatments to manage turbulence and reduce tonal noise, which is particularly crucial for premium and luxury vehicle segments. Material science advancements also play a vital role, with the use of lightweight, high-strength composite polymers for blower housings and impellers. These materials contribute to overall weight reduction, aiding fuel economy and EV performance, while maintaining structural integrity under high operating temperatures and rotational stress.

Control system technology is advancing rapidly, particularly with the incorporation of Pulse Width Modulation (PWM) and LIN (Local Interconnect Network) or CAN (Controller Area Network) communications protocols. These digital interfaces enable precise command and feedback loops between the vehicle's central HVAC module and the blower motor, facilitating multi-zone climate control and sophisticated diagnostics. The move toward modularization is also a key technological trend, where the blower, controller, and often the associated heating element are integrated into a compact, pre-assembled unit, simplifying installation for OEMs and improving serviceability in the aftermarket. Future technological developments are anticipated to focus heavily on integrating connectivity (IoT capabilities) for remote monitoring and software updates, particularly in large commercial HVAC systems, further solidifying the trend towards smart, interconnected thermal management components.

Regional Highlights

- Asia Pacific (APAC): Dominance in Production and Consumption

APAC holds the largest market share, driven primarily by its immense manufacturing capacity in China, India, and South Korea, which collectively account for the majority of global automotive production and assembly. The region's expanding middle class and resultant surge in vehicle sales, coupled with rapid urbanization boosting demand for residential and commercial HVAC infrastructure, underpin its dominant position. While cost sensitivity remains a factor, there is increasing demand for premium, high-efficiency BLDC blowers in markets like Japan and South Korea, aligned with global electrification trends. The aftermarket segment in APAC is also substantial, supported by the large volume of aging vehicles requiring component replacement, especially in countries like India and Southeast Asia where harsh climatic conditions accelerate wear and tear.

- North America: Focus on High Performance and Aftermarket Reliability

North America is characterized by high adoption rates of large vehicles (SUVs, light trucks), which often incorporate larger, more powerful HVAC systems requiring robust blower units. Market growth here is stable, emphasizing technological sophistication, regulatory compliance (especially efficiency standards), and durability to handle extreme climate variability. The US market exhibits strong demand for high-quality replacement parts, making the aftermarket segment extremely valuable for manufacturers. Furthermore, strict safety and emissions regulations push OEMs to adopt the latest BLDC technologies to optimize vehicle energy consumption and meet stringent noise standards, ensuring technological leadership in premium segments.

- Europe: Leading in Electrification and Regulatory-Driven Innovation

Europe is a pivotal market, spearheading the transition to electric vehicles (EVs) and setting global benchmarks for component efficiency and emissions standards (e.g., Euro 7). This environment mandates continuous innovation in the blower market, prioritizing lightweight design, exceptionally low NVH characteristics, and high thermal efficiency crucial for maximizing battery range in EVs. The European market sees robust competition among Tier 1 suppliers who must comply with complex and evolving sustainability and circular economy mandates. Central and Eastern European countries are also increasingly contributing to the OEM supply chain due to lower manufacturing costs, balancing the high R&D expenditures prevalent in Western Europe.

- Latin America (LATAM) & Middle East & Africa (MEA): Growth in Industrialization and Infrastructure

These regions, though smaller in scale than APAC or Europe, present significant long-term growth opportunities driven by industrialization and infrastructural development. LATAM shows consistent growth tied to local automotive assembly operations and urbanization driving demand for basic and mid-range HVAC systems. MEA, particularly the GCC countries, requires high-capacity, robust blowers capable of operating reliably in extreme heat conditions, benefiting both the automotive (for robust cabin cooling) and the industrial sectors (for essential process cooling). The aftermarket in these regions is rapidly developing as vehicle parc increases, providing reliable revenue streams for component suppliers focused on cost-effective durability.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Heater Blower Market.- Denso Corporation

- Robert Bosch GmbH

- Valeo SA

- Eberspächer Group

- Hanon Systems

- BorgWarner Inc.

- Continental AG

- Mahle GmbH

- Broan-NuTone LLC

- SPAL Automotive Srl

- Nidec Corporation

- Johnson Electric Holdings Ltd.

- Sunonwealth Electric Machine Industry Co. Ltd.

- Revcor Inc.

- Airflow Systems, Inc.

- Behr Hella Service GmbH

- Mitsuba Corporation

- Panasonic Automotive Systems

- Marelli (Calsonic Kansei)

- Gentherm Inc.

- Tenneco Inc. (via acquisition of certain systems)

- ACDelco (General Motors Aftermarket)

- Delphi Technologies (BorgWarner)

- Tiffin Motorhomes

- Modine Manufacturing Company

Frequently Asked Questions

Analyze common user questions about the Heater Blower market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of Brushless DC (BLDC) blowers in the automotive market?

The primary factor is the urgent need for enhanced energy efficiency and extended component lifespan. BLDC motors significantly reduce power consumption compared to older brushed designs, which is crucial for maximizing the driving range and preserving battery capacity in electric vehicles (EVs), while also meeting stringent OEM reliability standards.

How does the shift towards electric vehicles (EVs) fundamentally impact the design requirements of heater blowers?

EVs impose strict requirements for extremely low noise, high efficiency, and the need for dedicated high-voltage blower systems to manage the thermal loads of the battery pack and power electronics separately from the cabin climate. Blower designs must be optimized to handle these complex thermal loops while minimizing vibration.

Which segmentation—OEM or Aftermarket—is expected to witness faster growth in the short term?

While the OEM segment remains the largest volume purchaser, the Aftermarket segment is often projected to show faster revenue growth in the short term, driven by the increasing average age of the global vehicle fleet, necessitating frequent replacement and repair of aging HVAC components, including blowers.

What role does aerodynamic design optimization play in modern heater blower manufacturing?

Aerodynamic design, often achieved through Computational Fluid Dynamics (CFD), is crucial for achieving high static pressure and air volume while simultaneously minimizing Noise, Vibration, and Harshness (NVH). Optimization of the impeller and housing ensures efficient air circulation and meets strict comfort standards required by end-users.

What are the key differences between Centrifugal and Axial blowers and their typical applications?

Centrifugal (or radial) blowers generate high pressure and are ideal for moving air through complex ductwork and filtering systems, making them standard for primary automotive HVAC functions. Axial blowers move air parallel to the shaft, generating lower pressure but higher flow, and are typically used in localized cooling applications or specialized industrial ventilation.

How do global supply chain constraints, particularly rare earth magnet availability, affect the heater blower market?

Supply chain volatility, especially concerning rare earth magnets (critical for high-performance BLDC motors), directly impacts manufacturing costs and lead times. Manufacturers are mitigating this by diversifying sourcing, redesigning motors to use fewer magnets, or exploring non-rare-earth magnet alternatives, though these constraints pose continuous inflationary pressure.

What regulations are most influential in shaping the future technology development of heater blowers?

Regulations focused on energy efficiency (e.g., EU Ecodesign, US appliance standards for HVAC) and vehicle CO2 emissions/fuel economy standards (e.g., CAFE, Euro 7) are the most influential. These mandate the shift towards high-efficiency BLDC components and continuous minimization of parasitic power draw.

What is the strategic significance of the industrial HVAC segment for heater blower manufacturers?

The industrial HVAC segment offers stability and high margins, as applications often require specialized, durable, high-capacity blowers designed for continuous, long-life operation in demanding environmental conditions, unlike the shorter replacement cycles sometimes seen in consumer electronics or automotive aftermarket.

What is meant by the term "integrated modular design" in the context of heater blowers?

Integrated modular design refers to packaging the blower motor, the electronic control unit (ECU), and sometimes the thermal resistor/element into a single, pre-tested, compact assembly. This simplifies OEM installation, reduces the number of connections required on the assembly line, and improves system reliability and diagnostics.

How is the market addressing the consumer demand for quiet operation (low NVH)?

The market addresses NVH through multi-faceted strategies: utilizing BLDC motors for smoother operation, employing advanced acoustic dampening materials in the housing, and rigorously optimizing impeller blade geometry via CFD simulation to reduce aerodynamic noise and eliminate undesirable tonal frequencies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager